A1, M6: Modified Opinions Due to Audit Issues

1/9

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

When would an auditor use professional judgment to determine whether to issue a qualified opinion or a disclaimer of opinion?

When there is a limitation on the scope of the audit.

A qualified opinion is issued when an auditor is unable to obtain sufficient appropriate audit evidence on which to base an opinion and the auditor determines that the possible effects could be material but not pervasive.

A disclaimer of opinion is expressed when the auditor is unable to obtain sufficient appropriate audit evidence on which to base an opinion and the auditor determines that the possible effects could be BOTH material and pervasive.

Identify some examples of scope limitations.

Restrictions on the auditor’s ability to perform auditing procedures may be caused by:

time constraints

inability to observe inventory

inability to confirm receivables

inability to obtain audited F/S of a consolidate investee

restrictions on the use of auditing procedures

inadequacy of accounting records

refusal of the client’s attorney to respond to inquiry

refusal of mgmt to provide a representation letter

What situations may result in a disclaimer of opinion in an audit report?

pervasive inability to obtain sufficient appropriate audit evidence

lack of independence (always results in disclaimer)

Going concern uncertainty [Note: If adequate disclosure of going concern exists, the auditor may choose between either an unqualified opinion with a separate report section (nonissuer) or explanatory paragraph (issuer), or a disclaimer of opinion].

If an opinion is modified, on a nonissuer audit report where does the explanation of the modification appear?

The paragraph explaining the modification would appear after the opinion paragraph. The “basis for modification” paragraph should use the appropriate heading. Appropriate headings include:

Basis for Qualified Opinion

Basis for Adverse Opinion

Basis for Disclaimer of Opinion

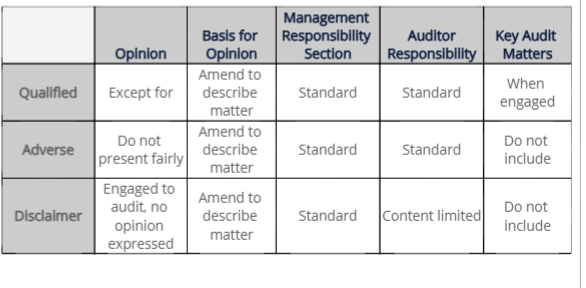

Compared to a standard unmodified opinion for a nonissuer, determine the paragraphs that are modified in an audit report when the following opinions are issued:

Qualified

Adverse

Disclaimer

*When an auditor qualifies his opinion because of a scope limitation, the wording in the opinion paragraph should indicate that the qualification pertains to the possible effects on the F/S and NOT to the scope limitation itself.

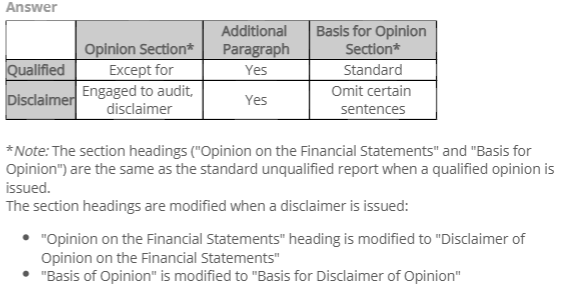

Compared to a standard unqualified opinion for an issuer, determine the paragraphs that are modified in an audit report when the following opinions are issued due to audit issues (scope limitation):

Qualified

Disclaimer

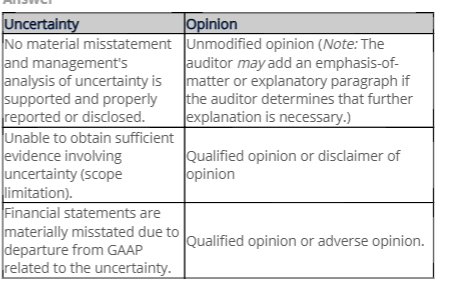

How do uncertainties affect the auditor’s report?

Is an auditor required to report on CAMs when issuing a disclaimer of opinion?

No, the auditor is not required to report CAMs when issuing a disclaimer of opinion.

The auditor may not issue a qualified opinion when?

The auditor is not independent with respect to the audited entity. When an auditor is not independent with respect to an entity, only a disclaimer of opinion may be issued.

Define Disclaimer.

A disclaimer of opinion is expressed when the auditor is unable to obtain sufficient appropriate audit evidence to base an opinion, and the auditor concludes that the possible effects of any undetected misstatements could be both material and pervasive. If the issuer is preventing an auditor from obtaining such evidence, the auditor should disclaim an opinion.

Client-imposed restrictions of scope such as those caused by inadequate records would cause the auditor to choose between issuing a disclaimer of opinion and a qualified opinion.