Most important terms for exam

1/97

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

98 Terms

Explain risk-return trade-off

Securities that offer greater return also impose greater risk to investors

TIPS bond

Treasury inflation protected bonds

is an indexed bond

R²

Squared correlation coefficient

ratio of total return variance explained by the market return

buying on margin amplifies both upside potential and downside risk

Margin = (value of stock - loan) / value of stock

When buying on margin, an investor borrows money to purchase more shares than would be possible using only their own funds. I

If the stock rises sufficiently it will give a higher return on investments because you initial investment is lower than if you would have bought the stock yourself.

If the stock falls then you have both the loss of the security decreasing in value as well as needing to pay off the loan

Difference between systemic and systematic risk?

Systematic risk

Risk that affects the entire market and connot be eliminated by diversification

Systemic risk

Risk that failure of one or more institutions leads to a breakdown of the financial system due to connectiveness. (crash of 2008)

What is the agency problem

conflict between shareholders and managers (agents)

e.g. managers persuing private benefits

difference between asset allocation and security selection?

Asset allacotion

how to distribute wealth across different asset classes

Security selection

Choice of specific securities within an asset class

Difference between treasury bonds and notes?

Treasury bonds

bonds from the government with maturities > 10 year

Treasury notes

bonds from the government with maturities 2 - 10 year

Call option vs put option

Call option

Right to puchase an asset at a specific exercise (strike) price on or before expiration date

Put option

Right to sell an asset at a specific exercise (strike) price on or before expiration date

Futures contract?

Agreement to buy/sell an asset at a future date for a set price

Money market vs capital market?

money market

short term low risk

T bills

Capital market

long term securities

Bonds, stocks

ask price, bid price and bid-ask spread

ask price

minimum price at which a seller is wiling to sell

bid price

maximum price at which a buyer is willing to buy

ask-bid spread

difference between ask price and bid price

YTM

Yield to maturity

Total annual return earned on a bond if held until maturity

Capital gain?

Profits earned from selling an asset at a higher price than purchase price

Asset vs security

Asset

An asset is anything that has economic value and can generate future benefits.

Security

A security is a tradable financial claim on an asset or on future cash flows.

P/E ratio?

ration of firm’s stock price to it’s earnings per share

high P/E => growth stock

Low P/E => value stock

Buying on margin

Borrowing money to buy more securities than can be purchased with one’s money alone.

If margin accounts falls below the maintenance level, the investor will get a margin call from the broker

Short selling

Selling securities that the seller does not own. The short seller borrows it from a broker, sells them and may be required to cover the short position at any time on demand.

broker usually requires that the seller deposit additional cash or securities as collateral

SEC

Securities and Exchange Commission

IPO

Initial Public Offering

First sale of company”s shares on the public market

Insider information

Non-public information about a firm

limit order

Buy or sell at certain price or better

Unit investments trusts vs managed investments companies

Unit investments trust are essentially unmanaged => portfolio is fixed once established

managed investments companies => portfolio manager may change portfolio composition

Closed-end fund vs open-end funds (mutual funds)

Closed-end funds

are traded like other securities

do NOT redeem shares for their investors

Open-end funs

trade like other securities

WILL redeem shares for NAV (net asse value) at the request of the investors

Net Asset Value (NAV)

NAV = (market value of assets - liabilities) / shares outstanding

Pro’s & contra’s of mutual funds (open end funds)

PRO

Advantage of large scale investors

lower trading costs

easier diversification

CONTRA

management fees and other expenses reducing rate of return

front end loads: sales charges

back end loads: redemption fees

12b-1 charges: marketting

Turnover rate

rate at which a fund buys and sells within it’s portfolio

Nominal rate of interest

equilibrium rate + expected rate of inflation (we can only observe nominal interest rates)

LPSD

Lower partial standard deviation

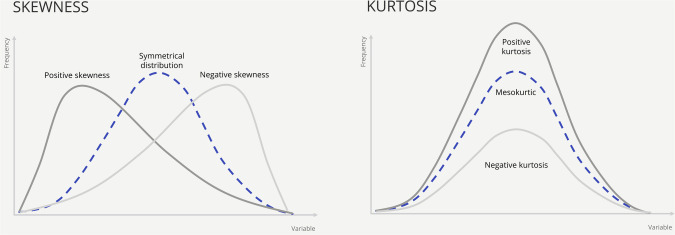

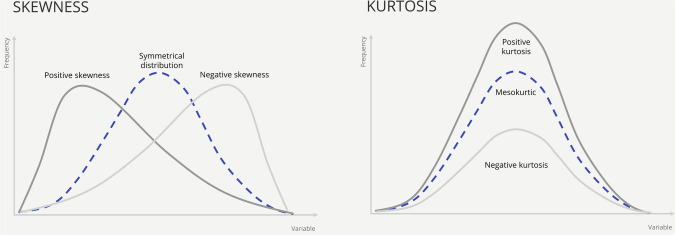

Skew

Kurtosis

Leptokurtic(>3) > mesokurtic (=3) > platykurtic (<3)

Investments in risky portfolios do not become safer in the long run?

On the contrary, the longer a risky investment is held, the greater the risk.

Probability of investment shortfall becomes smaller but ignores the magnitude of potential losses

Difference between Nominal interest rate, APR, EAR and real interest rate

Nominal interest rate

Interest rate not accounting for inflation

Annual Percentage Rate APR

Yearly nominal interest rate (doesn’t account for compounding)

Effective Annual Rate EAR

Real annual interes rate accounting for compounding

Real interest rate

real rate is Nominal rate - expected inflation

Risk free rate

Return on investments with no default risk

Risk premium

Excess return for bearing risk

Excess return

Return above risk free rate

Fair game

Risk premium = 0

Utility function

Investors’ preference toward expected return and volatility

Can be represented graphically using indifference curves

Hedging

Reducing risk by e.g. put option

What do we consider risk free assets

T-bills

Money market funds

CDs: Certificates of deposit

Commercial paper (unsecured)

Sharpe ratio (reward to volatility)

Excess return per unit of total risk

Slope of CAL (capital allocation line): line that goes from the risk free rate through the risky asset (all combinations of risky and risk-free asset lie on that line)

Capital Allocation Line CAL

Line that goes from the risk free rate through the risky asset

all combinations of risky and risk-free assets lie on that line

Degree of risk aversion

Slope of the indiference curve

more risk averse = > steeper curve

Risk averse => Prefers certainty above uncertainty

Risk neutral => only cares about expected return regardless of risk

Risk lover => prefers risk and is willing to accept lower return for more risk

What is the optimal position in the risky asset

Point at which the indifference curve is tangent to the CAL

Passive strategy?

Investment strategy to replicate market performance

Capital Market Line

The CML is the CAL but with the risky portfolio the market portfolio

When is portfolio diversification beneficial

As long as assets are less than perfectly correlated

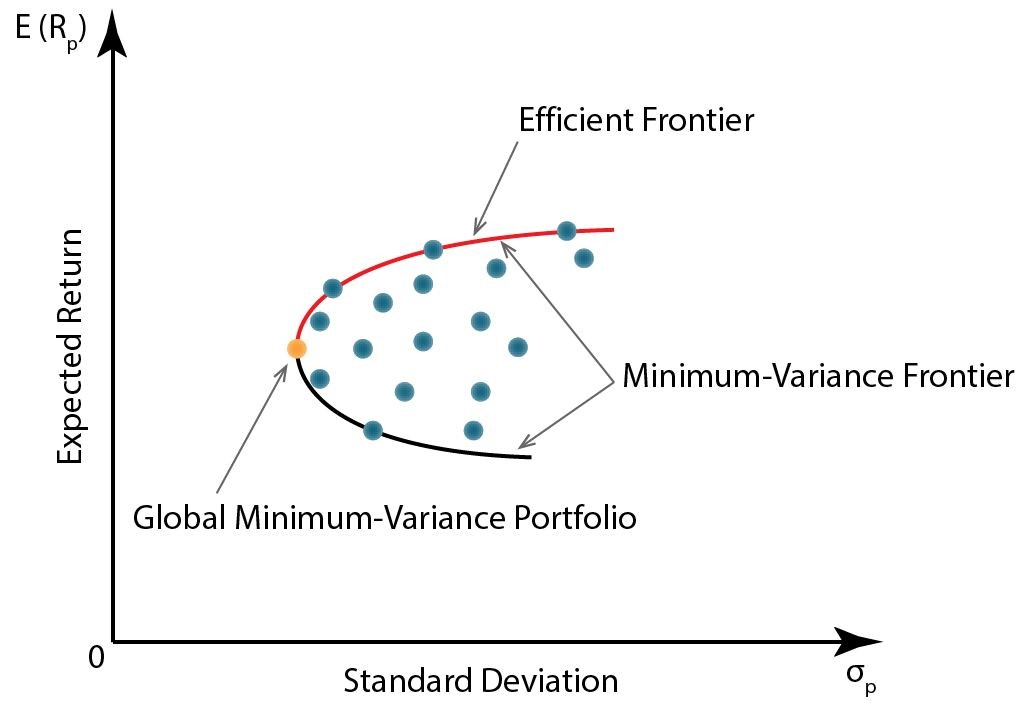

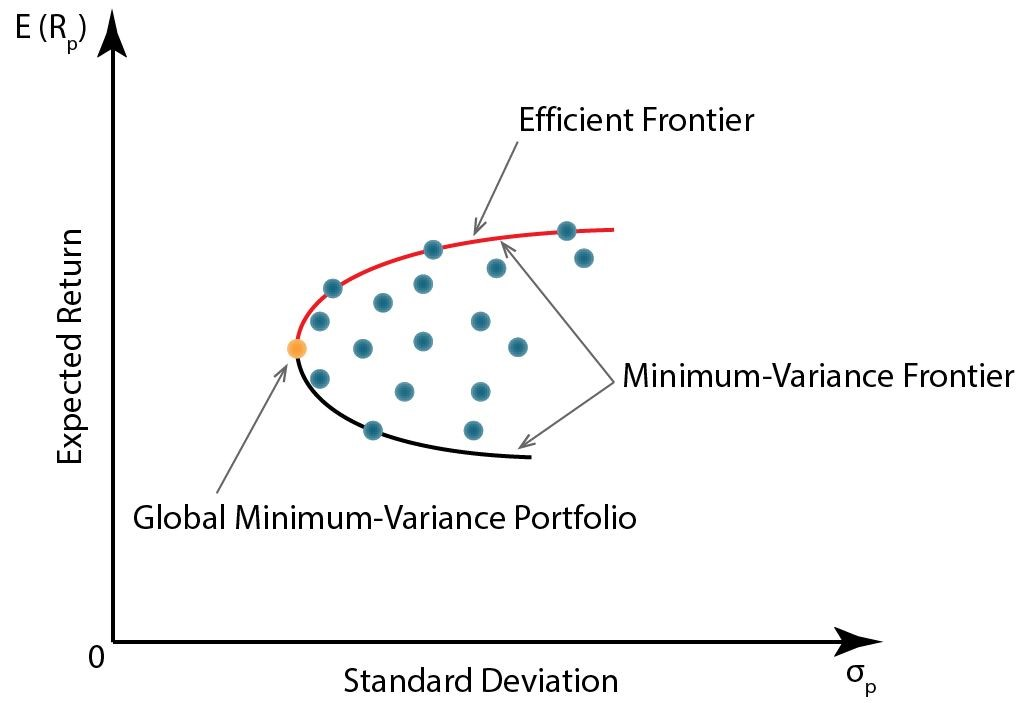

Efficient frontier

Set of portfolios that has the best expected return for a given risk

Rational investors will choose a portfolio on the efficient frontier

Why different for different portfolio managers

Difference in methods and security analysis

If a risk-free asset is available and input lists are identical, all investors will choose the same portfolio on the efficient frontier of risky assets: the portfolio tangent to the CAL.

All investors with identical input lists will hold an identical risky portfolio, differing only in how much each allocates to this optimal portfolio versus the risk-free asset.

CALLED SEPARATION PRINCIPLE

Minimum varianc frontier

Set of portfolios with the lowest variance for each expected return

Is index model inferior to the full covariance (Markowitz) model?

Full covariance matrix invokes estimation risk of thousands of terms. Effect of so many errors will result in a portfolio that is actually inferior to that derived from the single index model

are systematic and firm specific risk macro or micro economic factors?

Systematic risk => macro economic

Firm specific => micro economic

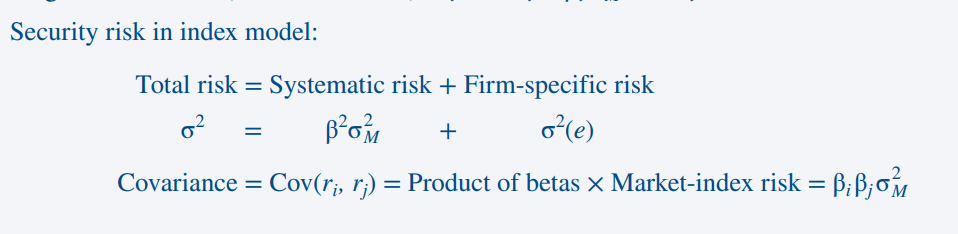

What is the systematic risk of a portfolio or asset in the single index model and what is the covariance between two assets?

systematic risk = β2 σM 2

Covariance between two assets = βi βj σM 2

What is the index model?

Estimated by applying regression analysis to excess rates of return

slope is beta (have a tendency to go towards 1 over time)

intercept is alpha

Regression line is called the The characteristic line (SCL)

What is statistical evidence of market efficiency

Stock prices seem to follow a random walk with no discernible predictable patterns that investors can exploit

What is the Efficient Market Hypothesis (EMH)

Idea that market prices reflect all currently available information there are three forms

Weak

Semistrong

Strong

often advocated by passive investment strategies

What is Weak EMH

All information from past trading data is already reflected in the stock

What is the semistrong EMH

All publicly available information is already reflected in the stock

What is the Strong EMH

All information including insider information is reflected in the prices

Explain abnormal stock returns

Studies usually show that there is some leakage of inside information to some market participants before it goes public

abnormal return = actual retun - expected return

Resistance levels and support levels

Resistance levels => price where stock prices tends to stop rising

support levels => price where stock prices tends to stop falling

Momentum effect

Stocks that perform well in the recent past tend to continue performing well and vice versa

Reversal effect

Stocks that performed well/poor in the past tend to reverse

P/E effect

Stocks with low P/E ratio earn higher average returns than high P/E ratio

small-firm effect

Small cap stocks earn higher average returns than large cap stocks

neglected firm effect

stocks followed by few analyst earn higher average returns

book-to-market effect

Firms with high book to market ratio outperform stocks with low book to market stocks

book to market = (assets - liabilities)/total value outstanding shares

What are convertible bonds?

Bond that can be converted into shares of issuing firm

Floating rate bond?

Coupon that adjust periodically according to a refference rate (fixed premium overe a reference short-term interest rate)

Credit default swaps?

Insurance against the default of a bond or loan. The swap buyer pays an annual premium to the swap seller but collects a payment equal to the lost value if the loan later goes into default

Investment-grade bonds vs speculative-grade bonds (junk bonds)

low default risk

high default risk

Sinking fund

bond issuer repays part of par value before maturity

Subordination clauses

Determines priority of claims in case of bankruptcy

Debenture bond

Unsecured bond with no collateral

CDO (collateralized debt obligation)

pools debt instruments and tranches them by risk

AAA

AA

A

BBB

BB

B

Term structure of interest rates

The term structure of interest rates describes the set of spot rates for different maturities, derived from default-free zero-coupon bonds.

forward rate

A forward rate is an interest rate agreed upon today for a loan that will occur in the future.

Expectation hypothesis

long term rates reflect future short term rate

Liquidity preference theory

long term rate = expected short term rate + liquidity premium

Liquidity premium?

Liquidity premium = forward rate - expected short rate

Yield curve

showing yield to maturity on bonds

bond stripping

separating a coupon bond into

individual ZCB (one per coupon)

one ZCB for principal

bond reconstitution

reverse of bond stripping

spot rate

yield on a ZCB for a given maturity

short rate

spot rate for shortes maturity

What is duration?

the weighted average time until you receive the bond’s cash flows

Convexity

curvature of a bond’s price-yield relationship

Immunization

Immunization is a bond portfolio strategy that protects a portfolio’s value against interest rate changes by matching the portfolio’s duration to the investment horizon.

Modified duration

Adjusts for the level of interest rates

rebalancing

adjustinging portfolio to meet target duration

cash flow matching

cash flow matches future liabilities

dedication strategy

hybrid between cash flow matching and immunization

Describe appropriate performance measures

Sharpe

Information ratio (appraisal

Treynor

Jensen (alpha)

Sharpe => when portfolio represents the entire investment fund

IR => when portfolio is an active portfolio to be optimally mixed with the passive portfolio

Treynor => when the portfolio is one subportfolio of many

Jensen (alpha) => all of these measures require a positive alpha for the portfolio to be considerd attractive

Treynors measure

excess return per unit of systematic risk

Jensen alpha

abnormal return relative to CAPM (capital asset pricing model)

Information ratio

The appraisal ratio measures a manager’s alpha per unit of idiosyncratic (residual) risk.

Survivorship bias

arises when only surving funds are included in performance analysis²

bogey

target benchmark a portfolio aims to beat