Course 8 - Models of product differentiation

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

11 Terms

Introduction - Products

Most products ≠ perfectly substitutable → Reasons:

Physical characteristics of products ≠ idem

Products = branded differently / designed for specific consumer groups

Economists distinguish vertical & horizontal product differentiation

HORIZONTALLY product differentiation - Definition

When each product = preferred by at least 1 consumer group

OR

When for same P consumers disagree on product they prefer

Ex.: Marketeers in fast moving consumer goods design product offers for groups of consumers according to their age, social-economic groups, passions, …

HORIZONTALLY product differentiation - Firm perspective

In horizontally differentiated product markets, fims choose:

price of the product &

its position in the product space

Usually assumed that consumers = located on a line (Hotelling) / circle (Salop) & incur cost when purchasing product far from them

→ Geographical interpretation:

Consumers incur higher cost to move a more distant shop

→ Products ≠ perfectly substitutable, consumers incur psychological transportation cost when consuming product that ≠ ideal

Proof:

1) Show that in Bertrand model where firms = located in different positions on the line, both firms set P above MC & enjoy positive profits

2) If firms choose locations, but not choose P, they choose to be located in same place

3) Firms choose P & location with linear & quadratic transportation costs

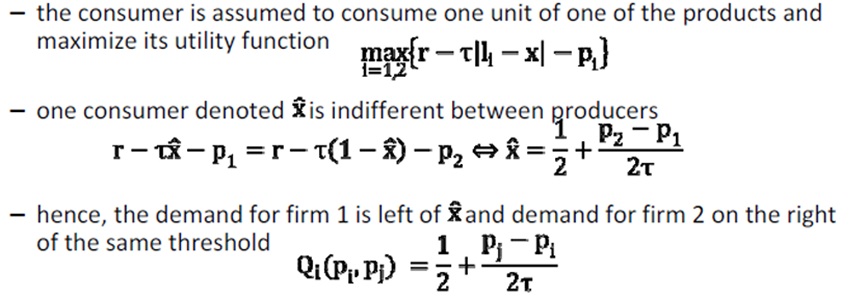

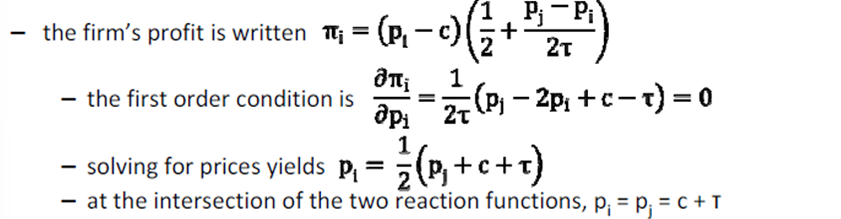

Proof - (1) P choice in differentiated product market (Bertrand model)

Bertrand model where 2 firms produce differentiated products:

2 producers denoted 1 & 2 with MC c = located at extreme locations of the [0,1] interval on which consumers = uniformly distributed

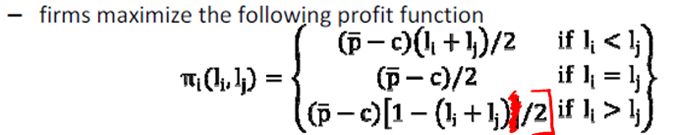

Firms max πi = (pi - c)Qi(pi,pj)

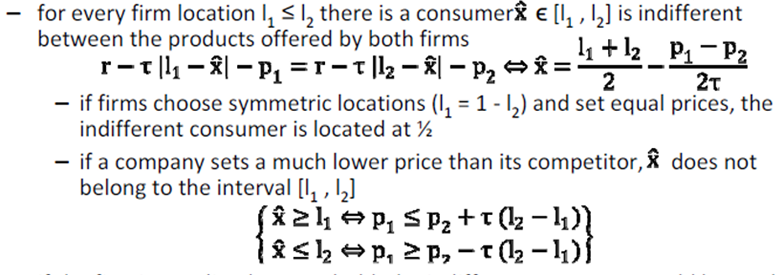

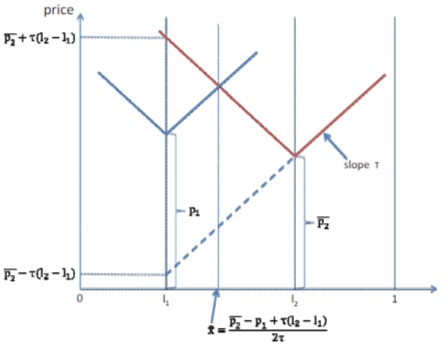

Indirect U fct of consumer located in x with preferred product U r & consuming 1 unit of product i located in li = r - T |li - x| - pi

Due to product differentiation, equilibrium P > MC:

→ Each firm faces D fct that ≠ perfectly elastic

→ Producers of more differentiated products (higher τ) enjoy higher price-cost margins

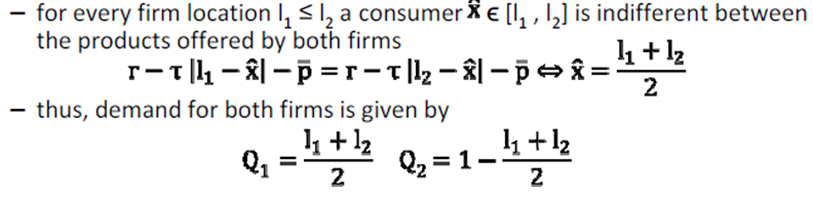

Proof - (2) Location choice in differentiated product market

Assume 2 firms ≠ choose P BUT choose location:

Model describes industries in which P = regulated (p*), but firms choose non-P aspects of their product offer

Mass 1 of consumers = assumed to have tastes uniformly distributed on interval [0,1]Indirect U fct of consumer located in x, consuming 1 unit of product i locatedli = vi(x) = r - T |li - x| - p*

In unique NE of location game, both firms locate at center of support

No firm has an incentive to deviate from this equilibrium, bc it would serve smaller proportion of market

If firm 1 moves to the right, firm 2 has an incentive to also move to the right & serve larger proportion of market

This simple model shows that firms that have opportunity to differentiate their products, choose not to do so:

From social perspective, total transport costs = minimized at locations ¼ & ¾

Intro of competition ≠ improve welfare: If fixed production costs, customers better off with single firm

Proof - (3) P & location choice in differentiated product market (Part 1)

Firms simultaneously choose P & location

Reservation value r for their ideal product, a mass 1 of consumers have tastes uniformly distributed on interval [0,1] & have U fct vi(x) = r - T |li - x| - p*

If first inequality ≠ hold, indifferent customer would be on left of l1 or in other terms, also consumers on left of l1 prefer good 2 to good 1

There = non-linearity at P1 = p2 + T(l2 - l1)

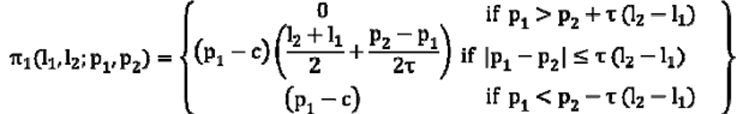

Proof - (3) P & location choice in differentiated product market (Part 2)

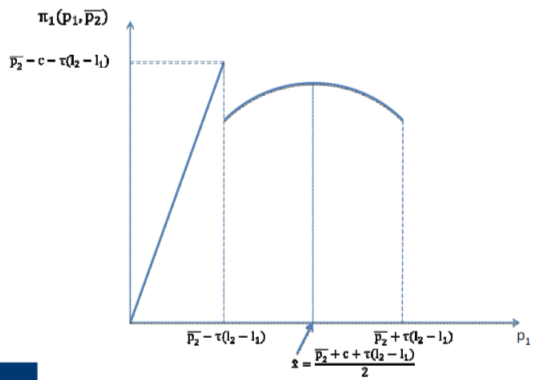

Profits = price-cost difference times demand:

Profit fct shows downward jump when firm starts sharing market with producer of good 2

Similarly, profit fct drops to 0, when no customer buys a good 1

Profit fct ≠ quasi-concave & has 2 local suprema

First order approach can lead to errors

Locations ≠ necessarily at the extremes:

Assuming that prices = such that the indifferent buyer belongs to

For l1 = l2 unique P equilib = p1 = p2 = c

Other P equilibria exist, but it can be demonstrated that, in dynamic setting, firms have a tendency to move closer to one another (offer closer substitutes) to increase D, which leads to instability in competition

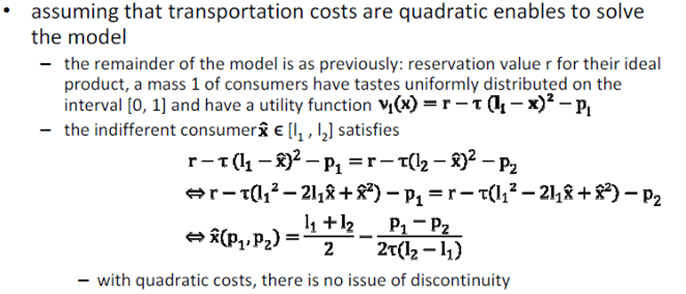

Proof - (3) P & location choice in differentiated product market (Part 3)

The subgame perfect equilibrium (SPE) of the 2-stage game with quadratic transportation costs, firm choose l*1 = 0 & l*2 = 1

With quadratic transportation costs, firms seek differentiate their product offerings in order to build some monopoly power vis-à-vis consumers located in their vicinities

In general, there are always 2 forces at play:

Competition effects drives firms apart in order to increase product differentiations & raise market power

Market size effect brings firms closer & reduces product differentiation

VERTICALLY product differentiation - Definition

When consumer groups agree on relative value of products, bc different q of desirable characteristic = embedded in product

Ex.: CPU (GHz), RAM (Mo), size screen of weight for laptops, l/100km or CO2g/km for cars, ABS, air conditioning, horsepower

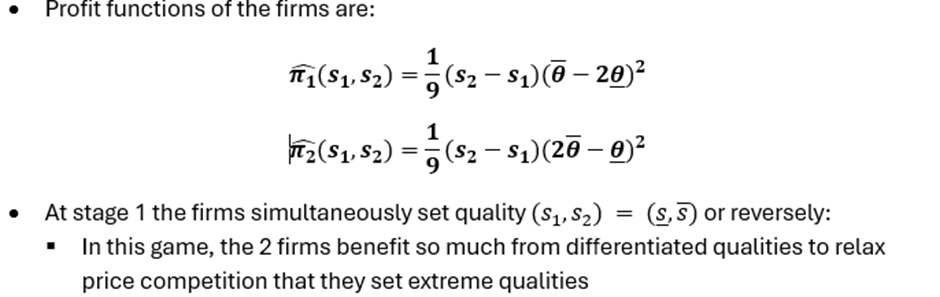

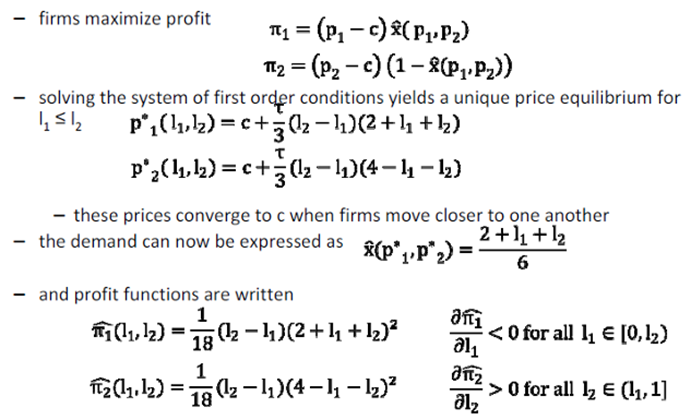

VERTICALLY product differentiation - Firm perspective (Part 1)

Products = vertically differentiated, when consumer groups agree on the relative value of products

→ products = different qualities

Quality = described by a number : si ∈ [▁s,s ̅ ] ⊂ R+

Consumers agree: high quality = better than low, but differ in intensity of their preferences → θ ∈ [▁θ,θ ̅ ] ⊂ R+

θ = uniformly distributed on its support & consumers = of mass M = θ ̅ - ▁θ

Consumer’s U fct:

u1 = q0 + θ(s1 - s ̅ )

with outside option u0 = q0 - r - θs ̅ &

budget constraint y = r + θs ̅

Consumers choose whether to buy product maximizing:

v(p, y ; θ)=max[0, max((r - p1 + θs1)]

2 firms = assumed to have 0 MC (independent of quality) but firm 2 produces higher quality good s1 < s2 & set P below r(p1, p2 < r)

VERTICALLY product differentiation - Firm perspective (Part 2)

Equilibrium P only depend on quality differences:

→ Not only P of high quality firm increase with quality difference

BUT P of low quality firm also increases with quality difference (which = more surprising & due to assumption that all consumers buy in market)