L3

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

15 Terms

Book keeping

=accounting system where every financial transaction is recorded in at least two accounts:

1- Debit

2-Credit

Principles

1-every transaction has two entries

2-debits=credits

3-based on the accounting equation

4-debit & credit rules by account type

5-every transaction tells a story

6-balance accumulates over time

7-trial balance confirms accuracy

1-every transaction has two entries

one debit & one credit

2-Debits = credits

must match on each side to keep the books balanced

3-Based on the Accounting equation

Assets = Equity + Liabilities

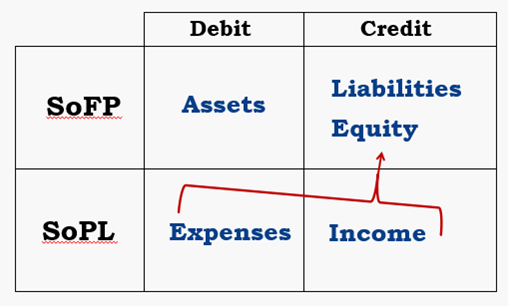

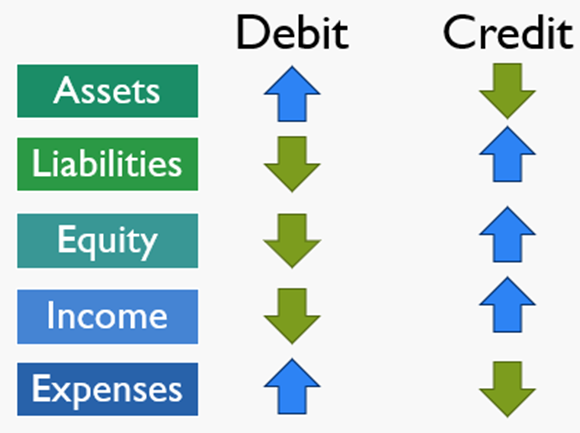

4-Debit & Credit rules by account type

DEAD CLIC

Debit: Expenses, Assets, Drawings

Credit: Liabilities, Income, Capital

5-Every transaction tells a story

What accounts effected, increase/decrease, debited/credited

6-Balances accumulate over time

Real accounts= assets, liabilities, equity accounts (balances carry forward) Nominal accounts= income, expense accounts (close to equity at year-end)

7-The trial balance confirms accuracy

if debits & credits recorded accurately, sum of both sides will agree

elements of financial statements & bookkeeping

Assets = Liabilities + Income – Expenses

A = L + OE

A = L + SC + RE + (I-E) – D

Key

Sc= shared capital

RE= retained earnings beginning

I= income

E= expenses

D= dividends paid

The Quadrant

every transaction must have opposite and equal impacts

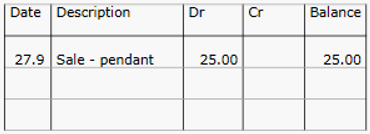

Accounting ledger

=book/collection of accounts to record financial transactions

set outs include: leger account, t account

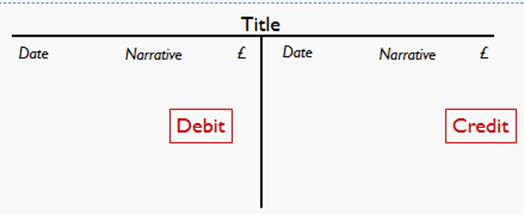

ledger account

example of setout

T account

example of setout

-simpler version of a ledger account