Oligopolies

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

Oligopoly - definition

An imperfectly competitive industry with a high level of market concentration

Examples of oligopolies

Airlines, broadband, banks, cinemas, fizzy drink, pharmaceuticals, car manufacturers

Concentration ratio - what is it

The combined market share of the leading 3-5 firms in a market

Generally what does the 5 firm concentration ratio need to be for an oligopoly?

>60%

5 firm concentration ratio of supermarket industry uk

75%

Tesco: 27%

Sainsburys: 15%

Asda: 14%

Aldi: 10%

Morrisons: 9%

Key characteristics of oligopolies

Few dominant firms

Interdependence

Relatively high barriers to entry

Non-price competition

Interdependence - what does this mean in oligopolies?

Each firm’s pricing and output decisions directly impact the profit of its rivals.

If one lowers prices, other may be forced to lower to compete. This creates a competitive and volatile market structure

Barriers to entry - examples

Economies of scale, vertical integration, brand loyalty, expertise/ reputation, patents, control of important platforms (eg aws)

Non-price competition - what is it in oligopolies

The use of other competitive strategies to gain an advantage over rivals, as price is less effective due to interdependence.

Types of product branding

Product brand - associated with particular products

Service brands - add perceived value to service

Umbrella brands - assigned to multiple products

Corporate brands - promoting the name of the business

Own label - when shops assign their name to branding

Global brand - household names across the world.

What’s the Hirfindhal-Hirschman Index?

An alternative and more accurate measure of market concentration

Price stickiness definition

If a firm lowers prices this will cause a price war and all parties lose profit

If a firm raises prices, others will keep theirs the same so that firm will lose customers

Therefore, pricing strategy generally remains constant

Why does the kinked demand curve arise?

As firms in oligopoly are more likely to match price decreases by a competitor than price increases

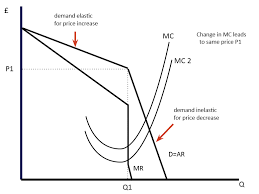

Kinked demand curve graphed

At high price rivals are assumed not to follow a price rise therefore PED is price elastic

However, rivals are assumed to follow a price fall therefore at lower prices demand is price inelastic

This shows how in oligopolies firms are likely to maintain their prices

What happens at the point where elasticities change?

This is the point of profit maximisation as MR equals MC at this equilibrium any change in price leads to a fall in total revenue

A shift in the MC curve does not necessarily lead to a change in price.

Collusion definition

When two or more firms work together to set prices or output levels at the expense of consumers and the market

What’s explicit collusion

Formal agreements

What’s tacit collision?

This is subtle collusion, for instance when firms follow the actions of rivals and act accordingly

Is collusion legal?

No, in the UK and many countries it is illegal

How is corporation different to collusion?

This is when firms work together to achieve mutual benefits in a way that does not harm consumers like industry standards

Key example of collusion

OPEC – oil producing and exporting countries they artificially restrict supply to ensure a higher price for oil

What are the two conditions that make collusion more likely?

small number of supplies producing a homogenous product

High barriers to entry and established firms have similar objectives of profit maximisation

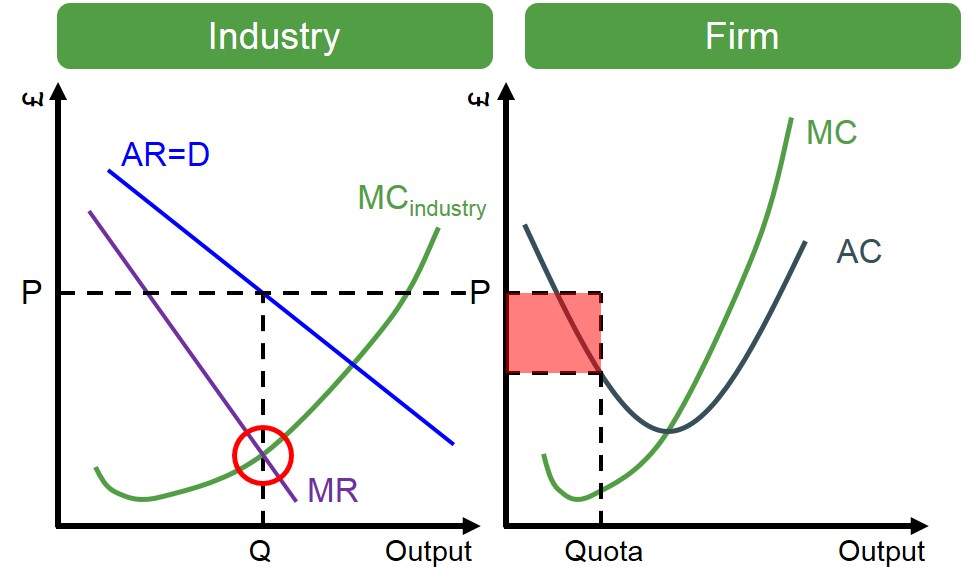

Collusion – graph for market and firm.

The cartel output is lower than that of market equilibrium which is where MC equals AR

For firms this leads super normal profits at the output quota

What is a quota in collusion?

An agreed upon output for firms

Why do cartels often fall apart?

Although the cartel is maximising profit each individual firm could increase their own profits by expanding output and undercutting the cartel price by small margin so members cheat their quotas