Institutions Ch 8 (Done)

1/96

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

97 Terms

Corporate stock

_________________ serves as a source of financing for firms, in addition to debt financing or retained earnings financing

Secondary stock markets

______________________ are the most closely watched and reported of all financial security markets

Stockholders are the legal owners of a corporation

Have a right to share in the firm’s profits (through dividends) after the payment of interest to bond holders and taxes

Have a residual claim on the firm’s assets

Have limited liability

Have voting rights (e.g., to elect board of directors)

Two types of corporate stock exist:

Common stock

Preferred stock

preferred stock

All public corporations issue common stock, but few issue ______________

Common stock is the fundamental ownership claim in a public or private corporation, and many characteristics differentiate it from other types of securities:

Discretionary dividend payments

Residual claim status

Limited liability

Voting rights

Common stock

______________ is the fundamental ownership claim in a public or private corporation, and many characteristics differentiate it from other types of securities:

Dividends are discretionary, and are thus not guaranteed

Payment and size of dividends are determined by the board of directors of the issuing firm

Dividends are taxed twice – once at the firm level and once at the personal level

May partially avoid this double taxation effect by holding stocks in growth firms that reinvest most of their earnings to finance growth rather than paying larger dividends

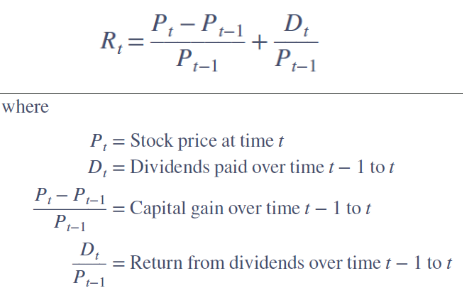

The return to a stockholder over a period t-1:

residual claim

Common stockholders have the lowest priority claim in the event of bankruptcy (i.e., they have a ____________)

Only after all senior claims are paid are common stockholders entitled to what assets of the firm are left

Senior claims may be payments owed to creditors such as the firm’s employees, bond holders, the government (taxes), and preferred stockholders

riskier than bonds

Residual claim feature associated with common stock makes it __________________ as an investible asset

Limited liability implies that common stockholder losses are limited to the amount of their original investment in the firm if the company’s asset value falls to less than the value of the debt it owes

In contrast, sole proprietorship or partnership stock interests mean the stockholders may be liable for the firm’s debts out of their total private wealth holdings if the company experiences financial difficulties

Limited liability

_________________ implies that common stockholder losses are limited to the amount of their original investment in the firm if the company’s asset value falls to less than the value of the debt it owes

voting rights

Common stockholders control the firm’s activities indirectly by exercising their ______________ in the election of the board of directors

vote per share

Typical voting rights arrangement is to assign one ___________ of common stock

dual-class firms

Some firms are organized as ________________, where two classes of common stock are outstanding, with different voting and/or dividend rights for each class

Two methods of electing a board are generally used:

Cumulative voting

Straight voting

Most shareholders do not attend annual meetings

A proxy is a voting ballot sent by a corporation to its stockholders

When returned to the issuing firm, a proxy allows stockholders to vote by absentee ballot or authorizes representatives of the stockholders to vote on their behalf

By the 2010s, virtually all U.S. firms were putting proxy statements online and allowing votes to be cast via the Internet

Preferred stock

_______________ is a hybrid security that has characteristics of both bonds and common stock

Preferred stock is a hybrid security that has characteristics of both bonds and common stock

Similar to common stock in that it represents an ownership interest in the issuing firm, but like a bond it pays a fixed periodic (dividend) payment

fixed (paid quarterly)

Dividends are generally _______________

may be converted to common stock

Preferred stockholders generally do not have voting rights in the firm, but most stock ____________________________ at any time the investor chooses

nonparticipating and cumulative

Typically, preferred stock is ___________________________

Nonparticipating preferred stock

______________________________ means the dividend is fixed regardless of any increase of decrease in the issuing firm’s profits, while participating preferred stock means actual dividends paid in any year may be greater than promised dividends

Cumulative preferred stock

_________________________ means that any missed dividend payments go into arrears and must be made up before any common stock dividends can be paid, while dividends of noncumulative preferred stocks do not go into arrears and are never paid

Primary stock markets

__________________________ are markets in which corporations raise funds through new issues of stocks

Primary stock markets are markets in which corporations raise funds through new issues of stocks

Most primary market transactions go through investment banks

Investment bank can conduct a primary sale using either a firm commitment or best efforts underwriting basis

In firm commitment underwriting, the investment bank guarantees the corporation a price for the newly issued securities

Best efforts underwriting occurs when the underwriter does not guarantee a price to the issuer

syndicate

A ____________ is a group of investment banks working in concert to sell and distribute a new issue; the lead banks in the ____________ is the originating house

Primary Market Stock Transaction

initial public offering (IPO)

An ________________________ is the first public issue of a financial instrument by a firm

seasoned offering

A __________________ is the sale of additional securities by a firm whose securities are currently publicly traded

Preemptive rights give existing stockholders the ability to maintain their proportional ownership

Preemptive rights

____________________ give existing stockholders the ability to maintain their proportional ownership

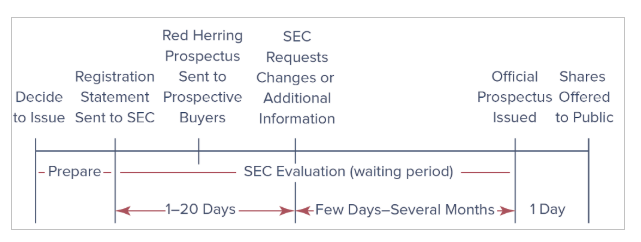

Registration of a stock can be a lengthy process

A red herring prospectus is a preliminary version of the prospectus that describes a new security issue

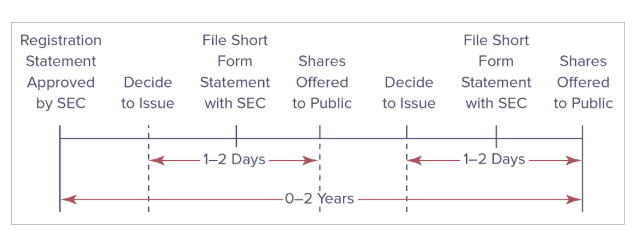

Shelf registration allows firms that plan to offer multiple issues of stock over a two-year period to submit one registration statement (i.e., master registration statement)

red herring prospectus

A _______________________ is a preliminary version of the prospectus that describes a new security issue

Shelf registration

___________________ allows firms that plan to offer multiple issues of stock over a two-year period to submit one registration statement (i.e., master registration statement)

Getting Shares of Stock to the Investing Public

Getting Shelf Registrations to the Investing Public

Secondary stock markets

_______________________ are the markets in which stocks, once issued, are traded by investors

Secondary stock markets are the markets in which stocks, once issued, are traded by investors

In secondary market transactions, funds are exchanged, usually with the help of a securities broker or firm acting as an intermediary between the buyer and seller of the stock

Original issuer of the stock is not involved in this transfer of stocks or funds

Two major U.S. stock markets are the following:

New York Stock Exchange Euronext (NYSE Euronext)

National Association of Securities Dealers Automated Quotation (NASDAQ) system

Worldwide, the NYSE Euronext is the most well known of all the organized exchanges

Exchange was created by the merger of the NYSE Group, Inc. and Euronext N.V. on April 4, 2007

World leader for listings, trading in cash equities, equity and interest rate derivatives, bonds, and the distribution of market data

First to create a truly global stock market

trading post | a specialist

All transactions occurring on the NYSE occur at a specific place on the floor of the exchange (__________), and each stock is assigned a special market maker (____________)

All transactions occurring on the NYSE occur at a specific place on the floor of the exchange (trading post), and each stock is assigned a special market maker (a specialist)

Specialists often organize themselves as firms due to large amount of capital needed to serve the market-making function

Three types of transactions can occur at a given post:

Brokers trade on behalf of customers at the “market” price (market order)

Limit orders are left with a specialist to be executed

Specialists transaction for their own account

Majority of orders sent to brokers are of two types:

A market order is an order to transact at the best price available when the order reaches the post

A limit order is an order to transact at a specified price

market order

A ____________ is an order to transact at the best price available when the order reaches the post

limit order

A _____________ is an order to transact at a specified price

Program trading is the simultaneous buying and selling of a portfolio of at least 15 different stocks valued at more than $1m, using computer programs to initiate the trades

Criticized for impact on stock market prices and increased volatility

NYSE introduced circuit breakers, which served as trading curbs, to account for increased volatility

Circuit breakers are an imposed halt in trading that gives buyers and sellers time to assimilate incoming information

Limit up-limit down (LULD) rules halts trading on individual stocks if the stock price moves outside the following price band:

Price Band Formula

Circuit-Breaker Levels

Flash trading

______________ is a practice in which, for a fee, traders are allowed to see incoming buy or sell orders milliseconds earlier than general market traders

Naked access

______________ allows some traders to rapidly buy and sell stocks directly on exchanges using a broker’s computer code without exchanges or regulators always knowing who is making the trades

SEC banned naked access trading in late 2010

Dark pools of liquidity

_______________________ are trading networks that provide liquidity but that do not display trades on order books

In 2013, the SEC approved a plan for new rules requiring dark pools to disclose and detail trading activity on their platforms

Securities not sold on one of the organized exchanges are traded over the counter (OTC)

OTC markets do not have a physical trading floor; rather, transactions are completed via an electronic market

NASDAQ was the world’s first electronic stock market

Primarily a dealer market, where dealers are the market makers who stand ready to buy or sell particular securities

In contrast to the NYSE, NASDAQ is a negotiated market (e.g., quotes from several dealers are usually obtained before a transaction is made)

Small Order Execution System (SOES) provides automatic order execution for individual traders with orders of less than or equal to 1,000 shares

Firms listed with the NYSE Euronext must meet the listing requirements of the exchange

Requirements are extensive

Reasons a NYSE listing is attractive to a firm:

Improved marketability of the firm’s stock

Publicity for the firm

Improved access to the financial markets

Firms that do not meet the requirements of the NYSE Euronext exchange listings trade on the NASDAQ

Most NASDAQ firms are smaller, of regional interest, or unable to meet the listing requirements of the organized exchanges

Over time, many NASDAQ firms apply for NYSE listing

Major stock markets currently open at 9:30 am eastern time and close at 4:00 pm eastern time

Extended-hours trading involves any securities transaction that occurs outside these regular trading hours

Most extended-hours trading is processed through computerized alternative trading systems (ATSs), also known as electronic communication networks (ECNs) such as NYSE Arca or Instinet

computerized systems that automatically match orders

ECNs are ________________________________________ between buyers and sellers and serve as an alternative to traditional market making and floor trading

A stock market index is the composite value of a group of secondary market-traded stocks

Dow Jones Industrial Average (DJIA) is the most widely reported stock market index and includes the values of 30 large corporations selected by the editors of The Wall Street Journal

Dow indexes are price-weighted averages

NYSE Composite Index includes all NYSE-listed common stocks

NYSE is a value-weighted index

S&P 500 Index consists of the stocks of the top 500 of the largest U.S. corporations listed on the NYSE and the NASDAQ

NASDAQ Composite Index consist of stocks traded through NASDAQ that are industrials, banks, and insurance companies

Dow Jones Industrial Average (DJIA) is the most widely reported stock market index and includes the values of 30 large corporations selected by the editors of The Wall Street Journal

Dow indexes are price-weighted averages

NYSE Composite Index includes all NYSE-listed common stocks

NYSE is a value-weighted index

NYSE and the NASDAQ

S&P 500 Index consists of the stocks of the top 500 of the largest U.S. corporations listed on the ____________________

industrials, banks, and insurance companies

NASDAQ Composite Index consist of stocks traded through NASDAQ that are _____________________________________

Wilshire 5000 Index

_________________ is the broadest stock market index and possibly the most accurate reflection of the overall stock markets

Wilshire 5000 Index contains virtually every stock that meets three criteria:

Firm is headquartered in the U.S.

Stock is actively traded in a U.S.-based stock market

Stock has widely available price information (which rules out the smaller OTC stocks from inclusion)

delistings, privatizations, and acquisitions

Though the index started with 5,000 firms, because of firm ___________________________________ it currently includes just 3,618 stocks

wilshire 5000 Index weighted

Value-weighted index

Holders of corporate stock from 1994 through 2021:

Households are the single largest holders (41.5% in 2021)

Mutual funds and foreign investors are also prominent holders (20.2% and 17.5%, respectively)

Households indirectly invest in corporate stock through investments in mutual funds and pension funds

Together, these holdings totaled approximately 79% in 2021

As unemployment rate decreased from 2016 through 2022, except for a sharp uptick during the Covid-19 crisis, stock ownership is starting to pick up slightly

Stock market indexes might be used to forecast future economic activity

An increase (decrease) in stock market indexes today potentially signals the market’s expectation of higher (lower) corporate dividends and profits and, in turn, higher (lower) economic growth

10 variables included in the index

Stock prices are one of the ___________________________ of leading economic indicators used by the Federal Reserve as it formulates economic policy

Market efficiency

__________________ refers to the speed with which financial security prices reflect unexpected news

Weak form market efficiency concludes that investors cannot make more than the fair (required) return using information based on historic price movements

Empirical research suggests markets are weak form efficient

According to semistrong form market efficiency, investors cannot make more than the fair (required) return by trading on public news releases

Financial markets have generally been found to immediately reflect information from news announcements

Strong form market efficiency states that stock prices fully reflect all information about the firm, both public and private

Implies that there is no set of information that allows investors to make more than the fair (required) rate of return on a stock

full and fair disclosure of information on securities issues

Main emphasis of SEC regulation is on __________________________________

Securities Act of 1933

________________________ required listed companies to file a registration statement and to issue a prospectus

Securities Exchange Act of 1934

___________________________ established the SEC as the main administrative agency responsible for the oversight of secondary stock markets

Sarbanes-Oxley Act

___________________, passed in July 2002, created an independent auditing oversight board under the SEC, increased penalties for corporate wrongdoers, forced faster and more extensive financial disclosure, and created avenues of recourse for aggrieved shareholders

SEC has delegated certain regulatory responsibilities to the markets (e.g., NYSE or NASDAQ)

In these matters, the NYSE and NASDAQ are self-regulatory organizations

Financial Industry Regulatory Authority (FINRA) is the largest independent regulatory for all securities firms doing business in the U.S.

Formed in July 2007

Oversees all aspects of the securities business

Wall Street Reform and Consumer Protection Act of 2010

_______________________________________________ gave the SEC and other regulators new powers to oversee the operations of stock markets

U.S. stock markets are the world’s largest

European markets grew in importance during the 2000s, as a result of implementing the euro, a common currency, in 2002

some risk can be eliminated

International stock markets are attractive to investors because ________________________ by holding stocks issued by corporations in foreign countries

International diversification can also introduce risk in the following manners:

Information about foreign stocks is less complete and timely than that for U.S. stocks

Foreign exchange risk

Political (sovereign risk)

Investment approach that considers environmental, social and governance (ESG) factors in portfolio selection and management

Community investment segment finances projects or institutions that serve poor and underserved communities

Sustainable investing spans a wide range of products and asset classes

Sustainable investors comprised of individuals, and institutions, such as universities, foundations, pension funds, nonprofits, and religious institutions

An ADR is a certificate that represents ownership of a foreign stock

Typically created by a U.S. bank, which buys stock in foreign corporations in their domestic currencies and places them with a custodian. The bank then issues dollar ADRs backed by the shares of the foreign stock

Three main types of ADR issuances

Level 1 ADRs are the most common and most basic of the ADRs

Have the least amount of regulatory requirements

Level 2 ADRs can be listed on the major stock exchanges, but they have more regulatory requirements than Level 1 ADRs

Level 3 ADRs represent the most respected ADR level a foreign company can achieve in the U.S. markets

Level 1 ADRs

______________ are the most common and most basic of the ADRs

Have the least amount of regulatory requirements

Level 2 ADRs

_______________ can be listed on the major stock exchanges, but they have more regulatory requirements than Level 1 ADRs

Level 3 ADRs

_______________ represent the most respected ADR level a foreign company can achieve in the U.S. markets