Financial Accounting Ch. 2

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

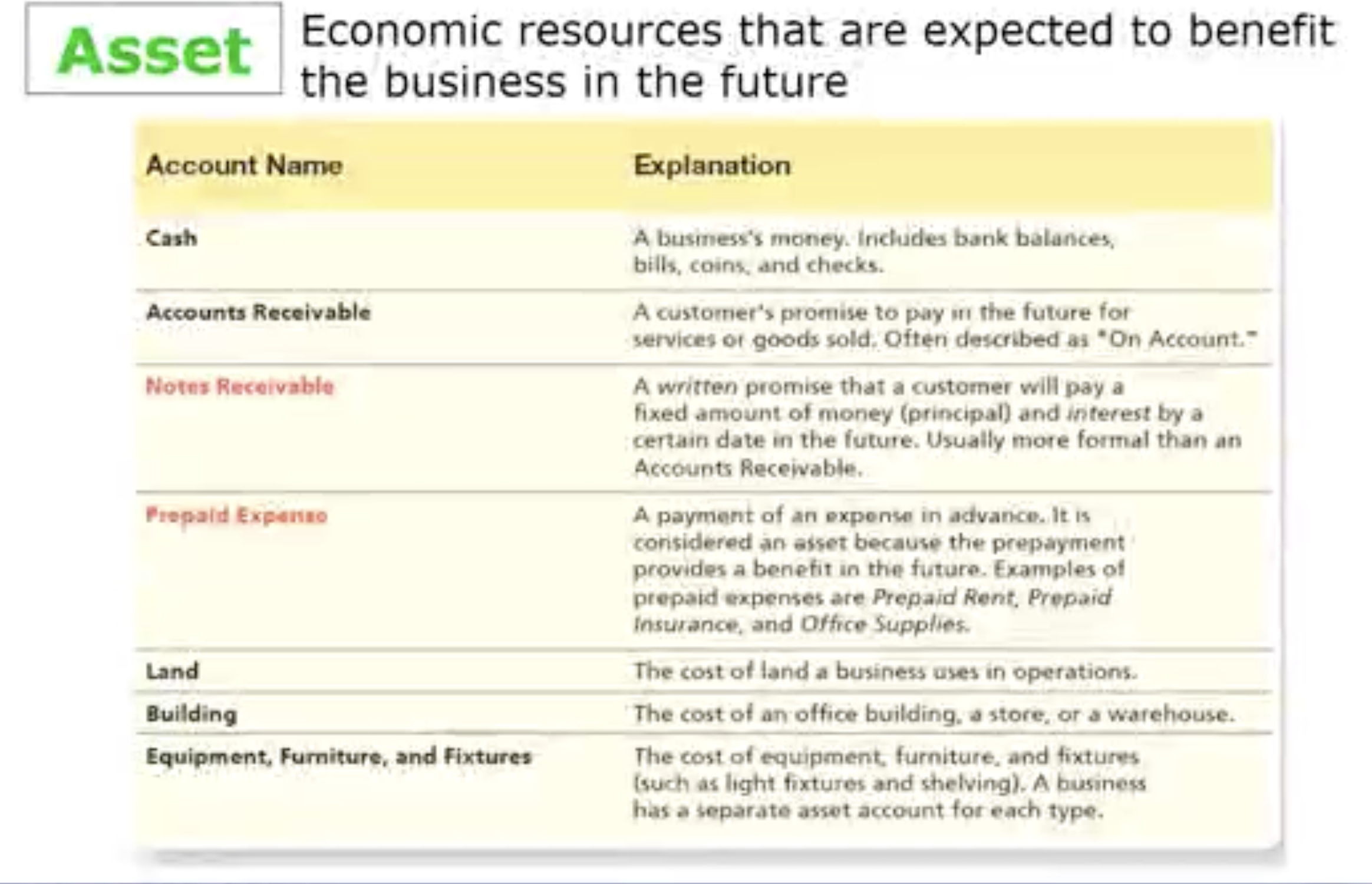

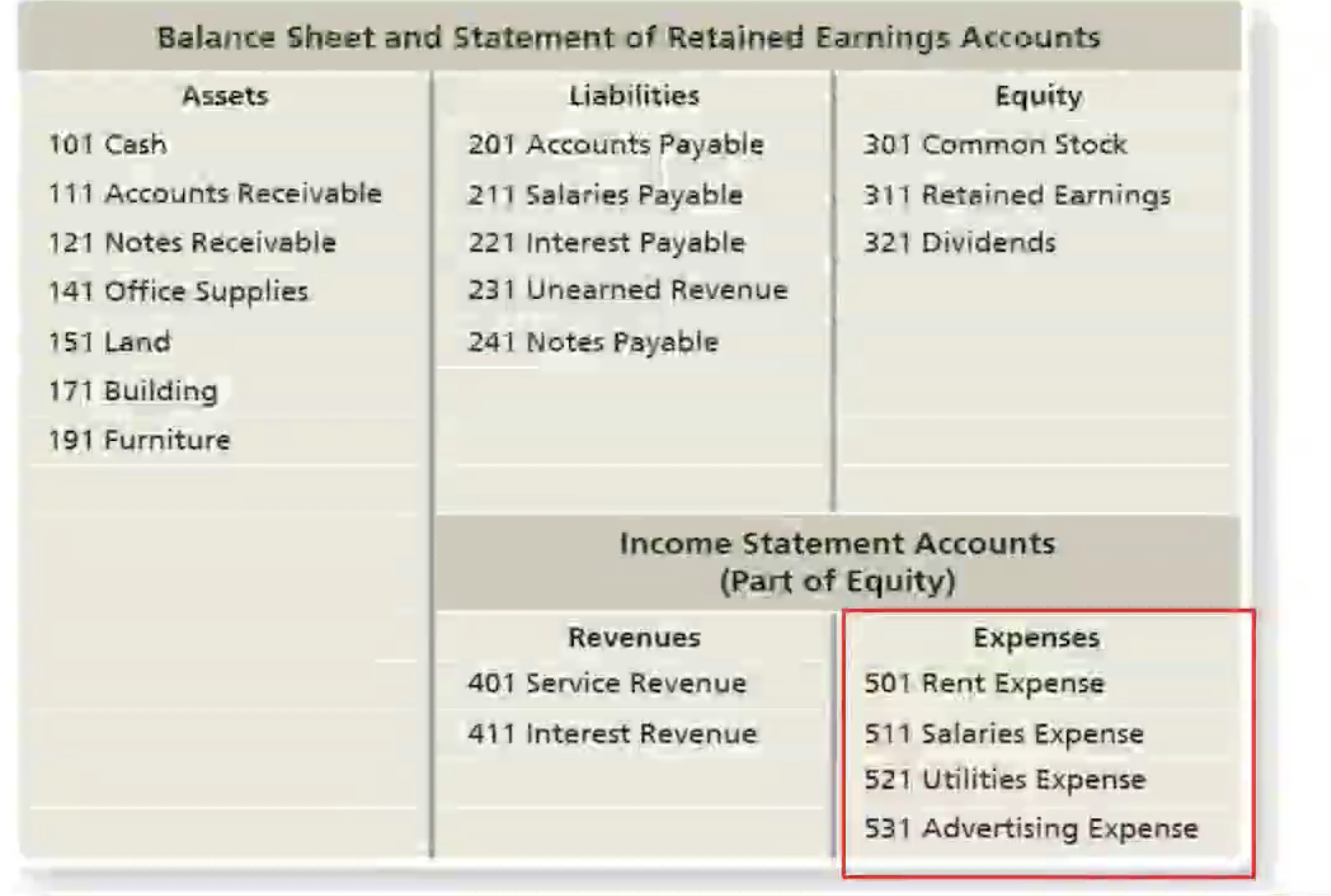

What is an Account: Asset

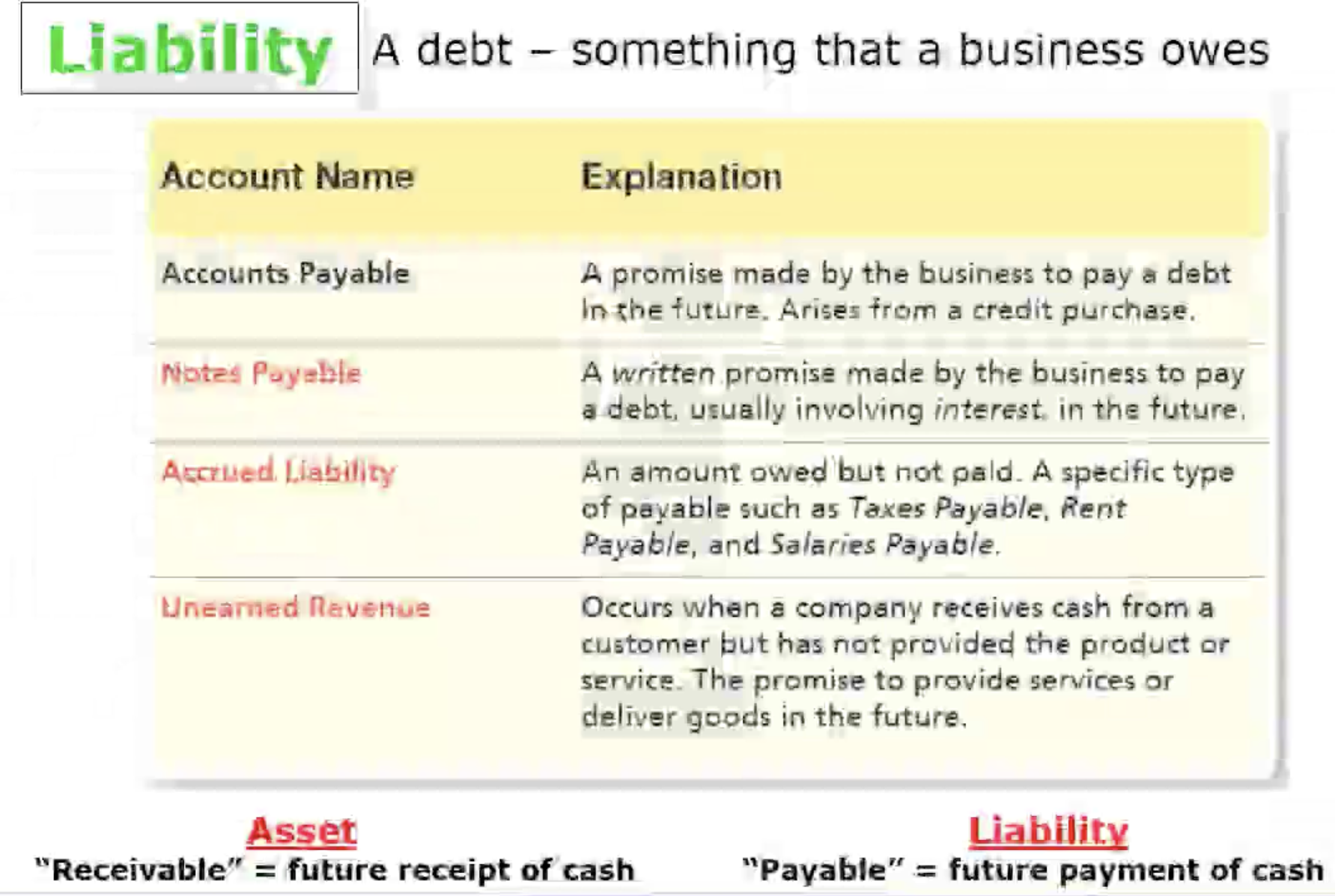

What is an Account: Liability

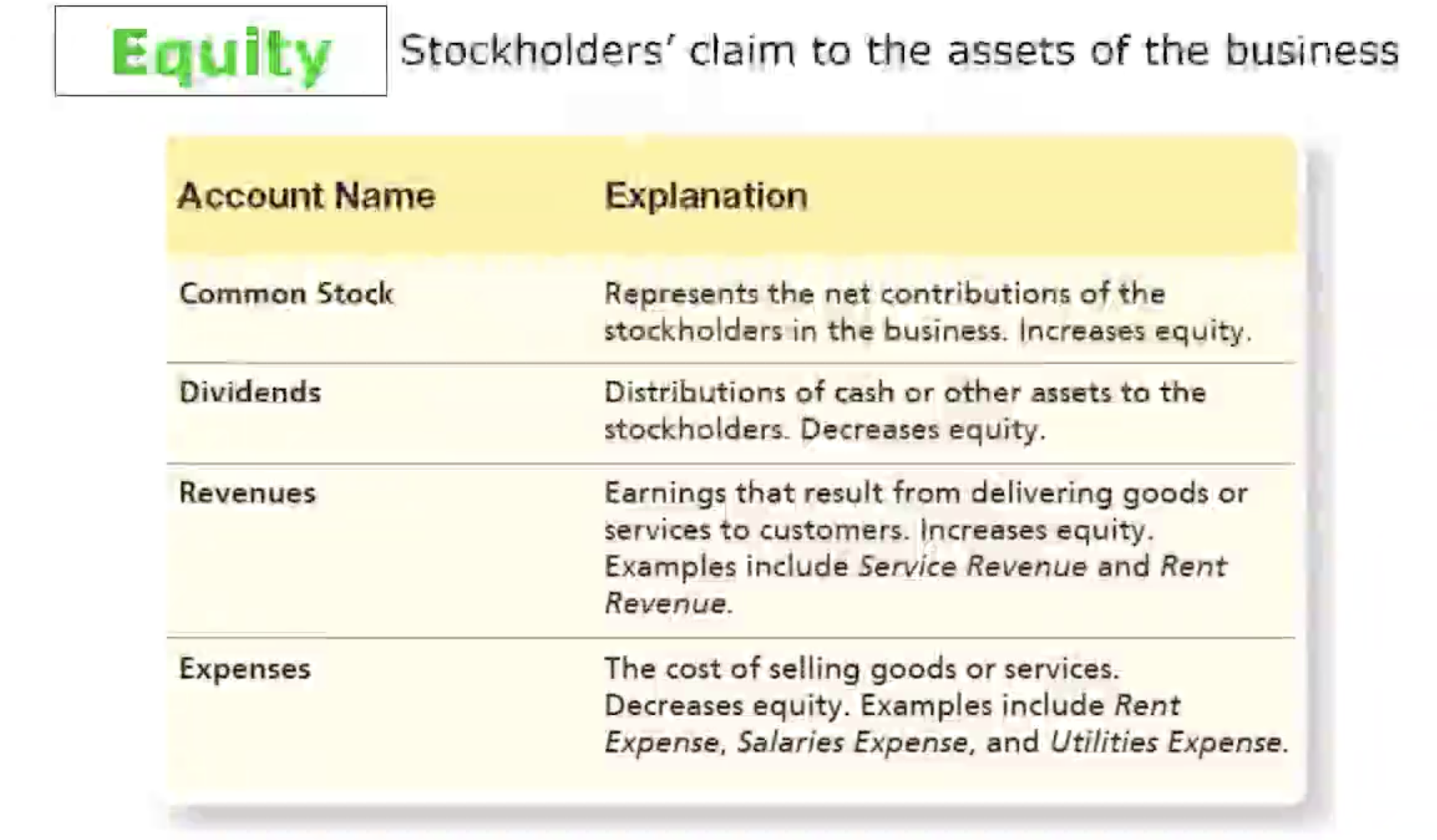

What is an Account: Equity

What is an Account: How do you Organize the accounts: Charts of Accounts

Lists all company accounts along with their account numbers.

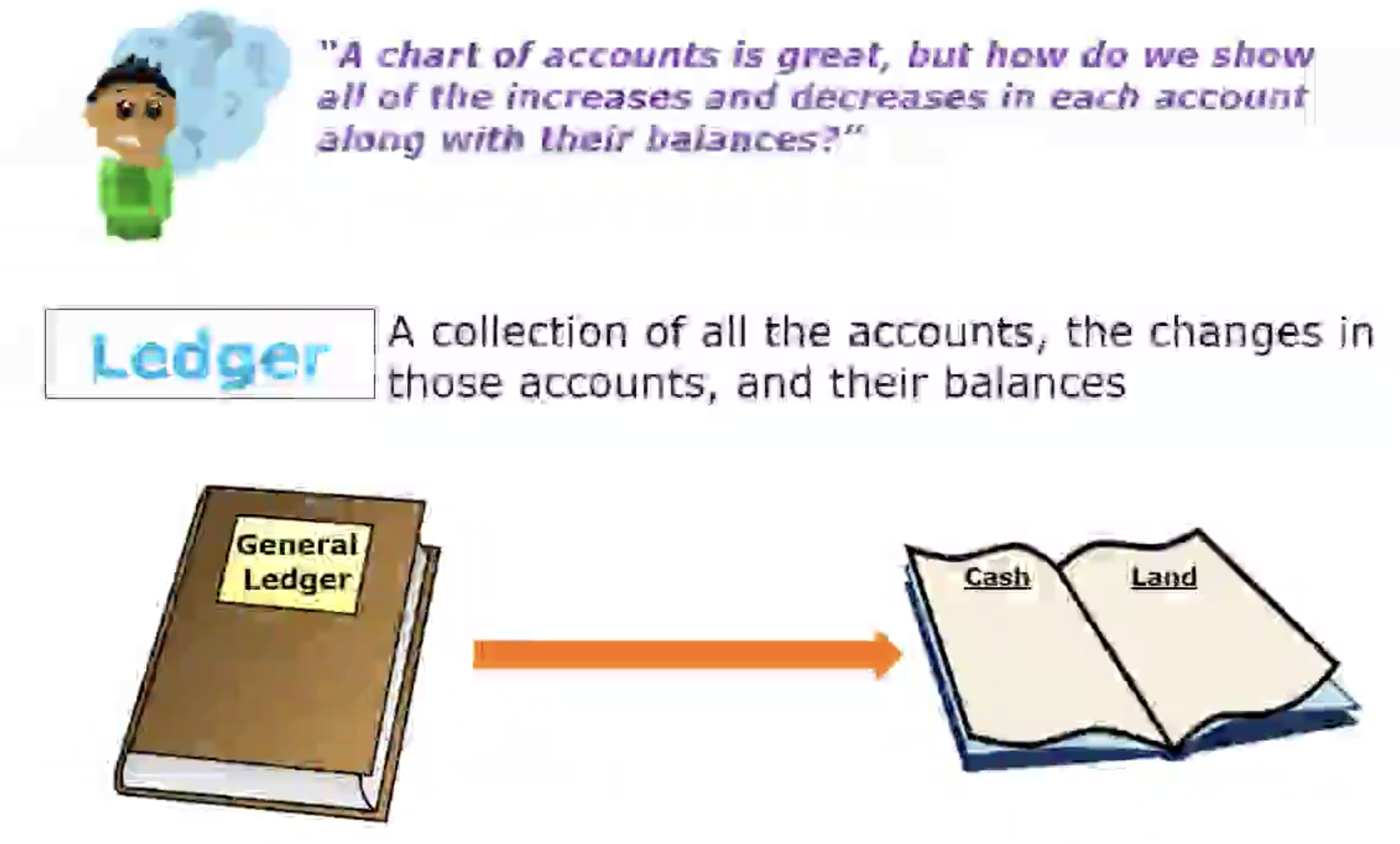

What is an Account: Ledger

What is Double- Entry Accounting:

A system of accounting in which every transaction affects at least two accounts.

What is Double- Entry Accounting: T- account

A summary device that is shaped like a capital “T” withe debits posted on the left side and credits posted on the right side.

What is Double- Entry Accounting: Debit & Credit

Does not mean “increase” or “decrease”

Does not mean “good” or “bad”

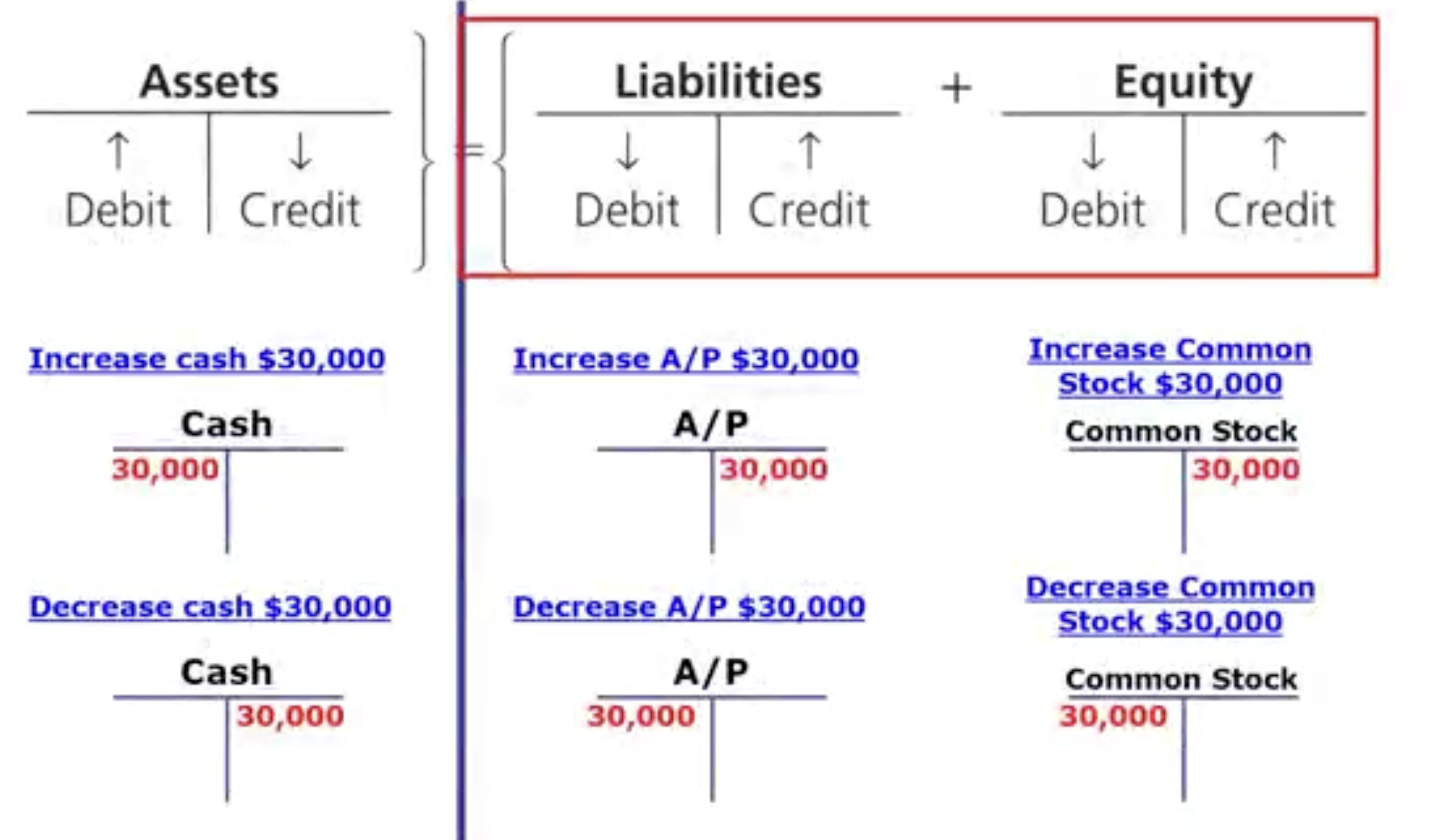

What is Double- Entry Accounting: Assets= Liab. + Equity for DR & CR.

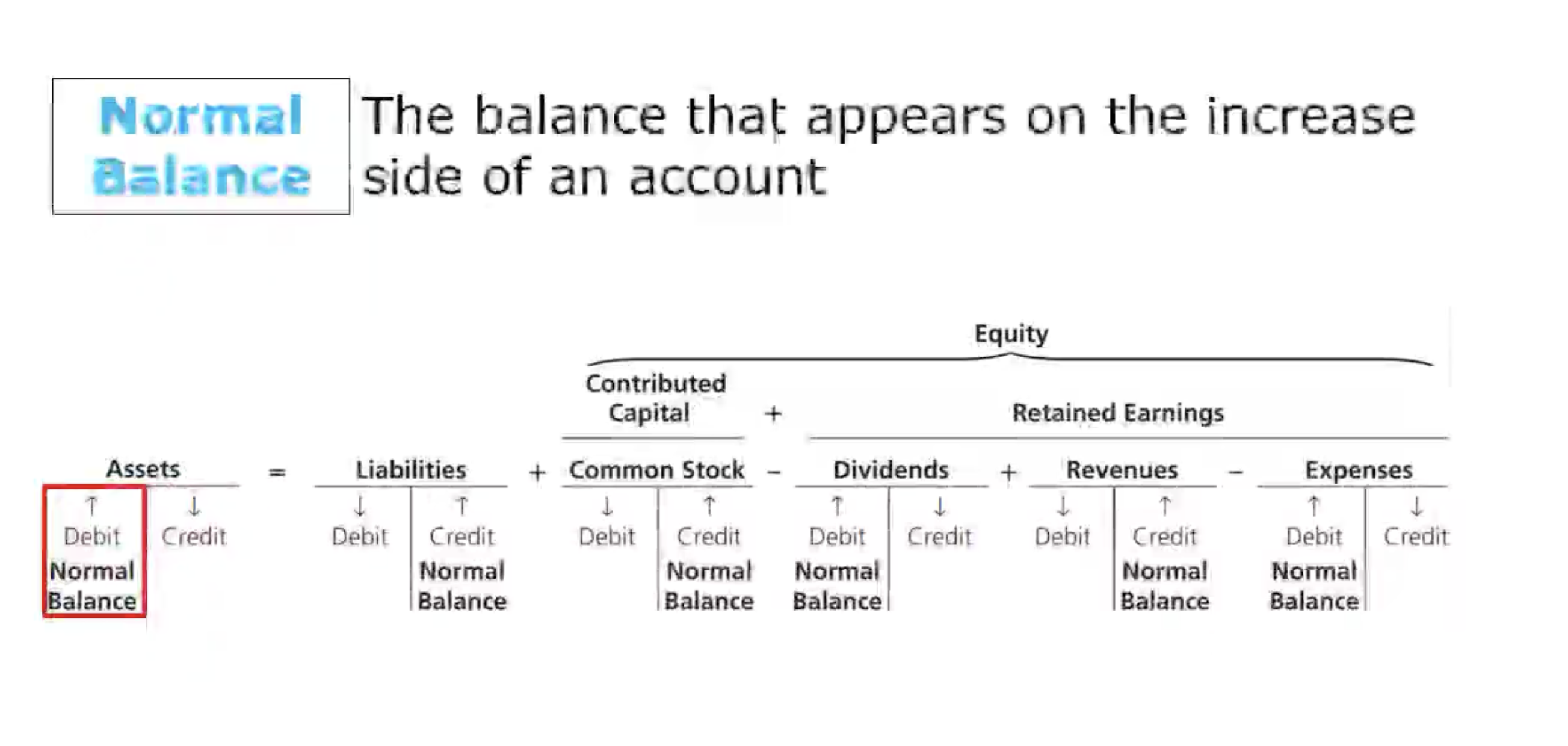

What is Double- Entry Accounting: Normal Balance

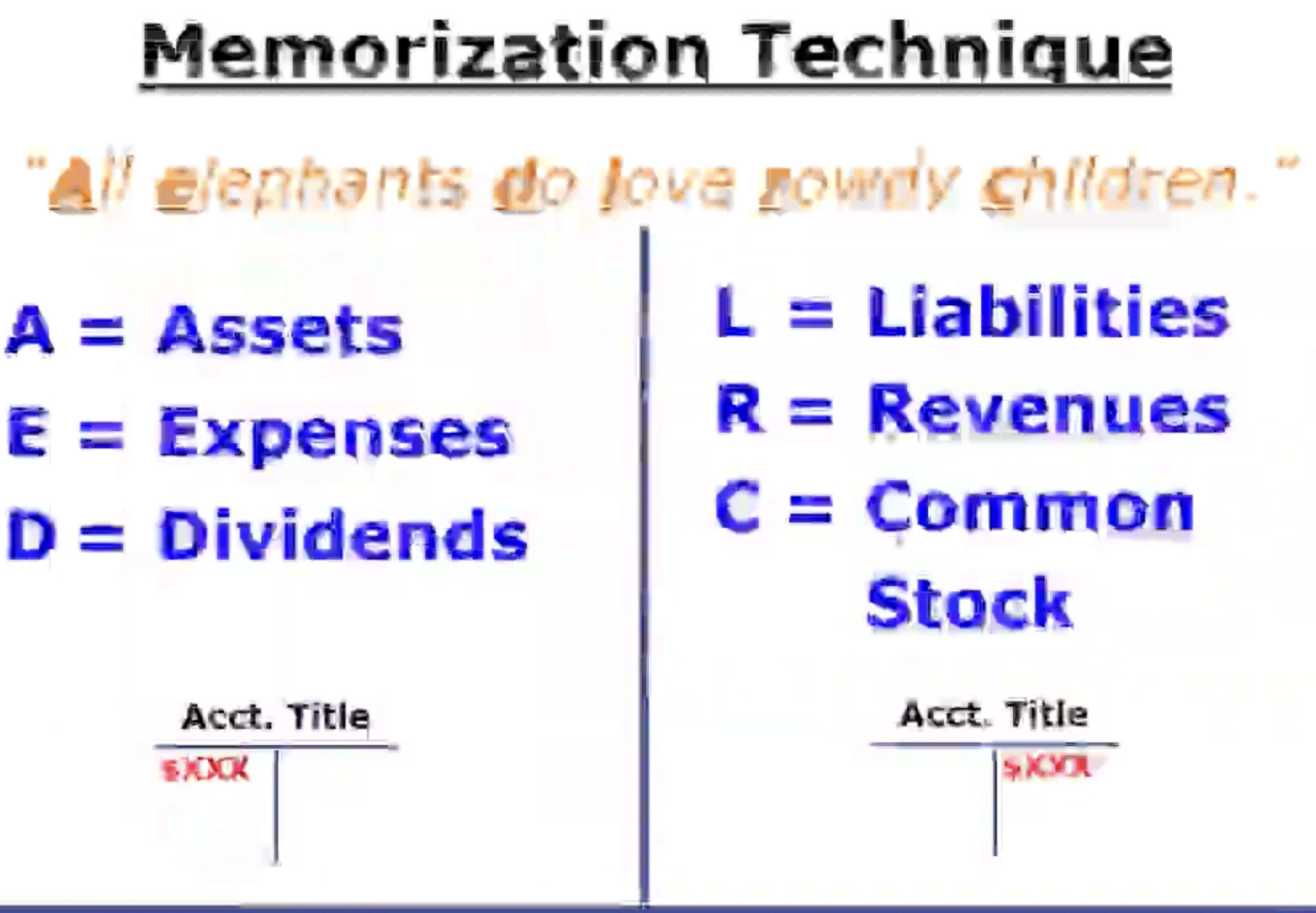

What is Double- Entry Accounting: memorization

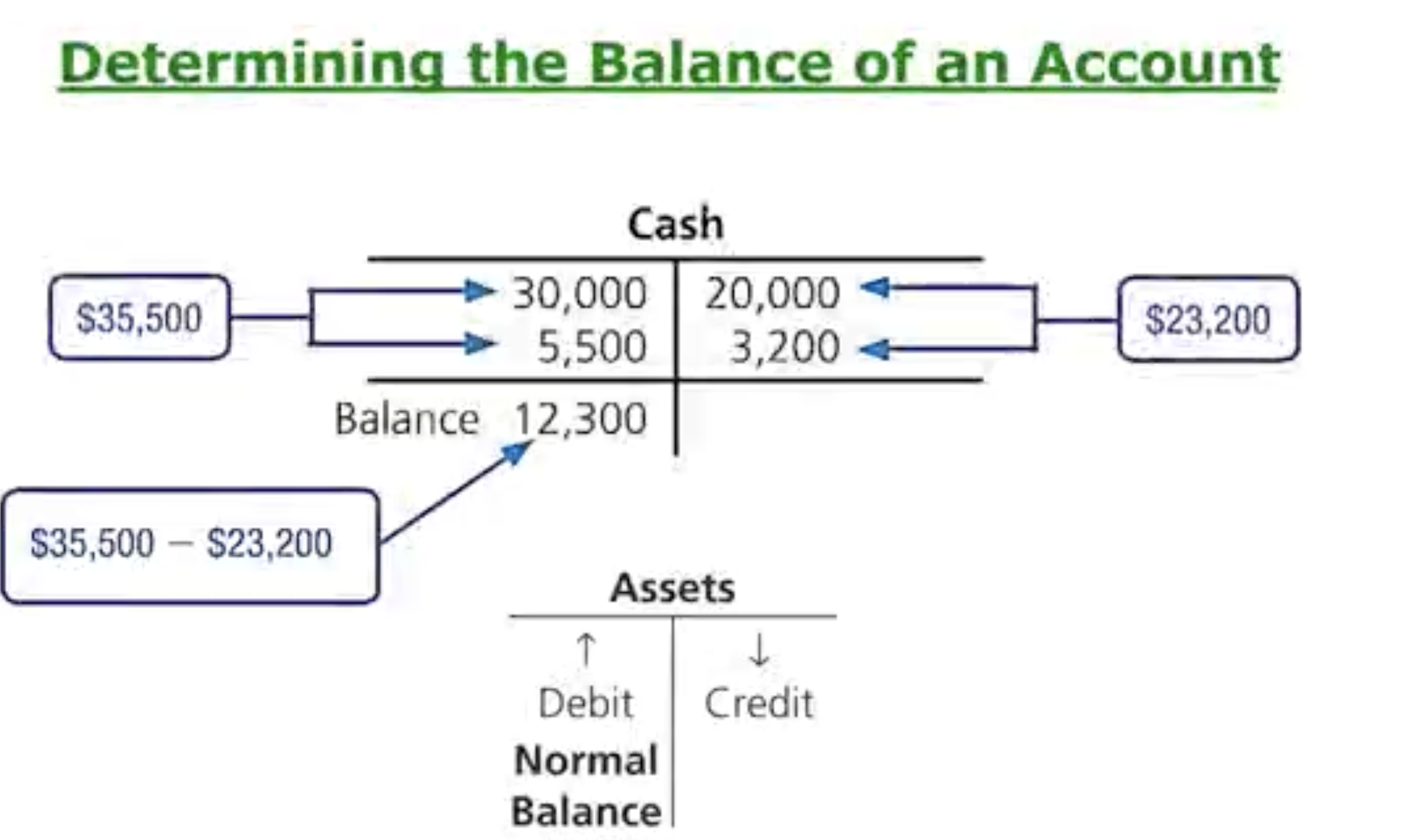

What is Double-Entry Accounting: Determine the Balance of An Account

Whichever side is greater, DR or CR, is where you put the total balance.

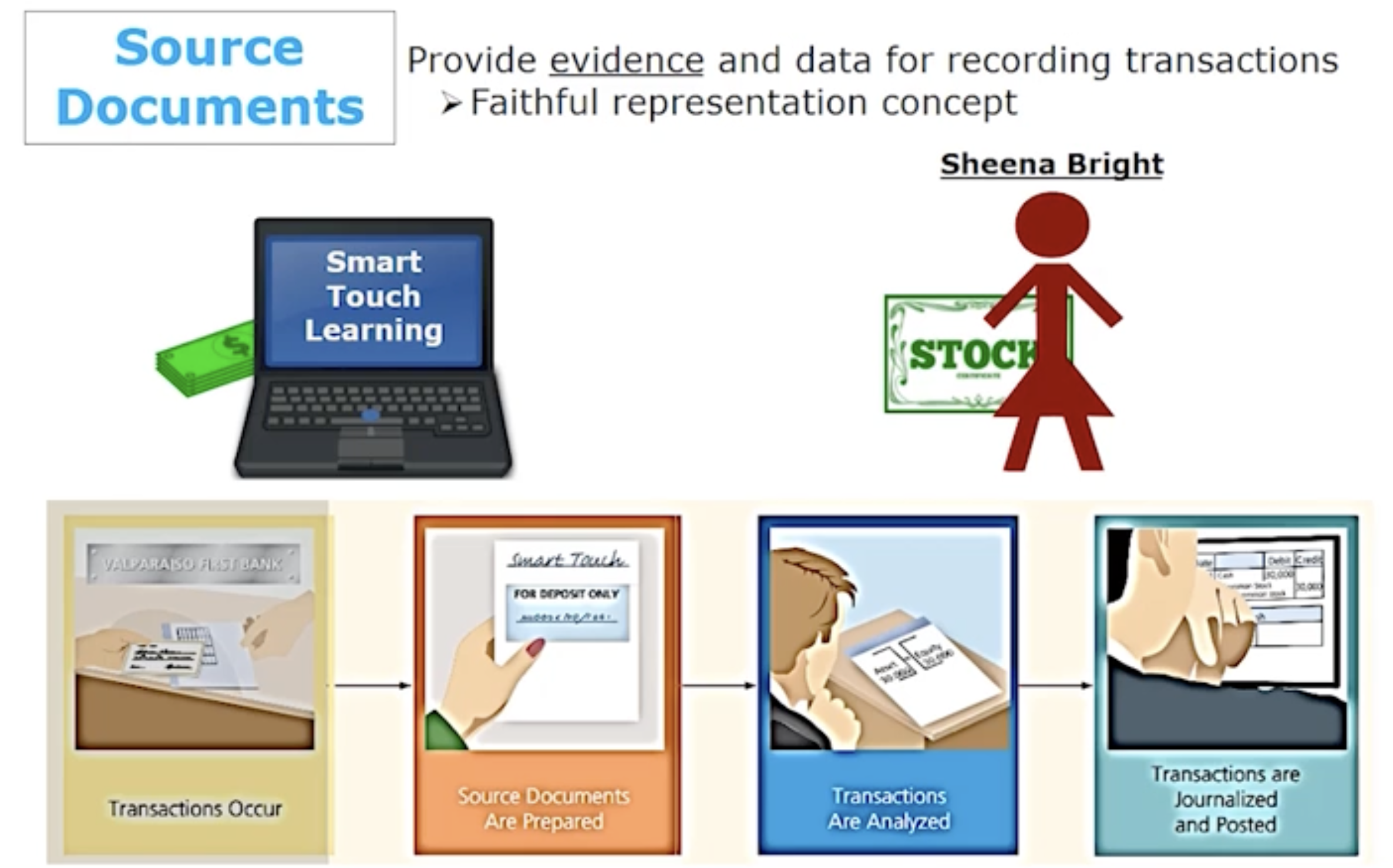

How do you Record Transactions: Source Documents

Provide evidence and data for recording transactions

Faithful representation concept

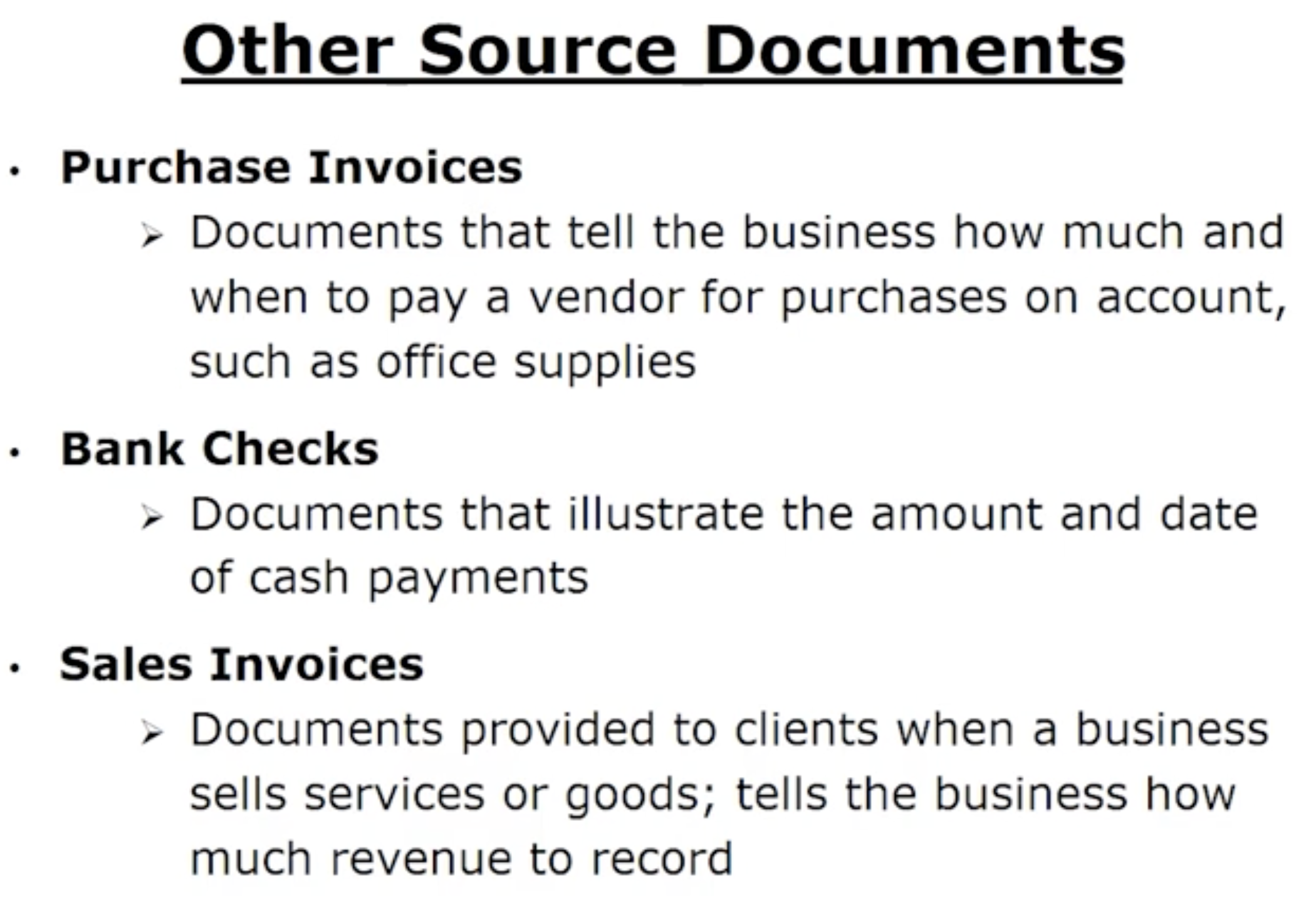

How do you Record Transactions: Other Source Documents

How do you Record Transactions: Journal

Record of transactions in date order

How do you Record Transactions: Posting

Transferring data from Journal to the ledger

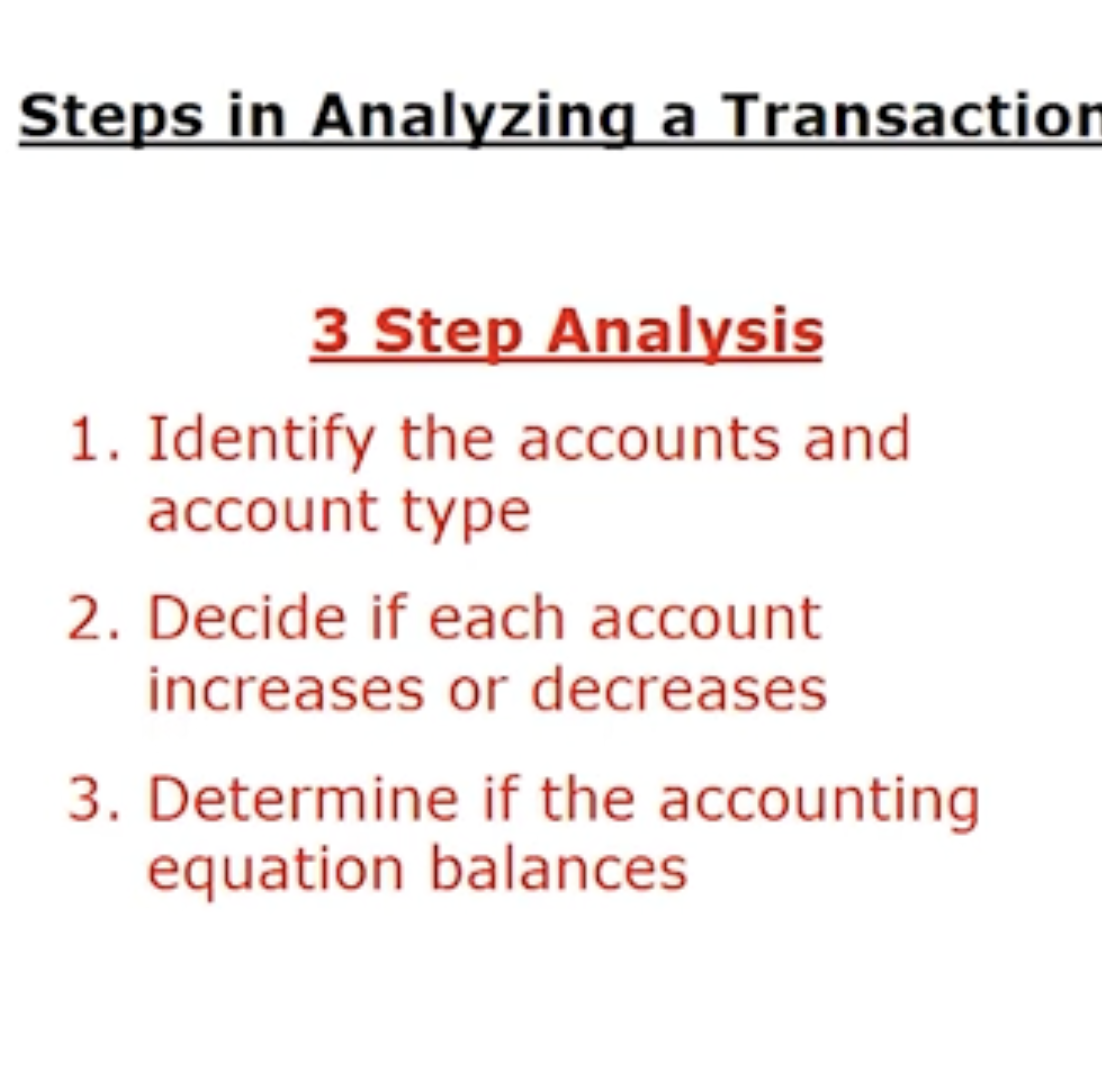

How do you Record Transactions: Steps in Analyzing a Transaction

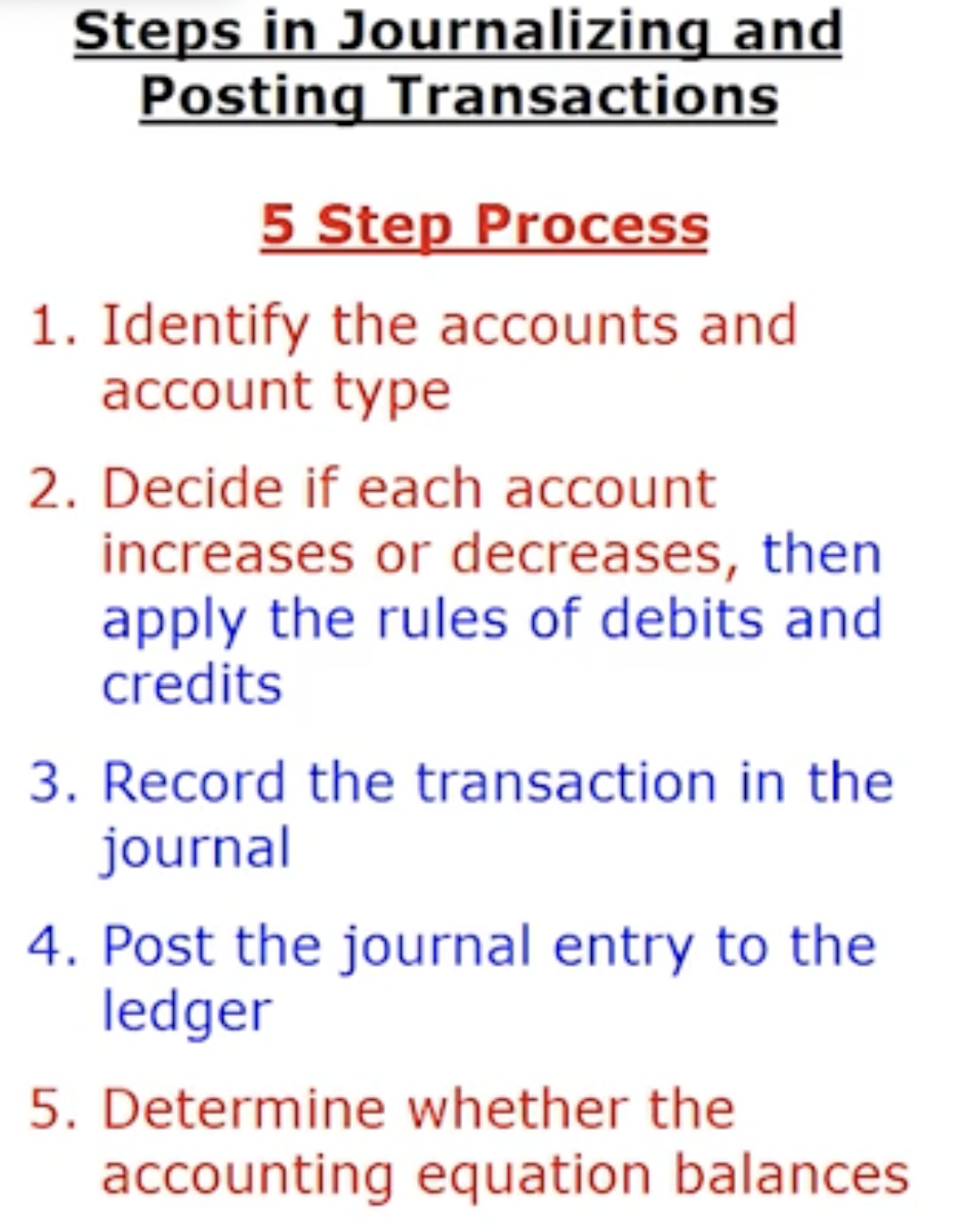

How do you Record Transactions: Steps in Journalizing and Posting Transactions

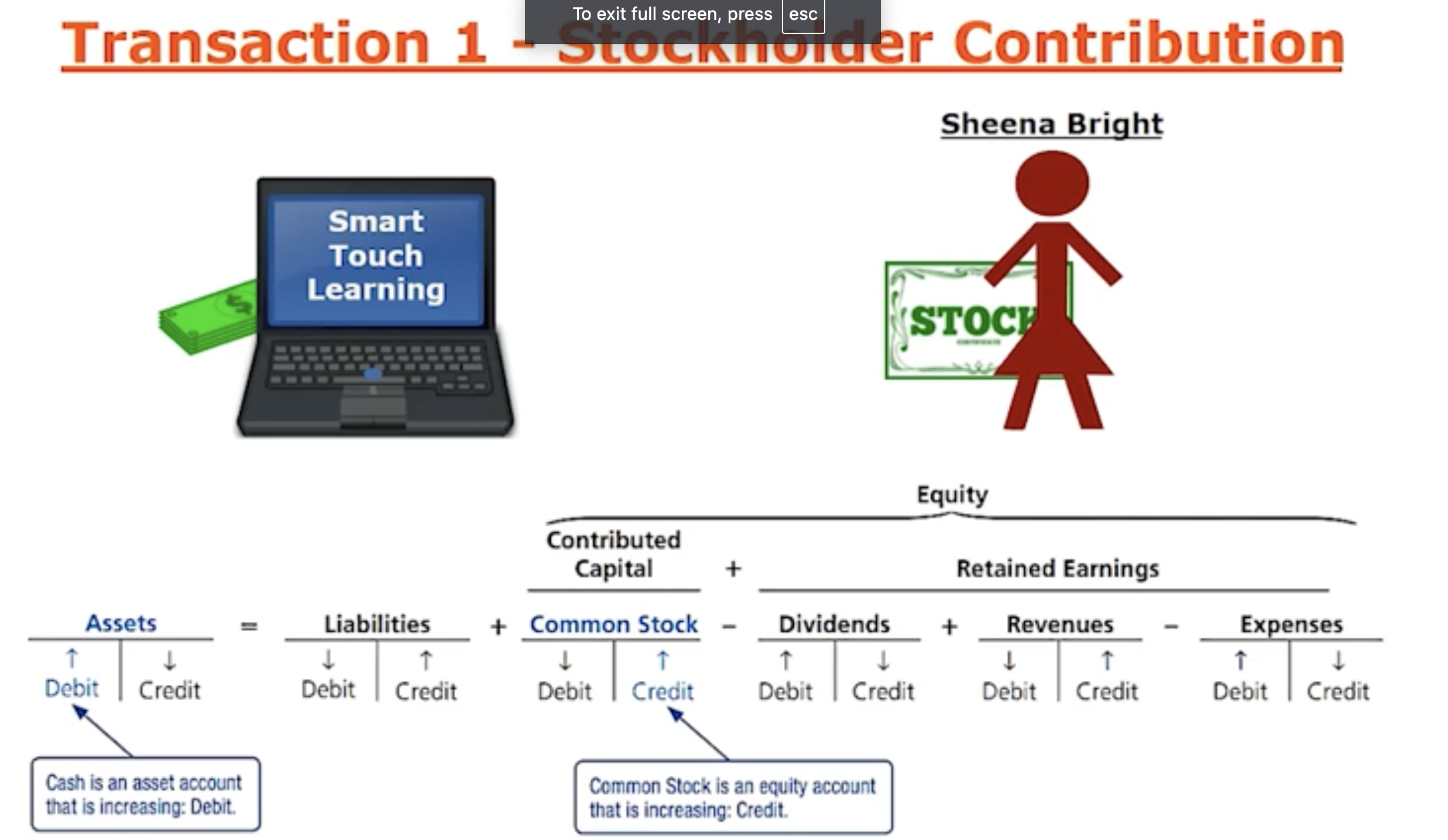

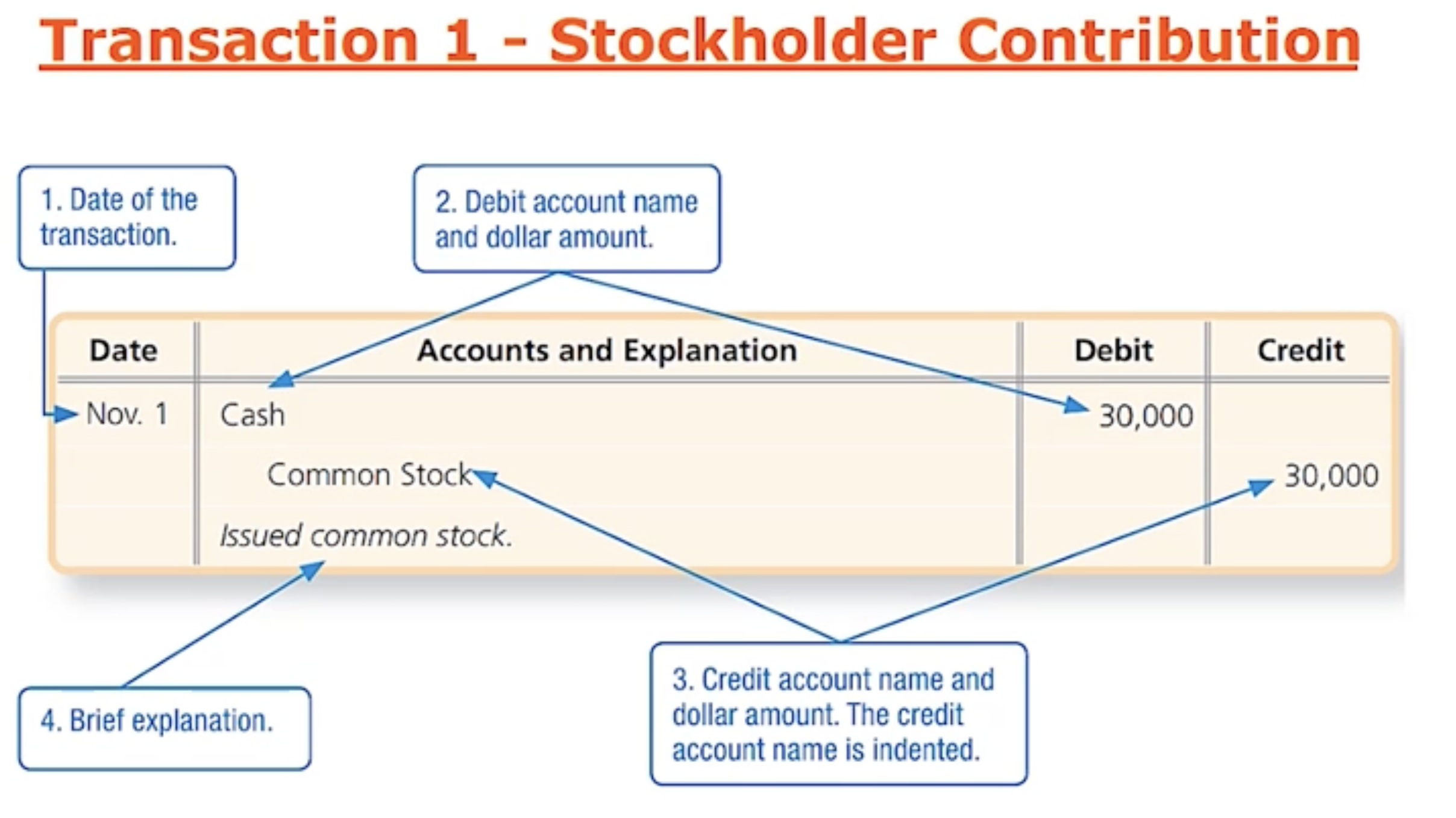

How do you Record Transactions: Transaction 1. Stockholder Contribution, match the pic to the journal entry

Ex: Sheena invested 30k cash into Smart Touch Learning, receiving common stock in exchange.

The two accounts that were affected was Cash— which is an asset and Common Stock— part of stockholder equity.

Cash is increasing which means its Debiting. Common Stock— part of equity is increasing which means its Crediting.

Make sure it balances

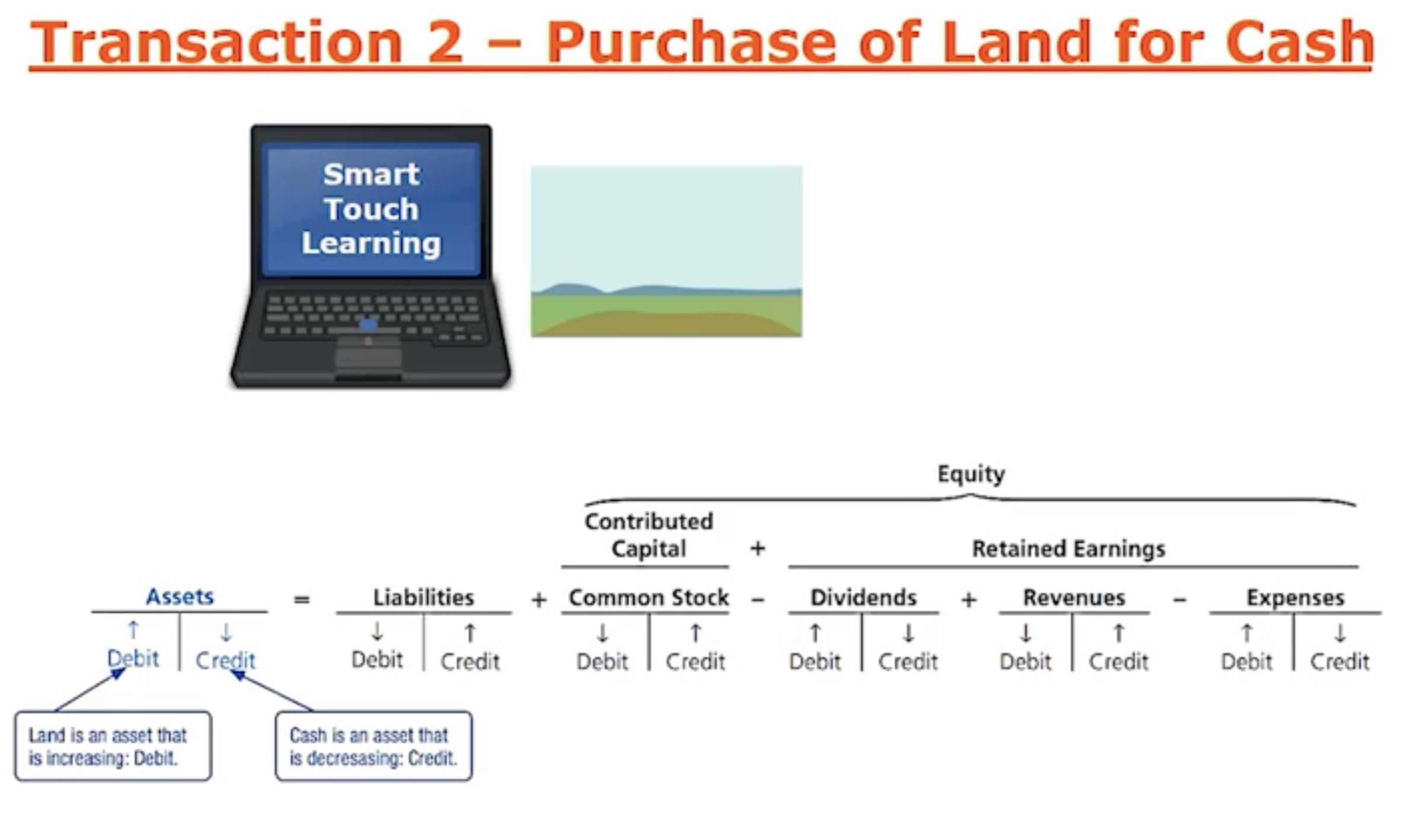

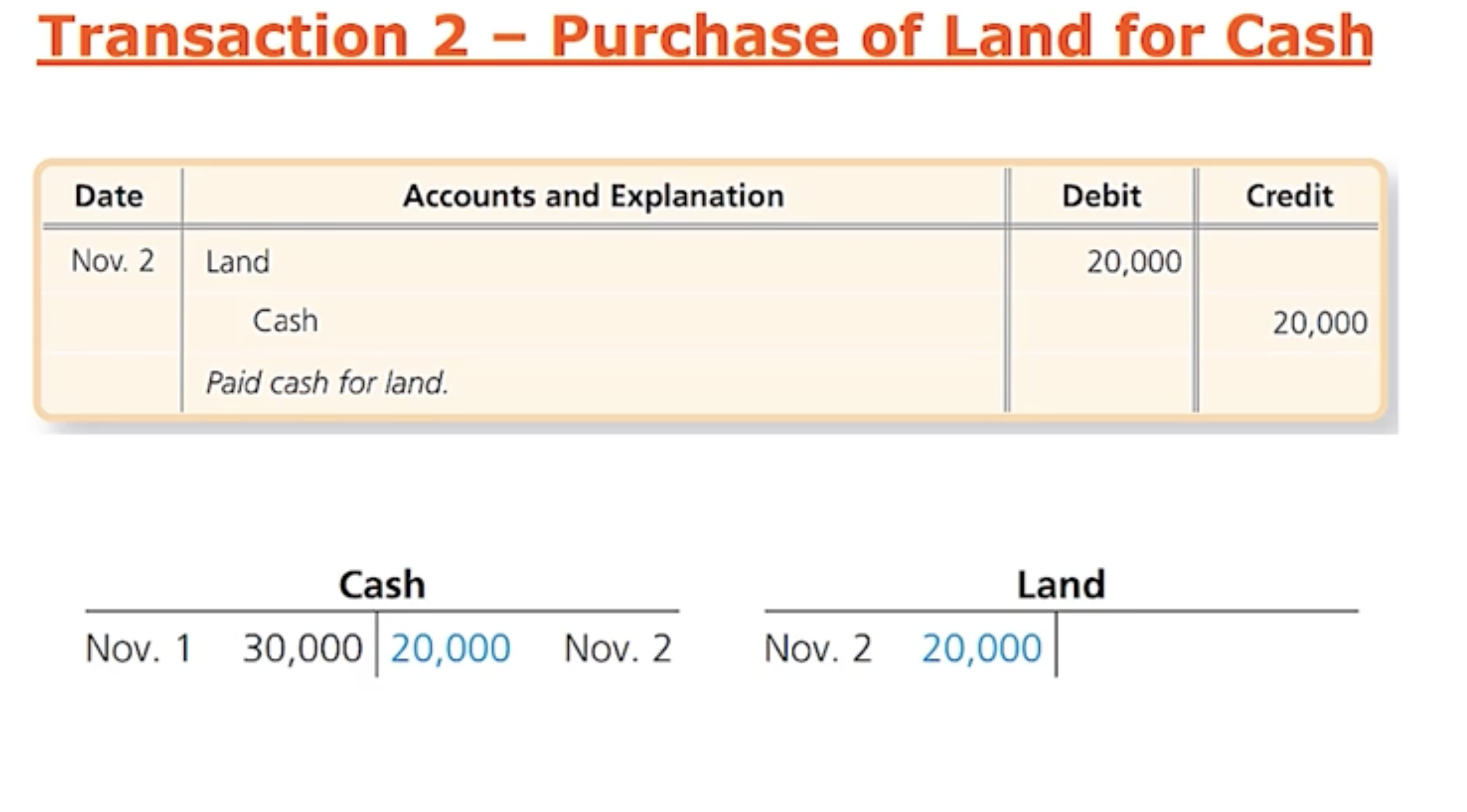

How do you Record Transactions: Transaction 2. Purchase of Land for Cash, match the pic to the journal entry

Ex: Smart Touch Learning is going to pay 20k in receive land in return.

Two different assets account will be affected when this process is done

Land— is increasing which means its debiting but Cash is going down which means its crediting

Make sure it balances

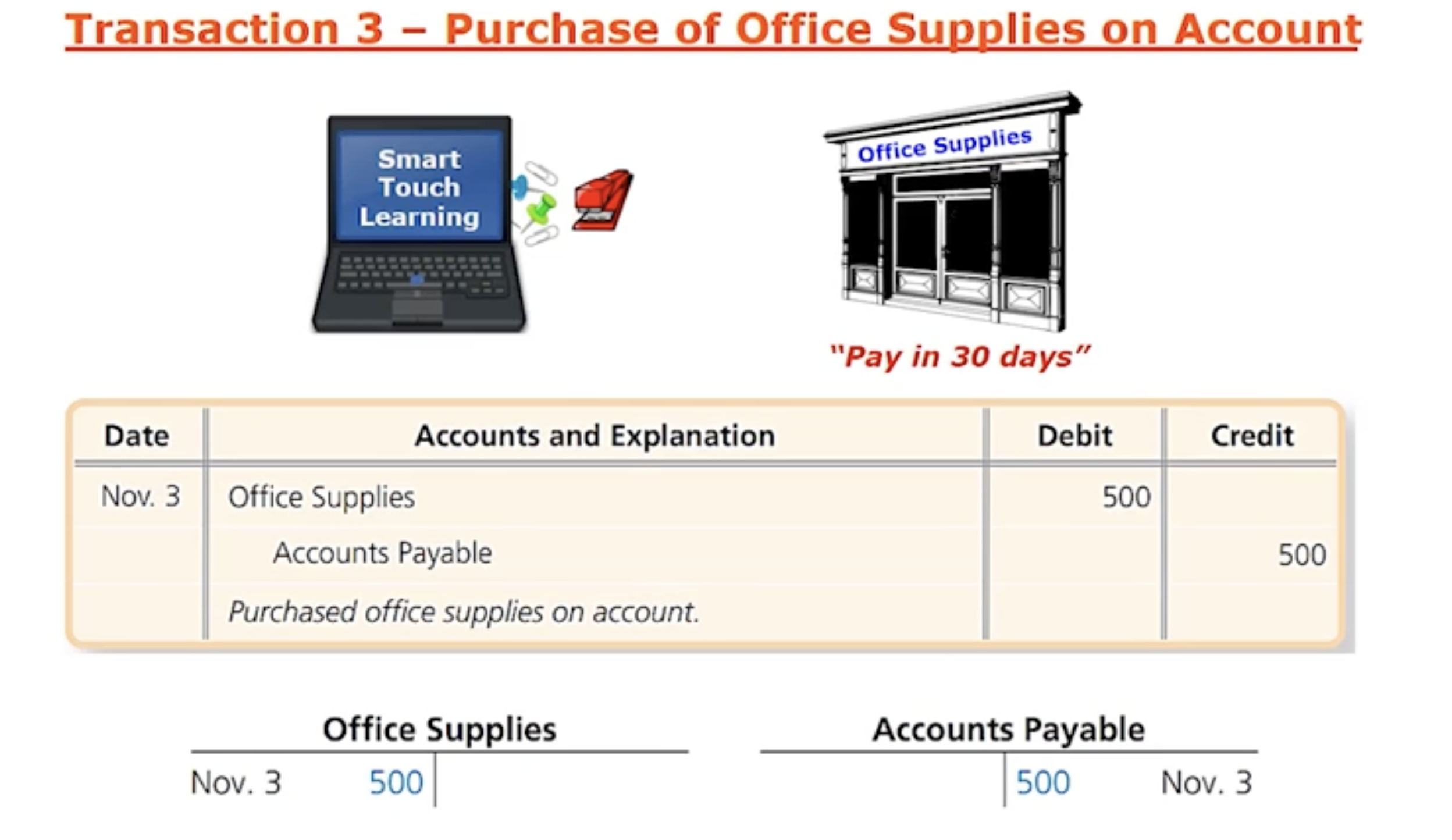

How do you Record Transactions: Transaction 3. Purchase of Office Supplies on Account—showcases the journal and general ledger

Ex: Smart Touch Learning purchases Office Supplies but they dont pay in cash now— let’s say they will pay in “30 days”

Office Supplies in assets is increasing which means it’s debiting and Accounts Payable is increasing which means its crediting (Smart touch learning owes more money).

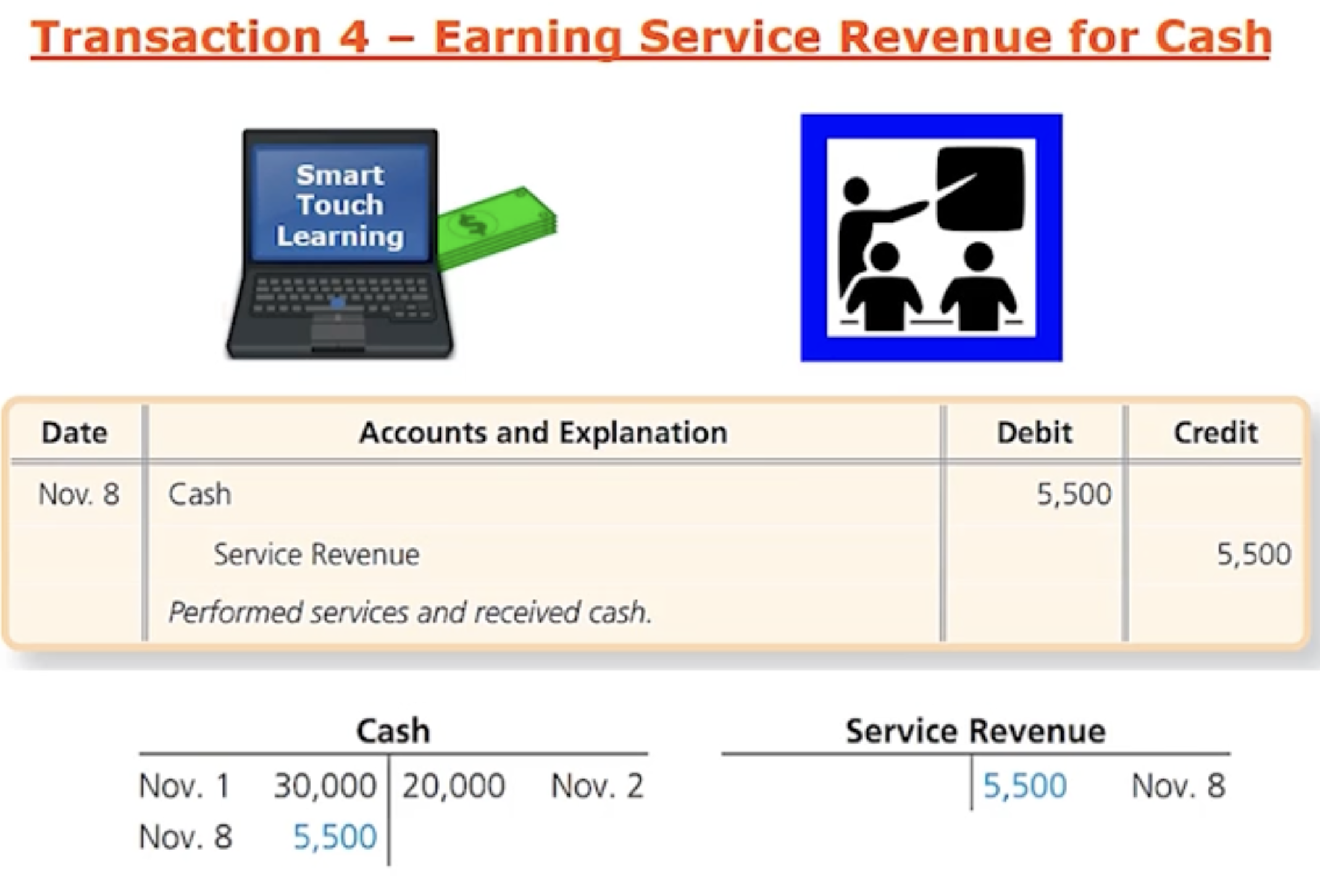

How do you Record Transactions: Transaction 4. Earning Service Revenue for Cash— showcases the journal and general ledger

Ex: Smart Touch Learning earns service revenue by performing e- learning training services for a client and that clients pays them cash immediately

Cash in assets is increasing, which means its being debited, and Service Revenue is increasing, which means it's being credited

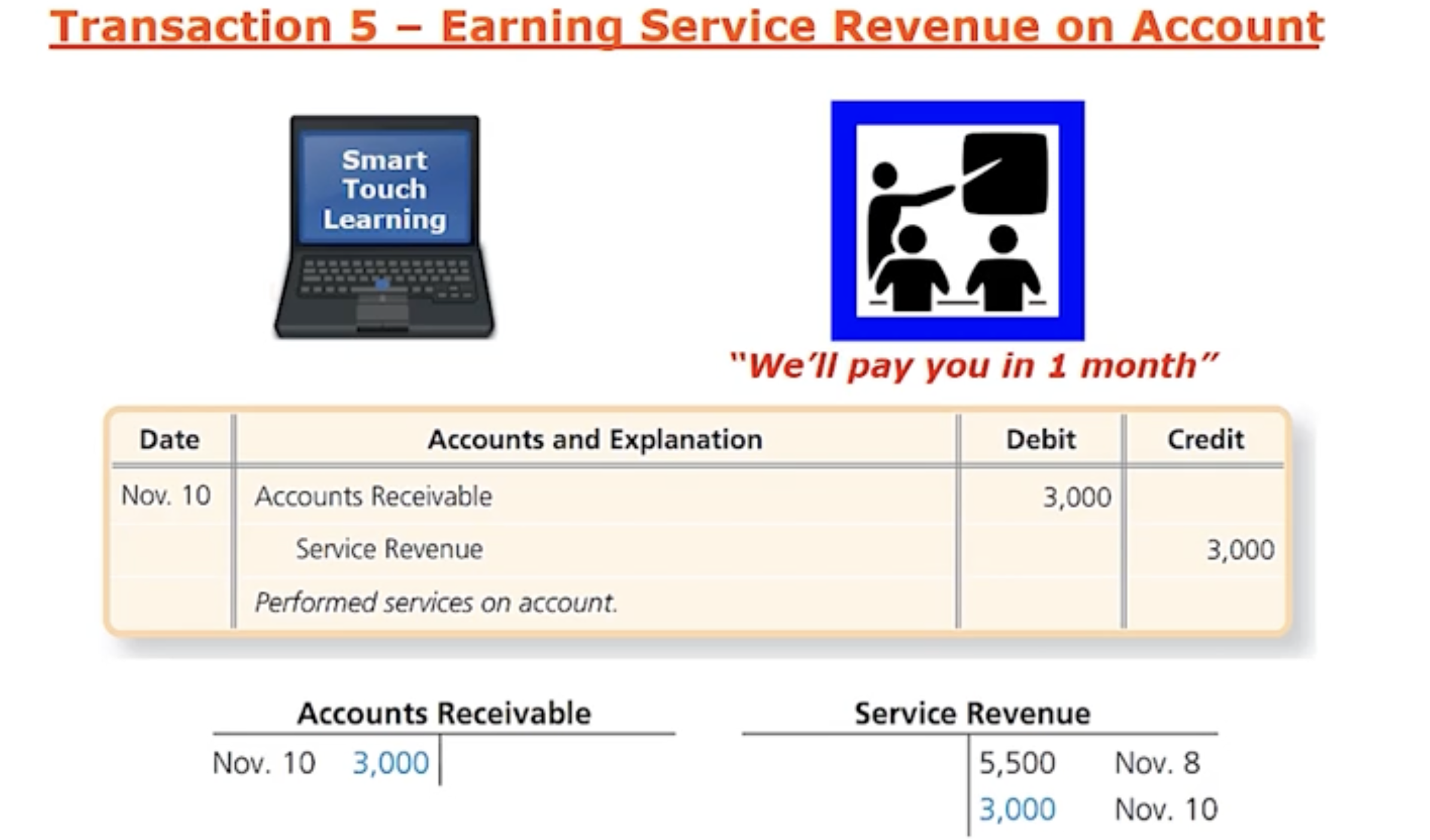

How do you Record Transactions: Transaction 5. Earning Service Revenue on Account— showcases the journal and general ledger

Ex: The client pays Smart touch Learning within “1 month” so they earn service revenue on account

Account receivable in assets is increasing which means debited and Service revenue is increasing which means credited goes up

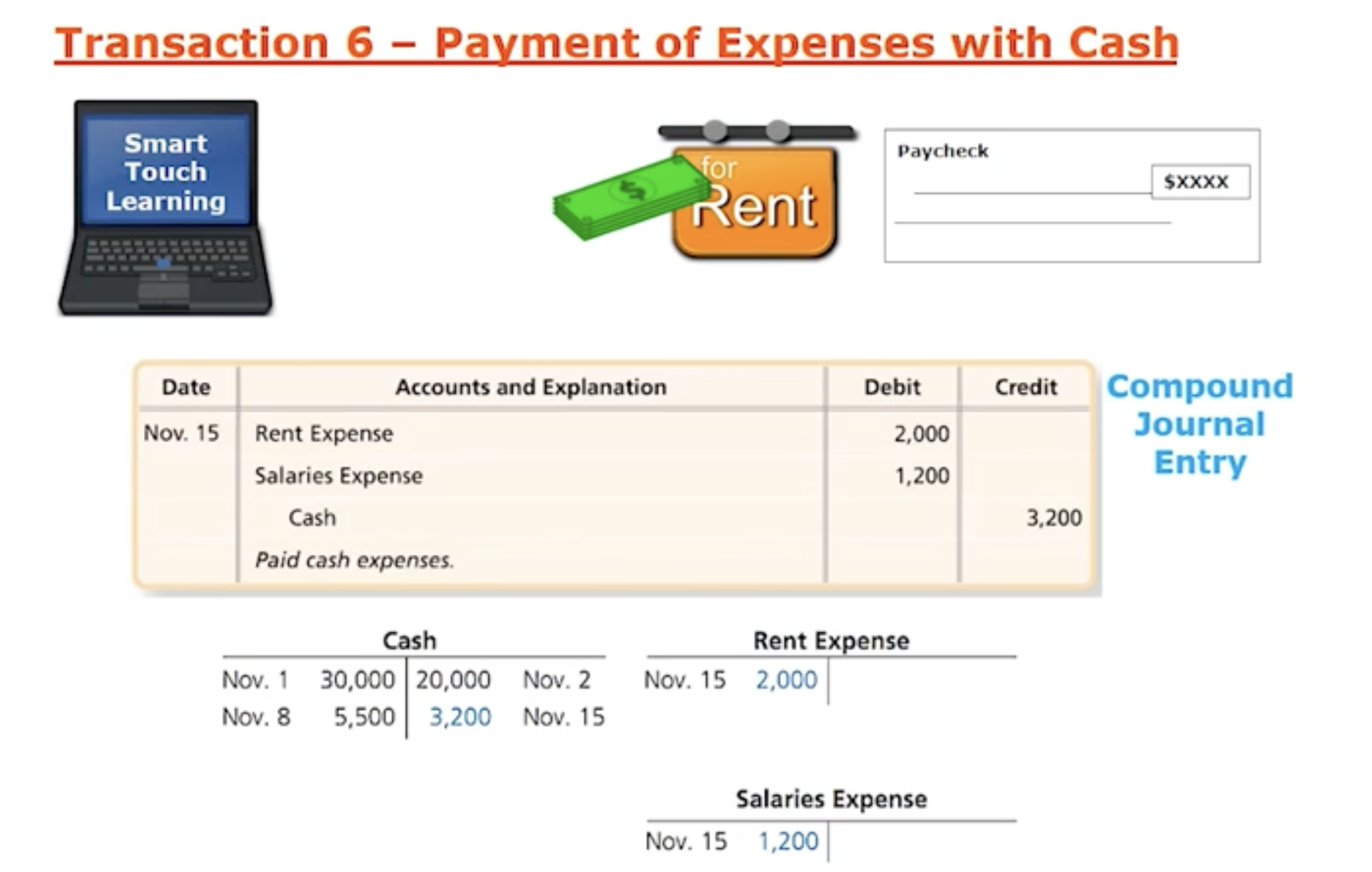

How do you Record Transactions: Transaction 6. Payment of Expenses with Cash— showcases the journal and general ledger

Ex: Smart Touch Learning is going to pay for two different types of expenses. The Rent and employee salary— Now when the journal entry is done for this entry its called a compound entry bc more than two accounts are being affected.

Rent Expense and Salary Expense are going to increase which means they are debited

Cash is the credit because its an asset which shows its decreasing

In all if you add the two debits together it equals the single credit entry

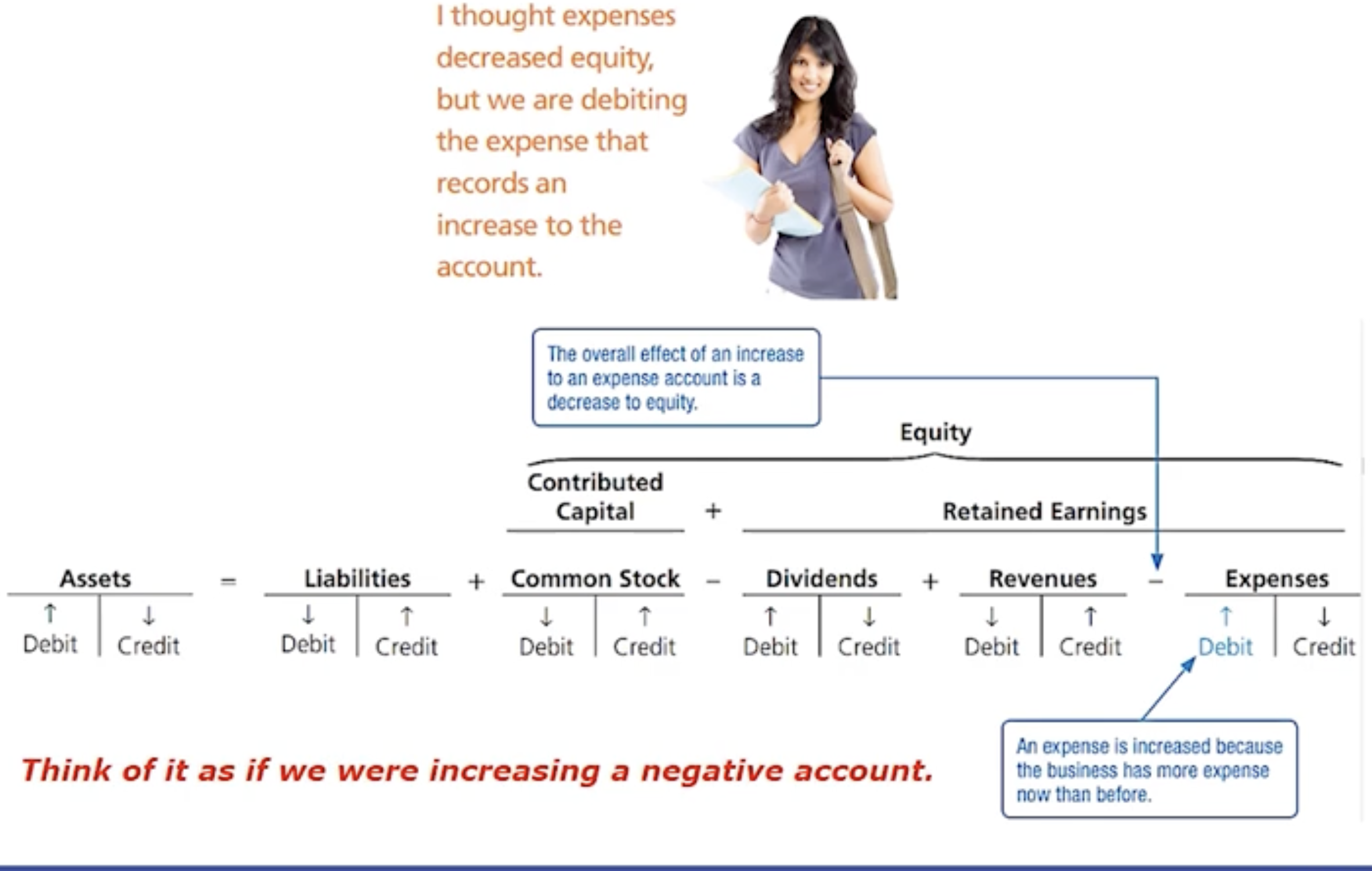

How do you Record Transactions: I thought expenses decrease equity, but we are debiting the expense that records an increase to the amount?

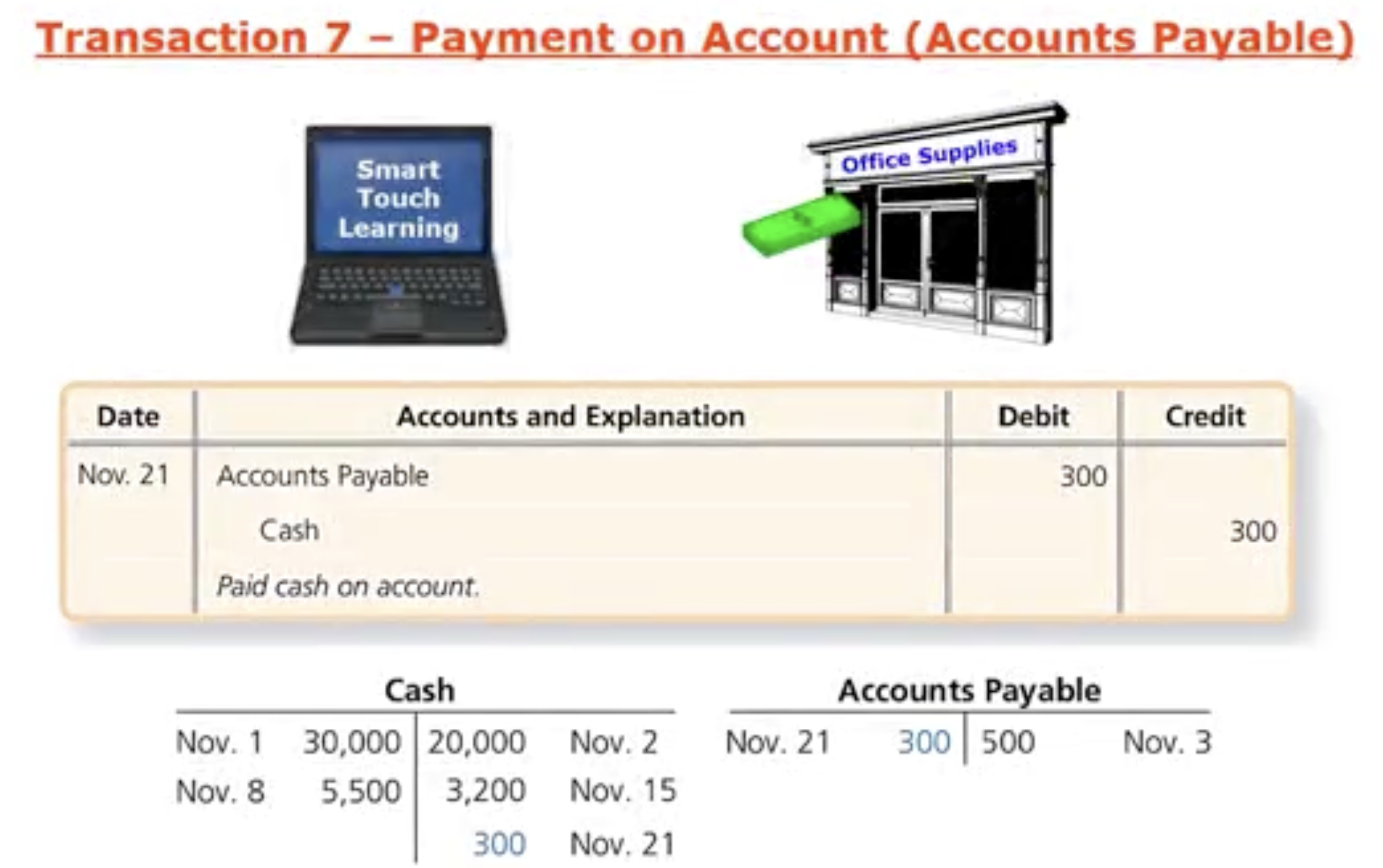

How do you Record Transactions: Transaction 7. Payment on Account (Accounts Payable)— showcases the journal and general ledger

Ex: Smart Touch Learning pays cash for the office supplies they previously purchased from the office supply store— so they are making a payment on account

Account Payable is a liability account which is decreasing so it means that its being paid down on the account so it’s debited

Cash is also decreasing which is an asset so its being put on the credit side

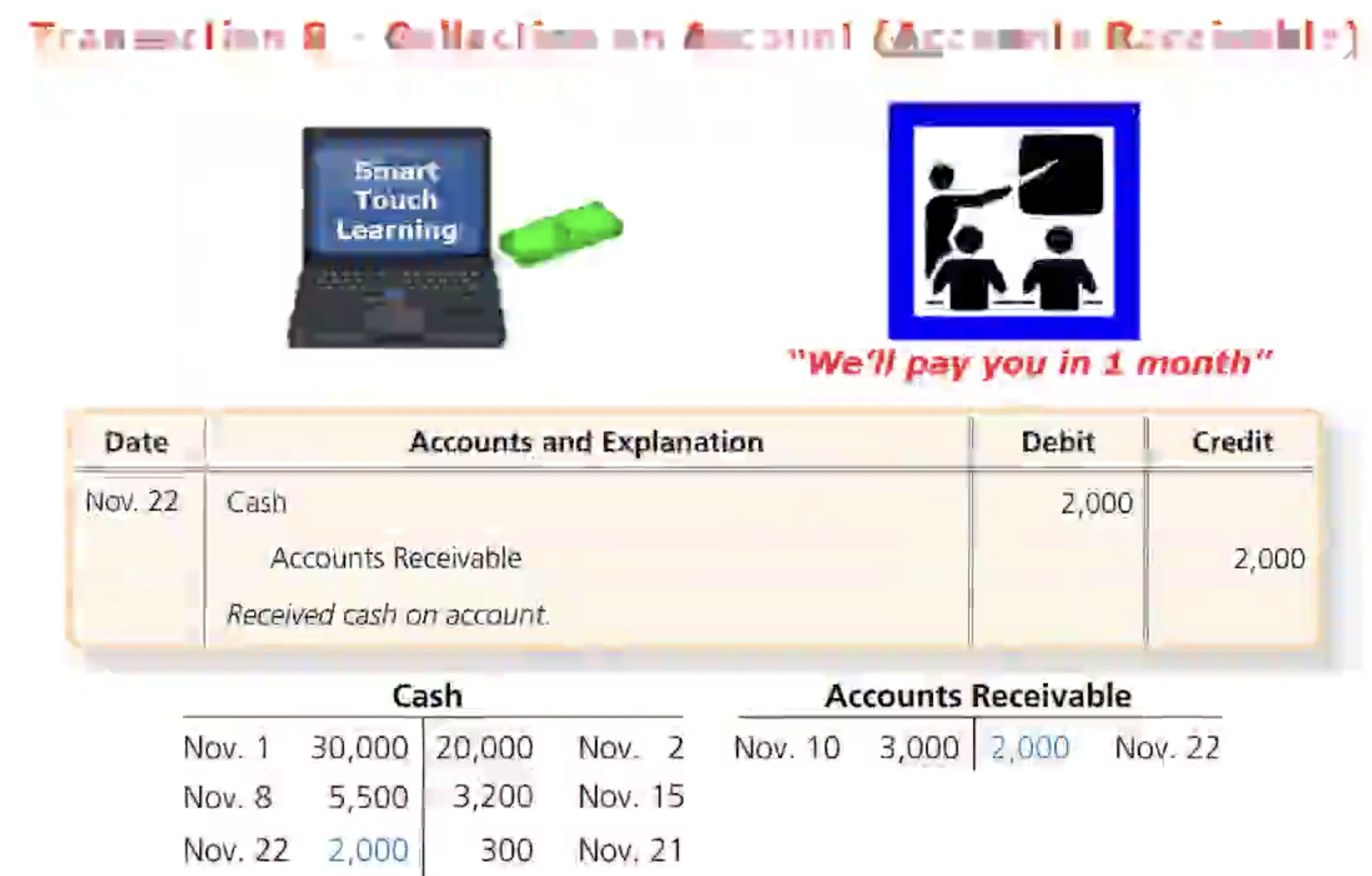

How do you Record Transactions: Transaction 8. Collection on Account (Accounts Receivable)— showcases the journal and general ledger

Ex: Remember the transaction where Smart Touch Learning provided services on account for a client, the client said they will pay Smart Touch Learning and “one month” well now the client is paying on this account (e-learning service).

Cash is an asset which is increasing so it’s on the debit side

Account receivable is an asset which is decreasing so it’s on the credit side

Summary: as Smart TL is collecting they are paying down on the account and the client still owed Smart Touch Learning 1k.

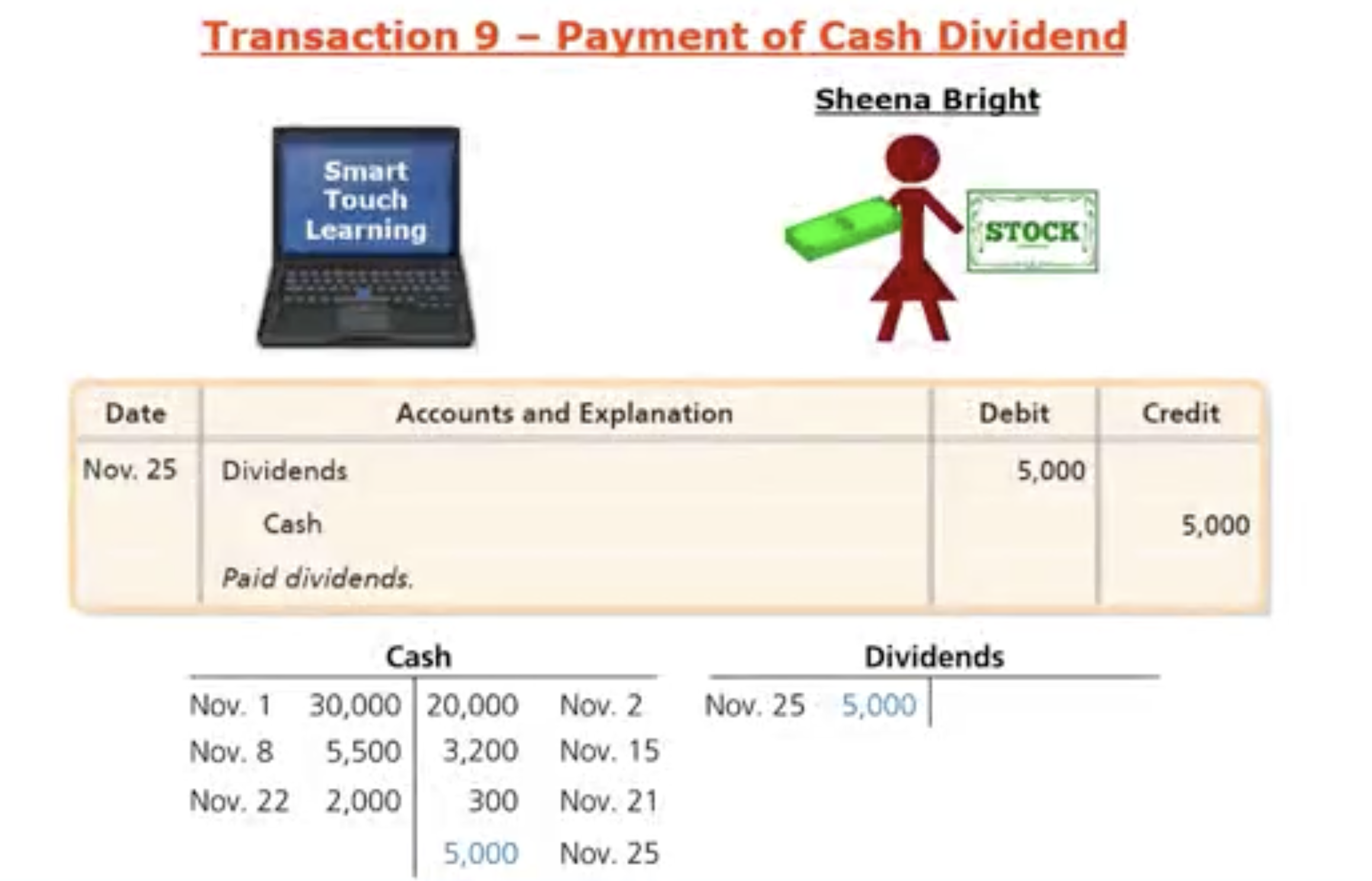

How do you Record Transactions: Transaction 9. Payment of Cash Dividend— showcases the journal and general ledger

Ex: Smart Touch Learning pays a 5k cash dividend to it’s lone stockholder Sheena

Dividends is increasing which means its on the debit side (think of dividend like expense) overall decreases equity though!

Cash is an asset— decreasing which means it will be on the credit side

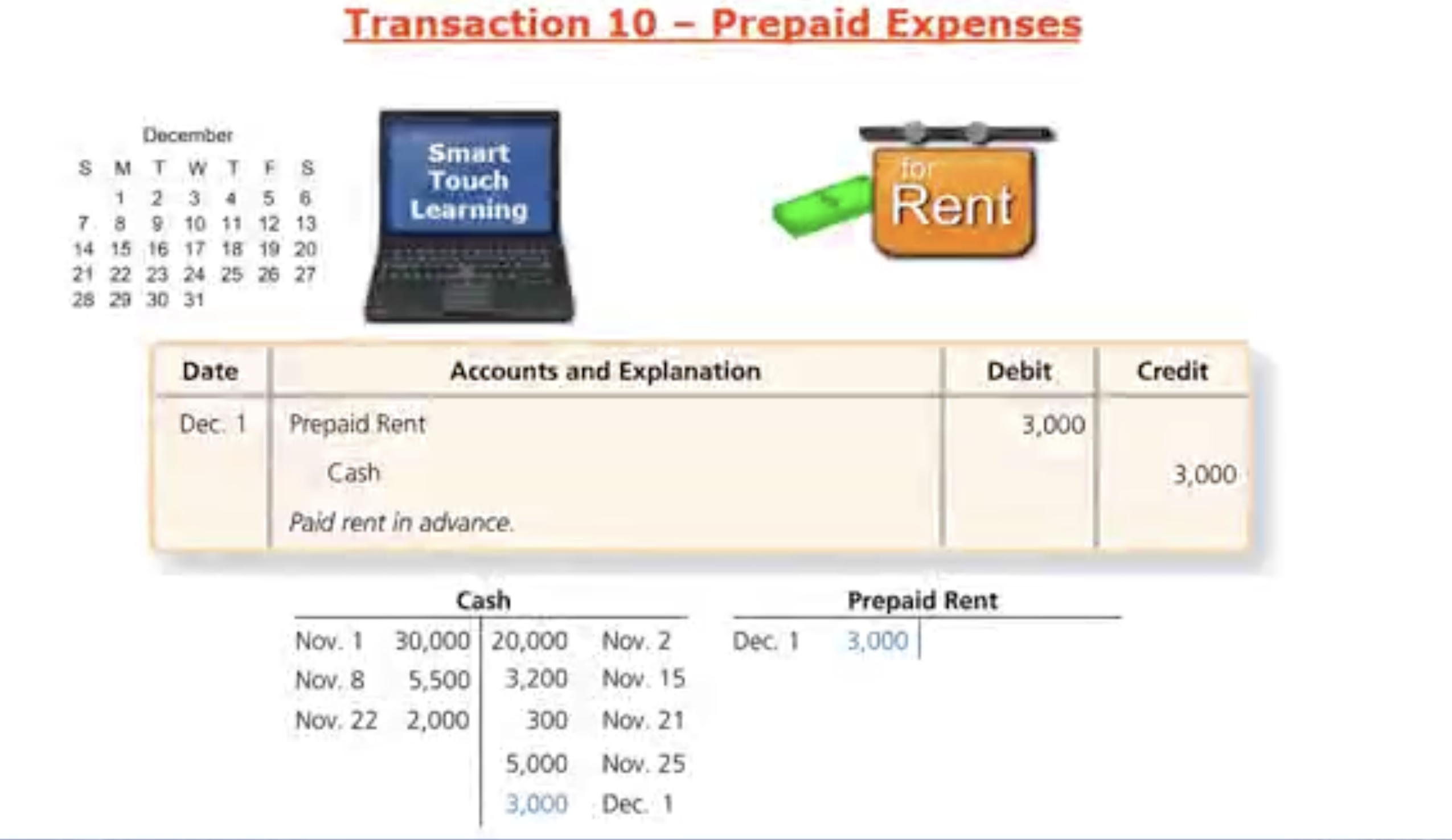

How do you Record Transactions: Transaction 10. Prepaid Expenses— showcases the journal and general ledger

Ex: On Dec.1 Smart Touch Learning for rent for the next 3 months.How do you Record Transactions: showcases the journal and general ledger

Prepaid Rent is an asset account which is increasing on the debit side (not an expense bc its providing us a future economic benefit— providing Smart TL to have office space for the next 3 months)

Where the Cash is decreasing on the credit side

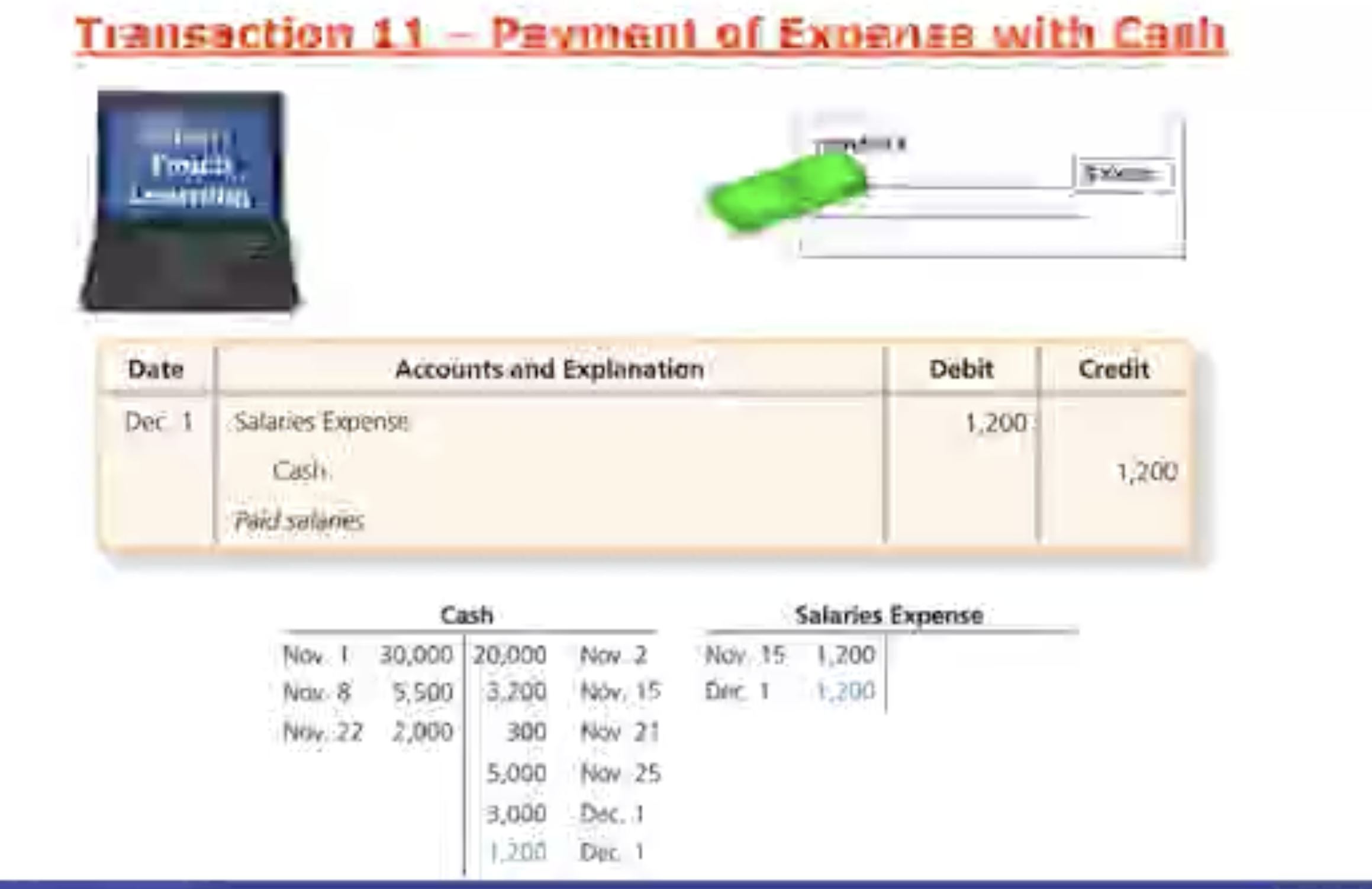

How do you Record Transactions: Transaction 11. Payment of Expense with Cash— showcases the journal and general ledger

Ex: Transactions 11 is a repeat that was recorded in November, Smart touch Learning is going to pay their employees salary— when its done on Dec. 1st.

Salary Expense is going to increase on the Debit side (reminder— think of it as a negative equity account that is increasing negatively)

Cash which is an asset is decreasing on the credit side

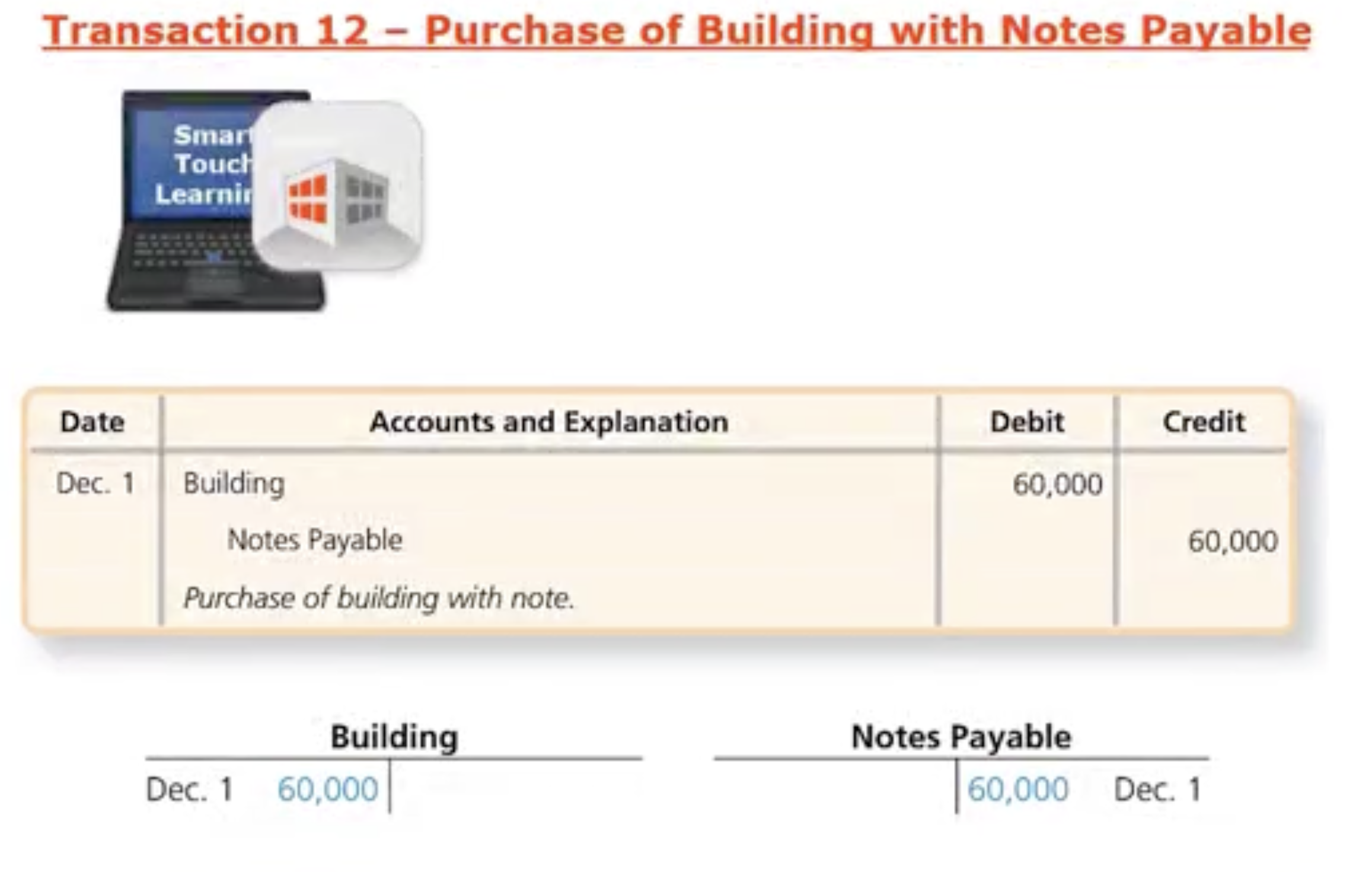

How do you Record Transactions: Transaction 12. Purchase of Building with Notes Payable— showcases the journal and general ledger

Ex: On Dec1st Smart Touch Learning purchases a building that can be used as office space in the future, but they do not have 60k cash on hand to be paid for that building— instead they will sign a Notes Payable= A formal written agreement to pay a sum in the future, usually with interest attach to it. In this case Smart TL will write a 60k promise to note and going to give that in exchange to purchase an office building.

Building account is an asset because it provides a future economic benefit and all asset increase on the debit side

Just like an account payable a Notes Payable is a debt or promise to pay in the future (liability) which is increasing on the credit side

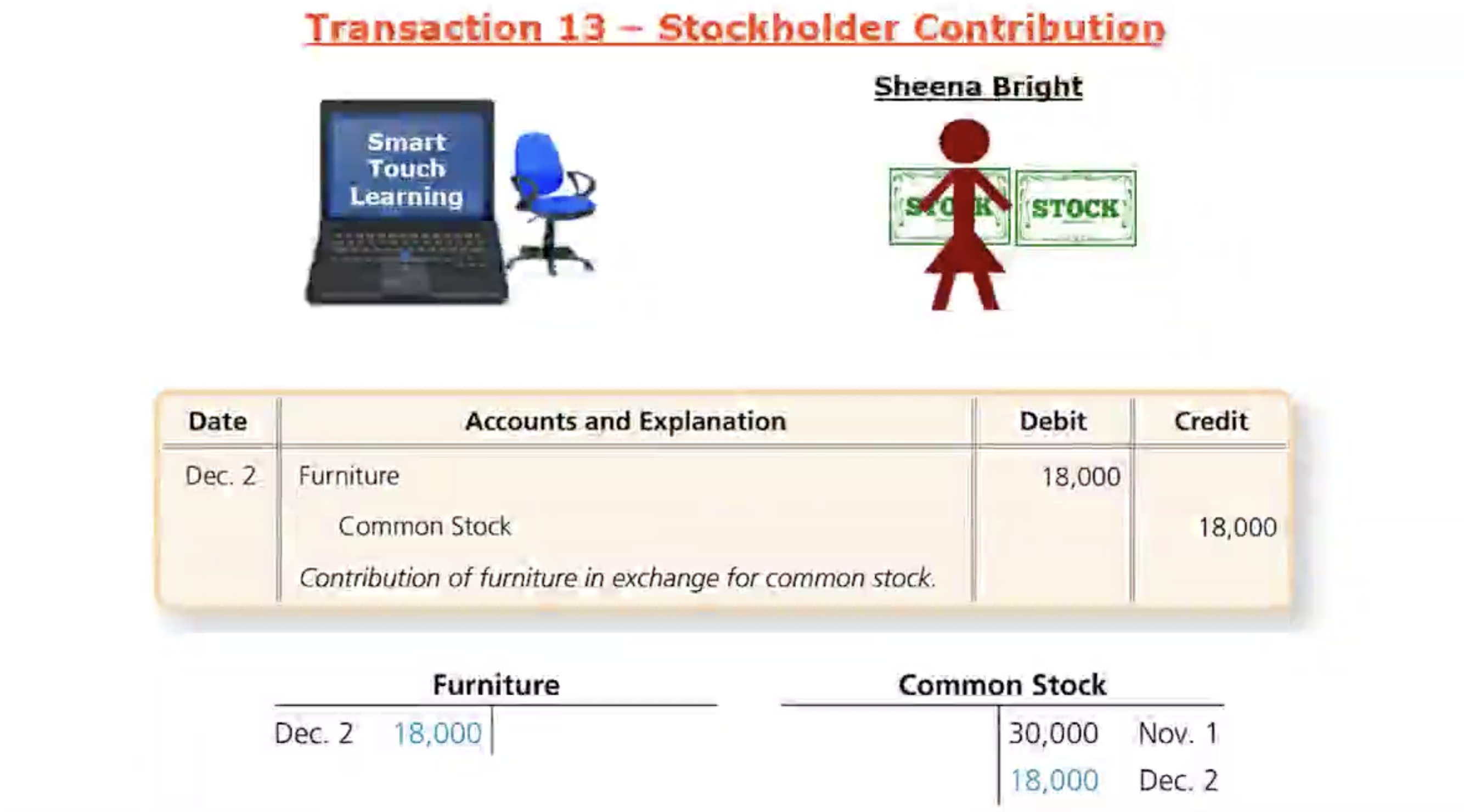

How do you Record Transactions: Transaction 13. Stockholder Contribution— showcases the journal and general ledger

Ex: Variation of the first transaction on Nov. 1st. When Sheena contributes 30k cash to create Smart Touch Learning— investors can contribute cash but they can also contribute other types of assets. On Dec2nd, Sheena contributes office furniture to Smart TL for their new office building. Smart TL exchange 18k worth of stock to Sheena.

Furniture is an asset bc it provides Smart TL future economic benefit— therefore furniture is debited which is increasing

Common Stock (equity) is increasing as well which is why it is on the credit side increasing.

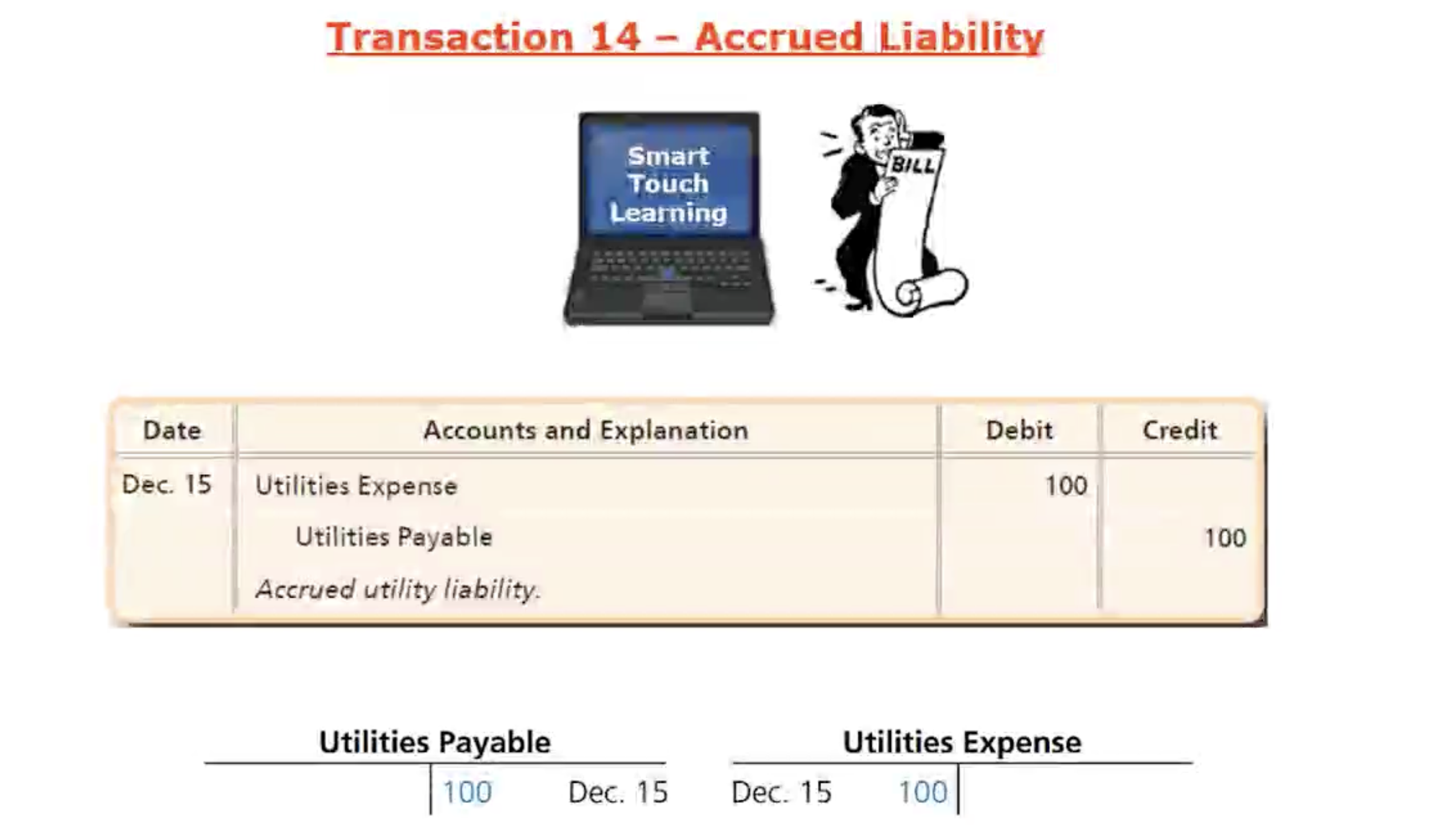

How do you Record Transactions: Transaction 14. Accrued Liability— showcases the journal and general ledger

Accrued: an expense has been occurred (expense has been charged to Smart TL but it has not been paid off yet).

Ex: Smart TL have received their utility bill for Dec on Dec 15. Expense is recorded even though it has not been paid yet bc we record it when it has been occurred.

Utility Expense increases on the Debit side

Utility Payable (Smart TL owe the $100 to the utility company)— all liability increase on the credit side— therefore credited for $100.

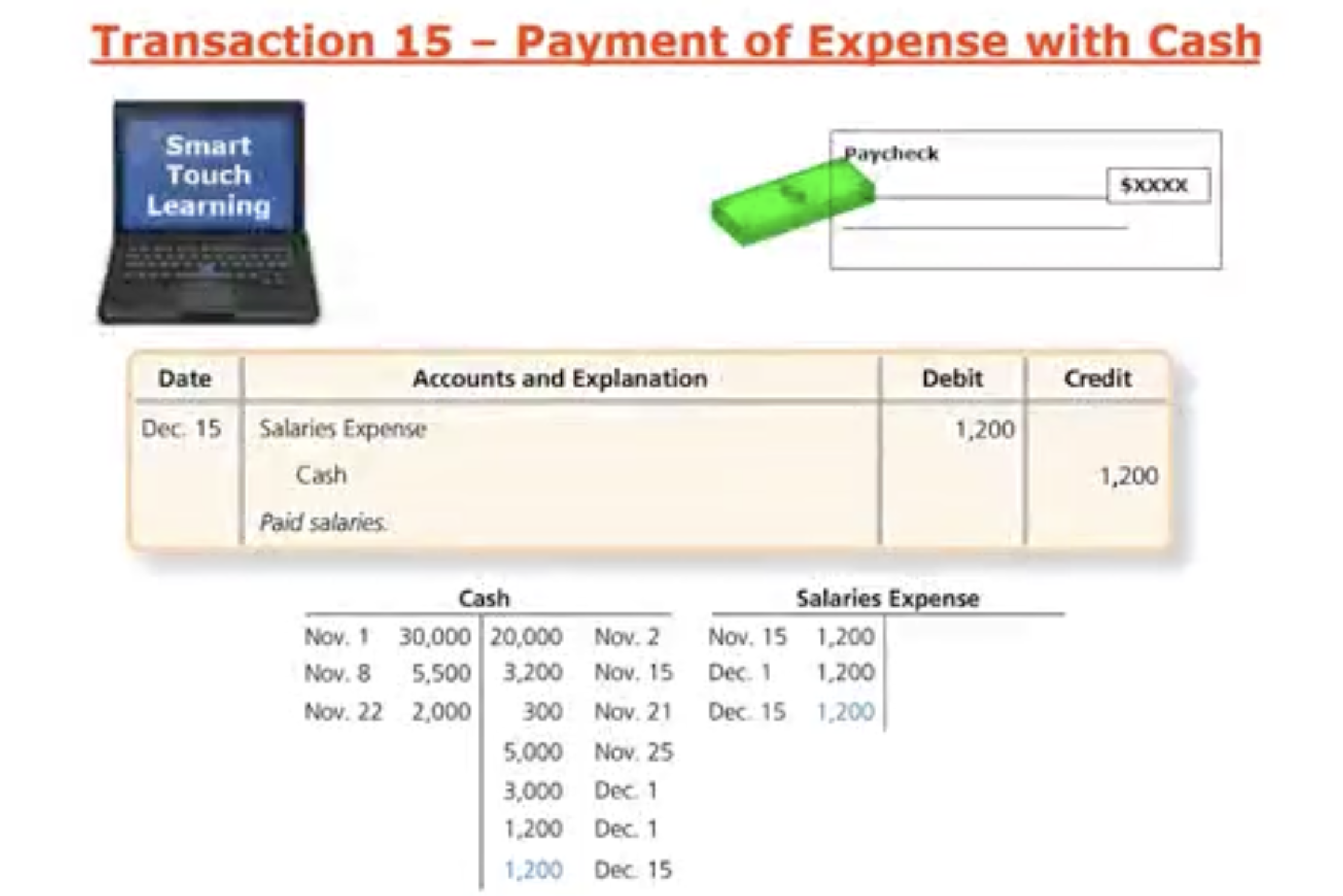

How do you Record Transactions: Transaction 15. Payment of Expense with Cash— showcases the journal and general ledger

Ex: Smart TL pay their employees twice per month, Smart TL is paying their employees again.

Salary Expense increase on the debit side

Cash will decrease on the credit side

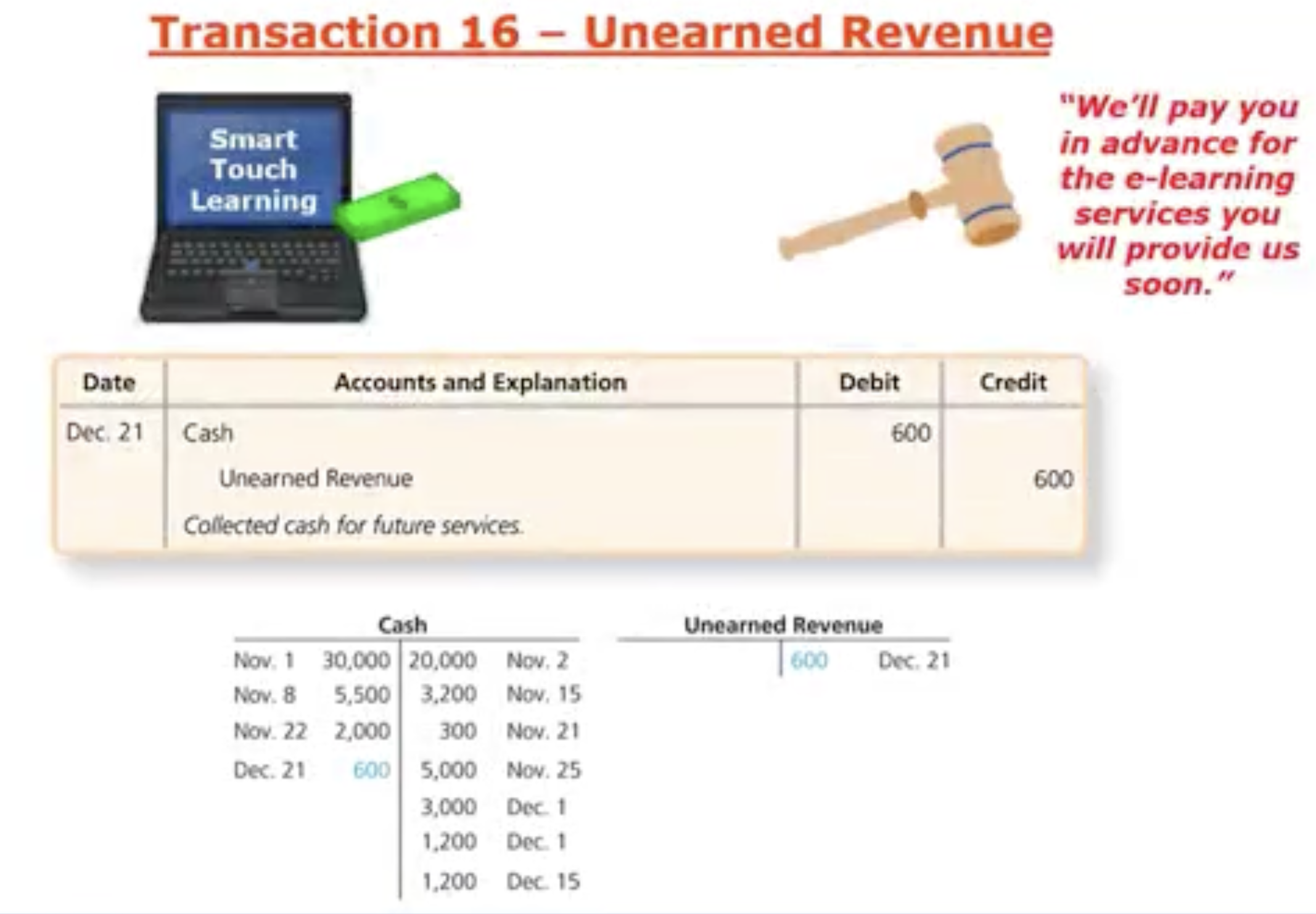

How do you Record Transactions: Transaction 16. Unearned Revenue— showcases the journal and general ledger

Ex: Dec.21st a law firm hires Smart TL to perform e-learning services for them in the future. On dec. 21st, they are going to pay Smart TL in advance $600— now Smart TL owes these services to the law firm, they dont owe them cash but e-learning services.

Cash is an asset increasing for Smart TL

Unearned Revenue is a Liability account which increases on the credit side, (Smart TL owes the law firm those e-learning services. So we cannot record a revenue that increases equity now, we only record a revenue when Smart TL earns that revenue by performing the services LATER).

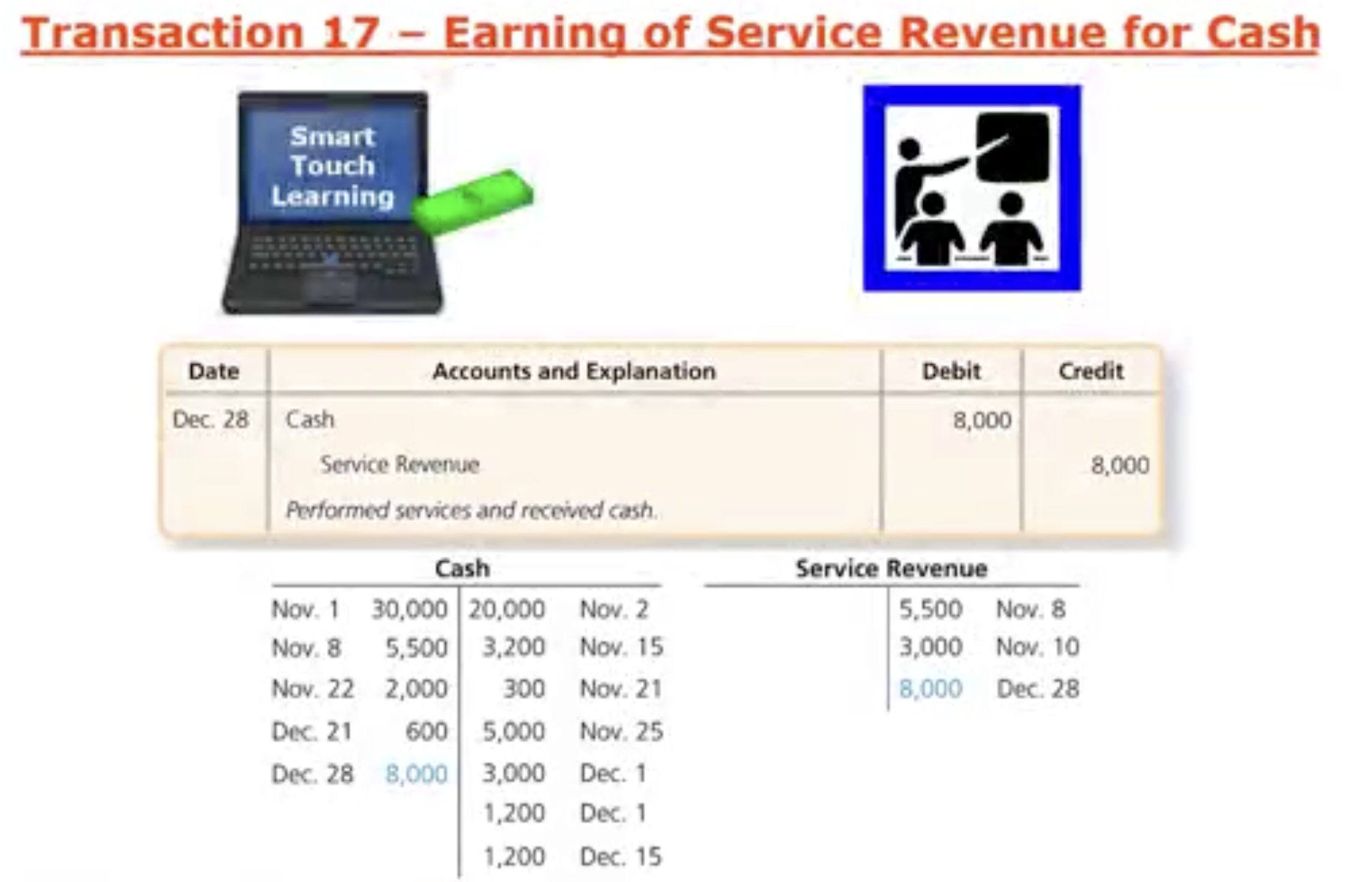

How do you Record Transactions: Transaction 17. Earning of Service Revenue for Cash— Payment of Expense with Cash— showcases the journal and general ledger

Ex: On the last month of Dec, Dec28th— Smart TL performs 8k worth of e-learning training services for a client in exchange for cash.

Cash is an asset increasing on the Debit side

Smart TL earned this revenue, so we record the increase to service revenue and that increases equity 8k on the credit side

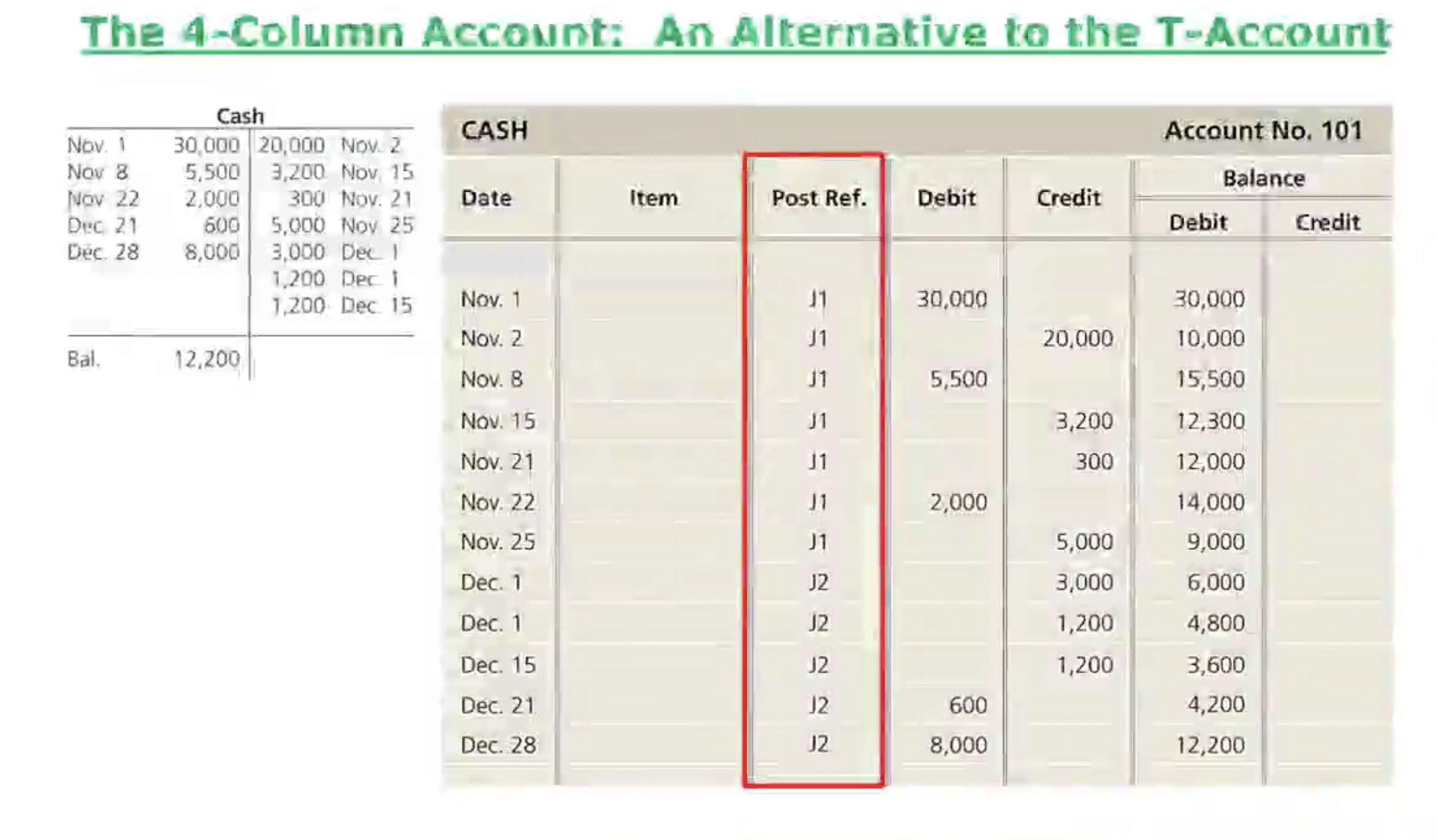

How do you Record Transactions: The 4- Column Account— an alternative to the T-Account

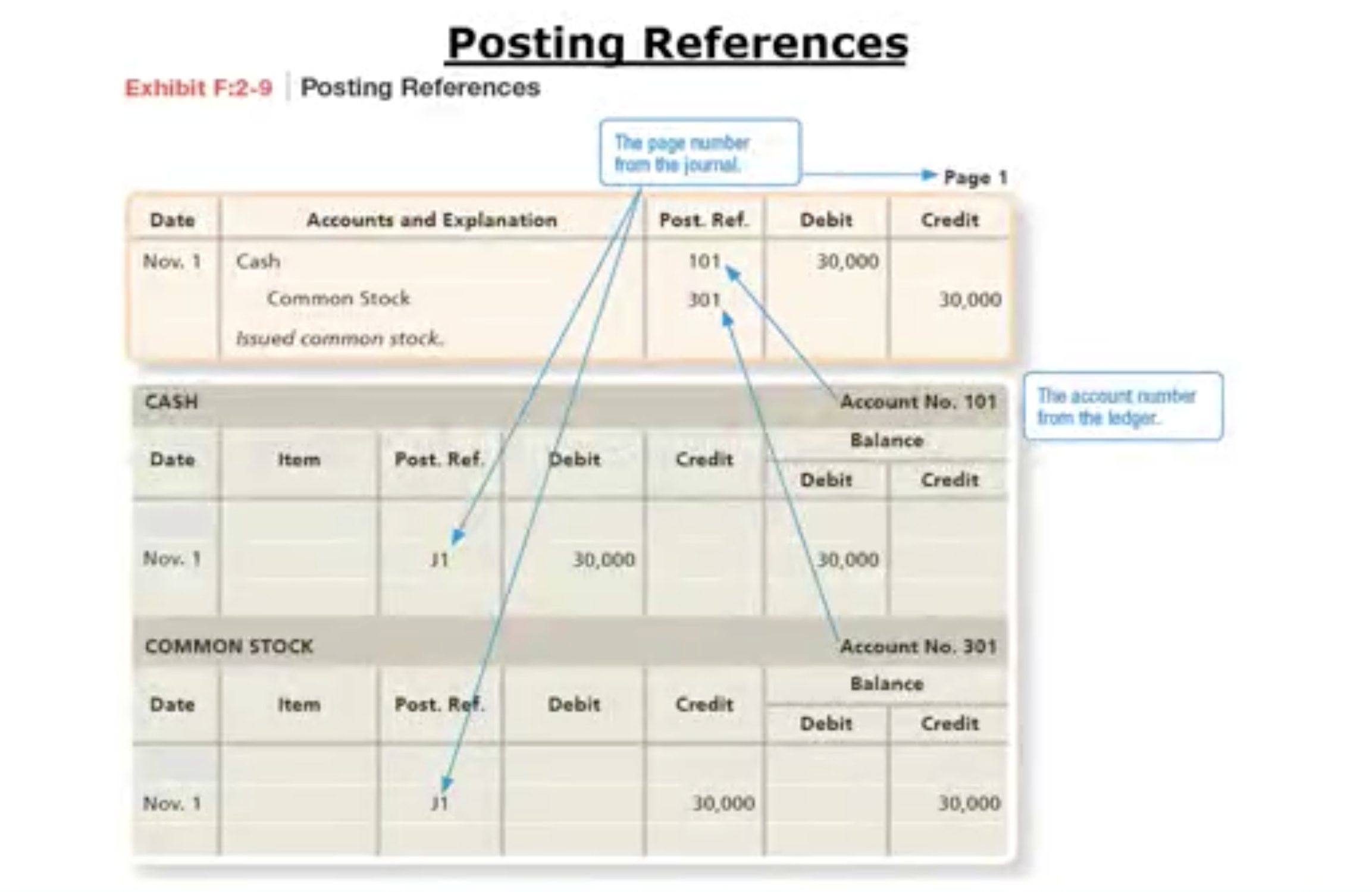

How do you Record Transactions: Posting References

What is the Accounting Cycle: The first 4 steps

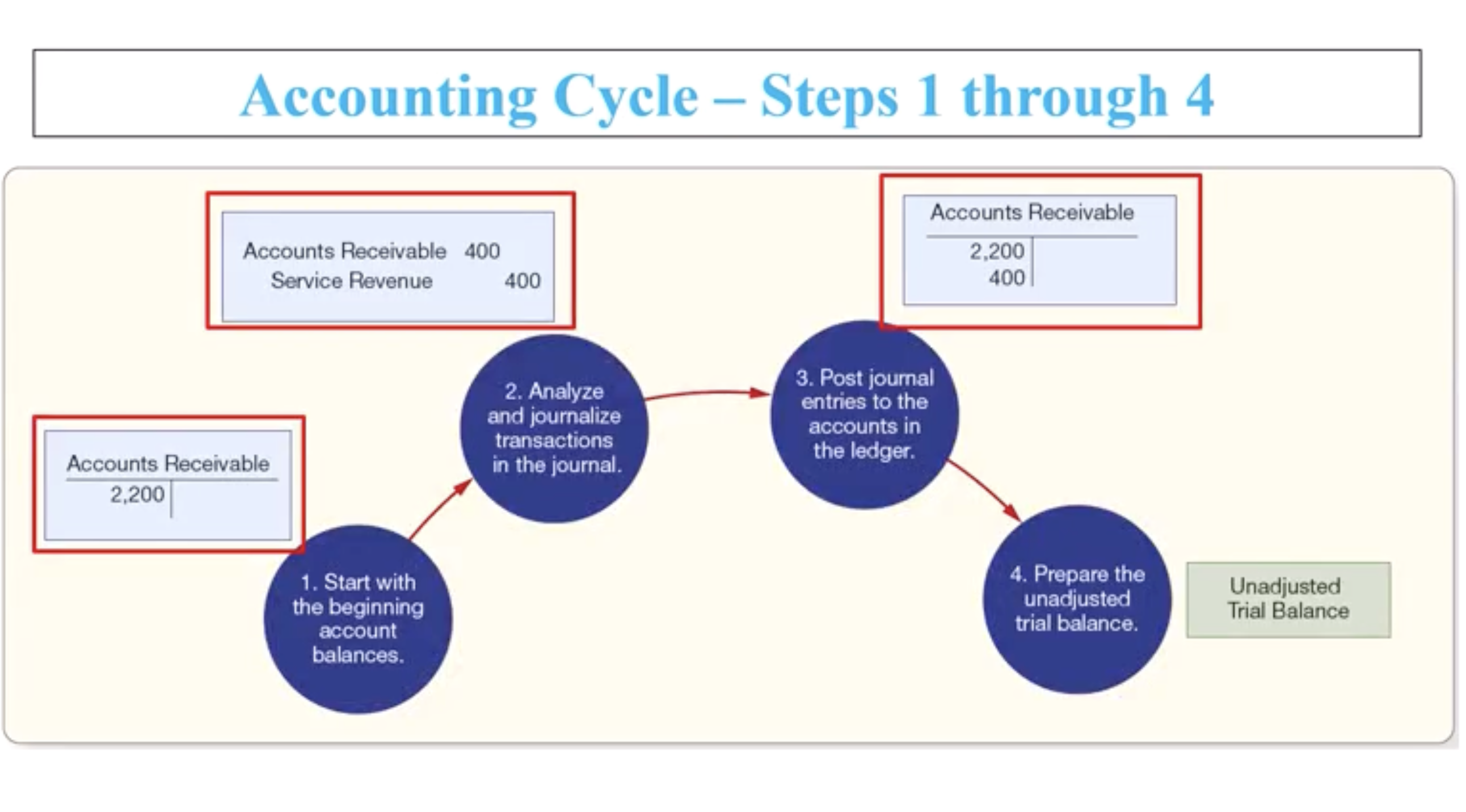

What is the Accounting Cycle: Steps 1-4

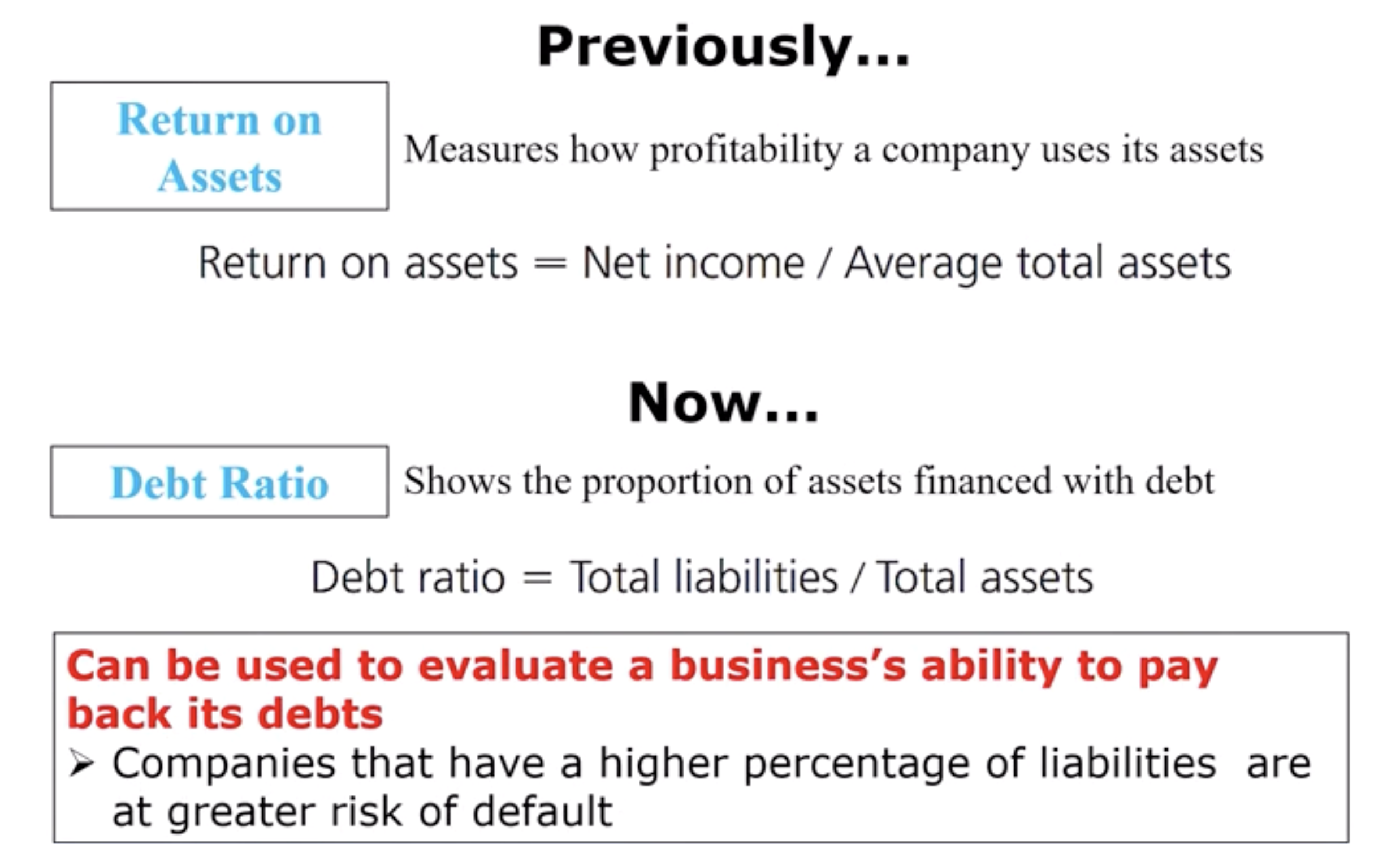

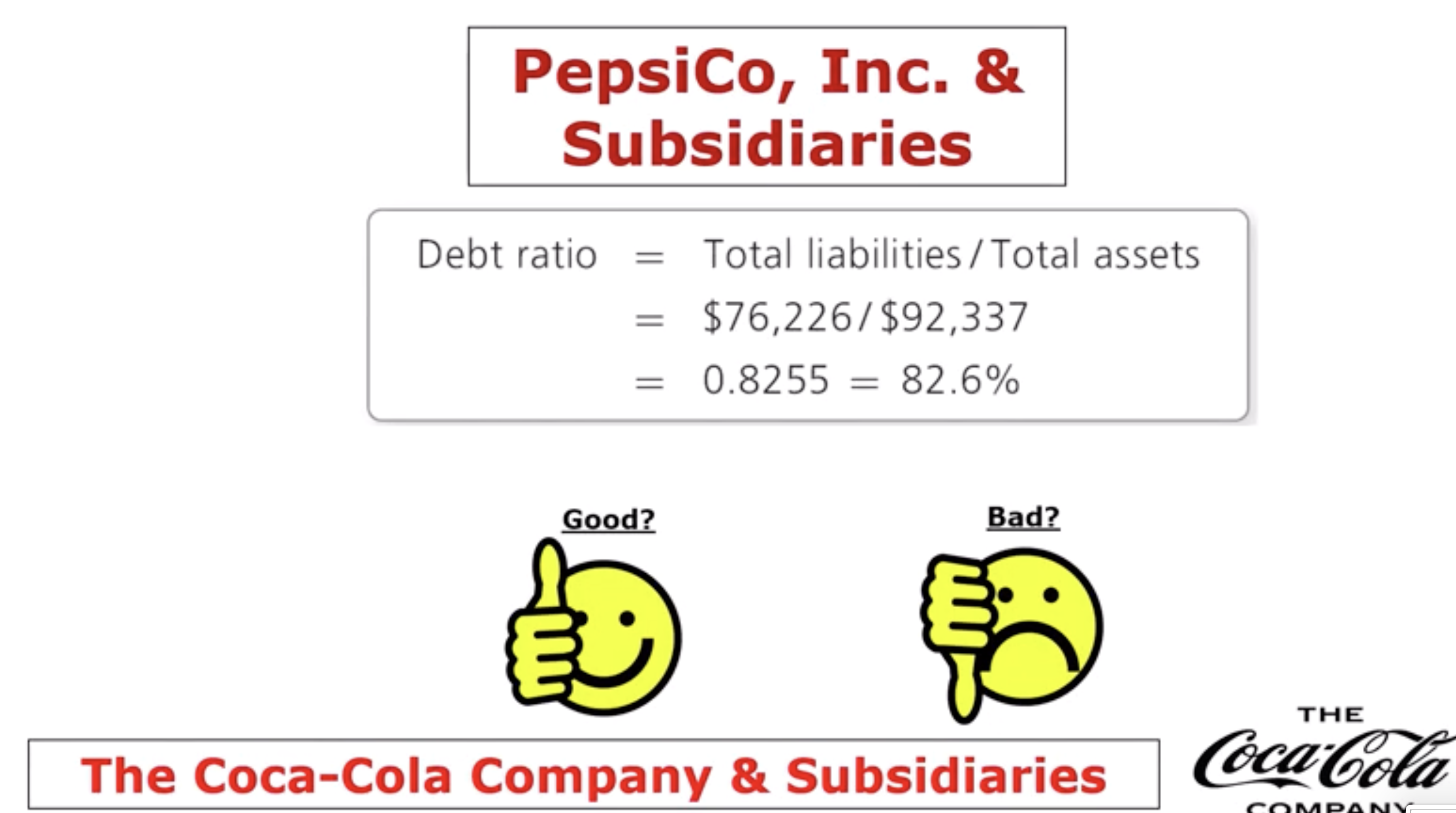

How do you use the Debt Ratio to Evaluate Business Performance: Debt Ratio & match the example to the term meaning (Pepsi has 82.6% as a assets finance by its liabilities and compare the debt ratio is increasing or decreasing which being financed their assets by debt).

Total Liabilities/ Total Assets