AP Macro Econ Study Guide

1/108

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

109 Terms

Economics is…

the study of scarcity

Economizing

The act of making decisions to fulfill needs first and wants second

Opportunity Cost

What one gives in order to gain.

ex. To gain extra sleep, one must give up scrolling on social media in the mornings

What are the 5 powers of economic thinking?

Resources

Rational Decisions

Decisions are make at the margin

Answers change depending on other factors

People are maximizers

Scarcity

Limited resources and unlimited wants

Resources

Land

Labor

Capital

Entrepreneurial Ability

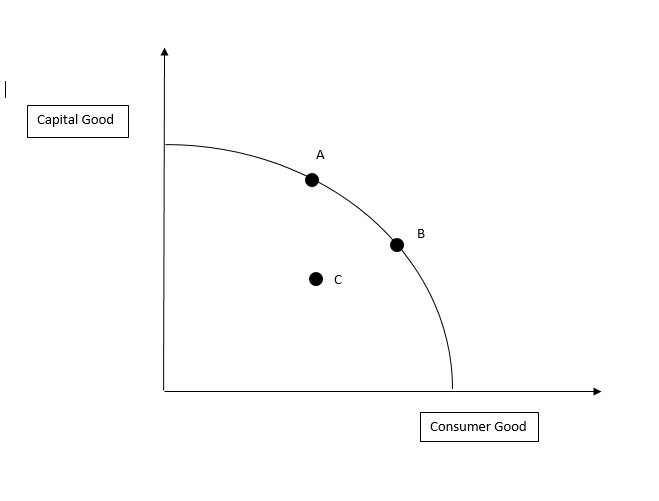

Productions Possibility Curve

A graph that shows the maximum feasible amount of two goods that can be produced with available resources and technology.

The Command System

Socialism / Communism

An economic system where the government makes all decisions regarding production and distribution.

2 major problems: coordination and lack of incentive

The Market System

Capitalism

An economic system where there is a private ownership of resources and the system uses the market to drive prices and direct the economy

9 characteristics: private property rights, freedom of enterprise and choice, self-interest, competition, markets driving prices, encouragement of capital goods and technology, specialization, use of money, and an active but limited government

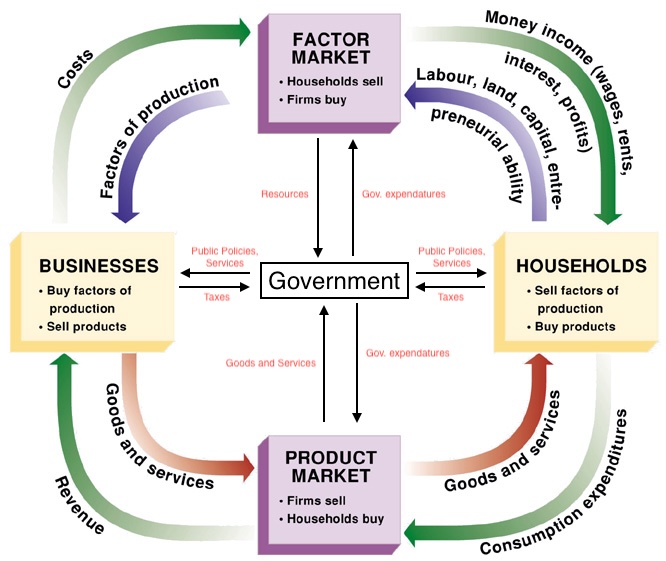

Circular Flow Model

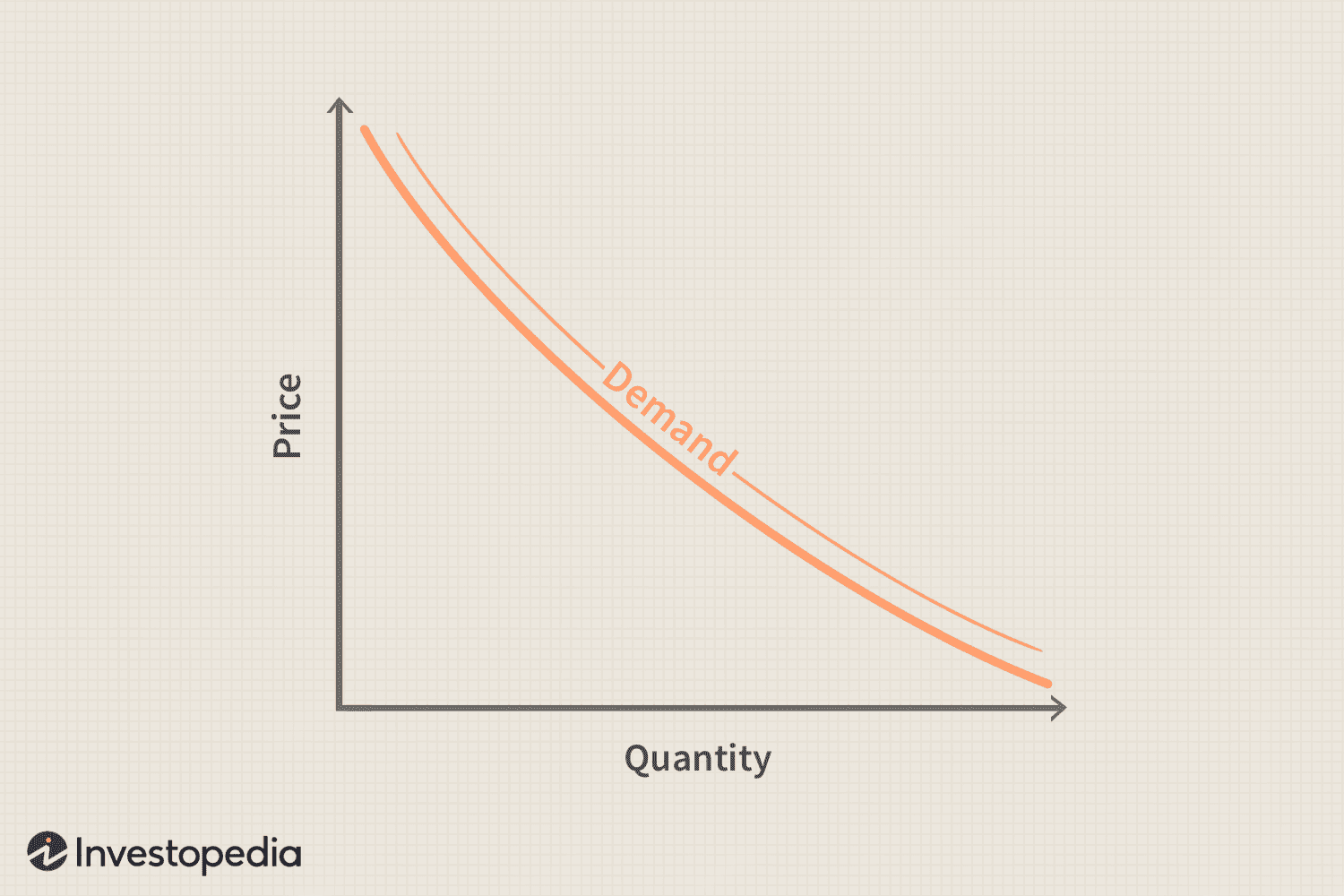

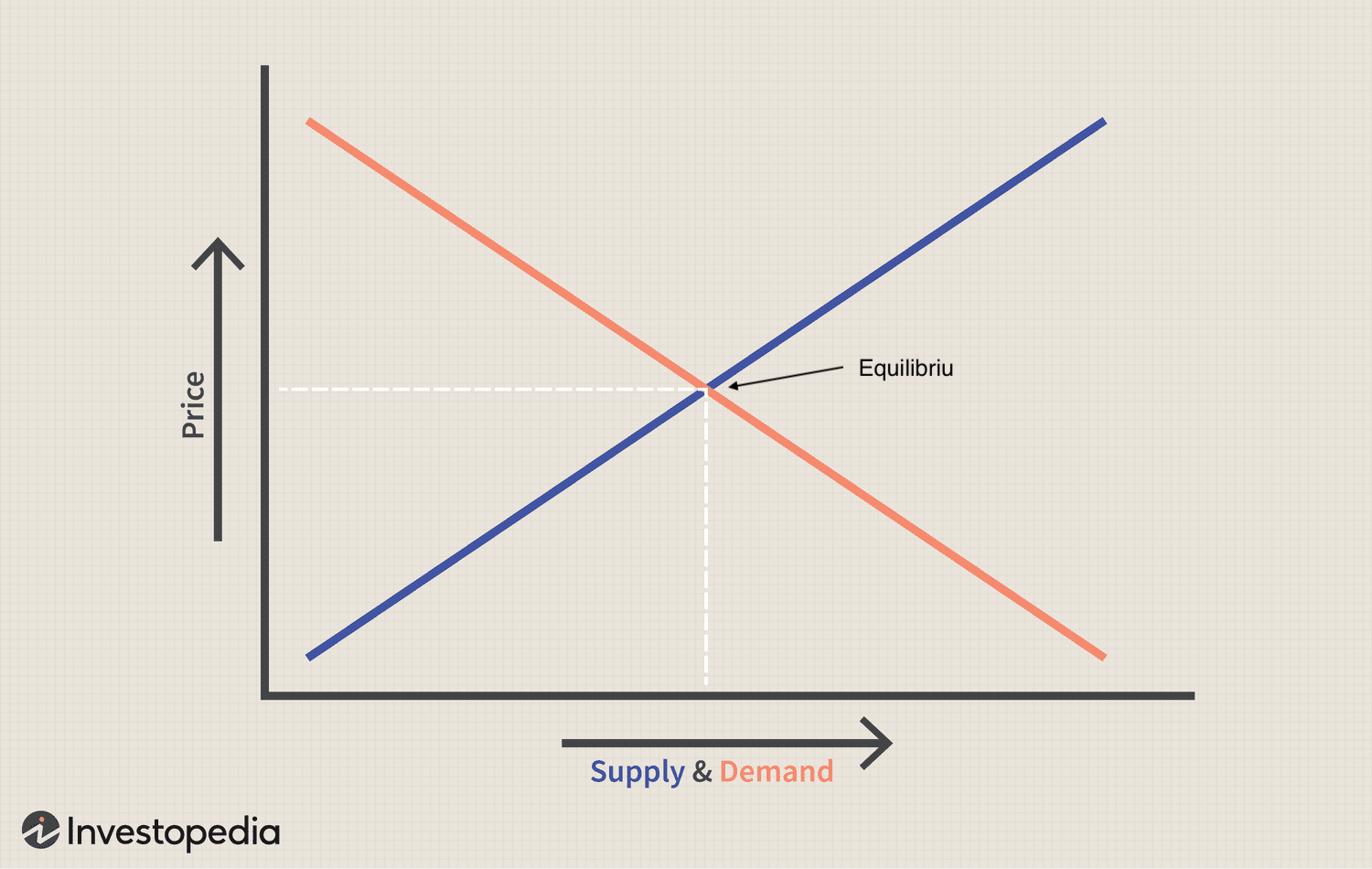

Demand

Quantity of a product that will be purchased at a variety of possible prices

Law of Demand

As the price of a product increases the quantity of demand decreases, and as the price decreases, the quantity increases.

Determinants of Demand

Change in taste or preference

Change in number of customers

Change in consumer income

Change in the price of related goods

Change in consumer expectations

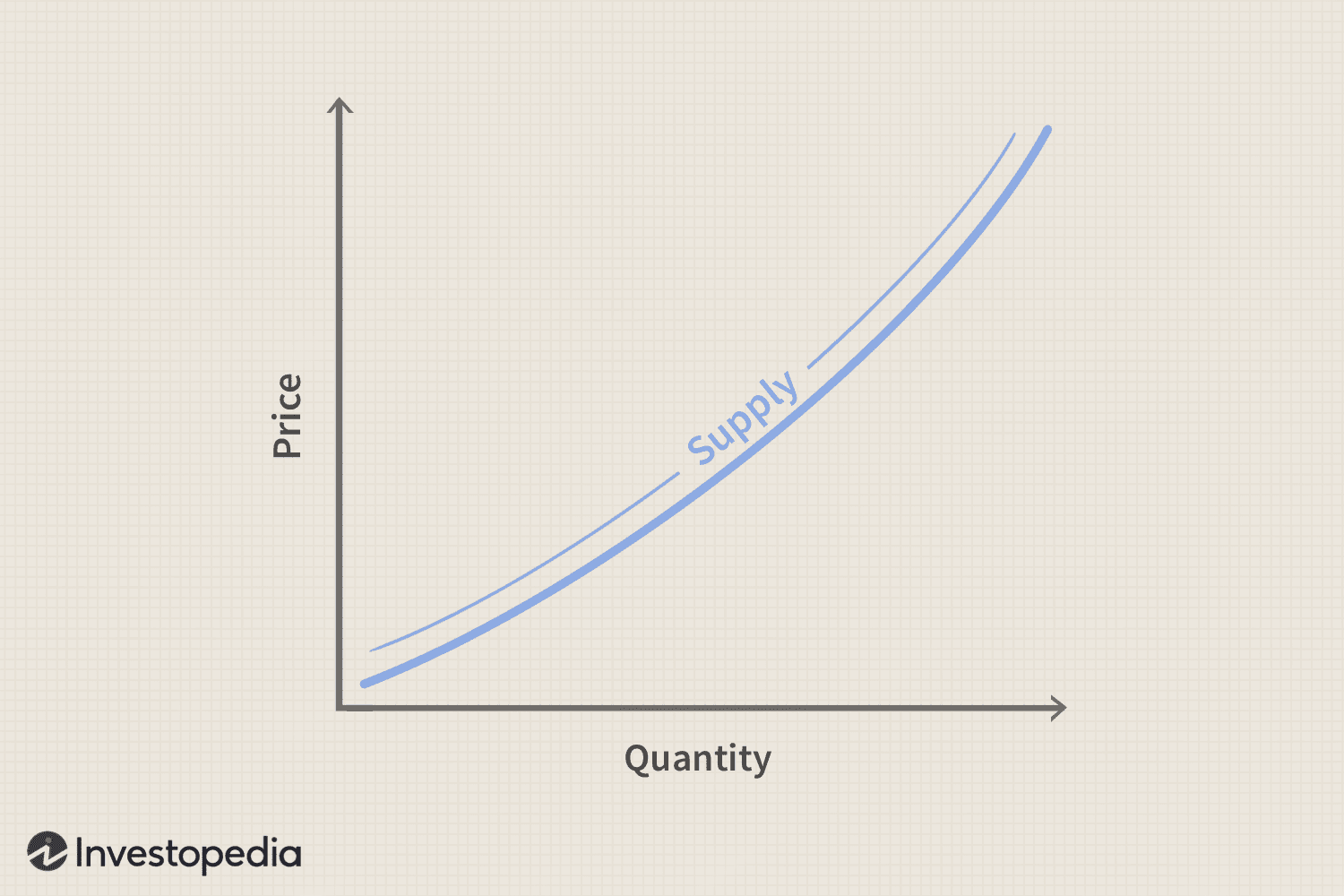

Supply

Various quantities of a product that producers are willing and able to make available at a series of possible prices

Law of Supply

As the price of a product increases the quantity of supply increases, and as the price decreases, the quantity decreases.

Determinants of Supply

Change in resource prices

Change in technology

Change in taxes and subsidies

Changes in prices and other goods produced

Change in the number of producers

Change in producer expectations

Equilibrium

What determines price and quantity a market where supply and demand meet. There is no shortage or surplus.

Shortage

When demand exceeds supply

Surplus

When supply exceeds demand

Price Ceiling

The maximum legal price a seller may charge for a good or service. It protects consumers but also causes shortages.

Price Floor

The minimum legal price set for a seller to charge for a food or service. It protects producers but causes surpluses.

GDP

Gross Domestic Product - The value of all goods and services produced INSIDE a country in a given year

Nominal GDP

GDP measured in current prices, without adjusting for inflation.

Real GDP

GDP that has been adjusted for inflation at a base years price.

Unemployment rate

The state someone is in if they don’t have a job but they are willing and able to and are actively seeking work.

Inflation

The increase in the general price level of goods and services in an economy over a period of time, affecting purchasing power.

Savings

When current consumption is less that current income

Economic Investing

The act of purchasing capital goods to produce more in the future

Shocks

Unexpected changes

What is counted in GDP?

final goods and services

items produced in the country

What is not counted in GDP?

used items (all ready counted)

stocks and bonds

transferred payments

underground economic activities

C

Personal consumption - what households spend on durable goods, non-durable goods, and services

I

Investment - what businesses spend on capital and other things

G

Government Purchases - what the government spends for the direct purchases of resources and goods and services

X-M

Net Exports - what foreign buyers spent on American goods/services (exports) MINUS what Americans spent on foreign goods and services (imports)

C + I + G + (X-M) = ?

GDP

The Income Approach

A method for calculating GDP that sums all incomes earned by factors of production, including wages, profits, rents, and taxes, minus subsidies.

GDP Per Capita

GDP divided by the population

Price Index

(Market Basket of year X / Market Basket of Base Year) x 100

Real GDP Calculation

Nominal GDP / Price Index in hundredths

Hours total of work x labor productivity

Growth Rate

(Change / Original) x 100

Rule of 70

To calculate doubling time, divide 70 by the annual growth rate percentage.

Institutional Structures the Promote Growth

Strong property rights

Patents and copy rights

Efficient financial institutions and systems

Education

Market System

Determinants of Growth

Supply factors

Increase in quality and quantity of natural resources, Human Resources, capital goods, and technology

Demand and efficiency factors

Increases in demand for goods and services, and full employment of resources

Factors Responsible for Productivity Growth

Technology advances (40%)

Quantity of capital (30%)

Education and training (15%)

Economies of scale and improved resource allocation (15%)

Antigrowth View

Growth causes environmental problems

Doesn’t solve sociological problems

Frantic job place

Unsustainable

Growth Positive View

Improved living standards

Reduces poverty

Improved working conditions

Allows more leisure time

Can deal with environmental concerns

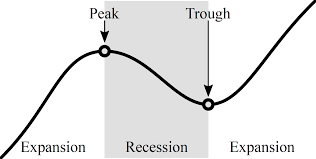

Business Cycle

Business Cycle Phases

Peak - business activity is at a temporary maximum

Recession - a decline in output, income, and employment (lasting 6 months or longer)

Trough - temporary bottom or low for GDP, income, and employment

Recovery - expansion in GDP and employment

Labor Force Participation Rate

Labor force / Age Eligible to Work

Frictional Unemployment

Everyday unemployment - quitting, being fired, out of college and looking for a job

Structural Unemployment

Job skill is no longer needed - ex. machines taking over for humans or run out of iron, you don’t need steel workers

Cyclical Unemployment

Increases and the cycle goes down - due to changes in the business cycle and demand

Full Employment

When there is no cyclical unemployment and all available resources are being used efficiently.

Okun’s Law

For every 1% unemployment beyond the national rate a negative GDP gap of 2% occurs

Demand Pull Inflation

A rise in prices caused by increased consumer demand, often outpacing supply in the economy.

Cost Push Inflation

A rise in prices caused by increased production costs, such as wages and raw materials, leading to a decrease in the supply of goods.

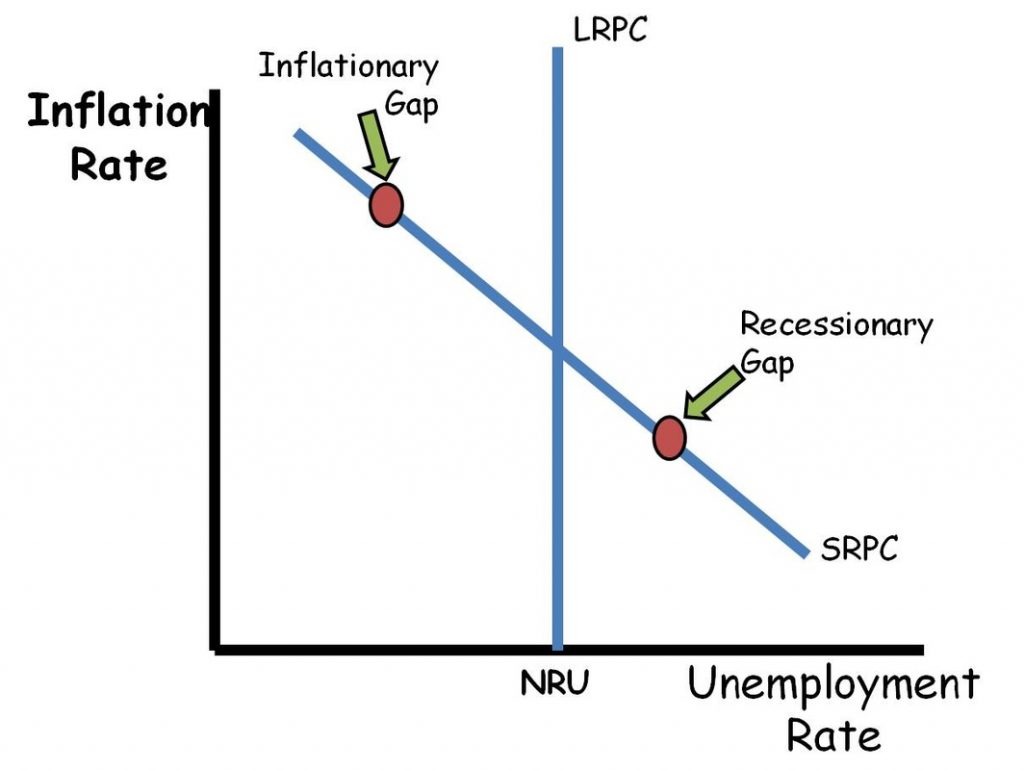

Philips Curve

As unemployment decreases, inflation increases and vise versa

LRPC

Long Run Philips Curve - the natural rate of unemployment

Shifting the Philips Curve

Changes in…

labor market instructions

technological advancements

education and training

immigration policies

government regulations on employment

Disposable Income

Consumption (C) + Savings (S)

Average Propensity to Consume

1 - APS

Average Propensity to Save

1 - APS

Marginal Propensity to Consume

MPC = Change in C / Change in DI

Marginal Propensity to Save

MPS = Change in S / Change in DI

Investment

The purchase of capital goods or new construction. Decision based on marginal cost (i) and marginal benefits

Expected Rate of Return

(Profit / Cost) x 100

Real Interest Rate (i)

The interest rate that has been adjusted for inflation, reflecting the true cost of borrowing.

Determents of Investment

Change in..

Acquisition, maintenance, operating cost

Business taxes

Technology

Stock of capital and land

Planned inventory changes

Expectations

The Multiplier Effect

A change in a component of total spending leads to a larger change in GDP

Calculated by (1/MPS) or (1/1-MPC)

Multiplier x initial change in spending = change in GDP

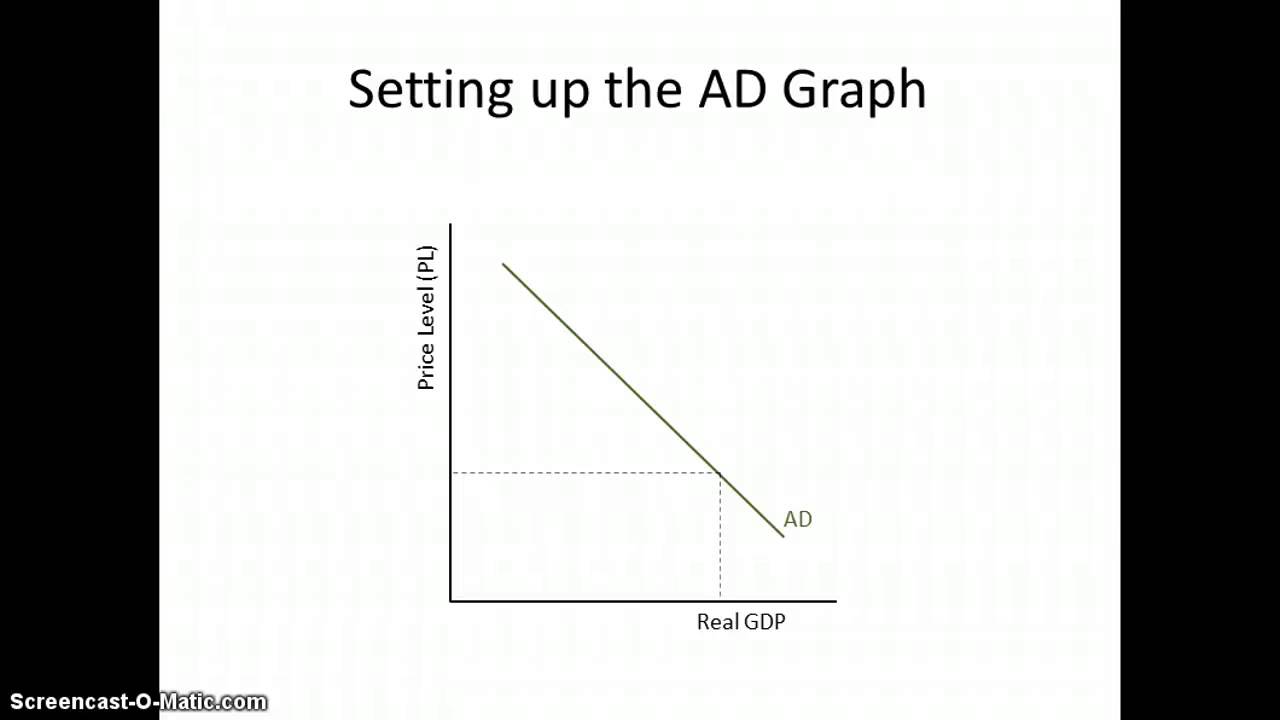

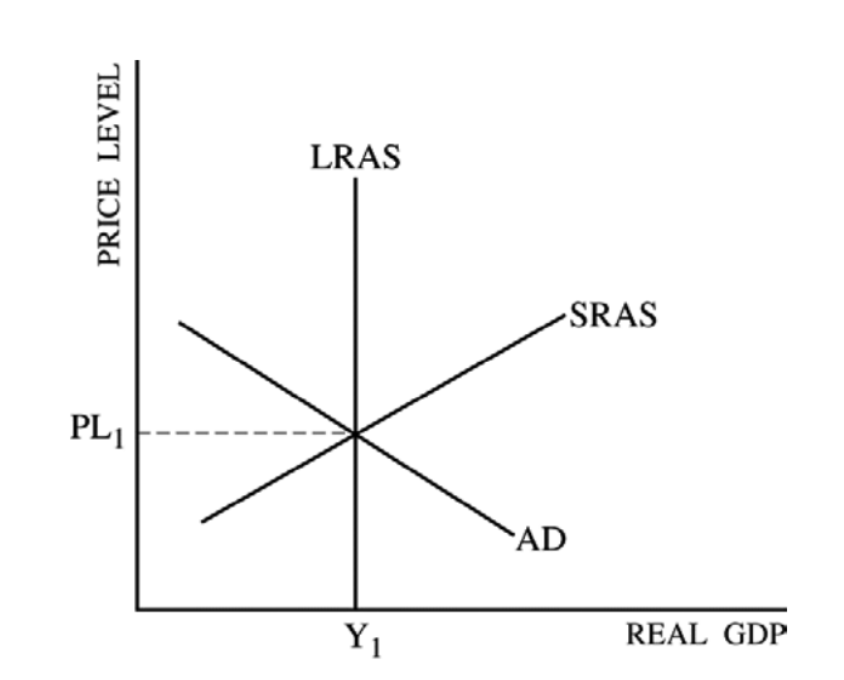

Aggregate Demand

The total demand for all goods and services in an economy at a given overall price level and during a specified time period.

Determinate of AD

Changes in…

C - wealth, expectations, debt, taxes

I - interest rates and expected returns

G - government spendings

(X-M) - national income, exchange rates

Aggregate Supply

The total supply of goods and services that firms in an economy plan to sell during a specific time period at a given price level.

Determents of Aggregate Supply

Changes in…

input prices

productivity

legal/institutionalized environment

Fiscal Policy

A choice made by the government referring to the deliberate manipulation of taxes and government spending by Congress to alter RGDP and employment. control inflation and stimulate economic growth.

Expansionary Fiscal Policy

Used during a recession to increase G, decrease T, increase C, and boost overall demand in the economy. Shifts AD curve to the right.

Contractionary Fiscal Polity

Used when demand pull inflation is too high and to decrease G, increase T, and decrease C. Shifts AD curve to the left.

Tax Multiplier

T Multiplier = 1 / (1 - MPC) or 1 less than the multiplier

Change in GDP Calculation

Tax Multiplier x Change in T Multiplier

The Crowding Out Effect

Occurs when Government spending increases interest rates and reduces investment spending. Can be corrected with Monetary Policy and by manipulating the money supply.

Money is…

a medium of exchnage

M1 (Money Supply)

Currency: dollars/cents (physical money)

Checkable Deposits: amount of money in checking accounts easily spent

Savings Account Deposits: easily transferred to checking and spent

M2

Money market accounts

CDs

Mutual fund balances

The Federal Reserve

The central banking system of the United States responsible for regulating monetary policy and supervising financial institutions.

Assets

The things/money in a bank that the bank owns. Ex. cash, property, reserves, loan money, etc.

Liabilities and Net Worth

The things/money in a bank that the bank owes. Ex. shares, checkable deposits, etc.

Actual Resevrves

The total amount of cash that a bank has on hand, including the physical currency and reserves held at the Federal Reserve. This is used to meet withdrawal demands and required reserves.

Required Reserves

The amount of money the bank is required to keep on hand by the Fed. Calculated by multiplying the ratio by actual reserves.

Excess Reserves

The amount of money left over in reserves that the bank can loan out. Calculated by subtracting the required reserves from the actual reserves.

Monetary Multiplier

1/RR. Shows how an initial increase in the monetary base (central bank money) leads to a larger increase in the overall money supply

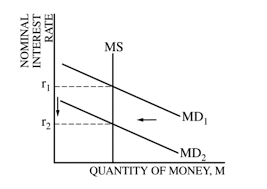

Money Market Graph

The Discount Rate

The interest rate charged on loand from the Fed to the Banks

Expansionary Monetary Policy

Used during a recession/unemployment to increase AD in order to increase RGDP. Put more money into M1 by buying securities, decreasing the reserve amount, decreasing the discount rate, and decreased interest on reserves

Restrictive Monetary Policy

Used during high inflation in order to decrease AD to decrease or control inflation. Take money out of M1 by selling securities, increasing the reserve requirement, increasing the discount rate, or increating interest rates.

Economic Investement

The purchasing of capital goods

Financial Investment

The buying or building of an asset in expectation of earning a financial gain.

Present Value

The measure of the current worth of an investment price of an asset.

Compounding Interest

Paying interest on the original amount and on any interest recieved

International Trade is…

a way for countries to specialize, increase productivity of their resurces, and realize a larger total output

Abosulte Advantage

Who can produce the most