Economies and diseconomies of scale

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

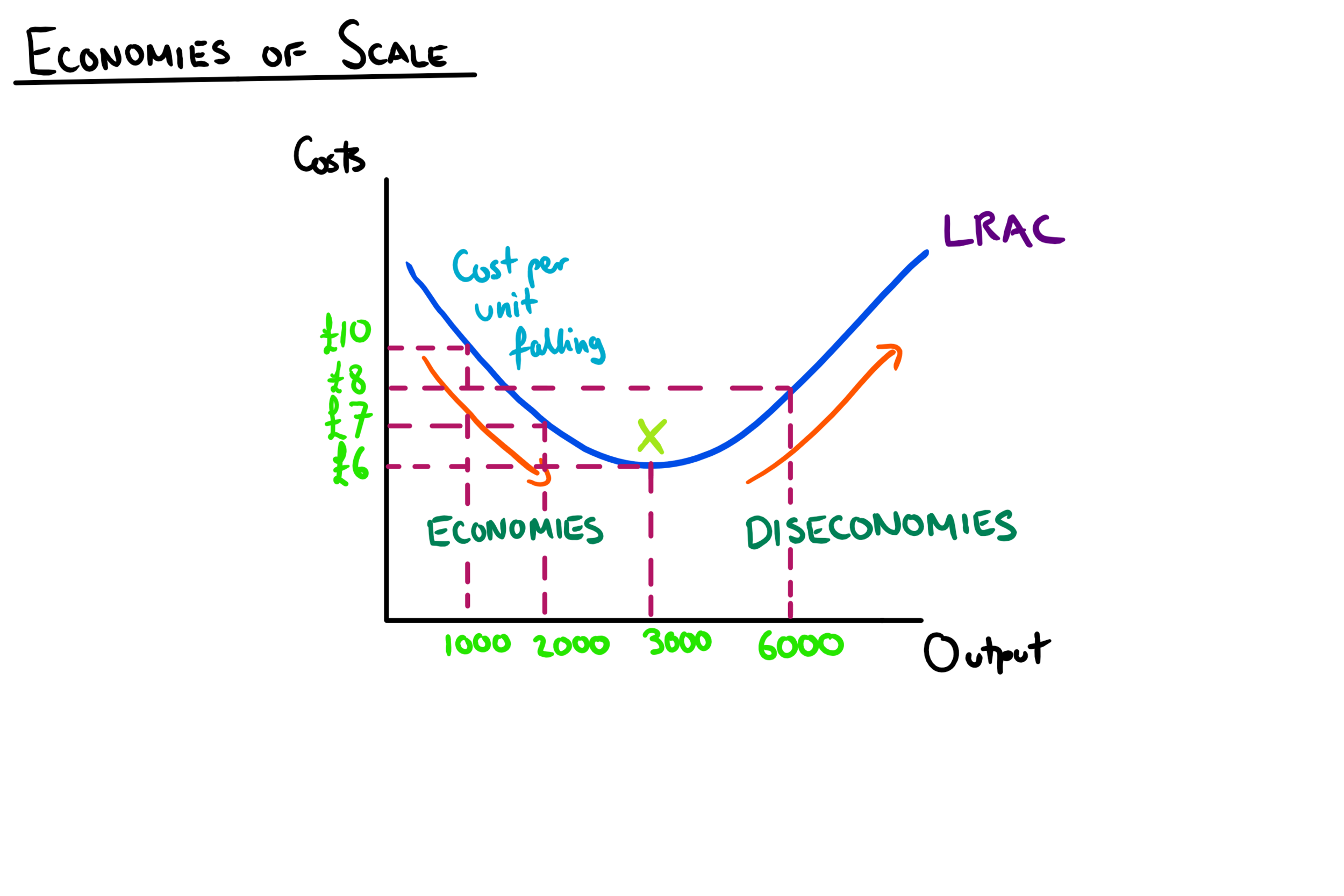

Economy of scale - definition

As a firm grows it is able to increase its scale of output, generating efficiencies which lower its average cost.

Diseconomy of scale - definition

After a certain point, average costs will start to increase as scale increases.

Long run avg. cost curve

Minimum point - minimum efficient scale, where avg costs are lowest - the optimum level of production

All internal economies of scale are fully exploited

Types of Internal economy of scale : Really Fun Mums Try Making Pies

Risk bearing

Financial

Managerial

Technological

Marketing

Purchasing

Risk bearing - definition

When a firm is larger they can expand their production range, therefore they can spread the cost of uncertainty as have other parts to fall back on if one fails.

Financial - definition

Banks are willing to lend loans more cheaply to larger firms, as less risky, so credit is cheaper

Managerial - definition

More able to specialise an employ supervisors, lowering their AC

Technological - definition

Larger firms can invest in more advanced and productive machinery and labour

Marketing - definition

Can divide marketing budget across larger outputs so avg marketing costs per unit is less than that of a smaller firm

Purchasing - definition

Larger firms can bulk buy which means each unit will cost them less, higher buying power

External economies of scale

Factors outside the firm, but on an industry scale:

geographic cluster

Transport links

Skilled labour

Favourable legislation

Types of diseconomies of scale

Control - it becomes harder to monitor how productive the workforce is as the firm becomes larger

Coordination - harder to coordinate every worker with 1000s of employees

Communication - workers may feel alienated and excluded as the firm grows, leading to fall in productivity.

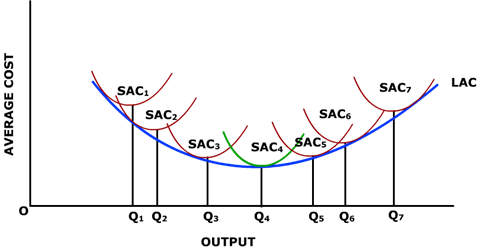

Short vs long run avg cost curves

Short run - day to day operations

Long run - firms can plan to increase the scale of production

What happens to firms’ cost curves when scale increases

In economies of scale, firms move onto a new SRAC with lower unit costs

How are SRAC and LRACs related

The LRAC is the line of best fit between the lowest points of the SRAC curves

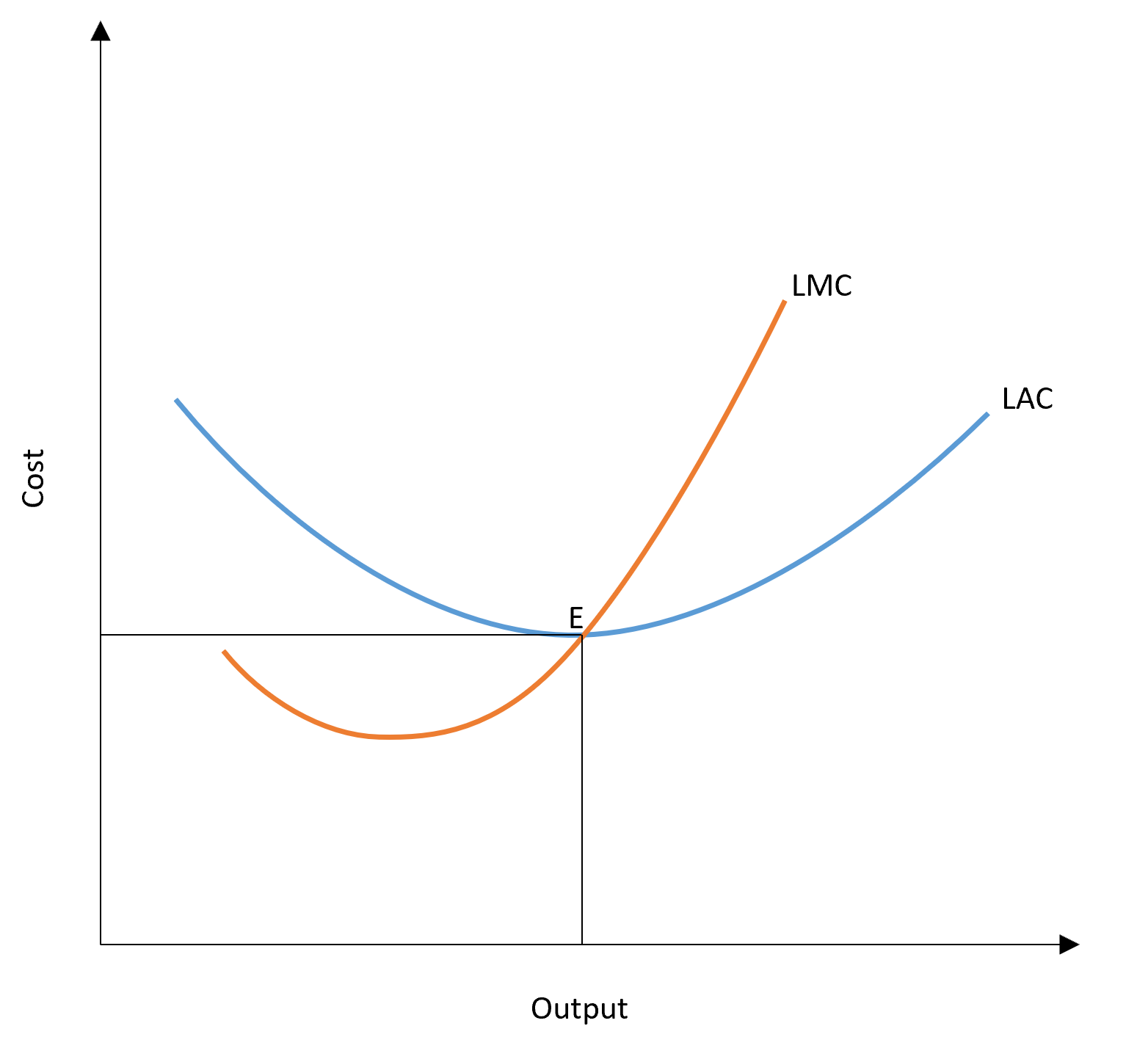

Where does LRAC meet the marginal cost curve

At the MES, as for each future unit produced average cost increases

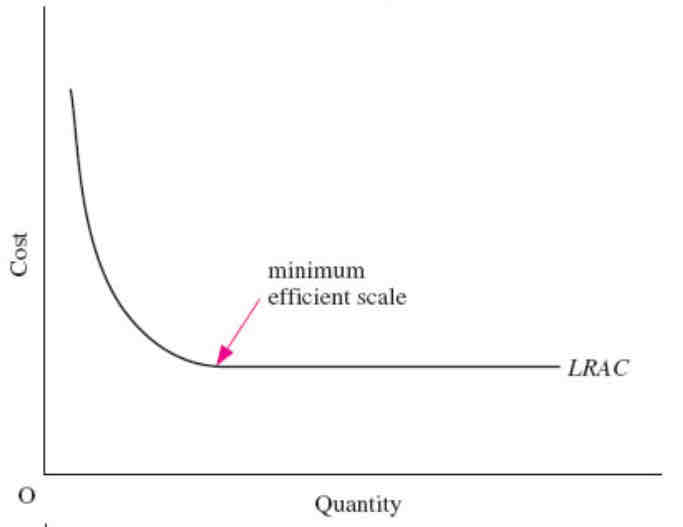

How are the LRAC curves different for small and large firms in market

MES is further right for large firms as a higher output is needed to reach it.

What does a flat LRAC curve show?

The whole flat part is the MES, no diseconomies of scale