Principles of Taxation - Chapter 4 - Trading profits

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

Which basis is the default method of calculating trading profits for an unincorporated business?

The cash basis

Which basis can unincorporated businesses can elect?

the accruals basis instead and prepare their accounts under generally accepted accounting principles (GAAP)

Which basis should you assume in the exam?

You will be told if the accruals basis is being used.

You should assume the cash basis is being used unless the question states otherwise.

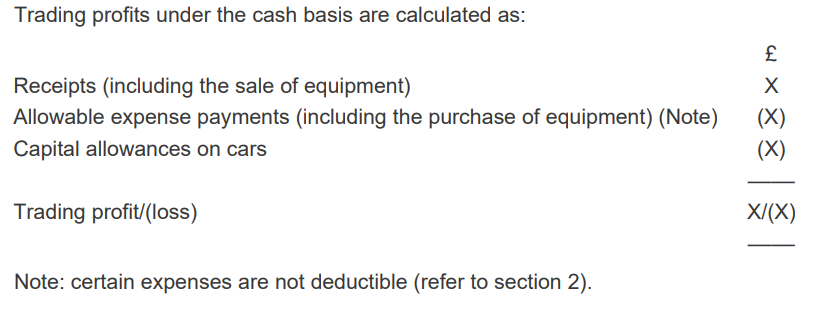

How do you calculated trading profits under the cash basis?

Trading profit/ (loss) = Receipts - Allowable expense payments - capital allowance on cars

Under cash basis, is there a distinction between capital & revenue expenditure?

NO

Therefore capital assets are treated as follows:

purchases are allowable deductions when paid for and proceeds are taxable receipts when the asset is sold (except cars, land and buildings)

if there is private use by the sole trader or a partner in a partnership only the business proportion of cost/proceeds will be deducted/taxed

capital allowances are available for cars only

there is no tax relief against business profits for purchases of land and buildings.

What type of income is not included in the accounts but is taxable trading income?

Example 1: The most common example of taxable trading income not included in the accounts is when a sole trader (or partner in a partnership) removes goods from the business for personal use. (DRAWINGS)

Example 2: Under the cash basis, if the sole trader or partner does not pay an arm’s length price, a ‘just and reasonable’ amount should be added to trading profits (e.g. the cost of the inventory).

What type of income is included in the accounts but is not taxable trading income?

There are two types of non-trading income that may have been included in the accounts but should be removed for tax purposes:

income taxed elsewhere e.g. chargeable gains on buildings, rental income or savings income.

income that is exempt from tax e.g. exempt capital gains

When is expenditure allowable?

Expenditure is usually allowable if it is incurred wholly and exclusively for the purposes of the trade.

This may not be the case if the expenditure:

is too remote from the purposes of the trade

has both a trade and non-trade purpose (the duality principle)

What will HMRC generally accept if there is a dual purpose for expenditure?

HMRC will generally accept a reasonable apportionment between business use (allowable) and private use (disallowable)

Give examples of payments to staff that are allowable?

salaries, bonuses and redundancy payments and the cost of providing benefits.

Is training expenditure for employees allowable?

Yes, provided that the training is aimed at improving the skills needed in the business.

Is training expenditure for a sole trader or a partner in a partnership allowable?

Yes, if they are maintaining existing skills

What is an appropriation? Is it allowable? Give examples

An appropriation is a withdrawal of funds from a business’s profits.

These are disallowable as expenses.

Common examples of appropriations include:

the business owner’s salary

drawings made by a sole trader/partner

Unreasonable payments made to family member employees are classified as appropriations of profit and the excess is therefore disallowed.

Are trade or professional association subscriptions allowable?

Yes, they are normally allowable since they will be made wholly and exclusively for the purposes of the trad

Are donations allowable? If so, give examples

The treatment of a donation depends on the nature of the organisation to which the sole trader or partnership is making the donation:

Small donations to local charities are allowable.

Gifts of stock or assets to local charities or schools are allowable.

Donations to national charities are disallowable but tax relief may be available through the gift aid scheme (refer to Chapter 2).

Subscriptions and donations to political parties are disallowable

Is expenditure relating to client and supplier entertaining allowable?

NO

Is expenditure relating to staff entertaining allowable?

YES

Is the gift of trade samples to customers allowable?

YES

Are other gifts to customers allowable?

NO unless the item:

cost < £50 per recipient per year, and

is not food, drink, tobacco or vouchers exchangeable for goods, and

carries a conspicuous advertisement for the business

Are gifts to employees allowable & what may they result in?

Yes, they are normally allowable

t the gift may result in an income tax charge for the employee under the employment benefits rules

When is expenditure on legal and professional fees allowable?

if incurred for the purposes of the trade, for example:

legal fees chasing debts

charges incurred in defending the title to fixed assets.

Legal and professional fees relating to capital expenditure are generally disallowable, e.g. fees associated with acquiring new fixed assets

What are the 3 exceptions of allowable expenses related to capital assets?

Fees and other costs of obtaining long term debt finance are allowable.

The cost of registering patents is allowable.

The expense of renewing a short lease (a lease for 50 years or less) is allowable (unless it relates to land).

Are fines allowable? What is an exception?

Fines are generally disallowable, but parking fines incurred by an employee (but not the business owner) whilst on work business are allowable.

Is interest on borrowings for the purpose of the trade (e.g. business account overdraft) allowable?

YES

Is interest on late paid tax allowable?

NO

Is irrecoverable VAT allowable?

YES if the related expenditure is allowable

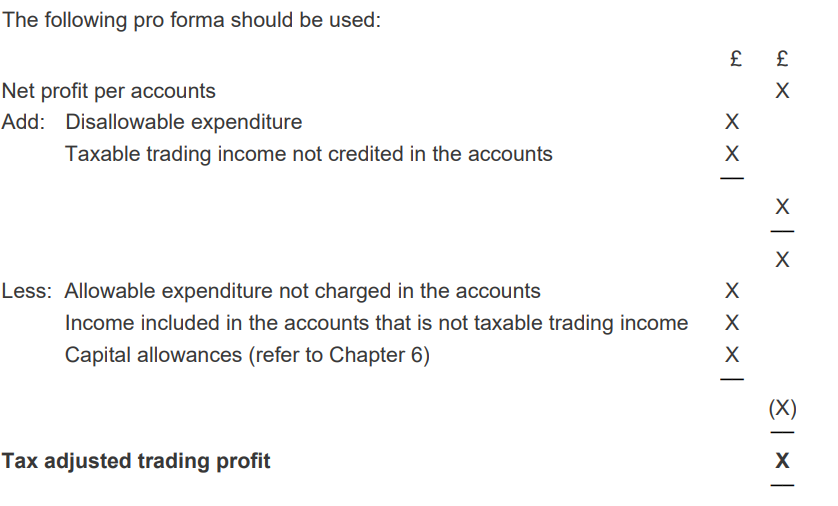

Which pro forma should be used if a sole trader or partnership uses the accruals basis?

Tax adjusted trading profit = Net profit per accounts + Disallowable expenditure + Taxable trading income not credited in the accounts - Allowable expenditure not charged in the accounts - Income included in the accounts that is not taxable trading income - Capital allowances

How do we treat goods taken for personal use under the accruals basis?

The treatment in the tax computation depends on the treatment in the accounts:

If correctly treated in the accounts (i.e. cost has been removed from purchases): add back the profit element.

If still included in purchases (i.e. no adjustment made to the accounts): add back selling price.

Are movements in specific provisions AND general provisions allowable?

Movements in specific provisions are allowable but movements in general provisions are disallowable.

Is the write-off of trade bad debts allowable?

YES

Is the write-off of non-trade bad debts allowable?

NO and it needs to be added back

Which payments to staff are & aren’t allowable under accruals basis?

Earnings not paid within nine months of the year end, are not deductible until the period in which they are paid.

Employers’ contributions to pension schemes are allowed when paid, rather than on the normal accruals basis

When and when isn’t expenditure on or relating to capital assets?

It’s not allowed in computing the taxable trading profit but may be allowed for capital gains tax or attract capital allowances

What are common examples of capital expenditure which is disallowable when calculating taxable trading profit?

depreciation

loss on sale of fixed assets (equally profit on the sale of fixed assets is deducted from net profit)

cost of capital assets included within repairs and maintenance

improvements/enhancements

expenditure required to first bring an asset into a useable state

capital related expenditure included within legal and professional fees

When are legal costs relating to the renewal of a short lease (even of land) allowable?

Under the accruals basis

Are repairs (returning an asset to its original condition) and maintenance (e.g. redecoration) allowable costs?

YES

Are repairs using current industry standard materials or technology allowable even though there is an element of improvement e.g. using steel girders to support a floor in place of old wooden beams, so long as the new floor cannot support more weight than the old one?

YES

Are the costs of hiring, leasing or renting plant and equipment allowable? & when are they not?

YES

But, there is a flat rate disallowance of 15% of car lease payments where CO2 emissions exceed 50g/km.

If the leased car is used by the sole trader (or partner in a partnership) partly for business and partly for private use, then there will also be a disallowance for the private use.

How do you work out the disallowance for a leased car that has private use?

It is easier to work out the allowable expense first, being 85% of the business proportion of the leasing cost, and then the disallowance is the remainder

What does it mean if a transaction is trading or capital?

Trading - It’s taxable under income tax

Capital - It’s taxable under capital gains tax

What are 9 badges of trade used to determine whether someone is trading?

The subject matter of the transaction (whether the asset has been bought for personal use, for investment, or for resale).

The length of the period of ownership (shorter periods of ownership may indicate trading).

The frequency or number of similar transactions by the same person (a high frequency of similar transactions may indicate trading).

Supplementary work and marketing (work performed on goods to improve them or make them more marketable may indicate trading).

The circumstances responsible for the realisation (being forced to make a sale to raise cash may indicate not trading).

The motive (an intention to profit may indicate trading).

The method of finance used to acquire the asset. If a short-term loan was used to enable the purchase this could suggest trading, particularly if the loan could only be repaid following the sale of the asset.

The method of acquisition and source of finance (an inherited asset is less likely to be classed as trading, but short-term finance to buy or improve the asset indicates a trading activity).

If the transactions are like those of the taxpayer’s existing trade it could indicate trading.

Who does the trading allowance of £1,000 apply to?

sole traders (not partnerships).

If a sole trader’s trading receipts (not profits) are up to £1,000, are those receipts taxable?

NO and they do not need to be declared for tax purposes

If a sole trader’s trading receipts are more than £1,000 the taxpayer, what can they choose to do?

To deduct the allowance from the receipts rather than any actual expenses incurred.

The election applies to all the individual’s trades and relates to a specific tax year.

What should we assume about trading allowance in the exam?

In the exam, assume the trading allowance applies if receipts ≤ £1,000, but if receipts > £1,000 assume that no election to use the trading allowance has been made unless told otherwise.