Market Structures and Economic Surplus Analysis

1/99

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

100 Terms

Economic Surplus

The extra money you make above your willingness to pay.

Consumer Surplus

Marginal benefit minus price.

Producer Surplus

Price minus marginal cost.

Market Efficiency

Producing a given quantity of output at the lowest possible cost.

Marginal Cost

The cost of producing one additional unit.

Deadweight Loss

How far economic surplus falls below the efficient outcome.

Market Failure

When competitive markets lead to inefficient production and allocation.

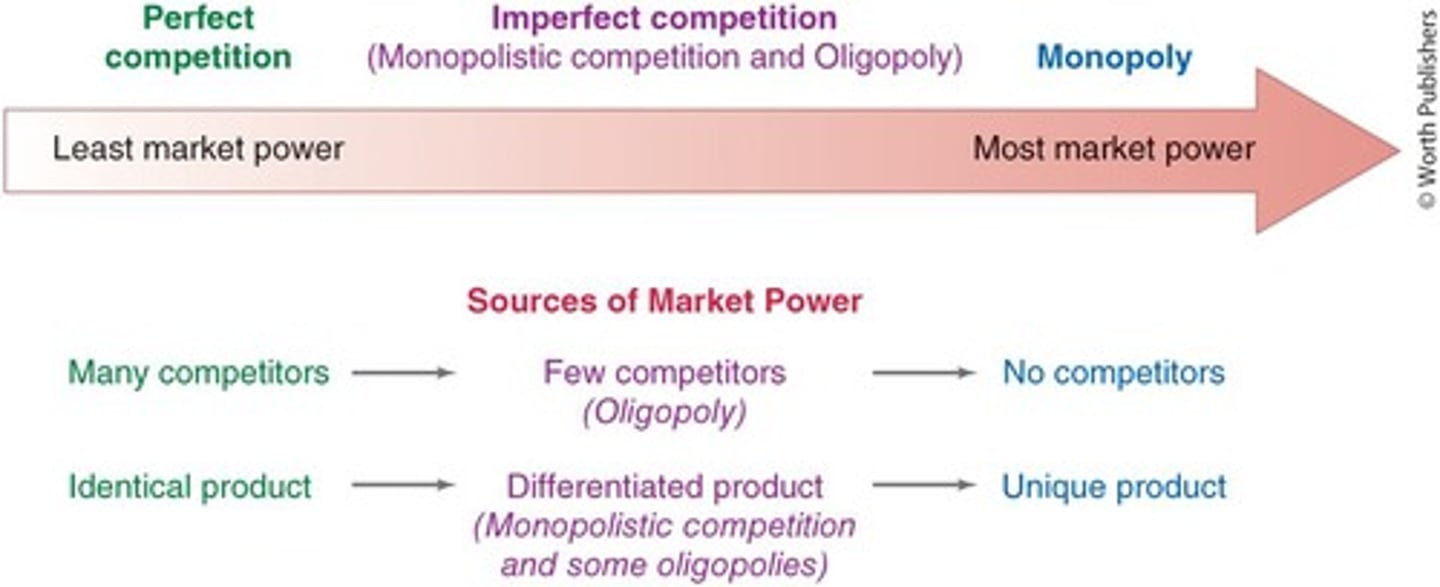

Market Power

The ability of a company to adjust their own price due to lack of competition.

Externalities

When the choices that buyers and sellers make have side effects on others.

Information Problems

Private information is not shared equally between both parties, leading to asymmetry.

Marginal Private Cost

The extra costs paid by the seller from producing one extra unit.

Marginal External Cost

The extra cost imposed on others from producing one extra unit.

Marginal Social Cost

The sum of marginal private cost and marginal external cost.

Marginal Private Benefit

The extra enjoyment by the buyer from purchasing one extra unit.

Marginal External Benefit

The extra benefit occurring to others from one extra unit.

Marginal Social Benefit

The sum of marginal private benefit and marginal external benefit.

Socially Optimal Quantity

The quantity that is most efficient for society as a whole, including the interests of buyers, sellers, and bystanders.

Rational Rule for Society

Marginal social benefit equals marginal social cost.

Market Structure

The organization of a market based on the degree of competition.

Pricing Strategy

The method used by a company to price its products.

Output Decisions

Decisions regarding the quantity of goods to produce.

Equilibrium Quantity

The quantity at which supply equals demand.

Positive Externalities

Benefits that affect third parties positively.

Negative Externalities

Costs that affect third parties negatively.

Rational rule for Society

marginal social benefit = marginal social cost

Equilibrium quantity

Forecast what you think will happen find where supply = demand

Externalities

Positive or negative effects involved in a market

Socially optimal quantity

Where marginal social benefit equals marginal social cost

Market failure

Occurs when there is overproduction or underproduction

Market power

The extent in which a seller can charge a higher price without losing many sales to competing business

Perfect Competition

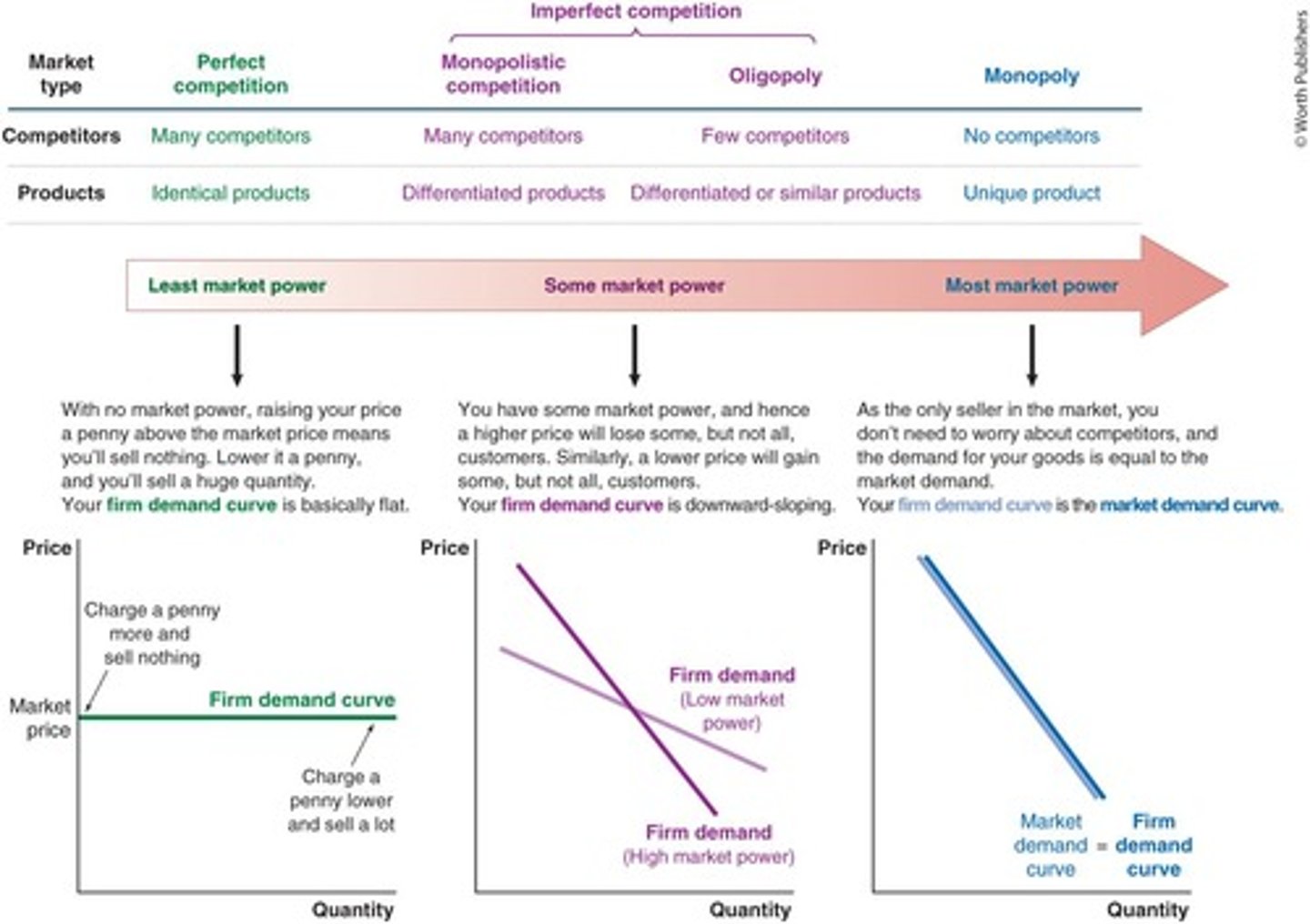

A market with identical goods, many sellers and buyers, and no market power

Price taker

A seller who accepts the market price as given

Monopoly

When there is only one seller in the market with almost absolute market power

Oligopoly

A market with only a handful of large sellers, resulting in substantial market power

Product differentiation

Efforts by sellers to make their products different from those of their competitors

Monopolistic Competition

A market with many small businesses competing, each selling differential products

Marginal revenue

The change in total revenue

Marginal cost

The change in total cost

Total revenue

Price x Quantity

Total cost

Next price x Quantity

Profit

Total revenue - Total cost

Market power outcomes

Market power quantity is less than competitive quantity

AIDS drug pricing

The drug was priced at $10,000 a year despite a marginal cost of less than a dollar

Competition policy

Antitrust policy that encourages competition

Anti-collusion laws

Laws that prevent the destruction of competition in the market

Merger laws

Laws that prevent competing businesses from combining to consolidate market power

Increasing Competition

Can lead to better outcomes, as seen with the AIDS drug price drop after patent expiration

Market outcomes comparison

The price in perfect competition is lower than in imperfect competition

Market Power

The extent to which a seller can charge a higher price without losing many sales to competing businesses.

Perfect Competition

Markets in which identical goods are sold by many sellers and many buyers, resulting in no market power and the seller being a price-taker.

Monopoly

When there is only one seller in the market, resulting in lots of market power and the ability to raise prices without losing customers.

Oligopoly

A market structure dominated by a small number of sellers, where each seller has some market power.

Monopolistic Competition

A market structure where many firms sell products that are similar but not identical, allowing for some degree of market power.

Perfectly Competitive Market Example

Gas Station Example: As one of four gas stations at a busy intersection, you are operating in a perfectly competitive market.

Identical Goods

Products that are the same in every aspect, leading to no differentiation among sellers.

Price-Taker

A seller who accepts the market price as given and cannot influence it by changing their own prices.

De Beers Diamonds Example

From its founding in 1888 until the mid-twentieth century, De Beers operated as a monopolist in the diamond market.

Cellular Service Market Example

The cellular service market is dominated by three sellers: AT&T (45%), Verizon (29%), T-Mobile (25%), and others (1%).

Market Structure

The organizational and competitive characteristics of a market that determine the level of competition and pricing power.

Competitive Environment

The landscape of competition in a market, influenced by the number of competitors and the nature of the products offered.

Pricing Strategy

The method companies use to price their products, which is influenced by the market structure and competition.

Output Decisions

Choices made by a business regarding the quantity of goods to produce, which are affected by market conditions.

Market Structure and Business Strategy

The relationship between the type of market structure and the strategic decisions a business makes.

Strategic Opponents

Competitors in a market that have a significant impact on a business's pricing and market share.

New Competitors

Firms that enter a market and potentially disrupt existing market dynamics by offering similar products.

Higher-Quality Products

Goods that offer superior features or benefits compared to competitors, allowing for potential market power.

Better Service

Enhanced customer service or support that can differentiate a business from its competitors.

Market Power Spectrum

The range of market power that businesses can have, depending on the market structure they operate within.

Agricultural Markets

Markets where many farmers sell identical products, such as corn, leading to perfect competition.

Commodities Markets

Markets where many sellers offer nearly identical products, such as gold, oil, and livestock.

Stock Market Example

There are many people selling Apple stock, and one share of Apple stock is the same as any other share.

Oligopoly

A market with only a handful of large sellers. Products can be somewhat different or somewhat similar.

Oligopoly result

Substantial market power (but less than monopolists). NOT a price-taker.

Strategic interaction

As you choose your price, you think about how your rivals will respond to your choices.

Monopolist Competition

A market with many small businesses competing, each selling differentiated products.

Product Differentiation

Efforts by sellers to make their products differ from those of their competitors.

Market power

The ability to pursue independent pricing strategies.

Imperfect competition

Includes monopolist competition and oligopoly.

Perfect competition

A market structure where no individual seller has market power.

Monopoly

A market structure where only one seller exists for a specific product.

Firm demand curve

Illustrates how the quantity that buyers demand from an individual business varies as it changes the price it charges.

Market demand curve

The quantity demanded across all firms in the entire market at various prices.

Individual demand curve

The quantity demanded by an individual buyer at various prices.

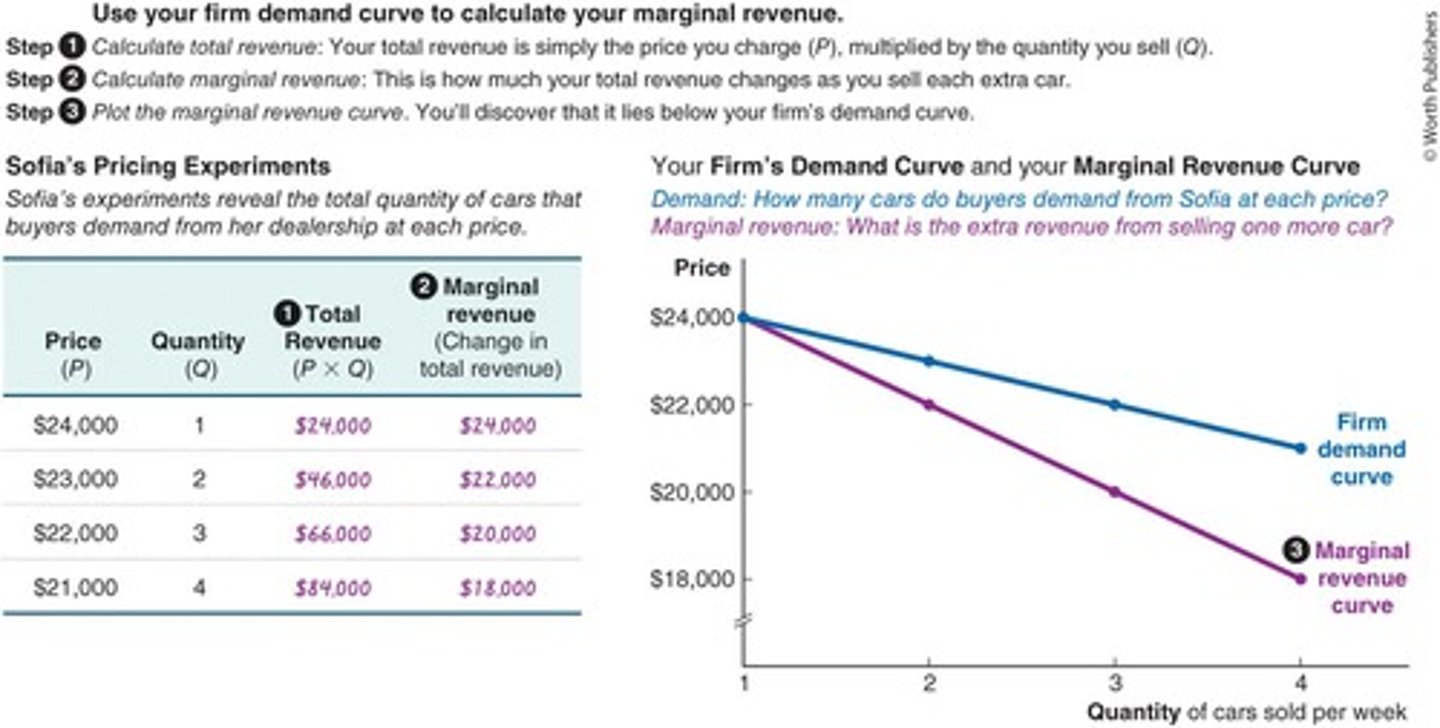

Marginal revenue

The addition to total revenue you get from selling one more unit.

Total Revenue

Price multiplied by Quantity.

Cost-benefit principle

Consider the benefits and costs of selling the additional unit.

Marginal principle

Should I sell one more unit?

Trade-off in pricing

If you lower your price, you sell more units, but you won't make as much money from each unit you sell.

Successful product differentiation

Gives you more market power.

Bargaining power of buyers

Imperfect competition among buyers gives them bargaining power.

Market power and competitors

Having more competitors leads to less market power.

Price setting decision

Key business decision to figure out what price to charge.

Profit margin

The difference between the selling price and the cost of goods sold.

Marginal revenue curve

A graphical representation of marginal revenue as quantity changes.

Calculate total revenue

Total Revenue = Price × Quantity.

Marginal revenue

Your marginal revenue reflects the balance of these opposing forces.

Discount effect

Discount effect = ∆P Q, where ∆P is the price cut you have to offer and Q is the quantity subject to that price cut.

Output effect

Output effect = Price, which is the price of the extra item you sell.

Marginal revenue formula

Marginal revenue = Output effect - Discount effect.

Third car marginal revenue calculation

Marginal revenue = $22,000 - $1,000 2, resulting in marginal revenue from the third car being $20,000.