MGCR 293 Chapter 9: Pricing Strategies

1/39

Earn XP

Description and Tags

These flashcards cover key terms and concepts related to pricing strategies, especially focusing on price discrimination and its various forms.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

40 Terms

Price Discrimination

The practice of charging different prices to different consumers for the same product.

First-Degree Price Discrimination

Perfect price discrimination; the firm charges each buyer their reservation price.

Second-Degree Price Discrimination

Consumers self-select into different pricing based on quantity purchased; also known as block pricing.

Third-Degree Price Discrimination

Different prices are set for different groups of customers based on their price sensitivity. The group with more elastic demand or higher price sensitivity gets lower price.

Coupons and Rebates

Tools used in third-degree price discrimination to target consumers with more elastic demand. Firms use coupons and rebates to price discriminate because other consumers (on the less elastic part of the demand curve) are willing to pay more. People who use coupons or send in rebates are likely to have more elastic demand than those who do not.

Peak-Load Pricing

A pricing strategy where higher prices are charged during periods of peak demand. Peak-load pricing is commonly used when firms face a production capacity constraint. When there is a capacity constraint, firms can use peak-load pricing to increase profits during periods high demand.

Market Power

The ability of a firm to influence the price of a product or service in the market.

Non-Uniform Pricing

A pricing strategy that involves charging different prices to different consumers. the price per unit of output is not constant but depends on how much customers want to buy. This strategy aims to maximize revenue by capturing consumer surplus and addressing variations in demand elasticity.

Consumer Surplus

The difference between the maximum price a consumer is willing to pay and the actual price paid.

Two-Part Pricing

A pricing strategy with two components: a fixed entry fee calculated by using consumer surplus and a per-unit price.

Marginal Cost (MC)

The cost of producing one additional unit of a product.

Total Surplus

The sum of consumer surplus and producer surplus in a market.

Deadweight Loss (DWL)

The loss of economic efficiency that occurs when the equilibrium outcome is not achievable.

Elastic Demand

Demand is considered elastic when a small change in price results in a large change in quantity demanded.

Inelastic Demand

Demand is considered inelastic when a change in price results in a relatively smaller change in quantity demanded.

Reservation Price

The maximum price a buyer is willing to pay for a product.

Producer Surplus

The difference between what producers are willing to accept for a good versus what they actually receive.

Oligopoly

A market structure in which a small number of firms have significant market power.

What are the three conditions for using price discrimination?

A firm must have market power. A monopoly firm might be able to price discriminate. A perfectly competitive firm cannot.

A firm can monitor customers’ purchases

A firm must be able to prevent resale from buyers who buy at the low price and sell at the higher price in resale markets

When to use Perfect/First-degree Price Discrimination

The firm has market power and can prevent resale.

The firm has complete information about every buyer’s reservation price before purchase. The reservation price is the price that a buyer is willing to pay

Perfect/First-degree Price Discrimination Pricing strategy

The firm charges each buyer exactly equal to the buyer’s reservation price. This is a purely theoretical situation

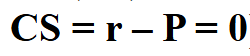

Consumer surplus for first-degree price discrimination

If the market price (P) set by the firm equals buyer’s reservation price (r), consumer surplus (CS) is zero. The firm can capture 100% of the consumer surplus to be its profit.

What is the firm’s marginal revenue curve for first-degree price discrimination

The firm’s marginal revenue curve is the same as its demand curve. This implies that each additional unit sold increases total revenue by the price charged at that unit, reflecting the maximum price consumers are willing to pay.

Conditions for Second-Degree Price Discrimination

The firm has market power and can prevent resale.

The firm cannot determine the exact customer’s reservation price.

The firm cannot directly identify customers into groups before purchase.

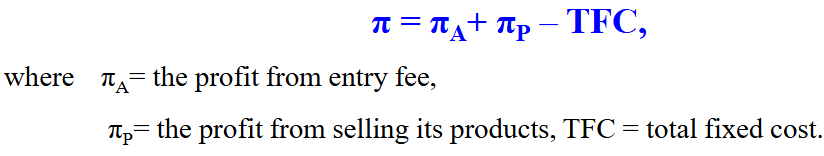

What is the firm’s total profit using two-part pricing?

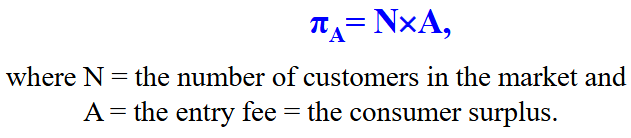

What is the firm’s profit from entry fee using two-part pricing?

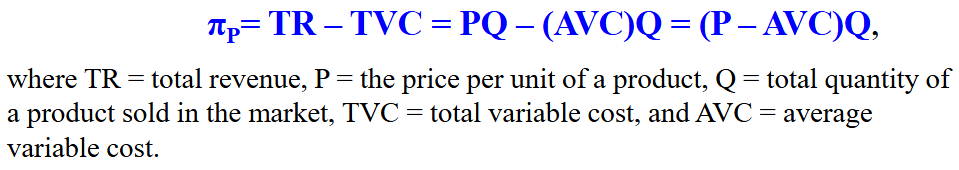

What is the firm’s profit of selling the product using two-part pricing?

The firm’s profit of selling the product = the firm’s variable cost profit = the firm’s producer surplus

What is scenario 1 for two-part pricing?

Identical Consumers:

The firm charges a per-unit price equal to marginal cost (P=MC).

The fixed entry fee is set equal to the entire consumer surplus (CSCS) of each consumer.

This allows the firm to capture all consumer surplus, maximizing profit and social welfare (no deadweight loss).

Consumers with identical demand functions

Constant marginal cost

What is the firm’s total profit function for Identical customers two=part pricing?

For this scenario, the firm sets P = MC to capture all the consumer surplus. If MC is constant, MC = AVC (see Cost analysis) and then P = AVC. If P = AVC, it follows that πP = 0.v

What is scenario 2 for two-part pricing?

Different Consumers:

There are two types of consumers in this scenario each with their own market demand functions:

Strong demanders (or higher willingness-to-pay)

Weak demanders (or lower willingness-to-pay)

The strong demander will buy more units at any given price than the weak demander

Constant MC

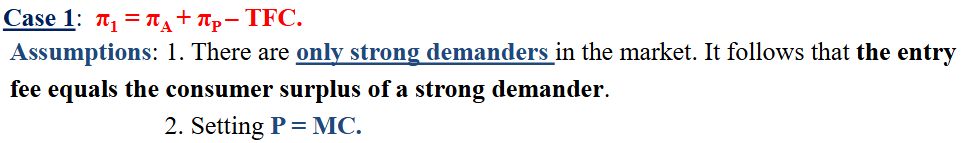

Two-Part pricing with different types of customers case 1

There are only strong demanders in the market. It follows that the entry fee equals the consumer surplus of a strong demander.

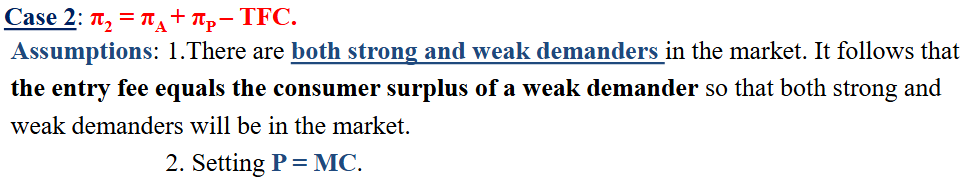

Two-Part pricing with different types of customers case 2

There are both strong and weak demanders in the market. It follows that the entry fee equals the consumer surplus of a weak demander so that both strong and weak demanders will be in the market

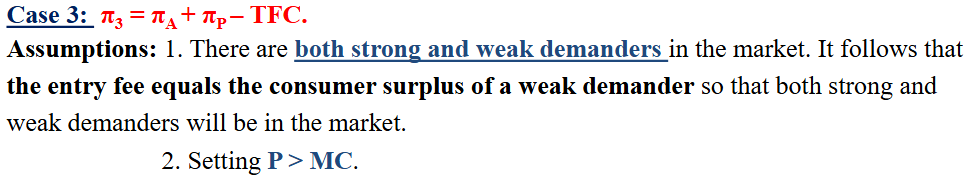

Two-Part pricing with different types of customers case 3

There are both strong and weak demanders in the market. It follows that the entry fee equals the consumer surplus of a weak demander so that both strong and weak demanders will be in the market.

Conditions for third-degree price discrimination

The firm has market power and can prevent resale.

The firm cannot determine its customer’s reservation price, but it can identify groups of customers with different price sensitivities (or price elasticity of demand) before purchase.

Third-degree Price Discrimination Profit-Maximizing Decision

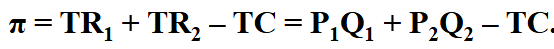

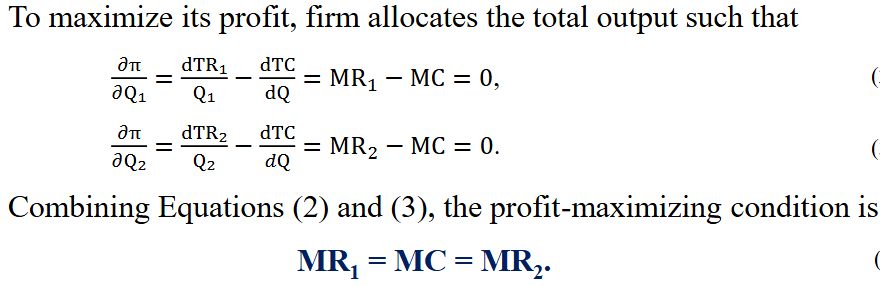

Suppose there are only two groups of customers with different demand functions or different price elasticities of demand. First, the firm produces total output Q units where Q = Q1 + Q2. Then, the firm allocates to Q1 units sold to the first group and sell Q2 units to the second group.

What is the firm’s total profit function using Third-degree Price Discrimination

What is the firm’s total output/profit maximizing condition using Third-degree Price Discrimination

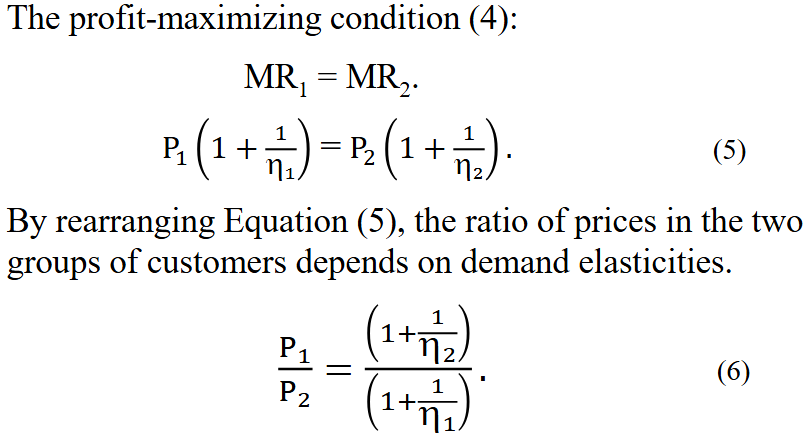

third degree price discrimination: What is the firm’s profit-maximizing condition if it knows the demand elasticity of each customer group

If the firm knows price elasticity of each group of customers (n1, n2), it can use the profit-maximizing condition (MR1=MR2) to determine the maximizing-profit prices of each group.

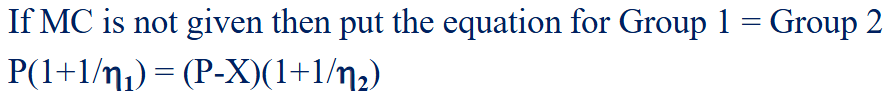

Coupon/rebate calculations when MC is not given

The firms choose a posted price ($P) but then issue a coupon for $X off in the newspaper local to the consumer types. What would the value of X be?

Profits under a monopoly are maximized when…

MR=MC