ACC312 Chapter 3- Product costing and cost accumulation

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

COGS, SG&A, taxes

Gross Margin Income Statement:

Sales - _____ = Gross Margin

Gross Margin - ____ = Operating costs

Operating costs - _____ = Net Income

planning, control, directing, and management decision making

In managerial accounting, full product costs are used for ____, control, ____, and management decision making

DL, DM, OVH, FGI

Flow of costs:

RM —> total manufacturing costs (___, ____, ___) —> WIP —> ___

Job cost and process

____ _____ ___ ____- 1st set of methods determine how to calculate the cost on an individual from WIP.

Actual and Normal

____ ___ ____-2nd set of methods determine how to add overhead costs to WIP

Process costing

For ____ ____, you record all product costs in one WIP account and divide the total WIP costs by the # of products produced. Not viable with very different products.

Job Costing

_____ _____- Set up an individual WIP account for every product being worked on and record costs specific to that product + overhead WIP account. Find predetermined overhead rate

manufacturing, manufacturing

Actual costing method #1- Allocate overhead to WIP: Add all the overhead costs to one overhead account, then take the total and multiply it by (amount moved to ______ for specific job / total amount moved to _______)

Actual method #1

____ ____ ___-

Use direct material cost

At month end, allocate overhead costs to WIP A/G

Pro rata —> DM $

POHR

Actual method #2- POHR x DL/DM (whichever one is used for ______).

overhead, direct labor, direct material

POHR = Estimated ______/ estimated _____ _____ or _____ ______

Actual method #2

_____ ____ ____-

Actual DM and DL combined with actual overhead

Hard to control costs running through on a daily basis

predetermined overhead rate

____ -

Actual direct material and direct labor combined with ____ ____

NOT allocating actual overhead costs

Flat rate is used all year

allocation base

An ____ _____, such as direct materials cost, direct labor hours, direct labor dollars, or machine hours, is used to assign manufacturing overhead to individual jobs. We use this because:

It is impossible or difficult to trace overhead costs to particular jobs

Manufacturing overhead consists of many different items ranging from the grease used in machines to the production manager’s salary

Many types of manufacturing overhead costs are fixed even though output fluctuates during the period

Which of the following statements are true?

Actual overhead costs are not assigned to jobs in a job costing system

If a job is not completed at year end, then no manufacturing overhead cost would be applied to that job when a predetermined overhead rate is used

The amount of overhead applied to a particular job equals the actual amount of overhead caused by the job

2

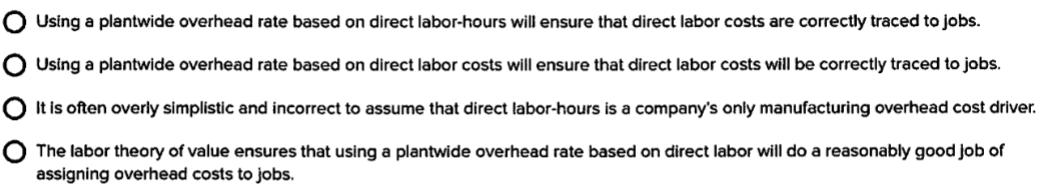

Which of the following statements about using a plantwide overhead rate based on direct labor is correct?

3