1.2.6 Government intervention

1/31

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

32 Terms

Negative externality of production

When third parties are negatively impacted by the production of a good/service, e.g. pollution

Negative externality of consumption

The third party spillover effects due to the consumption of a good/service (demerit goods). E.g. sugar, alcohol.

Types government intervention to stop negative externalities

Taxation

Subsidies

Fines

Government regulation

Polution permits

Tax

Financial charge made by a government on individuals, consumers and businesses.

Indirect tax

A type of tax applied to a good or service at the point of sale.

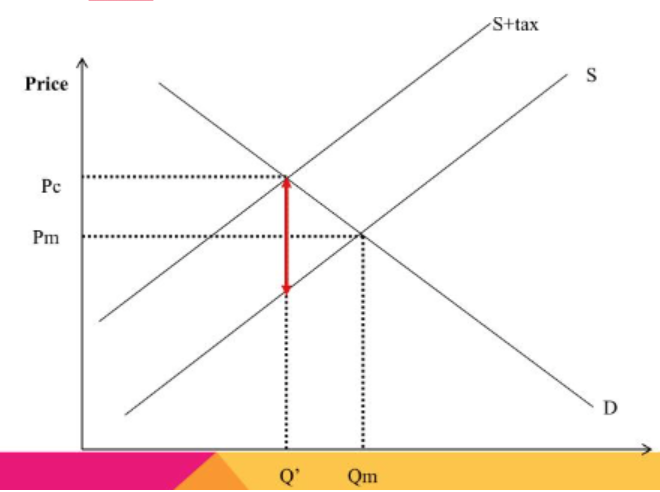

How will tax affect the supply curve

Causes its supply curve to shift to the left, because it causes the costs of the producer to rise

Advantages of tax

Reduces negative externalities

Provides revenue for the government

Disadvantages of tax

Difficult for the government to use the correct level of tax.

If demand is inelastic, the tax will not decrease demand much

Taxes can cause inequality

Cost of administration – the cost of collecting taxes. E.g. employing people to contact firms to ensure they are paying the correct level of tax.

Possibility of evasion – firms may avoid of evade paying tax

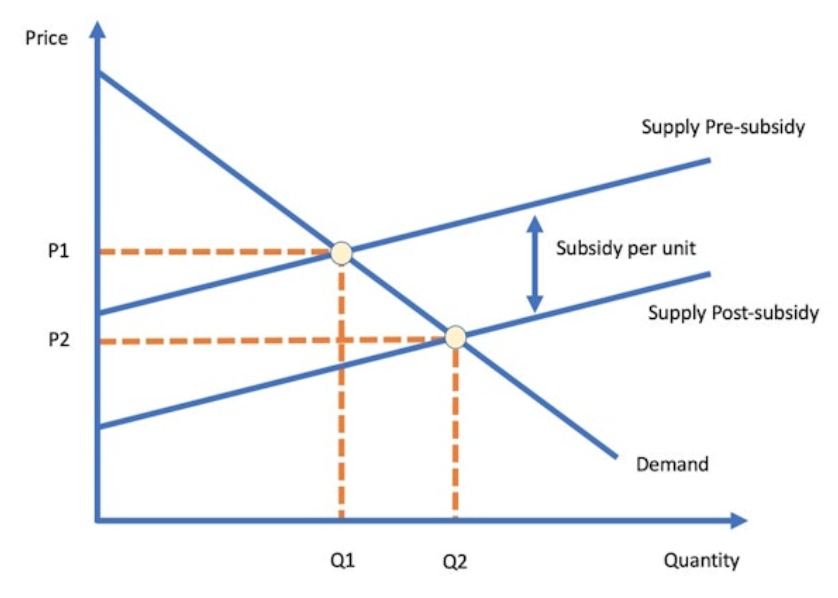

Subsidies

Government payments to firms to increase production and/or reduce cost of production for firms. They can also increase consumption of a good or service

How do subsidies affect the supply curve

Advantages of subsidies

Can result in increased production/consumption of goods with positive externalities, benefiting society.

If you subsidise public transport, it will encourage people to drive less, and reduce their negative externalities. In the long term, subsidies for a good will help change preferences. It will encourage firms to develop more products with positive externalities.

Disadvantages of subsidies

The cost will have to be met through taxation

Difficult to estimate the extent of the positive externality.

There is a danger that government subsidies may encourage firms to be inefficient and they come to rely on subsidy rather than improve efficiency.

The effect depends on the elasticity of demand. If demand is price elastic, a subsidy leads to large increase in demand. If demand is price inelastic, a subsidy is relatively ineffective in increasing demand.

Fine

Firms will need to make a payment to the government for doing something against regulation

What can firms be fined for

Firms can be fined if they pollute too much or if they do not act in the consumer interest

Advantages of fines

Can reduce negative externalities

Can increase government revenue

Disadvantages of fines

Depends on the level of the fine. Some firms may continue the behaviour and pay the fine if the fine is not big enough. If the fine is too much some firms may have to leave the market. Governments may not have enough information to set the fine at the correct level

If demand is inelastic, firms will simply pass the fine onto consumers in the form of higher prices.

Government intervention

It is difficult to get the tax/subsidy/fine level right. In some situations the government feels that their intervention needs to be a little more direct.

Examples of government intervention

Instead of taxing pollution, they may just ban it. Or at least legislate to control pollution levels. For example, cars now have to do an emissions test before they are allowed to be sold.

Another example of regulation is planning permission. In some countries, firms have to get permission from the government before they build on land, or they cannot build above the tree level etc.

Advantages of regulation

Can help reduce negative externalities

Can have a direct impact on firm behaviour

Disadvantages of regulation

Depends on how severe the regulation is

It may be difficult to control firm behaviour.

Pollution permits

Permits which only allow each country world-wide a certain amount of emissions of, say, greenhouse gases

Advantages of pollution permits

The total level of emissions allowed world-wide is fixed by the sum of the permits, so emissions should fall.

The countries that have to buy the spare permits because they struggle to keep their emissions down will probably also have lower costs.

Disadvantages of pollution

It is difficult to know how many permits to give out. The government may be too generous or too tight.

If firms buy more permits, they can just pass this extra cost onto consumers in the form of higher prices.

It can be difficult to measure pollution levels.

There are administration costs of implementing the scheme and measuring pollution levels.

For global pollution permits, countries who pollute more than their quotas can simply buy permits from other countries. Therefore rich developed countries can simply buy permits from less developed countries. This does not significantly reduce pollution but shifts it from the richer countries to poorer countries.

Types of government intervention to promote competition

Promoting competition

Controlling monopolies

Protecting consumer interests

Controlling mergers

Promoting competition

Encouraging the growth of small firms

Anti-competitive practices

Deregulation – can remove monopoly power and increase competition

Lowering barriers to entry – e.g. training and providing finance to firms

Privatisation

Controling monopolies

Price controls – Monopolies can be forced to set a maximum price.

Profit controls – The government set a level of profit a monopoly can earn and excess profit is taxed 100%.

Quality standards – A profit maximising monopolist focuses on profit and not quality. Governments can set quality standards.

Performance targets – Price, quality and other targets can be put in place to regulate monopolies. Targets include degrees of customer choice, costs of production etc.

Breaking-up the monopolist – The monopolist can be broken up into competing units by the government.

Lowering entry barriers

Deregulation – the process of removing government controls from markets.

Protect consumer interests

All legislation is aimed at protecting consumer interests. The government aim to control firms to lower prices and increase choice.

Controlling mergers

Mergers are investigated if they are too large. They can be prevented or fined.

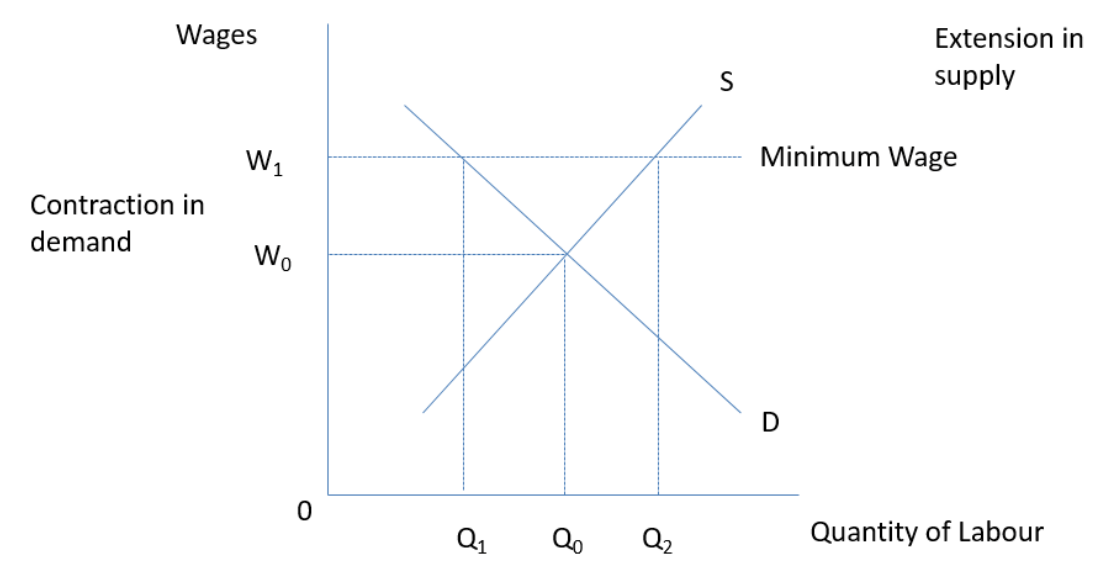

Minimum wage

legally enforced pay floor. Employers are not allowed to pay their employees a rate below the minimum wage

Minimum wage on a labour supply diagram

Advantages of having a minimum wage

Reducing poverty

Tax and benefits

The effect on productivity

Improved incentives

Disadvantages of minimum wage

Unemployment

High costs to employers