Economics & Personal Finance DLE 2025 Final Exam Study Guide

1/80

Earn XP

Description and Tags

Flashcards for Economics & Personal Finance DLE 2025 Final Exam Study Guide

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

81 Terms

What is personal financial planning?

Arranging to spend, save, and invest money to live comfortably, have financial security, and achieve goals

What are goals?

Things you want to accomplish (e.g., college education, buying a car, starting a business)

What are values?

Beliefs and principles you consider important, correct, and desirable

What is a need?

Something you must have to survive (food, shelter, clothing)

What is a want?

Something you desire or would like to have or do

What is an opportunity cost?

What is given up when making one choice instead of another

What is liquidity?

The ability to easily convert financial assets into cash without loss in value

What is the time frame of short-term goals?

One year or less

What is the time frame of intermediate goals?

Two to five years

What is the time frame of long-term goals?

More than five years

What is a service?

A task that a person or a machine performs for you

What is a good?

A physical item that is produced and can be weighed or measured

What is a consumable good?

Purchases that you make often and use up quickly

What is a durable good?

Expensive items that last three years or more when used on a regular basis

What are SMART goals?

Specific, Measurable, Achievable, Realistic, Time-based

What is economics?

The study of the decisions that go into making, distributing, and using goods and services; the study of the allocation of scarce resources

What is a safe-deposit box?

A small, secure storage compartment that you can rent in a bank

Where to keep home files, a safe-deposit box, and documents on a home computer?

Home files: receipts; Safe-deposit box: car titles; Home computer: digital documents

What is a personal financial statement?

A document that provides information about an individual’s current financial position and presents a summary of income and spending

What is a personal balance sheet? (net worth statement)

A financial statement that lists items of value owned, debts owed, and a person’s net worth

What is net worth?

The difference between the amount that you own and the debts that you owe

What is an asset?

Any item of value that an individual or company owns

cash,property,personal possessions,and investments

What is wealth?

An abundance of valuable material possessions or resources

4 categories of wealth:

-liquid assests

-real estate property

-personal possessions

-investment assets

What are liquid assets?

Cash and items that can be quickly converted into cash

What is real estate?

Land and any structures that are on it that a person or family owns

What is supply?

The amount of goods and services available for sale

What is demand?

The amount of goods and services people are willing and able to buy

What is the Federal Reserve System?

The central banking organization of the United States/regulates the money supply/determines intrest rates/buys & sells government securities

What is inflation?

The rise in the level of prices for goods and services

What is interest?

The price that is paid for the use of another’s money

What are examples of personal opportunity costs?

Health, knowledge, skills, time

What is insolvency?

A financial state that occurs if liabilities are greater than assets

What is a deficit?

More is being spent (outflow) than is being earned (inflow)

What is net (take-home) pay?

The amount of income left after taxes and other deductions are taken out of your gross (total) pay

What is discretionary income?

The money left over after paying for the essentials (i.e., rent, food, clothing)

What is a budget?

A plan for using money to meet wants and needs

What are common banking fees?

Out-of-network ATM fee, Overdraft fee, Minimum balance fee, Maintenance fee

How does overdraft protection on a checking account work?

If you overdraw your account, the bank covers the purchase and charges you a fee plus the amount of the coverage

What are some characteristics of a savings account?

Higher interest rates, limited access. Used for emergencies or specific goals

What are some characteristics of a checking account?

ATM withdrawals, writing checks. Debit card takes funds directly from account

What is a bank statement?

A list of all transactions for a bank account, according to the bank

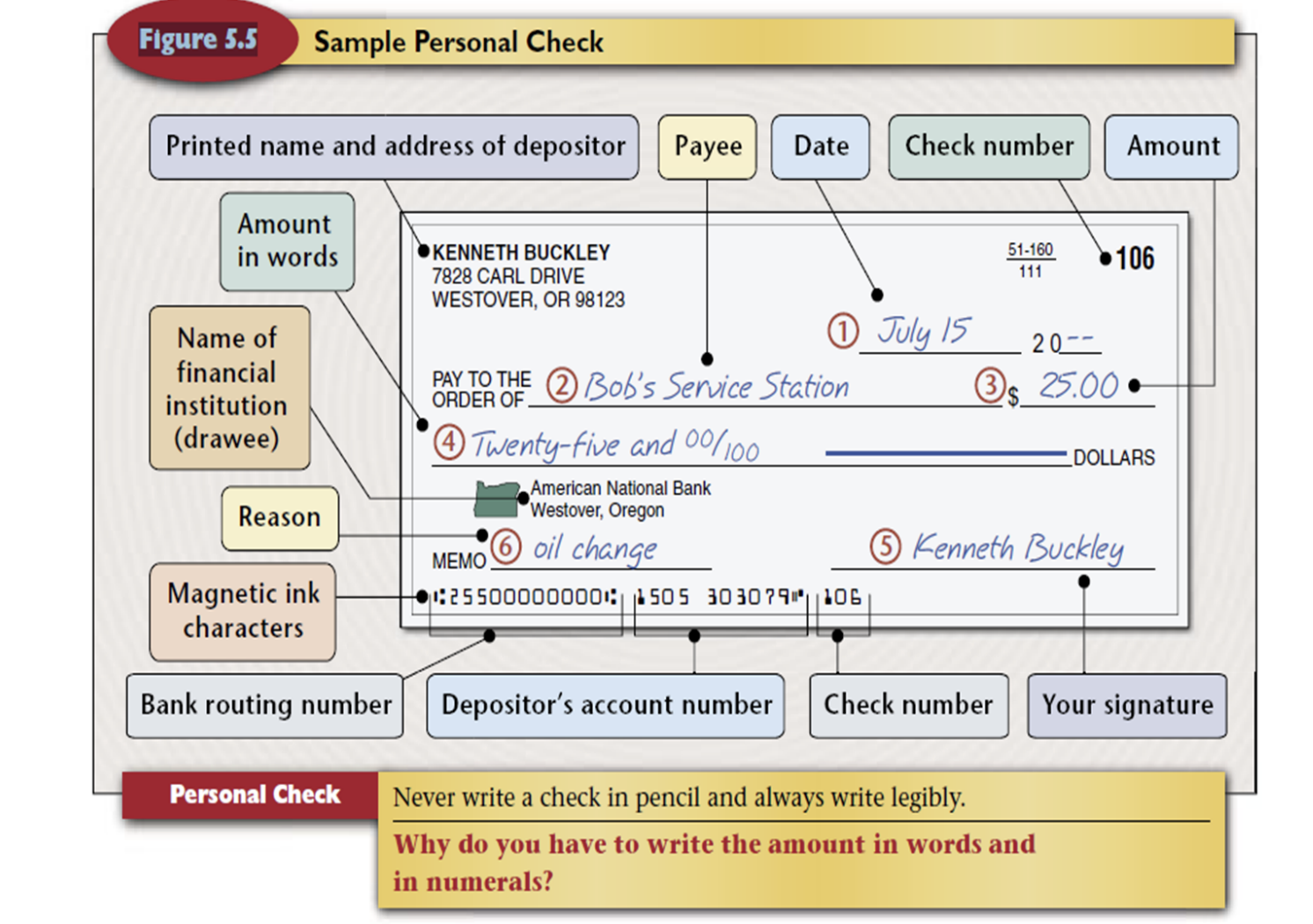

What is a check?

A document used to make a payment to an individual or business

What is a checkbook register?

A list of all transactions for a bank account, according to the individual account holder

What is a deposit slip?

A document used to put money into an account

What is a bank reconciliation?

A report that accounts for the differences between the bank statement and a checkbook balance

What is direct deposit?

An automatic deposit of net pay to an employee’s designated bank account

What are the benefits of online banking?

Easy transfers, mobile deposit, easy balance tracking

What transactions reduce the balance of a checking account?

Paying with a check, debit card, Withdrawing from an ATM

How does compound interest work?

Interest is earned on both the original amount you deposited and any previously earned interest

How should compound interest impact your long-term financial strategy?

If you begin saving/investing early, there is more time for earnings to accumulate - the most significant factor in the power of compounding is time

What is the annual percentage rate (APR)?

The cost of credit on a yearly basis, expressed as a percentage; the annualized interest rate on a credit account

What might be a consequence of missing a credit payment?

Paying a fee, having an increased APR for a predetermined period of time

What are the 5 C's of Credit?

Character(credit history), Capacity(debt-to-income ratio), Capital(amount of money an applicant has), Collateral(an asset that can back or act as security), Conditions(purpose of the loan,amount of the loan, prevailing interest rate)

When you make a purchase on credit, are you using your own money?

No. You must pay the credit company the amount of the purchase, plus any additional interest.

What is a credit rating/score?

A measure of a person’s ability and willingness to make credit payments on time

How is a credit score improved?

Make payments on time, prioritize paying down credit cards that are near the credit limit

What is the tradeoff between a short loan with high monthly payments and a longer loan with lower monthly payments?

The lower monthly payments are more affordable in the short-term, but lead to paying more in interest. OR The higher monthly payments are more difficult to afford, but result in paying less interest.

What is a security deposit?

An amount of money paid to the owner of the property by a tenant to guard against any financial loss or damage that the tenant might cause

When the tenant moves out, the landlord must return the deposit, minus any charges for damage caused or unpaid rent

What is renters insurance?

A type of insurance that covers the loss of a tenant’s personal property as a result of damage or theft, or medical/legal expenses caused by accidental injuries suffered on your premises

What is a down payment?

A portion of the total cost that is required at the time of purchase

What is a real estate agent?

A person who arranges the sale and purchase of homes and other property

What is common stock?

A unit of ownership of a company & entitles the stockholder to voting privileges/may pay dividends from company profits

What is preferred stock?

A type of stock that gives the owner the advantage of receiving cash dividends before common stockholders

If a company fails, preferred stockholders receive any leftover assets first

What is a bond?

The written pledge of a corporation, government, or municipality to repay a specific sum of money with interest

What is a mutual fund?

An investment in which investors pool their money to buy stocks, bonds, and other securities selected by professional managers

What is the goal of investing in real estate?

To own property that increases in value so that you can sell it at a profit, or to receive rental income

What is diversification?

The process of spreading your assets among several different types of investments to reduce risk

What is insurance?

Protection against possible financial loss through a contract called a policy

Insurance company agrees to take on the risk of the policyholder in exchange for a premium (a fee paid for insurance coverage)

What is a deductible?

The set amount that the policyholder must pay per loss on an insurance policy

What are the four risk management methods?

Risk avoidance(avoiding situations involving a particular risk altogether), Risk reduction(reducing the likelihood of harm), Risk assumption(taking on responsibility for the negative results of a risk), Risk shifting(transferring risk to an insurance company for a premium)

What is liability?

Legal responsibility for the financial cost of another person’s losses or injuries

What does collision insurance cover?

Damage to the vehicle of the insured person, regardless of who is at fault

What might cause differences in insurance premiums for the same coverage?

Perceived differences in risk

What is a peril?

Anything that may cause a loss

What is a hazard?

Anything that increases the likelihood of loss

What is negligence?

The failure to take ordinary or reasonable care to prevent accidents from happening

Cash flow

cash flow is divided into cash inflow(income)

cash outflow (spending)

A good budget is:

carefully planned

practical

flexible

written & easily understood

How to write a check?

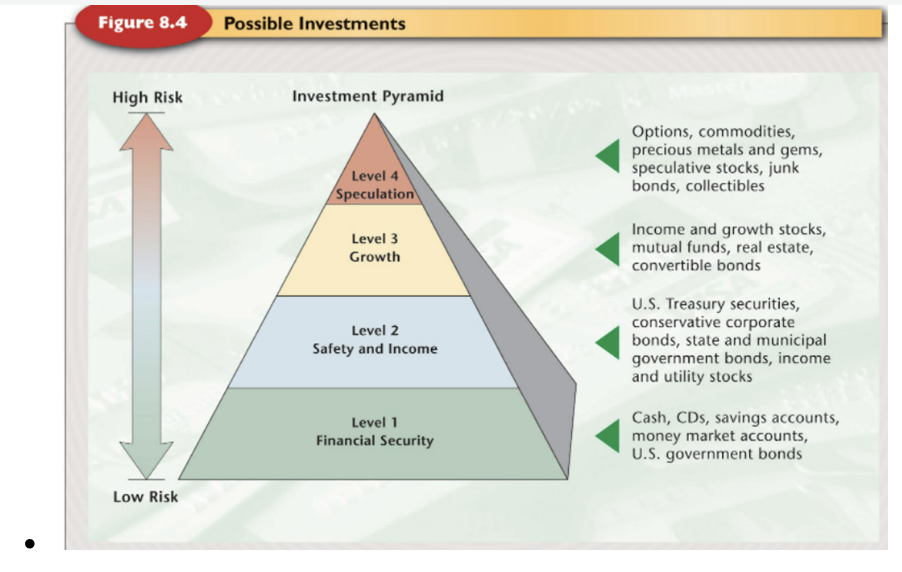

What is risk for various things?

savings

bonds

mutual bonds

stocks

What are possible investment?