4.1.7 Balance of Payments

1/71

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

72 Terms

balance of payments

record of allthe financial transactions that occur between a country and the rest of the world

what are the 2 main sections of the bop

current accont

financial and capital account

current account

all transactions related to goods/services along with payments related to the transfer of income

4 sections of current account

balance of trade in goods

balance of trade in services

net primary income

net secondary income

financial account

records the flow of all transactions associated with changes of ownership of the UK’s foreign financial assets and liabilities

capital account

records small capital flows between countries and is relatively inconsequential

what is money flowing into a country recorded as

credit

what is money flowig out of country recorded as

debit

what can goods be referred as

visible exports/imports

what can services be referred as

invisible exports/imports

credits

received from UK citizens who are abroad and send remittances home

debits

sent by foreigners working in the UK back to their countries

current transfers

typically payments at government level between countries

sub sections of the finncial account

FDI

Portfolio investment

Financial derivatives

Reserve assets

FDI in financial account

flows of money to purchase a controlling interest(10% or more) in a foreign rm. Money owing in is recorded as a credit(+) and money owing out is a debit(-)

portfolio investment in financial account

ows of money to purchase foreign company shares and debt securities (government and corporate bonds). Money owing in is recorded as a credit (+) and money owing outis a debit(-)

financial derivatives in financial account

are sophisticated financial instruments which investors use to speculate and return a profit. Money flowing in is recorded as a credit(+) and money flowing outis a debit(-)

reserve assets in financial account

are assets controlled by the CentralBank and available for use in achieving the goals of monetary policy. They include gold,foreign currency positions at the International Monetary Fund (IMF) and foreign exchange held by the CentralBank (USD, Euros etc.)

FDI

investment from one country into another (normally by companies rather than government) that involves establishing operations or acquiring tangible assets, including stakes in other businesses

why is it called balance of payments

as the current account should balance with the capital and financial and be equal to zero account

if there is a current account deficit what must be state of capital nd financial account

surplus in the capital and financial account

The excess spending on imports (current account decit) has to be nanced from money owing into the country from the sale of assets (nancial account surplus)

if there is a current account surplus what must be state of capital nd financial account

decit in the capital and nancial account The excess income from exports (current account surplus) is nancing the purchase of assets (nancial account decit) in other countries

country with current account balance

france and chile

countrys with current account surplus

china and germany

countrys with current accoutn deficit

britain and usa

auses of current account deficit

low productivity

high value of country’s currency

high rate of inflation

rapid economic growth resulting in increased imports

non price factors such as poor uality and disgn

poor price

recession in one or more major trading conutries

volatile flobal prices

short term causes of current account deficit

high levels of consumer demand

strong exchnge rate

high inflation

medium term cause of current accoutn deficit

As a country loses its comparative advantage, people will transfer their purchases to other countries and the UK will need to switch resources to production of other things. Similarly, the growth of cheap imports from countries like China has caused a substitution effect.

long term causes of current account deficit

A lack of capital investment means firms use older and more out of date technology. This contributes to a lack of productivity. Germany has 35% higher productivity per hour worked than the UK. In the UK, productivity is only growing at 1%. ● Deindustrialisation in the UK has led to a decrease in the relative importance of industry and manufacturing in the economy. This makes it more difficult to export, since services are harder to export. ● Countries with a large amount of natural resources tend to export more, and if they also have a small population ( e.g. Saudi Arabia) then they tend to have a current account surplus. ● Some countries are more competitive than others, for example high labour productivity or a reputation for high quality. ● Countries with corruption and where it is difficult to set up a business tend to find it difficult to export.

why does uk have current account deficit

he main issues are low levels of investment, the impact of the banking crisis on preventing borrowing, low innovation, skills shortages, inefficient monopolies and underperforming businesses and poor infrastructure

how does low roductivity cause current account deficit

Low productivity raises costs Exporting rms with low productivity may nd themselves at a price and cost disadvantage in overseas markets which will decrease competitiveness and the level of exports With higher domestic prices, consumers may also buy abroad thus increasing the imports Falling exports and rising imports creates a decit

how does high value of countrys currency cause current account deficit

Currency appreciation makes a country's exports more expensive relative to other nations Foreign buyers look for substitute products which are priced lower Exports fall and the balance on the current account worsens Similarly, currency appreciation makes imports cheaper Domestic consumers may switch demand to foreign goods and as imports rise,the balance on the current account worsens

how does high vinflation rate cause current account deficit

A relatively high rate of ination makes a country's exports more expensive than other nations Foreign buyers look for substitute products which are priced lower Exports fall and the balance on the current account worsens Similarly, high ination may mean that goods/services are cheaper in other countries Domestic consumers may switch demand to foreign goods and as imports rise,the balance on the current account worsens

how does rapid economic growth resulting in increased imports cause current account deficit

Rapid economic growth raises household income Households respond by purchasing goods/services with a high income elasticity of demand (income elastic) Many ofthese goods are imported and as imports rise,the balance on the current account worsens

how does non price factors such as poor quality and design cause current account deficit

When a country develops a reputation for poor quality and design, its exports fall as foreign buyers look for better substitutes elsewhere Domestic buyers who are able to shop abroad also choose to buy better quality products elsewhere and the level of imports rise A fall in exports and a rise in imports worsens the balance on the current account

how does poor price cause current acocunt deficit

Higher inflation than trading partners • Low levels of capital investment and researc

how does Recession in one or more major trade partner countrie cause current acocunt deficit

Recession cuts value of exports to these countries • Might be barriers to switching to other markets e.g. UK businesses struggle to sell to emerging markets such as India, Vietnam, Mexic

how does volatile global prices cause current acocunt deficit

Exporters of primary commodities might be hit by a fall in world prices • Importing nations could be hit by higher prices for oil and gas, raw materials et

consequence sof current account deficit

Loss of aggregate demand if there is a trade deficit (M>X) which causes weaker real GDP growth and reduced living standards and rising unemployment

Big current account deficits will cause the currency to depreciate, leading to higher cost-push inflation and a deterioration in the terms of trade Can lead to currency weakness and higher inflation and a country may run short of vital foreign currency reserves Trade deficit might be a reflection of lack of competitiveness / supply side weaknesses in the economy Some countries running current account deficits may choose to borrow to achieve a financial account surplus - increases risks Unsustainable current account deficits can ultimately lead to a loss of investor consequence, leading to capital flight and a currency / balance of payments crisi

is inward investment positove for Uk account

yes and inward flows in ul were £49.4Bn down from£80.6Bn in 2017

is outward investment positove for Uk account

no it is negative, value was £1.4Tn up from £1.37Tn in 2017

portfolio investment

when people/businessed from one country buy shares or other securities such as bonds in other nations

consequences of investment flows between countries

Long term flows – e.g. FDI and portfolio investment. They are often quite predictable and involves enhancement to the overall capital stock of an economy ▪ Profits of FDI investments in the UK - return to the country of origin – HOWEVER, it creates economic growth and employment which can boost productive potential ▪ However, a number of portfolio capital flows are short term and speculative which can create destabilising effects on the international monetary system

causes of current account surplus

Recession - A large and persistent surplus of savings (S) over investment (I) for households, firms and the government.

2. An export surplus may be the result of very high prices for exports of commodities such as oil and gas.

3. Depreciation of the currency

4. High interest rates

5. Competitive advantage – examples?

6. Increased productivity

consewquences of current account surplus

Over-reliance on exports e.g. China 2. Under-valued currency – can cause inflationary pressure 3. Increased employment –

what can persisten surpluses lead to

Persistent surpluses can lead to rising protectionist sentiment within trade deficit countries which in the long run threatens the process of globalisatio

they also mean focus ofthe allocation of a nation's resources is on meeting foreign demand as opposed to meeting domestic demand This can limit availability of goods/services in the local economy which can possibly decrease the standard ofliving for some households It can also create instability in the foreign exchange market ifthere is a oating exchange rate mechanism in operation

E.g. China ran a surplus for years but did not allow its currency to oatfreely. In recent years they have switched theirfocus to increasing domestic demand This surplus has resulted in signicantforeign directinvestment by Chinese rms and the level offoreign asset ownership is hig

how to correct balance of payments surplus

Encouraging free trade ➢ If import constraints are removed e.g. tariffs/quotas, then this may boost the demand for imports as they become cheaper or more available ▪ Appreciation/Revaluation of currency ➢ If the currency is allowed to rise or is revalued upwards, then this will make exports less price competitive and imports more attractive ▪ Reflation of domestic economy ➢ If domestic demand is weak, then policies to encourage spending e.g. lower interest rates will increase the demand for imports

ways to tackle current account deficit

do nothing

expenditure switching policies

expenditure reducing policies

supply-side policies

what are Expenditure-switching policies

designed to change the relative prices of exports and imports - this causes changes in spending away from imports and towards domestic/export productio

what are Expenditure - reducing policies

designed to control demand and limit spending on imports - squeeze on demand, encouraging rising private sector saving

types of expenditure switching policies

depreciation/devaluation of exchange rate

Direct Controls - Import tariff

deflation

depreciation of exchange rate to reduce current accoutn deficit

Reduces relative price of exports & makes imports more expensive

but Risk of cost-push inflation – which erodes competitive boost + fall in real income

Direct Controls - Import tariff to reduce current accoutn deficit

Increases the price of imports & makes domestic output more price competitiv

Risk of retaliation from other countries if import tariffs are used as BoP policy

deflation to reduce current accoutn deficit

Keeps general price level under control and makes exports more competitiv

Risks from deflation as a way of achieving internal devaluation – including lower investmen

types of expenditure reducing policies

increase income taxes

cut in real level of gov spending

increase income tax to reduce current account deficit

Reduces real disposable incomes causing falling demand for imports

but Cut in living standards and risk of damage to work incentives in labour market

Cuts in real level of government spending to reduce current account deficit

Lowers aggregate demand, firms may look to export their spare capacit

Damage to short term economic growth, risks that austerity hits investmen

benefit of dong nothing for current accoutn deficit

Floating exchange rates act as a self-correcting mechanism. Over time a higher level ofimports will end up depreciating the currency causing imports to decrease (they are now more expensive) and exports to increase (they are now cheaper). This improves the decit

cost of dong nothing for current accoutn deficit

There may be other external factors that preventthe currency from depreciating. It may take a long time for self-correction to happen and many domestic industries may go out of business in the interim. The longer ittakes to self-correct, the more rms will delay investment in the econom

benefit of expenditure switchign to reduce current accoutn deficit

This is often successful in changing the buying habits of consumers, switching consumption on imports to consumption on domestically produced goods/services. This helps improve a decit

cost of expenditure switchign to reduce current accoutn deficit

Any protectionist policy often leads to retaliation by trading partners. This may consist ofreverse taris/quotas which will decrease the level of exports. This may oset any improvementto the decit caused by the policy

benefit of expenditure reducing to reduce current accoutn deficit

Deationary scal policy invariably reduces discretionary income which leads to a fall in the demand for imported goods and improves a deci

cost of expenditure reducing to reduce current accoutn deficit

Deationary scal policy also dampens domestic demand which can cause outputto fall. When outputfalls, GDP growth slows and unemployment may increase

benefit of supply side to reduce current accoutn deficit

Improves the quality of products and lowers the costs of production.Both ofthese factors help the level of exports to increase thus reducing the decit

cost of supply side to reduce current accoutn deficit

These policies tend to be long term policies so the benets may not be seen for some time. They usually involve government spending in the form of subsidies and this always carries an opportunity cost

persistent deficit problem

can be problematic as it means that nance from abroad (in the form ofloans orforeign directinvestment) is required in orderto fund continued imports This may mean that a country is gradually selling its assets Owning money to a foreign entity creates vulnerabilities The 2008 Global Financial Crisis demonstrated the impact offast changing conditions in which creditors were insisting on being repaid quickly e.g. Greece owed creditors (including Germany) signicant sums and was required to pay these back creating numerous problems in their economy

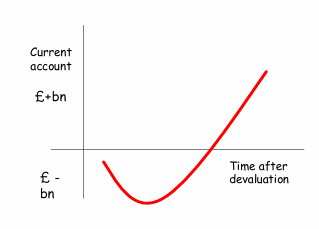

marshall lerner condition

states that a depreciation/devaluation of the exchange rate will eventually lead to a net improvement in the trade balance provided that the sum of the PED for exports and imports > 1

J curve evaulation

In the short run, it is likely that the demand for imports and exports will be inelastic

If the demand for imports and exports is highly inelastic, they will not be sensitive to changes in the price, and thus the deficit may in fact worse•Primarily, this is because lengthy contracts often exist, which ties in firms to pre-agreed deals •Consequently, as outlined by the Marshall-Lerner condition, the balance of payments deficit may worsen in the short-term, and only recover once the adjustment has been fully factored into new contracts

what can the significance of an economy of sustained and persistent deficits and surpluses may depend on

The size of the deficit/surplus ➢ Small imbalances are to some extent unavoidable as achieving equilibrium is extremely difficult given the complexity of international trade and money flows ➢ However, larger imbalances may indicate a more fundamental weakness within an economy with perhaps excessive reliance on imports demonstrating weak domestic productivity or lack of diversity of domestic output

The duration of the deficit/surplus ➢ If the duration of deficits or surpluses are relatively short, there is generally little concern ➢ However, if deficits/surpluses persist this creates a financing issue for the government, and is likely to lead to corrective measures, which can create other macroeconomic problems

The cause of the deficit/surplus ➢ If a deficit, for example, is caused by strong domestic employment leading to a boost in incomes that individuals spend on imports to improve living standards, this may be of relatively little concern in the wider economic picture ➢ However, if it is caused by a lack of competiveness of domestic industry, poor productivity, high inflation or an over-valued currency, this may be of greater and potentially more serious significanc

supply side policies that could be used to improve BOP

decrease red tape

decrease tax

increase education and training which increases skills increases productivity decrease unit cost

infrastructure

mobility of labour

if pound depreciates and PED of exports and imports is elastic what will happen to BOP

increase exports decrease exports improvign bop

if pound depreciates and PED of exports and imports is inelastic what will happen to BOP

imports wont fall worsen BOP