Ap Macro unit 4 and five

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

50 Terms

Federal Funds rate

the interest rate at which commercial banks make overnight loans to one another

Policy rate

the interest rate at which the central bank will lend money to commercial banks

real intrest rate equation

nominal interest rate - inflation rate

Expasionary fiscal policy

Decreasing taxes and increasing government spending

Contractionary Fiscal Policy

Increasing taxes and decreasing government spending

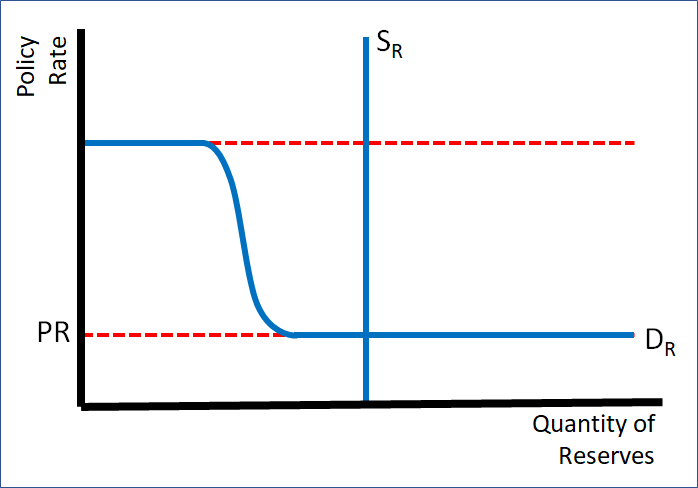

Expansionary Monetary Policy in a limited reserves system

The central bank buys bonds, decrease the reserve requirement, decrease the discount rate

Contractionary Monetary policy in a limited reserves system

The central bank sells bonds, increase the reserve requirement, increase the discount rate

expansionary monetary policy in an ample reserves system

decrease interest on reserves, decrease the discount rate, buy bonds

Contractionary monetary policy in an ample reserves system

increase interest on reserves, increase the discount rate, sell bonds

Discount rate

The rate that the central bank charges banks when they take loans from the central bank

Interest on reserves

The rate that a central bank will pay commercial banks foe holding their reserves in the central bank

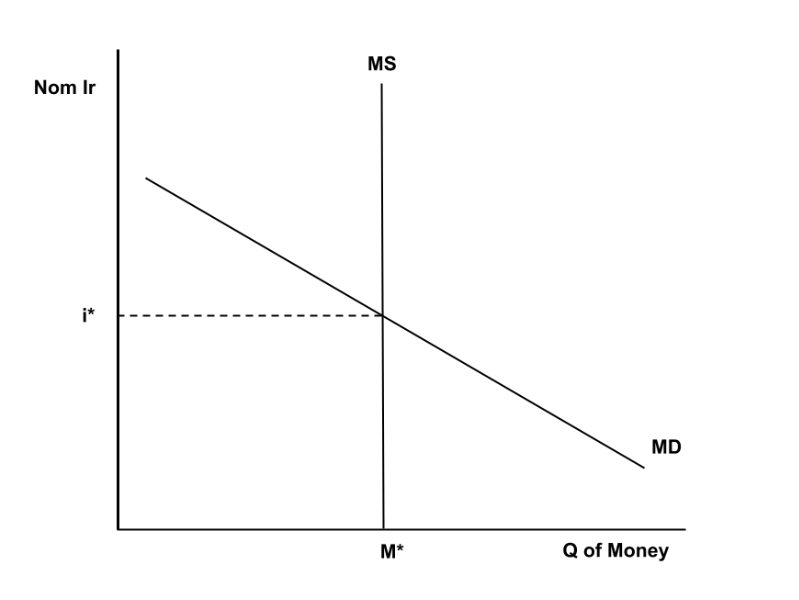

Money supply model

The y axis on the MS model

Nominal Interest rate

X-axis on the MS Model

quantity of Money

Money supply curve shifters

only the federal reserve can change the supply

Money demand curve shifters

a change in price level, RGDP, and transaction costs

Reserve market model

The y axis of the Reserve market Model

Policy rate

X axis on the Reserve Market Model

Quantity of reserves

Vertical line on the reserve market model

Supply of reserves

Top horizontal line on the reserve market model

Discount Rate

Bottom horizontal line on the Reserve Market Model

Demand For reserves, the dotted line is Interest on reserves

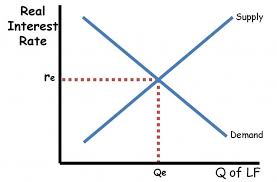

Loanable funds market Model

Y axis on the Loanable funds market Model

Real Interest Rate

X Axis on the Loanable Funds market Model

Quantity of loans

Downward sloping curve on Loanable funds rate model

demand for loans

upwards sloping curve on loanable funds rate mode

Supply of loanable funds

Loan demand shifters

change in private borrowing, change in public borrowing

Loan Supply Shifters

change in private savings, change in public savings

M1

Cash, Checking accounts, Travelers Checks

M2

Savings assets, Checking deposits, Money Market assets, +M1

Uses of money

Medium of exchange, unit of account, store of value

Recessionary gap on the Aggregate demand model

expansionary fiscal policy and monetary policy. Needs to increase the money supply and lower the nominal interest rate

Expansionary gap on the Aggregate Demand Model

contractionary fiscal policy and monetary policy. Need to decrease the money supply and increase the monetary policy

increase in money supply

decrease in nominal interest rate

decrease in money supply

increase in nominal interest rate

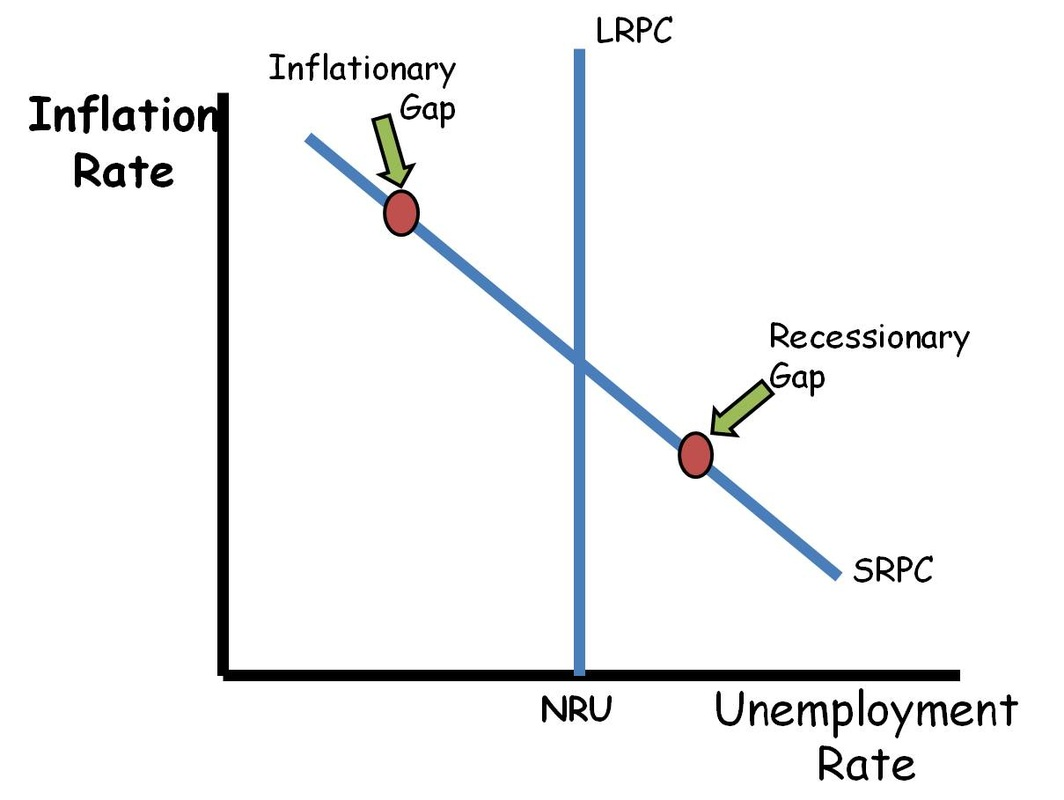

Short run Phillips curve shifter

a shift in ad results in movement along the curve, a shift in AS moves the SRPC in the opposite direction the shift occurred

Phillips curve model

y axis for the phillps curve model

Inflation rate

x axis for the phillips curve model

unemployment rate

downward sloping line on the Phillips curve model

Short run phillips curve

upward sloping line on the philips curve model

long run phillips curve

stagflation

caused by a decrease in aggregate supply which results in an increase in unemployment and inflation along with slow economic growth

velocity of money (v)

the amount of times a dollar is respent in a year

Quantity of money theory

Money Supply (M) x Velocity (V) = Price level (P) x Quantity of Output (Y)

Nominal Gdp formula

Price level (P) x Quantity of Output (Y)

Crowding out

The government deficit spends increasing demand for loans because there is less taxes being collected or an increase in spending. Interest rates increase due to this which decreases private sector borrowing in the short run “Crowding out” the private borrower

GDP per capita

GDP / population, is used to measure a nations standard of living

Productivity

output / input , ie. $80 / 4 hours

Long run Phillips curve shifter

the curve shifts the opposite direction of an LRAS shift