Econ Final Exam

1/98

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

99 Terms

Cost benefit analysis

comparing the cost of an action to its benefit

Opportunity cost

the most valued alternative you give up when you make a choice

Profit

money left over after costs of production (total revenue - total costs)

Incentive

attempt to change peoples behavior by offering a tangible reward

Circular Flow Chart

shows how money moves through the economy in a constant loop from producers to consumers

Economic Interdependence

working relationship between businesses, households, and the government

Free Enterprise (market economy)

supply, demand, and the price system help allocate resources and answer 3 basic questions (also called capitalism)

Command economies

a central authority (govt) makes most of the major economic decisions (socialism, communism)

Mixed economies

has some combination of command and/or market economies

Production possibilities frontier (PPF)

Shows possible alternatives of production

Illustrates trades offs and opportunity costs

What do you lose when you make a change.

Exports

when a country send goods/services to another country

Imports

when a country takes in gods and services sent in from another country

Specialization

focusing on a specific skill, activity, or production process,

Comparative Advantage

when a country can produce a good at a lower opportunity cost

absolute advantage

when a country can produce more of a good using the same quantity of resources.

balence of trade

Trade between countries consists of exporting and importing goods.

trade surplus

positive balance of trade = trade surplus (exports greater than imports)

trade deficit

negative balance of trade = trade deficit (exports less than imports)

free trade agreements pros vs. cons

pros: allows easier access to goods/services, spreads economic activity, countries can get foreign currency

cons: can destroy job sectors in other countries, make smaller nations economically dependent on larger ones

Trade Restrictions

Tariff - a tax placed on imports so they become more expensive

Quota - is a legal limit on the amount of a good that may be imported from other countries

Embargo - is a government order prohibiting the selling of goods to another country, usually because that country has bad/tyrannical/cruel leaders

How can the value of currency change

weak dollar - will lead to a trade surplus, make U.S. goods cheaper so exports will increase

strong dollar - U.S. good become more expensive, leading to fewer exports causing a trade deficit

Demand Shifters

If price stays the same…but for some reason more (or fewer) are being sold…then there has been a “shift in demand”, or a “change in demand”.

What are the demand shifers called?

N.I.C.E.S.T

Demand shifter #1: Number of buyers (N)

When more people immigrate to an area…or emigrate from an area.

Demand shifter #2: Income (I)

When people earn more or less money…they may buy more or less of a product (even though the price hasn’t changed)

Demand shifter #3: Price of complements (C)

Commonly purchased items together.

ex :Because printers are cheaper the quantity demanded will go up (price change).

Demand shifter #4: Expectations of future prices (E)

If people think the price of a good will change, they may either stop buying and wait for price to fall...or rush to buy before the price goes up.

Demand shifter #5: Price of substitutes (S)

Substitutes are used in place of another product. Usually with competitors

Price of one good can have an affect on another good.

Demand shifter #6: Taste/Preferences/Popularity (T)

refers to the popularity of a good. Fads or trends.

Demand

The willingness and ability to purchase an item.

Need both to have demand

Law of demand

As the price goes up quantity demanded goes down

demand schedule

a table that shows the quantity demanded of a good or service at different price levels

demand curve

a graph that shows the relationship between the price of a good/service and the quantity demanded within a specified time frame (Any time the price changes…the quantity demanded will change)

(supply to the sky, demand to the sand)

supply

Supply = How much of a product or a service will be produced and sold.

Businesses supply goods/services to buyers.

People supply their land, labor, capital, and entrepreneurial abilities.

a shift in supply

Sometimes price doesn’t change, yet supply does.

What are the supply shifters called?

T.W.I.N.G.E

Supply shifter #1: Technology/productivity

Technology allows companies to make things cheaper, and therefore increases supply

Technology lowers the per unit cost of producing the item. The cheaper it is to produce...the more they can produce

Per Unit Cost is the cost of making ONE item.

Supply shifter #2: Weather

Good weather usually increases supply (or at least keeps it the same)

Bad weather can decrease supply.

Supply shifter #3: Cost of input/resources

total cost of the resources needed to make the product. The price and cost of the resources and materials needed to make the product can have an impact on how much a business can supply.

Land, labor, capital.

If resource prices go up…supply will fall because it costs MORE to make the product

Supply shifter #4: Number of sellers

How many companies sell the product.

More companies selling means higher supply

Fewer companies means less supply.

Supply shifter #5: Government actions

The government can put rules, laws, and regulations on businesses that can increase or decrease supply.

ex:Subsidies are the opposite of taxes…the government PAYS companies to produce something

Tariffs, quotas, embargo

Supply shifter #6: expectations of future prices

If people think the price of a good will change, they may either stop buying and wait for price to fall...or rush to buy before the price goes up.

law of supply

Law of supply…as price goes up, quantity supplied goes up.

supply schedule

a table that shows the quantity supplied at each price

supply curve

a graph that shows how a change in the price of a good or service affects the quantity a seller supplies. (supply to the sky, demand to the sand)

surplus

supply is greater than demand - causes businesses to lower their prices

shortage

demand is greater than supply - causes businesses to increase their prices

equilibrium

the price on which the consumers and producers agree on

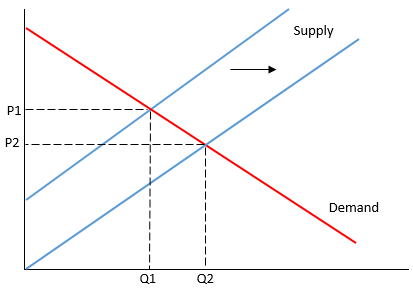

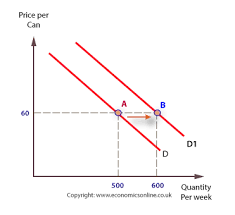

increase in supply graph

increase in demand

sole proprietorship

One individual, who makes all the decisions, takes all the losses...but makes all the profits

partnership

A business that is owned by two or more co-owners who share profits/debts of the business (firm).

corporation

A legal entity that can conduct business in its own name (as if it’s an individual)

Owned by stockholders

stockholders

owners of the corporations.

franchise

A company that allows people to buy and run a firm.

stock

certificate of ownership of a small piece of a corporation that can go up or down in value

limited liability

If your business fails, or if your business is losing money...courts cannot force you to pay debts with your personal assets.

unlimited liability

You are on the hook to pay any debts you owe...and you may be forced to use your own personal assets (like savings, or other holdings)

Pure/perfect competition

Type of Product = Identical

Barriers to Entry = No barriers

Control Over Prices = No control (price taker)

Advertising/product differentiation = no advertising and no product differentiation

Price takers: can sell all their output at the equilibrium price but can sell none of their output at any other price

ex: Farm Produce,Commodities (oil, gold), Stocks

monopolistic competition

Many buyers and sellers

Products are slightly/moderately different

Product Differentiation: Heavy use of advertising and nonprice differentiation

Easy to get in or out of market (low barriers to entry)

Price searchers...can change prices some…but can’t really go far beyond competitors price range

ex: Fast food, gas stations, car insurance, realtors, construction/carpenters, lawn care

Oligopoly

A few large companies

Similar/slightly different products

Product Differentiation: Fair amount of nonprice competition

Significant barriers to entry usually due to cost of entry and regulations

Price searchers: Have some control over prices, but can’t stray too far from competitors.

Potential for collusion/price-fixing

Examples: Auto companies, airline companies, Streaming services, health insurance, Cell phone carriers

monopoly

Number of Sellers = One

Type of Product = Unique

Barriers to Entry = Extremely High

Control over Prices = Total Control...but can’t go too high or nobody will purchase.

Advertising: None

Product Differentiation: None

Technically in the US they are illegal...unless the government allows them and control them.

Price Searchers: Chooses the price to make the most profit

Examples = Water, Electricity, First Class Mail

price searcher

can sell some of its products at various prices. The “range” of slightly higher or lower prices.

price taker

can sell all their output at the equilibrium price but can sell none of their output at any other price. Must sell at equalibrium

anti trust laws

Goal: Promote and preserve competition in the marketplace by regulating businesses and their practices.

Result: No monopolies unless the government allows. No price collusion.

wage rate

the wage level (dollar amount) that is paid to a worker for their service.

labor union

Organization seeking to increase the wages & improve the working conditions of its members…

price discrimination

When businesses charge different prices for different people

Age

Gender

Race

Generally illegal, except in some cases (allowed to give breaks to the elderly, the young…)

NOT allowed to discriminate based on race, religion, or gender in most cases.

externalities

Unintended side effects that can be positive or negative.

Positive side effect ex:public education (benefits all of society

Negative side effect ex: businesses polluting (hurts all of us)

money supply

How much money is in circulation. High interest rates lead to a lower supply. Low interest rates lead to a higher money supply.

interest rates

how much banks charge on loans to people or businesses. People like low interest rates so they can borrow and spend more money.

fractional reserve banking

When banks hold on to a “fraction” of people’s deposits and lend out the rest. Helps to increase the money supply.

The Federal Reserve System

Nation’s central bank. It controls the money supply and interest rates (which has an impact on the economy as a whole).

required reserves

the amount of money that a bank holds to ensure that it is able to meet liabilities in case of sudden withdrawals.

inflation

Caused by an increase in Aggregate Demand or a decrease in Aggregate Supply

caused by increase in wages, increase in the price of raw materials, increase in taxes, decline in productivity, increase in money supply

deflation

Caused by a decrease in Aggregate Demand. (An increase in supply COULD cause this but it’s rare)

caused by recession

aggregate demand

a measurement of the total amount of demand for all finished goods and services produced in an economy

Aggregate supply

total number of goods and services that producers make and are willing to sell at a certain price within a certain time.

business cycles

ups and downs of economy and GDP

Peak

high point of economy and GDP. (between the end of an economic expansion and the start of a recession in a business cycle.

Recession

economic indicators start to fall (GDP, housing, business earning, and unemployment rises)

Trough

economy bottoms out and starts to improve (before a rise/recovery)

Recovery

economy starts to improve (GDP rises, unemployment falls)

expansion/growth

an increase in the production of goods and services in an economy - GDP passes old peak and economy is growing bigger than previous

excess reserves

funds held at the bank that exceed the Federal Reserve's minimum requirement.

gross domestic product (GDP)

measure of U.S. economic activity

monetary policy

a set of actions to control a nation's overall money supply and achieve economic growth

expansionary fiscal policy

Goverment cuts taxes on people/businesses to allow them to have more money to spend

contractionary fiscal policy

government raises taxes and causes people to have less money to spend (decreases agg.demand)

exapnsionary monetary policy

expanding the money supply faster than usual or lowering short-term interest rates.

contractionary monetary policy

a type of monetary policy that is intended to reduce the rate of monetary expansion to fight inflation

national debt

the total amount of money that a country's government has borrowed

budget deficit

If the government spends more than it takes in with taxes for the year

budget surplus

if the government spends less than what it takes in

Credit scores (good)

Higher credit scores allow you to get loans at cheaper interest rates

Credit scores (bad)

If you have a bad credit score you may not get a loan, or it will be at a higher interest rate

Tariff

a tax placed on imports so they become more expensive

Quota

is a legal limit on the amount of a good that may be imported from other countries

Embargo

is a government order prohibiting the selling of goods to another country, usually because that country has bad/tyrannical/cruel leaders