non current assets

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

definition

non current assets that are not current assets (right)

current assets:

- realised in normal operating cycle

- usually held for trading (inventories)

- realised in 12 months

- cash and cash equivalents

non current assets:

- used in operating of a business

- no acquired for resale purposes

- long term assets

categories of non current assets

tangible/fixed assets

PPE (property, plant, equipment)

inventories etc

depreciationintangible assets

patents, software, brand

amortisationfinancial assets

shares, loans, security deposits etc

identifying intangible assets

sometimes hard to tell if its expense or non-current assets

especially for intangible assets like R&D

R&D for pharmaceutical companies is very expensive

→ can be recorded as assets

buying a new software is an asset

but when buying a new software requires training for employees, these are training expenses not assets

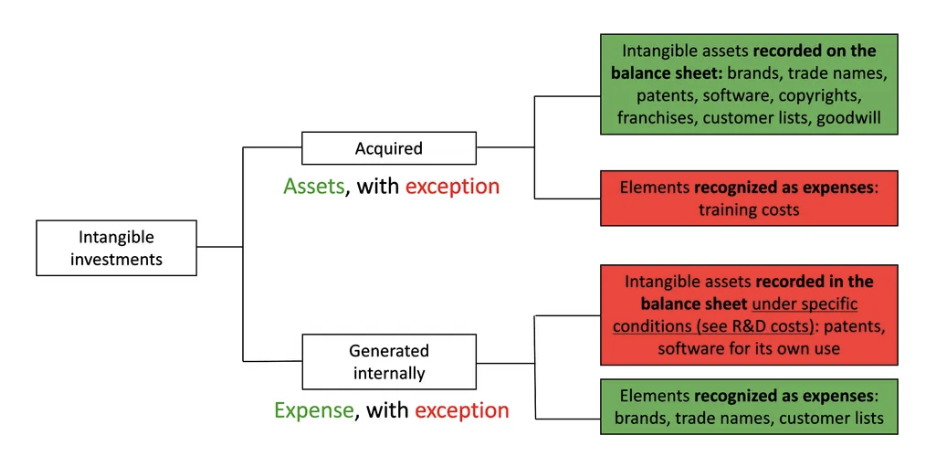

for intangible investments:

if you acquire its usually an asset (except for training costs)

if you generate internally its usually an expense (but patents, software for own use etc are assets)

R&D costs

research cost: expensed (uncertainty of success)

development costs: capitalised (treated as asset) if they meet the conditions of the IAS 38:

- technical feasibility of completing

- intangible that generates future economic benefits etc

capitalisation begins with project is developed enough that it will earn the company money

beginning of project → expense

when project becomes success → asset

recognition of non current assets

initially measured at historical cost

this includes all costs in acquiring asset and preparing it for use:

- purchase price after discounts

- transportation costs

- professional fees (architects, engineers etc)

- installation costs

- cost of trial runs

- estimated dismantling and removal cost

→ all expenses to make asset operational

training costs are NOT included

measuring non current assets after recognition

cost method:

valuation at historical cost MINUS accumulated depreciation MINUS impairment

revaluation method:

valuation at fair value MINUS accumulated depreciation MINUS impairment

eg a building that increases in value

spending money on tangible assets afterwards (repair/maintenance) → expense

UNLESS it improves the performance → capitalised/added to value

depreciation basics

cost allocation

process of allocating to expense the cost of a fixed asset over its useful life in a rational and systematic manner

rational: related to the flow of future economic benefit that’ll arise from asset

systematic: based on depreciation schedule decided at acquisition

tangible assets: depreciation

intangible assets: amortisation

depreciation schedule and amount

depreciation schedule:

3 factors in calculating depreciation expense:

- depreciable amount

- useful life

- depreciation method

depreciable amount:

usually acquisition cost minus the estimated residual value

acquisition cost:

all costs required to acquire asset and make it operational

residual value:

estimated value of asset at end of its useful life

- if useful life is shorter than economic life, company needs to dispose of asset at the end

- estimated sale price of asset at the end of expected use period

useful life, limited life and indefinite life

useful life:

time which a non-current asset is expected to be used

- estimated at acquisition

- expressed in years or units produced

some have an indefinite useful life:

- no foreseeable limit on time the asset can provide cash flow (land)

- not depreciated

- needs impairment testing

limited life examples:

patents, softwares, buildings

indefinite life examples:

artworks, brands, land

the component approach

sometimes not all components of an asset have the same useful lives

eg a building doesn’t have the same lifespan as a roof or the elevator in it

IFRS requirement:

each part of a PPE item that is important to the total cost must be depreciated separately

part 1/useful life = x

part 2/useful life = y

total depreciation = x + y

different depreciation methods

management selects method that best measures and assets contribution to revenue over its useful life

time based depreciation methods:

straight line method

same amount each year

= depreciable amount/number of yearsdeclining balance method

decreasing annual depreciation over the assets useful life

depreciation based on activity

units of activity method

depreciation varies on activity

companies estimate total units of activity made with asset to calculate depreciation rate for each year/per unit

= depreciable amount x (units produced in year/total units produced by machine)

if the residual value isn’t mentioned it’s 0

net book value:

acquisition cost - accumulated depreciation

year end net book value should be same as residual value

depreciable amount:

acquisition cost - residual amount

year end accumulated depreciation should be depreciable amount

impairment (vs depreciation)

applying conservatism and prudence principle

a non current asset is impaired when the company can’t recover the NBV through using or selling it

e.g. buying land, high speed road built there, land loses value → impairment test needed

impairment:

- asset valuation

- all assets

- unplanned

- can sometimes be reversed

depreciation:

- cost allocation

- non current assets with limited useful life

- planned

- cannot be reversed

when to impair?

non current assets with indefinite life need systematic annual impairment tests

non current assets with limited life need impairment tests if there are indicators

- external indicators (drop in market value, change in legal/economic situation)

- internal indicators (obsolescence/physical deterioration, changes in usage, lower performance than forecast)

if recoverable value (fair value or value in use) is lower than it’s NBV it needs to be fully/partially written down → impairment loss

impairment test

carrying amount vs recoverable amount

→ which is higher? if recoverable amount is lower then impairment loss

carrying amount: NBV

fair value: market value

value in use: present value of future cash flows expected from the asset until end of useful life

if fair value and value in use are different, we take the higher one

recording:

increase in impairment loss in income statement

decrease in tangible assets in balance sheet

how to dispose of non current assets

record sale price

increase in cash/accounts receivables and increase in saleseliminate non current asset

take off balance sheet

when disposing, a company either has a capital gain or a capital loss depending on the sale price in comparison to the NBV