Institutions Ch 9 (Done)

1/51

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

52 Terms

Cash flows from the sale of products, services, or assets denominated in a foreign currency are transacted in foreign exchange (FX) markets

A foreign exchange rate is the price at which one currency (e.g., the U.S. dollar) can be exchanged for another currency (e.g., the Swiss franc) in the foreign exchange markets

These transactions expose U.S. corporations and investors to foreign exchange risk as the cash flows are converted into and out of U.S. dollars

foreign exchange (FX) markets

Cash flows from the sale of products, services, or assets denominated in a foreign currency are transacted in ________________________

foreign exchange rate

A ___________________ is the price at which one currency (e.g., the U.S. dollar) can be exchanged for another currency (e.g., the Swiss franc) in the foreign exchange markets

foreign exchange risk

These transactions expose U.S. corporations and investors to _______________________ as the cash flows are converted into and out of U.S. dollars

Currency depreciation (appreciation)

_________________________________ occurs when a country’s currency falls (rises) in value relative to other currencies

gold system

During most of the 1800s, FX markets operated under a ___________, where currency issuers guaranteed to redeem notes, upon demand, in an equivalent amount of gold

From 1944-1971, the Bretton Woods Agreement called for the exchange rate of one currency for another to be fixed within narrow bands around a specified rate with the help of government intervention

Smithsonian Agreement of 1971 allowed the dollar to be devalued and the boundaries between which exchange rates could fluctuate were increased from 1% to 2.25%

In 1973, under Smithsonian Agreement II, exchange rate boundaries were eliminated, creating a free-floating system that is still partially in place

Bretton Woods Agreement

From 1944-1971, the ____________________ called for the exchange rate of one currency for another to be fixed within narrow bands around a specified rate with the help of government intervention

Smithsonian Agreement of 1971

__________________________ allowed the dollar to be devalued and the boundaries between which exchange rates could fluctuate were increased from 1% to 2.25%

Smithsonian Agreement II

In 1973, under ____________________, exchange rate boundaries were eliminated, creating a free-floating system that is still partially in place

Bretton Woods

Gold is linked to the USD and then the Pound, Franc, Mark and Yen are linked to the USD. Gold —→ USD —→ Pound, Franc, Mark, Yen

Though the free-floating FX rate system is still partially in place, central governments may still intervene in the FX markets

In 1992, 12 major European countries and Vatican City pegged their exchange rates together to create a single currency, called the euro

Until 1972, the interbank FX market was the only channel through which spot and forward FX transactions took place

Since 1972, organized markets such as the International Money Market (IMM) or the Chicago Mercantile Exchange (CME) have developed derivatives trading in FX currency futures and options

Euro is the European Union’s single currency (Not on Exam)

Started trading on January 1, 1999

Creation of the euro had its origins in the creation of the European Community (EC) a consolidation of three European communities in 1967:

European Coal and Steel Community, the European Economic Market, and the European Atomic Energy Community

Significant effect throughout Europe, as well as the global financial system

Dollar remains the unparalleled medium of exchange because it is the world’s easiest currency to buy or sell

In 2022, 88% of all FX transactions were denominated in dollars, while 31% were denominated in euros

Dollarization is the use of a foreign currency in parallel to, or instead of, the local currency

After the gold standard and the Bretton Woods Agreement were abandoned, many countries achieved currency stabilization by pegging the local currency to a major convertible currency

Other countries abandoned their local currency in favor of exclusive use of the U.S. dollar (or another major international currency, such as the euro)

Dollarization

______________ is the use of a foreign currency in parallel to, or instead of, the local currency

Dollarization may occur unofficially or officially

Major advantage is the promotion of fiscal discipline and thus greater financial stability and lower inflation

Panama, Ecuador, and El Salvador are the biggest economies to have officially dollarized

In 2005, China shifted away from its currency’s (the yuan) peg to the U.S. dollar

China stated the value of the yuan would be determined using a “managed” floating system with reference to an unspecified basket of foreign currencies

Partial free-floating of the yuan was in part the result of pressure from Western countries whose politicians argued that China’s currency regime gave it an unfair advantage in global markets

In 2009, China began a pilot program of internationalizing its currency by allowing Hong Kong banks to trade the yuan

In 2011, China began to allow Americans to trade in the currency

IMF-accepted reserve currency

In 2015, the IMF designated the Chines yuan an ___________________________

exchanged for another currency

Recall, a FX rate is the price at which one currency (e.g., the U.S. dollar) can be __________________________ (e.g., the Swiss franc)

FX rates are listed in two ways:

U.S. dollars received for one unit of the foreign currency exchanged (IN US$ or USD, also referred to as the direct quote)

Foreign currency received for each U.S. dollar exchanged (PER US$, also referred to as the indirect quote)

Two types of FX rates and FX transactions:

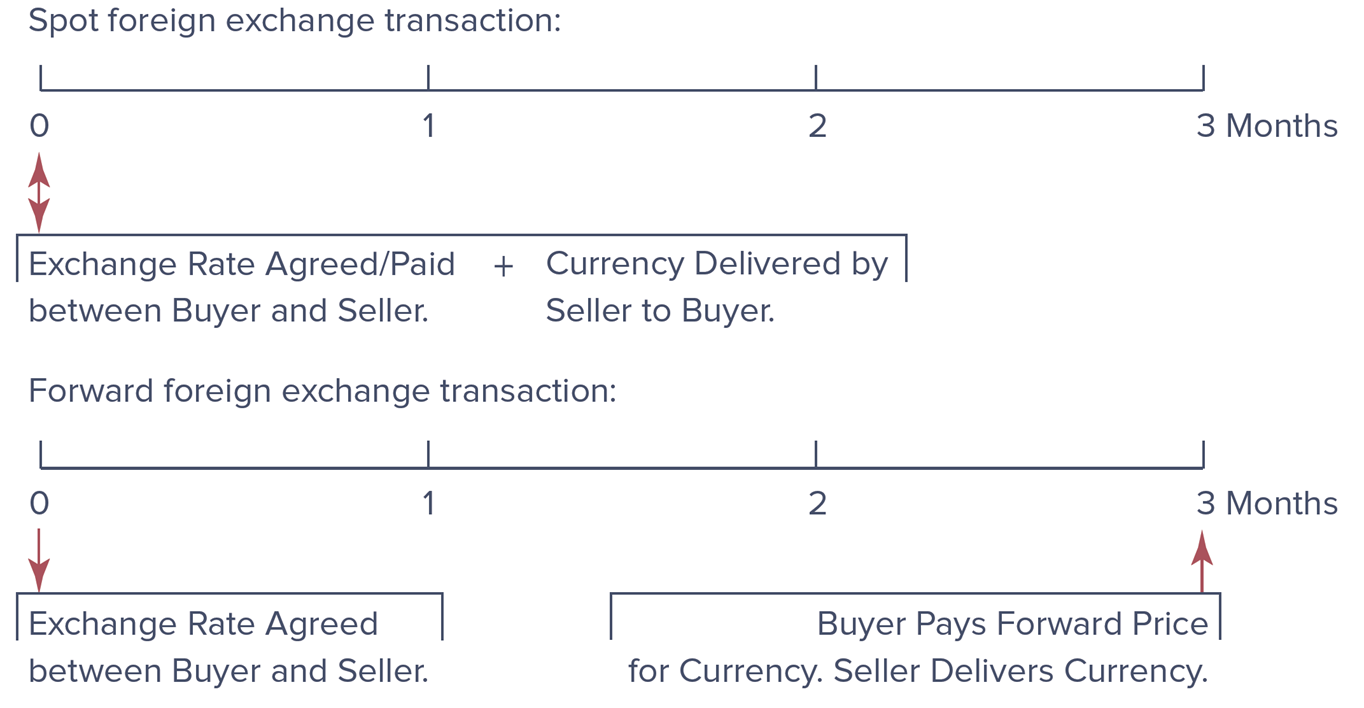

Spot FX transactions involve the immediate exchange of currencies at the current (or spot) exchange rate

Forward FX transaction is the exchange of currencies at a specified exchange rate (or forward exchange rate) at some specified date in the future

Example is an agreement today (at time 0) to exchange dollars for pounds at a given (forward) exchange rate in three months

Typically written for one-, three-, or six-month periods

Spot FX transactions

_______________________ involve the immediate exchange of currencies at the current (or spot) exchange rate

Forward FX transaction

________________________ is the exchange of currencies at a specified exchange rate (or forward exchange rate) at some specified date in the future

Example is an agreement today (at time 0) to exchange dollars for pounds at a given (forward) exchange rate in three months

Typically written for one-, three-, or six-month periods

28% involved spot transactions while 72% involved forward and other transactions

Of the $7.51 trillion in average daily trading volume in the FX markets in 2022(on a net-net basis), _____________________________________________________.

Spot versus Forward Foreign Exchange Transaction

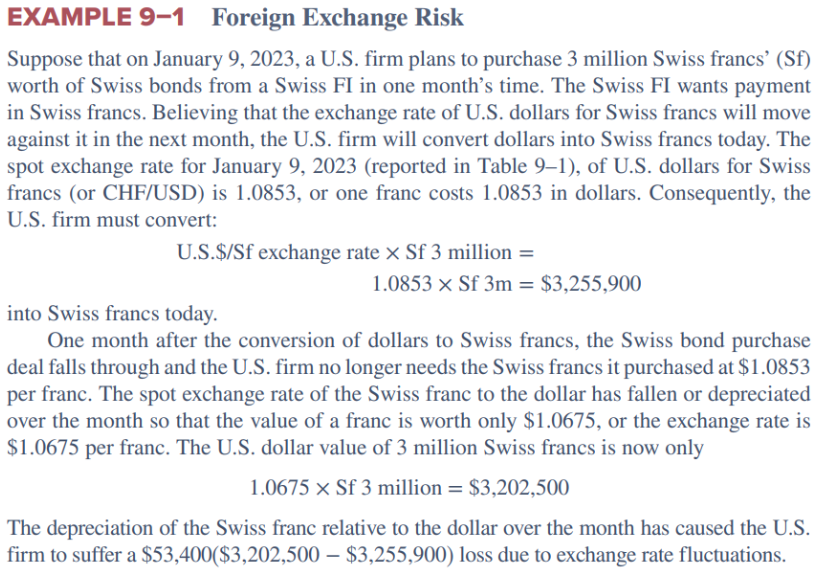

Risk involved with a spot FX transaction is that the value of the foreign currency may change relative to the U.S. dollar over a holding period

FX risk is also introduced by adding foreign currency assets and liabilities to a firm’s balance sheet

main participants

FIs, and particularly commercial banks, are the ____________________ in the FX markets

FX Risk: Example (On Quiz)

To hedge, the U.S. firm could have entered into a forward:

If the U.S. firm had entered into a one-month forward contract selling the Swiss franc on January 9, 2023, at the same time it purchase the spot francs, the U.S. firm would have been guaranteed an exchange rate of 1.0926 U.S. dollars per Swiss franc, or 0.9152 Swiss francs per U.S. dollar, on delivering the francs to the buyer in one month’s time

If the U.S. firm had sold francs one month forward at 1.0926 on January 9, 2023, it would have largely avoided the $53,400 loss

By selling 3 million francs forward, it would have received 1.0926 x Sf 3 million = $3,277,800 at the end of the month, suggesting a gain of $3,277,800 - $3,255,900 = $21,900.00 on the combined spot and forward transactions

Managers hedge to manage their exposure to currency risks, not to eliminate it

While it reduces possible losses, it also reduces possible gains

An FI can better control the scale of its FX exposure in either of two major ways:

On-balance-sheet hedging involves making changes in the on-balance-sheet assets and liabilities to protect the FI’s profits from FX risk

Off-balance-sheet hedging involves no on-balance-sheet changes, but rather involves taking a position in forward or other derivative securities to hedge FX risk

positive return or profit spread

By directly matching its foreign asset and liability book, an FI can lock in a _________________________ whichever direction exchange rates change over the investment period

Sources of FX risk exposure include the following:

International differentials in real prices

Cross-country differences in the real rate of interest

Regulatory and government intervention

Restrictions on capital movements

Trade barriers

Tariffs

Securities that may be used to hedge foreign exchange risk includes the following:

Forwards

Futures and options foreign exchange contracts

Foreign exchange swaps

FX market transactions are conducted among dealers mainly OTC using telecommunication and computer networks

A major structural change in FX trading has been the growing share of electronic brokerage in the interbank markets at the expense of direct dealing (and telecommunication)

Since 1982, when Singapore opened its FX market, FX markets have operated 24 hours a day

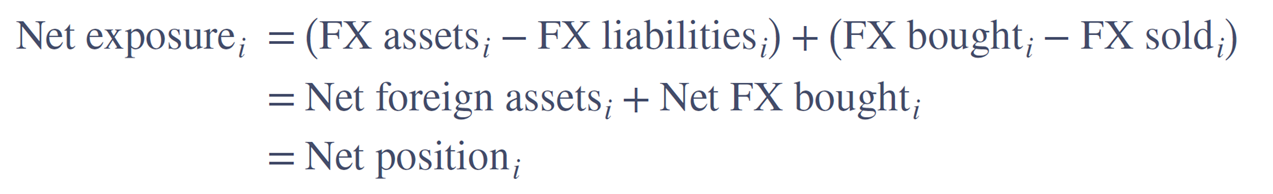

An FI’s net exposure is the overall FX exposure in any given currency, measured by its net book or position exposure, where i = ith country’s currency:

net long in a currency

A positive net exposure position implies an FI is overall _________________ (i.e., the FI has purchased more foreign currency than it has sold)

net short

lA negative net exposure position implies the FI is __________ (i.e., the FI has sold more foreign currency than it has purchased) in a foreign currency

A financial institution’s position in the FX markets generally reflects four trading activities:

Purchase and sale of foreign currencies to allow customers to partake in and complete international commercial trade transactions

Purchase and sale of foreign currencies to allow customers (or the FI itself) to take positions in foreign real and financial investments

Purchase and sale of foreign currencies for hedging purposes to offset customer (or FI) exposure in any given currency

Purchase and sale of foreign currencies for speculative purposes through forecasting or anticipating future movements in FX rates

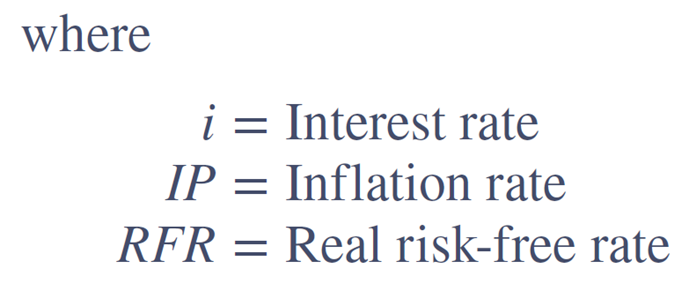

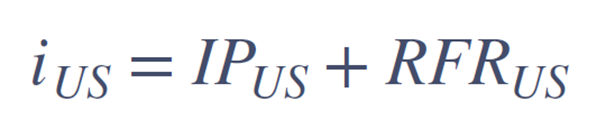

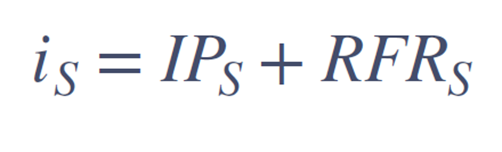

Recall the relationship among nominal interest rates, real interest rates, and expected inflation is the Fisher effect

The international Fisher effect incorporated FX rates into the relationship; the expected spot rate is the current spot rate multiplied by the ratio of the foreign nominal interest rate to the domestic nominal interest rate:

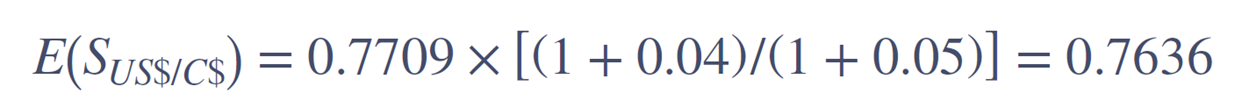

Suppose the spot exchange rate of U.S. dollars for Canadian dollars is 0.7709, the current nominal interest rate in the U.S. is 4%, and the nominal interest rate in Canada is 5%. The international Fisher effect predicts:

Purchasing power parity (PPP) is the theory explaining the change in foreign currency exchange rates as inflation rates in the countries change

Assuming real rates of interest (or rates of time preference) are equal across countries:

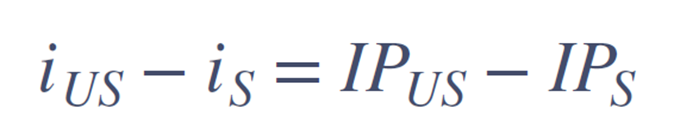

Then, the following is true:

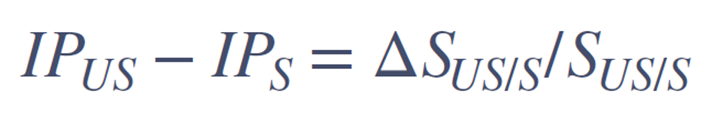

PPP theorem states the change in the exchange rate between two countries’ currencies is proportional to the difference in their inflation rates:

The law of one price is an economic rule which states that, in an efficient market, identical goods and services produced in different countries should have a single price

This is the theory behind purchasing power parity

An example of this line of thinking is demonstrated in The Economist’s “Big Mac” index

law of one price

The ______________ is an economic rule which states that, in an efficient market, identical goods and services produced in different countries should have a single price

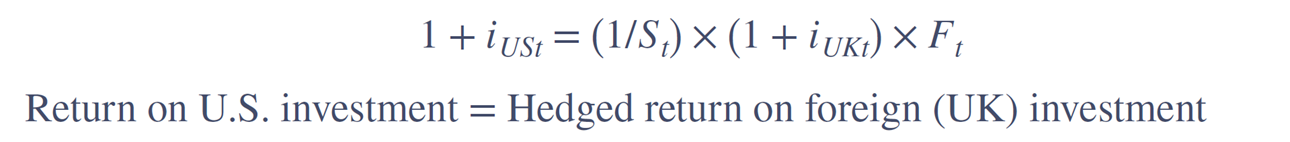

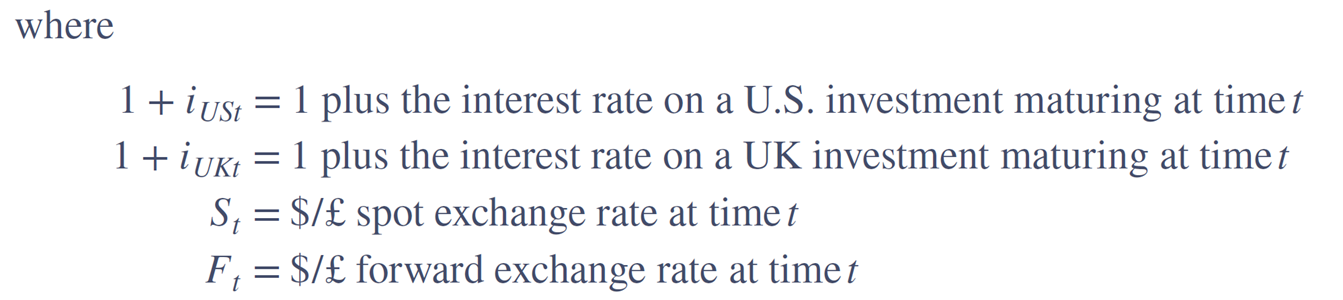

Interest rate parity theorem (IRPT)

______________________________ is the theory that the domestic interest rate should equal the foreign interest rate minus the expected appreciation of the domestic currency

IRPT can be expressed as the following:

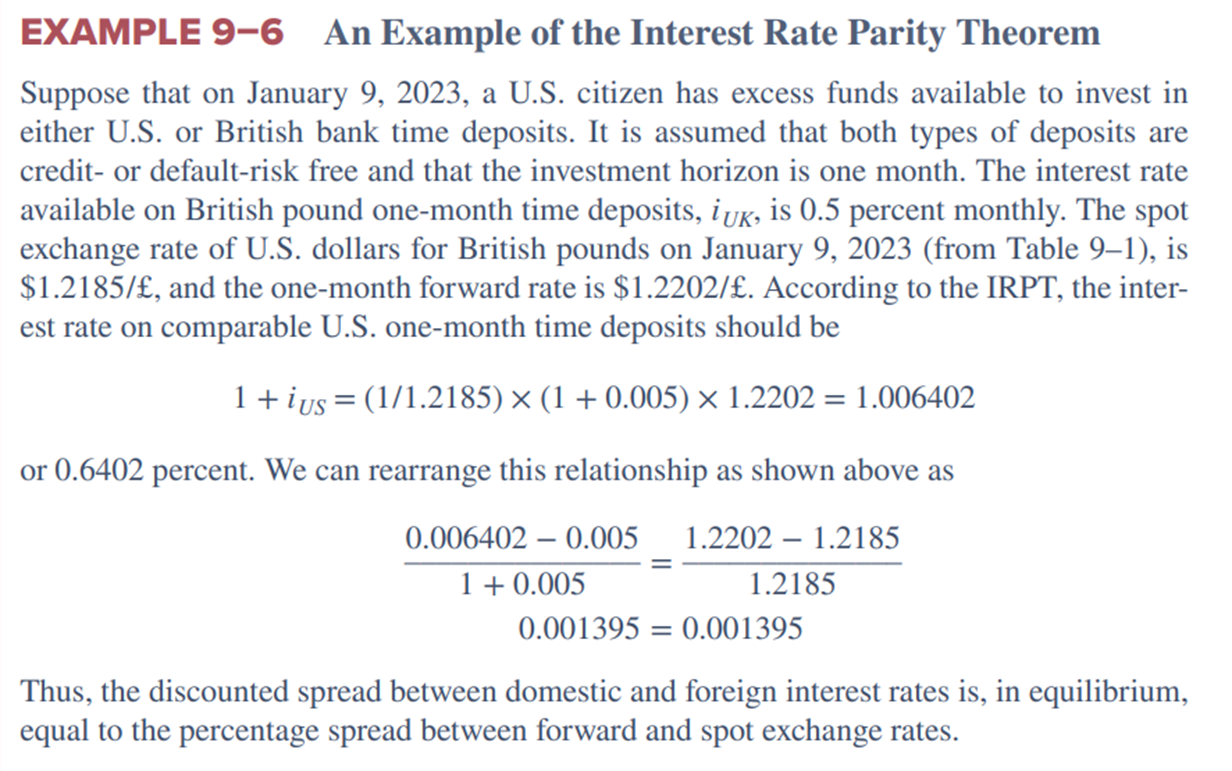

Interest Rate Parity: Example