SIE

1/965

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

966 Terms

Stockholder

An owner of a piece of a corporation

Shareholder

Stockholder is also known as a what?

B

Stockholders what in a company?

A Debt

B Equity

C Value

Authorized stock

When a corporation is formed, its corporate charter authorizes that a fixed number of common shared may be issued.

Par value

is the nominal or face value of a security, stated by the issuer. It is an arbitrary value that is used for accounting purposes.

A

To raise capital needed to finance a corporation, a company will do what?

A Issue stock

B Buy other companies

C Sell items

D Get rid of employees

B

Issuing stock means what?

A Selling stock

B Buying stock

Market cap = number of shares outstanding * market price

Market capitalization formula

Treasury stock

Repurchased shares are called what?

True

True or false: Common shares have the right to vote on issues that will affect them.

True

True or false: Treasury shares do not have the right to vote.

True

True or false: Common shares have the right to receive dividends.

True

True or false: Treasury shareholders do not have right to receive dividends.

True

True or false: Listed securities must meet stringent listing standards.

True

True or false: OTC securities (unlisted) are typically smaller companies that do not meet the requirments to be listed on an exchange such as the NYSE or the NASDAQ

New York Stock Exchange

NYSE is what?

National Association of Securities Dealers Automated Quotations

NASDAQ is what?

Settlement

When the securities and the purchase price have officially changed hands. At that time, the buyer becomes the owner of record.

Regular way settlement

When a trade is executed in an equity or equity related security, settlement occurs one business day after the trade date.

True

True or false: Shares outstanding increase when a company issues new shares.

True

True or false; A share buyback decreases the number of shares outstanding.

Treasury stock

Issued stock minus authorized stock (Issuer owns i)

True

True or false: Treasury stock is issued shared

Cash dividends

Enable a company to share a part of the corporations profits withs shareholders

Board of directors

Dividends are declared by whom?

True

True or false: Some companies, such as utilities, pay higher than average dividends, while many tect companies pay no dividend at all.

Stock dividend

Involve giving additional shares to existing stockholders. Defined as any stock distribution that involves less than 25% of the outstanding shares.

True

True or false: When a company issue stock dividends, the total number of shares outstanding increases, and the value of each outstanding share decrease.

Stock split

A stock distribution of shares that is more than 25% of the outstanding shares is considered a what?

True

True or false: Reverse stock split decreases the number of shares outstanding

True

True or false: A forward stock split increases shares outstanding.

True

True or false: Shareholder value stays same with a stock split and stock dividend. Just reduces price per share and increases number of shares outstanding.

True

True or false; A reverse stock spilt would result in fewer shares outstanding (like a 1:2), but a higher price per share.

True

True or false: A reverse stock split might be made for a company whose share price has fallen below a minimum price required by an exchange such as the NYSE.

number of shares = shares * stock split

number of shares formula

stock price = price * inverse split

stock price formula

True

True or false: Cash dividends are typically paid quarterly, stock dividends and stock splits are distributed on an irregular basis.

True

True or false: Cash dividends are taxable upon receipt, stock dividends and stock splits are not.

True

True or false: Reverse and forward splits are adjusted in cost basis and not tax deductable.

Less

Reverse stocks result in less or more shares?

More

Forward stocks result in more or less shares?

Proportional ownership

Shareholders may have the right to keep their proportional owner in the company if the company chooses to issue more shares and it protects shareholders from their investment being diluted.

Preemptive rights

Distributed to shareholders prior to the issuance of new shares to the public. They are short term securities that give the owner the option to buy a certain number of shares at a reduced price over a short period of time. Typically, rights are issued for 30-60 days and then expire.

Know

Exercise right and buy new shares below current market price

Sell the right to another investor

Do nothing and let the right expire worthless

Right gives the shareholder the 3 options to do what?

Balane

The balance sheet of a company is a “Snapshot” of all the company’s assets and liabilities at one point in time.

Total assets = total liabilities + net worth

Total assets formula

net worth = Total assets - liabilities

Net worth formula

Stockholders equity (net worth)

The amounts claimed by the shareholders are listed under ?

True

True or false; Long term liabilities and stockholder’s equity are the sources of a company’s capital

Bonds, preferred stock, common stock, and retained earning

What is under stockholder equity typically?

Total cap = long term debt + stockholders equity

What is total capitalization form?

True

True or false; Want a low inventory valuation.

True

TRUE OR FALSE: FIFO means oldest inventory leaves first, and newest is first in.

True

True or false: LIFO means oldest inventory is in, but newest is out.

True

True or false; Lower profits ocfur with LIFO

True

True or false: Higher profits occur with FIFO.

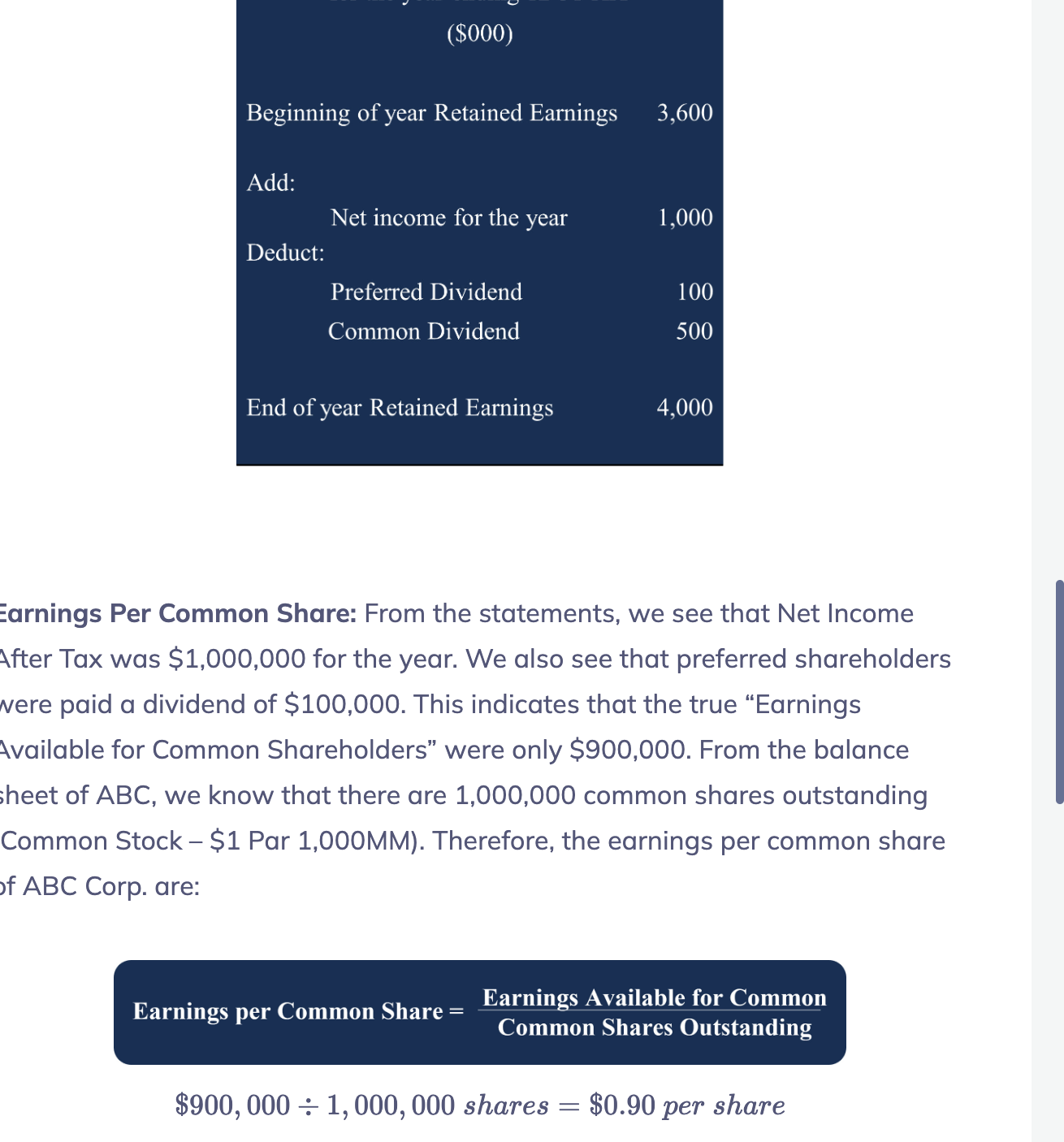

KNOW

Annual income / market price

Dividend (current yield) formula

PE = market price / earnings per share

PE Ratio formula

Right to inspect books and records

Corporations must provide shareholders with audited annual reports that include company’s financial statements.

Right to transfer ownership

Shares are lequid, meaning that they can be bought and sold.

Preemptive right

The right to proportional ownership of the company if new shares are issued.

Right to corporate distributions

Shareholders have the right to receive distributions such as dividends if declared by the board of directors

Right to corporate distributions

Shareholders have the right to receive distributions such as dividends if declared by the board of directors

Right to corporate assets upon dissoltion

In the event of liquidation, shareholers have rediudual claim to the company’s assets. This means they they will be paid after all other claims have been satifisfied.

Right to vote

Shareholders have the right to approve certain corporate decisions

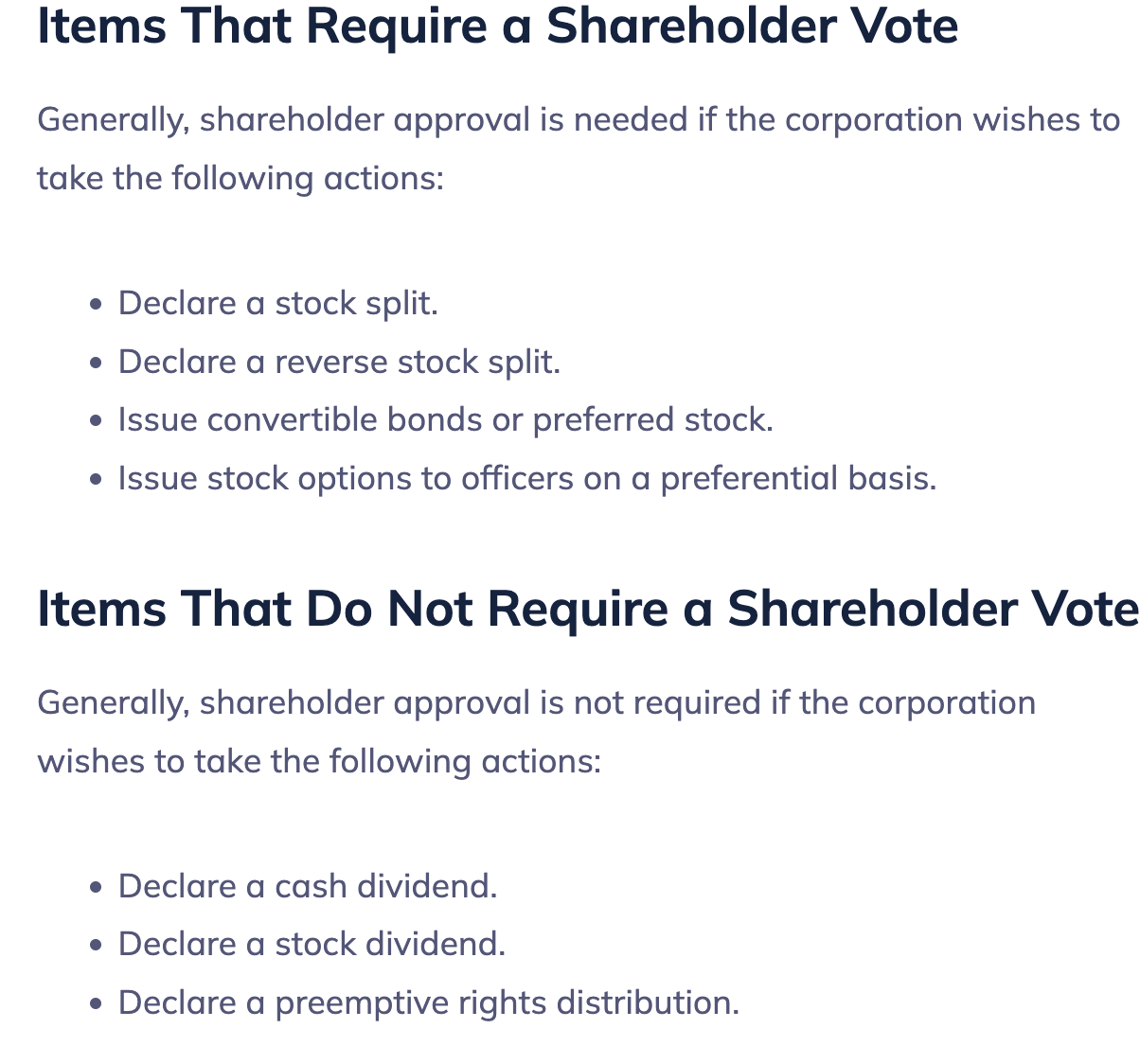

KNOW

No

Do cash and stock dividends require a shareholder vote?

Yes

Do stock and reverse splits require a shareholder vote?

True

True or false: Treasury stock does not vote and does not receive dividends.

True

True or fales: Each shareholder gets one vote per share per voting item.

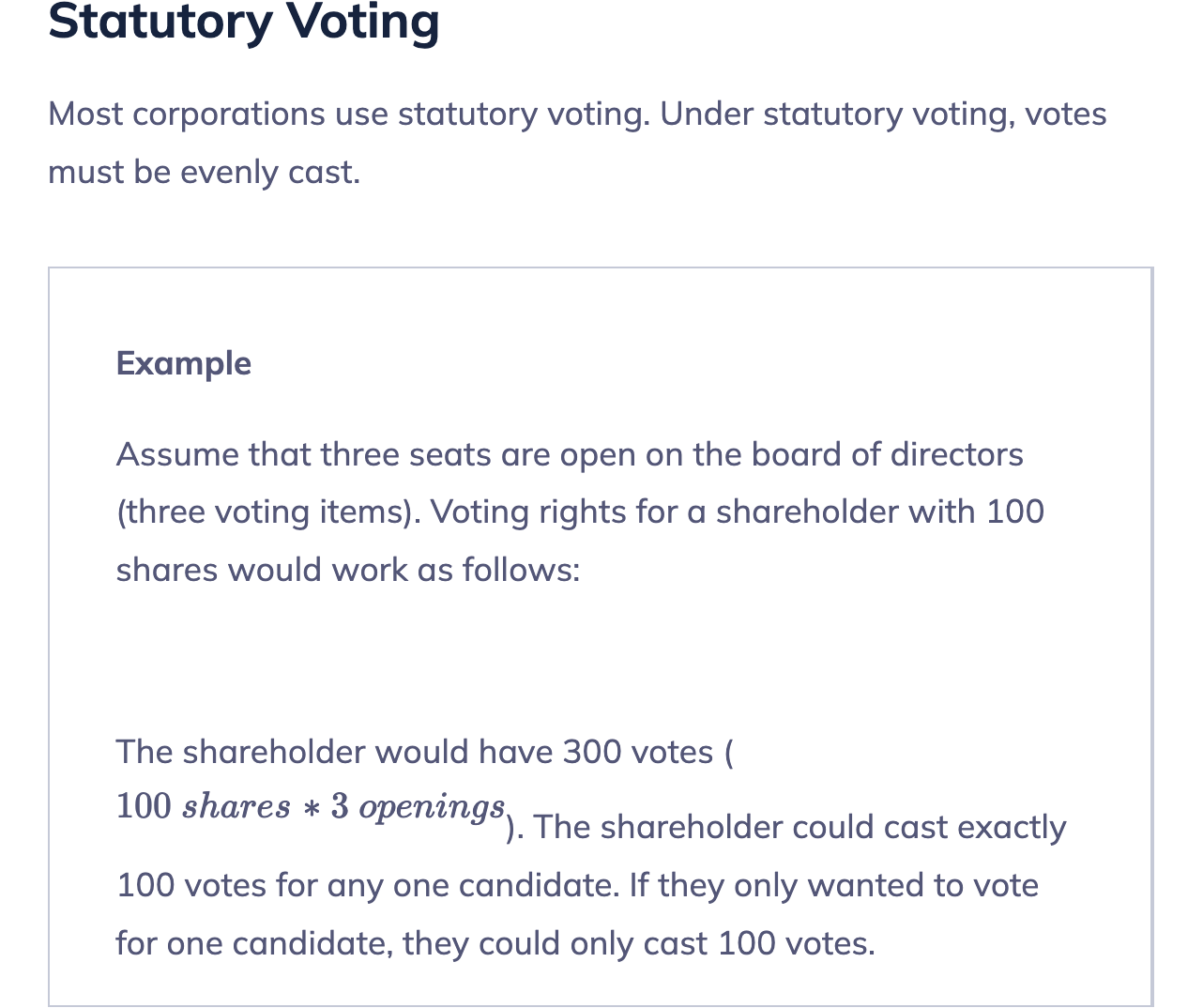

Statutory and cumulative voting

What are the two voting method?

Statutory voting

Votes must be event cast

Cumulative voting

The shareholder may di ide their total votes in whatever manner they choose

True

True or false: Cumulative voting is an advantage for the small investor since they can vote disproportionately to exert more influence in the election of individual directors.

Proxy

Casted votes from ballots on behalf of the shareholders who choose not to attend.

Creditors, preferred stockholders, and common stockholders

In a corporate liquidation, who is paid in first second and last?

true

True or false: In a corporate liquidation, creditors are paid first, then preferred stockholders, then common stockholders

Preferred stock

A senior equity security because it has priority over the common stock issued by a company. If the company declares a common stock dividend, preferred shareholder must recieve their dividends before the common stock can be paid.

True

True or false: Preferred dividends may be paid monthly, quarterly, semiannually, annually, or irregularly.

True

True or false; Unlike common stock, preferred stock does not have the right to vote and does not have preemptive rights.

Know

Differences between bonds and preferred stock

Cumulative preferred stock

If the issuer does not pay, the missed payments accumulate and must be paid before the issuer can resume making any other dividend payments.

Callable preferred

The issuer has the right to redeem the shares after a set date. When the stok is called, the shareholder will typically receive the pare amount.

True

True or false: Common stock is not callable

Convertible preferred

Shareholders can exchange their preferred shares for common stock based on a predetermined price.

True

True or false: The price of convertible preferred stock is typically driven by the price of the issuer’s common shares.

Participating preferred stock

In addition to the fixed dividend rate, participating preferred shareholders may also be given additional dividends. These extra dividens must be declared by the board of directors. This feature enables shareholders to participate in the earnings of the company more fully

True

True or false: When preferred stock is issued, the dividend rate is set at a level comparable with the current market rate of interest for equivalent securities.

TRUE OR FALSE: There is an inverse relationship between interest rate movements and preferred stock prices.

True

True or false: If interest rates increase, then stock price decrease.

Know

Know

Warrant

Long term option to buy a stock at a fixed price. This price is usually quite a bit above the market price of the stock when the warrant is issued. They only become valuable if the stock price rises. Typically attached to a new stock or

True

True or false: Warrants are tsometimes referred to as “sweetners” because they sweeten the deal, making the new issue more attractive to investors.

True

True or false: Warrants are a separate security that can be traded itself.

True or false: Warrants usally include a period before it can be exercised. After the waiting period it can be exercised at the set price until expiration. Many warrants have a lifetime at issuance of 5 to 10 years, but some are perpetual (infinite).

True

True or false: Rights exercise price is below the market price and short term.