European Economic Integration

1/103

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

104 Terms

Integration

removing frontiers in region

Integration Objectives

promote peace, economic stability, and cooperation among member states, values of EU

negative vs positive integration

negartive: liberation positive: supranational

Integration vs Cooperation

Integration: transfer sovereinty cooperation: common agreed policies

Intergovernmentalism vs Supragovernalism

Inter: volentary cooperation Supra: supranational insititutions

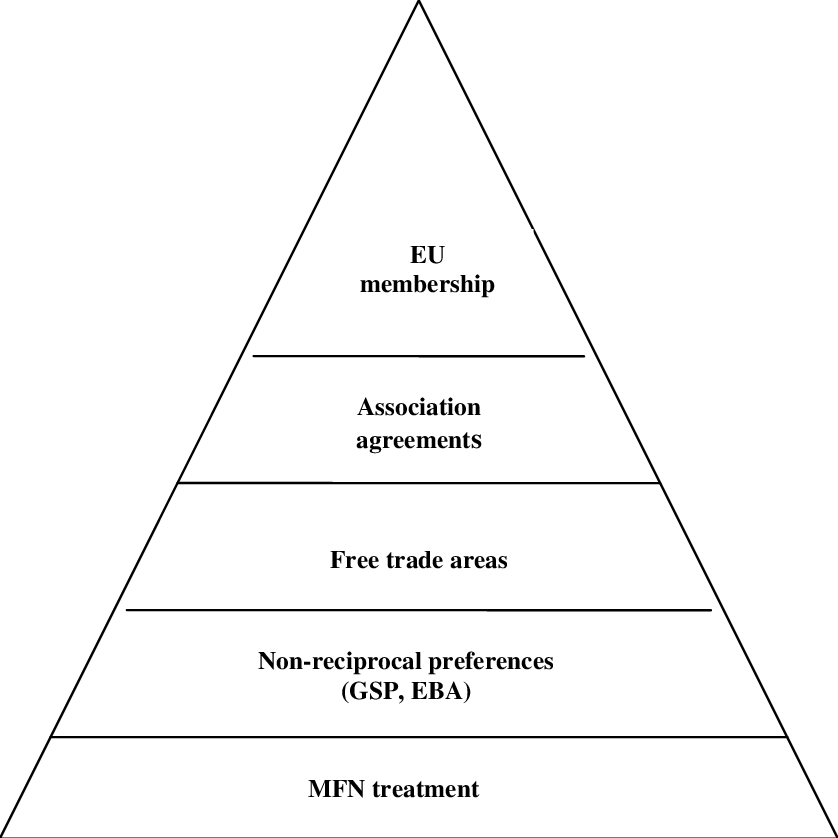

Stages integration low to high

Free Trade Area (no tariffs), Customs Union(equalization of outside tariffs), Customs Market(free movement of production factors), Economic Union (slected economic policies), Total integration (centralization)

Copenhagen Critearia

Politics: stable inistitutions, democarcy, rule of law, respect for human rights and minorities.

Economy: functioning market economy and the ability to cope with market forces.

Institutional: possiable to apply law and policies

Structure EU governance

EU council (poli leadership)

European Commission (general EU interest)

Council EU (general interest states)

European Court (legislative)

European parliament (judicative)

Single european Act

Qualified majority voting on issues (fiscal policy and harmonization, social cohesion)

liberation of government procurements and services in industries

Maastrict Treaty

A treaty signed in 1992 that established the European Union

led to the creation of the Euro,

setting out the framework for economic and political integration among member states

Monetary Union: ECB, ban excessive deficits, economic coordination

Three pillars EU:

European communities

common foreign and security policy

justice and home affairs

Subsidiarity

A principle in the EU that dictates decisions should be made at the closest possible level to the citizens affected, ensuring that higher levels of authority only intervene when necessary.

This is aimed at promoting local governance and efficiency in public affairs.

Arguments for Free Trade

Ricadian Theory: compertaive advantage argues that countries should specialize in the production of goods where they have a lower opportunity cost, promoting overall economic efficiency and increasing wealth for all trading nations.

Heckscher Olin Theodrem: suggests that countries will export goods that utilize their abundant factors of production and import goods that require scarce factors, thus enhancing global trade benefits.

Intra Industry Trade: trades within the same industry between countries, leading to specialization and increased competition, driving innovation and consumer choice.

Arguments for protection

Infant Industry: small young firms have it harder

Second Best: Some violate perfect competition

Optimal Tariff: maximize benefit for domestic firms and thus national welfare

Strategic Trade Theory: be used to max compertive and domestic economic power

Tariffs

Quotas

Volunteer export restrainers

dumping

export subsidies

technical barriers of trade

tax, levies imposed on imports

restrictive number on imports or the origin country

restrictions imposed by the exporting country

extreme quantities because of surplus dropped by the exporter compared to the domestic price

assistance to exportes

specific modifications which make trade harder ( health restrictions, substance restrictions, regulations, transport)

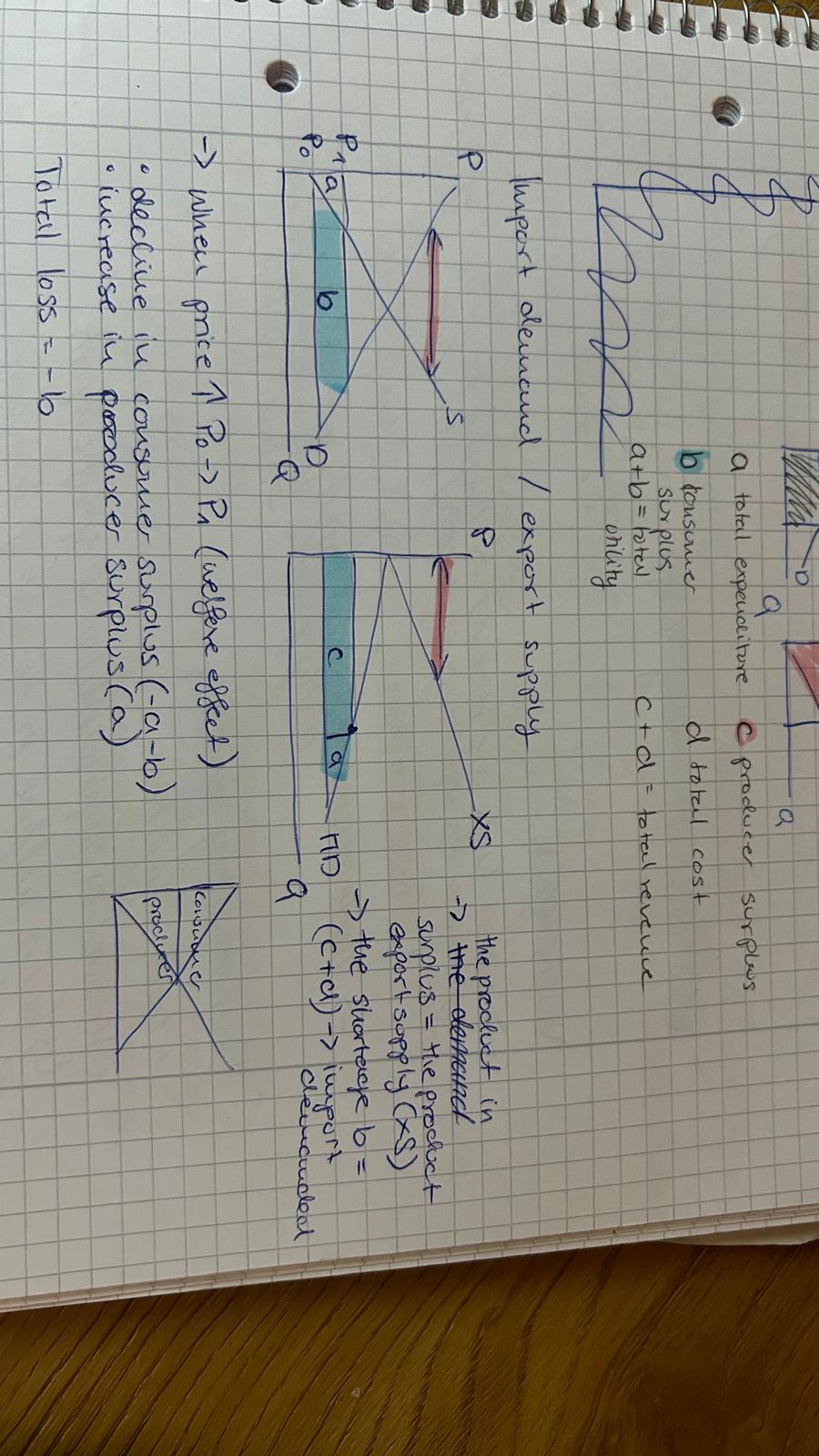

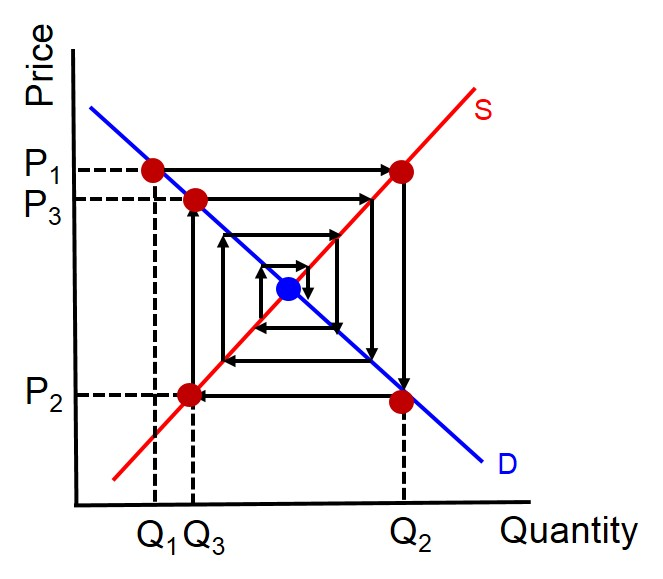

Import Demand with Export Supply

Free Trade Equilibrium

is a market condition where the quantity of goods demanded by consumers equals the quantity supplied by producers without trade barriers, leading to optimal resource allocation.

The P set by Home economy = demand foreogn economy

This equilibrium occurs when the international prices align with domestic demand, ensuring an efficient market for imports and exports.

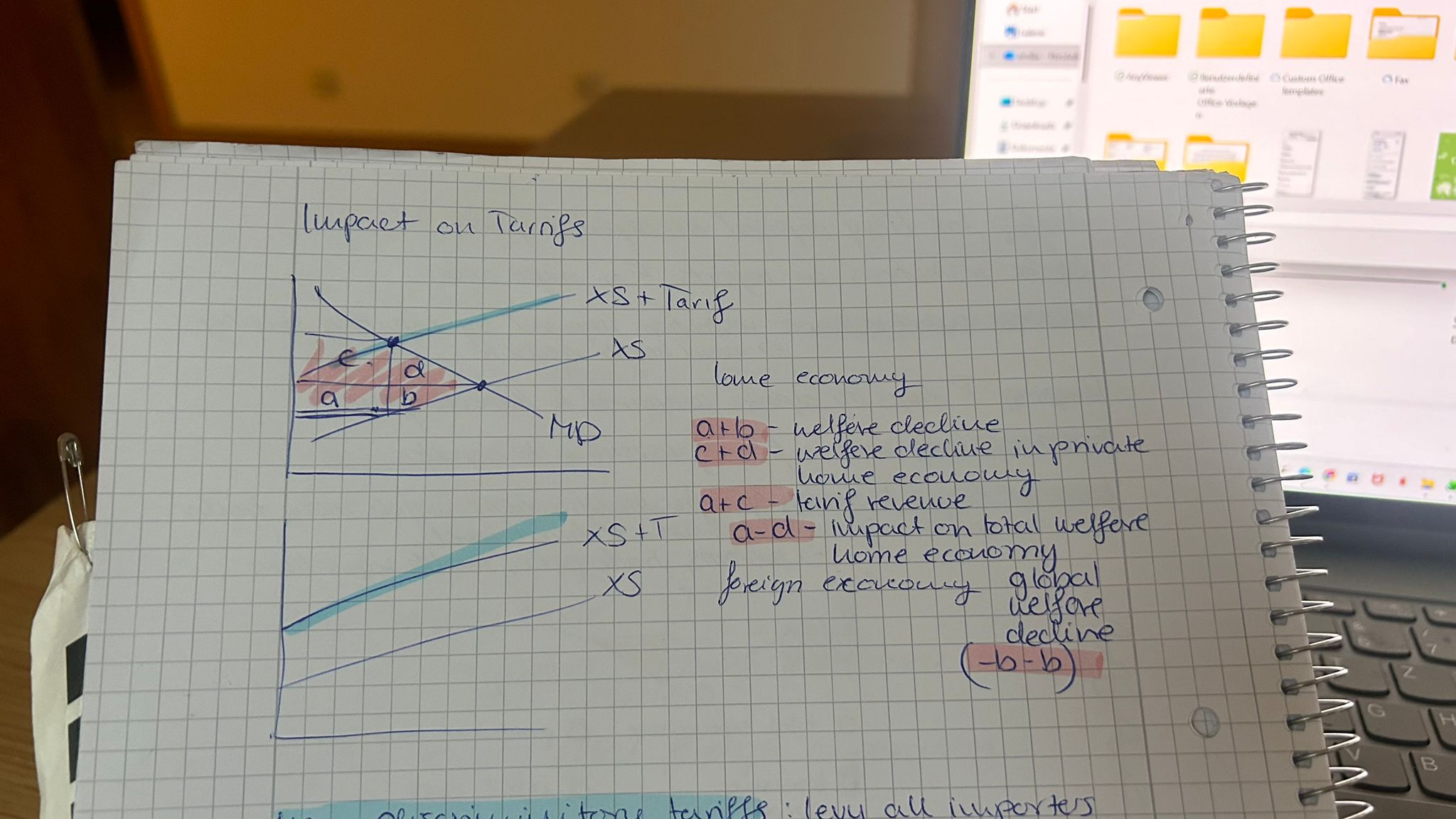

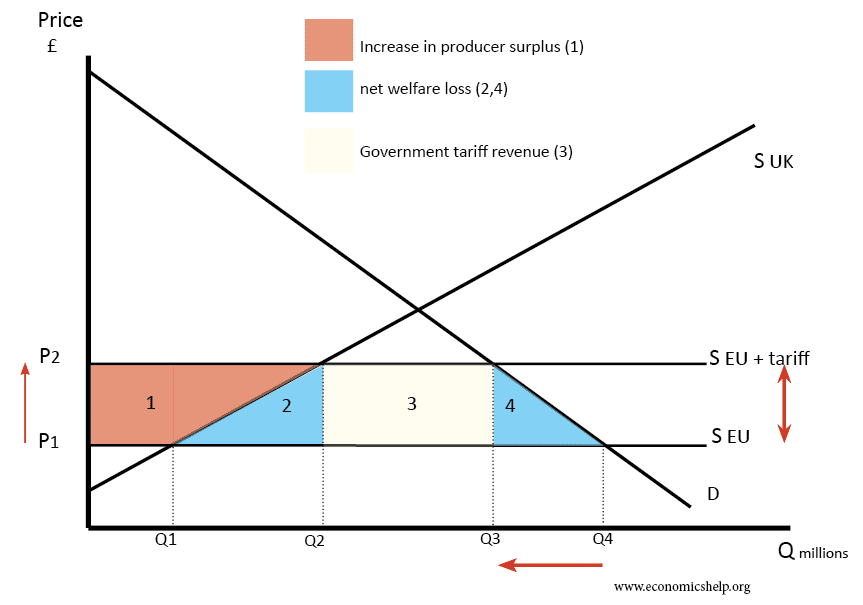

Impact of Tariffs

refers to the economic effects resulting from the imposition of tariffs, which typically leads to higher prices for consumers, reduced import volumes, and potential retaliation from trading partners, ultimately affecting overall trade dynamics and domestic industries.

Non discriminitory Tariffs

are tariffs applied equally to all imports without favoring any particular trading partner, promoting fairness in international trade.

Viners effect

impact on welfare of customs unions and FTA

Trade Creation: occurs when high-cost domestic producers are replaced by lower-cost imports, leading to increased overall welfare.

Trade diversion: occurs when lower-cost imports from a member country replace previously imported goods from a non-member country, potentially resulting in a loss of overall welfare.

Dicriminatory tariffs

are tariffs that are applied differently to different trading partners, often favoring certain countries over others, and can lead to trade imbalances and disputes.

Custom Unions

A codefied form of trade liberation, eliminates tariffs while maintaining common external tariff

Services

are economic activities that provide value without the production of physical goods, often including sectors such as finance, healthcare, and education.

Freedom of services: the unrestricted movement of services across borders, facilitating trade and investment among member countries.

70% of EU activities

tradeables (cyclical)

non-tradeables (less cyclical)

Why regulate services:

Info asymmetry: difficult to assess the market, high quality might be pushed out

Imperfect competition: low contestability - can lead to monopoly

Systemisk risk: contagious effect

Social Considerations: discrimination in employment

Treaty Of Rome

right to provide services, right to set up establishments

Capital

factors of production, not for itself but for the ability of producing goods

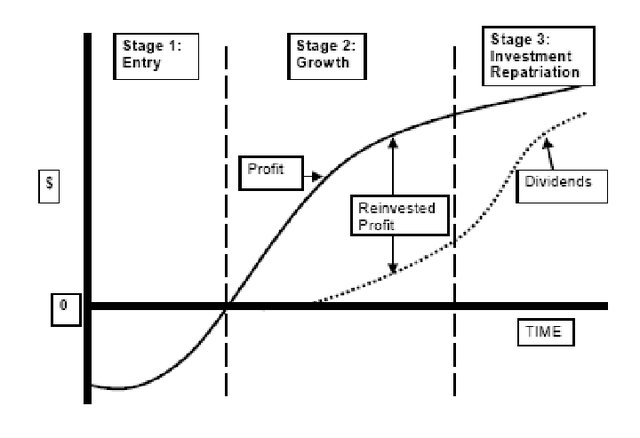

Life Cycle foreign domestic investment

controlling a business in a foreign country through ownership or controlling interest.

The effect of capital market integration

Through market integration, capital will move to where it yields the highest rates of return, thereby enhancing overall economic efficiency by allocating resources effectively.

Capital Controls

administrative (direct)

market-based (indirect)

direct. porhobitions

indirect: costly

Capital Flow

Long short term

Inlfow outflow

resident non resident

safe money, hot money (investments)

treatemnt of capital inflow and outflow (dutch disiease: too much inflow stops outflow)

control over domestic assets

Finantial Integration

full integrated market(same price everywhere)

the more integrated the better monetray policies

Benefits of Financial integration

Consumption smoothing (risk sharing), domestic investment growth, macroeconomic discipline, and financial and bank stability

Costs of Finantial Integration

Potential loss of monetary control, increased vulnerability to global shocks, herding, lack of access by other countries, misallocation

Monetary Policy

Successful: countercyclical

and stabilizes inflation; involves regulation of money supply and interest rates to influence economic activity.

expensitory: stimulates spending, boostst demand and promotes econ growth (higher GDP) - more money supply (lower interst rates) problem: raises inflation

contractionary: reduces spending - stops economic overheating , lowers demand, and curbs inflation - less money supply (higher interest rates) which can slow economic growth (lower GDP)

Conventional Monetary Policy

Increase/decrease Interest Rates, control the money supply, and influence inflation and economic activity.

Unconventional Monetary Policy

when cant decrease interst rates: #

Quantitive easing (balance sheets expands, liquidity unchanged)

Qualitative easing (balance sheet the same, changes composition )

Credit easing (expands sheet, liquidity decreases)

Forward Guiding:

Assymetric shocks in monetary Union

A situation where different regions within a monetary union experience economic shocks differently, leading to unequal effects on their economies. This can complicate the implementation of a unified monetary policy.

Solution: wage flexibility , price flexibility, fiscal transfer, coordination of fiscal policy, labor mobility

ECB will only rect when whole eu is effected

european Centran Bank

Governing council - main decsions every 6 weeks

General Council: advisors - info allocation

Impossiable trinity

The economic theory stating that it is impossible for a country to have all three of the following: a stable foreign exchange rate, free capital movement, and an independent monetary policy at the same time.

Tosovsky monetary dilemma

A situation in which a country faces a trade-off between maintaining currency stability, controlling inflation, and fostering economic growth, particularly in the context of economic integration.

optimun currecy areas

Regions that benefit from sharing a common currency due to economic similarities, which can enhance trade and stability.

Sysmetric shocks in OCA

Economic disturbances that affect all regions within an optimal currency area similarly, necessitating synchronized responses and policies.

decline in symetric shocks raises cost compared to benefit in monetary union

Logic OCA

where marginal benefit crosses marginal cost - optimal size

endogenity principle: a country does not need perfect condotions, if it joins the OCA will be established faster

Maastricht Criteria

price stability, long term interst rate convergence, ex r stability, sustainable public finance, independent national bank

Monetary Criteria:

Inflation: § lowest eu plus 1.5 % points

Interest rates must converge with the lowest three EU countries plus 2 percentage points.

Exchange rate stability must be maintained against EU currencies for at least two years.

Cost of Euro

loss independent monetary policy, limited reaction asymetric shocks, loww ex r adjustment, cost with change over

benefit of Euro

reduction of transaction cost, no exchange rate risk, greater transparency, fiscal stability, more effective CB

Prudential policy

Measures to ensure financial stability and mitigate systemic risks in the banking and financial system. - eliminate fragile equalibrium

Micro Prudential Policies

Banking Union: transfer of responsibilities, supervision, and regulation of banks to a centralized authority, aiming to enhance financial stability and mitigate systemic risks.

Fiscal Trilemma: fiscal stability, fiscal integration, national fiscal policy

Pillars of Banking Unions

single rulebook

single supervision

single resolutions

unified systems of deposit transfers

Micro Level prudential Policy Spervision

European security Market Authority (risk assesing)

European Banking Authority

european insurance and occupational pensions authority.

European Supervision Authority

Macro prudential Policy

Policies aimed at mitigating systemic risk and ensuring the stability of the financial system as a whole, differing from microprudential approaches that focus on individual institutions.

Based on indicators

Macro prduential Supervision

European Risk Board: gudiance, risk assessing framework for systemic risks, recommendations

neutral in normal times

counter cyclical in not normal times

Monetary vs Financial stability

normal times: Finantial report

Not normal: Inflation report

Instruments: Buffers, limits

Buffers and limits

Buffers: financial reserves used to absorb losses, while limits refer to constraints placed on exposure or risk-taking activities in the financial system to maintain stability.

Limits: constraints on risk exposure, ensuring that institutions do not exceed predetermined thresholds that could jeopardize financial stability.

Fiscal Policy

expansionary: increase gov spending, lowers tax, AD up, GDP growth

contractionary: lowers gov spending, higher taxes, AD down, GDP down

promotes balance of government budgets

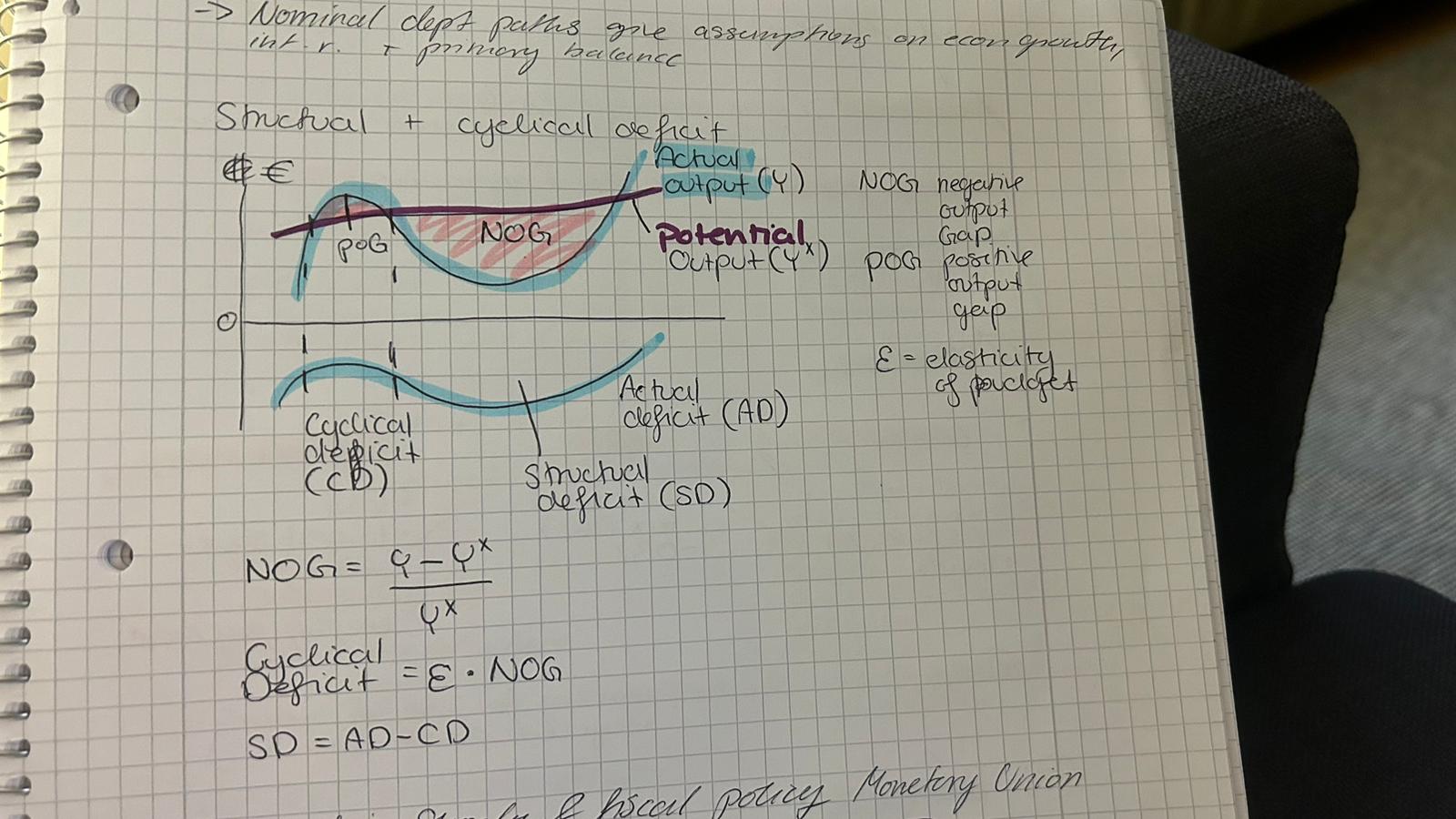

Structual and cyclical defict

Asymmetric shocks in a monetary Union

occurrences that affect member countries differently, requiring varied responses from national policymakers.

solution:

fiscal policy - redistribution among members, shock absorption

tax contributions and benefits adjustments

EU Budget

reserves: Customs duty, value added tax, contribution, Plastic

spending: relatively small, 7-year spending plan (mutual financial market, Next Generation EU)

Taxes EU - Tax harmonization

Pro: fair competition, race to bottom taxes, costly maintance of fiscal frontires

con: loose sovergnty, potential diffirent outcomes, loss of discipline of government

Tax direct vs Indirect

direct: income tax indirect: VTA, customs, consumption tax

destination tax vs origin principle

destination tax is imposed based on where goods or services are consumed, while origin principle taxes are based on where the goods or services are produced.

Regional Policies region def

Subnational: government policies tailored to specific geographic areas within a country, aimed at addressing regional disparities.

supranational: region among countries

region NUTS

Nomenclature of Territorial Units for Statistics, a classification system used by the European Union to collect, develop, and analyze regional statistics.

NUTS 1 - major socio economic policies

NUTS 2 - basic regional policies

NUTS 3 - specific disgonstics

Aggimeration vs Dispersion

The term "agglomeration" refers to the concentration of populations and economic activities in specific geographical areas, leading to increased efficiency and productivity. This phenomenon often occurs in urban areas where businesses and services cluster together.

could be a negative effect of intergration as it can lead to overcrowding, increased competition, and disparity between urban and rural areas.

Disperasion refers to the distribution of populations and economic activities across wider geographical areas, encouraging growth in rural regions and reducing urban congestion. This can be a positive outcome of integration, promoting balanced development.

Modern Growth Theory

More wealthy countries can enjoy prosperity longer. Disparities prevail though knowledge increases.

Priciples of Region Policy:

Consentration of regional objectives

Allocation of funds through multi year programs

cooperation among regional partners

suppport for underdevelpoed regions and promotion of sustainable development.

Structural funds regional policies

European Social Funds (75% below GDP)

Argiculturaö Guidance Funds

European regional development funds

financial instrument fishery guidance

cohesion funds (those 90% below EU average GDP)

EE-KK-Model

Aggomeration and Dispersion in diagram:

two region N and S

2 factors - mobile and immobile

2 sectors

Common Agricultural Policies Problems

Uncertainly, Unavoidability, externalies, social cohesion

Agricultural Intervention why?

income vunrability

long-term declining problem

social cohesion: highly competitive, income disparities

externalities: pollution, enviromental disparities

Cohweb Theorem

Small shocks are amplified due to the producer’s behaviour

Pricaples of CAP

market Unity, community preference, financial solidarity

CAP instruments:

Levys and tariffs

Interventions (intevention price - dumping)

Producer subsidies: pay farmers guaranteed price and direct payments to support income stability.

CAP Direct payments

pro: less contriversial, no market interverenvce, greater exposure to market sygnals

con: leakage, high red tape, dependency

Problems of CAP

down pressure on world P

ham less developed countries

dumping

potential trade conflicts

budget lower than actual cost

dependence

Paradox of CAP

often not felt by farmers, farms dissapearing, more support to the north

CAP trands 2010-2020

development

anti discrimination

cost efficiency

decoupling direct payments from production

Thoeries of trade

apsolute andcomparative advantage

Hecksher Olin Theodrem

new trade theory

Gravity Model

Leontif Paradox

Absolute Advantage

the ability of a country to produce a good more efficiently than another country.

Comperative advantage

the ability of a country to produce a good at a lower opportunity cost than another country, which allows for beneficial trade between nations.

Hecksher Olin Theodrem

a theory in international trade that emphasizes the differences in factor endowments of countries to explain trade patterns. It suggests that countries export goods that utilize their abundant factors of production and import goods that utilize their scarce factors.

Leontif Paradox

the observation that countries with a higher capital-labor ratio tend to export labor-intensive goods, contrary to the Heckscher-Ohlin theory's predictions. (US should export less capital intensive goods - but dont)

New Trade Theory

a theory that explains international trade patterns based on increasing returns to scale and network effects rather than just comparative advantage, suggesting that countries can gain from trade even with similar factor endowments.

Home market effect: market will move where tarnsport cost is low

Gravity Model

a model in international trade that predicts trade flows between two countries based on their economic sizes and distance, suggesting that larger economies have more trade with each other and that greater distances reduce trade volume.

World Trade Set Up

Multilateralism - multiple countries

Regionalism - regional trade

Unilateralism - a single country's trade policies and actions, often leading to preferential treatment in trade agreements.

Pricaples of the WTO

non- discriminatory

Recreational: consessions extendend to all members, trade liberalization, and transparency in trade policies.

Relationship Budget and Account

Twin deficit

account deficit

feedback linkage

no linkage

Keysian Absorbtion theory

An economic theory that explains how a country can absorb its trade deficits through domestic consumption, investment, and savings adjustments.

Trade Integration

EU comission, Kurgman

Oragnisation of Trad ein EU

Commission: main head and decisions

Council: Approves negotiations

Complications - EC only for goods

Prefrence pyramid of EU trade

EEA

The European Economic Area, which extends the EU's internal market to non-EU countries.

Competition and Industrial Market Policy

A policy framework aimed at promoting competition and regulating industries within the EU to enhance market efficiency and consumer welfare.

fosters Innovation, wider choice, healthy competition

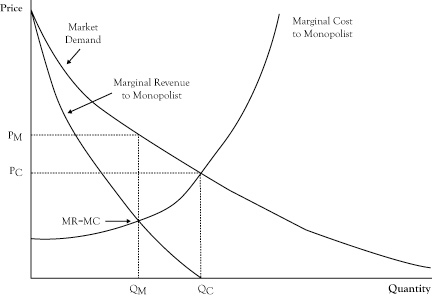

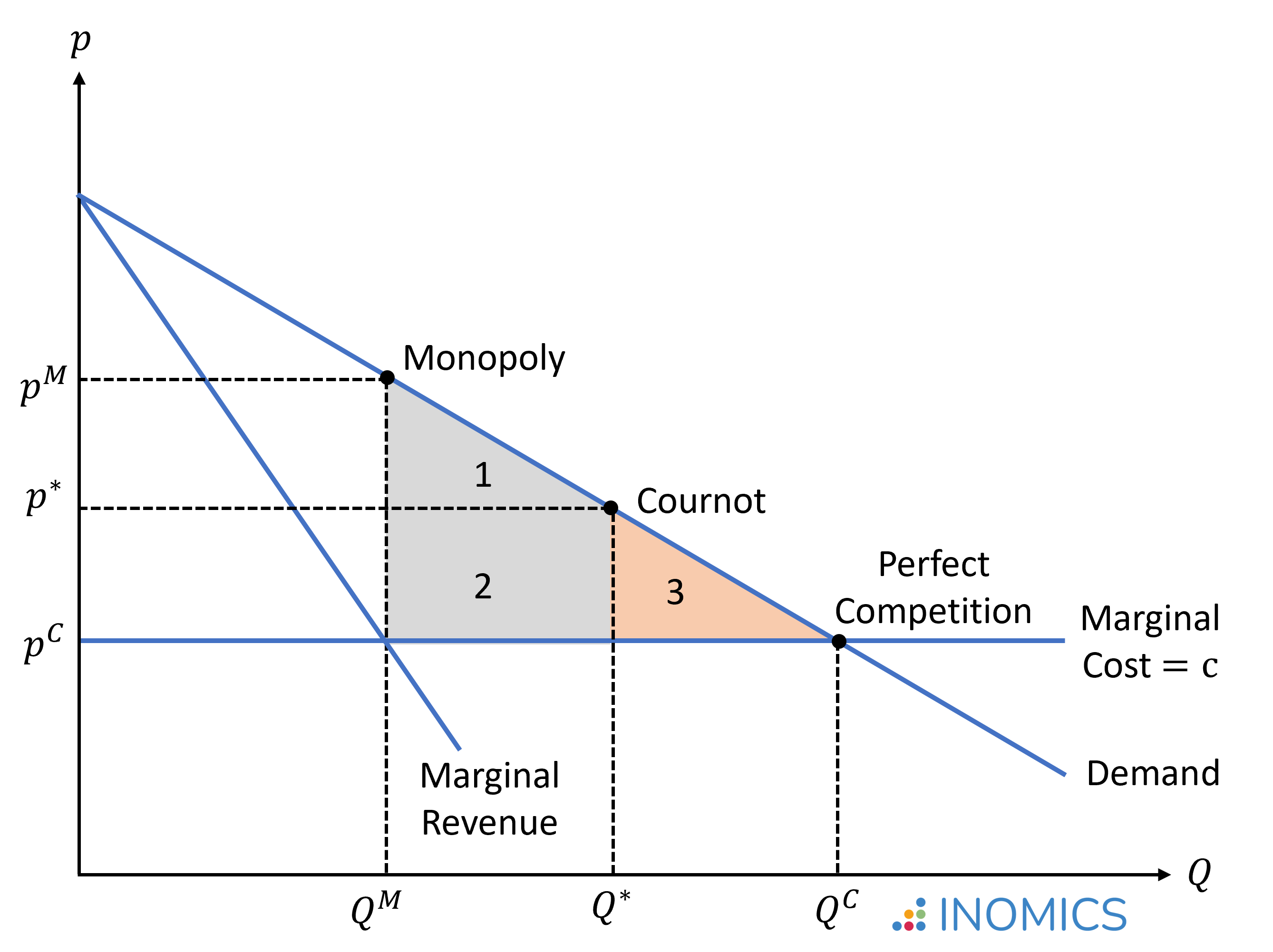

Monopolist Equalibrium

the profit-maximizing output and price for a single-seller market, found where Marginal Revenue (MR) equals Marginal Cost (MC), with the monopolist then setting the highest price the market will bear for that quantity, typically leading to higher prices and lower output than competitive markets, with significant profits possibl

Quantity competition

A market structure where firms compete on the quantity of output produced rather than prices, leading to strategic interactions in deciding production levels. Firms choose output levels to maximize profits while considering competitors' output decisions, typical in oligopolistic markets.

Wh Policy on Competition

proper function of internal market

avoid jurostiction

source discrimination: withstand global competition, national champions

Competition Policy among firms

Component 1

Component 2

Component 3

Component 4

Component 5

anti competitive agreemnt (horizontal and vertical)

Abuse dominant position (large firm advantage, sanctions)

merger control (focus on large companies, tries to avoid too many market shares)

control of state intervenence (no interstate lobbyism)#

liberation market which is usually state-owned (transport, oil, electricity)

Organisation Competition

national Competition Authorities

Court of first instance

european court of justice

National Courts

Alignemnt Euro area Convergence vs alignment

Convergence poorer countries will grow faster than wealthier once

Alignment refers to the economic policies and conditions in the euro area that aim to synchronize member states' economic performance and regulatory practices to ensure stability and coherence.

Real Convergence: even though grow faster still lack behind

PPP

Purchasing Power Parity, a theoretical exchange rate which would allow all goods to be bought by the same price (compare big macs)