4.1.5s (excluding 4.1.5.5/6/7)

1/117

Earn XP

Description and Tags

4.1.5.1-4, 8-11

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

118 Terms

Advantages of competition

Lower prices -> CS increase

Innovation -> greater choice and improved quality for consumers -> increases satisfaction and welfare

Increase firm’s customer base

Disadvantages of competition

Businesses may lose market share -> job loss, reduced income

Some products becoming obsolete / unsupported very quickly, so consumer spending might rise if they need the ‘latest version’ - can cause environmental problems too

Market become ‘flooded’ due to over-production -> stocks build up

Excess choice -> ‘paradox of choice -> slow down consumer decision-making

For all but pure ___, where barriers to entry ___ be overcome, competitive market process gives firms ___ to innovate to gain a ___ advantage, improve the ___ of the service provided or introduce new products. Even in ___, there is incentive for firms to undertake ___ to innovate and ___ barriers to entry

monopoly, cannot, incentive, cost, quality, monopoly, R&D, overcome

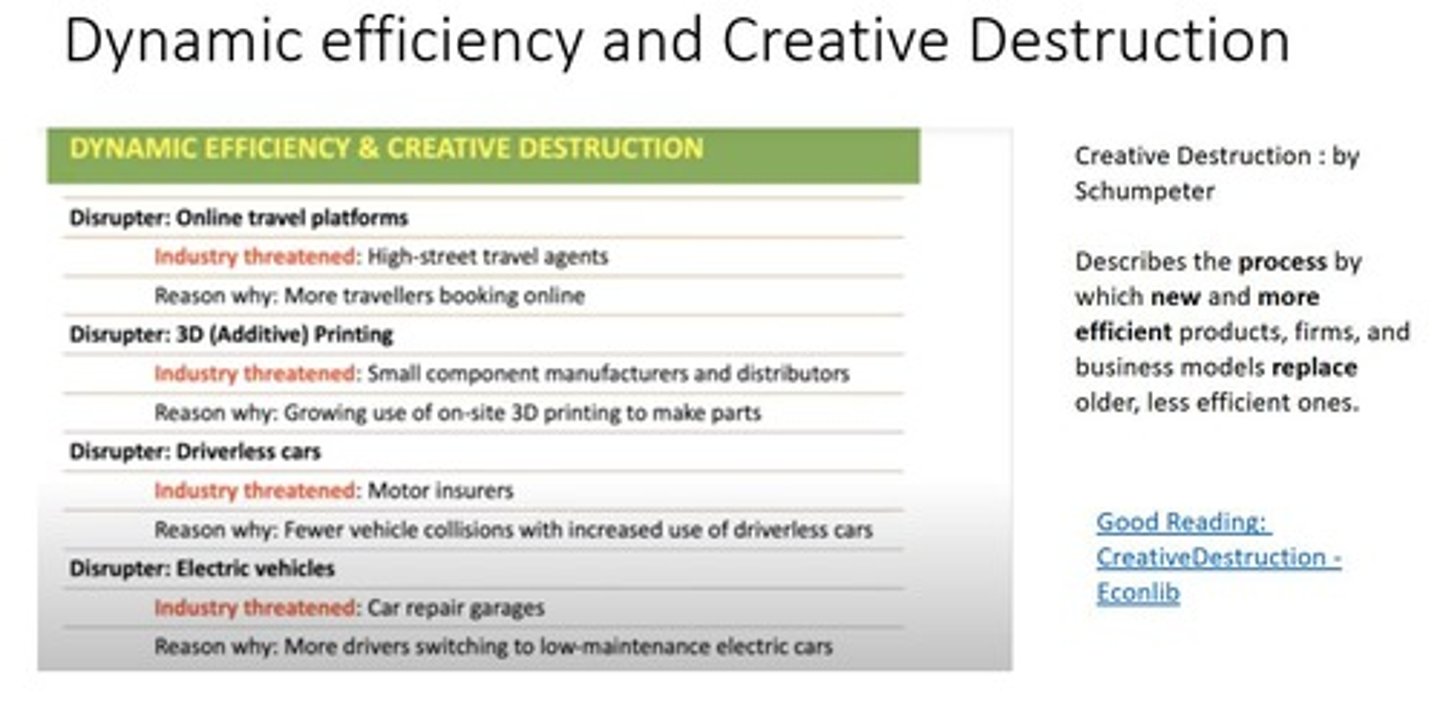

Joseph Schumpeter coined the term…

Creative destruction

What does creative destruction refer to?

the upheaval of the established order in the pursuit of innovation

Product innovation definition

small-scale and frequent subtle changes to the characteristics and performance of a good or a service. E.g. I-phone, augmented reality

Process innovation definition

refer to changes to the way in which production takes place or is organised, or changes in business models and pricing strategies. E.g. sharing economy Uber, air B&B

two side effects in individual markets and the economy as a whole with creative destruction

demand and supply

Dynamic efficiency and creative destruction

Creative destruction should lead to improvements in dynamic efficiency

Focuses on changes in choice in market together with quality/performance of products

Identify close link between dynamic efficiency and pace of innovation in market

Can cause firm’s cost curve shift downwards, and / or demand (revenue) curves shift right

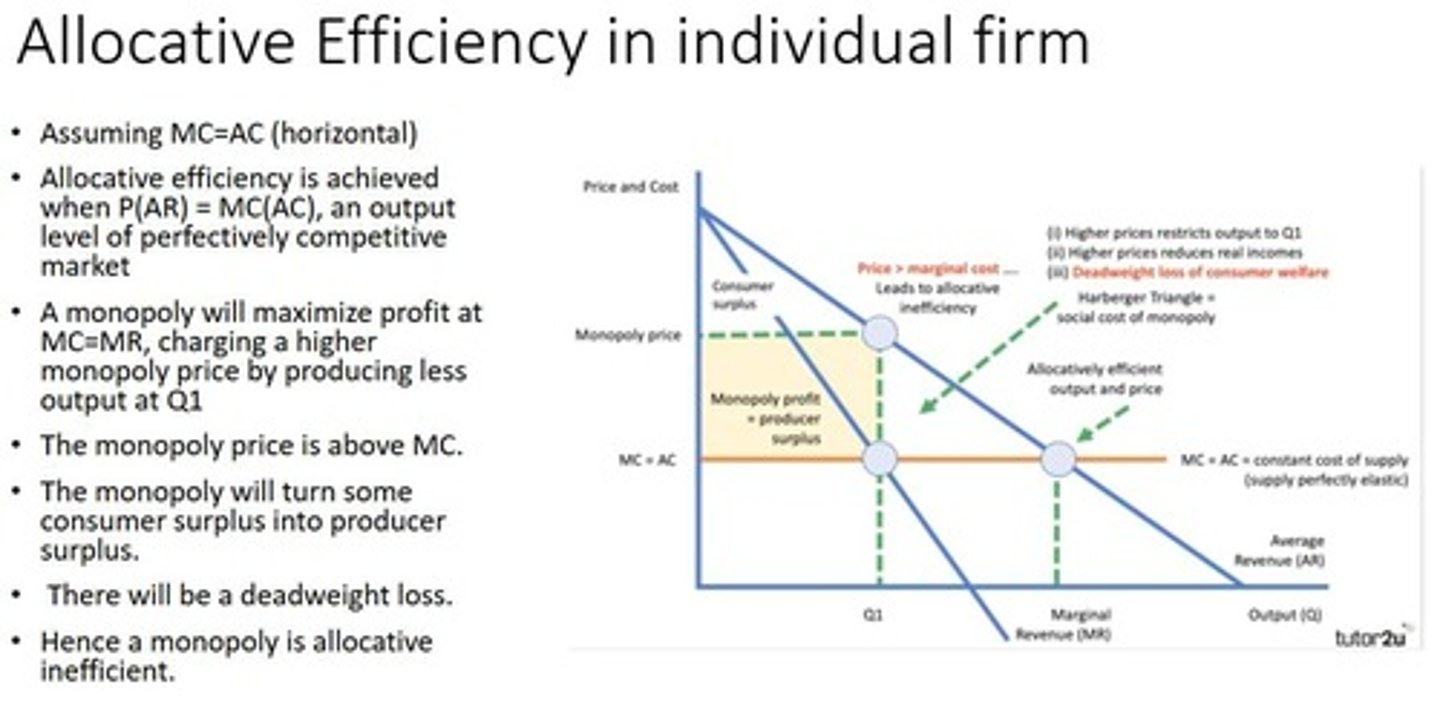

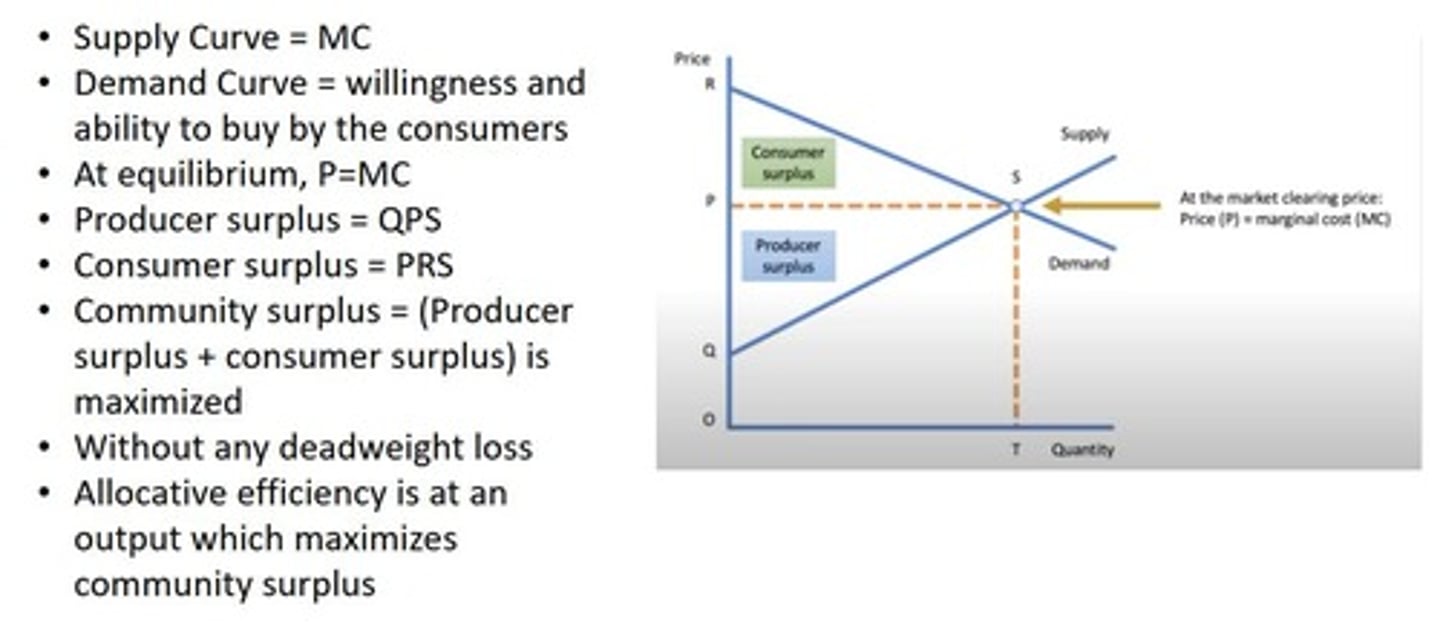

Allocative efficiency

Resources match consumer preferences (P = MC or AR=AC, P = MSC if there is externalities).

Productive efficiency

Operating at lowest average cost (AC = MC).

Dynamic efficiency

Sustained efficiency through innovation over time.

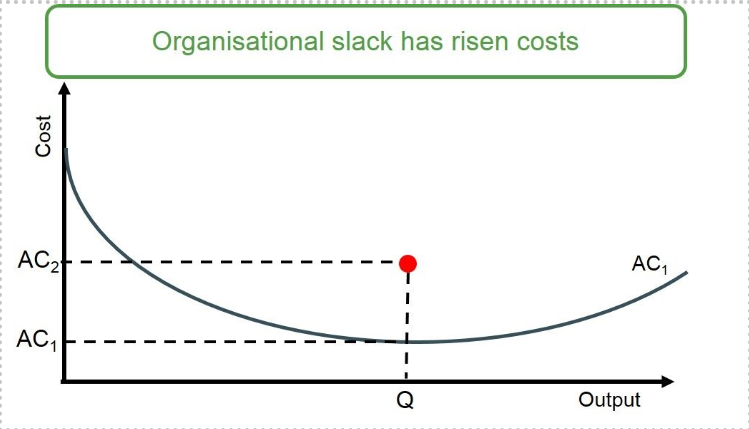

X-inefficiency

Higher average costs due to lack of competition.

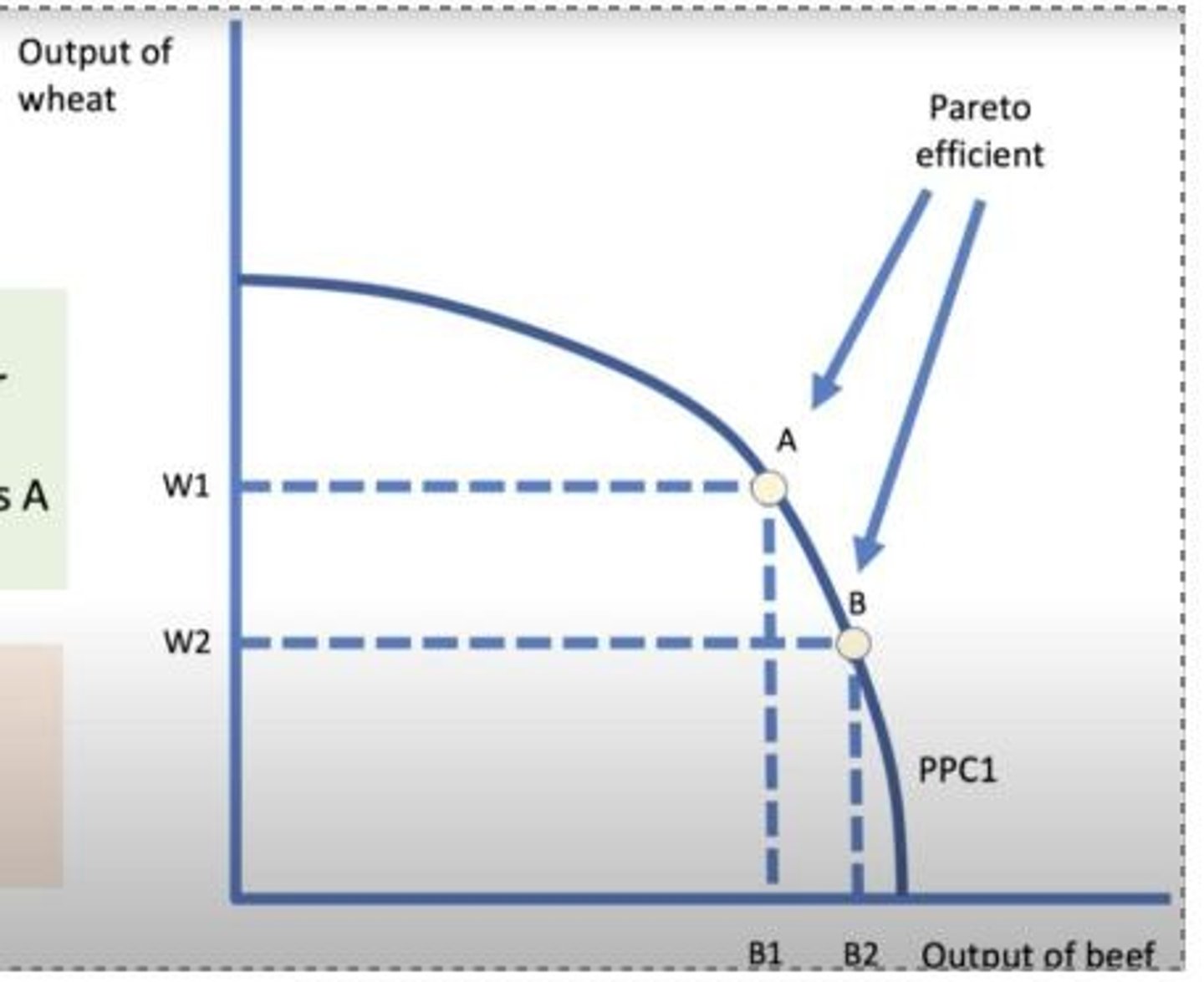

Pareto efficiency

Resource allocation where one's gain harms another, all points on a PPF. If you want to produce more beef to satisfy beef eater, you must sacrifice some wheat. The wheat eater will be worse off i.e. OC is involved

True or false: a pareto improvement will always lead to equitable outcome of resource allocation

False because pareto improvement does not say anything about the distribution of resources amongst different groups in the society.

Pareto improvement

Change that benefits one without harming others.

Demand and supply analysis

Framework for understanding market equilibrium.

5 types of market structure (PMMDC)

Perfect competition, monopolistic competition, monopoly & natural monopoly, duopoly / oligopoly, contestable markets

7 key features of market structure (NNESNAP)

No. firms in market, nature of product, entry barrier, strength of pricing power, nature of profit earned, allocative efficiency, productive efficiency

5 perfect competiton characteristics (VFEIN)

Very large no. sellers, Full of price takers, Easy entry / exit, Identical product, No market power held

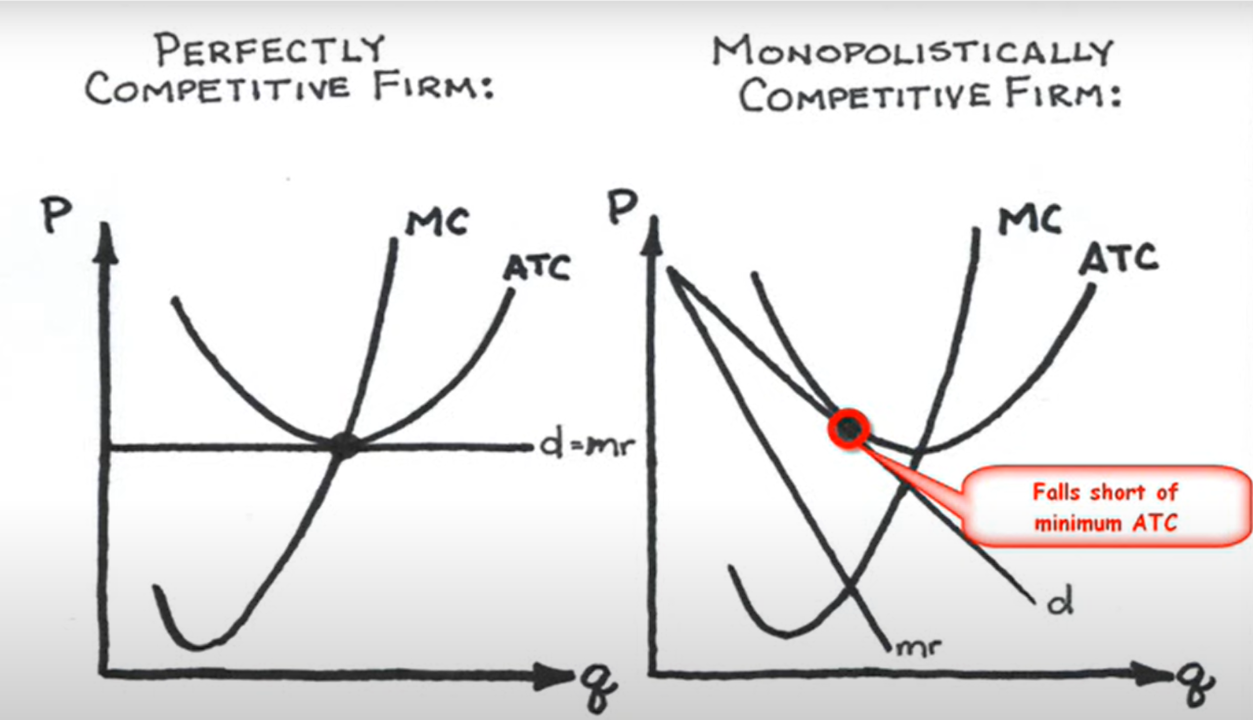

4 Monopolistic competition characteristics (SLEND)

Small amount of market power held, Large no. sellers, easy entry / exit, not price taker, Differentiated product

Two graphs: perfectly competitive vs monopolistically competitive firms

4 Oligopoly / duopoly characteristics (SLID)

Small no. sellers, Large amount of market power held, Identical / differentiated product, Difficult entry

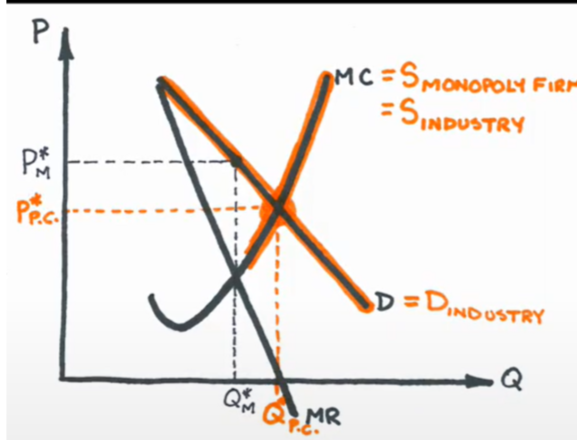

5 Monopoly characteristics (HOUCI)

Hard to find, One single seller, Unique product, Complete market power, Impossible entry

Monopoly graph

Economic efficiency includes:

Allocative efficiency, productive efficiency, X-efficiency, dynamic efficiency

Allocative efficiency (Static efficiency)

Resources follow consumer demand, society surplus and net social benefit are maximised

Allocative efficiency equations

D = S, MSB = MSC, P = MC, → bc D = AR = P and S = MC

Productive efficiency (Static efficiency)

Firm operating at lowest point on AC curve, full exploitation of E of S

At productive efficiency MC =

AC

X - efficiency (Static efficiency)

minimising waste, production on the AC curve

Example of X-Efficiency

Monopolies, public sector firms -no drive to decrease price to make more profit bc of impacts that it will have on producer and workers (e.g. fewer work perks)

Dynamic efficiency

Re-investment of LR supernormal profit, economic efficiency over a long period of time

Reasons for achieving dynamic efficiency

Make supernormal profit → partly invested into research and technology → decrease AC in the long term

Static efficiency occurs at ___ ___ ___ ___

one single production point

Examples of static efficiency

allocative-efficiency, productive-efficiency, X-efficiency

Dynamic efficiency ___ ___ ___

occurs over time

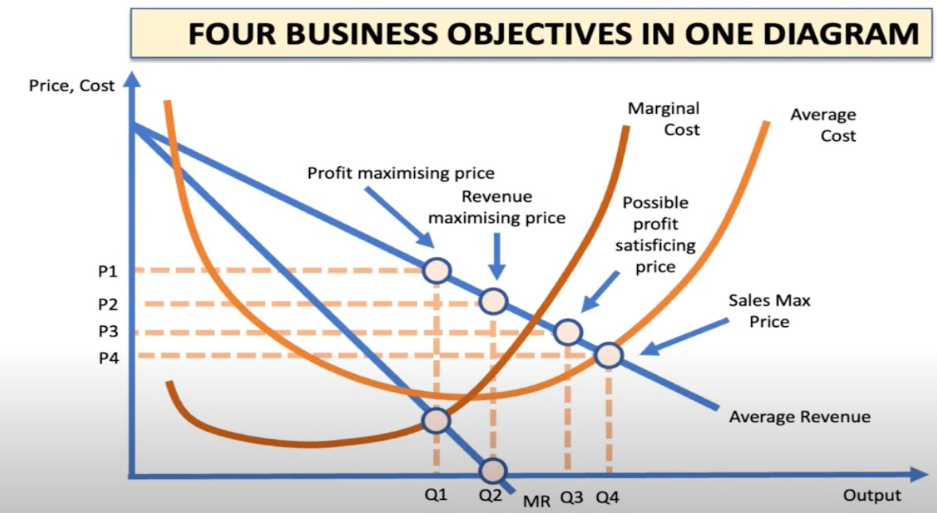

Business objectives

Profit maximisation, Revenue maximisation, sales (volume) maximisation, satisficing behaviour

Pricing strategies (closely linked to objectives) SILI

Scope for collusive behaviour between sellers, Interdependent decision-making, Limit and predatory pricing, Importance of threat of entry in a contestable market

Market performance (TSP)

Trends in real prices for consumers over time, Scale & persistence of profits - including supernormal profit, productivity growth and other performance metrics

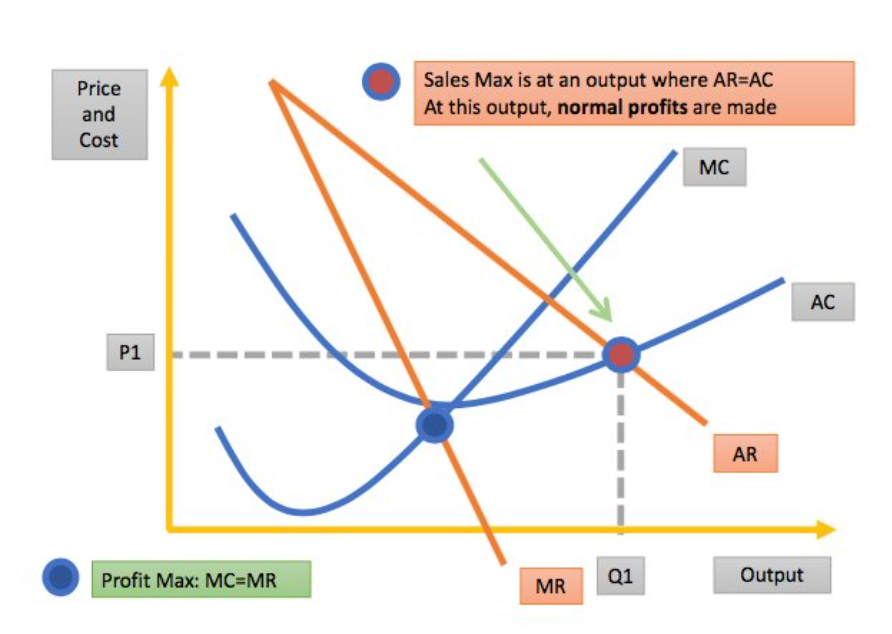

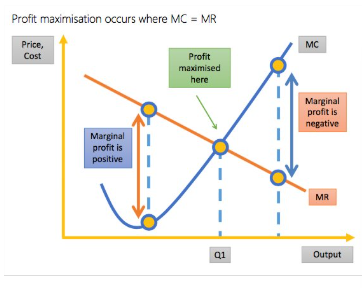

Profit maximisation

Q level where MC = MR

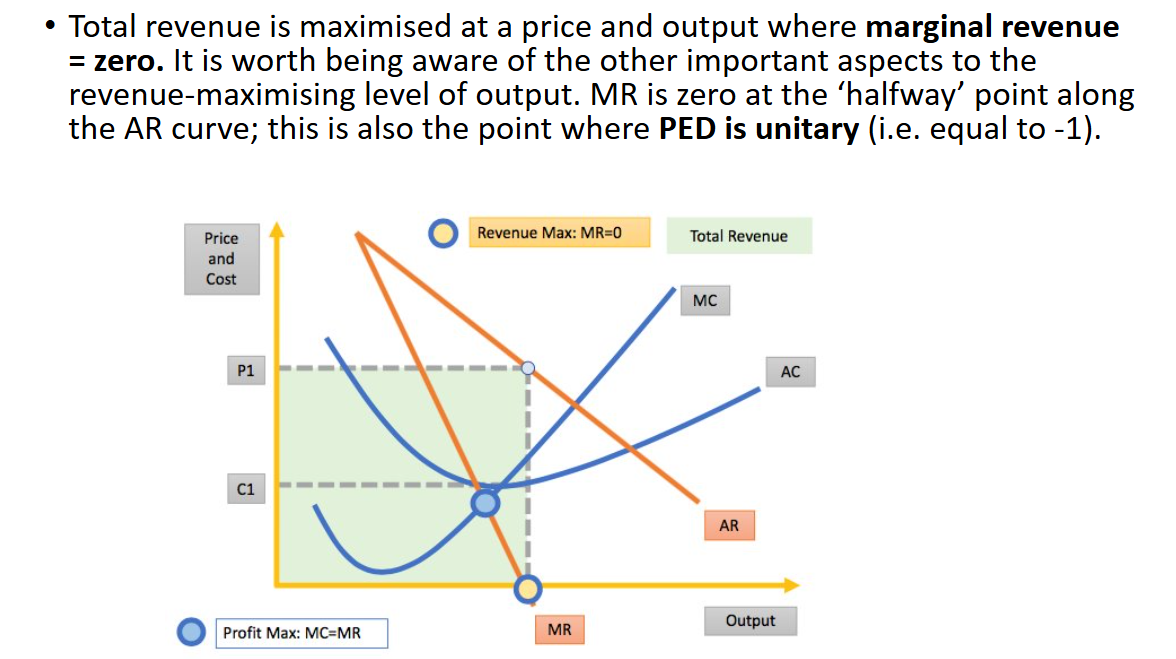

Revenue maximisation

Q where MR = 0

Sales (volume) maximisation

Consistent with earning at least normal profits where AR = AC, economic profit = 0, objective to maximise market share

Sales maximisation graph

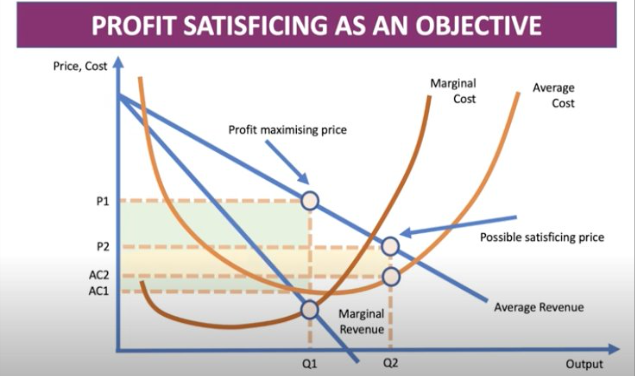

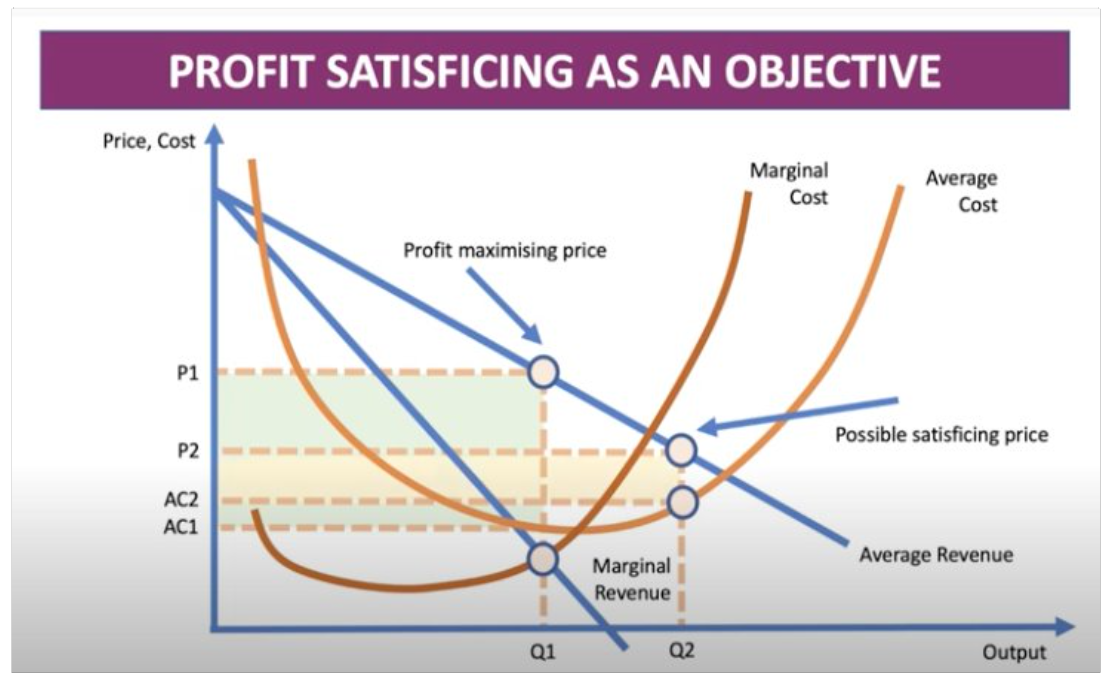

Satisficing behaviour

Owners (shareholders) setting minimum acceptable levels of achievement of either revenue or operating profits to satisfy different stakeholders

What is satisficing?

best from all available alternatives, ‘keeping a range of stakeholders happy’, simple rules of thumb, ‘“cost plus approaches” e.g. charge unit cost of supply + 10%

There is ___ unique satisficing output. It can occur at any output between ___ maximisation at Q___ and ___ maximisation.

no, profit, 1

4 business objectives in one diagram

Reasons for different objectives (MISS)

Managerial objectives / utility, Information constraints / gaps, Small businesses, State-owned corporations

Profit maximisation diagram + explanation

If MR > MC - firm could increase profit by raising Q, if MR < MC, marginal profit is negative better to decrease Q

Supply and marketing cooperative in China

Planned economy, job security, return of gov-run cooperatives and cafes, state-run businesses are returning and selling items from the 1970s.

Benefits from aiming to maximise profits (SHERRI)

Safety net, Higher dividends, Employees may gain, R and D, reduce need to borrow, increase scale of operation and reduce AC in LR

Drawbacks from aiming to maximise profits (HILP)

Higher prices which reduces real incomes and lower level of consumer surplus in SR, Incentive to enter market in LR reduce returns to shareholders as increased competition, Lose sight of social / ethical and environmental aspect, Pushing costs lower impacts quality

Revenue Maximisation (MSDR) objective and William Baumol research

sales + rewards for managers were closely linked to revenue rather than profits (principal & agent problem), aim to max revenue → deter entry, maintain market power, can lead to reduction in P of firm’s shares - operating profit likely to be lowe

Total revenue maximisation graph

Shareholders / Owners interests

Return on investment, success and growth, proper running

Managers & Employees interests

Rewards, job security, promotion, job satisfaction & status

Principal Agent Problem

Owners of firm often cannot observe directly the day-to-day decisions of management. Decisions and performance of the agent are costly and difficult to monitor.

3 Overcoming Principal Agent Problem (ELL)

Employee share ownership schemes, Long term employment contracts for senior management, Long term stock commitment

Satisficing

Maximisers behave in a traditional economic way and always try to make the best possible choice from all available alternatives

Satisficing behaviour by firms

Examine a limited set of alternatives

Generally concerned with ‘keeping a range of stakeholders happy’

Simple rules of thumb like “cost plus approaches” (e.g. charge unit cost of supply + 10%)

No unique profit satisficing output

Can occur at any output between profit max at Q1 and sales max

Profit satisficing on graph

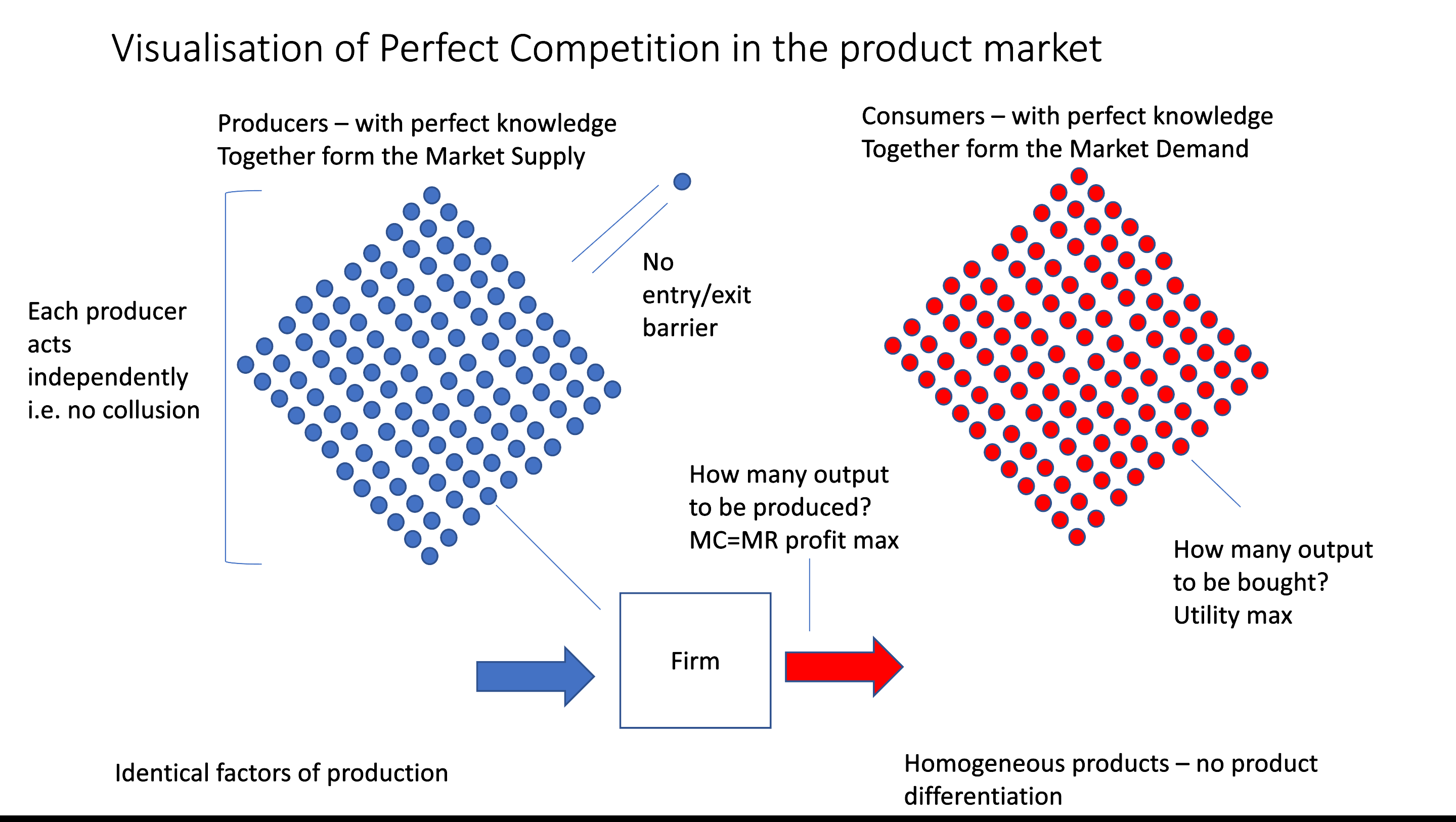

Perfect competition is an extreme ___ example which assumes an ___ number of buyers and sellers (assumes no ___-___ competition)

theoretical, unlimited, non, price

Close examples of perfect competition

Many small bakeries in a large city, small-scale wheat growers, fruit seller in a big street market

Assumptions of a perfectly competitive market

Homogenous products

Access same quality FOPs

Large no. buyers and sellers, sellers act independently, no price collusion

costless entry and exit

Perfect knowledge

Profit max key objective - consumers assumed to be utility maximisers

Evaluating assumptions of the perfect competition model

Most firms have some amount of price-setting power – price makers

Dominance of differentiated / branded products

Highly complex products -> information gaps

Impossible to avoid search costs

Patents, control of intellectual property, control of key inputs are all ignored by the

Rare for entry and exit in industry to be costless

Model assumes no externalities; in reality, there are often 3rd party effects of every market

Visualisation of perfect competition in product market

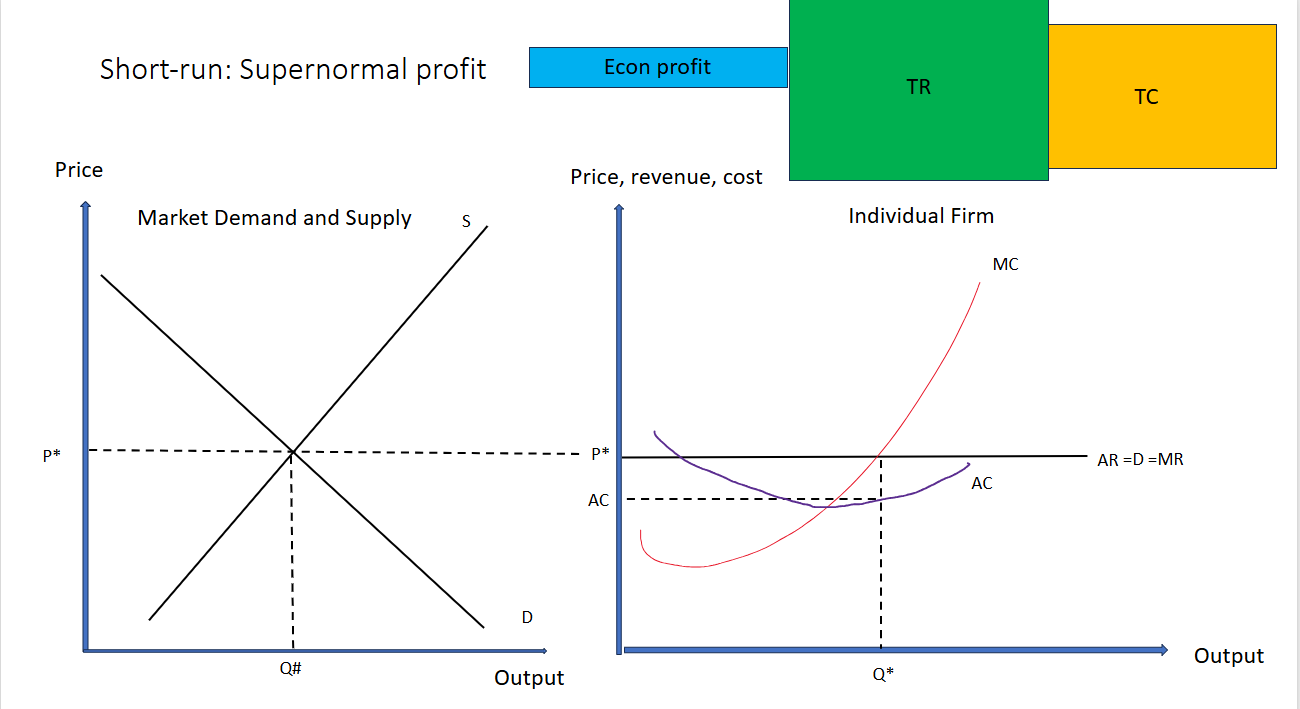

Short-run supernormal profit

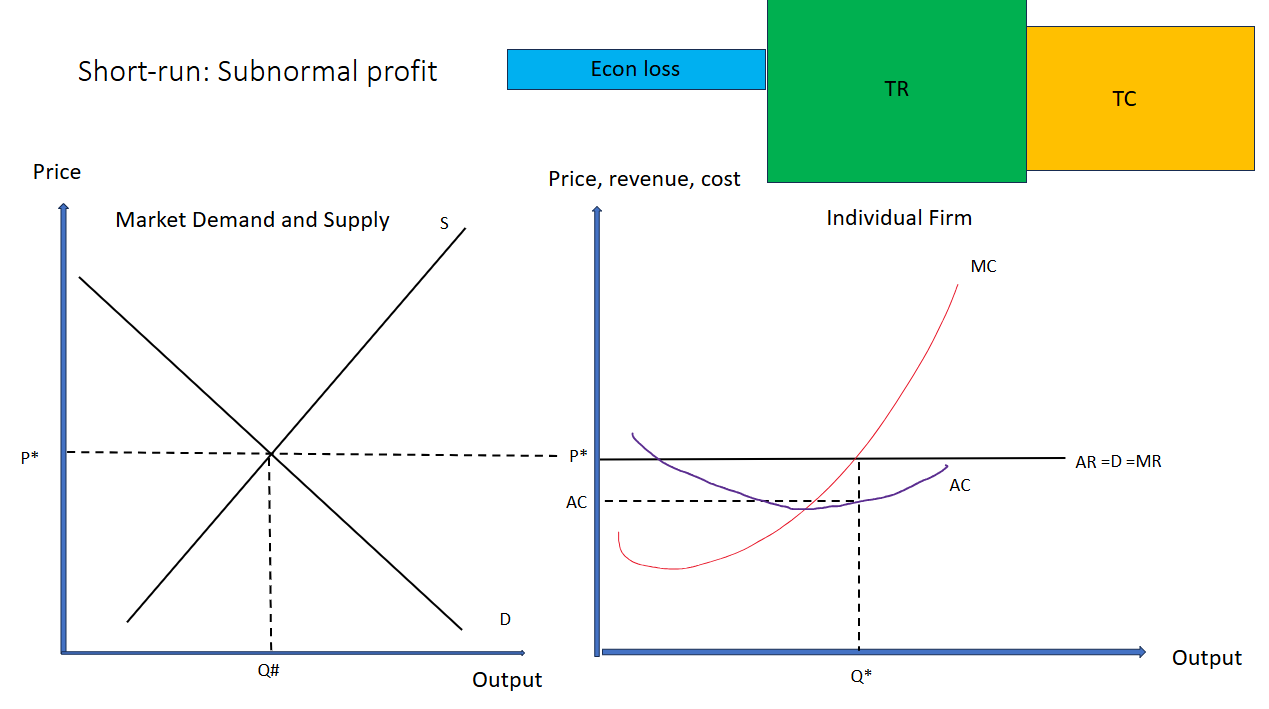

Short run subnormal profit

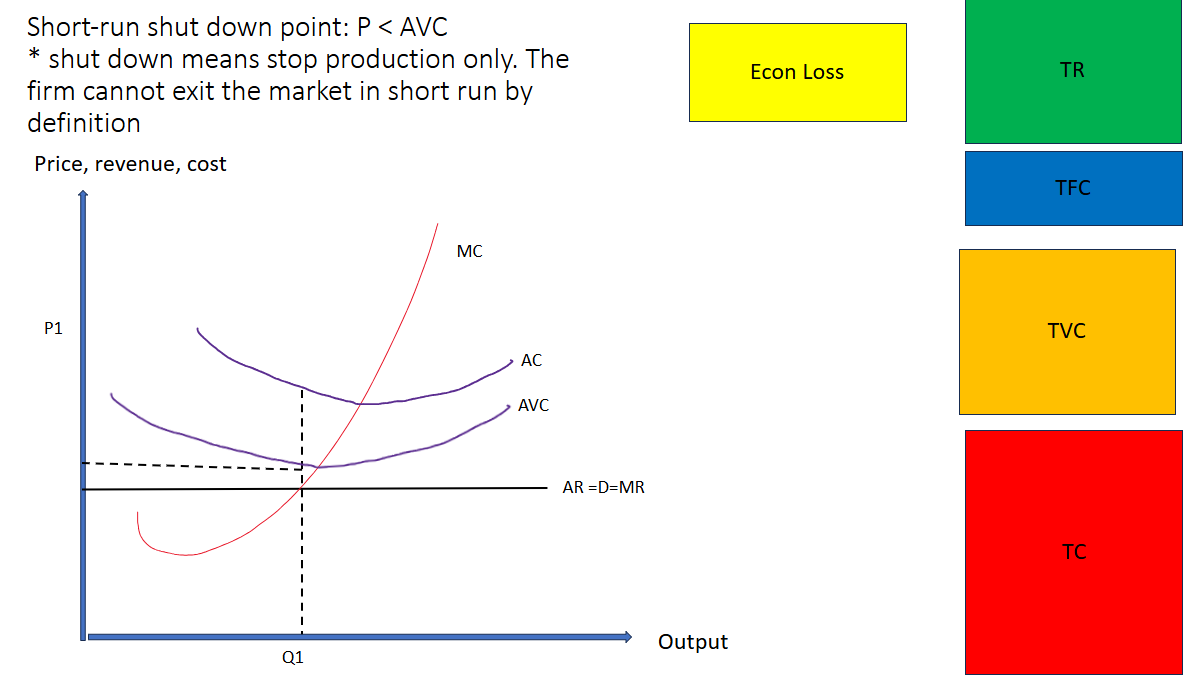

short-run shut down point

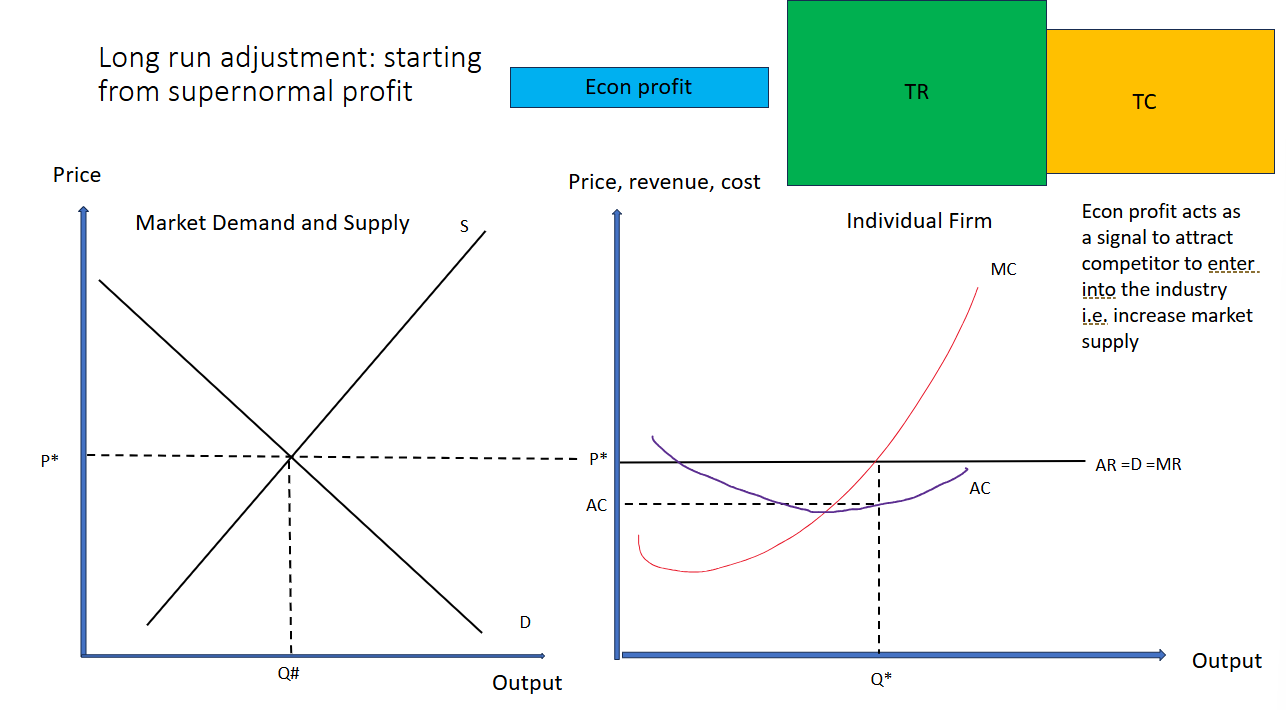

Long run adjustment: starting from supernormal profit

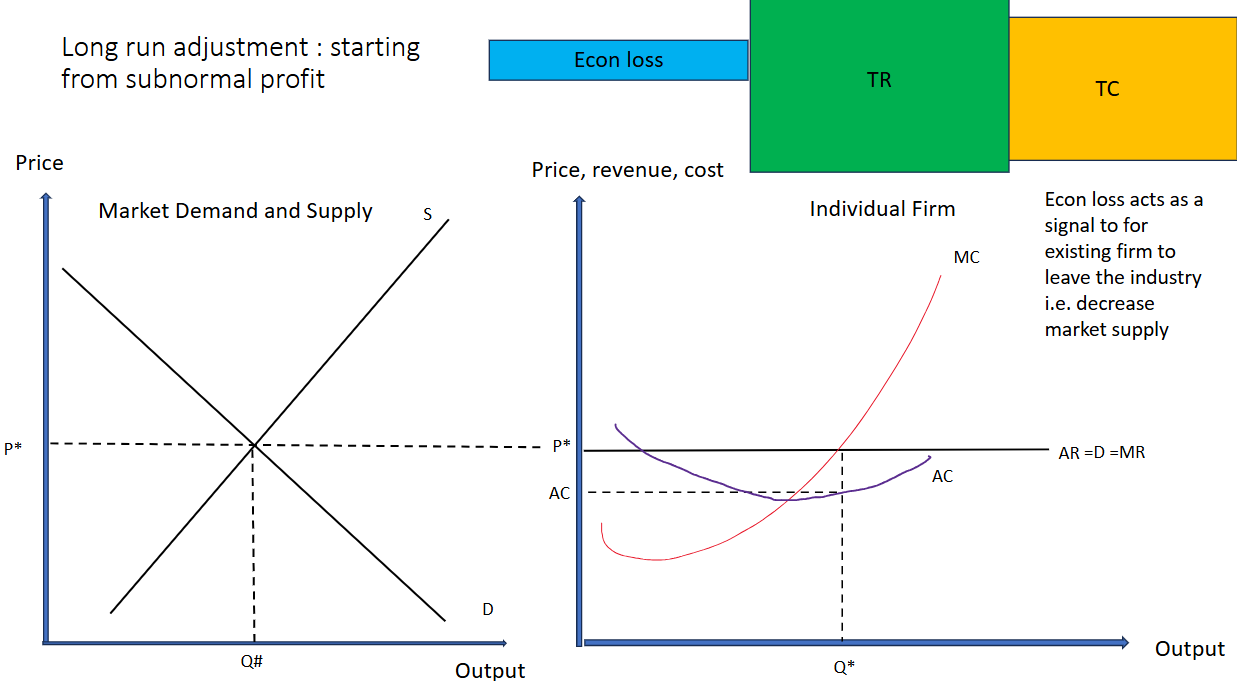

Long run adjustment: starting from subnormal profit

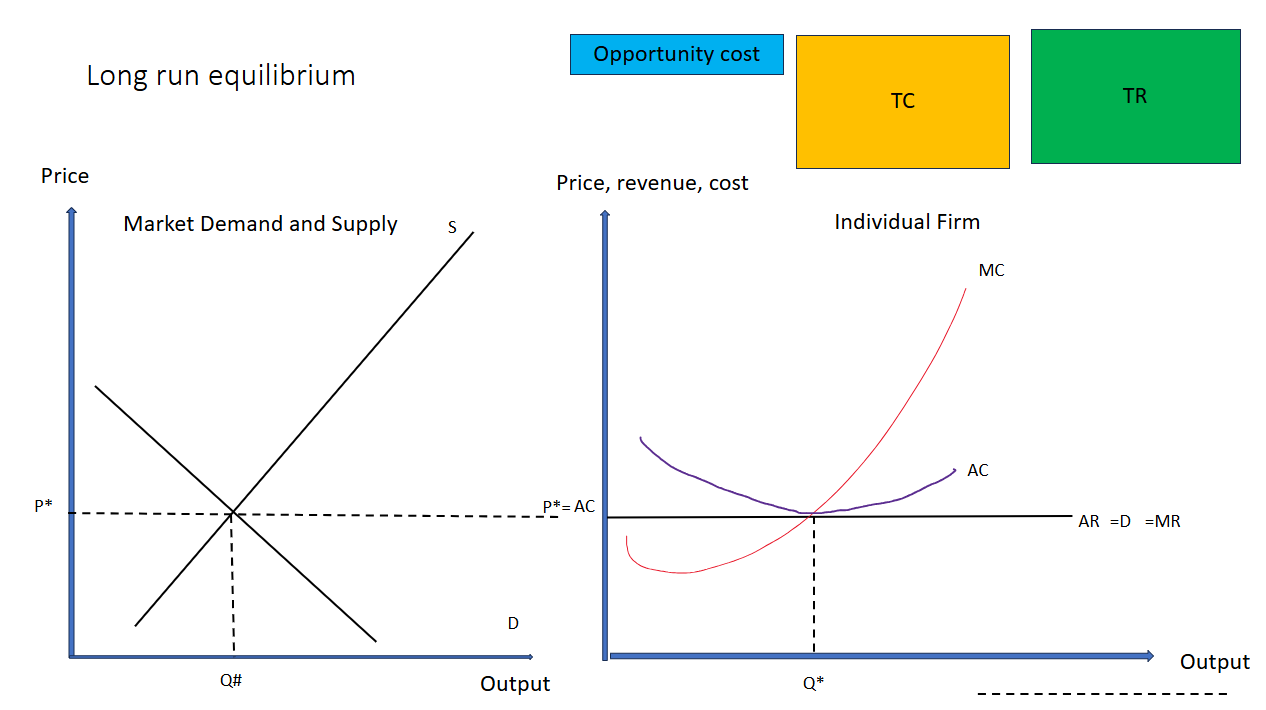

Long run equilibrium

Examples of monopolistic competition

shoe repairs and key makers, taxi and minibus companies, dry-cleaners and launderettes

Monopolistic competition

A form of imperfect competition and can be found in many real-world markets ranging from sandwich bars and coffee stores in a busy town center to pizza delivery businesses in a city or hairdressers in a local area.

Monopolistic competition examples

Shoe repairs and key makers

Taxi and minibus companies

Dry-cleaners and launderettes

Key assumptions about monopolistic competition (IGVMS)

industry concentration low, good info, very low barriers, max profit, slight differentiation

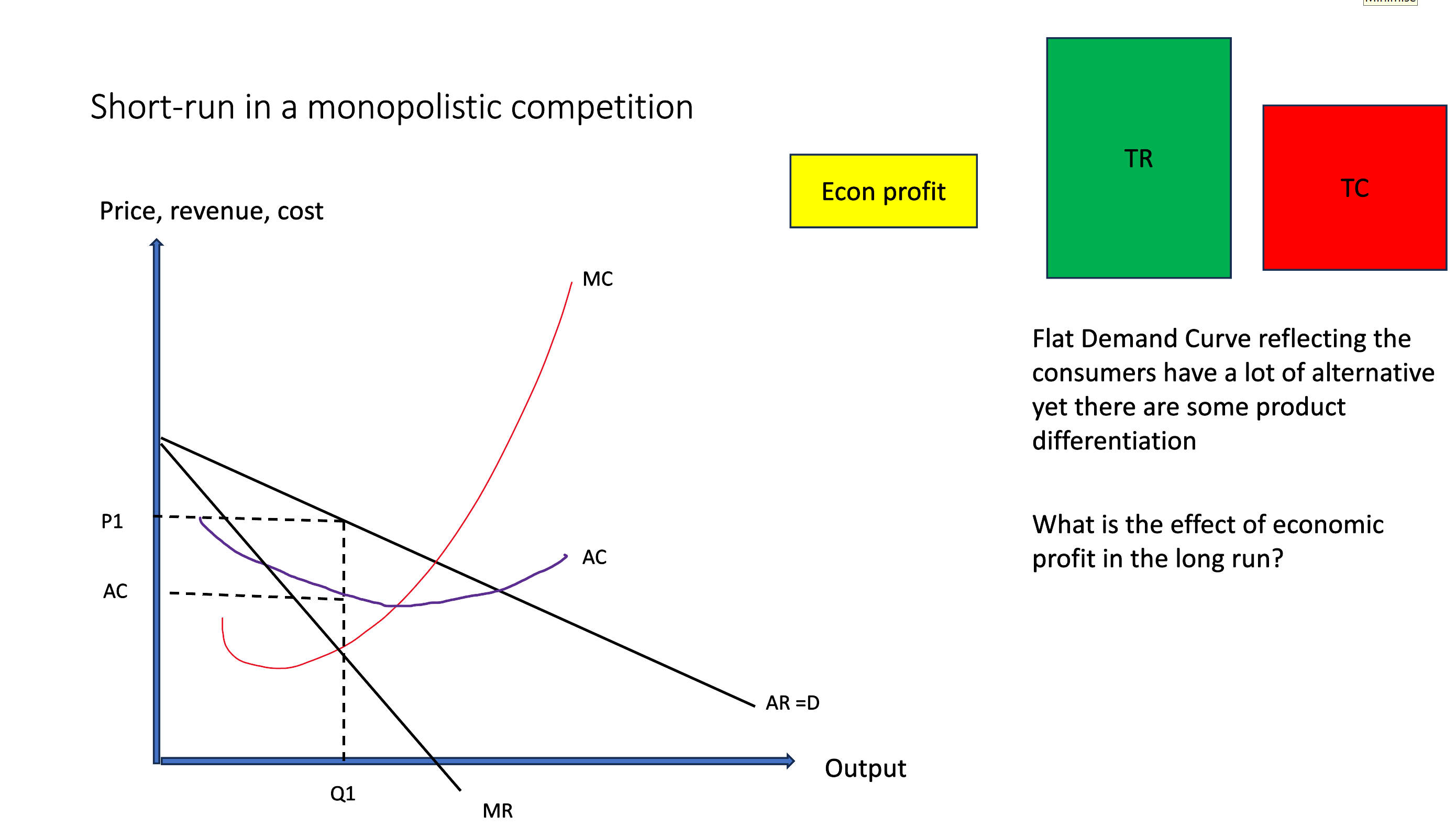

Short-run in a monopolistic competition graph

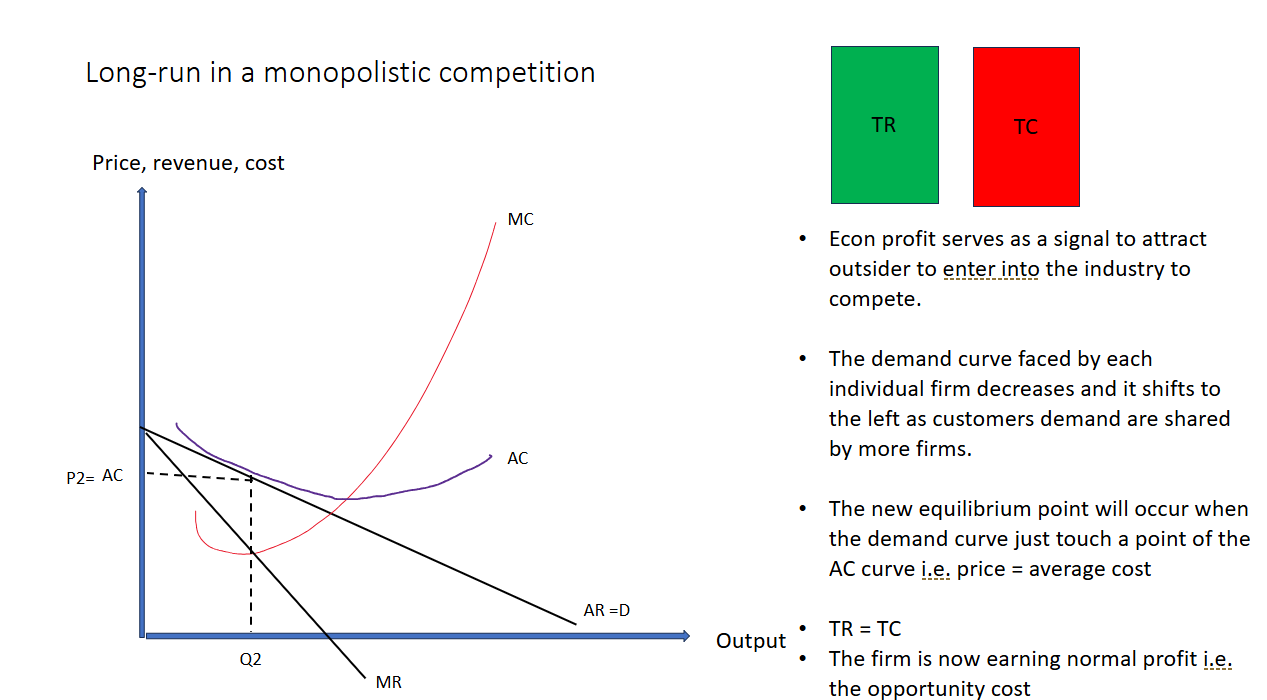

Monopolistic competition - increase in no. sellers bc ___ of __ ___ → more competition → demand shifts ___/___→ bc demand for individual firms ___ as there are more firms to buy from

incentive, supernormal profit, left, decreases, decreases

Monopolistic competition. Zero econ profit → dc shifts left until it touches one point on the ___ curve. Decreases ___ for new firms to join market, ___ profit, TR = ___

AC, incentive, normal, TC

Long-run in a monopolistic competition graph

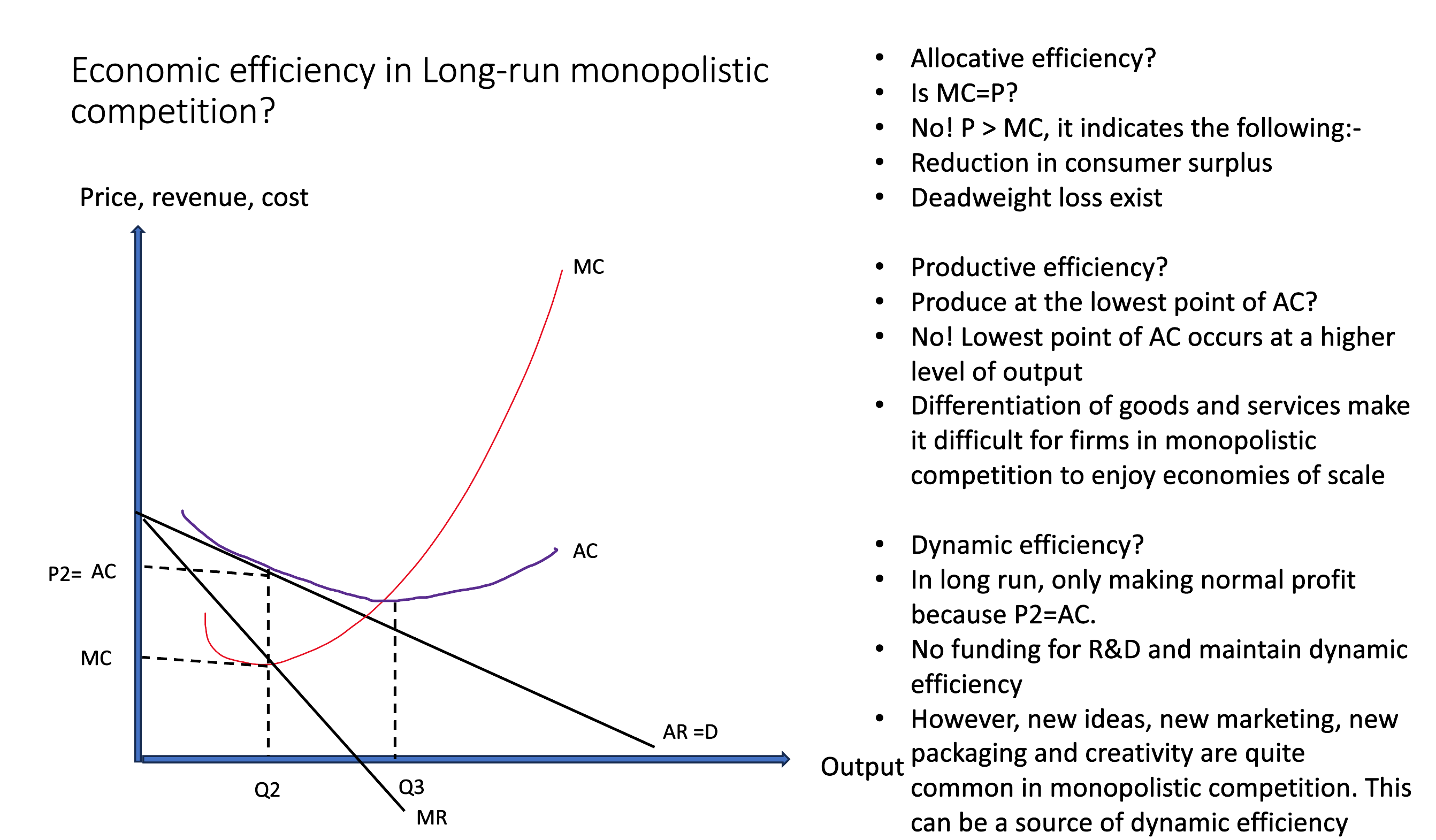

Econ efficiency in long-run monopolistic competition, graph and requirements

Dc is a tangent and touches one point of AC, MC curve through min point of AC

Monopolistic competition - real world cases

Price of ordinary coffee vs price of caramel coffee => P > MC

AC of a small grocery much higher than larger chain supermarket, closing business

Salon firms rarely make important innovation, lack of dynamic efficiency

Monopolistic competition - allocative efficiency explanation

D = P and S = MC

Allocative efficiency when P = MC

Resources allocated in best way to satisfy consumer wants

No DWL

Socially optimal allocation of resources

Producer surplus definition

Area below the price and above the MC/supply curve

Monopolistic competition non-price competition

Due to product diff → decrease PED → more expensive packaging → increase P and MC → P>MC→ no allocative efficiency

OR excessive packaging -> disposal waste -> recycle, landfill, incinerator, foreign countries -> cost to 3rd party (outside the initial transaction), externality -> market failure

Externality

How excessive packaging in monopolistic competition affects allocative efficiency

Higher costs due to packaging -> increases MC, overuse of resources, diverting them from more productive uses

Perceived differentiation – excessive packaging is a part of non-price competition, inflates willingness to pay

Environmental externalities - waste

Non-price competition examples

Product differentiation,Eco-friendliness and Corporate Social Responsibility (CSR), customer service, loyalty programs

Collusion between business can be:

Horizontal – between firms at the same stage of production e.g. Price-fixing between airlines offering similar flight routes

Vertical – between businesses at different stages of production e.g. A car manufacturer signing an exclusive supply agreement with a parts supplier.

Explicit - verbal or written agreement e.g. OPEC (a cartel) setting oil production quotas, can also be seen as vertical collusion in primary production

Tactic collusion – occurs when firms in an oligopoly implicitly coordinate their actions – such as pricing or output levels- without explicit agreements (behaviour looks like they have an agreement), leading to anti-competitive outcomes. Detecting and penalizing tacit collusion is challenging due to the absence of direct communication evidence.

Collusion definition

usually refers to businesses working together to agree to jointly set prices high and/or restrict output and/or share market, form of anti-competitive behaviour, firms behave together like a single monopoly firm

Contestable Market

Market with low entry and exit barriers. Threat of competition. Threat of potential competition.

Characteristics of contestable markets

No significant entry/exit costs, low barriers to entry, acces to tech, weak brand loyalty, pool of new businesss, hit and run competition

Factors affecting barriers to entry

E of S, vertical integration, brand (consumer) loyalty, control of key tech, expertise, goodwill and reputation

Threat of Competition in a contestable market

Potential competition constrains incumbent pricing.

Sunk Cost

Non-recoverable costs if exiting a business.

Weak Brand Loyalty

Consumers prioritize price over brand preference.

Hit and Run Competition

Temporary market entry during high demand events.

Vertical Integration

Control over supply chain enhances market power.

UK Airline Industry Yes – is a contestable market

High fixed costs, vertical integration, strong brand loyalty

UK Airline Industry No – it is not a contestable market

weak brand loyalty when there are cheaper prices, new firms entering the market in recent years which buy or rent planes cheaply → cheaper tickets