EVERYTHING FAR 🧠

1/151

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

152 Terms

Operating, investing, or financing?

Purchasing stock

Investing

Operating, investing, or financing?

Borrowing funds

Financing

Operating, investing, or financing?

Paying interest on debt

Operating

Operating, investing, or financing?

Paying taxes

Operating

Operating, investing, or financing?

Anything with trading securities

Operating

Operating, investing, or financing?

Purchasing investments like bonds

Investing

Operating, investing, or financing?

Paying principal on debt

Financing

Operating, investing, or financing?

Issuing stock/bonds

Financing

Operating, investing, or financing?

Repurchasing stock

Financing

Operating, investing, or financing?

Paying dividends

Financing

Operating, investing, or financing?

Paying debt and extinguishment costs

financing

Operating, investing, or financing?

Collecting interest or dividends on investments

Operating

Operating, investing, or financing?

Goodwill impairment

Operating

Required financial statements for non profits

Stmt of financial position (B/S), stmt of activities, and stmt of cash flows

Primary purpose of non profit’s stmt of activities

To demonstrate how the organization's resources are used in providing various programs and services.

and to provide relevant info to its resource providers

Primary purpose of non profit’s stmt of financial position

To provide info about the assets, liabilities, and net assets, and about their relationship to one another at a moment in time

Categories/items in the stmt of financial position

Assets, liabilities, and net assets (and in that specific order too)

Like a BS

Primary objective of financial reporting for the government

Accountability

What is an endowment fund?

a fund of assets to provide income for the maintenance of the non profit (like a 20 year investment that designates that the interest income be used for a certain purpose, and then the fund itself has a purpose when it expires)

What are the restriction types? (like for an asset with donor restrictions)

Specified purpose and time

Trading securities

What they are: Debt securities bought and held to sell in the near term

How they are reported on BS: FV, current assets

What cash flow: Operating or investing

Interest/gain/loss would be on the income stmt (gains/losses in net income)

When selling, income=sale price - CV

CECL loss if CV>FV

Loss = CV - PV of expected cash flow

Available for sale debt securities (AFS)

What they are: Those not meeting the definition of trading or HTM

How they are reported on BS: FV, current OR non-current assets

What cash flow: Investing

Interest and any realized gain/loss would be on the income stmt

Income if selling it= Sale price - CV

Unrealized gains/losses would be in OCI

Unreal gain/loss= FV - Cost (purch price)

With CECL, if CV>FV, the asset must be written down to FV by recording a credit loss on the inc stmt.

Held to maturity debt securities (HTM)

What they are: corp has intent and ability to hold them to maturity

How they are reported on BS: most likely non-current, amortized cost

What cash flow: Investing

Interest would be on the income stmt (no gains or losses)

Credit loss if CV>PV (HTM only)

Credit loss = CV - PV

What are the different names for the Stated Rate? (for bond amort)

stated rate, incremental borrowing rate

What are the different names for the market rate? (for bond amort)

Effective, market, implicit, “to yield x%”

Always use this rate for PV factors

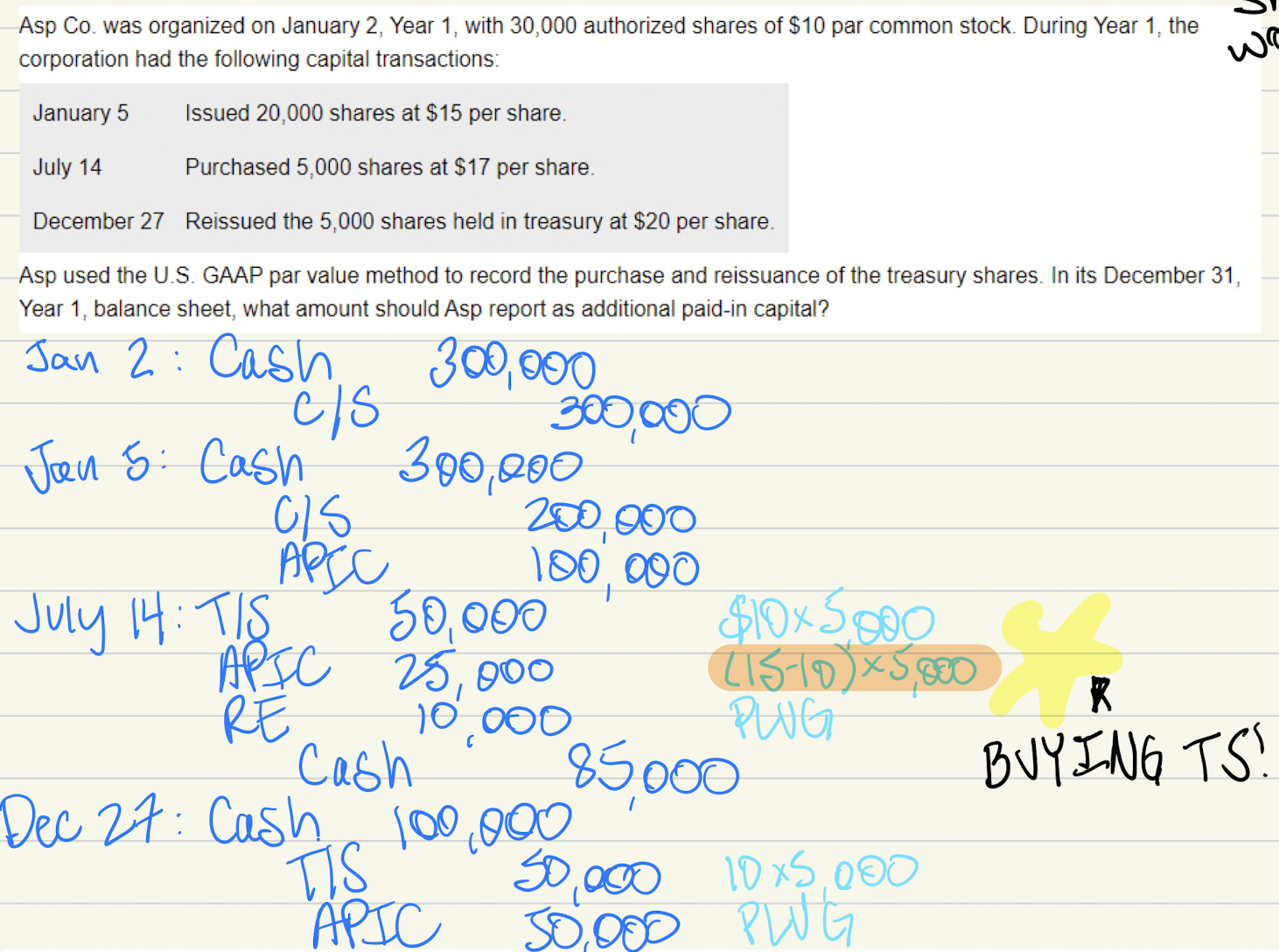

Cost method

When you purchase TS, it’s the simple entry

When you sell that TS, the value of the stock is that purchase price above

But if it’s a loss, it will hit RE first then APIC

Par value/legal method

TS is debited at par value of the shares repurchased

When selling shares, it won’t hit RE

Change in accounting Estimate

Change in accounting ESTIMATE

Prospective approach: now and future periods

No effect on previously reported RE

Events/examples:

Changes in lives of fixed assets

Computation of warranty costs

Change in accounting Principle

Change in accounting PRINCIPLE

RETROSPECTIVE

Always adjust beginning RE, net of tax

You're usually going from one acceptable method to another

Events:

Change in reporting entity (M&A, consolidation)(this one restates all prior periods)

INVENTORY METHODS BASICALLY (like weighted average, FIFO, etc.)

Main causes for DTAs

Estimated liability/warranty expense

Prepaid rent, interest, and royalties

• The IRC uses the term "prepaid"

• GAAP uses "unearned"

Bad debt expense

NOL carryforward

Main causes for DTLs

Installment sales

Depreciation expense (only if tax>book)

Amortization

Prepaid expenses

Unrealized gain/loss on trading securities

What are the characteristics/requirements of governmental funds?

Modified accrual accounting

Current financial resources measurement focus

Often a budgetary focus

Also a focus on the fund balance (where as proprietary funds focus on the net position)

What are the characteristics/requirements of proprietary/fiduciary funds?

Proprietary funds use the full accrual basis of accounting.

Their focus is economic resources measurement!!

(also this one is similar to commercial accounting)

SE CIPPOE

What basis of accounting must non profits use?

Full accrual

Are unconditional promises to give considered contributions?

Yes, unconditional promises to give are contributions

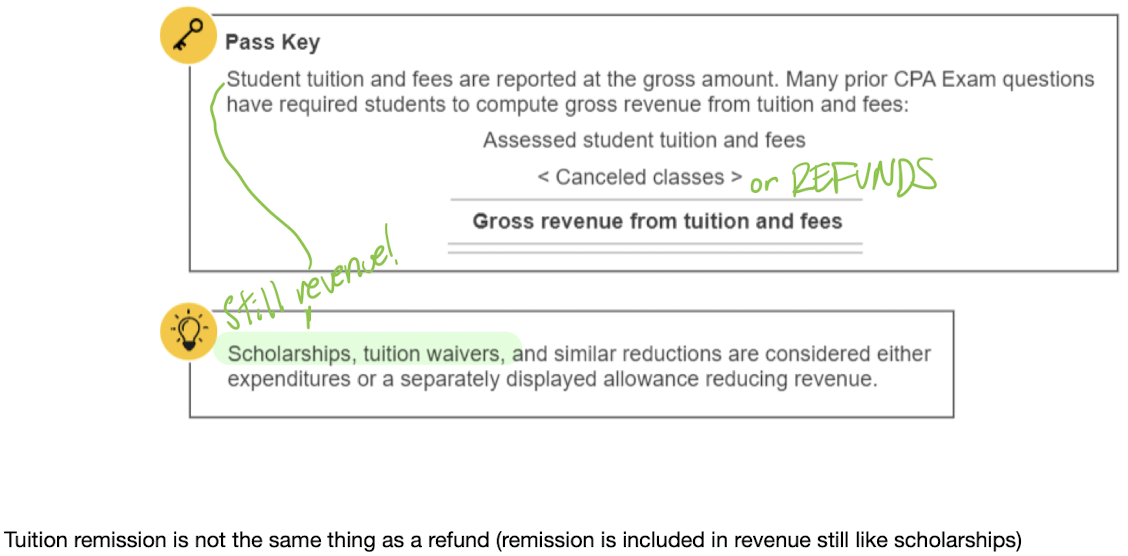

What is included in gross revenue from tuition and fees?

When fin stmt income exceeds taxable income, is it a DTA or DTL?

Fin stmt income > Taxable income = DTL

(Imagine that we LIKE when taxable income is low)

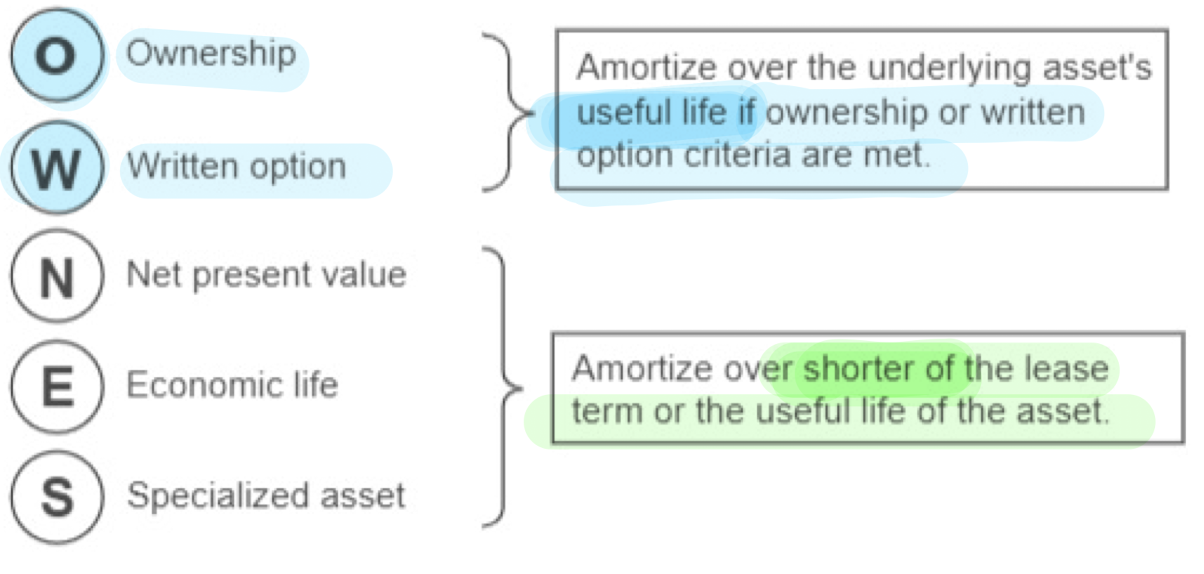

How long do you amortize a lease?

When accruing a loss that is probable and you are given a range of possible losses and the amount can be reasonably estimated, what amount do you accrue?

the MINIMUM of the range

(if it can’t be reasonably estimated, give the range itself)

What cost are purchased intangible assets recorded at?

at COST, not fair value

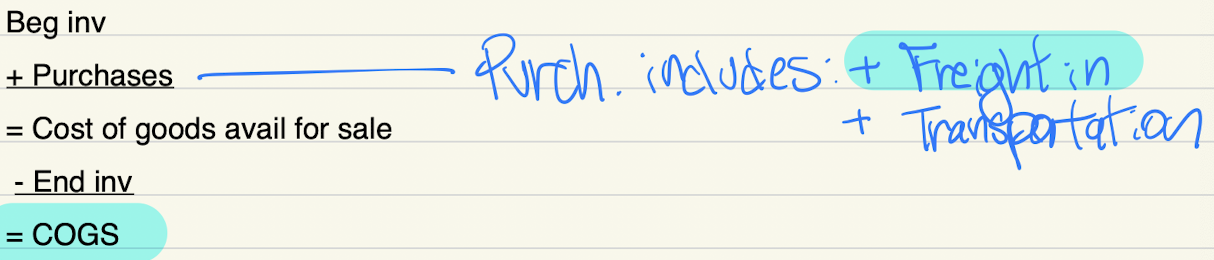

What is the inventory equation for errors in inventory?

Begin inv

+Purch

(COGS)

End inv

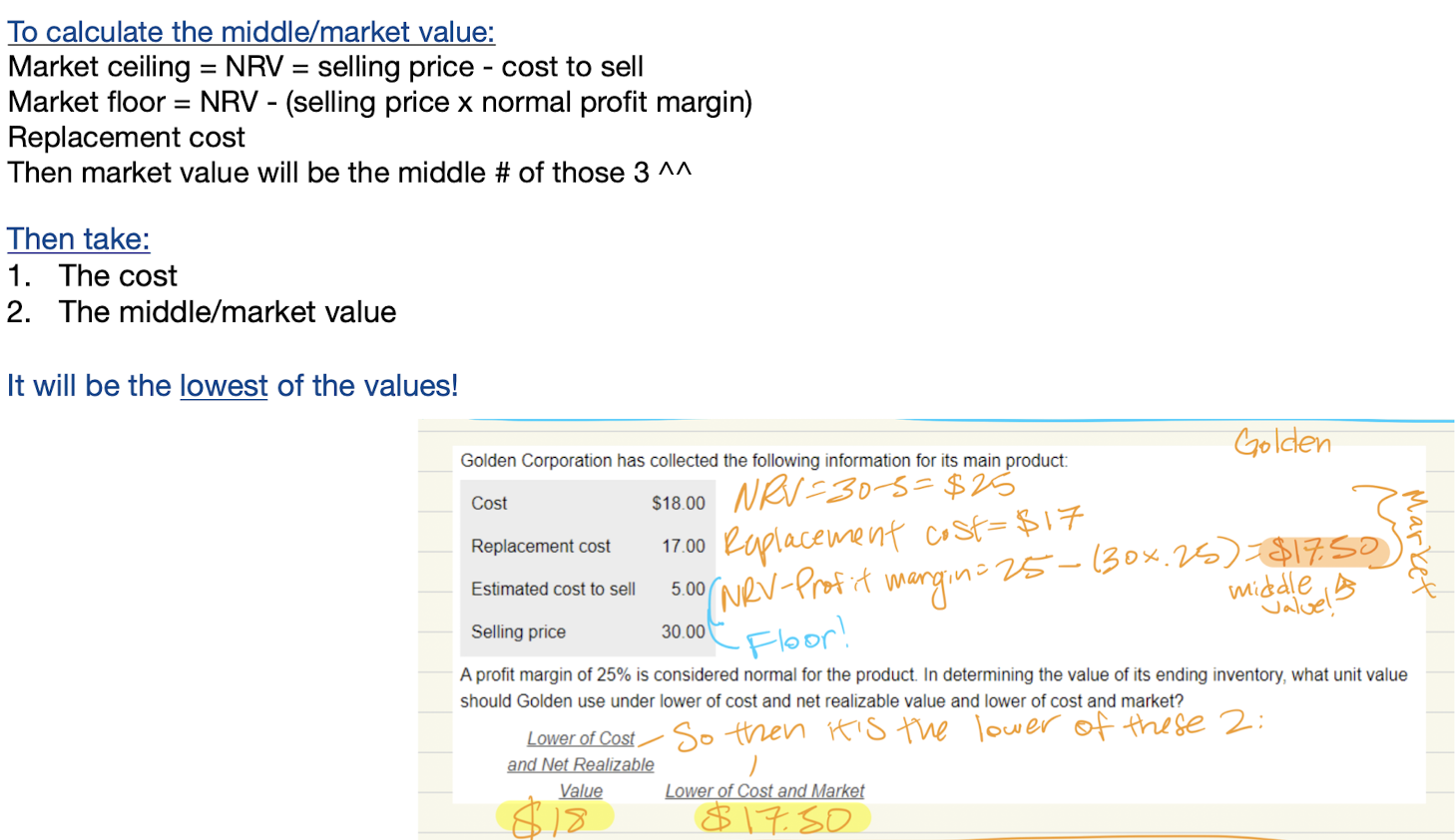

How do you use lower of cost or market?

What is the NRV equation?

NRV = selling price - cost to sell

Form 10-Q

What type of filing: Quarterly

Large accelerated and Accelerated: 40 days

All others: 45 days

This filing is NOT audited!!

Which B/S periods: most recent quarter end, end of the preceding fiscal year

Form 10-K

What type of filing: Annually

Large accelerated: due 60 days after, $700 million

Accelerated: 75 days, $75-700 million (small company technically)

All others: 90 days

This filing is audited!!

Gross profit margin equation

Gross profit margin = Sales (net) - COGS

Sales (net)

Quick ratio

= Cash & Cash Equivalents + Marketable Securities + Net Receivables

Current Liabilities

Issued vs Outstanding Stock

Issued is ALL of the stock, O/S is just the stock that is owned

Change in accounting principle that is inseparable from a change in estimate

Only to LIFO

Any depreciation or amort changes!!!

Prospective (no prior period adj)

Classify as change in Estimate (I think)

Items in OCI

PUFI:

Pension adjustments

Unrealized gains/losses in AVAILABLE FOR SALE DEBT securities and hedges

Foreign currency items

Instrument-specific credit risk

Also OCI is reported NET of tax

What is in comprehensive income?

Comprehensive income = Net income + OCI

(net income includes loss from disc. operations)

Basic EPS formula

= Net income - Preferred dividends

WACSO

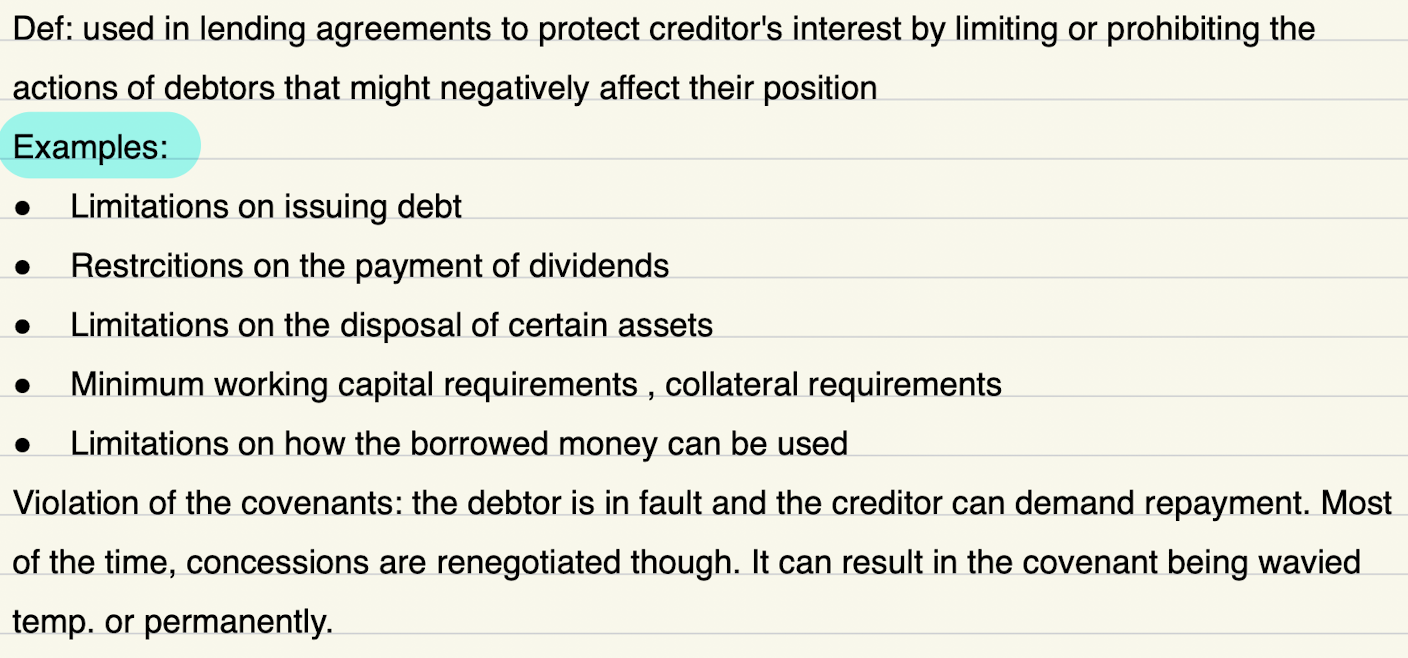

Debt covenants

Gain/Loss on bond extinguishment before maturity

= Reacquisition price - Net carrying amount

Negative answer = gain

Positive answer = loss

Diluted EPS formula

= income + interest on dilutive securities(net of tax)

WACSO

also we don't worry about dividends paid on stock here ^^

and this ADDS converted shares

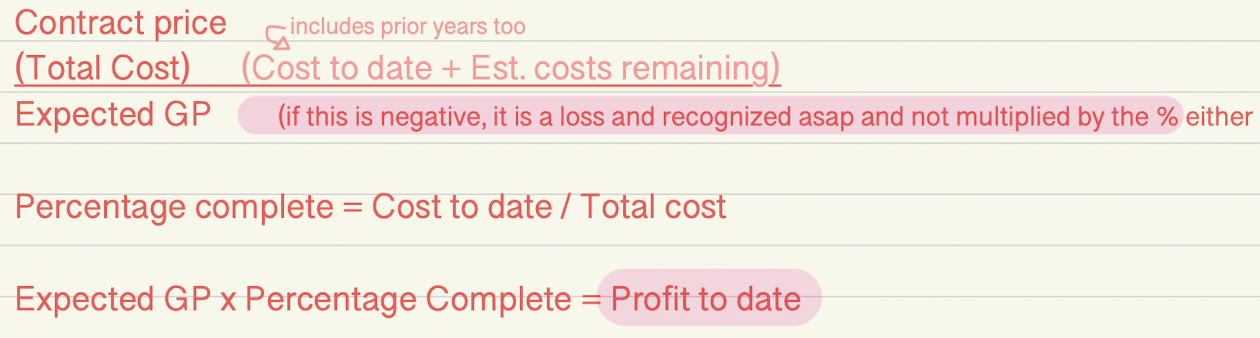

How do you find profit using the percentage of completion method/rev rec OVER time?

Also if it asks for Year 2 profit, subtract Year 1 profit from the amount that you come to!

How do you find the current liability/asset using the percentage of completion method/rev rec OVER time?

To find current liability or asset:

+ Actual costs incurred

+ GP for the year

(Progress billings)

Asset if positive or Liability if negative

How do you find profit using the completed contract method/rev rec AT A POINT in time?

Revenue is only recognized when project is complete!

Only losses will be booked ASAP

Contract price

(Total Cost)

Expected GP - if this is negative, the loss will be booked ASAP

BASE equation for credit loss expense

Beginning balance

(Write offs)

Account Recoveries

Credit loss expense (add this)

Ending balance

Inventory equation (for errors in inventory, etc)

Equation for Total Income Tax Expense with DTAs/DTLs

Tax Expense

+DTL

(DTA)

Total Income Tax Exp

Tax provision vs Tax liability

Tax provision = how much you owe for the year

Tax liability = how much you have left to pay

(so = tax provision - ES pmts) like MCQ-849

JE for bond issuance at a DISCOUNT

Cash xx

Discount xx

BP xx

JE for bond issuance at a PREMIUM

Cash xx

BP xx

Premium xx

Equation for calculating Goodwill under the Equity Method

Purchase price

(FV of assets x % owned)

Goodwill

How do you calculate income from an investment under the Equity Method?

Income from an investment = Subsidiary’s income x % owned

(Disregard any dividends)

Under the Equity Method, are dividends income or a reduction of investment?

Dividends are a reduction of investment

How do you find the ending CV of an investment under the Equity Method?

Beg. Carrying Amount

+[(Income -Dividends) x % of share]

End. Carrying Amount

Are pref stock dividends treated as income or a reduction of investment under the Equity Method?

Pref stock dividends are ALWAYS only income

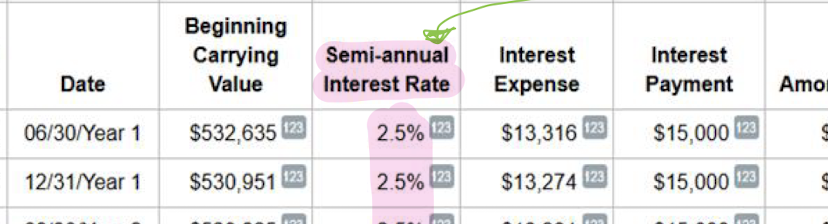

When you populate an amortization table for bonds, what interest rate are they going to want you to enter?

Enter the effective market rate (and if it is semi-annual, enter the semi-annual rate like 2.5% instead of 5%)(like TBS 4202 or 34000)

If any of the OWNES criteria are met, what kind of lease is it?

Finance lease! (so like 75% of the lease life or 90% of the NBV)

What is the GAAP rule/basis for an asset contributed to a partnership?

Use the FV of the asset contributed

What is the Tax rule/basis for an asset contributed to a partnership?

Use the NBV of the asset contributed

Is OCI usually a credit balance or debit balance?

OCI is a credit balance

If someone has over 20% ownership of a nonvoting stock, would you use the equity method or fair value method?

Fair value method because it is nonvoting

MAC GRaSPP/SE CIPPOE:

Internal service fund (goods and services provided internally by designated departments, like building maintenance)

S in SE CIPPOE

MAC GRaSPP/SE CIPPOE:

Enterprise

E in SE CIPPOE

MAC GRaSPP/SE CIPPOE:

Custodial

C in SE CIPPOE

MAC GRaSPP/SE CIPPOE:

Investment trust (external investment pools)

I in SE CIPPOE

MAC GRaSPP/SE CIPPOE:

Private purpose (activities not properly accounted for either as pension or investment trust funds)

P in SE CIPPOE

MAC GRaSPP/SE CIPPOE:

Pension

P in SE CIPPOE

MAC GRaSPP/SE CIPPOE:

Other Employee trust fund

OE in SE CIPPOE

MAC GRaSPP/SE CIPPOE:

General

G in MAC GRASPP

MAC GRaSPP/SE CIPPOE:

Special Revenue

R in MAC GRASPP

MAC GRaSPP/SE CIPPOE:

Debt Service (accumulation of resources)

S in MAC GRASPP

MAC GRaSPP/SE CIPPOE:

Capital Projects (used for acquisition or construction of major capital assets)

P in MAC GRASPP

MAC GRaSPP/SE CIPPOE:

Permanent (legally restricted to an extent, like an endowment fund)

P in MAC GRASPP

Impairment loss test

Impaired if CV > Future cash flow (undiscounted)

(you’re impaired if you care more about your future)

Impairment loss formula (not the test)

Impairment loss = CV - FV

Operating, investing, or financing?

Gains/losses from sales of fixed assets

Operating - but they need to be backed out from NI!

Gains - subtract

Losses - add

When they show you a consolidated balance sheet and ask for the amount eliminated for something: eliminated profit

eliminated profit = parent inventory + sub. Inventory

= amount

(consolidated inventory)

answer

When they show you a consolidated balance sheet and ask for the amount eliminated for something: intercompany sales

intercompany sales= revenues added together

(consolidated revenue)

answer

When they show you a consolidated balance sheet and ask for the amount eliminated for something: amount payable for intercompany sales

AP for intercompany sales= AR balances added together

(consolidated AR balance)

answer

How to find the Bonus in a Partnership

Bonus = Partner balances + New person's investment

= Total balance

= Total x % Share of new guy

= His capital account balance

= His capital account balance - Investment amount

= Bonus!

How to find the Goodwill in a Partnership

Goodwill = New guy's investment / % share

= Total capital

= Total - existing balances (incl. new guy's)

= Goodwill

How is a stock split applied retroactively?

It will be applied to ALL years presented (so even if the split is in Yr 2, you apply it to Yr 1 as well)

Also, apply the split to the existing amounts throughout the year rather than just multiplying the most recent balance by the split

Under a bill and hold arrangement, when is revenue recognized on a sale?

When the assets are ready for transfer (and also these are all met in the SS)

Where is a foreign transaction gain/loss recorded?

Income from continuing operations

CECL Loss test and formula

CECL loss if CV>FV

Loss = CV - PV of expected cash flow

CV=Amort. cost

Also this loss is on the income statement

How would an endowment fund be classified as a cash flow and also is it restricted?

Financing cash flow

WITH donor restrictions