Production, costs and revenue

1/132

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

133 Terms

what is production?

production converts inputs, including the services of factors of production e.g. capital and labour, into final output

what are these factors of production?

- land, natural resources e.g. oil reserves

- labour, human effort e.g. factory workers

- capital, man-made resources used to produce goods or services e.g. buildings, machinery

- enterprise, the organisation of factors of production

what are the types of production?

- primary production, extracting raw materials from the earth e.g. mining

- secondary production, manufacturing raw materials into finished goods e.g. car manufacturing

- tertiary production, providing services e.g. education

- quaternary sector, industry based on human knowledge which involves technology, information, financial planning, research, and development

what is productivity?

a measure of the efficiency with which inputs are converted into outputs

what is labour productivity?

- output per unit of labour input

- labour productivity = output / labour input

- e.g. if a factory produces 1000 units with 50 workers, labour productivity is 1000/50 = 20 units per worker

what is the importance of productivity?

- economic growth, higher productivity leads to higher economic growth

- competitiveness, productive firms can offer lower prices or higher quality goods/services

- e.g. tech companies are constantly trying to improve productivity to stay competitive

- standard of living, increased productivity can lead to higher wages and improved living standards

what are some real world examples of productivity?

- toyota production system: they applied lean production principles to maximise efficiency. this reduced waste in production and lead to higher productivity

- amamzon robotics: implementation of robots in warehouses to improve order fulfilment. this increased order processing speed and reduced errors

- singapore's economic growth: there was an emphasis on education and technology to boost productivity. there was a transformation from a labour-intensive to a knowledge-based economy

what is specialisation?

the concentration of a worker, firm, region or country to produce a narrow range of goods and services

what does specialisation need in order to be successful?

- requires a means of exchange e.g. trade

- if we as an economy specialise in one thing, that's only helpful if we have a way of getting the other goods we need

- if there was no one producing these goods or there was no way of getting these goods,

what does it also need?

- through this trade we also need some form of monetary payment

- nowadays money acts as an appropriate medium of exchange

what's the main pro of specialisation?

- it reduces scarcity

- the economic problem becomes less of an issue

- because if an economy were to specialise, they'd use the factors of production available to them

- whereas if one economy had the problem of scarcity, e.g. in the UK we can't produce bananas

- therefore we can import those goods from an economy that can

- we don't have to worry about bananas or oranges being scarce

what are the advantages of specialisation?

- larger range of goods and services available, although specialisation means focusing on a narrow range of goods/services, but if lots of firms or economies focus on one small thing, then all together there'll be lots of stuff produced

- greater output and quality, amount of goods/services produced will be higher and the quality will be to a very high standard as workers to become more skilled at a particular task, so they make fewer mistakes and can produce more goods in the same amount of time

- trade and growth, as they decide to specialise, trade will be increased and more will be exported hence causing economic growth

what are the disadvantages of specialisation?

- finite resources, if one economy relies heavily on one specific resource to specialise in and trade there's problems as resources are finite e.g. rubber

- over reliance on good weather, e.g. if an economy relies on tourism or agriculture

- problems with changing tastes and fashions, if tastes change they'll be stuck

- national interdependence, as countries specialise and more trade takes place, countries become more closely linked. if relations between countries break down e.g. war or the trump-china trade war, where america placed heavy tariffs and trade barriers on china's exports

- de-industrialisation, if a country decides to specialise as the uk did via industrialisation, then what if another country emerges and can do it better/cheaper. this is what happened in the uk and the manufacturing sector slumped causing large unemployed resources and labour

what is the division of labour?

- occurs when specialisation has taken place where the production process is broken down into separate tasks

- so for example a firm has already decided to specialise in producing footballs, how do they then divide that labour into different sections and production processes

- so a firm may split that process up into different production lines and different workers will be allocated to them

what are the advantages of division of labour?

- workers get very good at doing their job, the quality of what they do is going to improve and so they'll feel valued as they know what they're doing is good for the company

- production will increase, as workers improve there'll produce more in the same time period meaning productivity increases

- by splitting the production process up there'll be time savings, as workers will be better at carrying out their one specific task instead of having to produce the whole good

- cost effective capital for workers, when workers are divided into different production processes, if you then give them capital machinery to help, it'll increase efficiency massively

- consumers will benefit via low prices, division of labour can raise output per person as people become proficient through constant repetition of a task. this gain in labour productivity then helps to lower the supply cost per unit for a business. reduced supply costs in theory will lead to lower prices for consumers of goods and services causing gains in economic welfare e.g. through an increase in consumer surplus.

what are the disadvantages of division of labour?

- boredom, if they're doing the same process for ages then boredom will set in and workers will feel devalued as they're not getting promotions or any more responsibilities and therefore quality might suffer

- payments are low, factories in china/central europe, the workers don't have very good working conditions, they have cramped spaces and long hours, all while pay is quite low

- too much reliance on other countries, they may require low skilled low wage workers and so they are reliant on these workers from other countries so there's issues if these relations between countries break down

- or if they produce a product that they export a lot, then if relations between key export markets breaks down then this labour will become unemployed and it'll be very hard for them to find another job

what is the short run?

- in the short run, at least one factor of production is fixed, so the business has basically chosen its scale of production and sticks to it in the short run

- therefore the only way to increase output is by increasing labour, we see labour as our variable factor of production

- elasticity of supply may be low due to limited spare capacity or a lengthy production time frame

- in the SR we talk about returns to extra variable factors

- if there's increasing returns to additional labour, then marginal cost is falling

- if there's decreasing returns to additional labour, then marginal cost is rising

what is the long run?

- in the long run, there are no fixed factor inputs. all factors of production are variable

- the business can change the whole scale of production

- supply is likely to be much more elastic as all factor inputs can be changed

- in the LR we talk about returns to scale: adding more land, labour and capital

- if returns to scale are increasing then the LRAC is falling

- if returns to scale are decreasing then LRAC is rising

how can the short run and the long run vary by industry?

- because production time frame varies by sector

- an example is the difference between nuclear power and ridesharing services

- hinkley point nuclear power plant, are building another nuclear power station but all that extra infrastructure takes years to build so the long run is very long for them

- but services such as lyft and uber, between 2017 and 2022, the number of ridesharing drivers globally doubled

- so for these digital platform services like uber but also amazon, airbnb etc., they can change their scale of production very quickly so the long run is much shorter

what is marginal product?

the additional output as a result of employing one more worker

what is the law of diminishing returns?

- a short-run concept

- law of diminishing returns states that in the short-run, when variable factors of production (i.e. labour)

- are added to a stock of fixed factors of production (our land and capital)

- total/marginal product will initially rise, and then fall

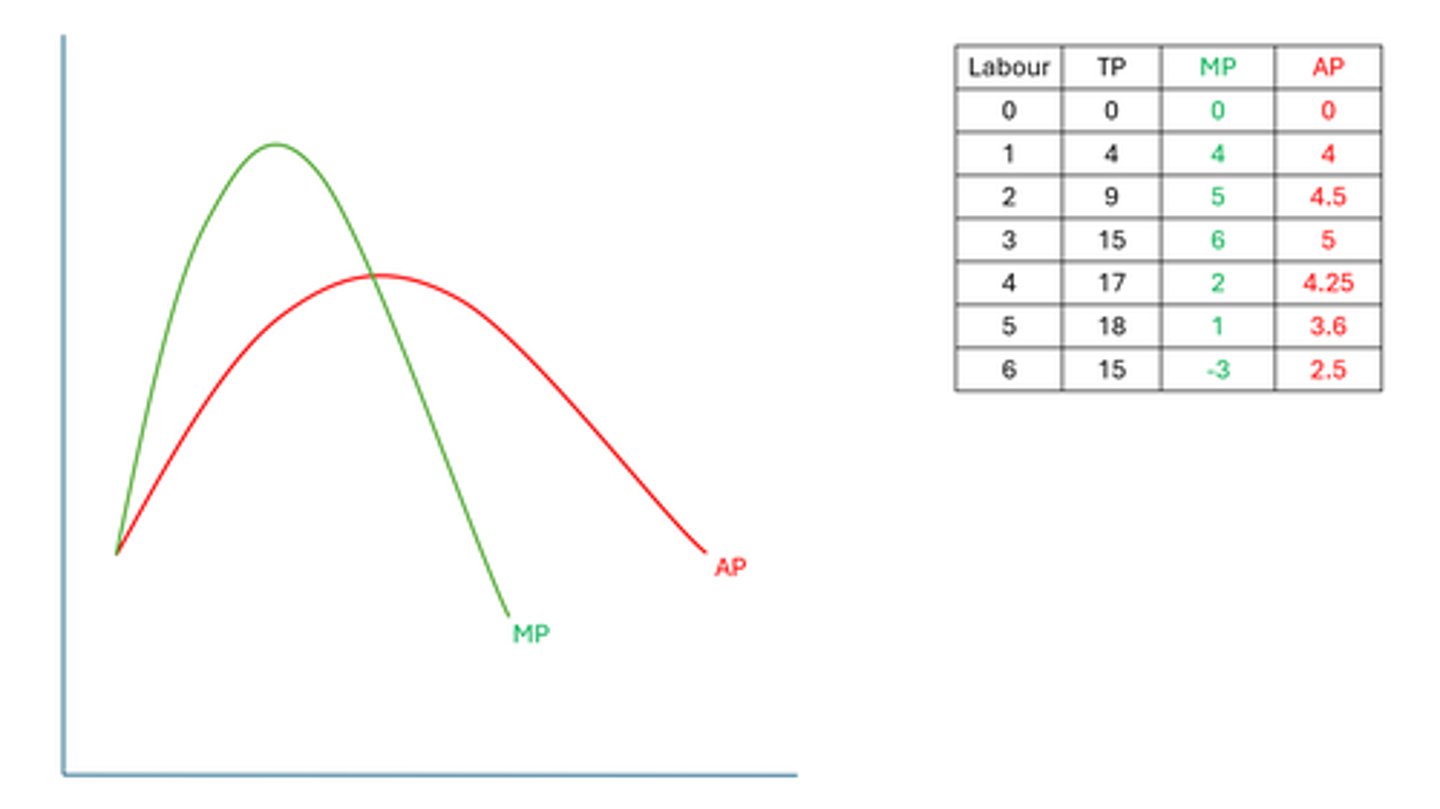

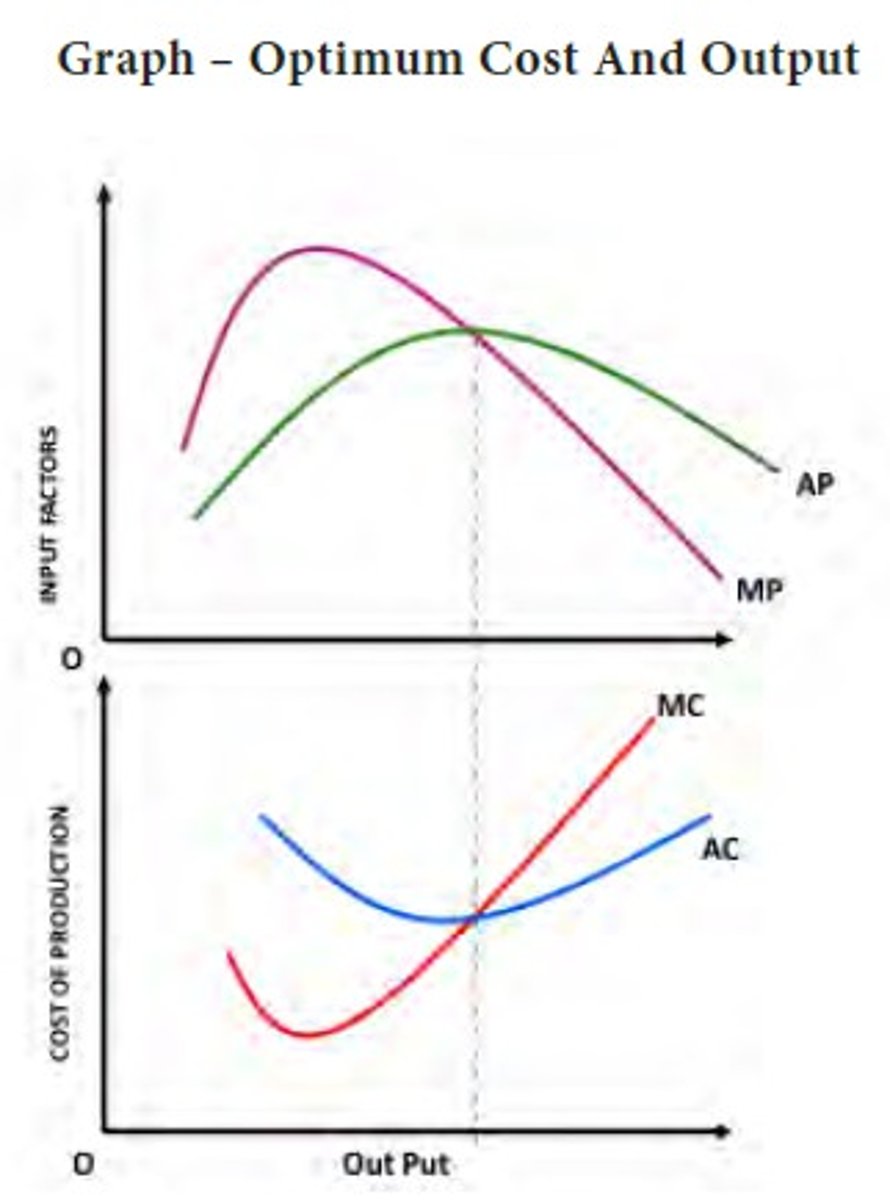

what does this look like on a curve?

- use a pizza restaurant as an example

- at first, as more labour is added there's much more total product being produced and hence marginal product is high

- however at a certain point, every extra labour added adds less and less to the total product until it actually becomes negative

- so the marginal product curve rises very steeply but then decreases

- same with average product, it increases but then starts to decrease

- so the AP curve will go up at first and then decrease

- marginal product curve needs to cut average product curve at its highest point

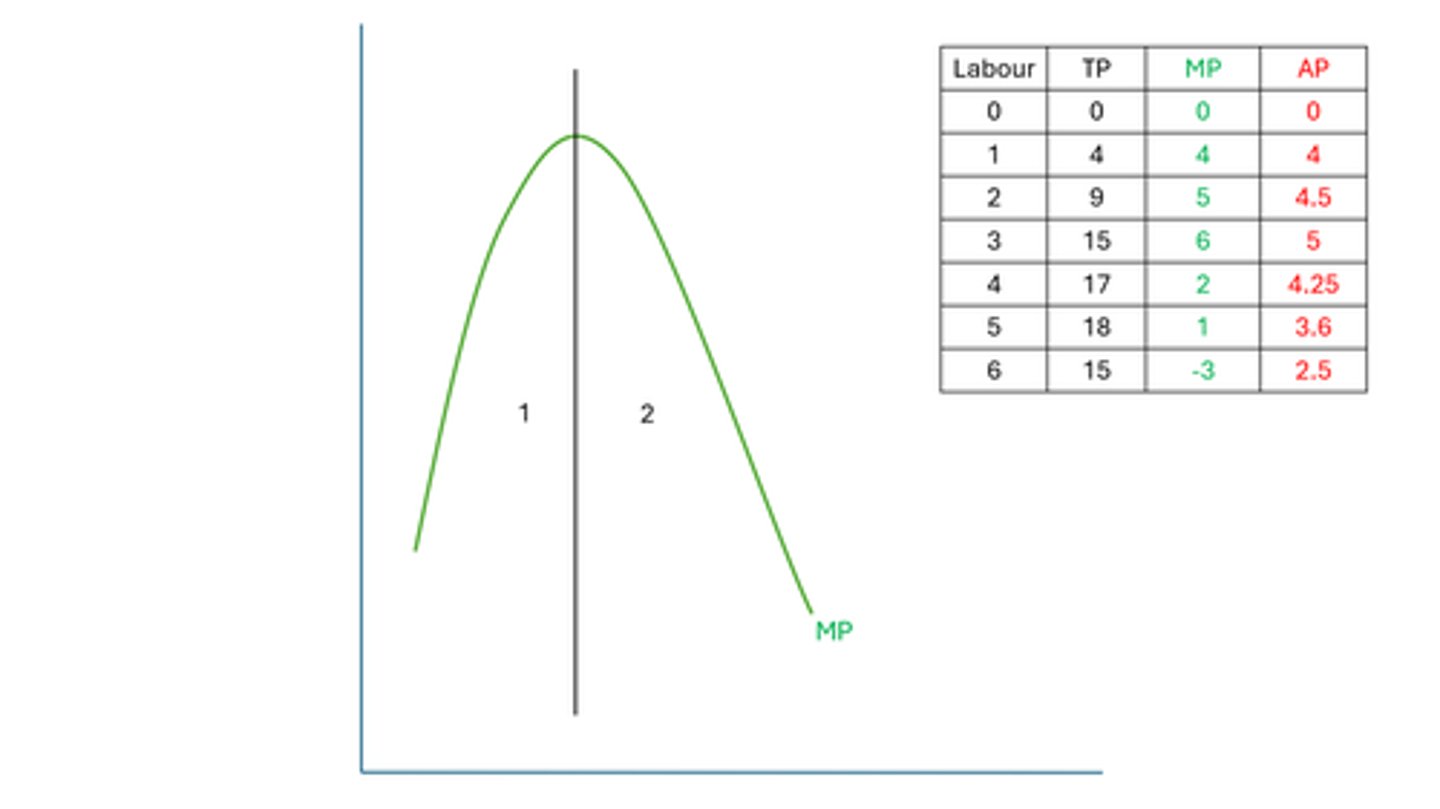

what two sections can the marginal product curve be split into?

- we can see in the first half that marginal product is rising

- with each additional worker is bringing in more output than the last

- we are seeing interesting returns to labour as MP rises

- more pizzas are being made than the last person

- but then in the second half once we employ our 4th worker, marginal product starts to fall

- this is because the law of diminishing returns sets in

why does marginal product rise in the first half?

- as labour productivity is increasing

- first reason is because specialisation is taking place

- as we employ the second worker, he is learning from the first worker on how to make pizzas fast

- and specialisation takes place e.g. one puts the sauce on and one one puts the cheese on

- second reason is because our fixed factors of production are being under utilised

- for example there are unused ovens so when we employ more workers they can use these ovens, this spare capacity

- or maybe there's enough work space for three workers, so any less and this is being under-utilised

why does marginal product fall in the second half?

- labour productivity falls as there's a constraint on production

- very simply there aren't enough fixed factors of production for extra labour

- e.g. there aren't enough ovens, there isn't enough work space

- so workers start to get in the way of one another and impact each other's output

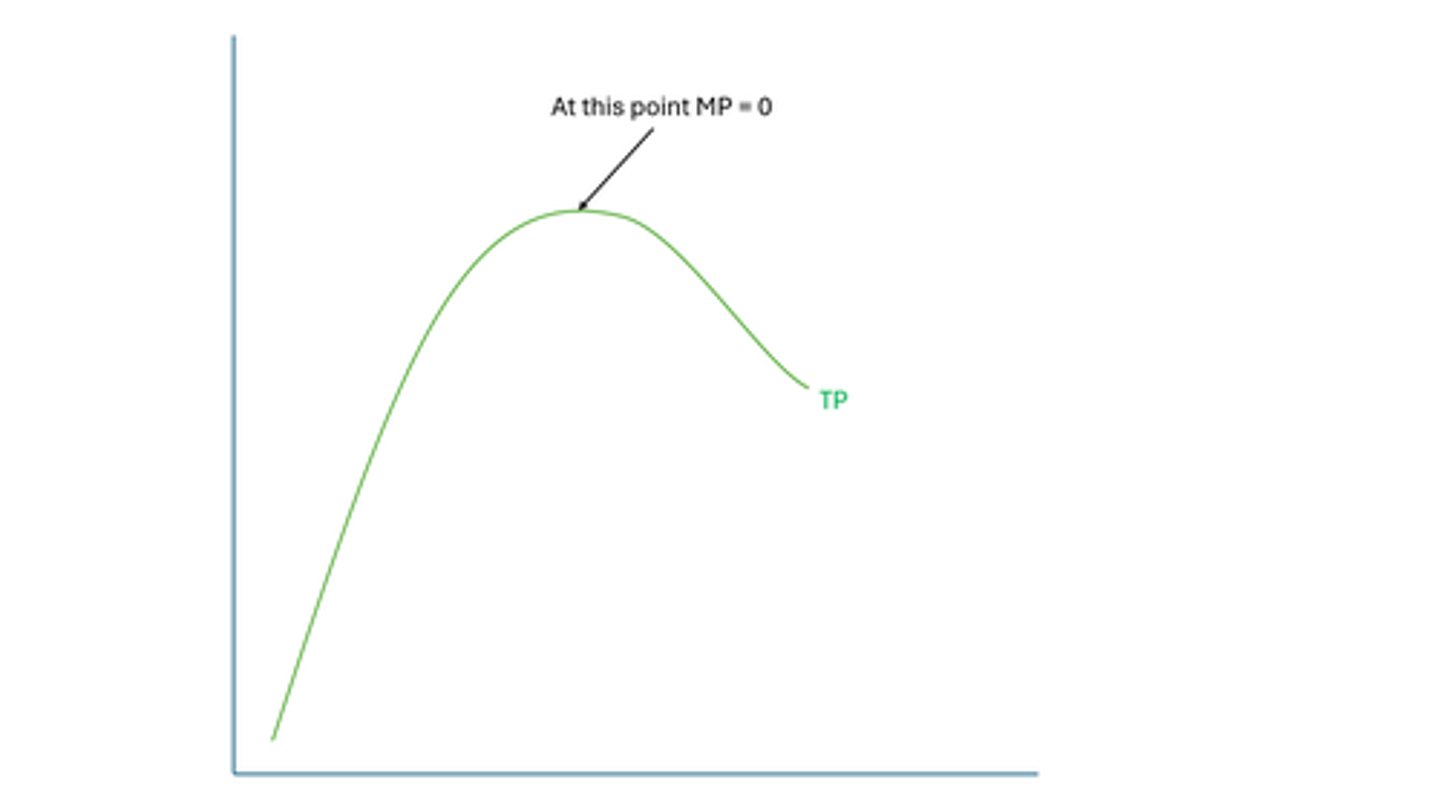

what does total product look like on a curve?

- total product rises but at a slower rate

- total product is maximised when marginal product = 0

why is total product maximised when MP = 0?

- if marginal product is negative, then total product is going to be falling so that can't be maximised

- if marginal product is positive, then each extra worker hired is going to bring in more output and therefore total product is going to keep rising

- so as long as MP is positive, the next worker is going to bring in more output and that will keep increasing TP

- therefore the only point where MP is maximised is when there's no more marginal product left

what is returns to scale?

- returns to scale is how a firm's output changes as it increases or decreases its factors of production

- land, labor, capital etc.

why is returns to scale a long-run concept?

- long run is when all factors of production are variable

- so now businesses can increase any of their factors of production

- and we say that the business is scaling up

- so the LR is about returns to scale

- what are the changes in output when we increase those factors of production, when a business scales up

what's an example of firms whose scale has increased massively?

- platform business can scale very quickly

- a platform business connects different groups, like buyers and sellers, to allow exchanges and interactions between them

- this could be aggregation platforms (business that brings together products or info from multiple sources and presents them to users in a clear way) such as amazon or expedia

- social platforms such as whatsapp

- long run varies by industry, e.g. digital businesses can change scale at rapid pace

what is the hut group?

- the hut group is a british e-commerce company with numerous cosmetic businesses

- they've managed to scale up their company and increase revenue massively in recent years

what are the two types of costs for a business?

- fixed costs, costs that do not vary with output

- even if nothing is being produced, a business has to pay fixed costs

- variable costs, costs that do vary with output

- as you produce more, you pay more

what are some examples of fixed costs?

- rent

- salaries

- interest on loans

- advertising

what are some examples of variable costs?

- wages

- utility bills

- raw materials

- transport costs

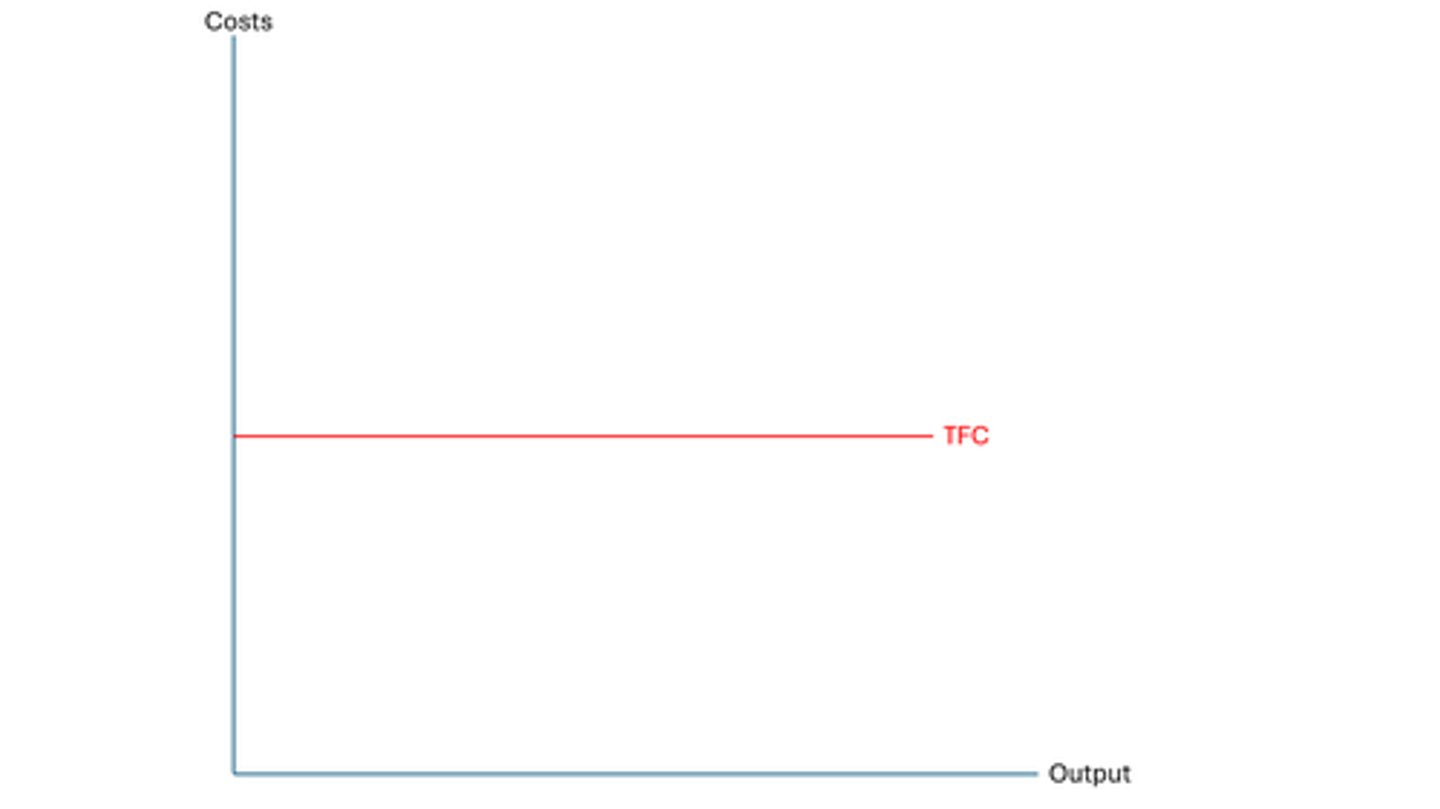

what do total fixed costs look like on a graph?

- total fixed costs remain the same despite output changing, so it would just be a straight horizontal line

- this curve is not influenced by the law of diminishing returns as it's a fixed cost, so it's very simple to draw

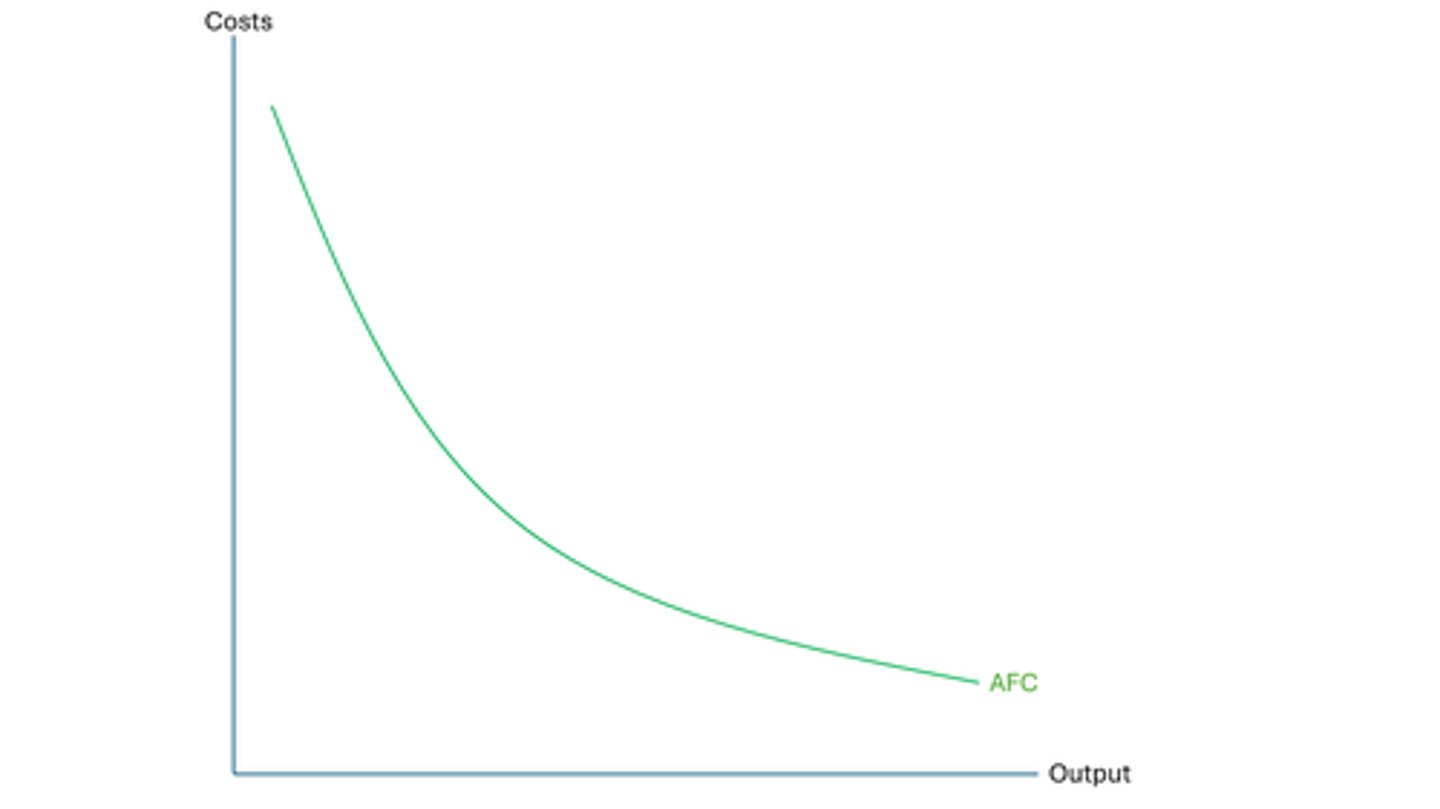

what does average fixed costs look like on a graph?

- AFC = TFC / quantity

- therefore, as quantity increases, you're dividing a constant number by an increasing number

- and so average fixed costs will fall the more we produce

- this curve is not influenced by the law of diminishing returns as it's a fixed cost, so it's very simple to draw

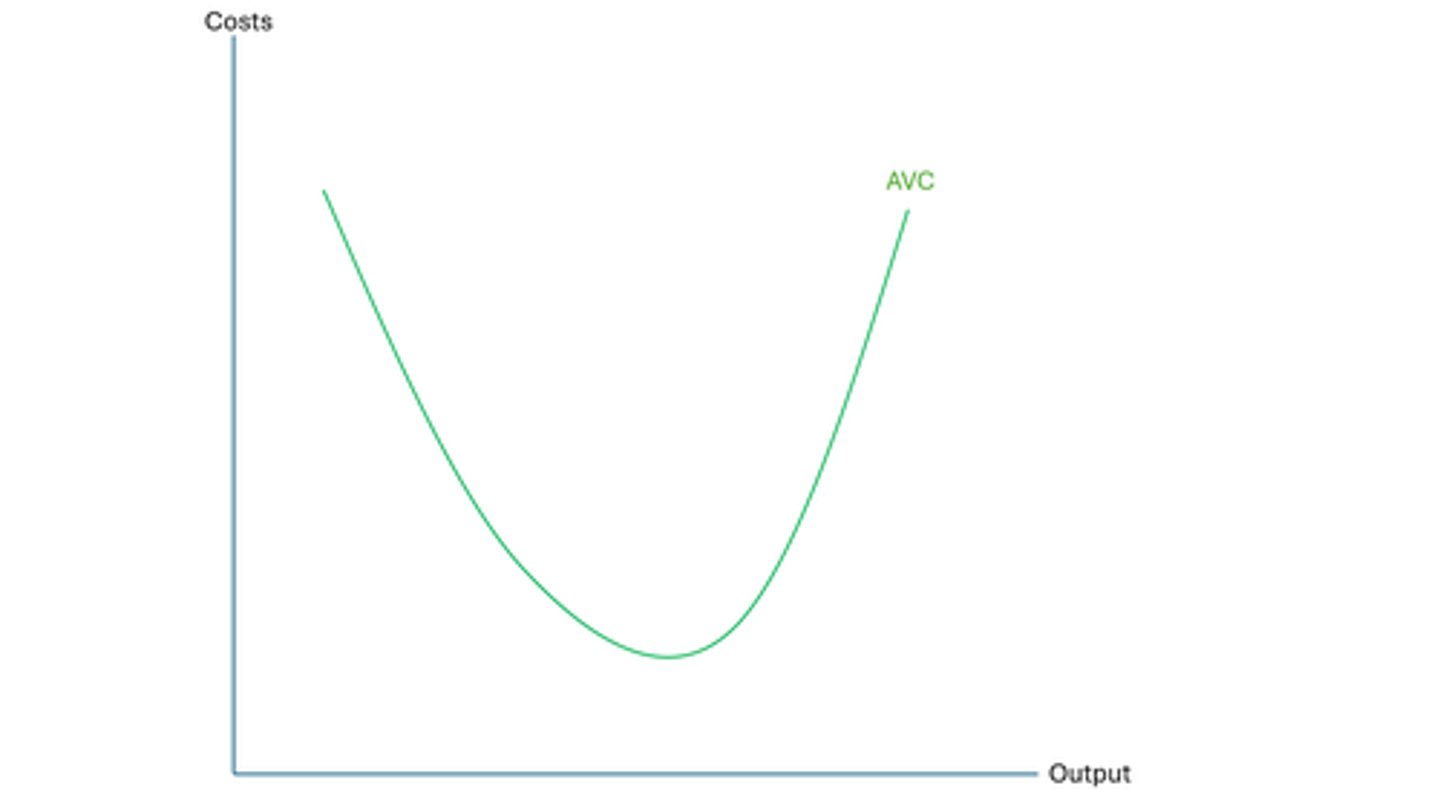

what does the average variable cost curve look like?

- lets assume we have a business, and for this business the only variable cost in the short run is wages

- workers are hired at a daily rate of £100

- for one worker, they produce 10 units in a day, so the average variable cost = 100/10 = £10

- now 2 workers, are hired and produce 30 units, so the AVC = £200/30 = £6.67

- so we can see here there are increasing returns to labour, labour productivity and marginal product is rising which reduces AVC

- however, now we have 10 workers and they produce 100, so average variable cost = £1000/10 = £10

- so average variable cost has risen as labour productivity has fallen and marginal product is reduced

- this is as the law of diminishng returns has kicked in

what is marginal cost?

- marginal cost is the extra cost when we produce one more unit of output

- marginal cost = change in total cost / change in output

- so if we went from producing 4 units at a total cost of £20 to producing 9 units at a total cost of £30

- then the marginal cost = 10/5 = £2

- so the cost of producing one more unit from 4 to 9 = £2

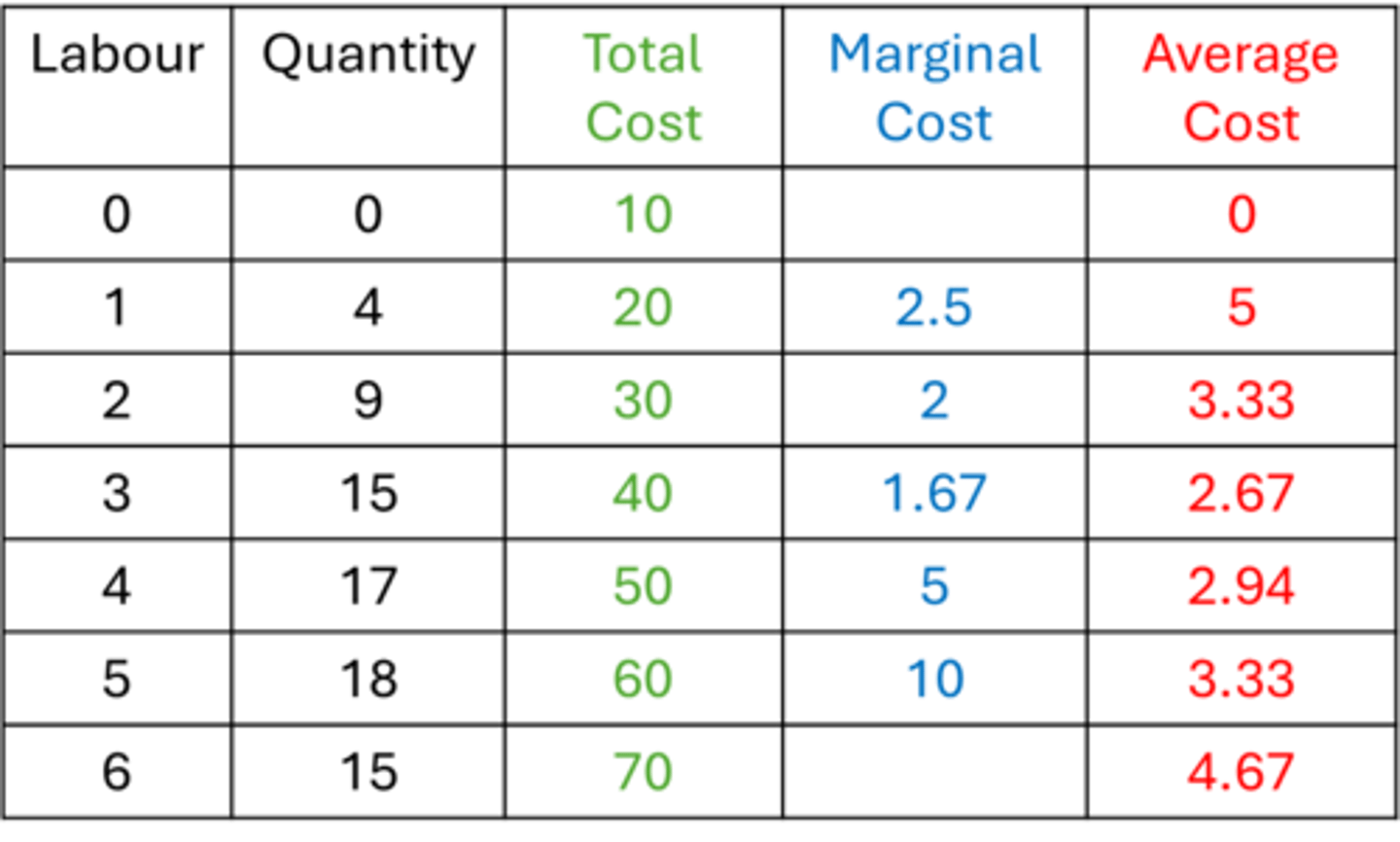

how do you calculate average cost?

- average cost = total cost / quantity

how can you work out what the average and marginal cost curves look like?

- we assume here that the fixed costs are £10 that always have to be paid and that workers are paid £10 an hour, which explains the total cost column

- by looking at the costs, we can see that the average cost decreases at first but then rises again

- again we can see marginal costs decrease at first but then rise much more dramatically

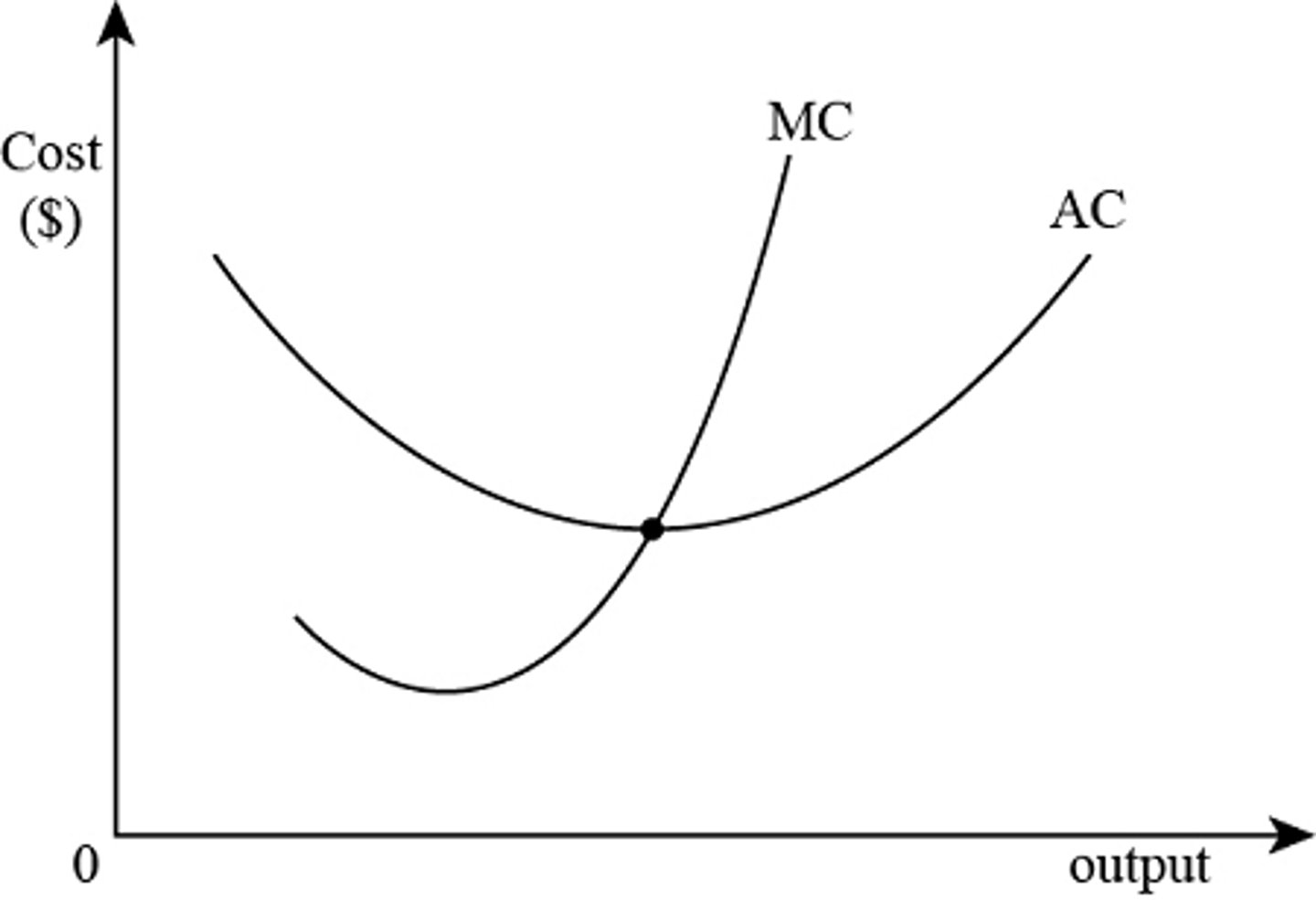

what does the average and marginal cost curves look like?

what is the shape of the marginal and average cost curve due to?

- you'll see the MP and AP curves are the exact same as the MC and AC curves but just mirrored

- this is because they are both due to the law of diminishing returns

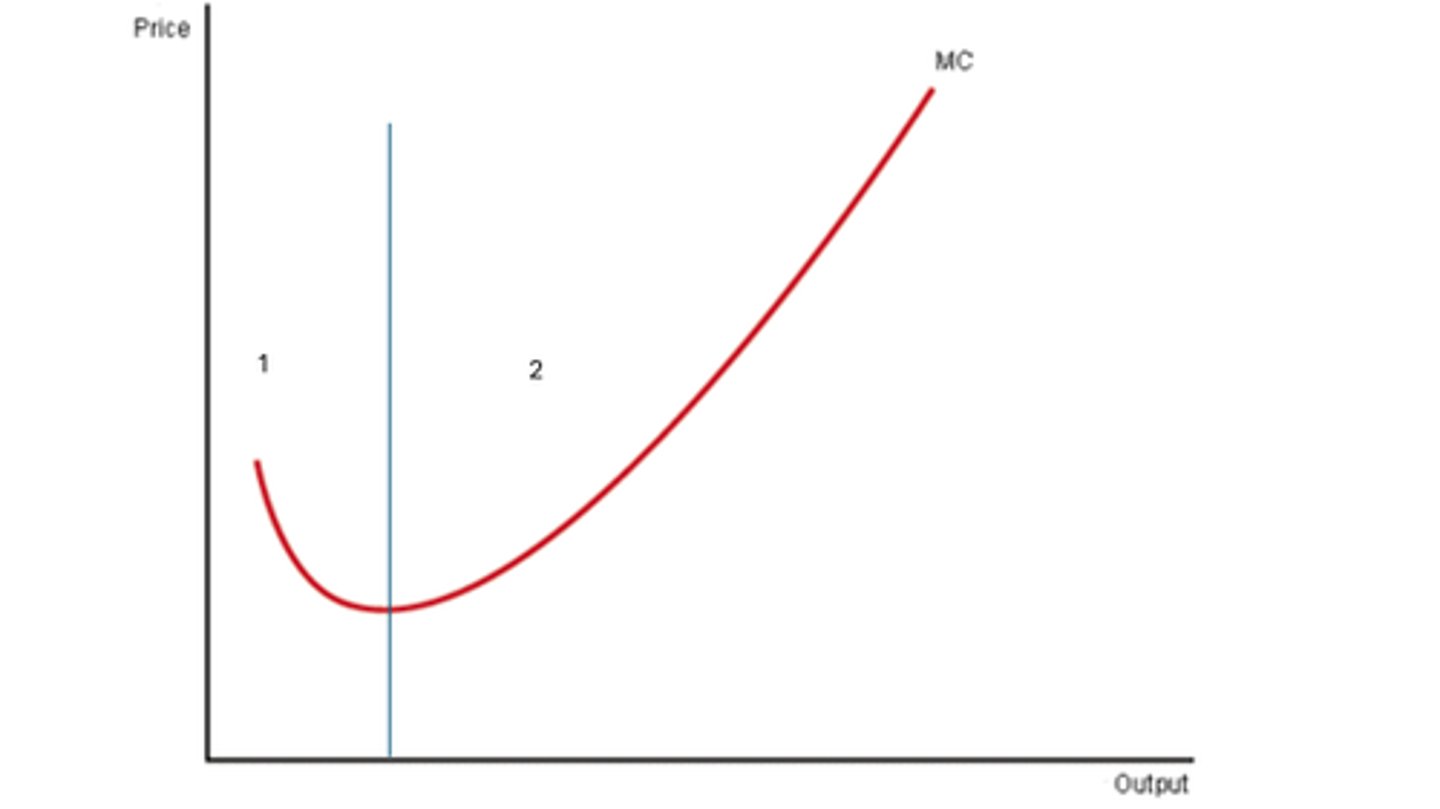

explain how the marginal cost curve is affected by the law of diminishing returns

- we can show this by breaking the curves up into 2 parts

- in stage 1, we can see that there is increasing labour productivity, there is increasing marginal product

- this is due to specialisation between workers and underutilised fixed factors of production are now being used

- as a result labour productivity increases and marginal product increases

- and we can see as a result, marginal costs will decrease

- but then the law of diminishing returns kick in in stage 2

- this is because labour productivity and marginal product decreases

- as fixed factors of production become a constraint on production and therefore marginal costs will rise

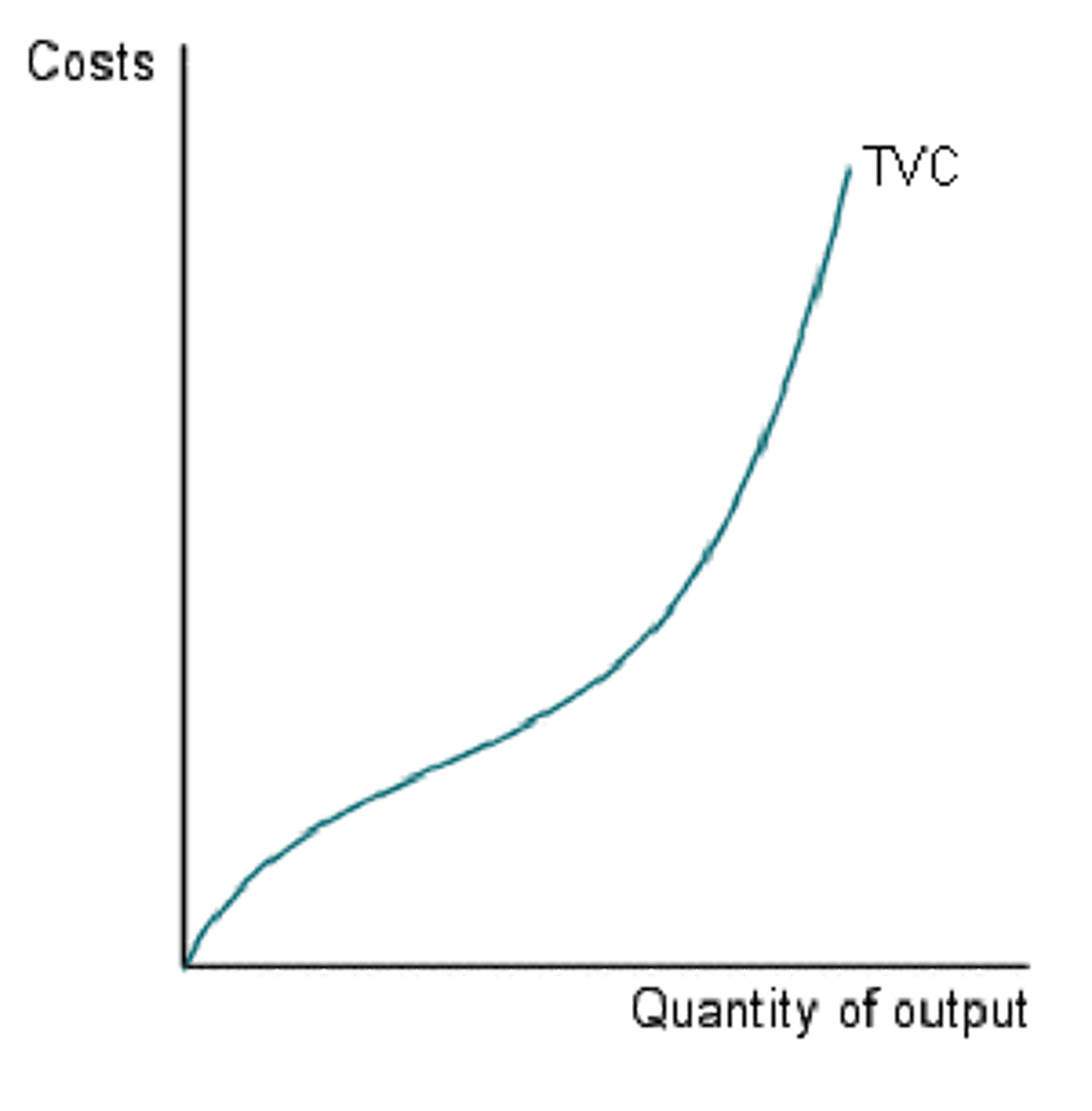

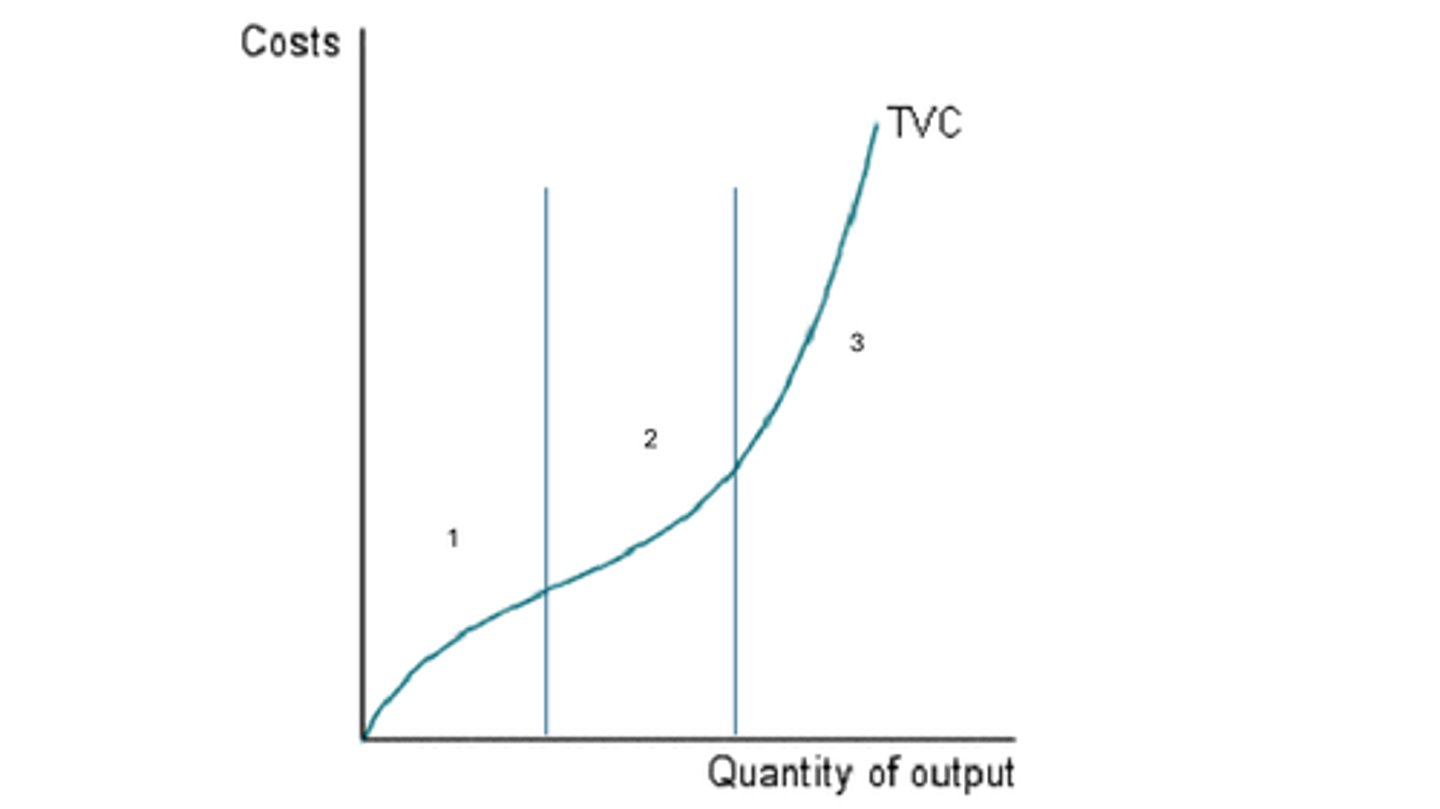

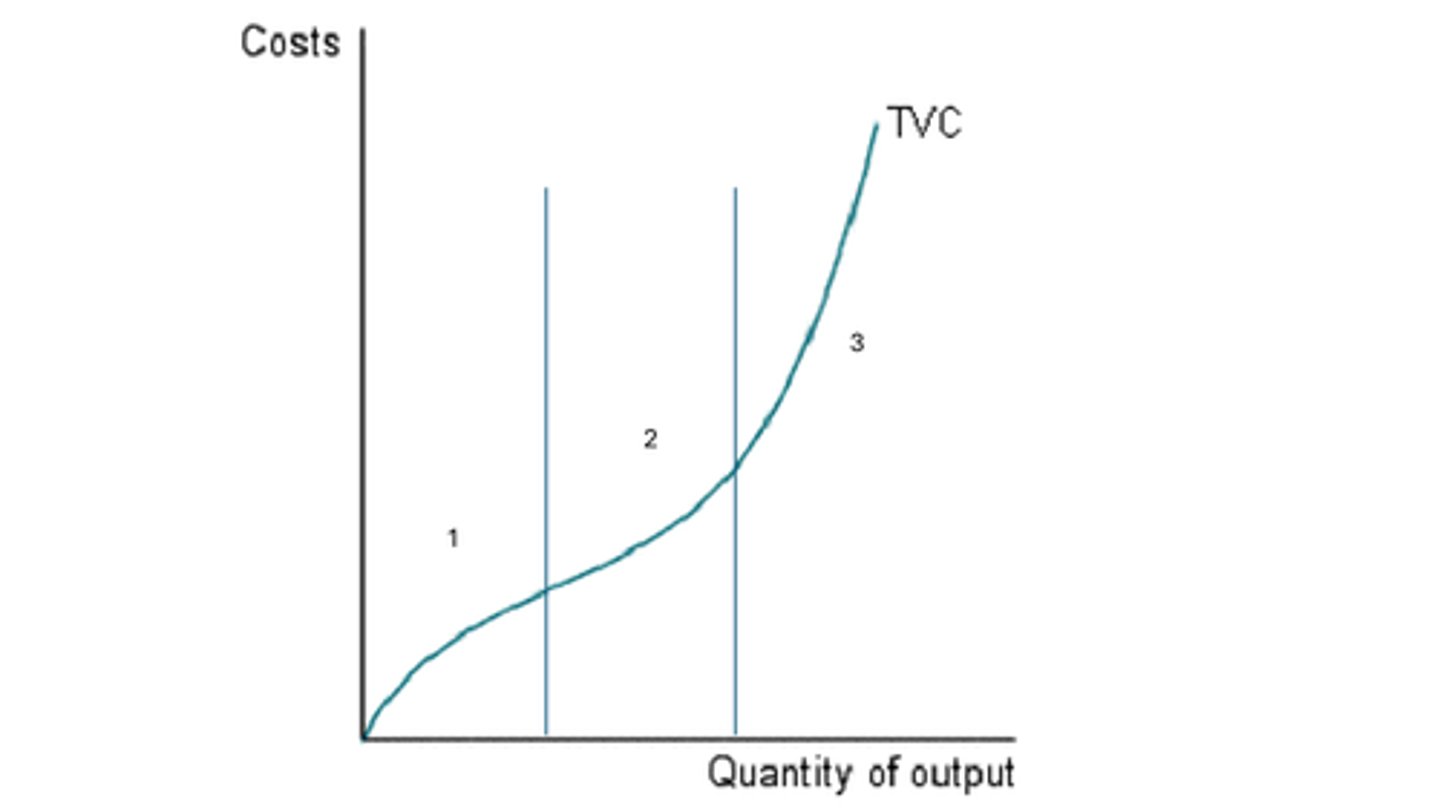

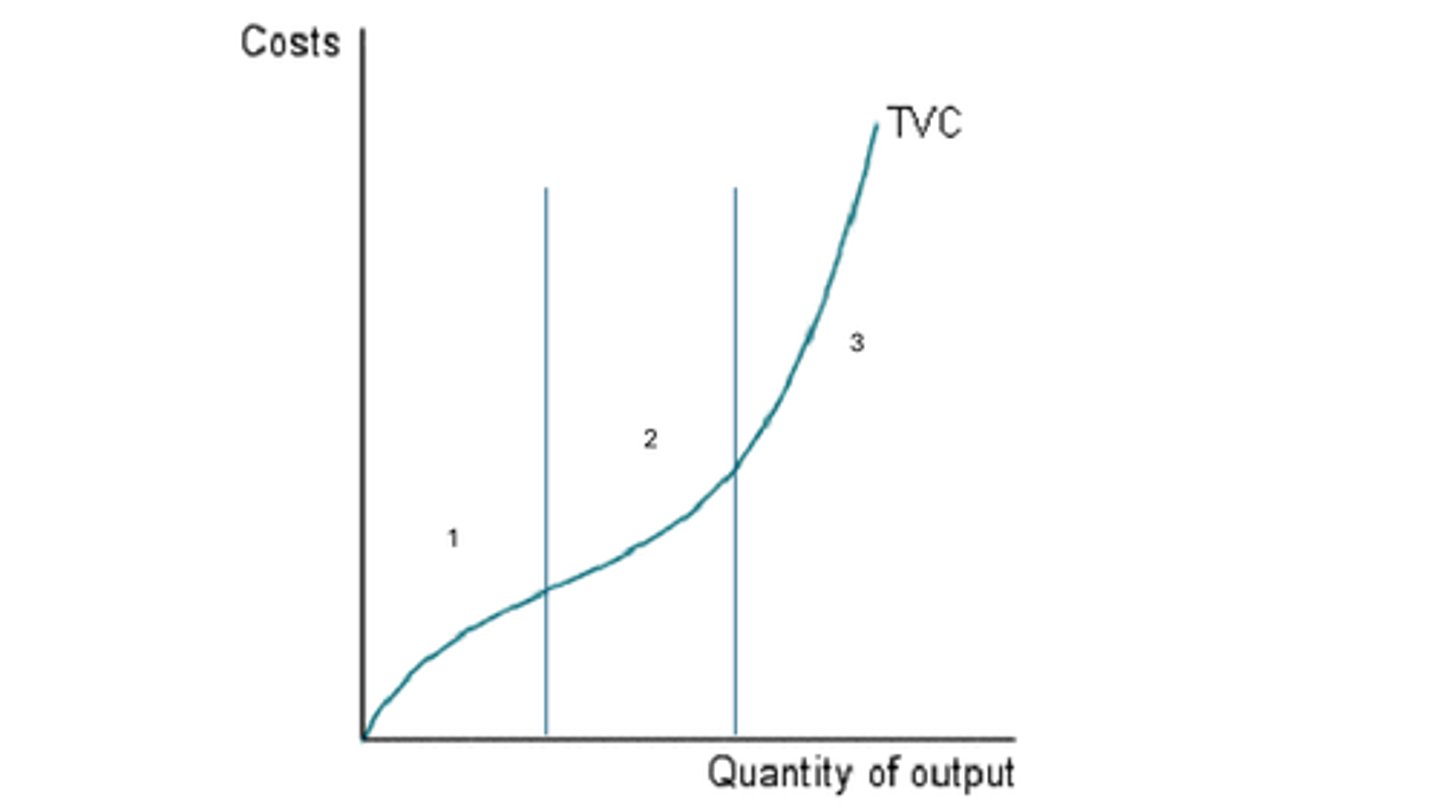

what does the total variable cost curve look like?

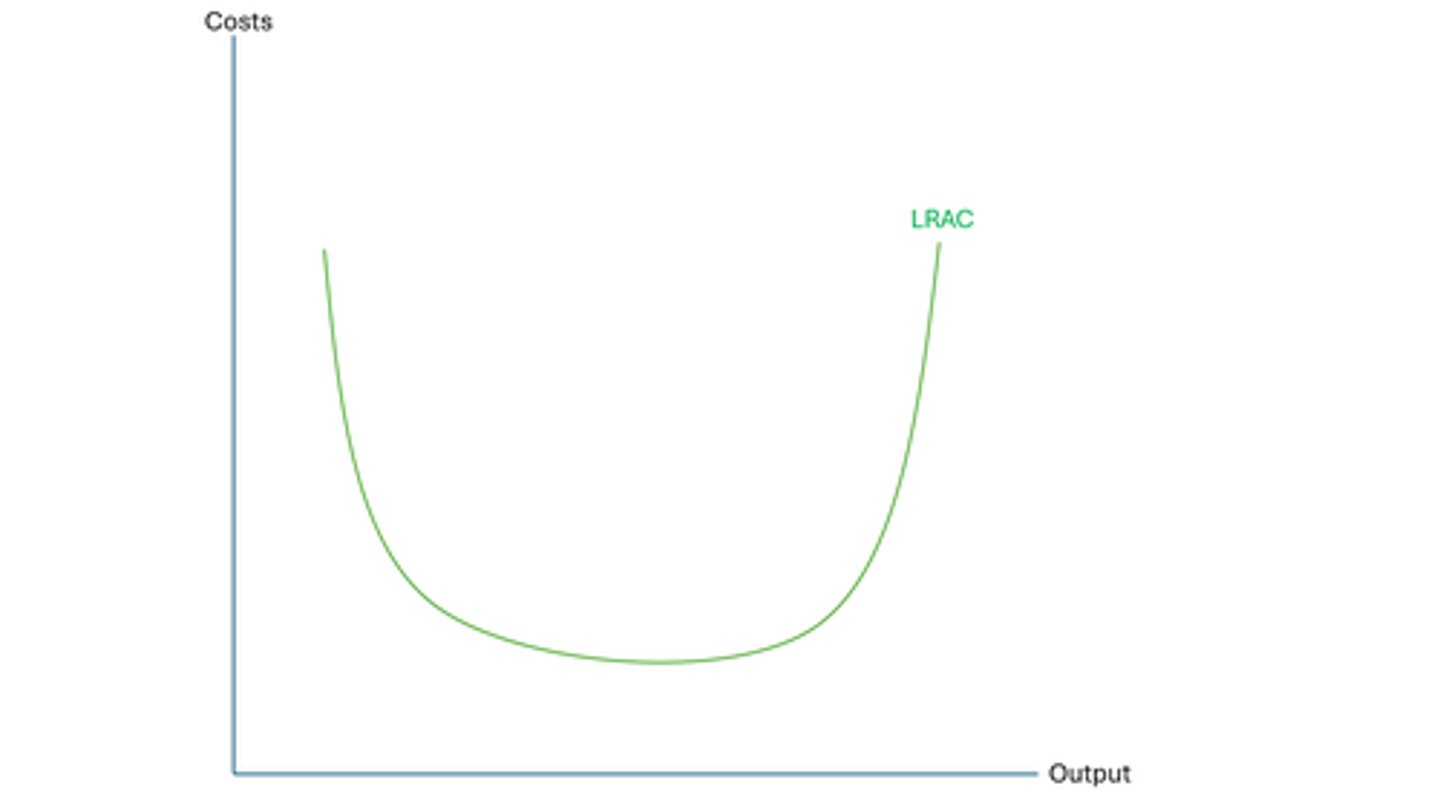

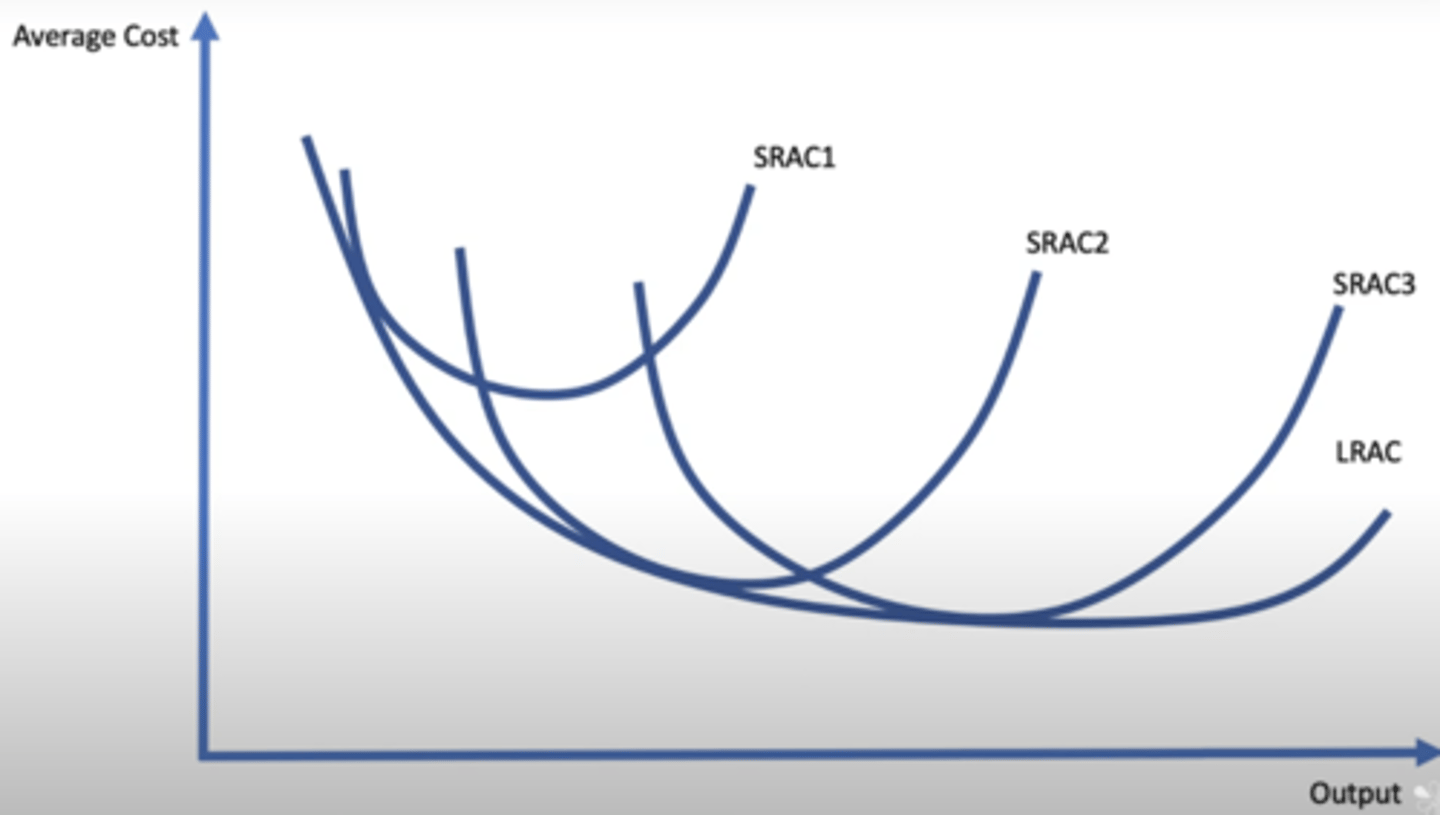

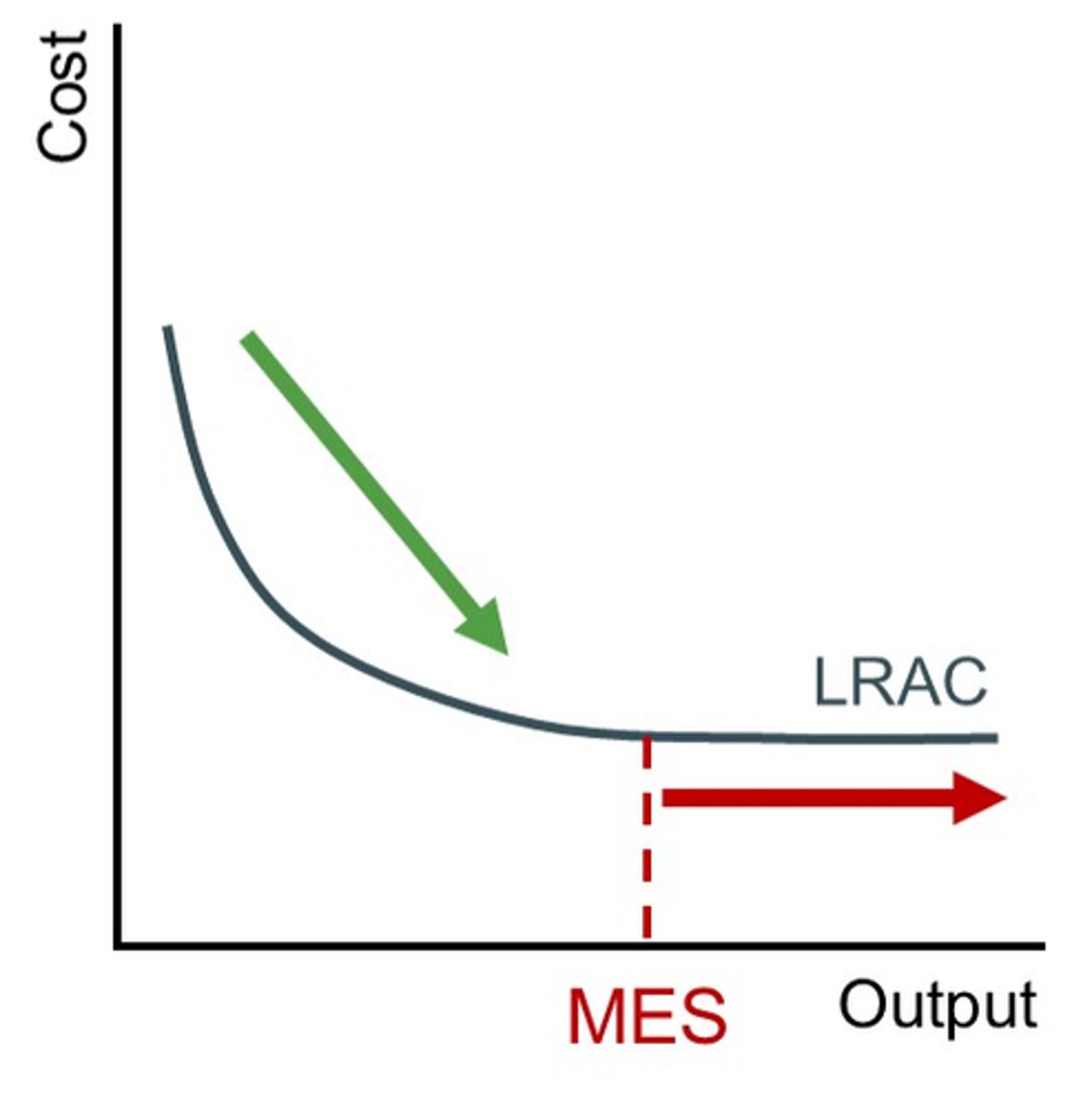

what does the LRAC curve look like?

- if you think about it the long-run costs of lots of short runs

- initially, a business is confined by fixed factors of production

- eventually they can increase their factors of production

- but then they're confined again by new fixed factors of production

- if we join up all the different SRAC curves, we end up with one LRAC curve

what happens in stage 1 of the total variable cost curve?

- lets assume that the only variable cost in the short-run is wages

- we know that the law of diminishing returns states that in the SR, when we add a variable factor of production which is labour to a stock of fixed factors of production, initially total output will start to rise and then it'll fall

- initially in stage 1, we hire some workers, so the variable costs in terms of wages that we pay are quite high

- it takes a certain amount of wages to pay those workers that we've hired

what happens in stage 2 of the total variable cost curve?

- but in stage 2, those workers are so productive that you don't need to increase wages by that much to get a much greater increase in output

- so when the curve becomes slightly more horizontal, that's the productivity gains that we are seeing

- as output is increasing much greater than the costs of those wages

- because initially there is under utilised capital and there are specialisation gains to be made by adding more workers into the production process

what happens in stage 3 of the total variable cost curve?

- however, when we get to stage 3, we start to increase workers but are seeing diminishing returns to the each extra unit of labour added

- there's an over utilisation of our capital

- the fixed factors of production i.e. land and capital become a constraint on our production process and their productivity falls

- so costs begin to increase quicker than output

so overall whats happening?

- initially, we're seeing increasing returns to labour

- then the law of diminishing returns kicks in

- and we start to see decreasing returns to labour

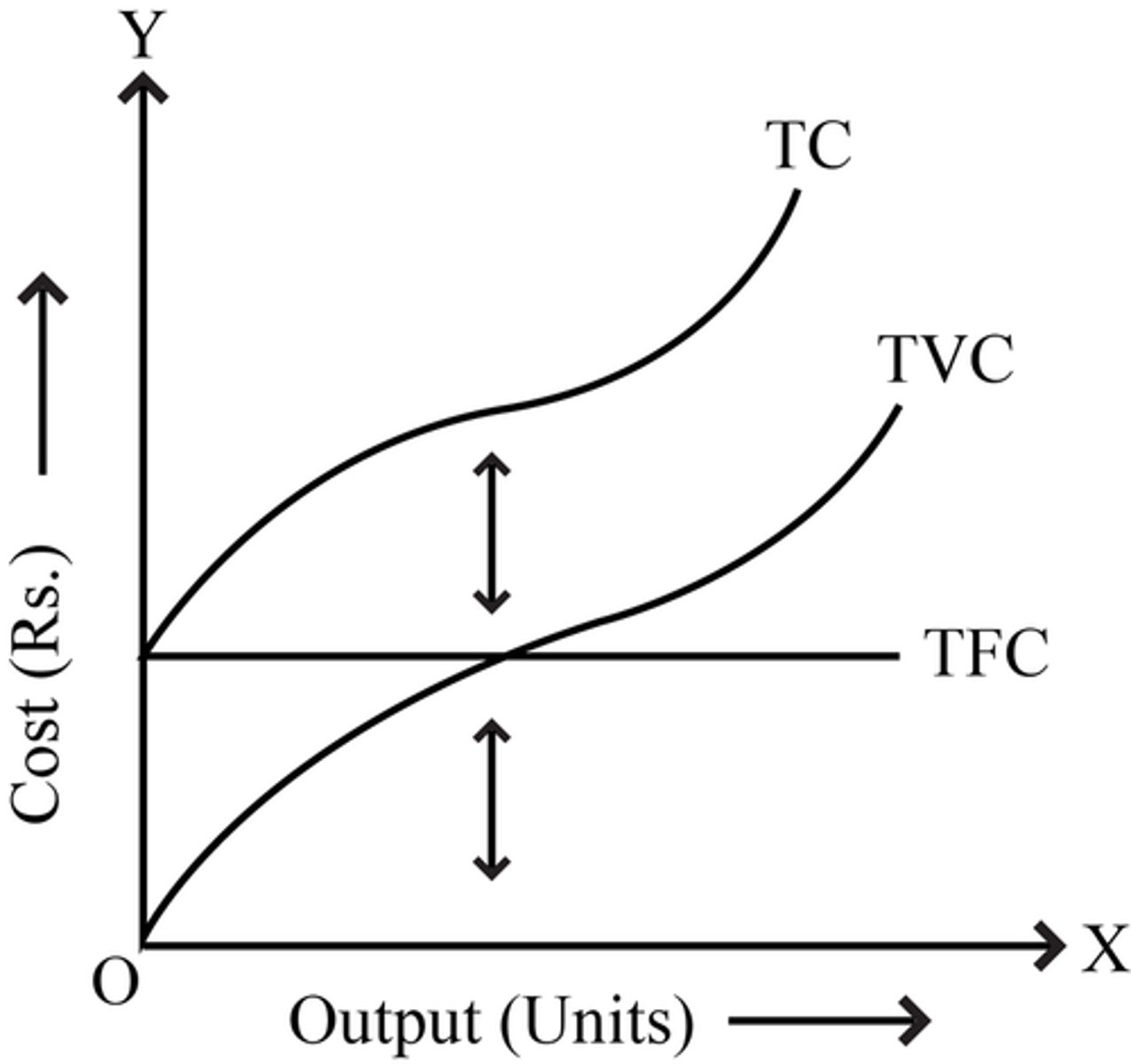

what does the total cost curve look like?

- total costs = total fixed costs + total variable costs

- if total fixed costs are constant regardless of output

- then the total cost curve will look exactly like the total variable cost curve but just a bit higher

- it will have to start at the total fixed cost point as when output is 0, the only cost is the fixed costs

- the vertical distance between the two curves represents the total fixed costs

what are short-run costs?

- in the short run, costs are divided into two categories

- variable costs and fixed costs

- fixed costs remain constant in the short run because the firm cannot change its fixed inputs

what are long-run costs?

- in the long run, all costs are variable because a firm can adjust its production capacity and all inputs can be modified

- this means that both variable costs and fixed costs can change in response to changes in production levels or the scale of operations

where does the LRAC curve come from?

- the LRAC curve is derived from lots of SRAC curves shifting outwards

- each SRAC is associated with a given scale/size of the company

- they can operate with an AC curve of ASRC1 in the short-run, but they might be able to scale up production and move on to SRAC2 e.g. by adding more labour, land

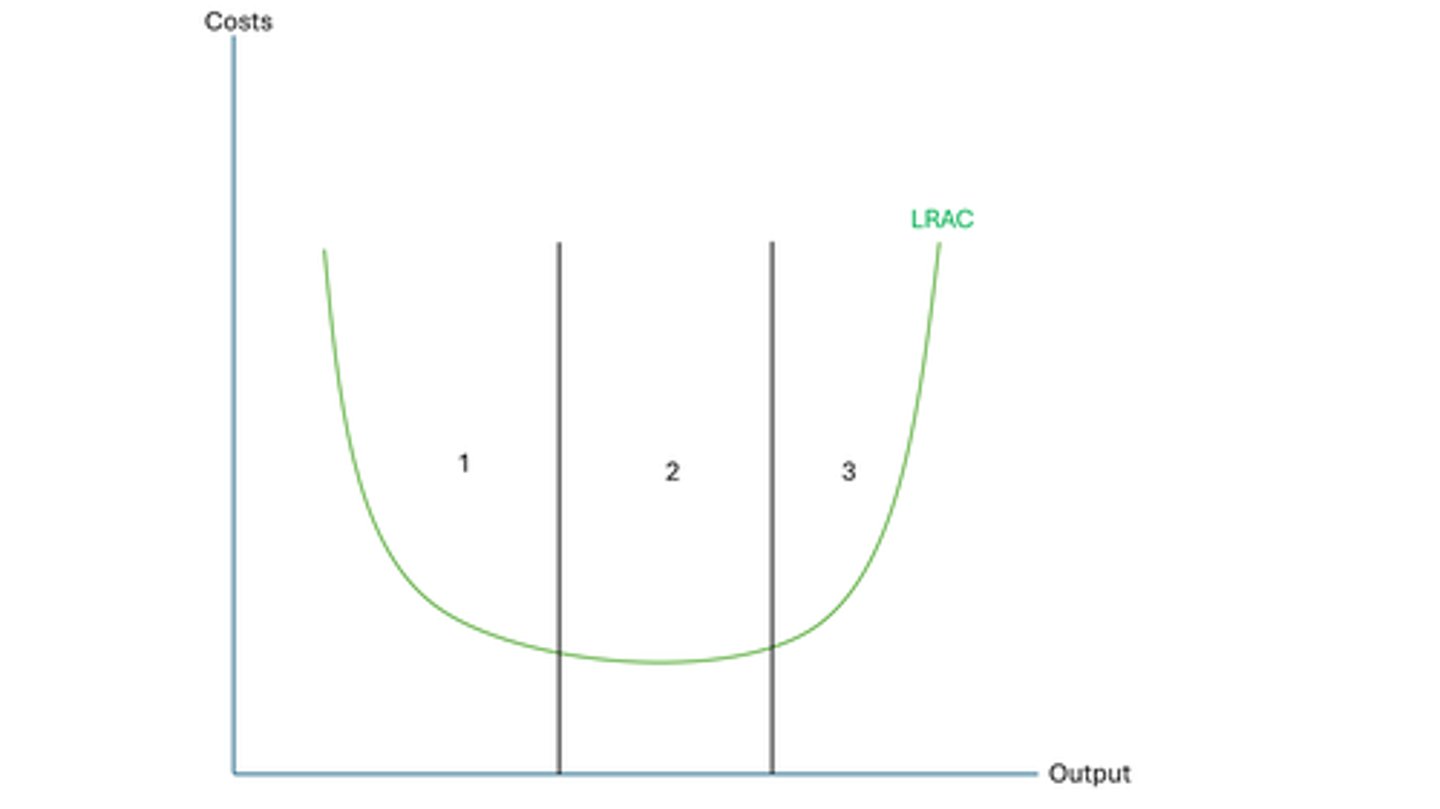

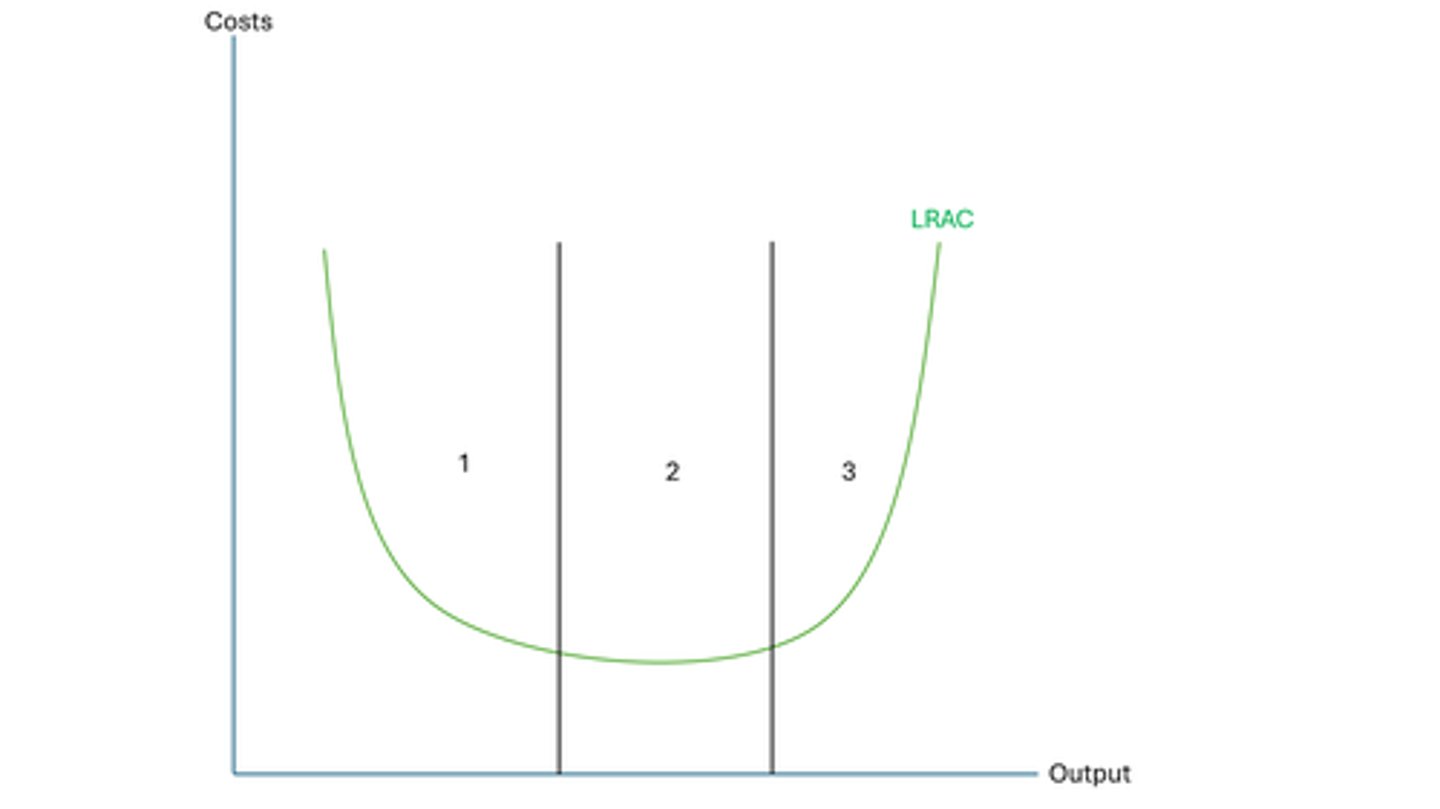

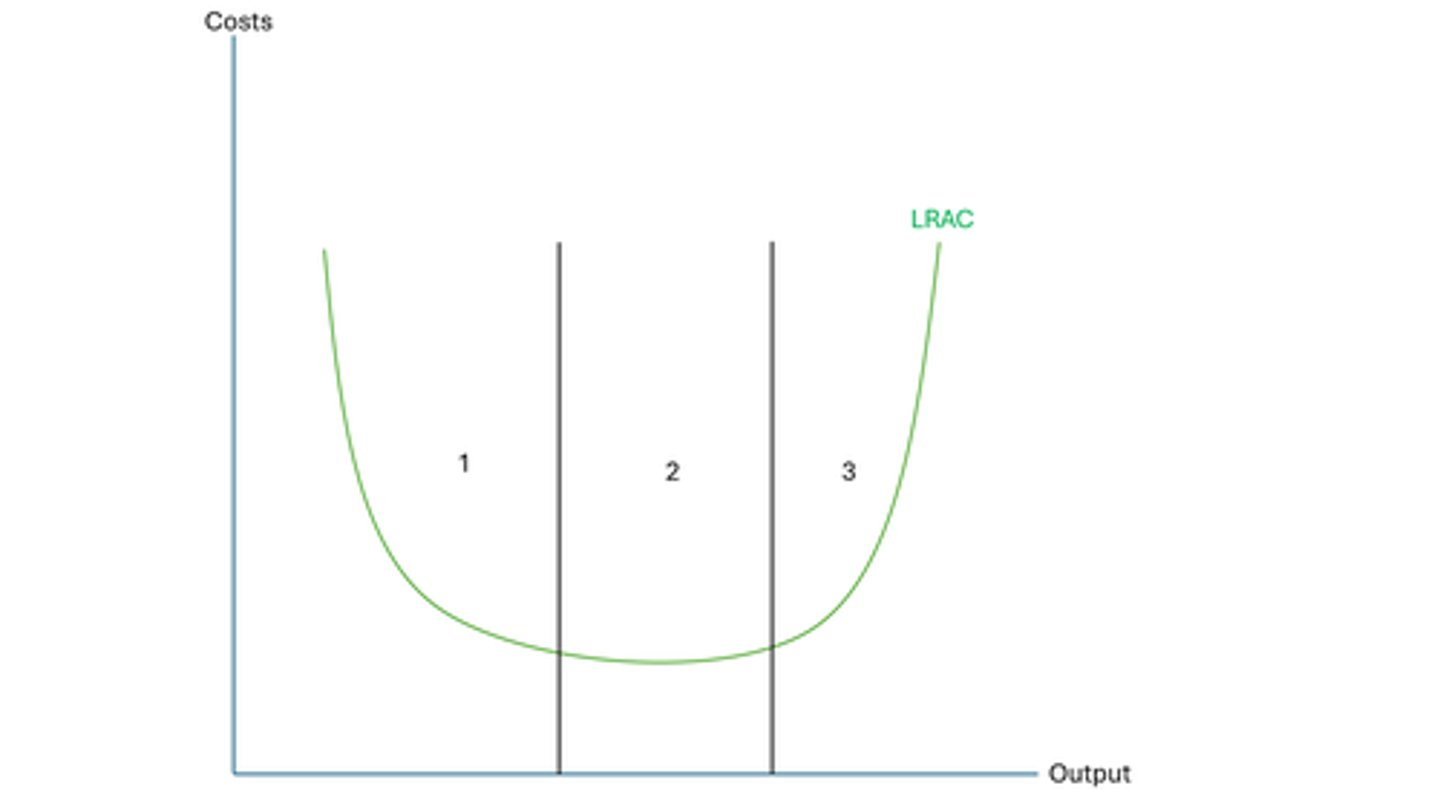

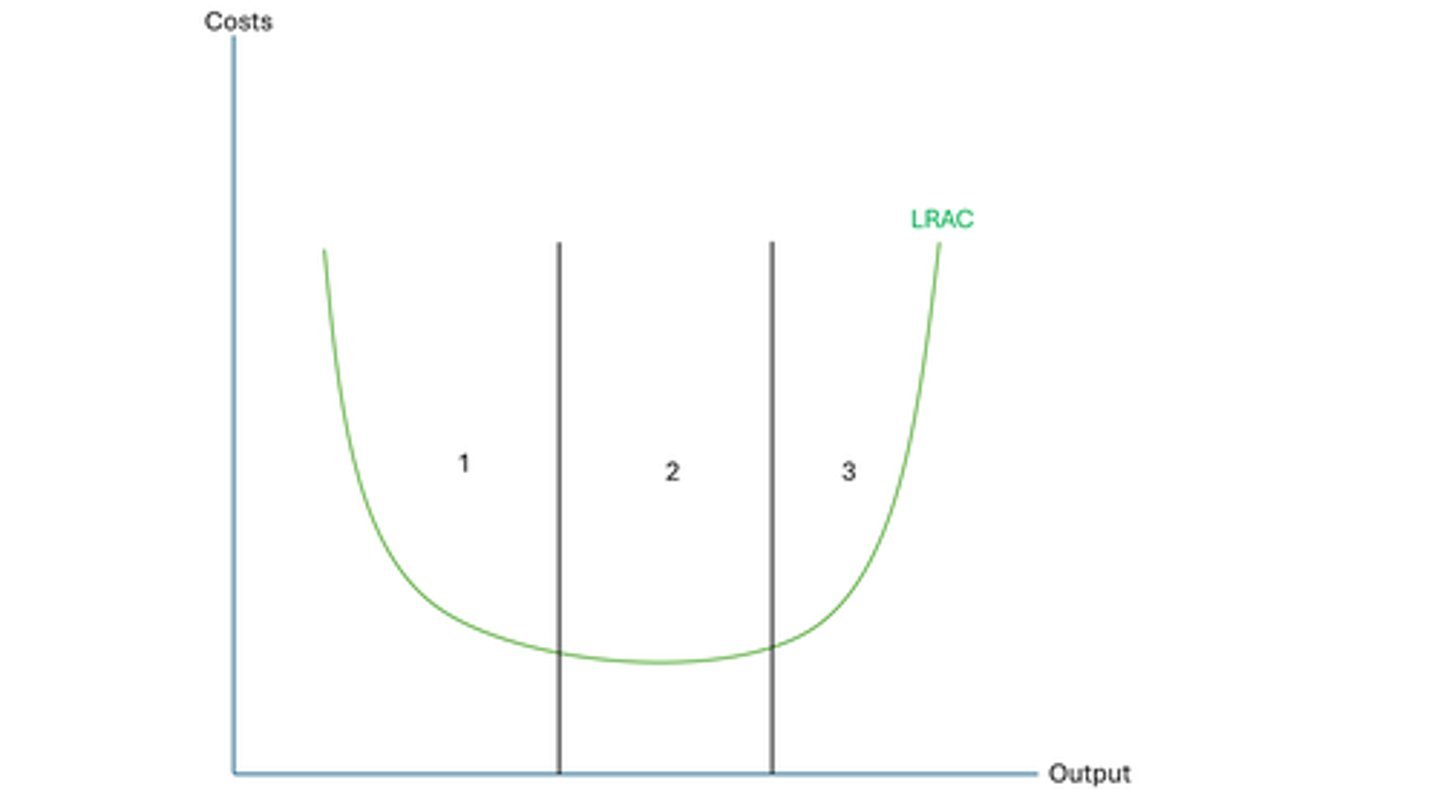

how can this LRAC be split up?

what's happening in stage 1?

- the firm is benefitting from increasing returns to scale

- this occurs when the % change in inputs is less than the % change of outputs

- so when a business is increasing their factors of production, they're getting more out than they are putting in

- so yes costs are rising but output is rising faster and therefore average costs are decreasing

what's happening in stage 2?

- there are constant returns to scale

- this is when the % change in output = % change in input

- therefore average costs are flat and constant

what's happening in stage 3?

- there are decreasing returns to scale

- this is when the % change in inputs is greater than the % change in outputs

- so when a business is increasing their factors of production, costs are rising, but they're getting less output in return

- so quantity is rising but less than the rise in costs

- so average costs are rising

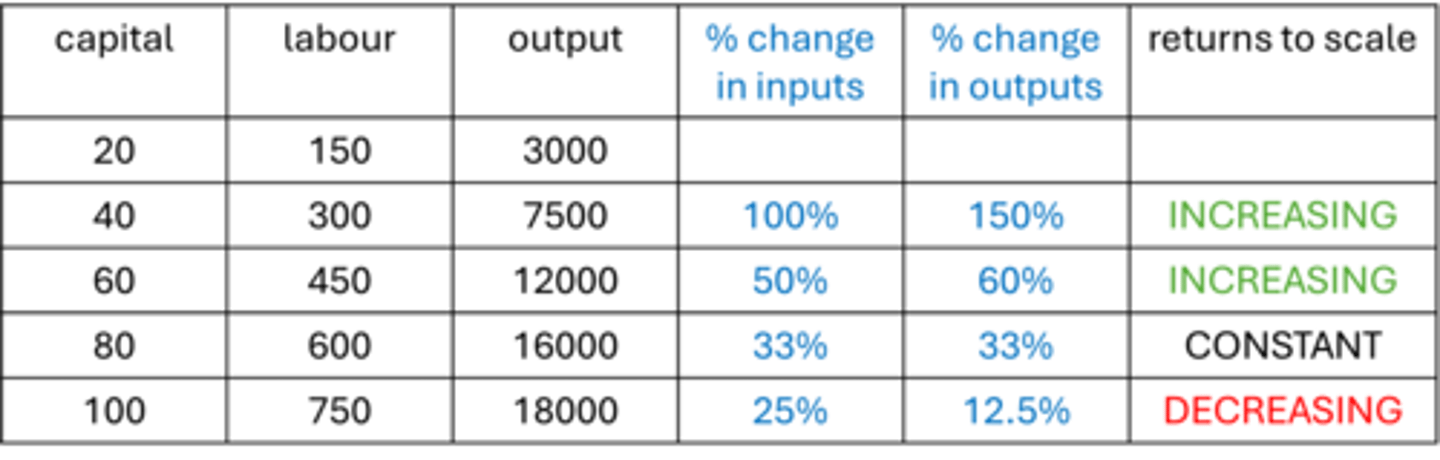

how can you show returns to scale numerically?

- as we go from 170 inputs to 340 inputs, that's a 100% input change

- however with outputs, from 3000 to 7500 outputs, that's a 150% change in outputs

- therefore, the % change in outputs is greater than the % change in inputs so there's increasing returns to scale

- same for the next one

- in the third one the two are equal, so there's constant returns to scale

- for the last one, the % change in output is smaller than the % change in input, so there's decreasing returns to scale

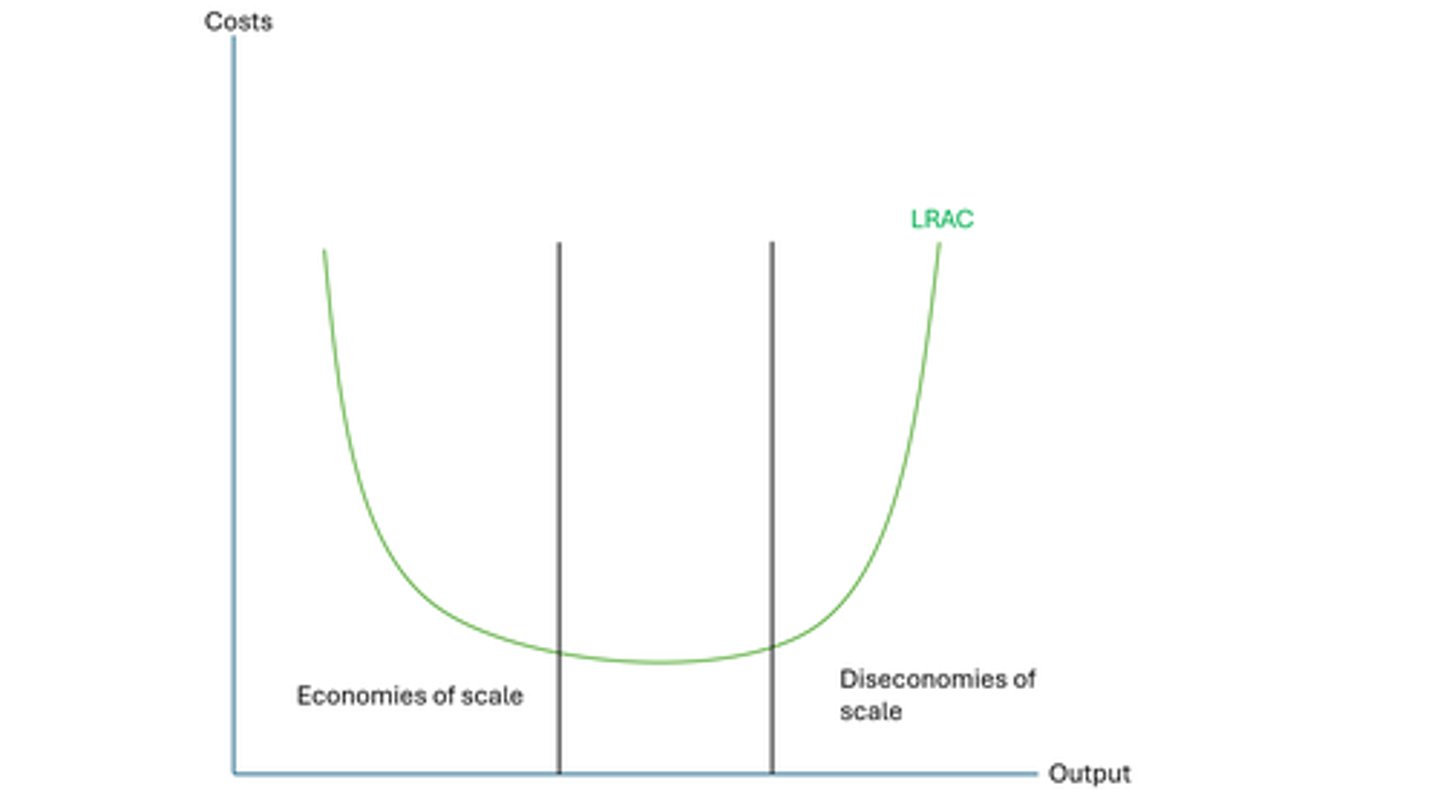

so why can firms experience increasing/decreasing returns to scale?

- economies and diseconomies of scale

- if a business experiences economies of scale, they can experience increasing returns to scale

- if a business experiences diseconomies of scale, they can experience decreasing returns to scale

what are economies of scale?

- a reduction LRAC as output increases

what are the two groups of economies of scale?

- internal economies of scale

- external economies of scale

what are internal economies of scale?

- internal economies of scale are the cost advantages a firm can achieve as a result of its own growth and expansion

- these cost reductions are generated from within the firm itself

- mainly by optimising its production processes and utilizing its resources more efficiently

what are the different types of internal economies of scale?

- risk bearing

- financial

- managerial

- technical

- marketing

- purchasing

- AC = TC / quantity

- in each of these cases total cost will be rising, but quantity will be rising faster, hence decreasing long-run average costs

what are managerial economies of scale?

- as a firm gets larger they can employ specialist managers

- these managers can mange the productivity of the workforce and boost it

- additionally, they bring in their specialist skills as managers which also helps to boost productivity

what are technical economies of scale?

- bringing in specialist machinery as the firm gets larger

- this specialist machinery can boost productivity

- this could be as the firm is using their factory more efficiently

- or this could be employing more workers as the firm gets larger and then making them specialise

- so yes costs will rise but productivity will rise as well, so quantity will rise faster, hence reducing average costs

what are purchasing economies of scale?

- as a firms grow they're able to buy their raw materials in bulk

- clearly as the firms grows they're going to have to buy lots of raw materials

- and when they buy in bulk they can negotiate unit discounts

who can benefit from purchasing economies of scale?

- supermarkets can benefit from economies of scale because they can buy food in bulk and get lower average costs

- if you had a delivery of just 100 cartons of milk the average cost is quite high

- the marginal cost of delivering 10,000 cartons is quite low

- you still need to pay only one driver; the fuel costs will be similar

- you may need a bigger van, but the average cost of transporting 10,000 is going to be a lot less than transporting 100.

what are marketing economies of scale?

- larger firms can divide their marketing budgets across larger outputs

- so the average cost of advertising per unit is less than that of a smaller firm

- if you spend £100 on a national tv advertising campaign, it is only worthwhile if you are a big national company like starbucks or coca-cola

- if your output is small, the average cost of the advertising is much higher.

what are financial economies of scale?

- as a business gets larger, they can negotiate lower rates of interest when they get a loan from the bank

- this is because the firm is reputable and profitable

- they are a proven success

- so when they go the bank and get a loan, the bank sees them as a lower risk so they are able to get lower IR

- so, costs are rising, but they'll be able to be spread over a larger range of output

what are risk bearing economies of scale?

- risk is a cost to firms, it will be priced for

- but as a business gets larger and larger, they can spread their risk, which is their opportunity cost, over a larger output

who benefits from risk-bearing economies of scale?

- to develop new drugs to treat illness takes considerable degrees of investment and research with no guarantee of success

- therefore this can only be undertaken by pharmaceutical companies with significant resources

- major pharmaceuticals companies, such as Novartis, Pfizer Inc and GlaxoSmithKline Plc all undertake significant research in developing new drugs

what is containerisation?

- containerisation is a standardised transport system using steel containers for easy transfer between ships, lorries, and trains

- the container principle is when increasing surface area increases volume more than proportionally, larger containers maximised this principle, allowing more goods per shipment

- universal container sizes eased compatibility with lorries, forklifts, and other transport systems

- these encouraged larger container ships = reduced shipping costs = economies of scale

- they facilitated globalisation by improving trade efficiency

- this is significant as it shows how a very low-tech innovation comes with major global trade benefits

how is tap water an example of an economy of scale?

- to produce tap water, water companies had to invest in a huge network of water pipes stretching throughout the country

- the fixed cost of this investment is very high

- however, since they distribute water to over 25 million households, it brings the average cost down

- but would it be worth another water company building another network of water pipes to compete with the existing company?

-no, because if they only got a small share of the market, the average cost would be very high and they would go out of business

what are external economies of scale?

- when the growth and expansion of an entire industry/ cluster of firms in the same geographical area means they benefit from lower long-run average costs

- these cost reductions are external to individual firms and benefit all firms in the industry

how could external economies of scale occur due to transport?

- better transport infrastructure, e.g. new roads, airports or railway lines built near the business

- this reduces costs as a business as it's cheaper to transport goods and also to access raw materials

- so in this case total costs will decrease, making average costs lower

how could external economies of scale occur due to suppliers?

- if there's a huge firm/ cluster of firms e.g. hollywood

- then it's in the interest of suppliers to move closer to you

- and if that's the case then it cuts down costs of transporting these components/raw materials

- so total costs will decrease here as well

how could external economies of scale occur due to R&D?

- R&D firms could move closer

- seeing that you're a key business for them

- if they move closer, you can use that R&D to improve technology

- and reduce costs as a result of that

what are diseconomies of scale?

- an increase in LRAC as output increases

why do diseconomies of scale occur?

- all these diseconomies of scale have impacts on productivity

- this means total costs will rise faster than quantity

- this is due to control, communication co-ordination and motivation

how could diseconomies of scale occur due to control?

- as a business gets larger, it becomes much more difficult for managers to control the workforce

- if workers know that managers aren't really looking at what they're doing, they'll slack off more

- this will impact productivity

- so quantity suffers, and total costs rise faster than quantity does

how could diseconomies of scale occur due to communication?

- it's much harder to spread messages through the business

- could be from the top, from CEOs down to directors to workers on the shop floor

- or maybe workers have great ideas on how to improve the efficiency of the business but they can't spread that message quickly to those at the top

- therefore it takes time and effort, all the time it takes to spread messages or the messages that aren't clear

- this wasted time impacts productivity so costs will rise faster than quantity, increasing average costs

how could diseconomies of scale occur due to co-ordination?

- coordinating different parts of the business becomes much more difficult as you get larger

- so to ensure all different departments behave in the same way and work alongside each other becomes very difficult

- this means productivity suffers

- so costs will rise faster than quantity

how could diseconomies of scale occur due to motivation?

- as a business gets larger and there are more workers

- each individual worker will feel less and less valued as they feel more insignificant and easily replaced

- if that's how you feel as a worker, it will hit your motivation and productivity

- therefore costs will be rising much faster than quantity

how do internal an external economies of scale change the LRAC curve differently?

- internal economies of scale cause a movement down the LRAC curve for a business

- external economies of scale cause a downwards shift in the LRAC curve as they tend to reduce costs at all levels of output

what is the minimum efficient scale (MES)?

- the long-run scale of output where internal economies of scale have been fully exploited

- it's when the firm has benefitted from all the economies of scale available to it

- in other words, it's when increasing returns turn to constant returns and the average cost in the long-run reaches a minimum point

why does the MES vary by industry?

- in some industries, fixed costs are very high and marginal costs are low, the cost of setting up the business is particularly high. but the cost of selling to an extra consumer is low. this high ratio of fixed to marginal costs means that increasing the scale of production will reduce the average cost as the overheads are being spread out over a much larger range of output

- this means that some industries develop a natural monopoly

- so it's an industry where the average cost in the long-run keeps on falling over a very long range of production

- whereas in other industries, there are some scale economies but they're not significant

- the advantages of being large relative to competitors are fairly low

- and you can the reach the MES at a lower level of output

what's the relevance of MES and digital tech companies?

- the GAFAM companies (google, apple, facebook, amazon and microsoft) have values of trillions combined

- GAFAM firms have high fixed costs and low marginal costs, they invest heavily in infrastructure, research, and development e.g. software development but once established, the marginal cost of serving additional users is minimal e.g. cloud usage

- therefore, they have a large MES, these firms operate in industries where MES is achieved only at a very large scale due to the substantial fixed costs.

- so GAFAM businesses benefit from network effects—where the value of a service increases as more users join (e.g., Facebook's social network, Microsoft's software ecosystems).

what's the relevance of MES and air bnb?

- Aribnb has an asset-light model, unlike traditional hospitality businesses, Airbnb doesn't own physical assets like hotels and instead, it uses an online platform to connect property owners and renters

- so its MES is relatively low compared to traditional hotel chains because fixed costs are minimal, and scalability is tied to technology

- Airbnb's asset-light model allows it to achieve MES at a lower cost and faster pace than traditional businesses in the accommodation sector and hence it has scaled massively and is making a big dent in the hotel industry in the USA

what's the significance of the MES?

- the size of the MES relative to the size of the market is the crucial idea

- it indicates how many firms (operating at scale) that an industry can support

- if MES is at 30% of the market, then up to 3 firms could possibly reach MES, so it's a highly concentrated market

- if MES is very low at 2%, up to 50 firms can reach MES which is closer to perfect competition

- if MES is very high, at 80%, then it's a natural monopoly as only one firm can fully exploit internal economies of scale

what are the key evaluation points of MES?

- MES can change with technological advances, in many digital markets and online suppliers, lots of firms can very quickly set up online so you can scale particularly quickly

- MES is unlikely to be a single output, instead a range of production in which the cost per unit is constant

- it depends on how you define the market, if we talk about airbus and boeing, then the global market is particularly important or are we talking about the regional market for e.g. insurance in the european market or a national market of train services?

- even in a world of scale, small businesses can and do prosper particularly if they target a niche element of the larger market

what's an example of a successful business that didn't need to 'hyper-scale'

- aldi

- aldi has become very successful in the UK recently, and is on track to become the third biggest UKS supermarket

- but aldi has chosen mid-range stores and only stocks around 1,400 items compared to 40,000 at traditional supermarkets

- and they've found many ways to reduce costs by operating at store level on a lower, smaller scale than the big hyper markets

what is revenue?

the money made by sales by a business

what is total revenue?

price x quantity

what is average revenue?

total revenue / quantity

what is average revenue also equal to?

- average revenue is just the price

- as the amount a business receives from a good will be the same as the price they charge for it

what is marginal revenue?

- marginal just means extra

- so the extra revenue generated when we sell more output

- MR = change in total revenue / change in output

what are the characteristics of perfect competition?

- many buyers and sellers

- homogeneous (identical) goods and services

- firms are price takers, so they have no ability to set their price

- no barriers to entry and exit, so free movement in and out of the market

- perfect information

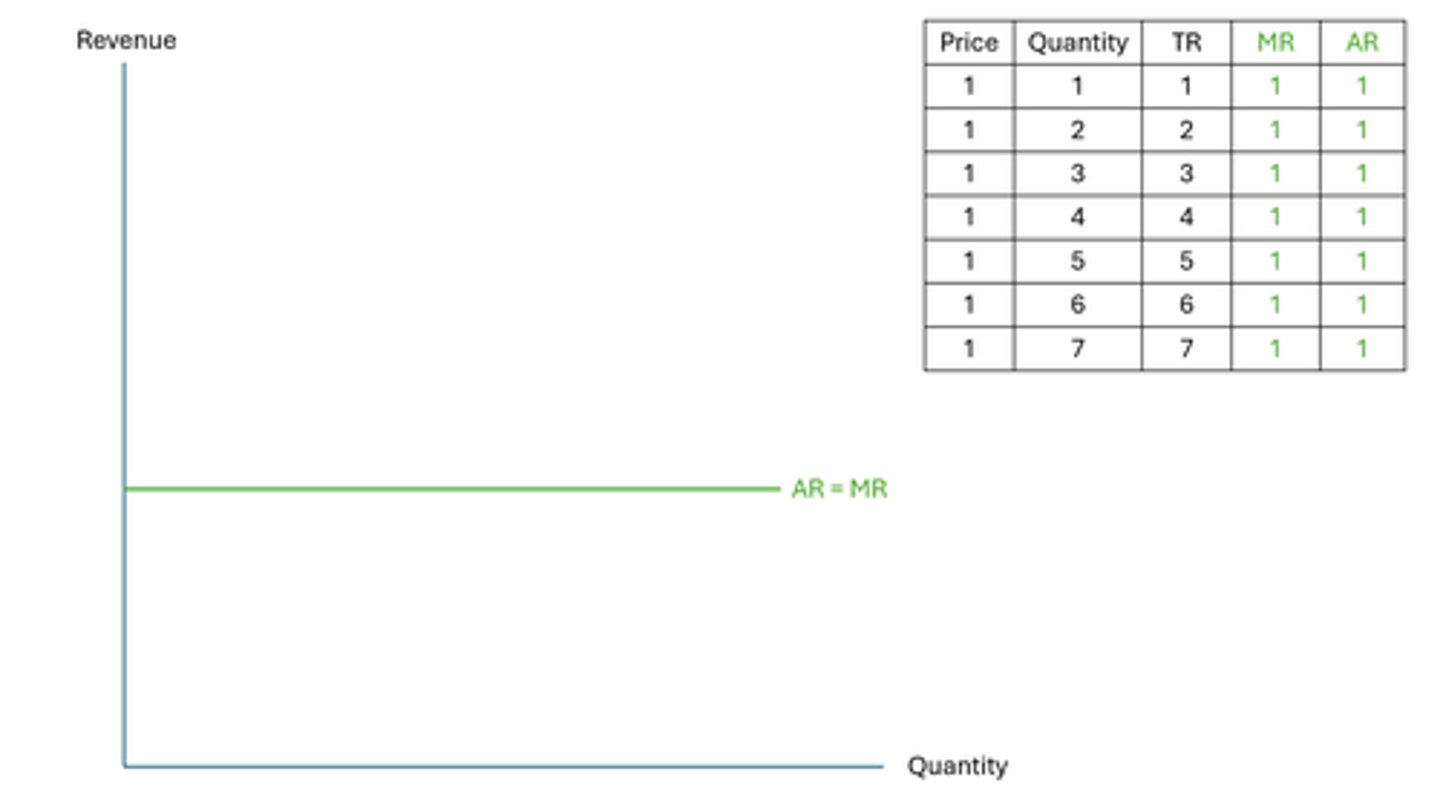

what will price and quantity look like for firms with perfect competition?

- firms are price takers

- so regardless of the number of units they're selling, they're always going to be selling them at the same price

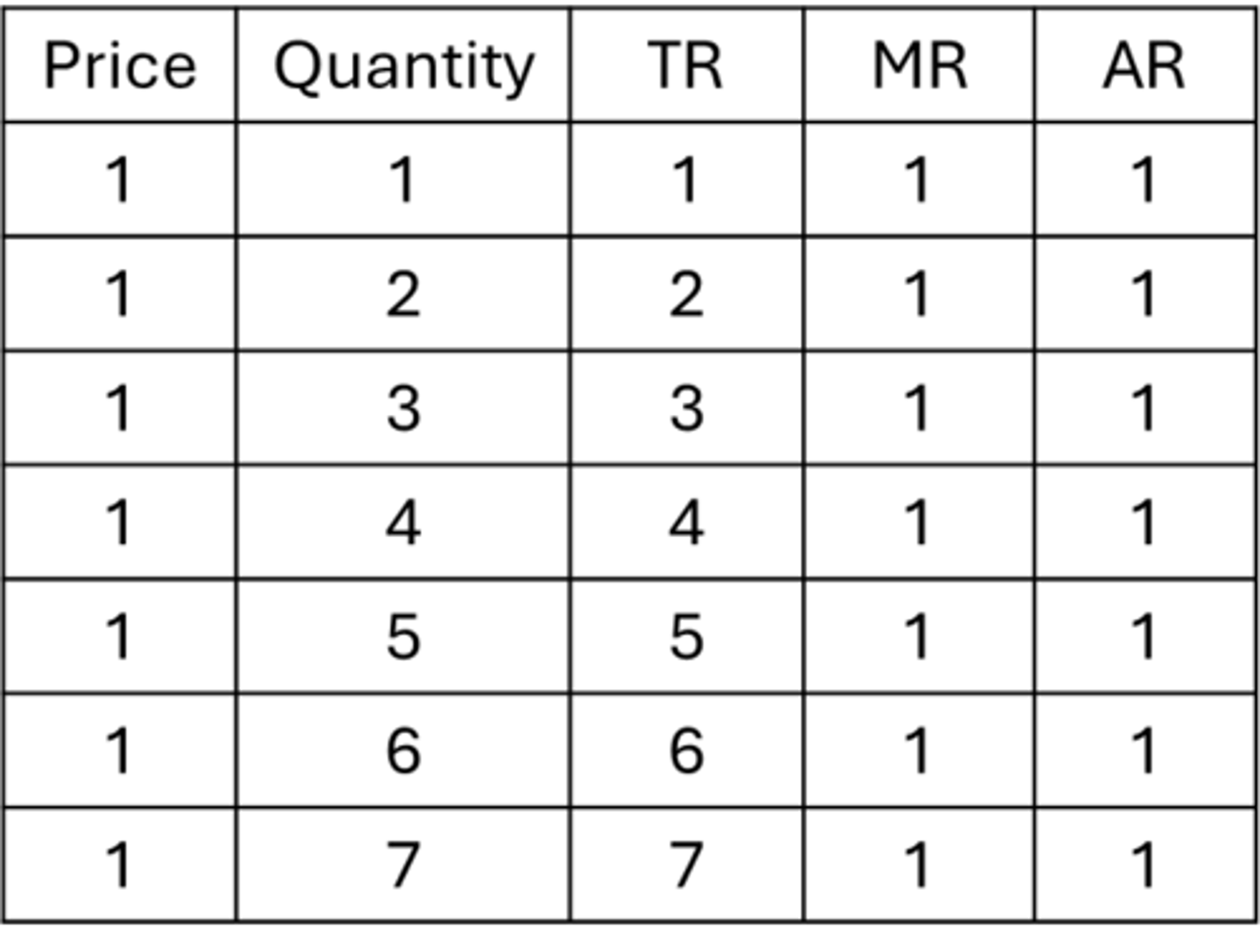

what will TR, MR and AR look like for this?

- marginal revenue is just the extra revenue we gain when we sell one more output

- in this case as we sell one more, we got £1 extra revenue

- AR is also £1 as we're selling them for £1

what does AR and MR look like on a diagram?

- we can see AR and MR are the same, and they are constant over a range of quantity