Naked forex

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

54 Terms

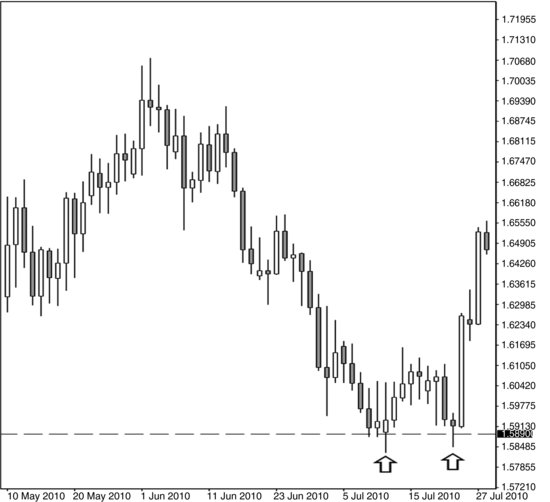

Double Bottom

A price pattern characterized by two touches from above on a zone.

Double top

A price pattern characterized by two touches from below on a zone.

Wammie

The market touches a support twice but the second touch is a higher low.

How many minimum candles for a wammie or moolah to be validated?

6

Moolah

The market touches resistance twice but the second double top is a lower higher.

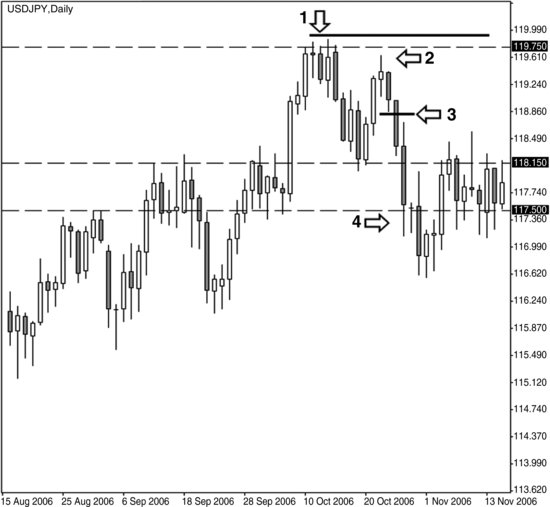

Consolidation zone

Box that shows S&R in a choppy market.

Breakout trade

Once the market breaks out beyond a zone, a trade is triggered.

The Fake-Out

A candle outside of the box where it fakes a trend but goes back into the box.

The retouch

The market trades beyond a zone before returning to the zone from the other side to confirm the importance of the zone.

The last kiss

When the market goes for one last retouch of the zone before trending.

When to trade last kiss?

There must be a large candle sticks to confirm the trend.

SL for the Last Kiss

((R - S )/2 )+S

When to exit a bad last kiss trade?

When the candlestick closes back inside the box

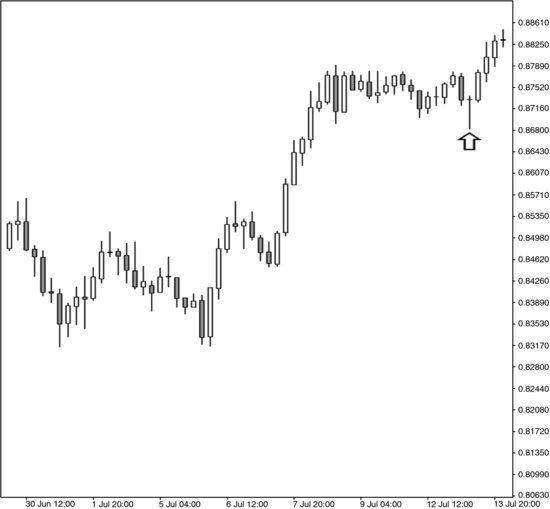

The Big Shadow

A big engulfing candle stick that signals a reversal

Big shadow SL

The stop loss is placed a few pips away.

Entering big shadow

Wait until it moves a few pips towards the expected direction.

Room to the left

In a big shadow you look too the left to see if there is any price movement at this area, to determine a reversal.

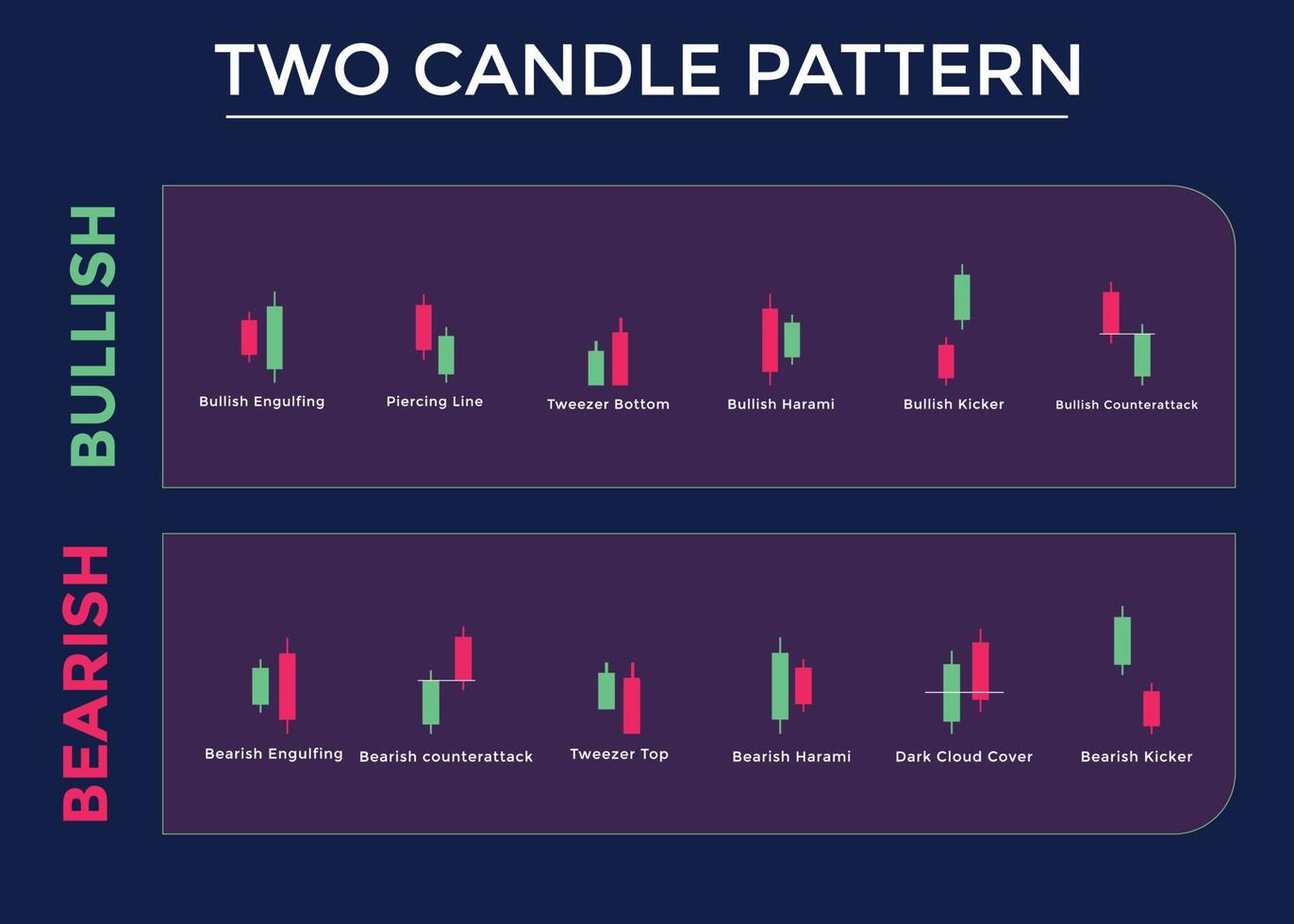

Two candle stick formation

A price pattern made up of two candlesticks.

Profiting from big shadow

Place the tp at the nearest zone.

Single candlestick formation

A price pattern made up of a single candlestick

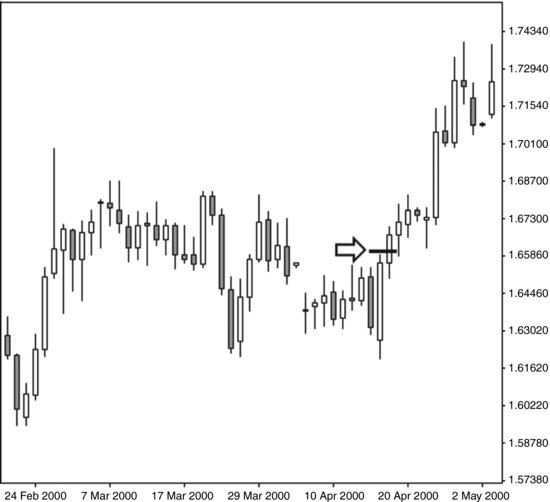

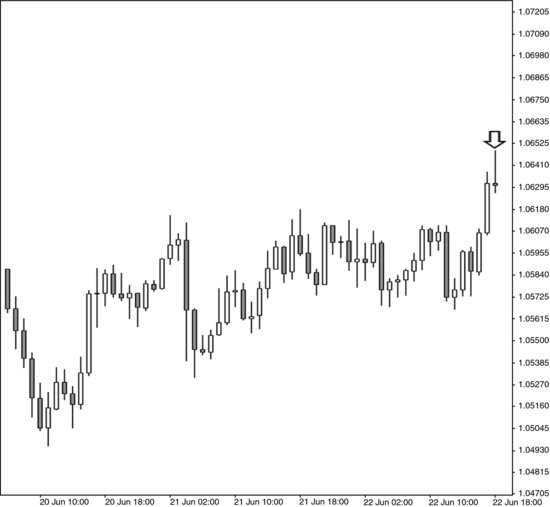

Kangaroo tail

A reversal signal where the tail is longer than the body.

Open and close of kangaroo tail

The open and close needs to be the bottom third of a candle.

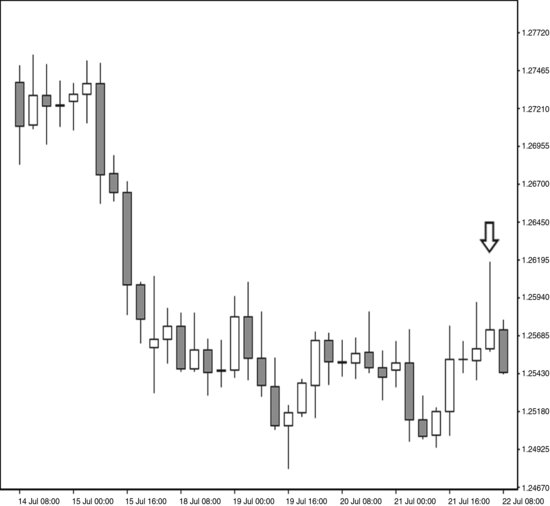

Is this a good kangaroo tail?

No

Is this a good kangaroo tail?

yes

Range

the distance in pips between the high and low of the candlestick.

Kangaroo tail placement

The kangaroo tail should be in the range of the previous candlestick

Is this kangaroo tail placement good?

no

Is this a good kangaroo tail?

no because of the previous large candlestick

Where to put sell stop for kangaroo tail?

Few pips away from the kangaroo body

SL for kangaroo tail

a few pips away from the tail

When is the big belt usually occur

Very first day of the trading week

Big belt

When the market gets overvalued so it starts to trend back to the regular zone.

Where to put sell stop or for big belt

A few pips below or above the big belt.

What time from should the big belt be at

daily

Where to put TP for big belt

Next zone

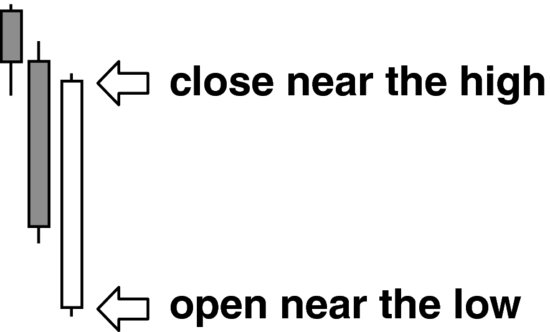

Should the bullish big belt open lower?

yes

What is this good for?

bullish big belts

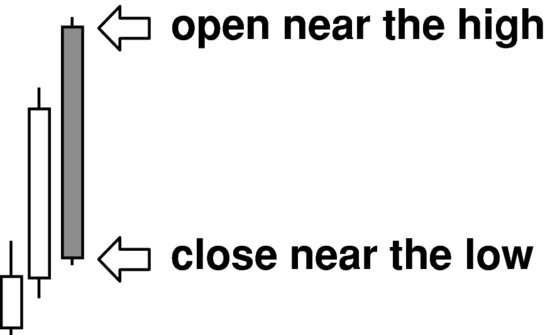

What is this good for?

Bearish big belts

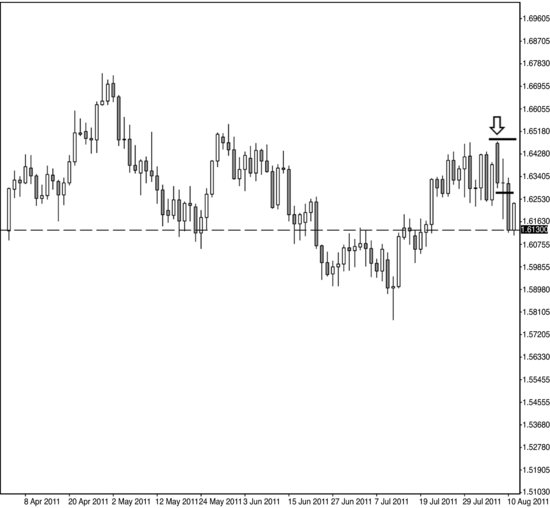

What is the issue for this big belt?

No room on the left

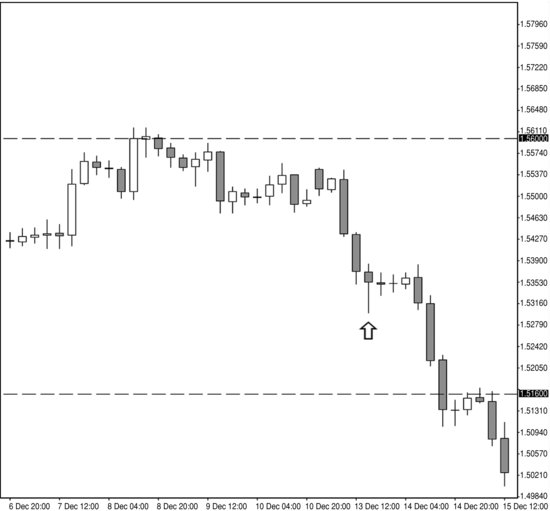

Resting spot

3-10 candles in a small consolidation box

Trendy kangaroo tail

A kangaroo tail that sticks out massively in a resting spot

Is this a good trendy kangaroo

yes because the tail is out of the resting zone.

Is this a good trendy kangaroo

No because it does not stick out of the consolidation range.

Is this a good trendy kangaroo?

No, because it was printed after a severe market correction.

Stage 1

Identify a trade opportunity and weight the risk and rewards.

Stage 2

Create a plan and follow that plan.

Stage 3

Enter the trade at the price you picked in your plan.

Stage 4

Manage the trade and adapt to new information.

Stage 5

Exit the trade and make money.

Stage 6

Learn from the trade and see if you need to improve.

Zone exit

Placing a tp a few pips near the zone.

Split exit

You half your position and give each one a different take profit of a few pips.

What type of exit is this?

Split exit

The cycle of doom

search, action, blame