Session #8 Notes - HSML 6209

1/91

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

92 Terms

Types of Costs

- Traceability

- Relation to activity

- Management Responsibility (or not)

- Relation to time

Traceability types

Direct + indirect

Relation to activity types

Variable + fixed + semi-fixed

Management responsibility types

Controllable + non-controllable

Relation to time types

Avoidable + sunk

Direct (traceability cost type)

Can be traced back to a specific department

Examples: lab salaries, lab office supplies, lab contracts (leases + depreciation expense)

Indirect (traceability cost type)

Cannot be traced back to a specific department

ALWAYS REQUIRES AN ALLOCATION METHODOLOGY

Examples: whole building depriet., shared costs (housekeeping), HR+marketing+legal

Allocation methodology examples

Housekeeping/environment services, utilities, lab space

Housekeeping/environment services are allocated by...

# of beds (or laundry by Ibs of linens)

Utilities & lab space are allocated by...

Square feet

Additional depts (HR, legal, marketing) are allocated by...

# of employees per dept

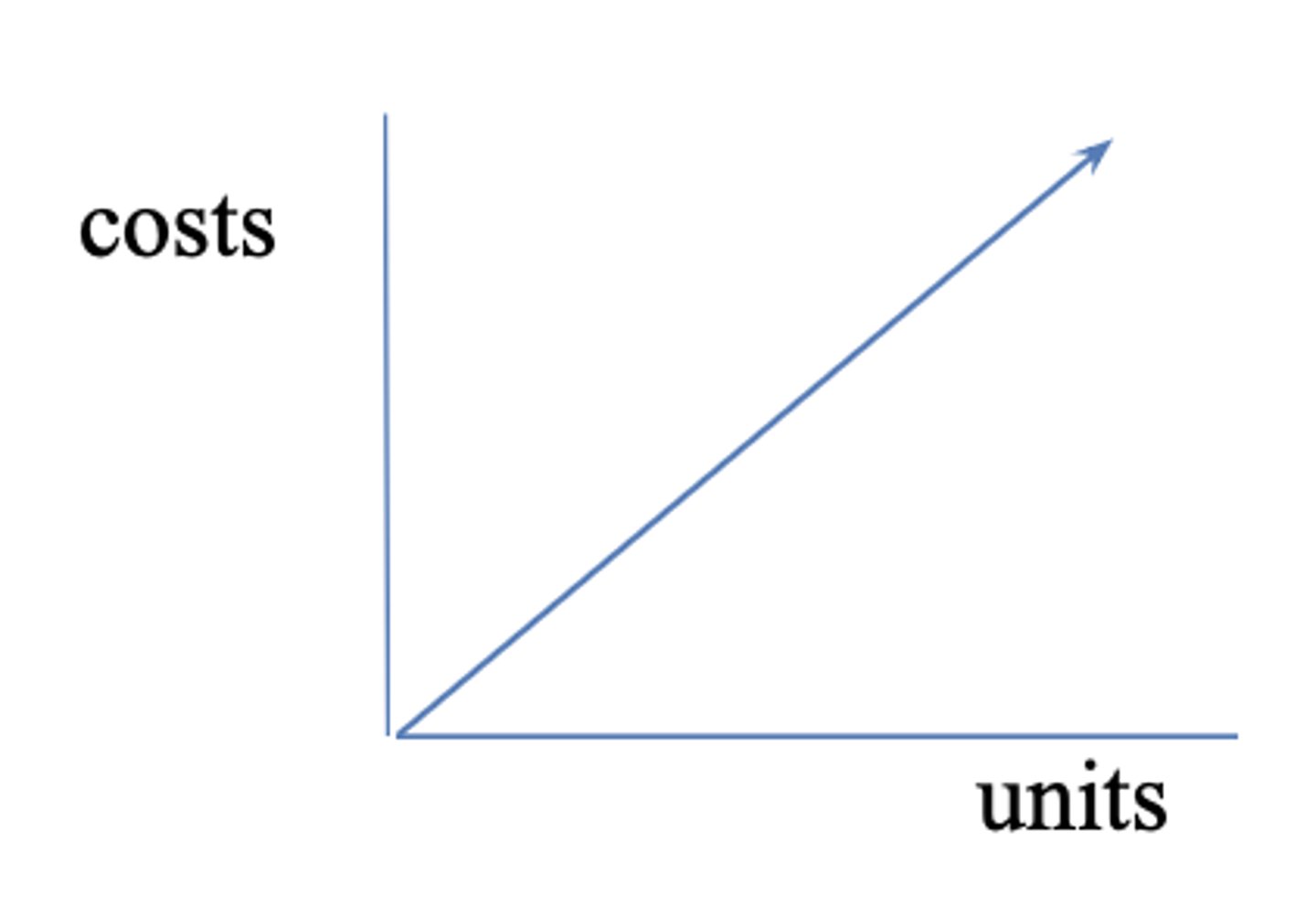

Variable (relation to activity cost type)

Changes PROPORTIONALLY according to change in volume

example: always supplies (every time you draw CBC, cost $2)

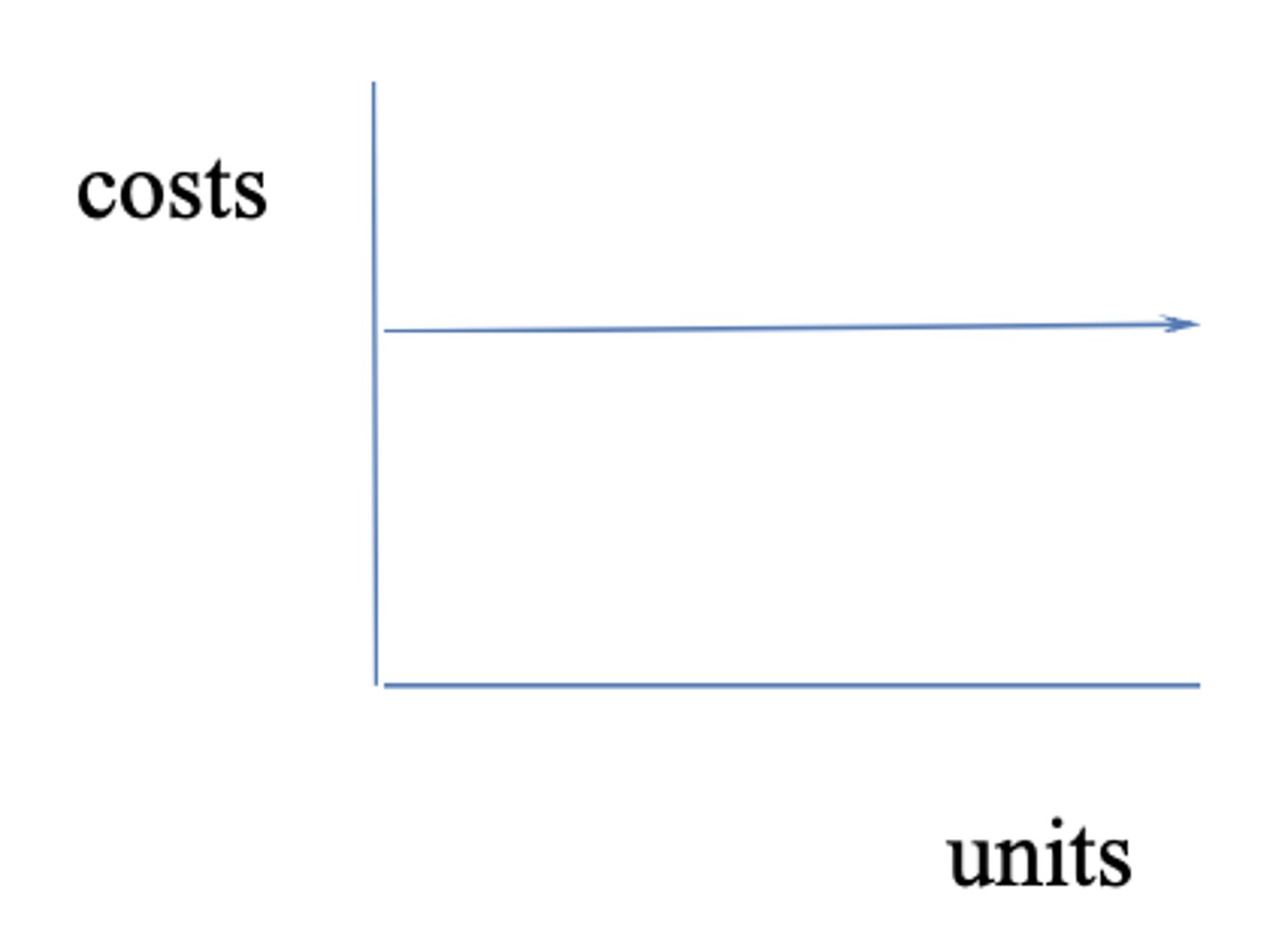

Fixed (relation to activity cost type)

DOES NOT change according to change in volume (no matter volume, cost never changes)

example: lease fee on lab machine is $2000/month regardless of usage

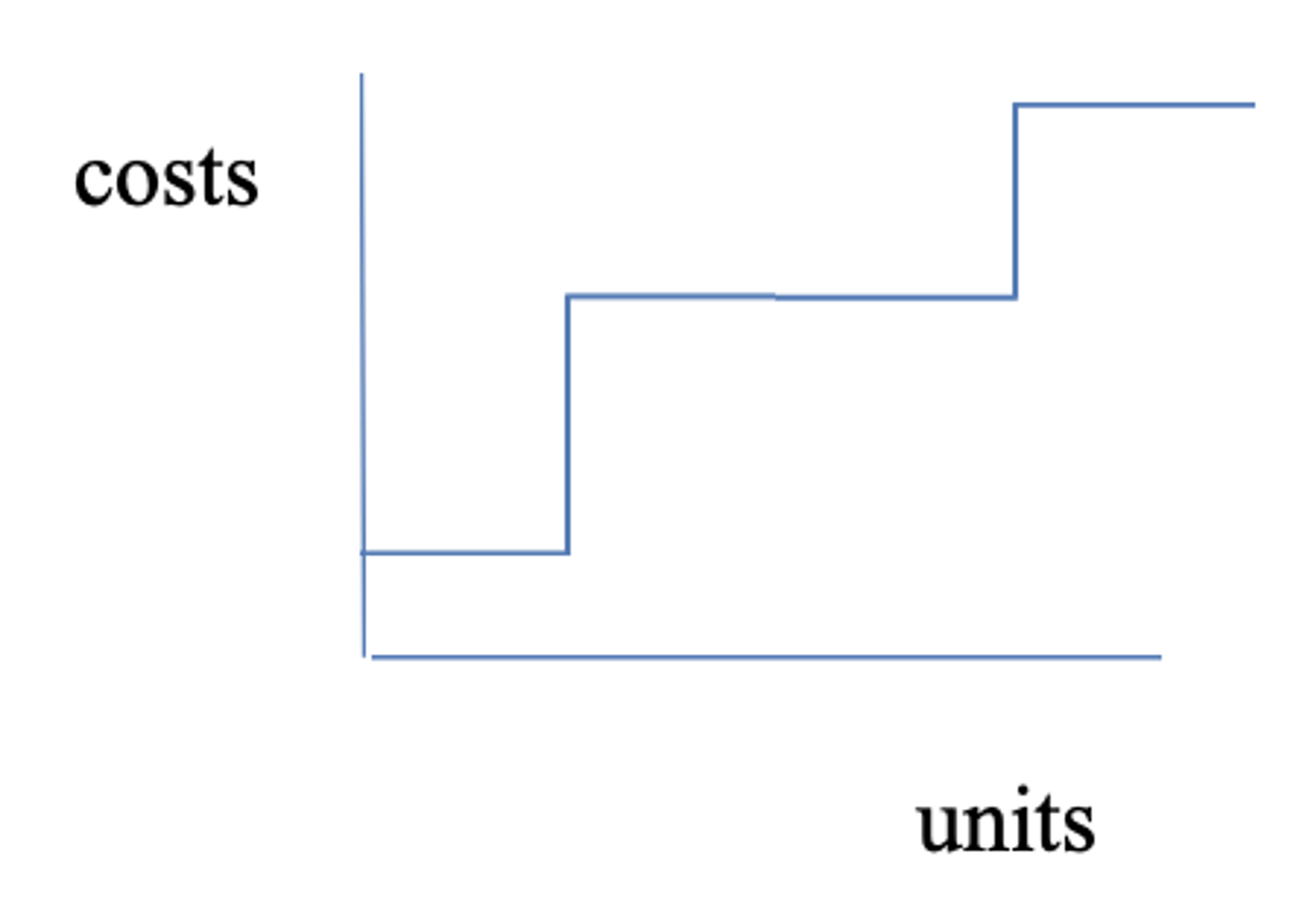

Semi-fixed (relation to activity cost type)

Changes but NOT PROPORTIONALLY according to changes to time in volume ("stair-step")

example: staffing (aka salaries - salary expense of lab staff)

Controllable (management responsibility cost type)

The department manager can control within the defined time period

example: salaries + supplies

Non-controllable (management responsibility cost type)

The department manager cannot control within the defined time period

example: employee benefits (health plans), indirect expenses (rent, utilities)

Avoidable (relation to time cost type)

If you change operations, the cost goes away

example: close lab - no longer pays for salaries

Sunk (relation to time cost type)

If you change operations the cost doesn't go away

example: close lab - still required to pay remaining lease, depreciation expense, + admin costs (HR, legal, marketing)

60%

The amount healthcare orgs allocate toward personnel expenses.

Payroll department

Responsible for orgs employees under controller (can be in-house or outsources)

2 most common outsourcing companies for payroll

ADP + PayChecks

ADP

An outsourcing payroll company for larger + international/multistate companies

Paychecks

An outsourcing payroll company for usually smaller + 1-3 state companies

Payroll for single-state companies

Are more likely to be in-house

Payroll for multi-state companies

Are more likely to be out-sourced

Three guidelines to differentiate between employee or indept. contractor - "Resting B*tch Face"

Relationship of parties

Behavioral control

Financial control

Requirements for ER if hiring an EE

- Must follow payroll laws

- Set EE up in payroll system

- Must pay a share of taxes

- Responsible for holding EE's share of taxes

*END-YEAR - ER must provide EE with a IRS W2 doc.

ER share of taxes for an EE is marked as what in an IS/SOO?

Benefit expenses

EE share of taxes that ER holds is documented as what on BS?

Current liabilities (only until paid to IRS)

IRS W2

Document that ER must provide to EE (is a list of tax information)

Hiring Independent Contractor

- Self-employed individuals who are contracted

- Provide expert services on a specific subject/area

- Contract length can be over weeks/months/years

- Paid through A/P

*END-YEAR - Company sends IRS 1099 Form to I.C.

Examples of Independent Contractors

Accountants, attorneys, architects

Steps of how I.C. gets paid

I.C. provides company with an invoice → Companies A/P pays I.C.

IRS 1099 Form

Document that a company must provide to I.C. (I.C. could have more than one depending on how many companies they worked for)

Hiring Temporary Agencies

- Companies that are contracted to provide individual workers

- Contract length could last day/week/months

- Company is paid with A/P

*THESE ARE VERY EXPENSIVE*

Steps of how temporary agency gets paid

The temporary agency provides company with an invoice → Companies pays agency through A/P

Examples of Temporary Agency

Travel nurses + clinical workers

Problem w/Temp agency

The hourly rate that is being charged is 2x then regular amount - due to admin fees (i.e. background checks/drug tests)

Hiring Outsourced Work

- Companies contracted to provide services as a whole

- Contracts are routine basis (not a one time thing)

Steps of how outsourced work gets paid

They send a monthly invoice → companies pay through A/P

Outsourced work examples

Marketing Firms + security + environmental service companies

1938

FLSA (Fair Labor Standards Act) passed under U.S. department of labor

*FOR NON-EXEMPT WORKERS*

FLSA established these requirements - "Fast Horses Read Yelp"

- Federal minimum wage

- Hours worked more than 40hrs/week = paid time+1/2

- Record keeping

- Youth employment standards (ages 13-17)

Federal Minimum Wage under FLSA

Originally was $7.25/hr

*State rate must be more generous than the federal rate

2009

States created "living wages" for minimum wage

Hours worked under FLSA

If EE work more than 40hrs/week must be paid time + 1/2

*Holidays+sick days don't count toward hours worked

Record keeping under FLSA

EE's must track hours worked - can include work preformed at home/travel time/training - time clocks now created

Exempt Workers (exempt from FLSA)

- Workers are paid a flat rate salary

- Paid the same amount each pay period no matter amount of hours worked

- Are paid CURRENT

Examples of exempt workers

Managers + professionals (people who conduct independent decision-making)

Type of workers paid current

Exempt workers (ex. if work from 9/1-9/30 - gets paid 9/30)

Non-Exempt Workers (not exempt from FLSA/it applies)

- Workers are paid hourly

- Paycheck is different each pay period based on hours worked

- Are paid ARREARS

Type of workers paid arrears

Non-exempt workers (ex. if work 9/1-9/14 - gets paid 9/21)

When workers are paid, depends on state laws

Why it is important to know the difference of exempt vs. non-exempt as a manager?

- Non-exempt workers must be set up in time+attendance

- You have to approve EE requests for leave

Payroll has three options

- Direct deposit

- Hard checks

- Paycards

Paycards

- A reloadable debit card

- Funded with employee wages from each pay period

- Strict laws for federal+state related to fees charged (must be disclosed)

BEST PRACTICES for Paycards

- Cannot be mandatory

- ER must disclose all fees+rules around usage

- Easy availablity

- Need to permit full withdrawal w/limited fees

Unbankable employees

Don't have bank accounts (could be due to legal/bankruptcy) - DD + check is not an option for them (pay cards are best)

2019 (pre-Covid)

Bureau of Labor Statistics - 24% of workers performed some work at home on average day. With Covid accelerating WFH arrangements, issuing bulletin

1961

When DOL last issued interpretive rules for FLSA record-keeping - states:

"If the employer knows or has reason to believe that the work is being performed, he must count the time as hours worked, and pay for it, even if they did not ask for or want the work, Burden is on ER to ensure that work is not performed that they do not wish to be performed. Applied to all EEs, regardless of where work is done (telework)."

Steps in Payroll Process - "Students Try To Stay Positive Exam Semester"

- Set up new EE

- Time and attendance system

- Time passes to payroll sub-ledger

- Salary calculated

- Paychecks prepped + sent as paper/DD/pay card

- Expenses from payroll sub-ledger go to GL

- Submit withheld taxes + benefits deductions to appropriate entity

Step 1 → Set Up New Employee (payroll process)

- EE must be coded to correct dept+account via chart of accounts

- Enter salary or hourly/weekly rate → exempt vs. non-exempt

- Form W4

- HR form for health plan selection/deductions

Chart of accounts

A document that lists the amount (expenses) for each dept (different for every company)

IRS W4 Form

A document for tax withholds filled out by EE prior to working

Step 2 → Time + Attendance System (payroll process)

- Time is tracked

-Time is approved by manager (only signs off on ours, not amount being paid)

Step 4 → Salary Calculated (payroll process)

- Based on hourly rate, OT, differentials

- calculate taxes and benefits to get total expenses

Step 6 → Expenses from SubL pass to GL (payroll process)

- Salary → based on charts of accounts

- Benefits depends on if they are treated as direct/indirect (allocated by %)

What is included in pre-tax benefits?

- Health/dental ins premiums

- Health savings account

- Flex spending account

- Retirement → 401K or profit sharing

Health/Dental Ins Premiums

- BOTH EE+ER contribute

- Required for large ER with more than 50 FTEs

Health Savings Account (HSA)

- BOTH EE+ER contribute

- Only used with HDHP

Retirement - 401K or profit sharing

- BOTH EE+ER contribute

- Completely optional for ERs to offer

- EE max roughly $20K (updated by IRS yearly)

Pre-Tax Benefits

ER must submit to vendor based on contract

What is included in taxes?

- Soc Security 6.2% each - up to IRS limit

- MC Part A fund 1.45% each, no limit

- FUTA 6% of $7000

- Fed Income

- State Income

- Local Income

Taxes

Large ER must submit both EE+ER portions to IRS by Wednesday following pay date

Out of taxes, what are the only two things that EE's do not contribute too?

FUTA 6% of $7000 + SUTA/SUI varies

Soc Security 6.2% each - up to IRS limit

- BOTH EE+ER contribute

- Limit changes each year, 2019 = $132,900

MC Part A fund 1.45% each, no limit

- BOTH EE+ER contribute

FUTA 6% of $7000

- ONLY ER contributes

- Can be reduced if paying SUTA

SUTA/SUI varies by state

- ONLY ER contributes

- % rate calculated annually based on company's unemployment data

Fed Income

- ONLY EE contributes

- Based on salary level and Fed W4 form compared to IRS withholding tables

State Income

- ONLY EE contributes

- In 41 states and DC - based on salary level and Fed W4 form and state withholding tables

Local Income

- ONLY EE contributes

- Can be flat % or based on state info

If it were a for-profit hospital, which three tax categories would ER end up contributing to?

Fed, State, Local Income tax

What is included in other benefits?

- Short-term disability

- Long term disability

- Garnishments

- Charitable contribution

Short-term disability (STD) - benefits

- BOTH EE+ER contribute

- Optional for ER's to offer, generally covers from 6 weeks to 6 months after disabling event

Long-term disability (LTD) - benefits

- BOTH EE+ER contribute

- Optional for ERs to offer, generally covers % of salary from 6 months to age 65

Garnishments - benefits

- ONLY EE contributes

- Court ordered withholding for debts not paid (ex.taxes+childsupport)

Charitable Contribution - benefits

- BOTH EE+ER contribute

- Optional for ER's - is a volunteered amount EE will have taken out of paycheck (sometimes ER matches amount)

How is money contributed by EE recorded under payroll taxes and benefits?

Recorded as deductions from EE paycheck

How is money contributed by ER recorded under payroll taxes and benefits?

Recorded as "fringe benefit expense" on SOO

Type of taxes under FICA

Social Sec. 6.2% each & MC Part A fund 1.45%

FICA

Federal Insurance Contributions Act - *#1 thing ER contributes too

1961

Department of Labor issued the last interpretation and just added clarifying info on telework