Financial Reporting [Lectures]

1/116

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

117 Terms

Providing information about the performance and financial position of companies so that users can make economic decisions best describes the role of:

financial reporting

A company’s current financial position would best be evaluated using the:

balance sheet

A company’s profitability for an period would be best evaluated using the:

income statement

Accounting policies, methods and strategies used in preparing financial statements are most likely found in the:

notes to the financial statements

Information about management and director compensation would least likely be found in the:

auditor’s report

Information about a company’s objectives, strategies and significant risks would most likely be found in the:

management commentary

What type of audit opinion is preferred when analyzing financial statements?

unqualified

Ratios are an input into which step in the financial statement analysis framework?

analyze / interpret the processed data

What is most likely not an objective of financial statements?

To provide information about the users of an entity’s financial statements

International financial reporting standards are currently developed by which entity?

The International Accounting Standards Board

Which of the following statements about desirable attributes of accounting standards boards is most accurate?

Accounting standards boards should

be guided by a well articulated framework

A core objective of the International Organization of Securities Commissions is to:

ensure that markets are fair, effi cient, and transparent

The assumption that an entity will continue to operate for the foreseeable future is called:

going concern

The assumption that the eff ects of transactions and other events are recognized when they occur, not when the cash fl ows occur, is called:

accrual basis

Neutrality of information in the fi nancial statements most closely contributes to which qualitative characteristic?

Faithful representation

Valuing assets at the amount of cash or equivalents paid or the fair value of the consideration given to acquire them at the time of acquisition most closely describes which measurement of financial statement elements?

Historical cost

The valuation technique under which assets are recorded at the amount that would be received in an orderly disposal is:

realizable value

Which of the following elements of financial statements is most closely related to the measurement of performance?

Expenses

Which of the following elements of financial statements is most closely related to measurement of fi nancial position?

Equity

What is not a characteristic of a coherent financial reporting framework?

Timeliness

What is not a recognized approach to standard-setting?

An asset/liability approach

Which of the following disclosures regarding new accounting standards provides the most meaningful information to an analyst?

The impact of adoption is discussed

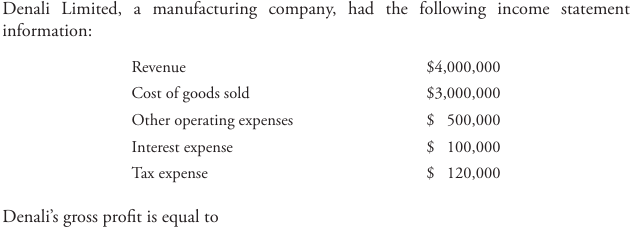

Expenses on the income statement may be grouped by:

either function or nature

An example of an expense classification by function is

interest expense

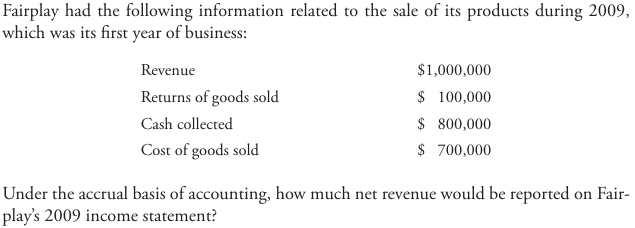

$1,000,000

$900,000

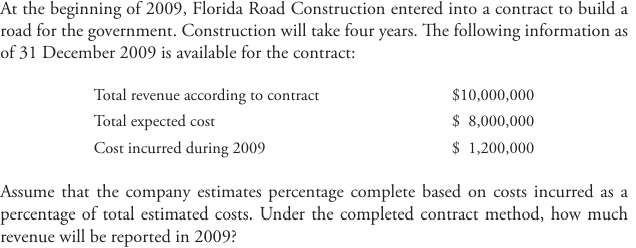

None

During 2009, Argo Company sold 10 acres of prime commercial zoned land to a builder for $5,000,000. The builder gave Argo a $1,000,000 down payment and will pay the remaining balance of $4,000,000 to Argo in 2010. Argo purchased the land in 2002 for $2,000,000.

How much profit commercial-zoned will Argo report for 2009 using the instalment method?

$600,000

Using the same information, how much profit will Argo report for 2009 using the cost recovery method?

None

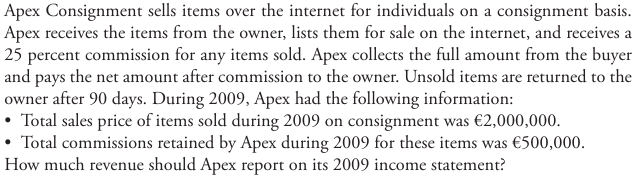

€500,000

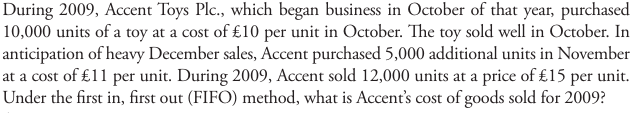

₤122,000

Using the same information, what would Accent’s cost of goods sold be under the weighted average cost method?

₤124,000

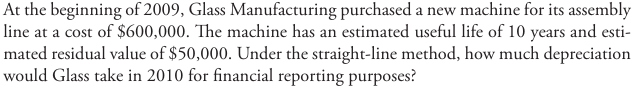

$55,000

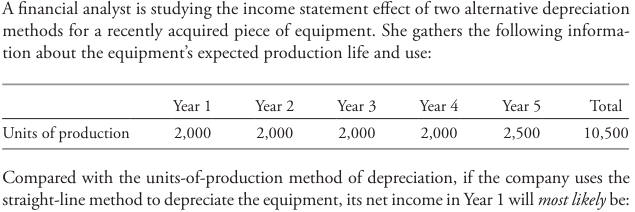

What is the combination of depreciation methods and useful lives, that is most conservative in the year a depreciable asset is acquired?

Declining balance depreciation with a short useful life

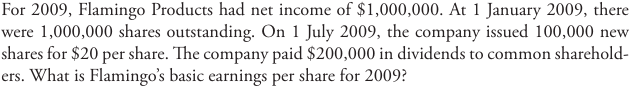

$0.95

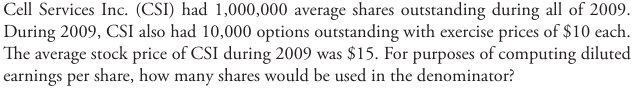

1,003,333

Resources controlled by a company as a result of past events are:

assets

Equity equals:

Assets – Liabilities

Distinguishing between current and non-current items on the balance sheet and presenting a subtotal for current assets and liabilities is referred to as:

a classified balance sheet

What is not a current asset?

goodwill

Debt due within one year is considered:

current

Money received from customers for products to be delivered in the future is recorded as:

an asset and a liability

Th e carrying value of inventories reflects:

the lower of historical cost or net realizable value

When a company pays its rent in advance, its balance sheet will reflect a reduction in:

one category of assets and an increase in another

Accrued expenses (accrued liabilities) are:

expenses that have been reported on the income statement but not yet paid.

The initial measurement of goodwill is most likely affected by:

an acquisition’s purchase price

Defining total asset turnover as revenue divided by average total assets, all else equal, impairment write-downs of long-lived assets owned by a company will most likely result in an increase for that company in:

both the debt-to-equity ratio and the total asset turnover

For financial assets classifi ed as trading securities, how are unrealized gains and losses reflected in shareholders’ equity?

They flow through income into retained earnings

For financial assets classified as available for sale, how are unrealized gains and losses reflected in shareholders’ equity?

They are a component of accumulated other comprehensive income

For financial assets classified as held to maturity, how are unrealized gains and losses reflected in shareholders’ equity?

They are not recognized.

The non-controlling (minority) interest in consolidated subsidiaries is presented on the balance sheet:

separately, but as a part of shareholders’ equity

The item “retained earnings” is a component of:

shareholders’ equity

Which of the following would an analyst most likely be able to determine from a common-size analysis of a company’s balance sheet over several periods?

An increase or decrease in financial leverage

An investor concerned whether a company can meet its near-term obligations is most likely to calculate the:

current ratio

The most stringent test of a company’s liquidity is its:

cash ratio

An investor worried about a company’s long-term solvency would most likely examine its:

debt-to-equity ratio

The three major classifications of activities in a cash flow statement are:

operating, investing, and fi nancing

The sale of a building for cash would be classified as what type of activity on the cash flow statement?

Investing

A conversion of a face value $1 million convertible bond for $1 million of common stock would most likely be:

reported as supplementary information to the cash flow statement

Which of the following is most likely to appear in the operating section of a cash flow statement under the indirect method?

Net income

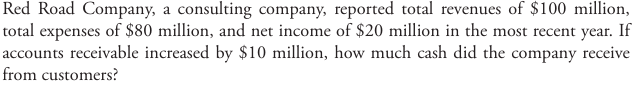

$90 million

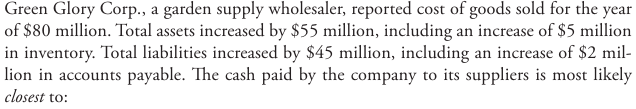

$83 million

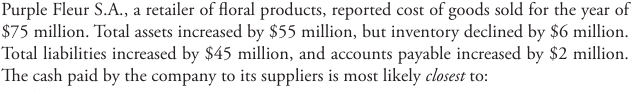

$67 million

$22 million

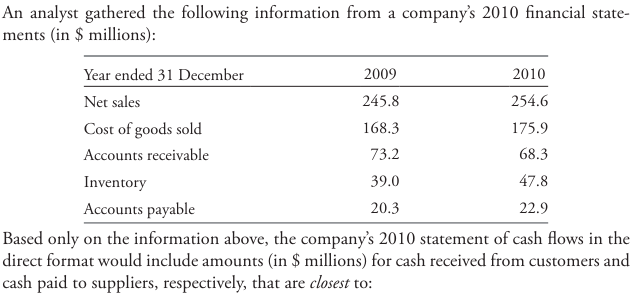

Cash Received from Customers - 259.5

Cash Paid to Suppliers - 182.1

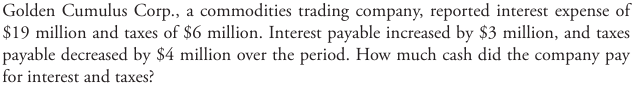

$16 million for interest and $10 million for taxes

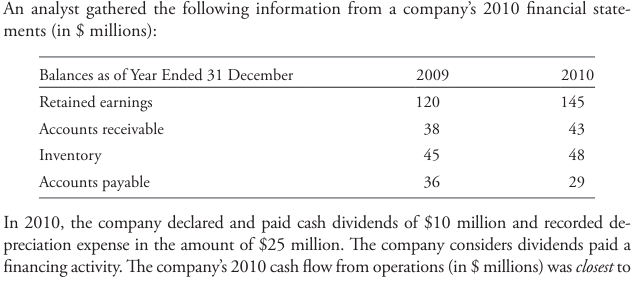

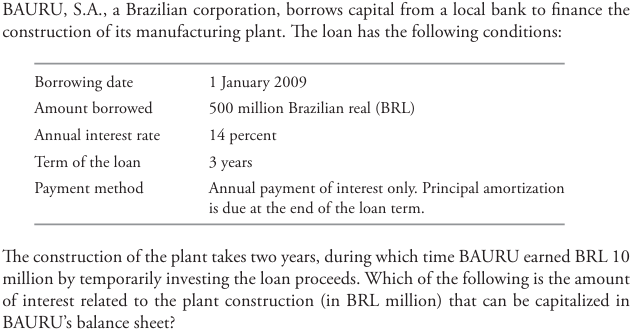

45

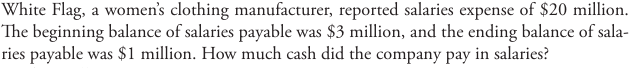

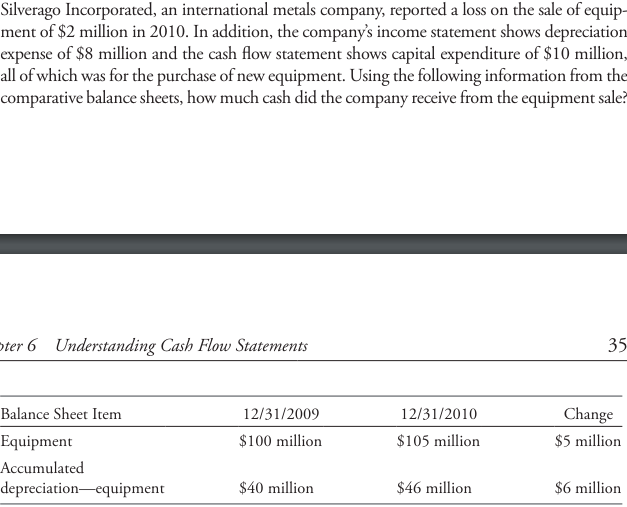

$1 million

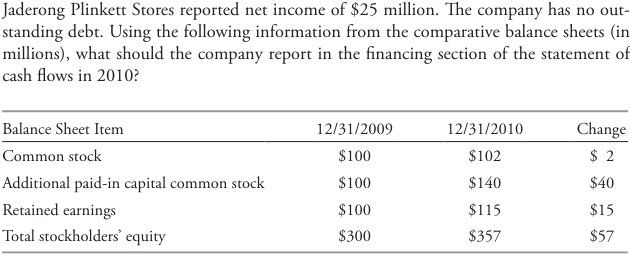

Issuance of common stock of $42 million; dividends paid of $10 million

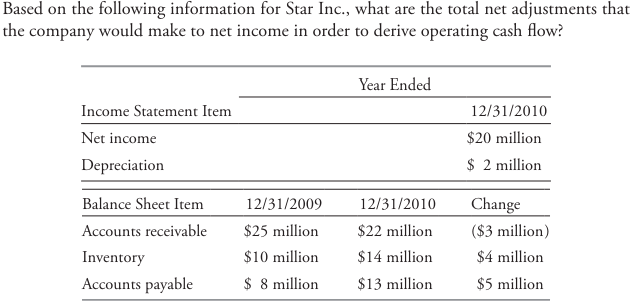

Add $6 million

The first step in cash flow statement analysis should be to:

identify the major sources and uses of cash

What is an appropriate method of preparing a common-size cash flow statement?

Show each line item on the cash fl ow statement as a percentage of net revenue

What is an appropriate method of computing free cash flow for the firm?

Add operating cash fl ows to after-tax interest payments and deduct capital expenditures

An analyst has calculated a ratio using as the numerator the sum of operating cash flow, interest, and taxes and as the denominator the amount of interest.

What is this ratio, what does it measure, and what does it indicate?

Th is ratio is an interest coverage ratio, measuring a company’s ability to meet its interest obligations and indicating a company’s solvency

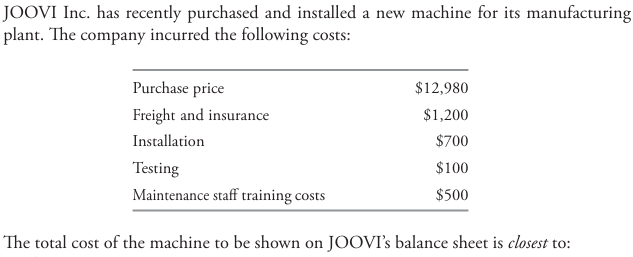

$14,980

130

Intangible assets with finite useful lives mostly differ from intangible assets with infinite useful lives for accounting treatment of:

amortization

lower

Double-declining balance method

What is a amortization method that is most likely to evenly distribute the cost of an intangible asset over its useful life?

Straight-line method

What will cause a company to show a lower amount of amortization of intangible assets in the first year after acquisition?

A higher residual value

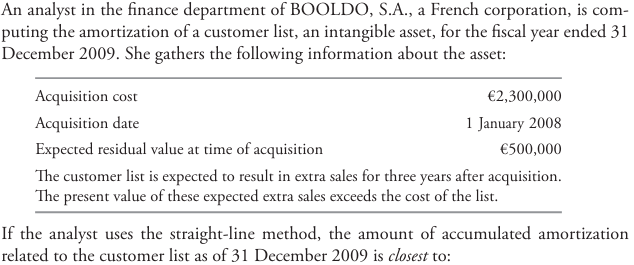

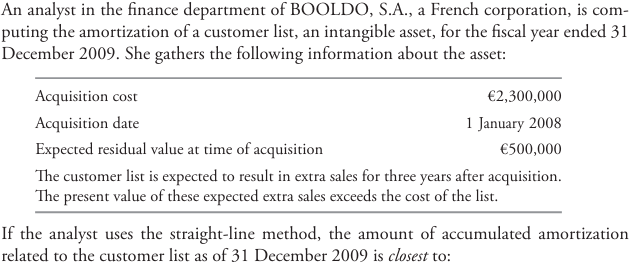

€1,200,000

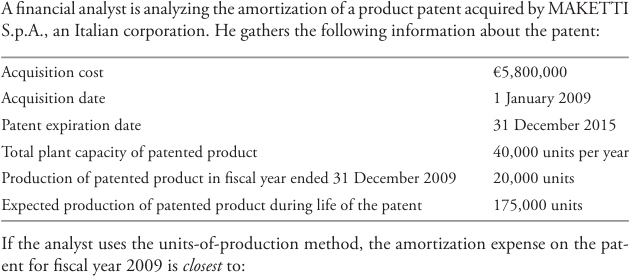

€662,857

MARU S.A. de C.V., a Mexican corporation that follows IFRS, has elected to use the revaluation model for its property, plant, and equipment. One of MARU’s machines was purchased for 2,500,000 Mexican pesos (MXN) at the beginning of the fiscal year ended 31 March 2010. As of 31 March 2010, the machine has a fair value of MXN 3,000,000.

Should MARU show a profit for the revaluation of the machine?

No, because this revaluation is recorded directly in equity

£3,100,000

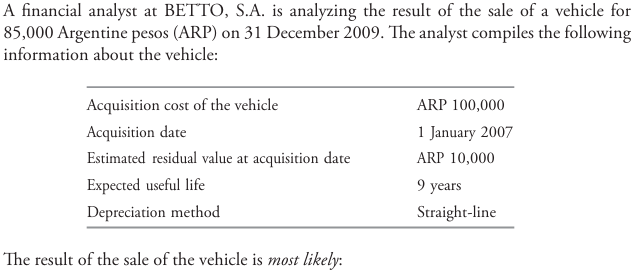

a gain of ARP 15,000

CROCO S.p.A. sells an intangible asset with a historical acquisition cost of €12 million and an accumulated depreciation of €2 million and reports a loss on the sale of €3.2 million.

Which of the following amounts is most likely the sale price of the asset?

€6.8 million

What is the characteristic that is most likely to differentiate investment property from property, plant, and equipment?

It earns rent

If a company uses the fair value model to value investment property, changes in the fair value of the asset are least likely to affect:

other comprehensive income

Investment property is most likely to:

earn rent

A company is most likely to:

change from the fair value model when the company transfers investment property to property, plant, and equipment.

A company issues €1 million of bonds at face value. When the bonds are issued, the company will record a:

cash inflow from financing activities

At the time of the issue of 4.50% coupon bonds, the effective interest rate was 5.00%. The bonds were most likely issued at:

a discount

On 1 January 2010, Elegant Fragrances Company issues £1,000,000 face value, five year bonds with annual interest payments of £55,000 to be paid each 31 December. The market interest rate is 6.0 per cent.

Using the effective interest rate method of amortisation, Elegant Fragrances is most likely to record:

a liability of £982,674 on the 31 December 2010 balance sheet

Consolidated Enterprises issues €10 million face value, five-year bonds with a coupon rate of 6.5 per cent. At the time of issuance, the market interest rate is 6.0 per cent.

Using the effective per cent interest rate method of amortisation, the carrying value after one year will be closest to:

€10.17 million

The management of Bank EZ repurchases its bonds in the open market. They pay €6.5 million for bonds with a face value of €10.0 million and a carrying value of €9.8 million.

The bank will most likely report:

a gain of €3.3 million on the income statement

Innovative Inventions, Inc. needs to raise €10 million. If the company chooses to issue zero-coupon bonds, its debt-to-equity ratio will most likely:

rise as the maturity date approaches

Fairmont Golf issued fixed-rate debt when interest rates were 6 per cent. Rates have since risen to 7 per cent.

Using only the carrying amount (based on historical cost) reported on the balance sheet to analyze the company’s financial position would most likely cause an analyst to:

overestimate Fairmont’s economic liabilities

Debt covenants are least likely to place restrictions on the issuer’s ability to:

issue additional equity

Compared to using a fi nance lease, a lessee that makes use of an operating lease will most likely report higher:

rent expense