D104 - OA #2 Intermediate Accounting II

1/142

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

143 Terms

Sum-of-the-years’-digits Method

Accelerated depreciation method that results in higher depreciation costs in the earlier years and lower charges in later periods

Each fraction uses the sum of the years as a denominator (e.g., 5 + 4 + 3 + 2 + 1 = 15). The numerator is the number of years of estimated life remaining at the beginning of the year. In this method, the numerator decreases yearly, and the denominator remains constant (e.g., 5/15, 4/15, 3/15, 2/15, and 1/15)

Depreciation Expense - Sum-of-the-years’-digits Method

(Cost - Salvage Value) x (Remaining Useful Life / Sum-of-the-years’ digits)

Salvage Value

At the end of the asset’s useful life, the balance remaining should equal the salvage value. Never depreciate beyond an asset’s salvage value

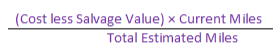

The Activity Method

Also called the variable-charge or units-of-activity/production approach

It assumes that depreciation is a function of use or productivity instead of the passage of time

It calculates depreciation based on the asset’s activity, such as the number of units produced or the number of hours/miles the asset is used during the period. The amount of depreciation expense is directly proportional to the amount of the asset’s usage

Depreciation Charge - Activity Method

Book Value/Carrying Value

It is an asset’s original cost minus accumulated depreciation

Straight-line Depreciation

Most used and simplest depreciation method for allocating the cost of a capital asset

With the straight-line depreciation method, the value of an asset is reduced uniformly over each period until it reaches its salvage value

If used, it would give you the smallest deprecation in the first year of an asset’s life

Double-Declining Balance (DDB) Method

An accelerated depreciation that records larger depreciation expenses during the earlier years of an asset’s useful life and smaller ones in later years

Step 1: Straight-line rate = 100% / Useful life

Step 2: DDB Rate: 2 x Straight-line rate

Step 3: Depreciation Expense = DDB Rate x beginning period book value

What method is used by composite or group depreciation?

Straight-line method

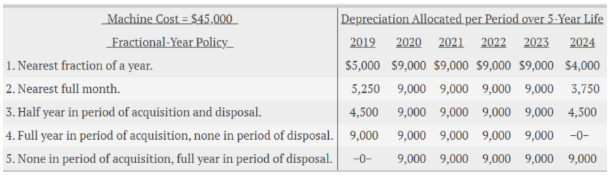

Depreciation Expense for Partial Periods

First determine the depreciation expense for the full year and then prorate this amount between the two periods involved

Fractional-Year Depreciation Policy Calculations

Half-Year - Fractional-Year Depreciation

The asset will be depreciated for 6 months in the first year

Nearest Full Month - Fractional-Year Depreciation

The asset will be depreciated for 9 months in the first year

Nearest Fraction of a Year - Fractional-Year Depreciation

Asset will be depreciated for 8 ⅔ months in the first year

Composite Depreciation Rate

(Total Annual Depreciation) / (Total Original Cost)

Smallest depreciation in the first year of an asset’s life

Composite Life

(Total Depreciable Cost) / (Total Annual Depreciation)

The Composite Method

It uses an average rate for determining depreciation expense and is used when the assets are different and have varying useful lives

Allows the company to use one rate to depreciate all the assets

The Group Method

It uses an average rate for determining depreciation expense and is used when the assets are similar and have the same useful live

Recoverability Test

Used to determine if an asset has suffered an impairment

Examines the undiscounted future cash flows of the asset to its book/carrying value

Undiscounted future cash flows > Carrying amount, no impairment exists

Undiscounted future cash flows < Carrying amount, an impairment exists, and the loss needs to be measured

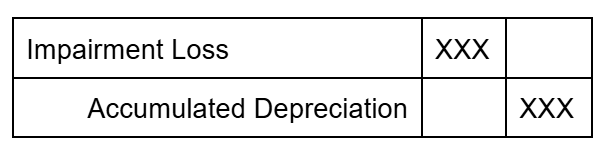

Fair Value Test

Used to determine the impairment loss amount

The impairment loss is the difference between current value and fair value

If FV < CV, the asset’s new basis is the FV

Fair Value Test - Impairment Loss

The amount by which the carrying amount of the asset exceeds its fair value

CV > FV

What happens after recording an impairment loss?

The reduced carrying amount of the asset held for use becomes its new cost basis

A company does not change the new cost basis except for depreciation in future periods or for additional impairments

Net Realizable Value

Fair value minus costs to sell/dispose

Assets Held for Disposal - Impairment Loss

Impairment loss is reported at the lower-of-cost-or-net realizable value, like inventory

Assets Held for Disposal Impairment Test

Compare net realizable value (NRV) to carrying value (CV)

If CV > NRV, recognize a loss.

If CV < NRV, recognize a gain; however, the gain cannot exceed the amount of the initial impairment loss

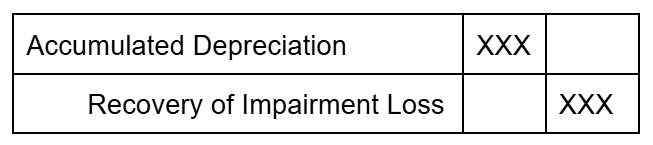

Restoration of Impairment

Assets that are impaired can only have their carrying value restored if they are held for disposal

Held-for-use assets are not allowed to have restoration of their carrying value

Two-Step Process for Accounting for Impairment Losses

The first step is to perform a recoverability test, comparing the assets' book/carrying value and expected future cash flows (undiscounted)

The second step is to do the fair value test to measure the amount of impairment as the excess of the asset’s book/carrying value over its fair value

Depletion Base

Cost to acquire + cost to explore + cost to develop (intangible costs) + cost to restore

Equipment should not be included if it can be used elsewhere

Tangible & Intangible Assets in Depletion

Tangible assets used in extracting natural resources are normally set up in a separate account and depreciated separately. Tangible costs include all transportation and other heavy equipment needed to extract the resource and get it ready for market

Intangible costs are drilling costs, tunnels, shafts, and wells

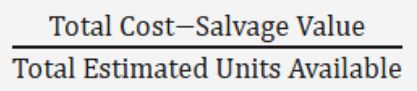

Depletion Rate

(Depletion Base - Salvage Value) ÷ (Total Units to be Recovered)

Depletion Expense

(Depletion Rate) x (Units of Usage/Extracted)

****Investment in Natural Resources Recap Journal Entries

baboy

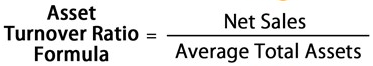

Asset Turnover Ratio

(Net Sales) / (Average Total Assets)

Defines how efficiently a company uses its assets to generate sales

The higher the asset turnover ratio, the more efficient a company is at generating revenue from its assets

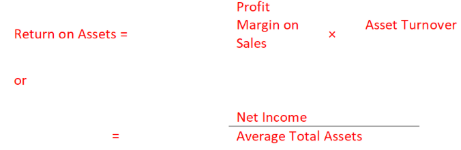

Return on Assets Ratio

The return on assets ratio measures how profitably assets were used to generate profit during a period. The higher the ratio, the better. A high return on assets means that the company was able to utilize its resources well in generating income

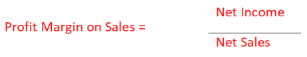

Profit Margin on Sales

The profit margin on sales ratio measures the ability of a company to generate profit on each sales dollar

Ratio Recap Rule

The asset turnover ratio, the return on assets ratio, and the profit margin on sales ratio are all profitability ratios. The higher the ratio, the more profitable it is.

The asset turnover ratio measures how much sales are generated from $1.00 of assets

The return on assets ratio measures how much net income is generated from $1.00 of assets

The profit margin on sales ratio measures how much net income is generated from $1.00 of sale

Current Liabilities

Accounts payable

Notes payable

Dividends payable

Customer advances/deposits

Unearned (deferred) revenues

Sales taxes payable

Current maturities of long-term debt

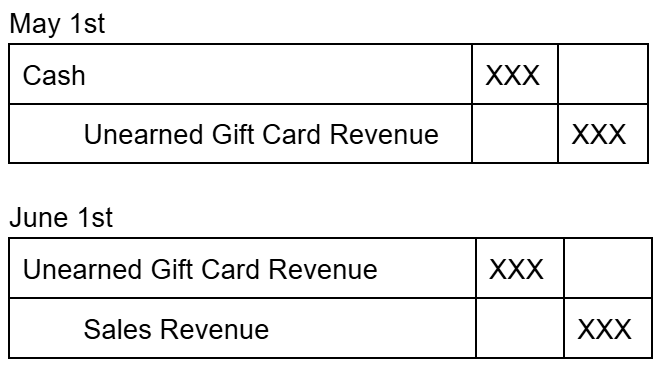

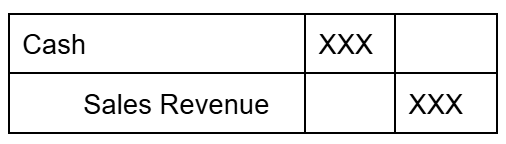

****Unearned Revenue Journal Entry

Unearned revenue is recorded as a debit to cash, an asset account, and credit to unearned revenue, a current liability.

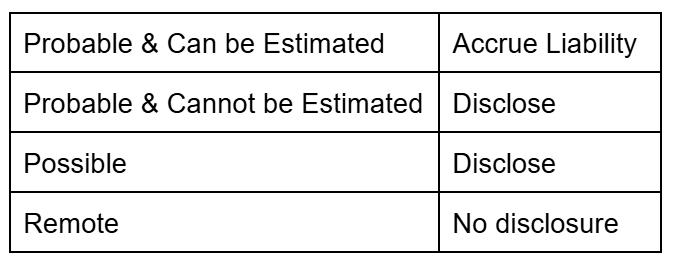

Recording Loss Contingencies and Liabilities

A company records a loss contingency and a liability if the loss is both probable and estimable. But, if the loss is either probable or estimable but not both, and if there is at least a reasonable possibility that a company may have incurred a liability, it must disclose the following in the notes

The nature of the contingency

An estimate of the possible loss or range of loss or a statement that an estimate cannot be made

Quick Ratio (aka Acid-Test)

It is a liquidity ratio that measures the ability of a company to pay its short-term liabilities by having assets that are readily convertible into cash (like quick assets)

A larger quick ratio is better

There are two ways to calculate the quick ratio:

(current assets – inventories – prepaids) / current liabilities

(cash + cash equivalents + marketable securities or short-term investments + net accounts receivable) / current liabilities

Quick Assets

Assets that can quickly be converted into cash, such as cash, marketable securities or short-term investments, and net accounts receivable

Stated Interest Rate (SIR)

Coupon or nominal rate

Market Interest Rate (MIR)

Effective or yield rate

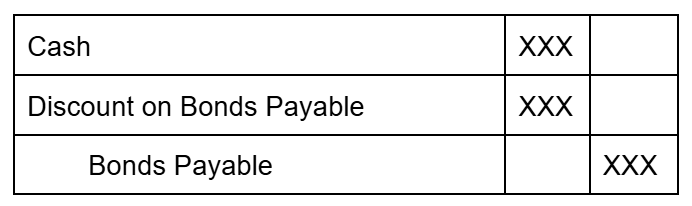

Discount Bonds

If the bonds sell for less than face value, they sell at a discount

The stated interest rate on the bonds is less than the market or effective yield rate

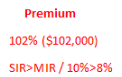

Premium Bonds

If the bonds sell for more than face value, they sell at a premium

The stated interest rate on the bonds is more than the market or effective yield rate

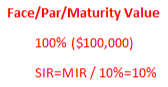

Face Value Bonds

Also called the par value, principal amount, or maturity value

The stated interest rate on the bonds equals the market or effective yield rate

How are bond issuance costs recorded?

They are recorded as a deduction from the bond liability on the balance sheet. The costs are then charged to expense over the life of the associated bond, using the straight-line method. Under this amortization method, the same amount is charged to expense in each period over the life of the bonds. The full period over which bond issue costs is charged to expense is from the date of bond issuance to the bond maturity date

Gain vs Loss due to Reacquisition

There is a gain when the reacquisition price is less than the current net carrying value

The extinguishment of debt will be recorded as a loss when the reacquisition price is more than the current net carrying value

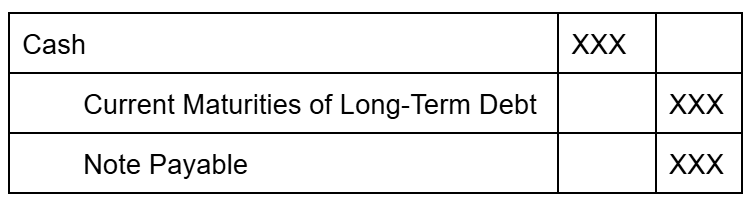

Long-Term Debt

Long-term debt is broken into two parts: current maturity of long-term debt with the remaining portion posted to long-term debt

Current maturity is anything due within the next twelve months operating cycle, whichever is longer

Points

Points reduce the cash received, but do not affect the basis of the mortgage liability. A point is 1% of the face of the note

Times Interest Earned Ratio

Earnings before interest and taxes (EBIT) ÷ Interest

(Net income + interest expense + income tax expense) divided by interest expense

Measures the ability of a company to pay its debt obligations

It indicates the margin of safety provided to creditors

Debt to Asset Ratio

(Total liabilities) / (Total assets)

It is a leverage ratio that measures the amount of total assets that are financed by creditors (liabilities) instead of investors (equity)

It shows the percentage of a company’s total assets financed by creditors

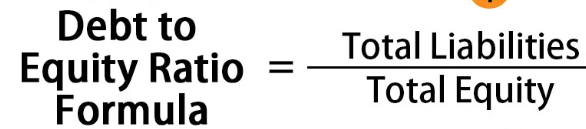

Debt-to-Equity Ratio

It is a financial leverage ratio that measures how much of a company is financed by its debtholders compare with its owners

A company with a lot of debt will have a very high debt/equity ratio, while one with little debt will have a low debt/equity ratio

When depreciation is computed for partial periods under a decreasing charge depreciation method, it is necessary to…

determine depreciation expense for the full year and then prorate the expense between the two periods involved

Depreciation Base

Cost - Salvage Value

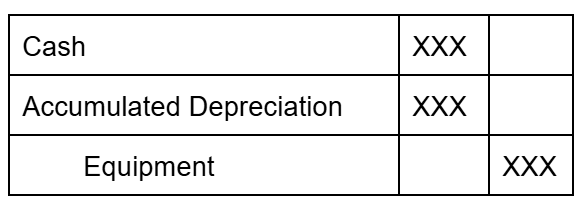

Gain/Loss from Sale of Equipment

Sale Amount - (Cost - Accumulated Depreciation)

If it offsets with accumulated depreciation, then there is no gain

When is the restoration of an impairment loss permitted?

Assets held for disposal

When is the restoration of an impairment loss prohibited?

Assets held for use

Journal Entry - Sale of Equipment

Journal Entry - Impairment Loss

Journal Entry - Recovery of Impairment Loss

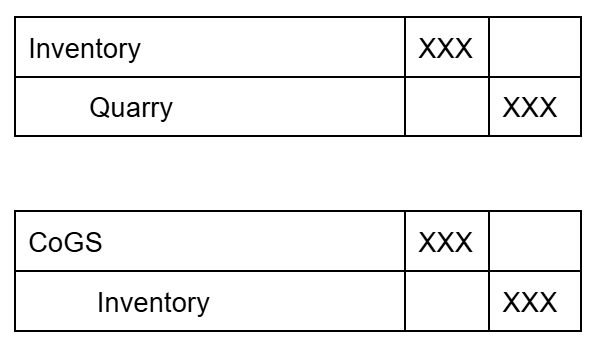

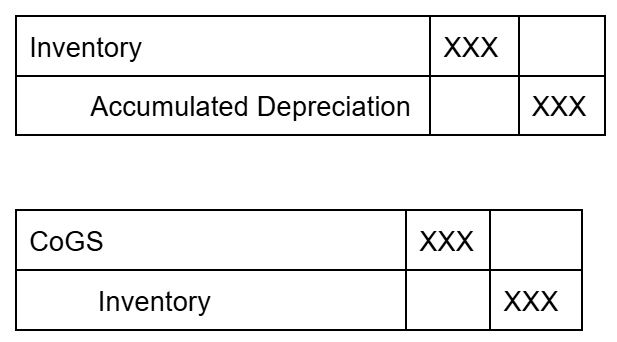

Journal Entry - Recording Depletion

Journal Entry - Inventory Extracted and Sold

Depletion Cost per Unit

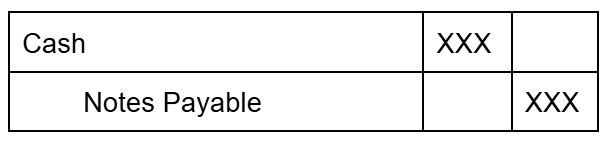

Journal Entry - Borrowing Money

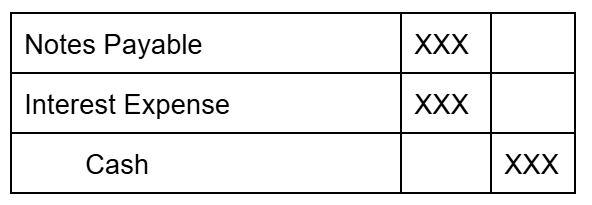

Journal Entry - Recording Payment of Note and Interest at Maturity

Journal Entry - Record Sale of Gift Booklet and Redemption

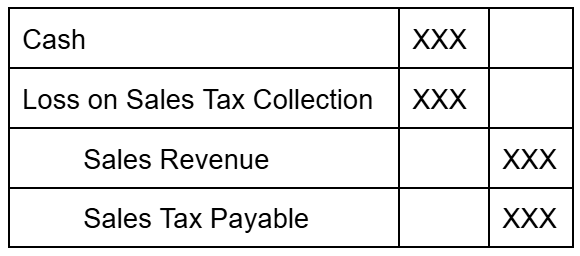

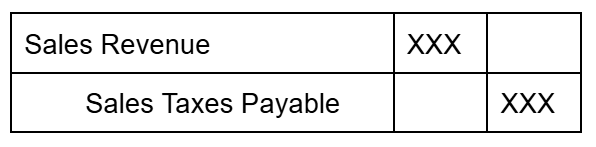

Journal Entry - Record Sale (Segregating Sales Tax and Sale)

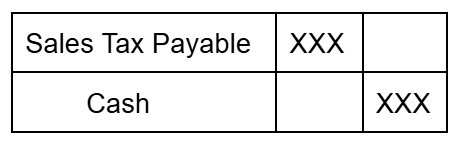

Journal Entry - Payment to Sales Tax Agency (Segregated Sales Tax and Sale)

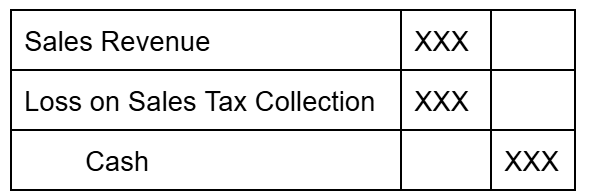

Journal Entry - Record Sale (Sales Tax & Sale)

Journal Entry - Payment to Sales Tax Agency (Sales Tax and Sale)

Journal Entry - Amount due to Taxing Unit

Journal Entry - Recording Loan Taken

Estimated loss from a loss contingency should be accrued by a charge to expense & a liability recorded IF BOTH conditions are met:

It is probable (70% or higher)

Amount of loss can be reasonably estimated

In situations where the loss is a range of potential losses..

the minimum amount of the estimated loss must be accrued, and the footnotes should disclose the range of the potential loss too. However, if the amount can be estimated more accurately, then accrue said amount and disclose the additional contingency,

When should a contingent loss be reported in a disclosure note to the financial statements rather than being accrued?

Premiums, coupon offers, and rebates also create a…

contingency liability that should be accrued

Gain contingencies are not recorded/accrued until realized, but they are…

disclosed in the notes to the financial statements when a high probability exists they will be realized

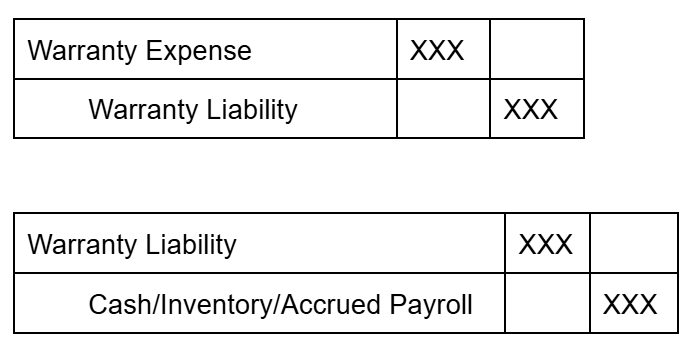

Journal Entry - Accounting for Warranty Liability Expense

If the loss is either probable OR estimable, but not both, and if there’s at least a reasonable possibility that a company may have incurred a liability, it must disclose the following in the notes:

Nature of contingency

An estimate of the possible loss or range of loss or a statement that an estimate cannot be made

Current Ratio

(Current Assets) / (Current Liabilities)

PP&E is not part of current assets

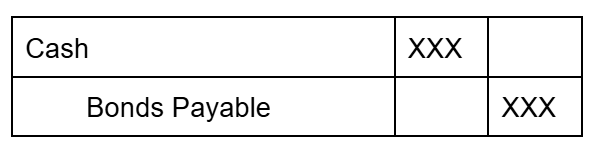

Journal Entry - Record Bond Issuance at Par

Journal Entry - Record Bond Issuance at Discount

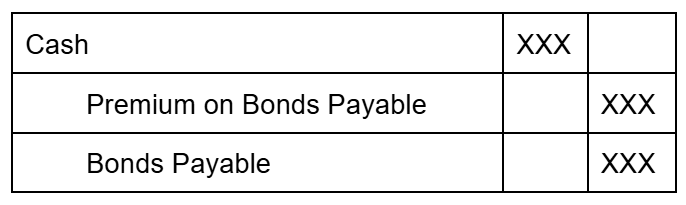

Journal Entry - Record Bond Issuance at Premium

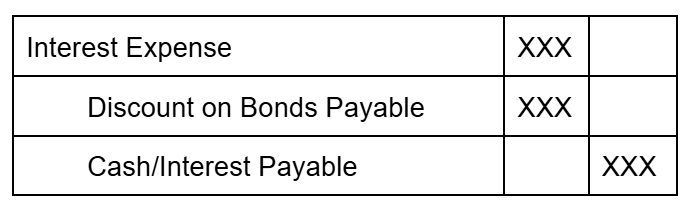

Journal Entry - Recording Interest Expense on Discounted Bonds

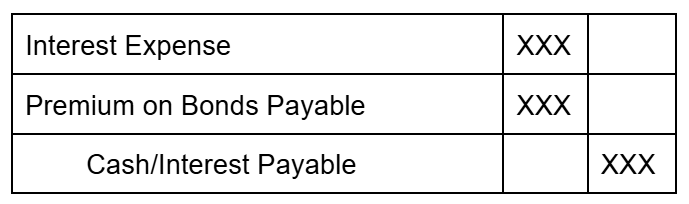

Journal Entry - Recording Interest Expense on Premium Bonds

Bond issuance costs should…

be accumulated in a deferred charge account and amortized over the life of the bonds

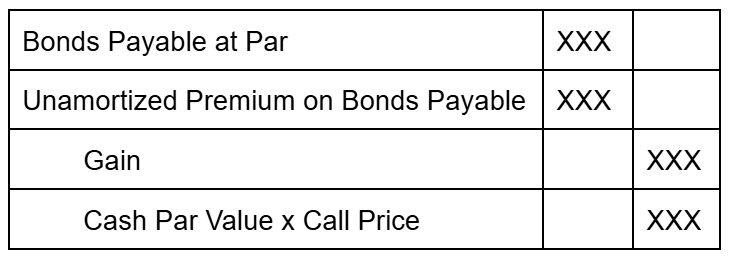

Journal Entry - Purchasing Back Premium Bonds

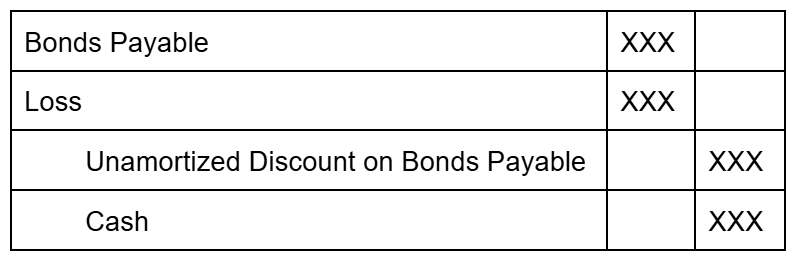

Journal Entry - Purchasing Back Discounted Bonds

Debt to Equity Ratio

(Total Liabilities) / (Total Shareholder’s Equity)

Loss Contingency Balance

(Estimate Total Warranty) + (Units sold x Estimated Warranty Cost) - (Paid Warranty Claims)

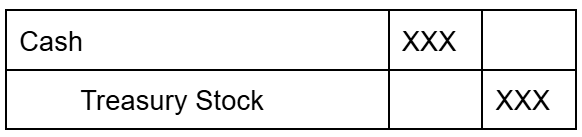

Cost Method

Results in debiting the Treasury Stock account for the reacquisition cost and in reporting this account as a deduction from the total paid-in capital and retained earnings on the balance sheet.

Stockholders’ Equity

Includes:

Common stock

Preferred stock

Additional paid-in capital

Retained earnings

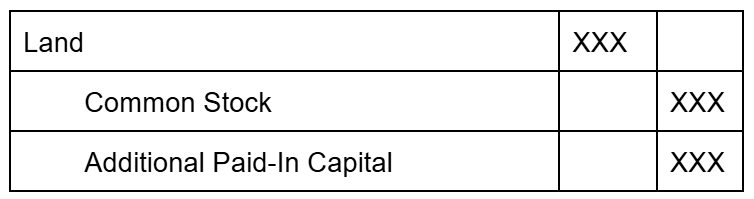

Journal Entry - Exchanging Shares for Land

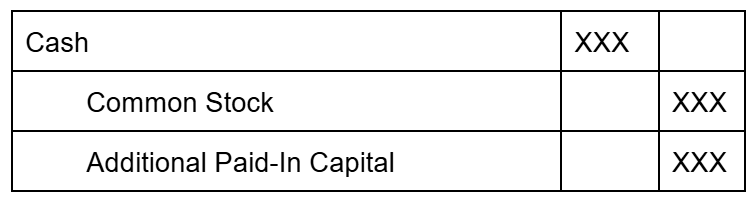

Journal Entry - Common Stock Issuance

Journal Entry - Selling Treasury Stock at Par

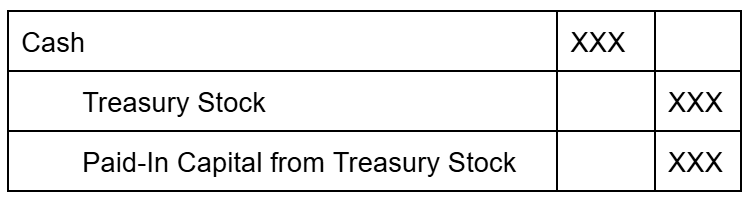

Journal Entry - Selling Treasury Stock at Premium

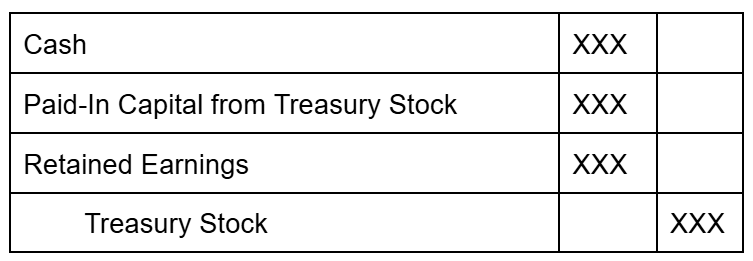

Journal Entry - Selling Treasury Stock at Discount

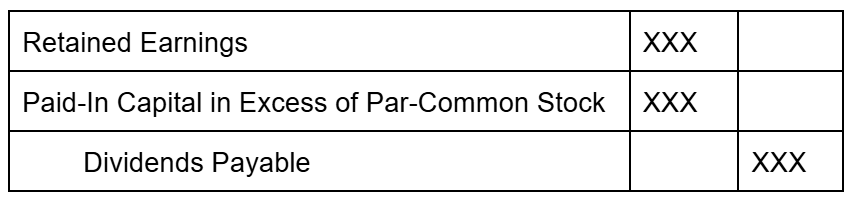

Journal Entry - Recording Dividends

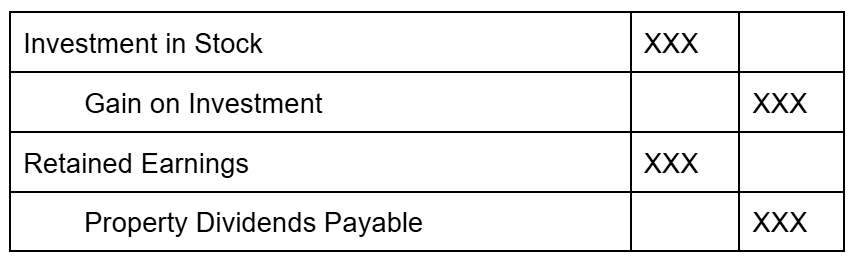

Journal Entry - Property Dividend Declaration Date

This is in the forms of shares of stock held as an investment