Microeconomics Final Exam Study Guide

1/102

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

103 Terms

Economics

The study of making decisions

Scarcity

In the economy, consumers have unlimited wants and needs, but there are limited resources

Microeconomics

Branch of economics that focuses on individual behavior, such as firms, consumers, and markets

Macroeconomics

Branch of economics that focuses on the entire economy as a whole, including the global and domestic economies

Incentives

rewards or punishments that motivate individuals to act a certain way (can be direct or indirect, positive or negative)

Positive Incentives

encourage a desired behavior

Negative Incentives

discourage an undesired behavior

Direct Incentives

explicit incentives clearly linked to a specific action

Indirect Incentives & Unintended Consequences

unintended effects that influence behavior

Trade-offs

everything is limited in economics, so each decision made means giving up something else

Opportunity Cost

the cost of making a decision (what is given up)

Marginal Thinking

evaluating each additional benefit or cost of something

Trade

buying and selling goods and services for greater benefit (uses specialization)

Steps in the Scientific Method

1) observe

2) develop a hypothesis

3) create a model to test the hypothesis

4) analyze the results & draw conclusions

5) apply the findings

Models and Assumptions

a simplified version of reality with certain fixed assumptions to simplify

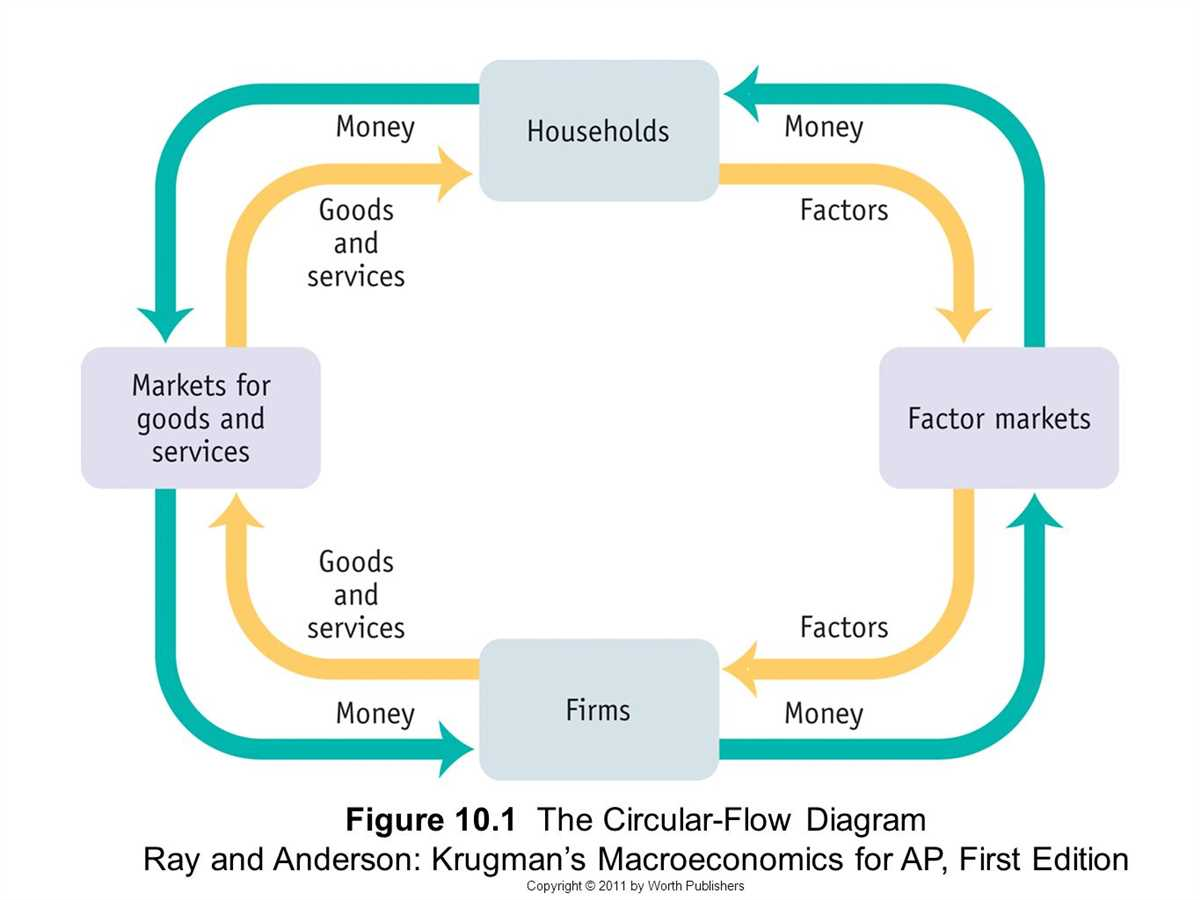

Circular Flow Diagram

Markets

place where buyers and sellers come together to exchange goods

Resources

the input used in the production of goods and services; limited leading to trade-offs

Labor

human effort used in the production of goods and services

Land

natural resource, raw materials from the Earth

Capital

man-made tools and machinery used in the production of goods and services

Human Capital

skills, knowledge and experience used by individuals toward the production of goods and services

Entreprenourship

the combination of K,L,H,N used strategically

Variables vs Constants

while variables change due to outputs, constants remain the same

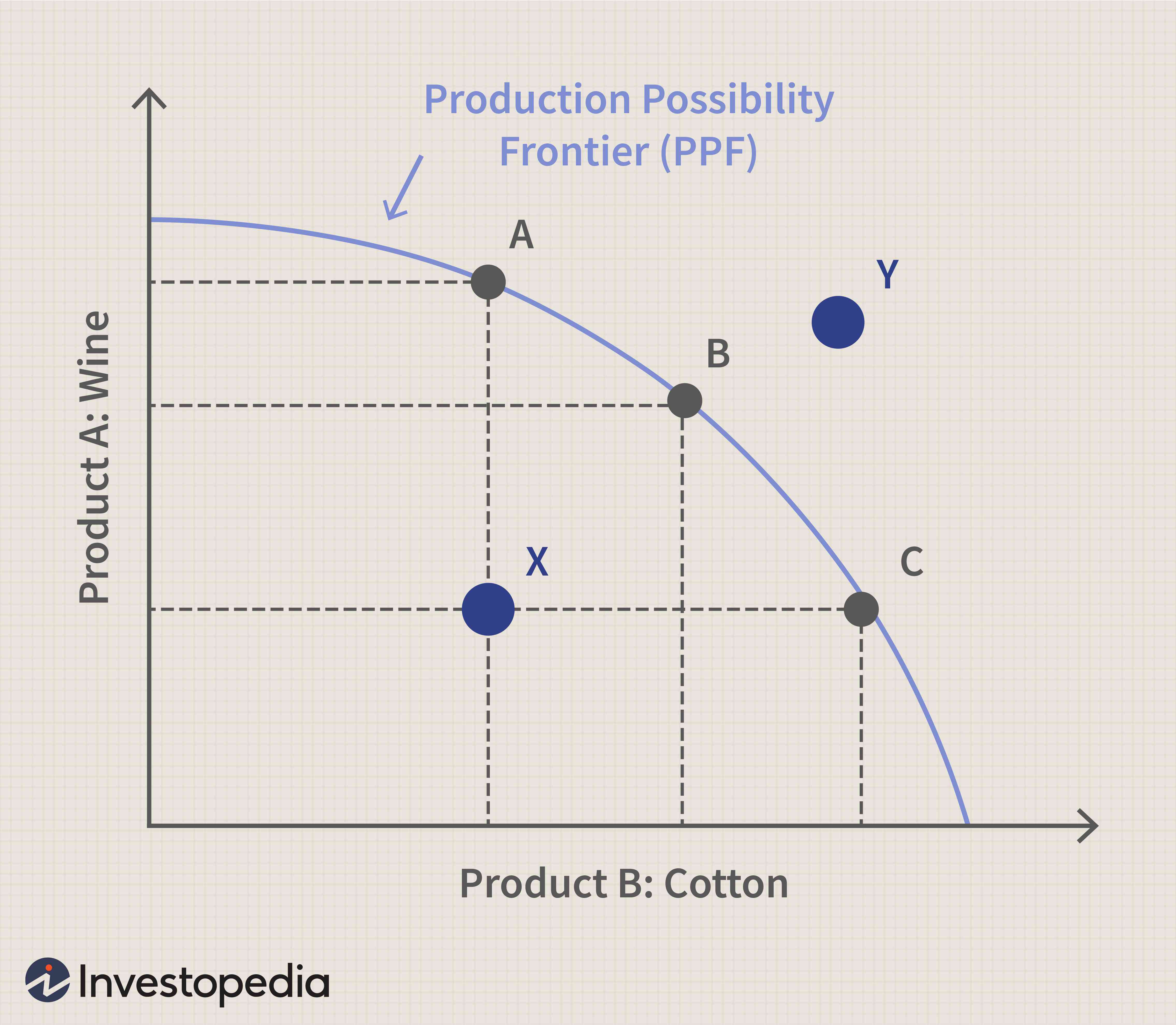

Production Possibility Frontier (PPF)

Absolute Advantage

whoever is better at producing something than another person has this

Comparative Advantage

whoever produces something at a lower opportunity cost has this

Specialization

when individuals/firms focus only on what they produce at the lowest opportunity cost

Exports vs Imports

trades given vs trades received

Gains from Trade

the economic benefits that comes when firms specialize and trade with each other

Lower and upper bounds for pricing goods in exchange

between the two individuals’/firms’ comparative advantages

Consumer vs Capital Good Trade-off

consumer - consumption

capital - used in production

trade-off - negative correlation (more capital = less consumer)

Investment

spending on capital goods to increase future production

Two Roles for Economists

scientists: explain how the economy works (positive)

advisors: recommend how it should work (normative)

Positive vs Normative statements

positive: factual, testable statements

normative: opinion-based, value judgements

Adam Smith

wrote Wealth of Nations

introduced the invisible hand

Invisible Hand

means that the economy is ruled by something other than the government and works for the best interest of everyone when everyone works for the best interest of themselves

Market Economy

decisions are decentralized, made by the buyers and sellers

Competitive Markets

many buyers and sellers; no one controls the price

Monopolies

one seller dominates the market

Quantity Demanded

amount consumers are willing to buy at a specific price

Quantity Supplied

amount producers are willing to sell at a specific price

Demand

relationship between price and quantity demanded

Supply

relationship between price and quantity supplied

Individual vs Market Demand

individual: one consumer’s demand

market: total demand of all consumers

Movement along the Demand and Supply Curves

caused by a change in price

Demand Shifters (D changes)

income

tastes

expectations

number of buyers

price of related goods

Supply Shifters (S changes)

input prices

technology

expectations

number of sellers

Law of Demand

as price increases, quantity demanded decreases (negative relationship)

Law of Supply

as price increases, quantity supplied increases (positive relationship)

Demand and Supply Schedule

table that shows the quantity demanded and quantity supplied in a market

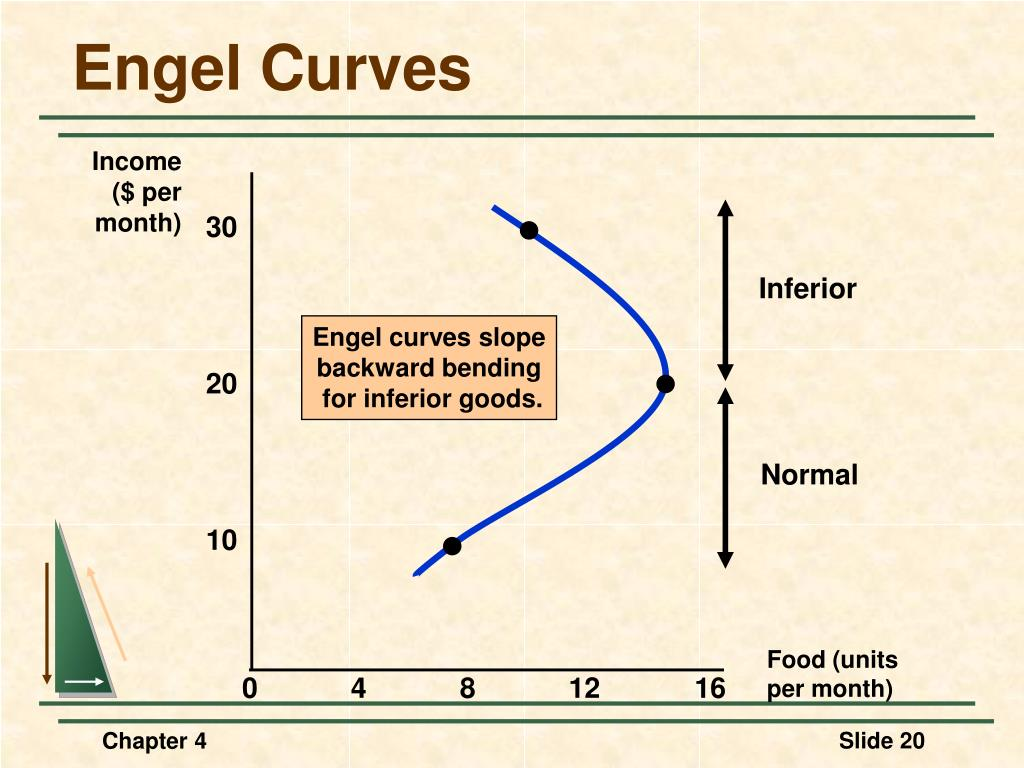

Normal and Inferior Goods

normal: as income increases, demand increases (positive) - ex. sports cars

inferior: as income increases, demand decreases (negative) - ex. bus tickets

Substitutes vs Compliments

substitute: goods used in place of one another

complements: goods used together

Panic Buying vs Speculative Buying

panic: buying driven by fear

speculative: buying based on the expectation that prices will rise

Excise Taxes

per-unit tax

Sales Taxes

tax that’s a percentage of the price

Capital Gain Taxes

tax on profits from selling assets

Subsidies

government payments to encourage production or consumption

Supply and Demand Model

a model showing the relationship between quantity supplied and quantity demanded

Equilibrium

where quantity demanded = quantity supplied

Disequilibrium (Shortage vs Surplus)

surplus: quantity supplied > quantity demanded

shortage: quantity supplied < quantity demanded

Self-guided Economic Adjustments to Equilibrium (Price Mechanism)

price adjusts until the market reaches equilibrium

OPEC

organization of the Petroleum Exporting Countries (a supply cartel)

Ownership Structures of Firms

sole proprietorship: one owner

partnership: 2 owners

corporation: group of owners

Stocks

ownership shares in a company

Engel Curve

shows the relationship between income and quantity demanded of a good

Price Elasticity of Demand

measures how sensitive quantity demanded is to price changes

Elastic Demand

when the quantity demanded fluctuates a lot due to changes in price (ex. luxury goods)

revenue falls when price rises

Inelastic Demand

when the quantity demanded stays relatively the same even with changes in price (ex. necessities)

revenue rises when price rises

Unitary Elastic Demand

revenue stays relatively the same when price rises

Ed = 1

Determinants of Price Elasticity of Demand

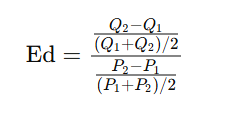

Ed = %change quantity demanded / %change in price

elastic: Ed > 1

inelastic: Ed < 1

unitary: Ed = 1

Perfectly Inelastic and Perfectly Elastic Demand

perfectly inelastic: quantity demanded does not change at all if price changes

perfectly elastic: quantity demanded drops to zero when the price changes

Total Revenue

price x quantity

Relationship between TR and Elasticity

elastic: as price increases, TR drops

inelastic: as price increases, TR rises

cross-price elasticity of demand

measures how quantity demanded of one good responds to the price change of another

positive: substitutes

negative: complements

Price Elasticity of Supply

how sensitive quantity supplied is to price changes

determinants of supply elasticity

time period

flexibility of production

availability of inputs

Midpoint Method of Calculating Elasticities

when to use: comparing two points on a demand or supply curve (before and after change); asked to find elasticity over a range of prices and quantities; when you want a consistent, direction-independent result

Willingness to Pay (WTP)

maximum amount a buyer is willing to pay for a good

Consumer Surplus (CS)

= WTP - price paid

market CS: the area between demand curve and price level

English Auction

bids go up until the highest bidder wins

Dutch Auction

price goes down until a buyer accepts

Willingness to Sell (WTS)

minimum price a seller is willing to accept

Producer Surplus (PS)

= price received - WTS

market PS = area between supply curve and price level

Total Surplus (social welfare)

= CS + PS

measures the total benefit to society

Desirability of Free Markets

maximize total surplus and allocate resources efficiently

Taxes and their Economic Consequences

affect price paid by buyers and received by sellers

cause deadweight loss and reduce total surplus

Tax Incidence

who actually bears the burden of a tax - buyers and sellers (depends on relative elasticities)

Tax Revenue

= tax x quantity sold

Deadweight Loss (DWL)

loss in total surplus due to market distortion, like taxes or tarrifs

Nonbinding Price Controls

has no effect because the market equilibrium is already legal

Binding Price Controls

has an economic effect because it forces the price away from equilibrium

Price Ceiling

legal maximum price, like rent controls; binding if set below equilibrium (causes shortages)

Price Floor

legal minimum price, like minimum wage; binding if set above equilibrium (causes surpluses)

Rent Control

price ceiling applied to housing rents

Price Gouging Laws

temporarily limiting prices during emergencies

Minimum Wage & its history

price floor for labor

Short-Run and Long-Run Effects of Price Controls

SR: quantity and supply/demand are less responsive

LR: elasticities increase, making effects of DWL worse

Fixed Costs (FC)

costs that do not change with the level of output

ex. rent, salaries, insurance (all must be paid even in production = 0)

Variable Costs (VC)

costs that change with the level of output

ex. raw materials, hourly wages, electricity