Macroeconomic objectives and policies

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

22 Terms

The seven major objectives

Economic growth i.e increase in real incomes, or potential output

A reduction in unemployment

Control of inflation i.e preventing prices to rise too quickly

Restoration of equilibrium in the balance of payments, there should not be either a persistent and heavy outflow or inflow of income and wealth.

Fiscal balance

Protection of the environment

Making distribution of income more equal

Demand side policies

Any deliberate action taken by governments or monetary authorities to shift the AD curve

Two types of demand side policy

Monetary policy

Fiscal policy

Monetary variables

Money supply

Interest rates

Exchange rates

Monetary policy

The manipulation of monetary variables to achieve government objectives

Fiscal policy

The manipulation of government spending and taxation to shift AD

Interest rates

If aggregate demand needs to decrease, then interest rates are raised, this means C, I, and (X-M) tends to fall. The AD shifts left

If aggregate demand needs to increase, the interest rate is cut. This means that C, I, and (X - M) will tend to rise. The AD shifts right.

There are multiplier effects which increase the impact of the change

Who sets the interest rate

The Monetary policy committee of the Bank of England

Quantitative easing

A bank buys a large amount of financial assets (like government bonds) from the market

This increases demand for those bonds, raising their price

When bond prices goes up, their interest goes down

It has the same effect as lowering interest rates, makes borrowing cheaper and encourages spending/ investment

Fiscal deficit

When government spending is greater than government taxation revenue

Expands AD with multiplier effects

Fiscal surplus

When gov spending is lesser than government taxation revenue

Contracts AD, with multiplier effects

Direct and indirect taxes

A rise in direct taxes might mean people have reduced incentives to work hard and earn money

whilst if indirect taxes are raised, the cost of living increases, particularly for those on lower incomes

Strengths of demand side policies

According to Keynesian economics:

Demand side policies are the only way to get a country out of demand deficient unemployment and stagnation

If the multiplier is large, it can have a significant impact on growth

if there is spare capacity, the economy can grow quickly

If used to control demand-pull inflation, they can act quickly and solve the problem.

Weaknesses of demand side policies

Expansionary demand side policies only cause inflation in the long run

The multiplier might be so low they have little effect

If there is no spare capacity, supply side policies will be needed instead fir economic growth

The gov can end up running a huge deficit, adding to debt

Supply side policies

Government measures aimed at improving the productive capacity and efficiency of the economy

Types of supply side policies

Cutting corporation taxes

Removing regulations and restrictions preventing firms from growing

Encouraging investment by forcing banks to lend money, or quantitative easing

Increasing competition in markets

Privatising or subsidising industries

Improving labour market with improved education

Improving infrastructure

Conflict of inflation and unemployment

When the government tries to control inflation it is likely to try to dampen aggregate demand.

So, less spending means less upwards pressure on prices

The gov may increase taxes, or the MPC may increase interest rates

This may prevent inflation, but it reduces spending

Reduced spending means firms start laying off workers as they’re unable to sell all their products

As workers are laid off, incomes fall so the cycle continues

Conflict of unemployment and inflation

If the gov wants to reduce unemployment they may start spending more on training workers, or start subsidising firms to take on more workers.

The increased spending in the economy causes incomes to rise, pushing AD to the right.

If supply cant match this it causes an increase in prices as it is competitive

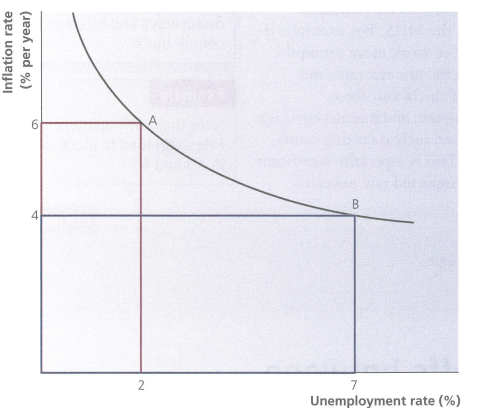

Philips curve

an economic model that suggests an inverse relationship between the rate of unemployment and the rate of inflation

Conflict between economic growth and sustainability

When an economy grows, standards of living tends to improve

For standards of living to be sustainable, growth must not occur at the expense of future generations

There is a conflict between someone enjoying a resource today and in the future

Think of damage to the environment

If increased use of fuels increase global warming then it may not be as appealing

Sustainable growth

Sustainable growth is growth that does not compromise the welfare of future generations

Conflict between