Price Action

1/195

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

196 Terms

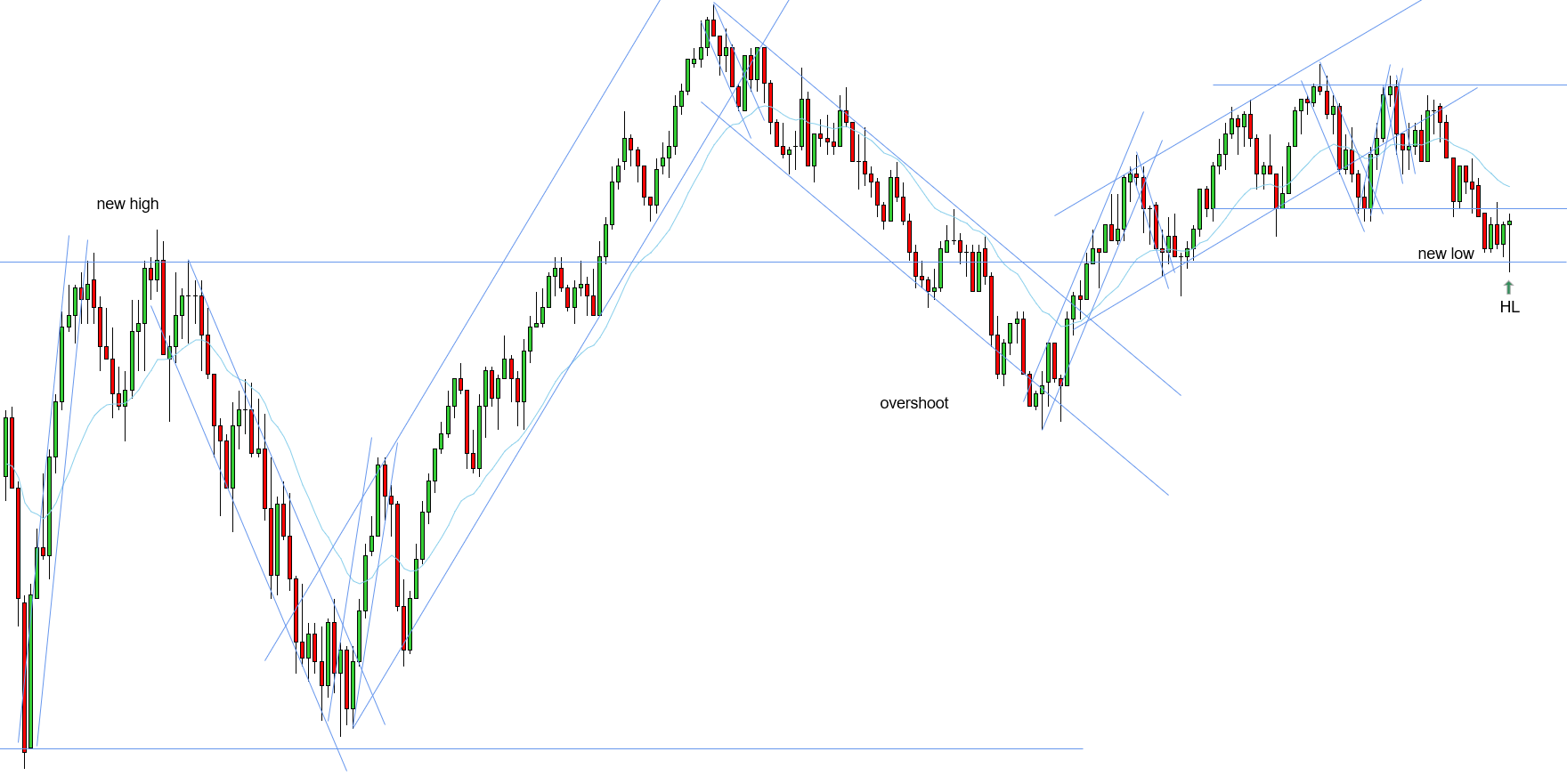

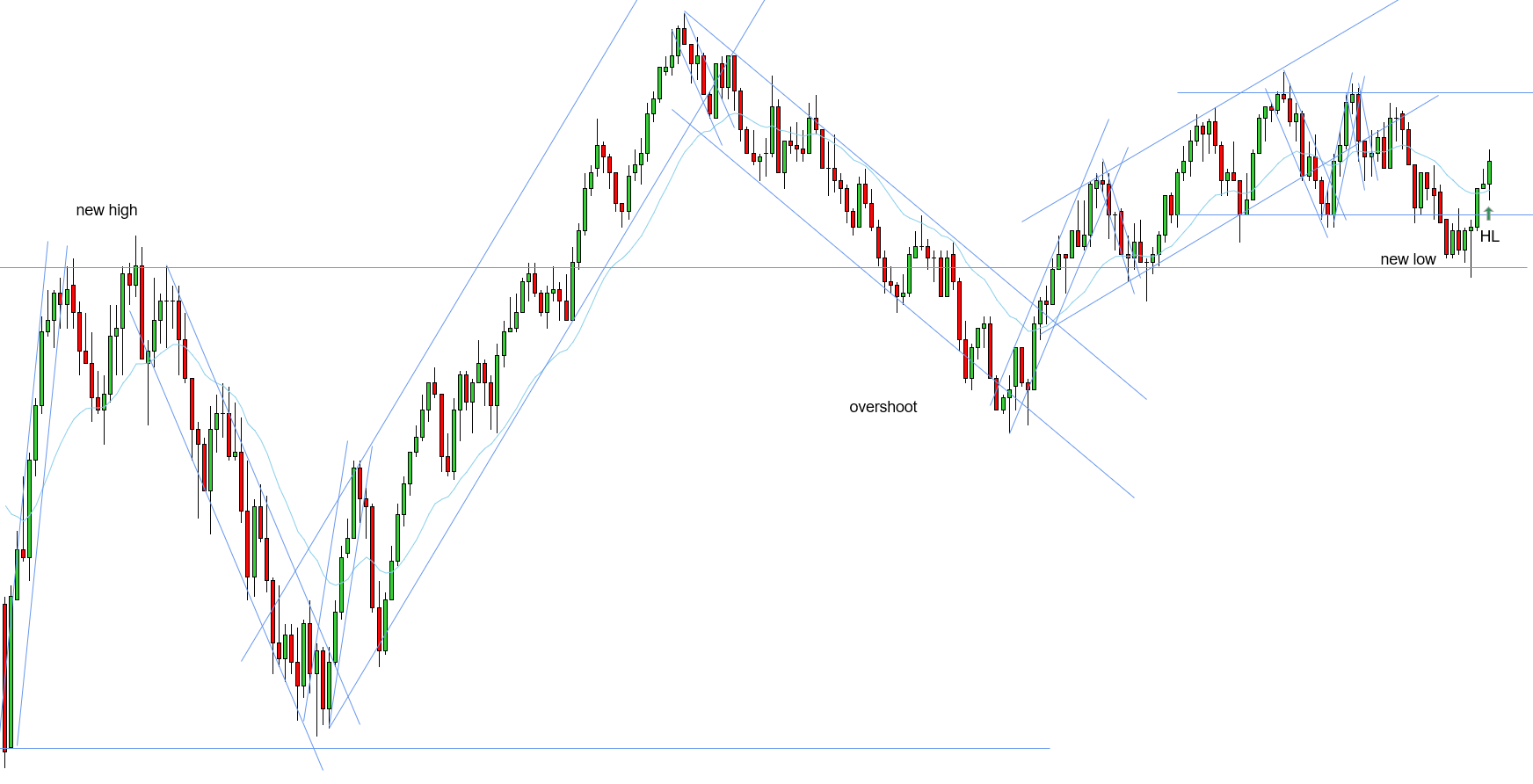

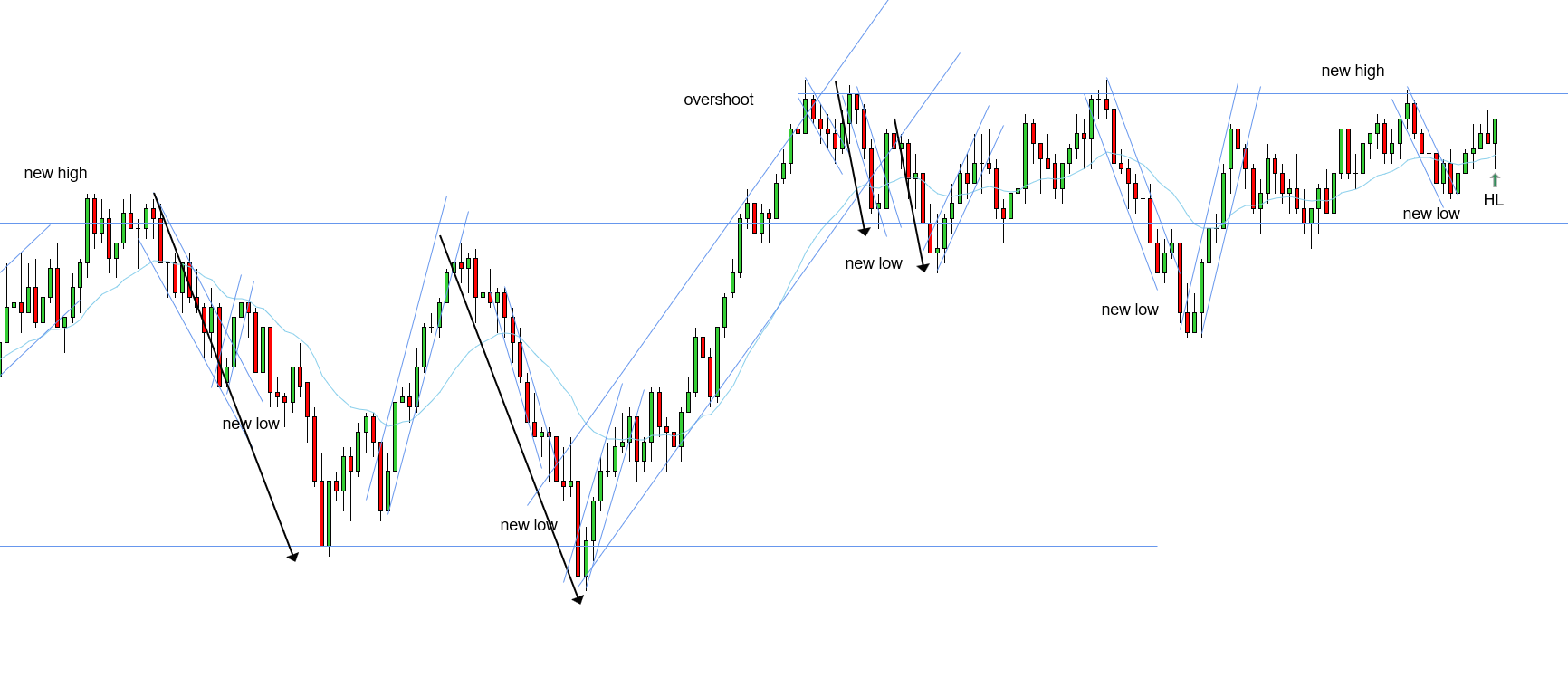

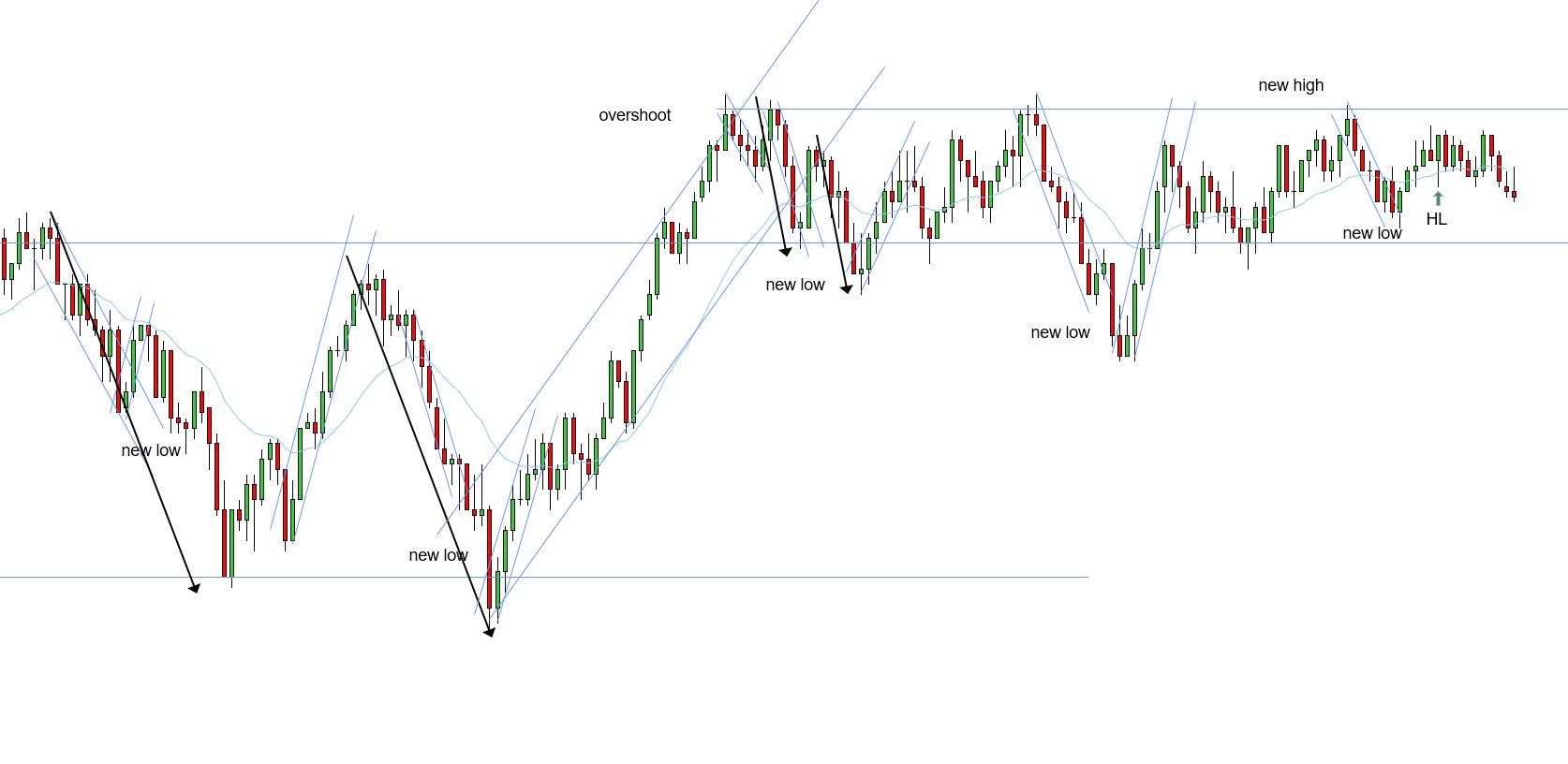

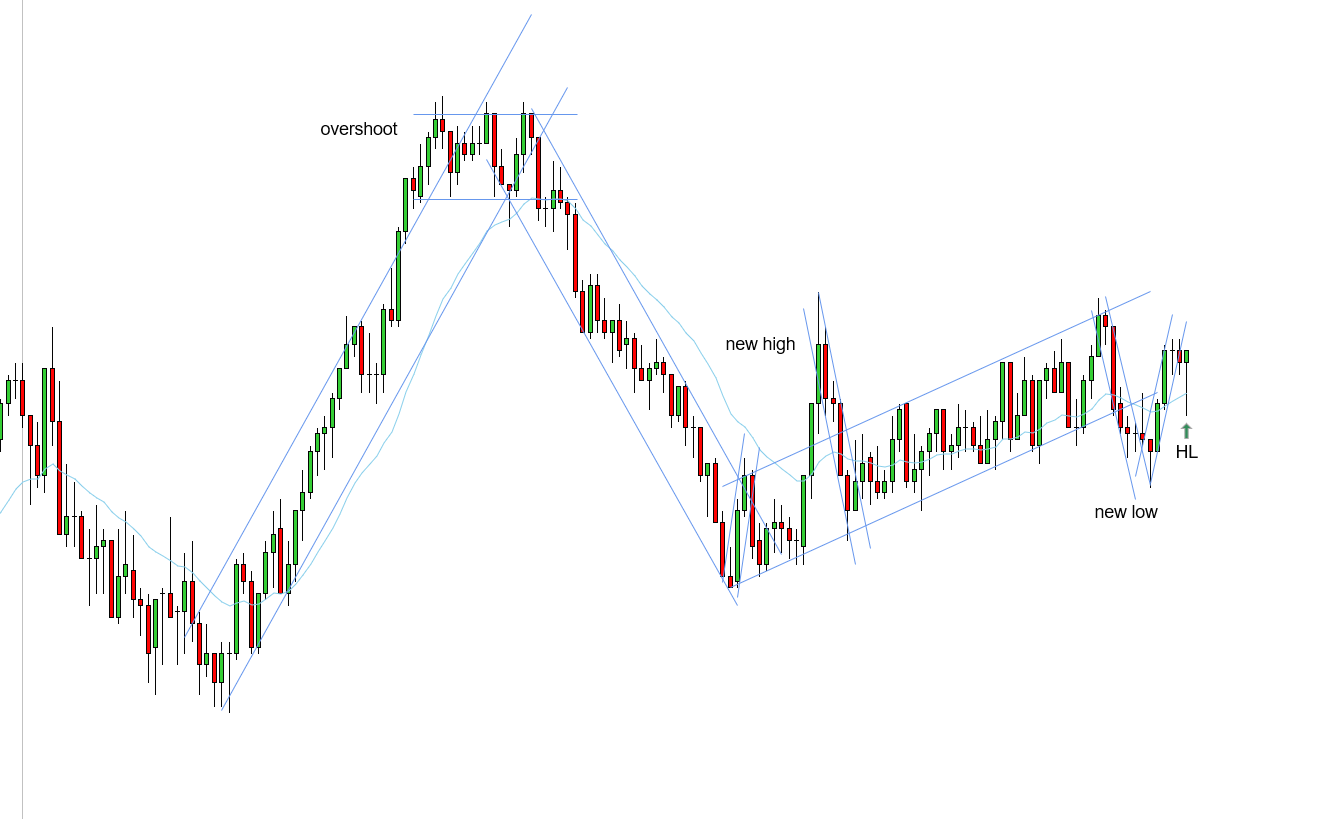

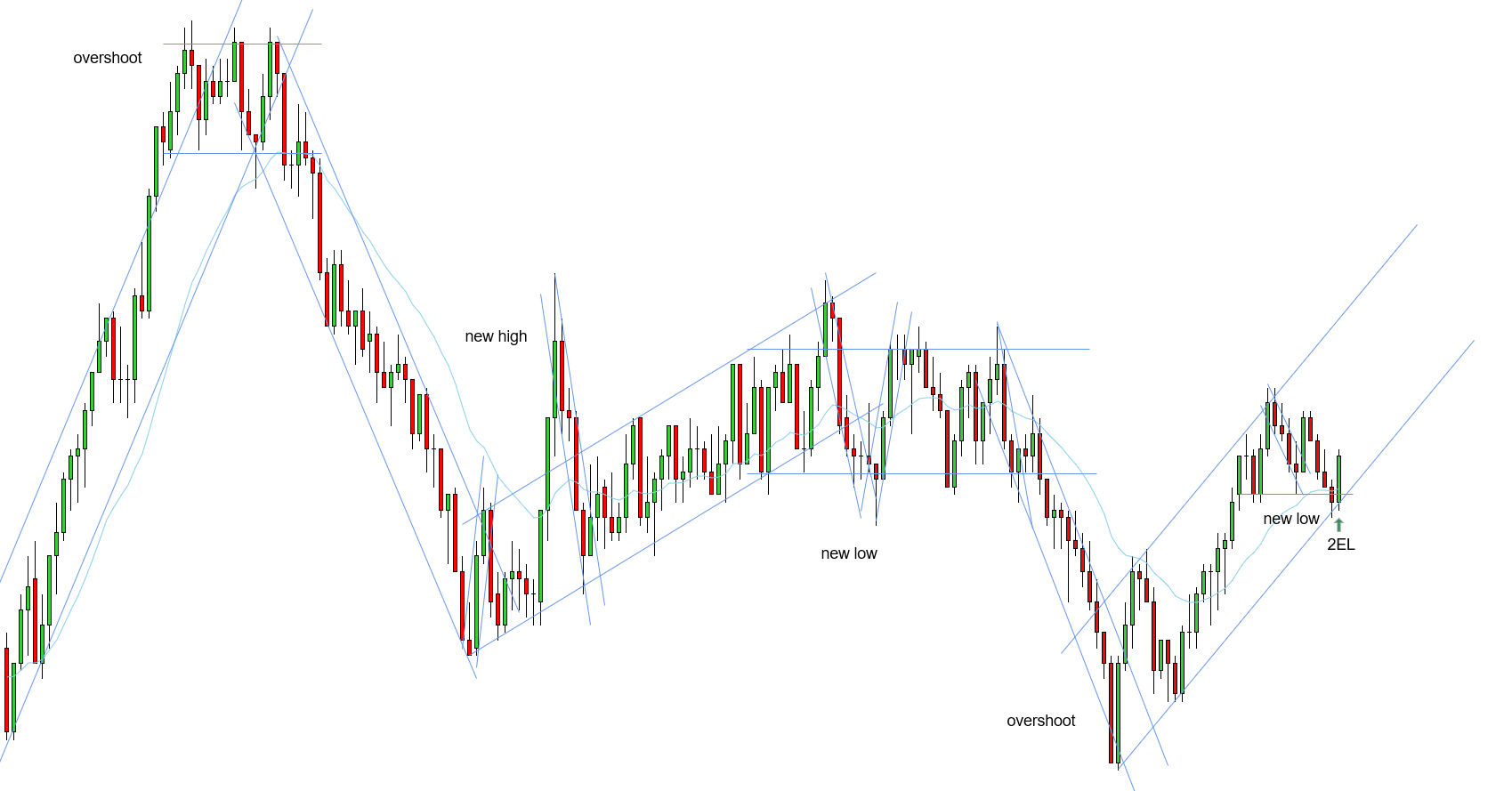

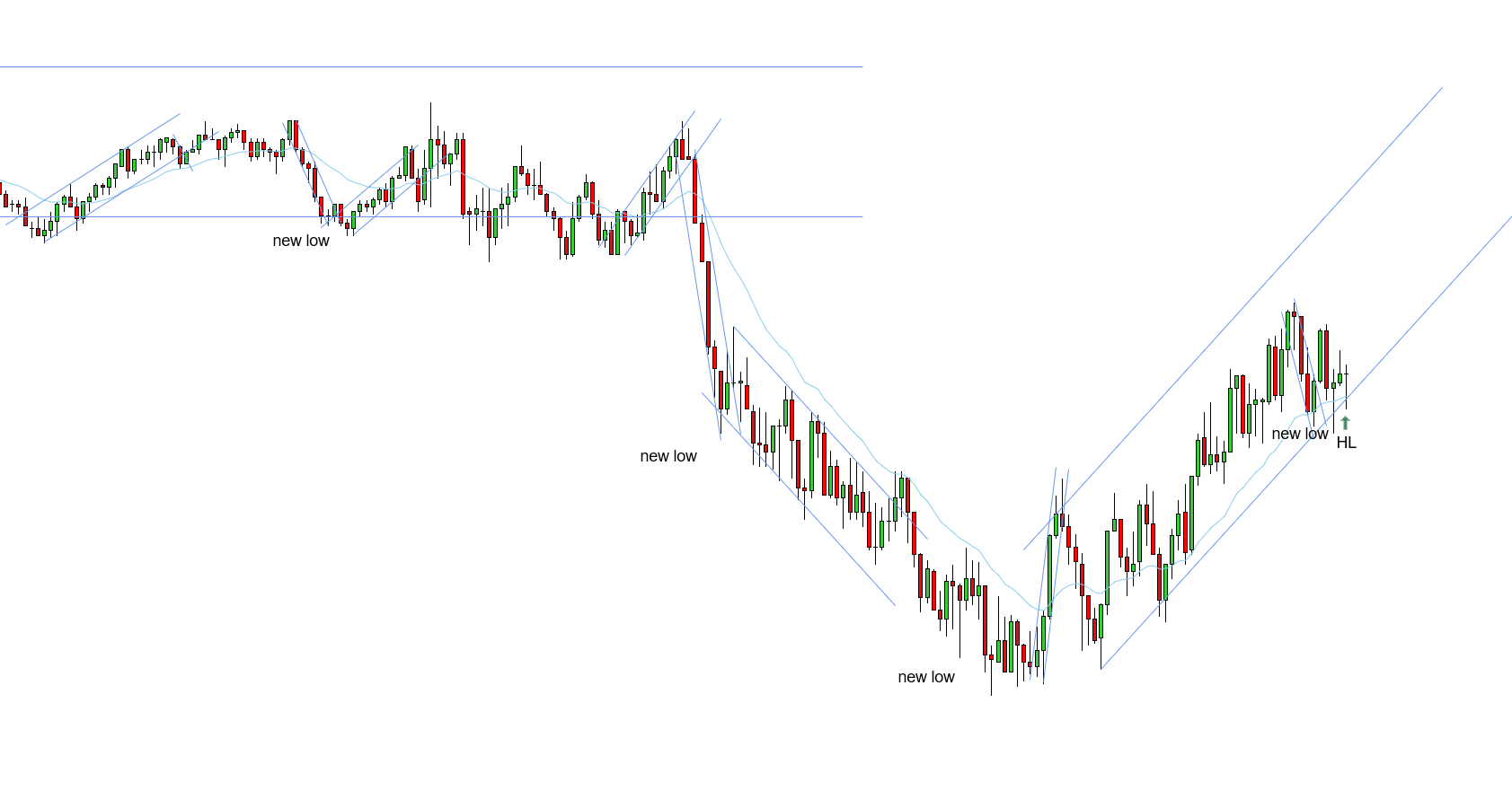

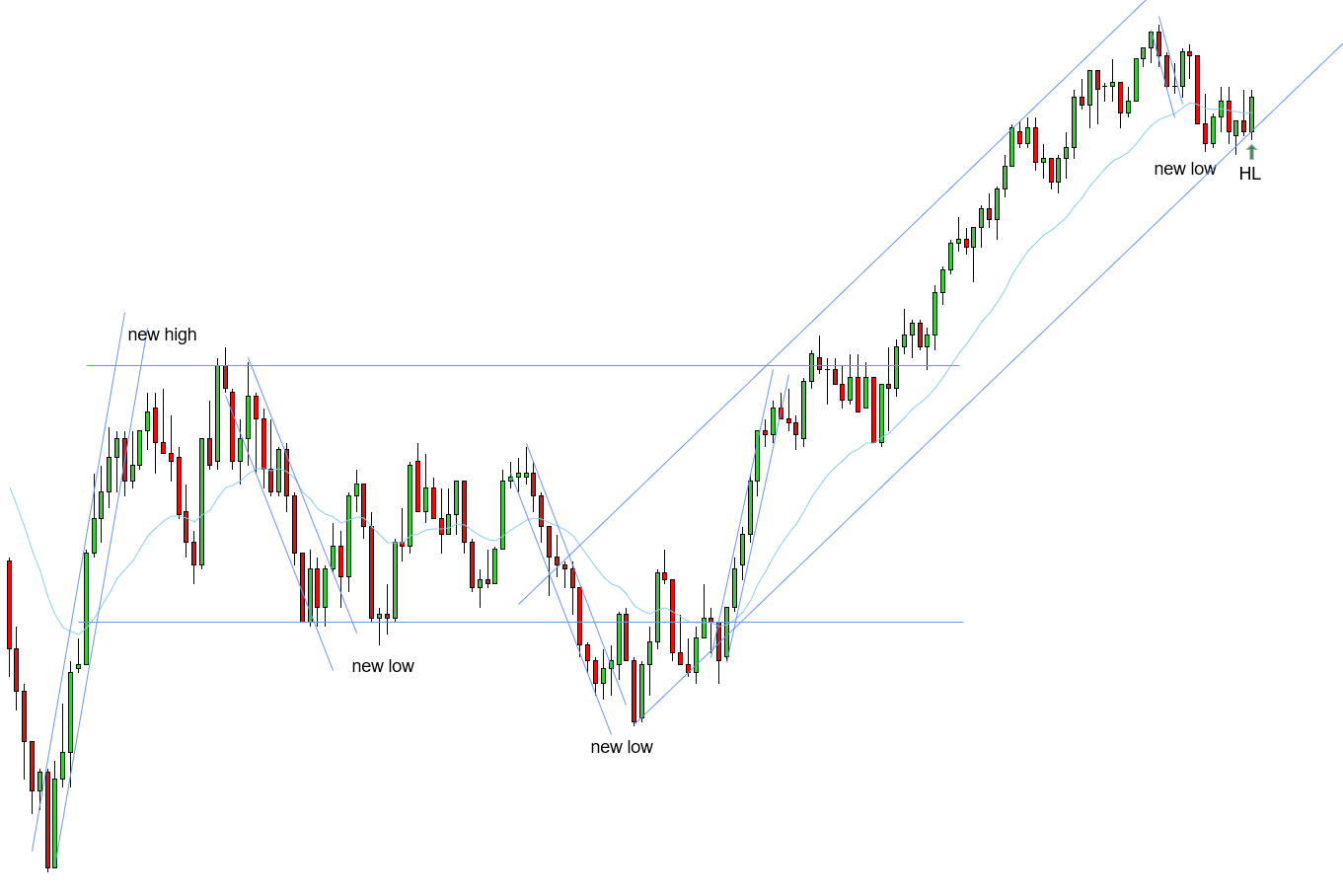

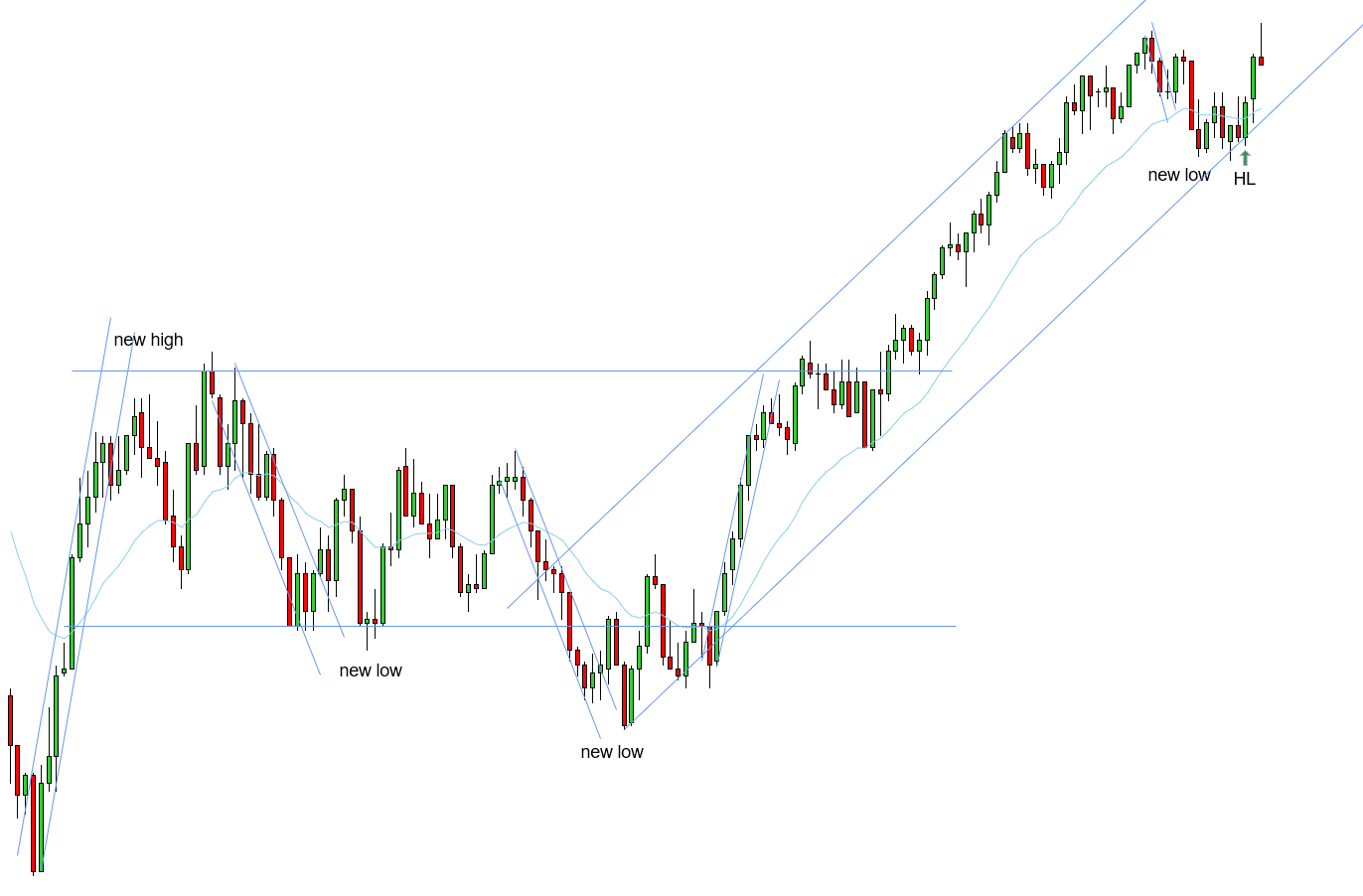

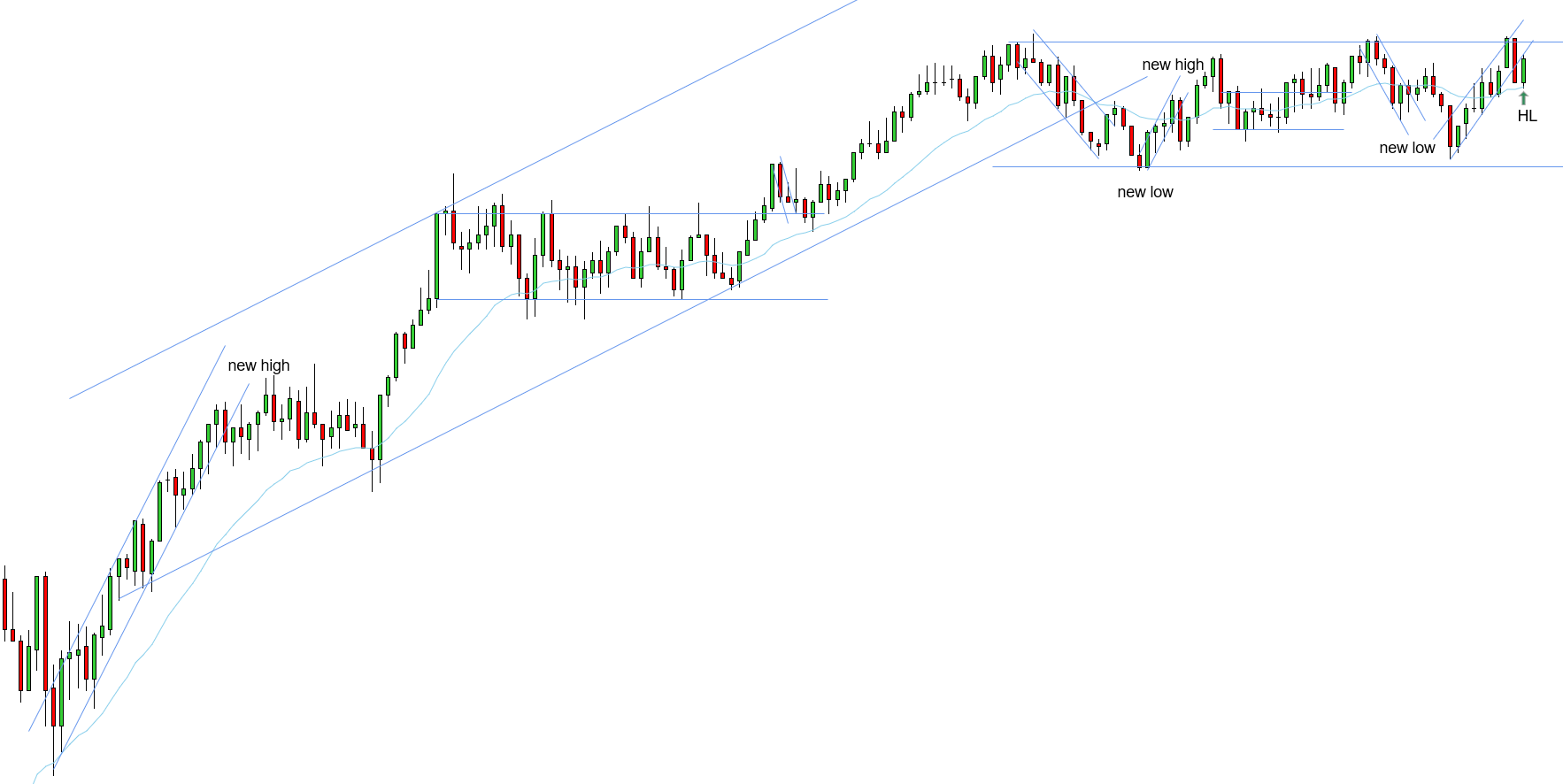

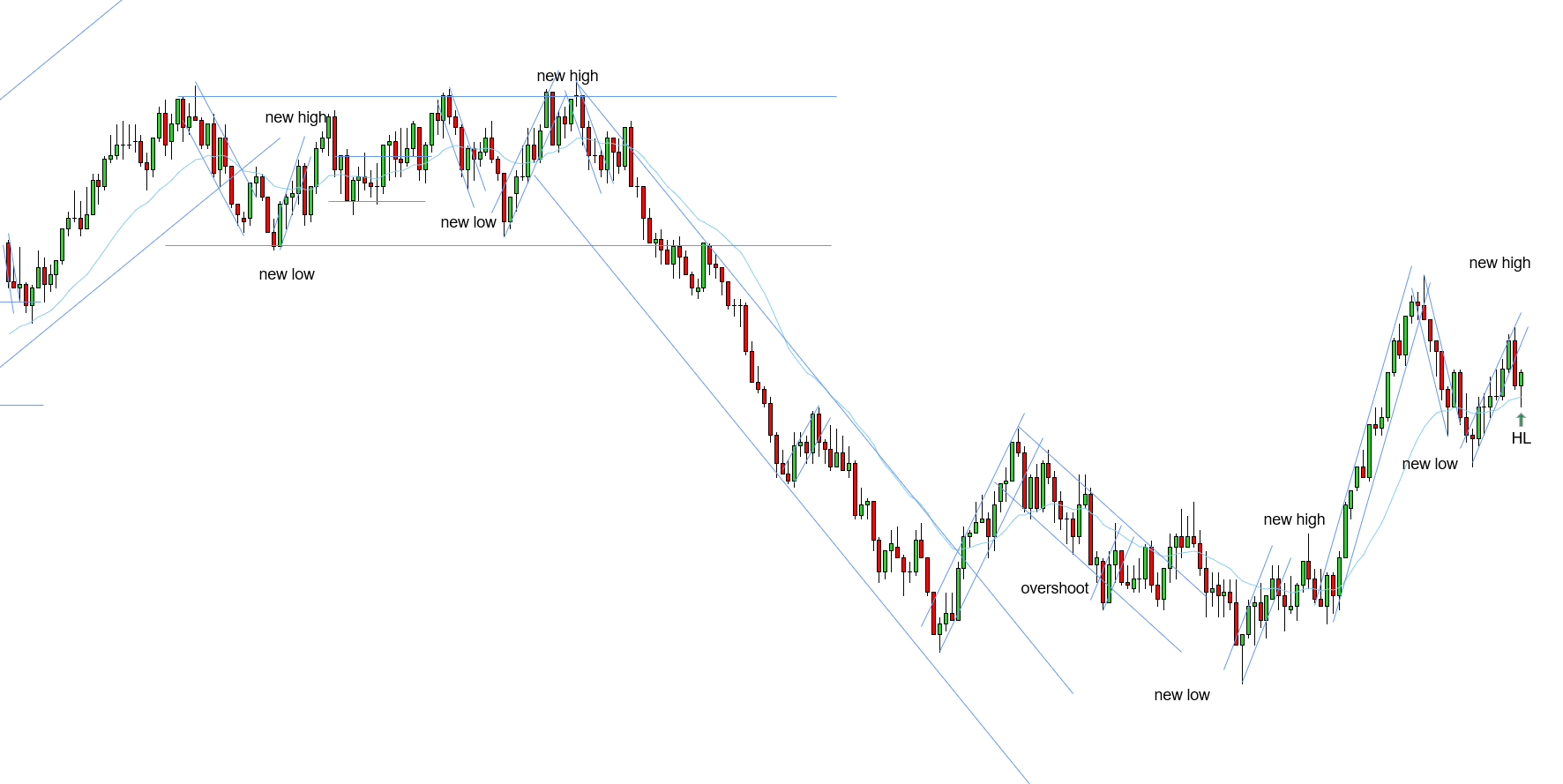

HL - 10/15/2025

W - New high for uptrend

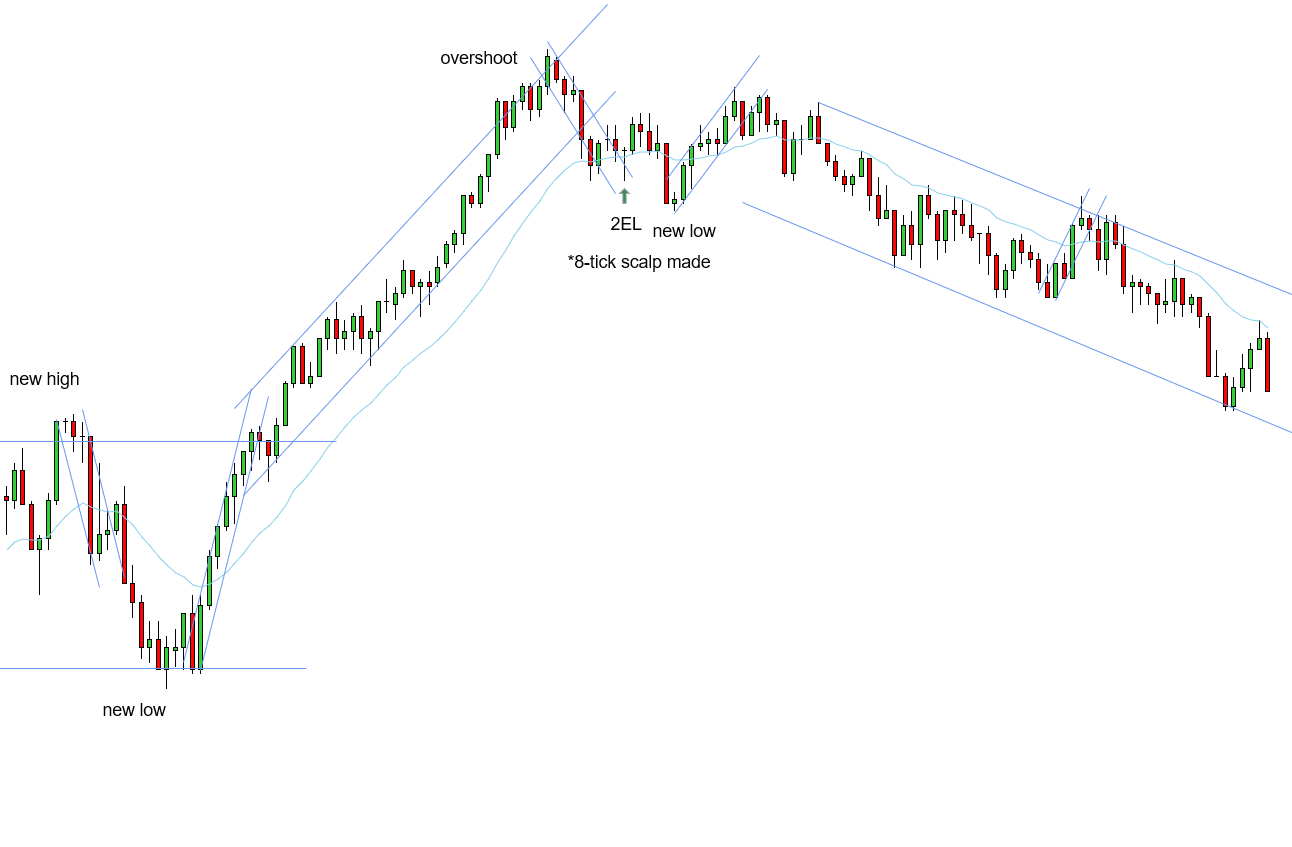

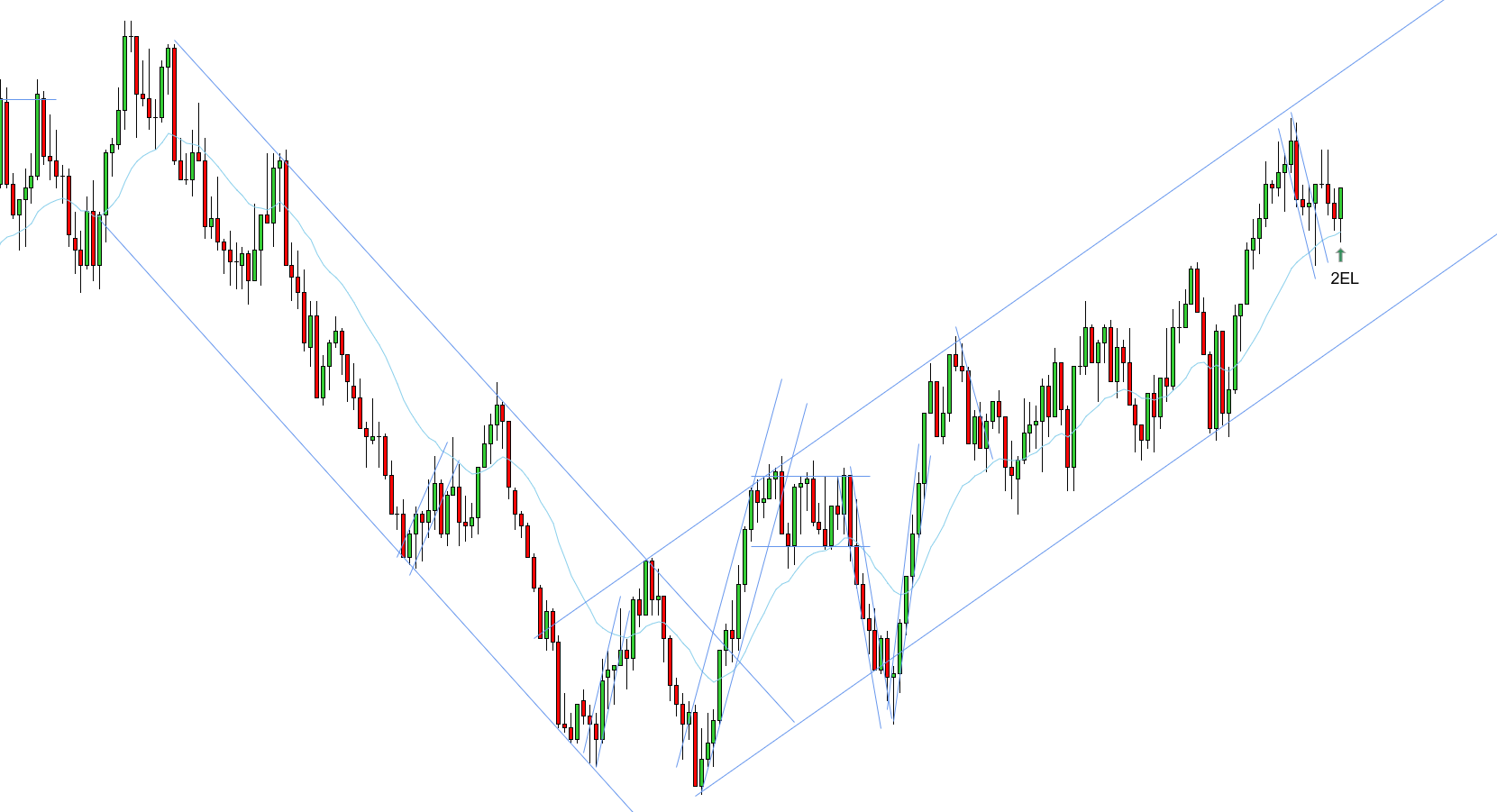

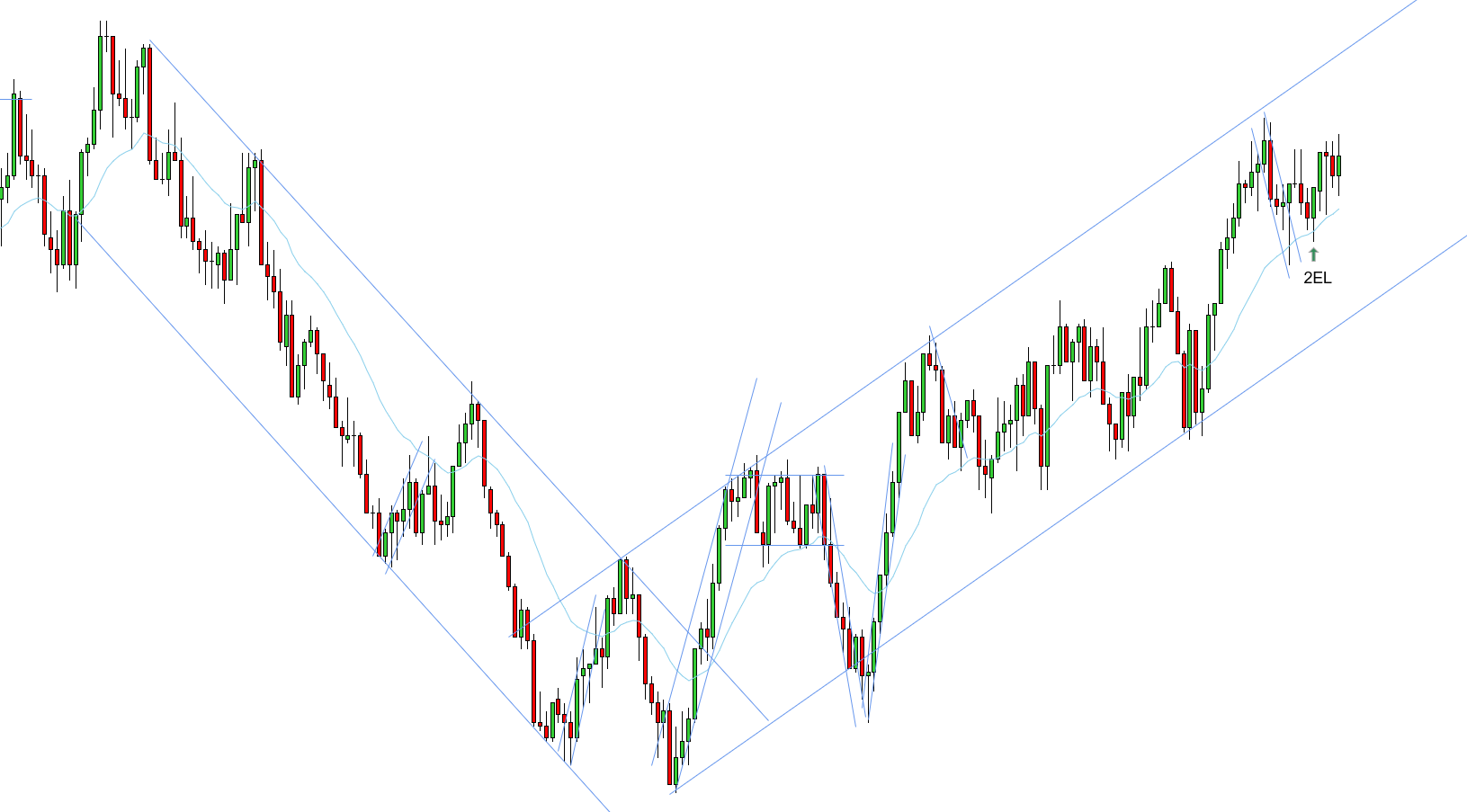

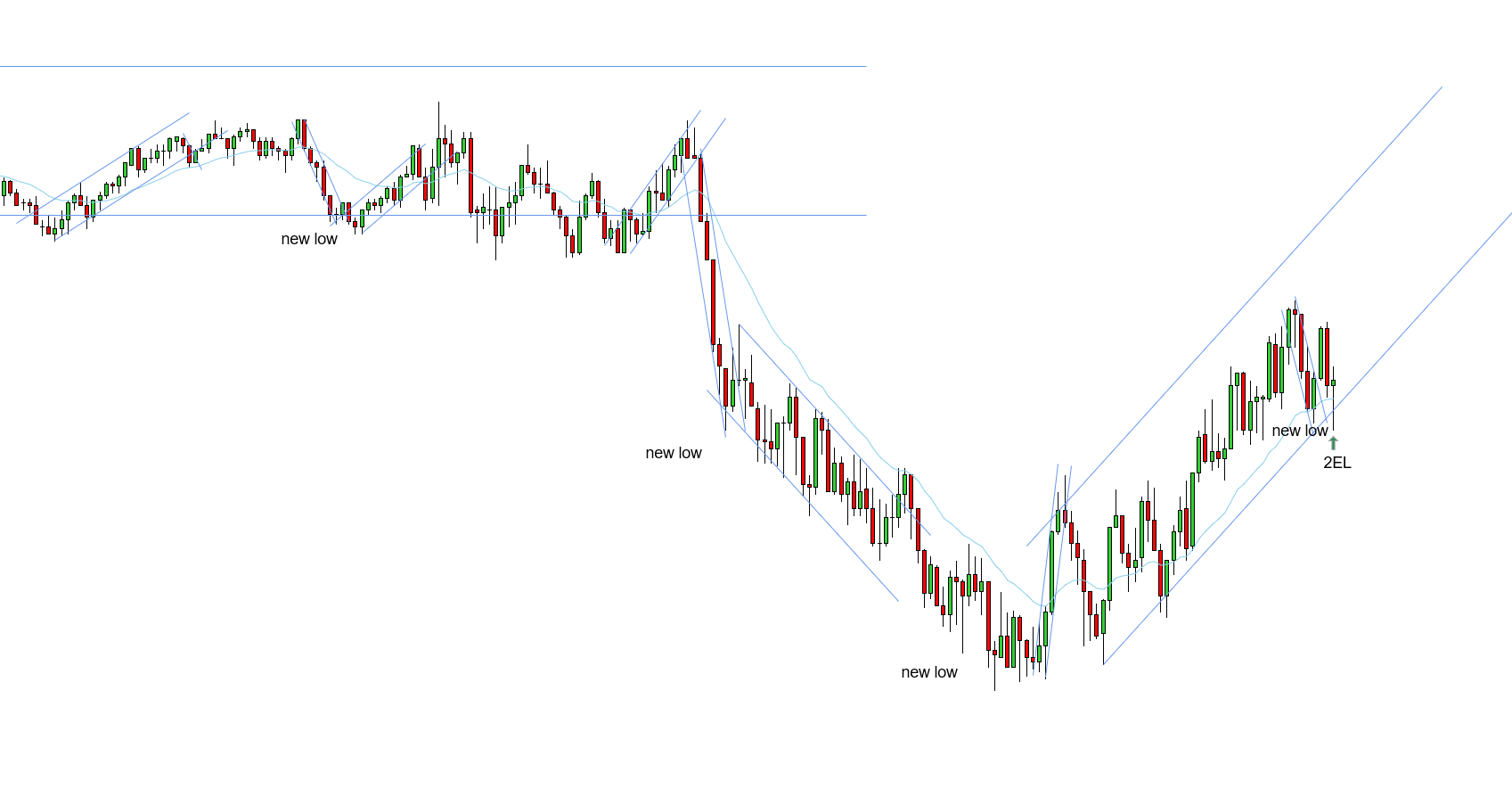

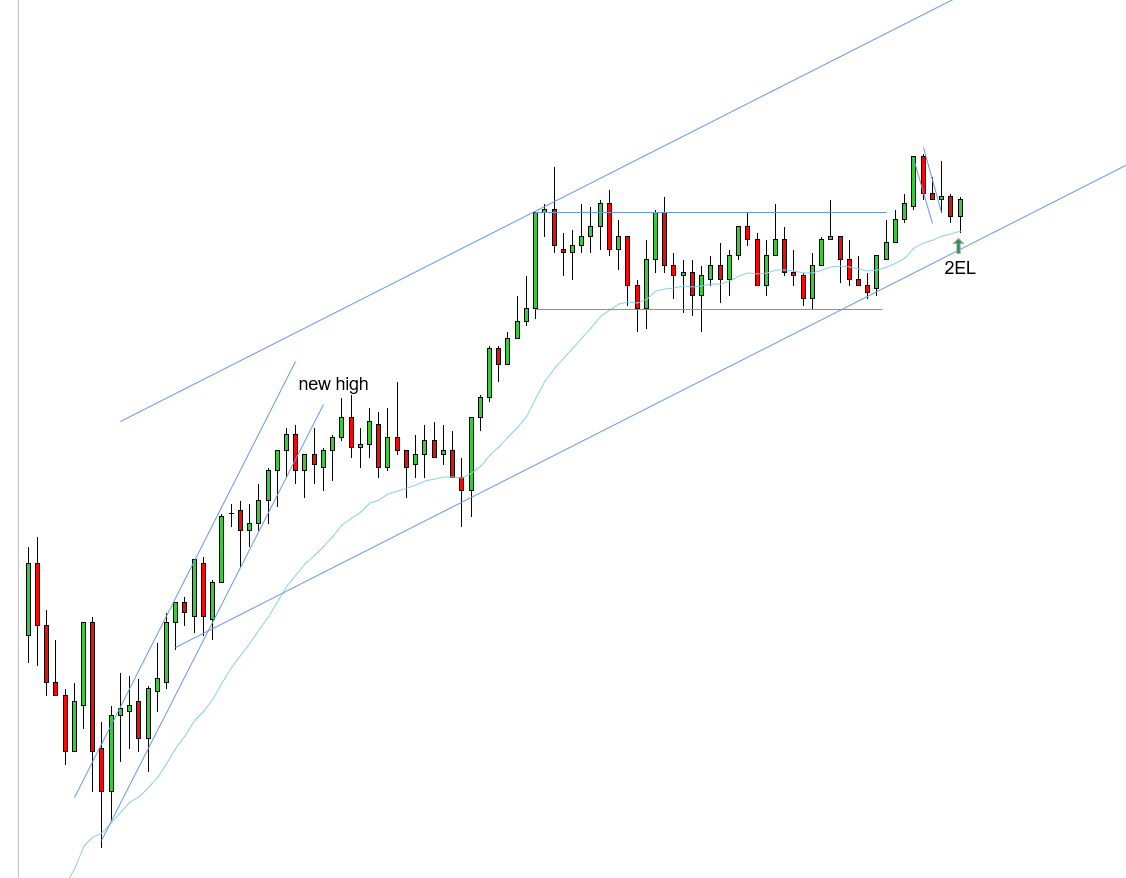

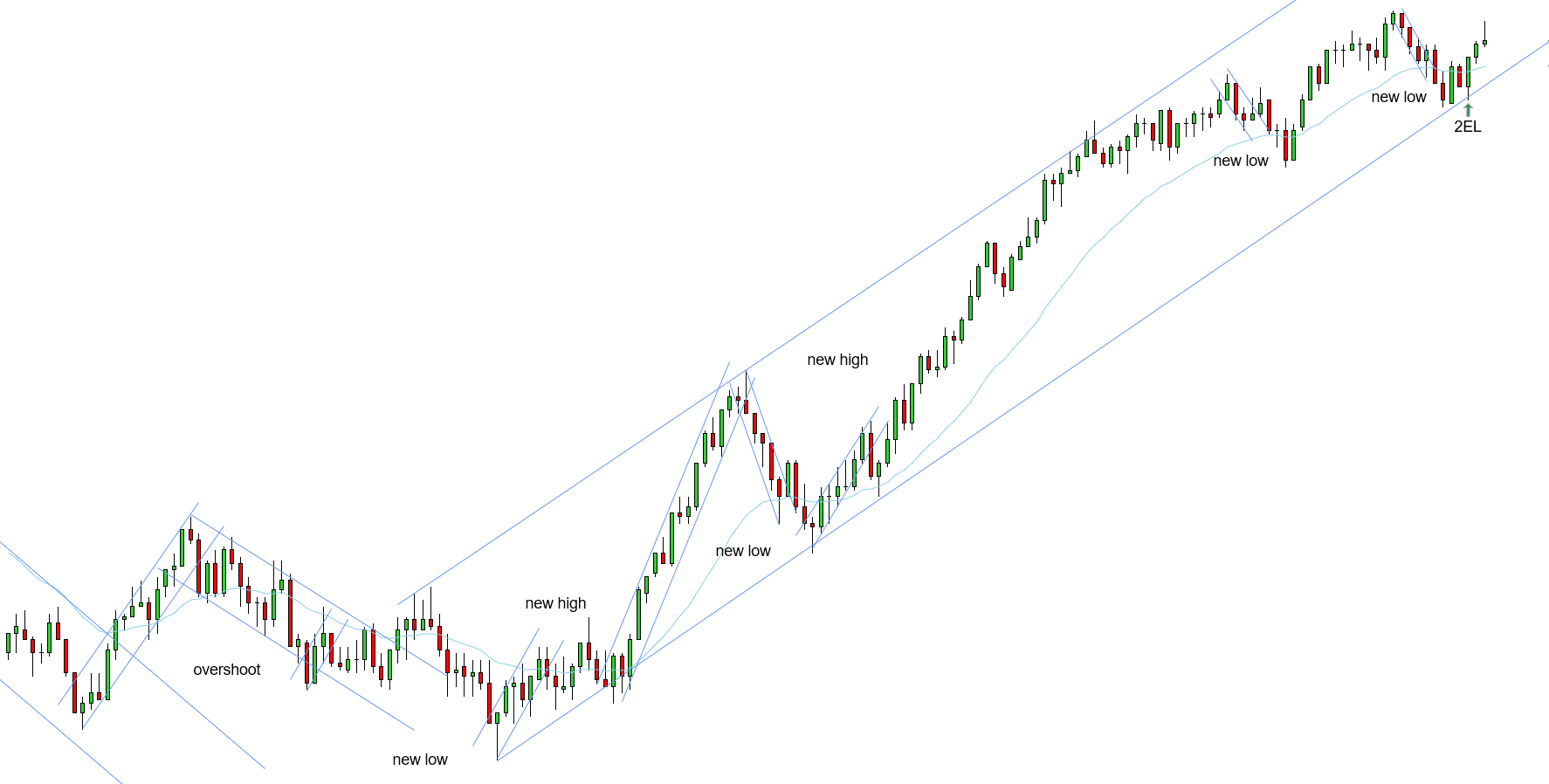

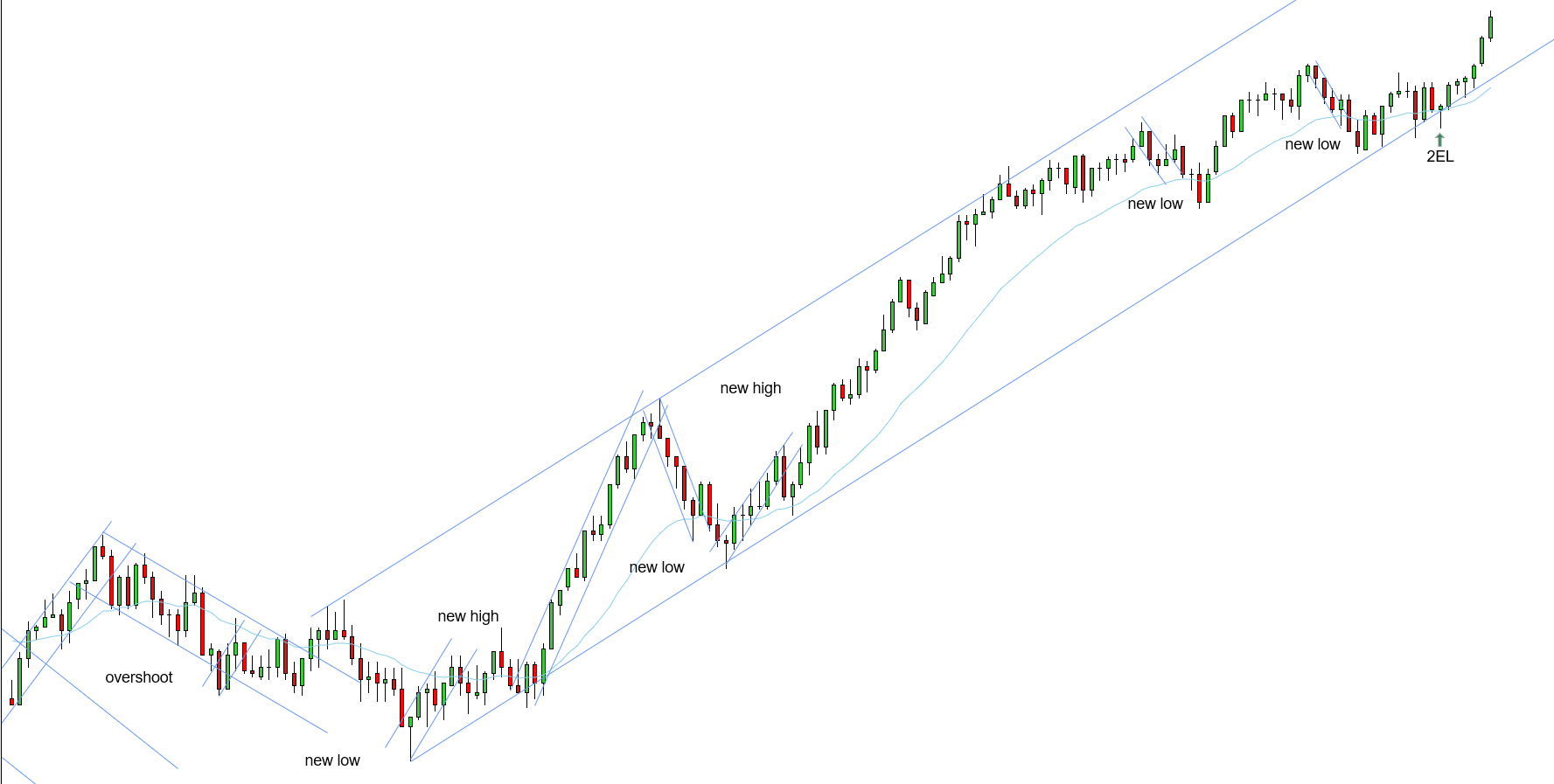

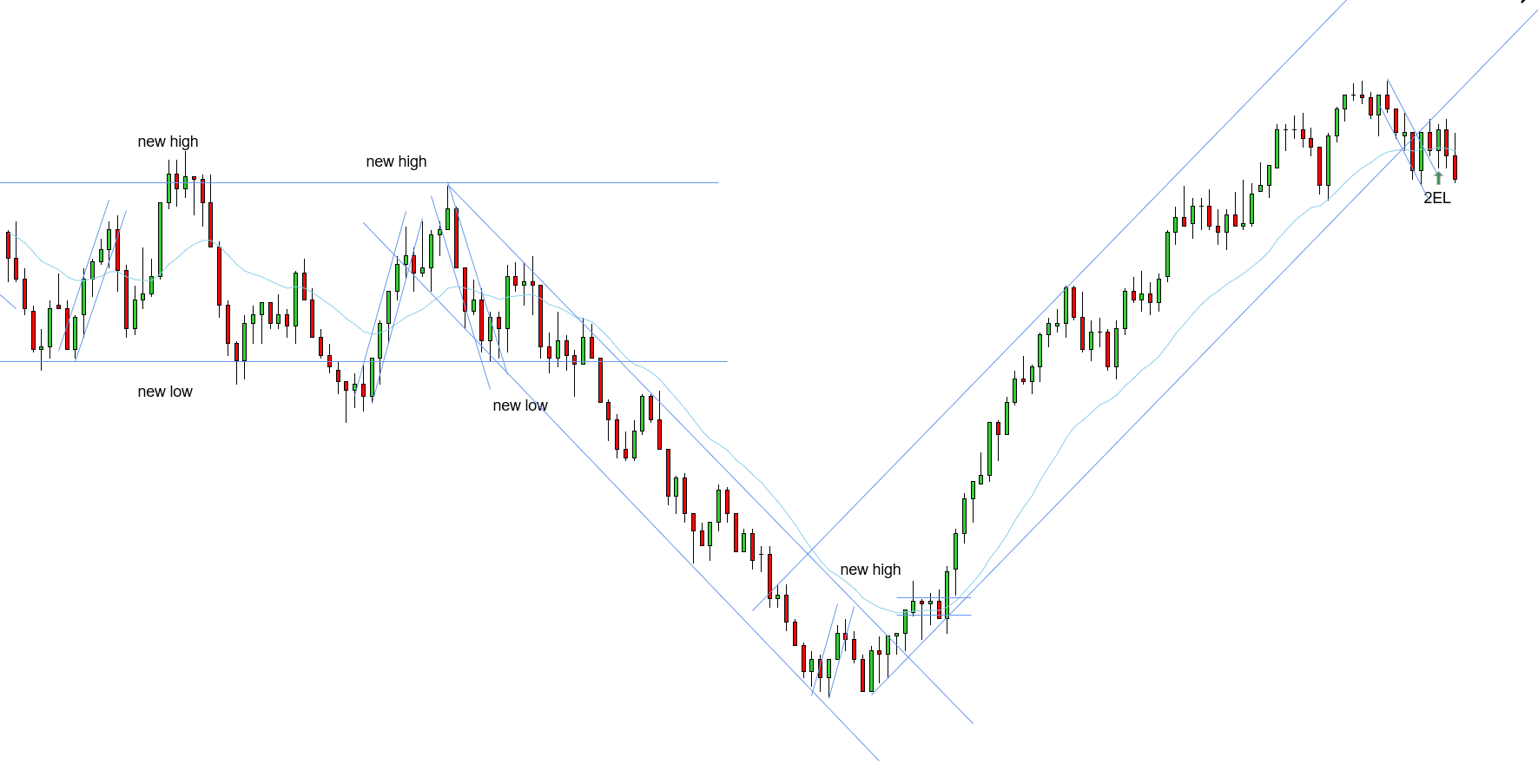

2EL - 10/15/2025

W - 8-tick scalp made - overshoot reversed the market

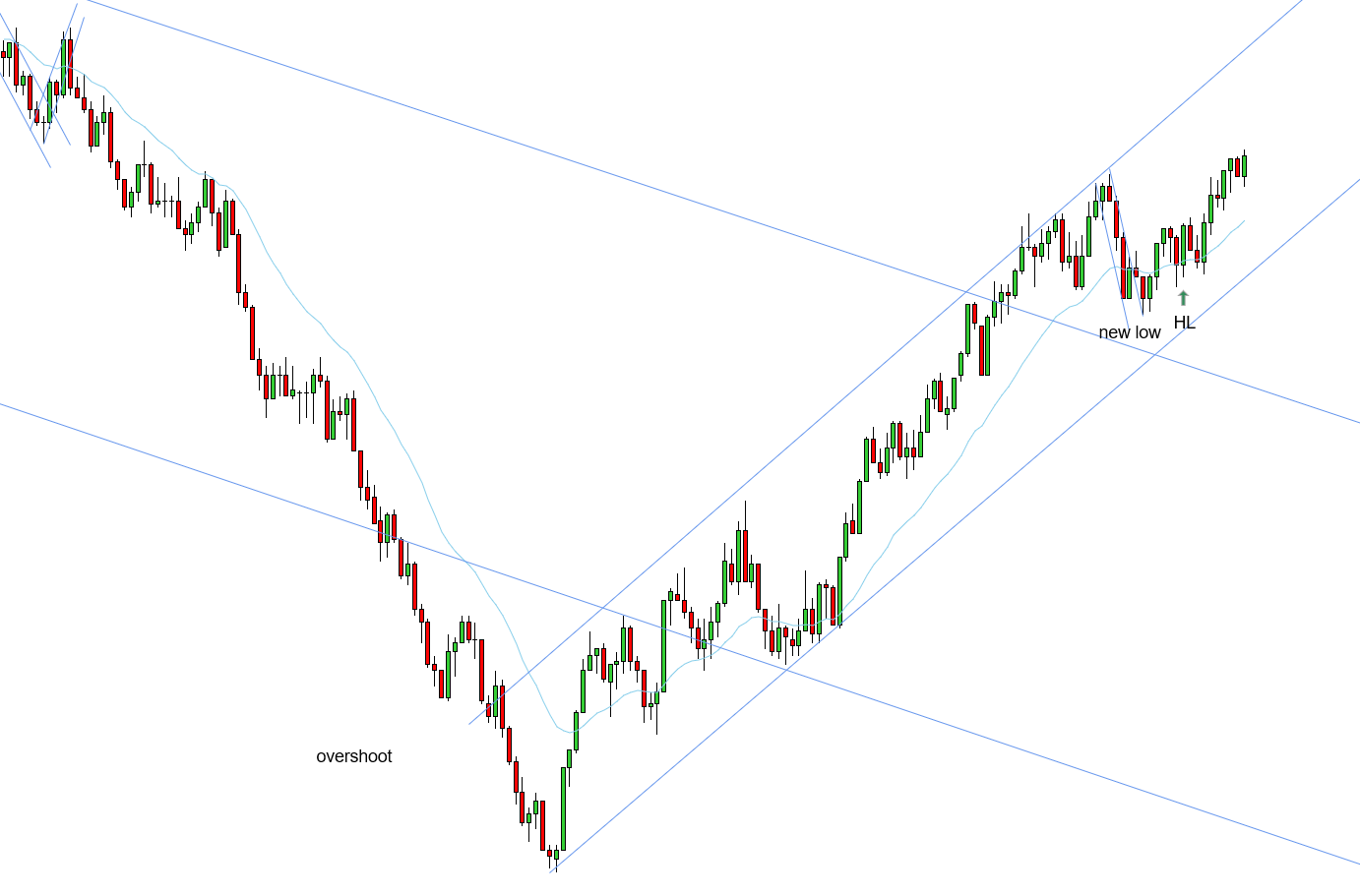

HL - 10/15/2025 (2)

W - HL with trend - STT played out

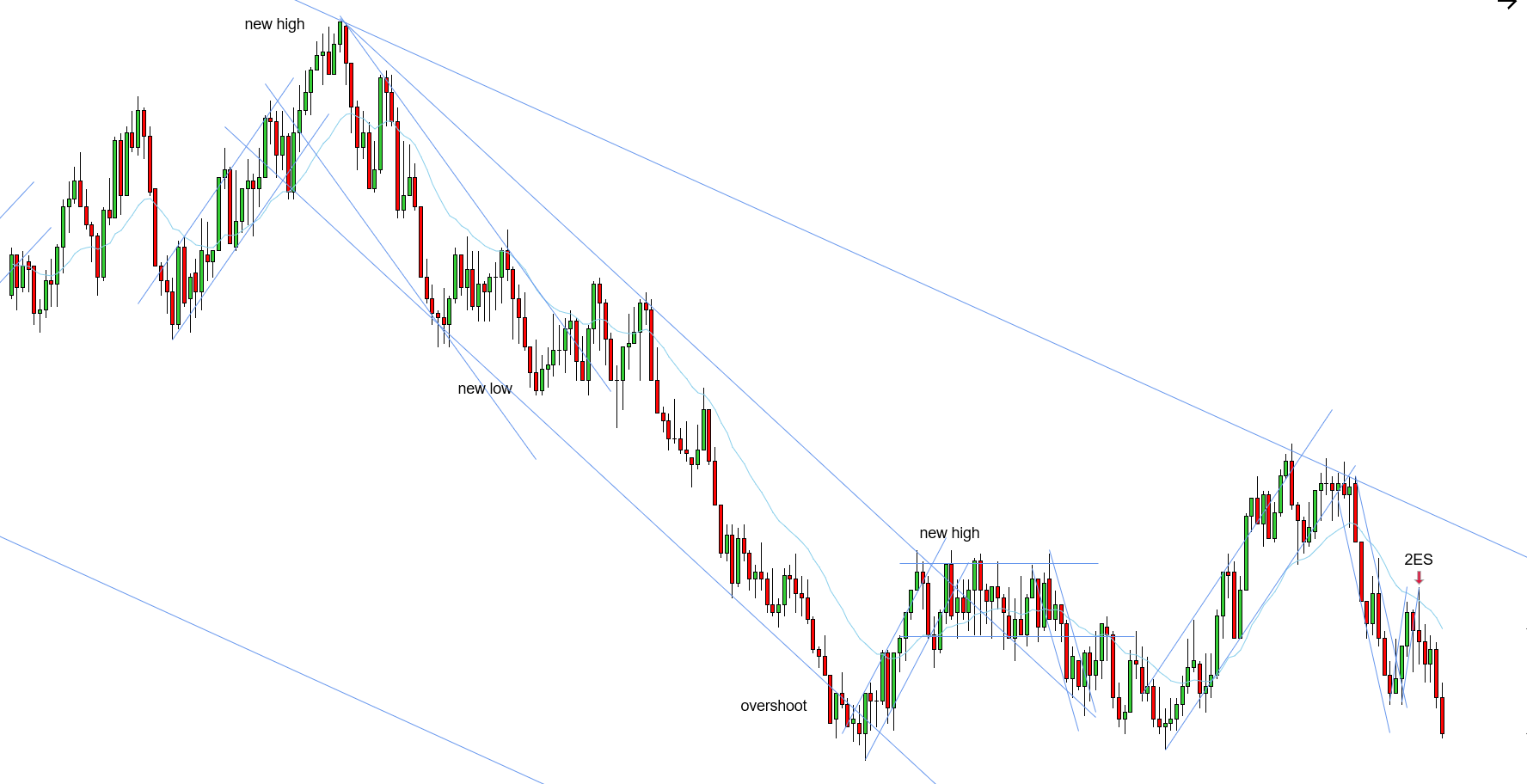

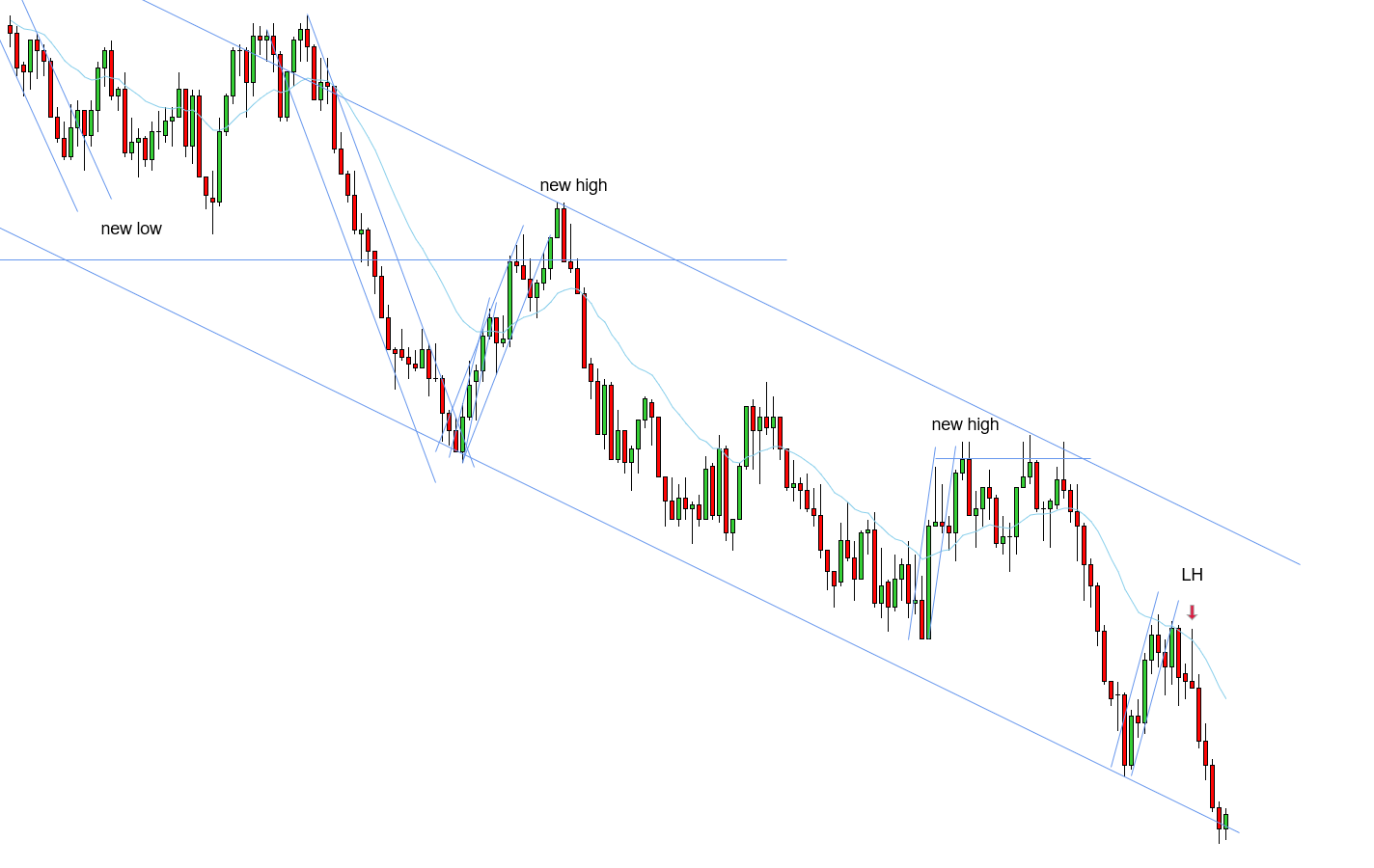

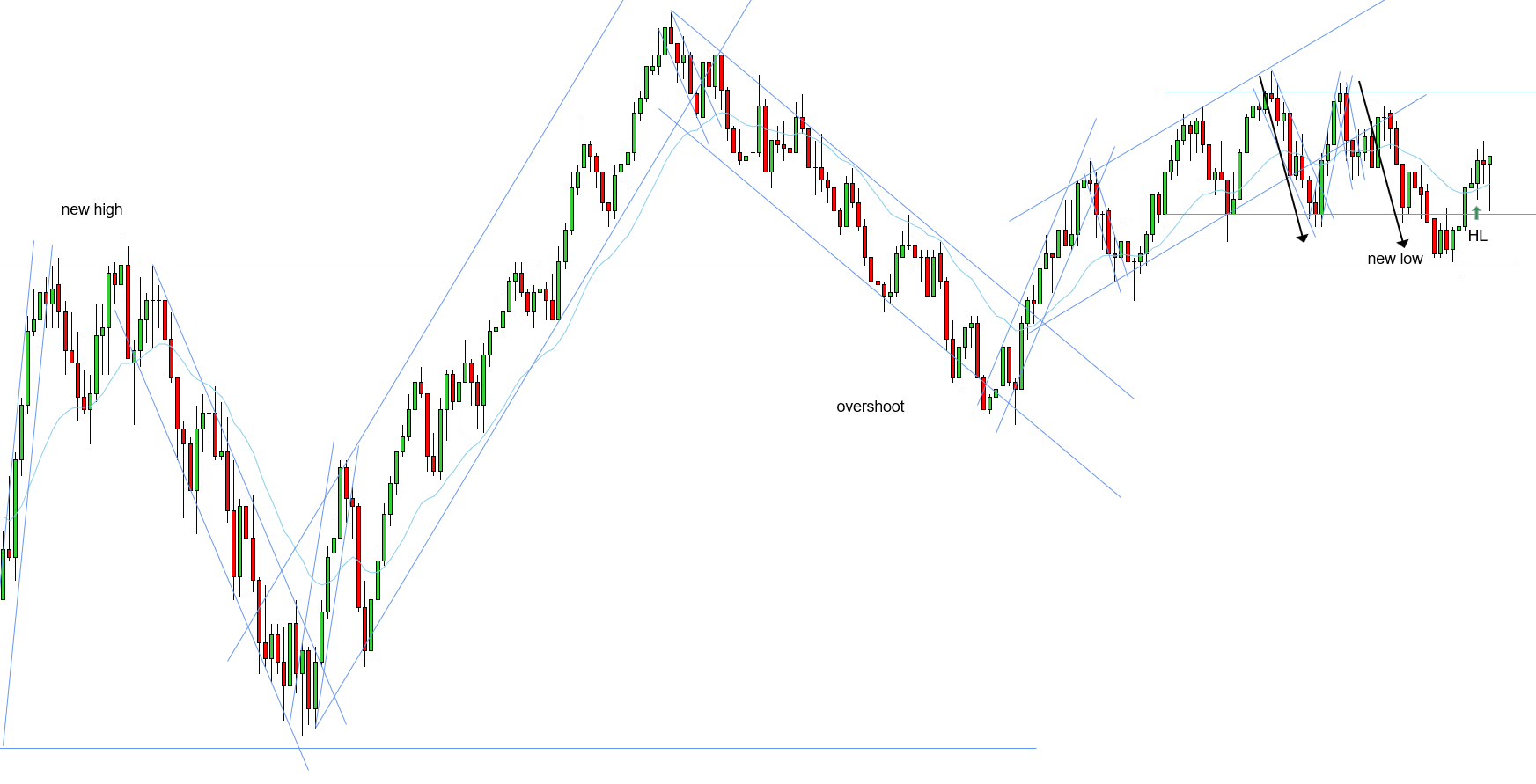

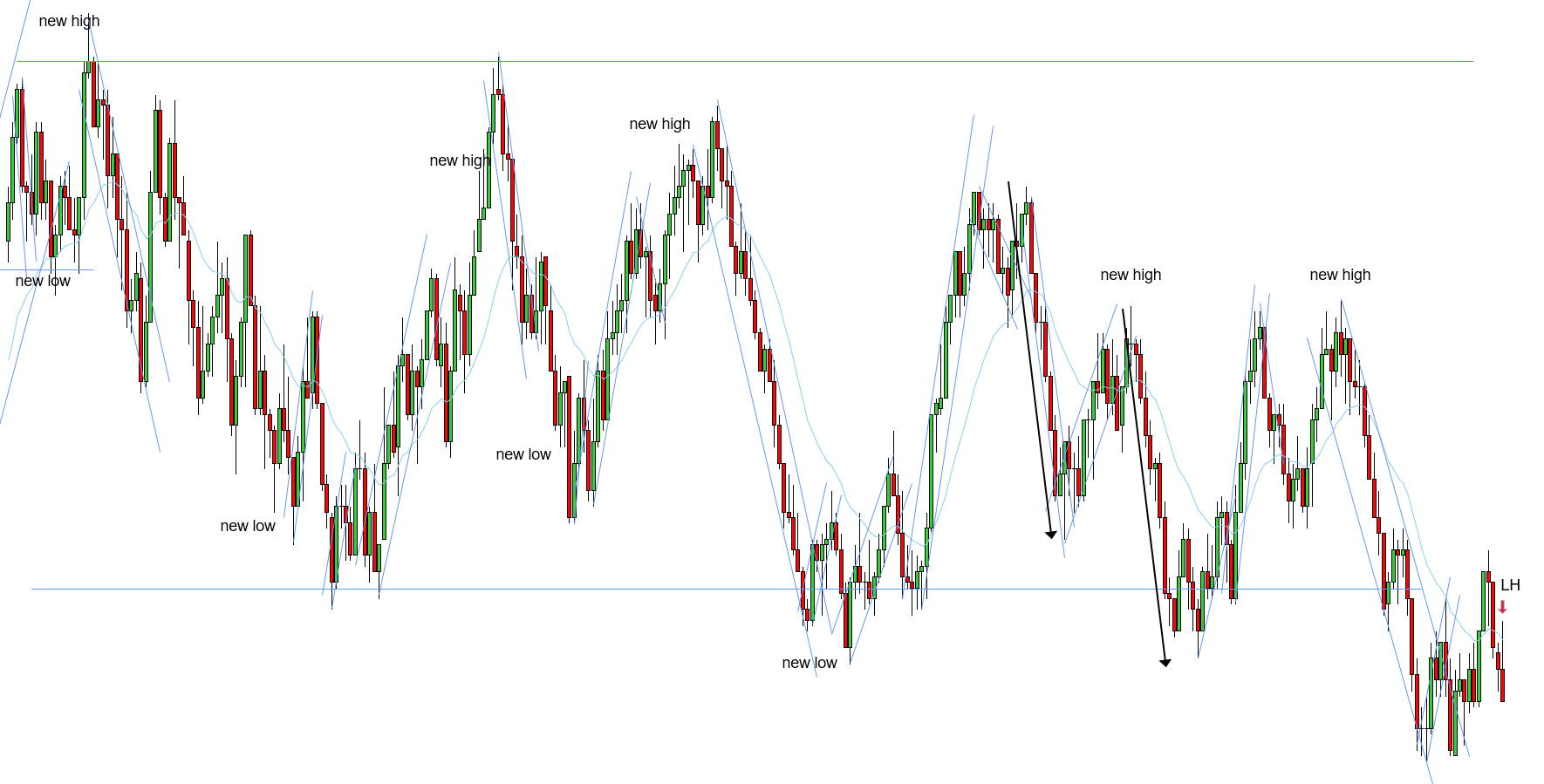

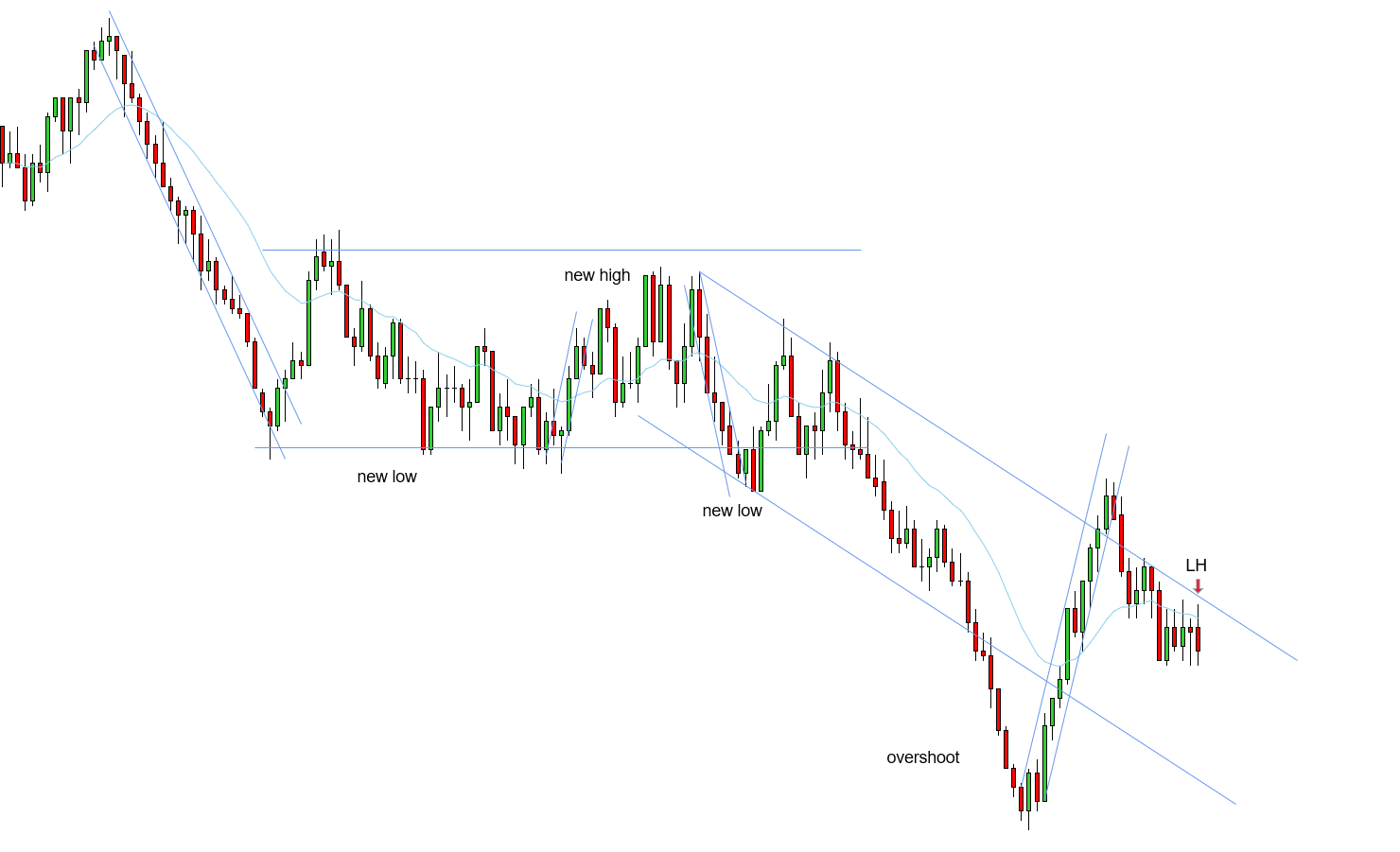

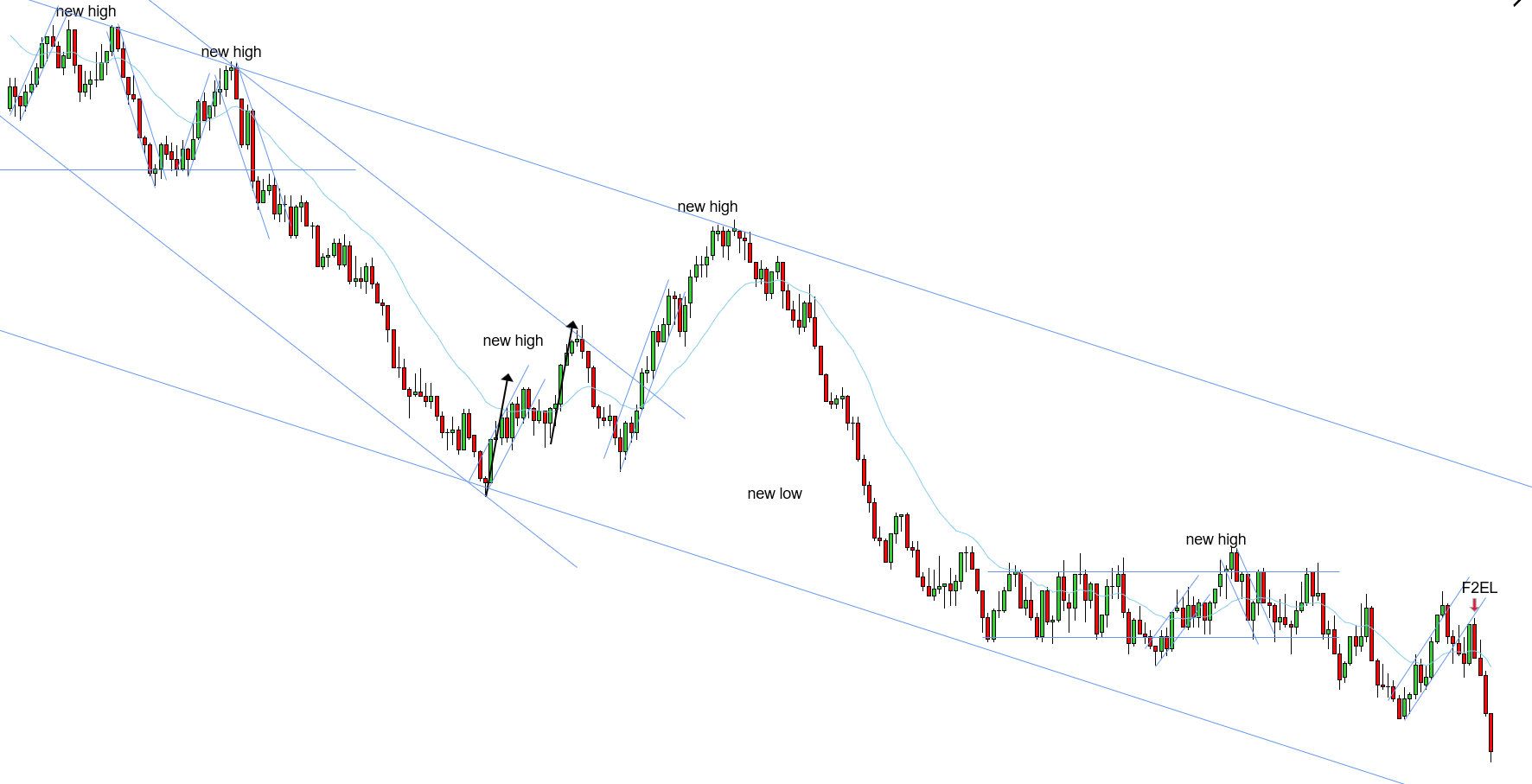

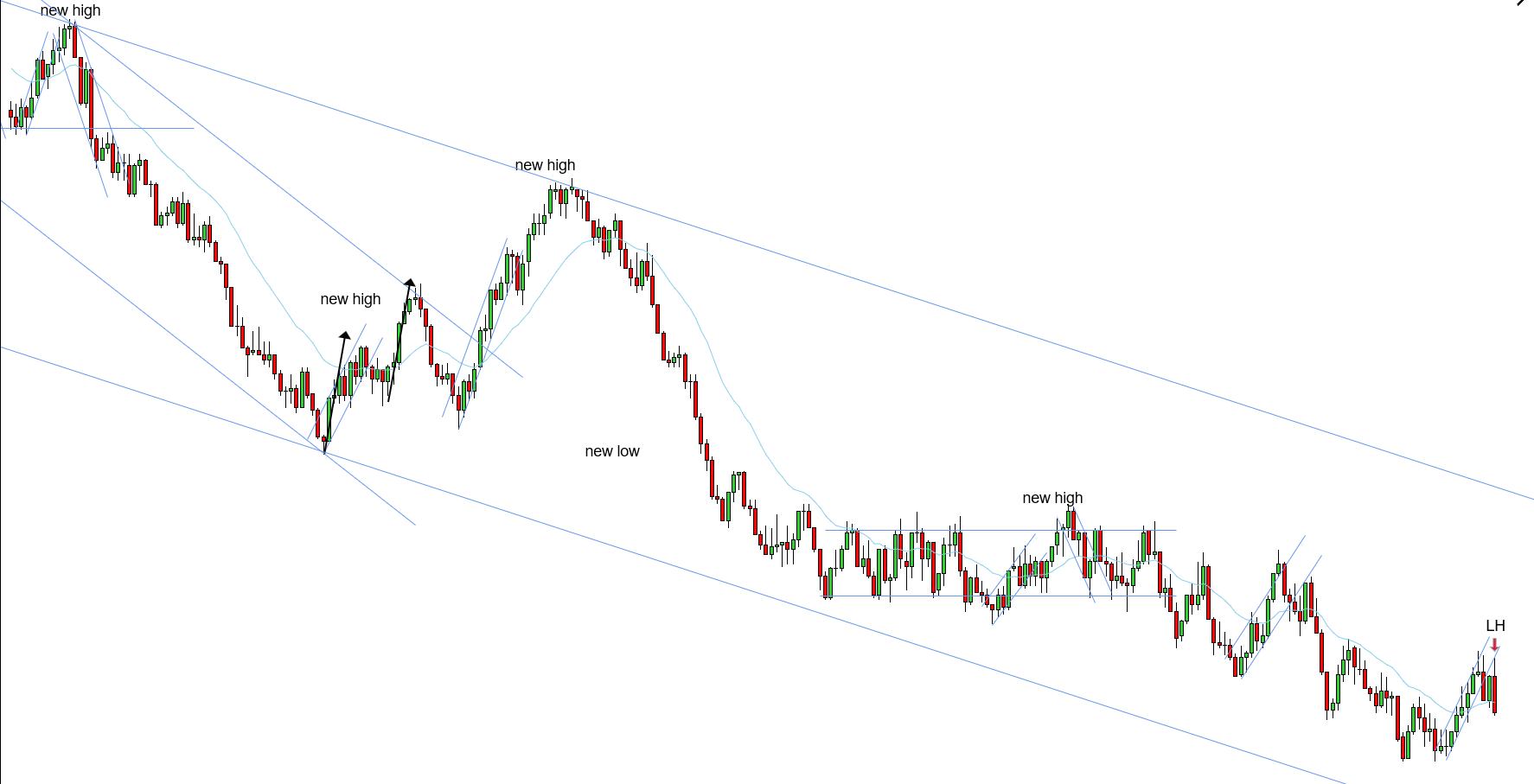

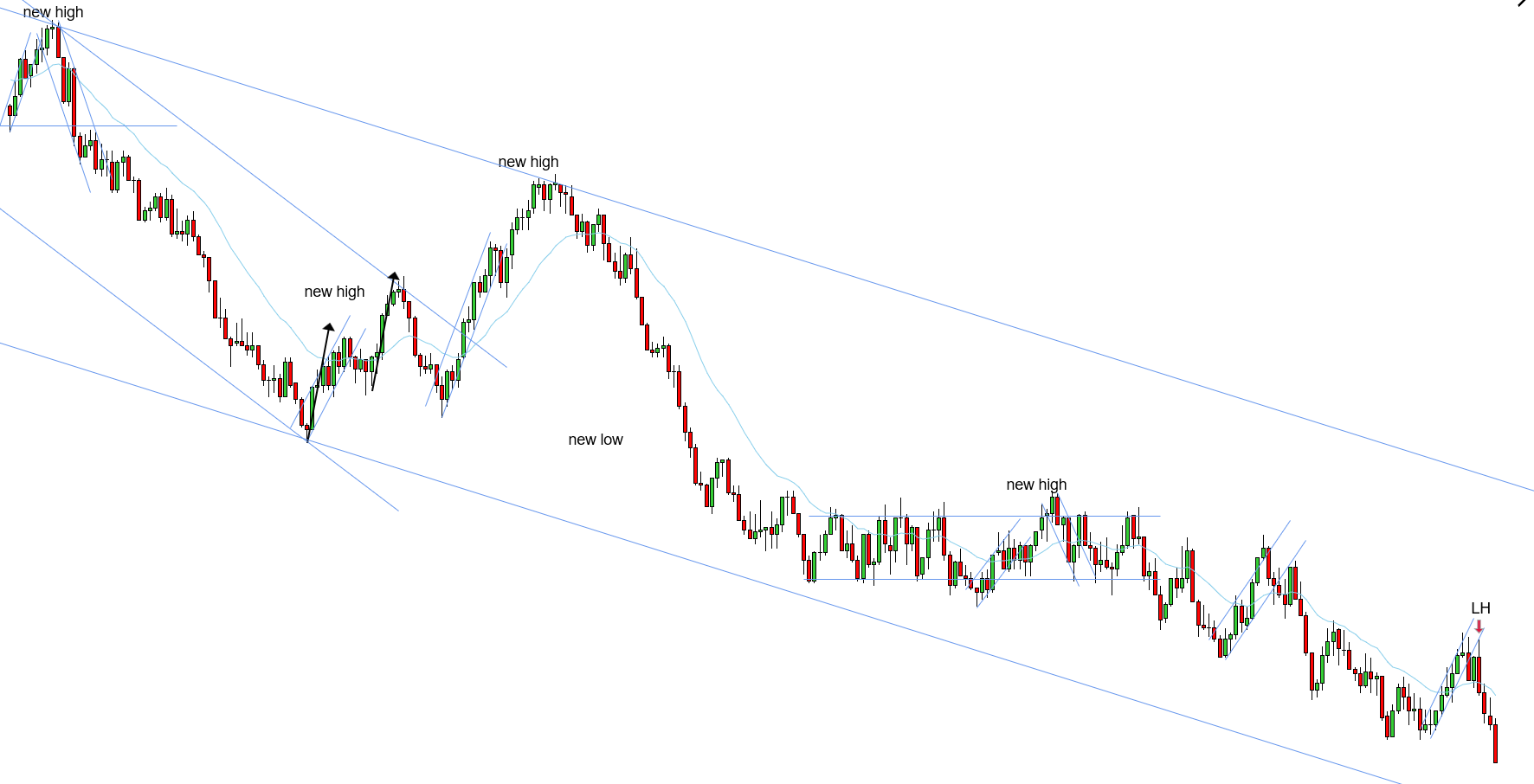

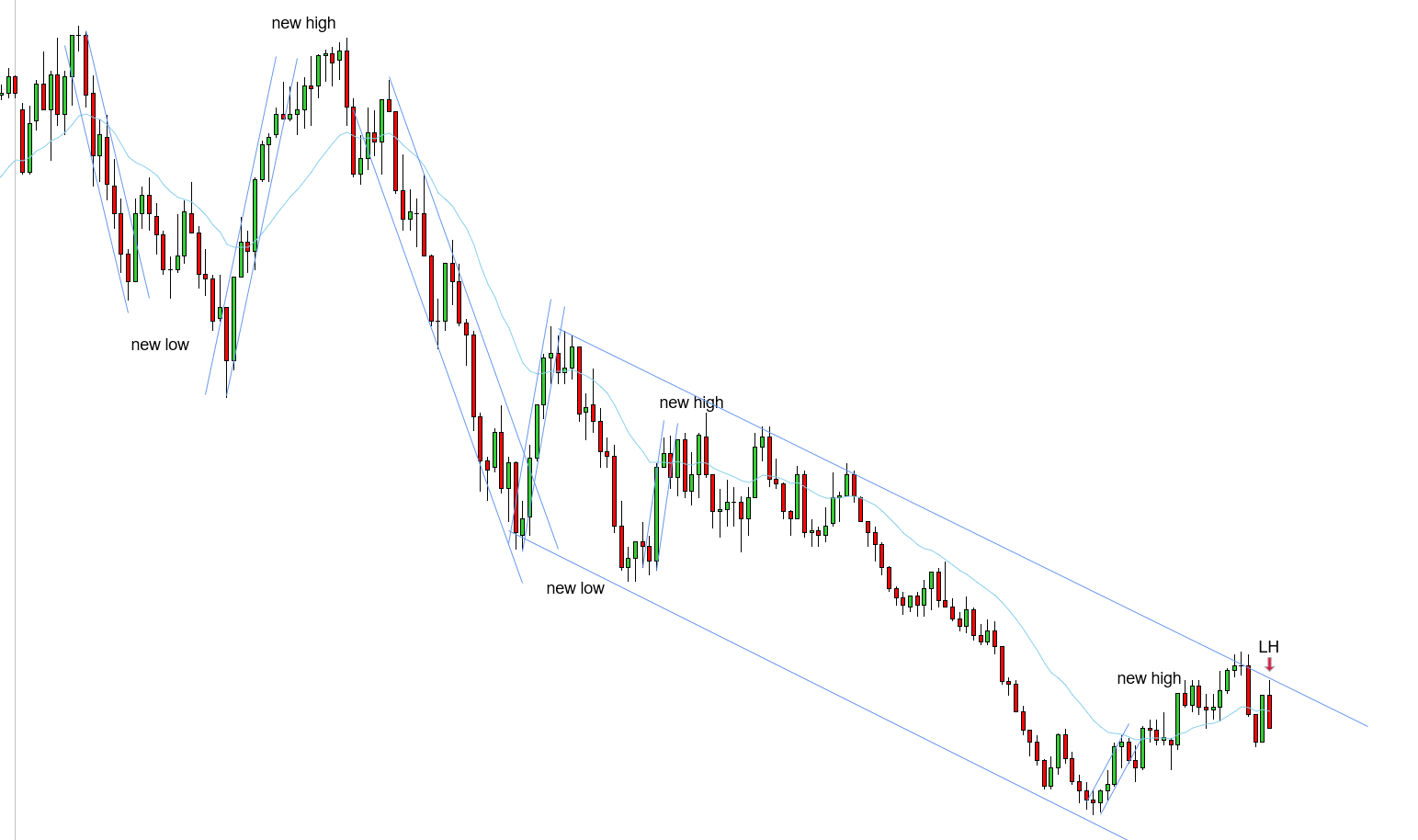

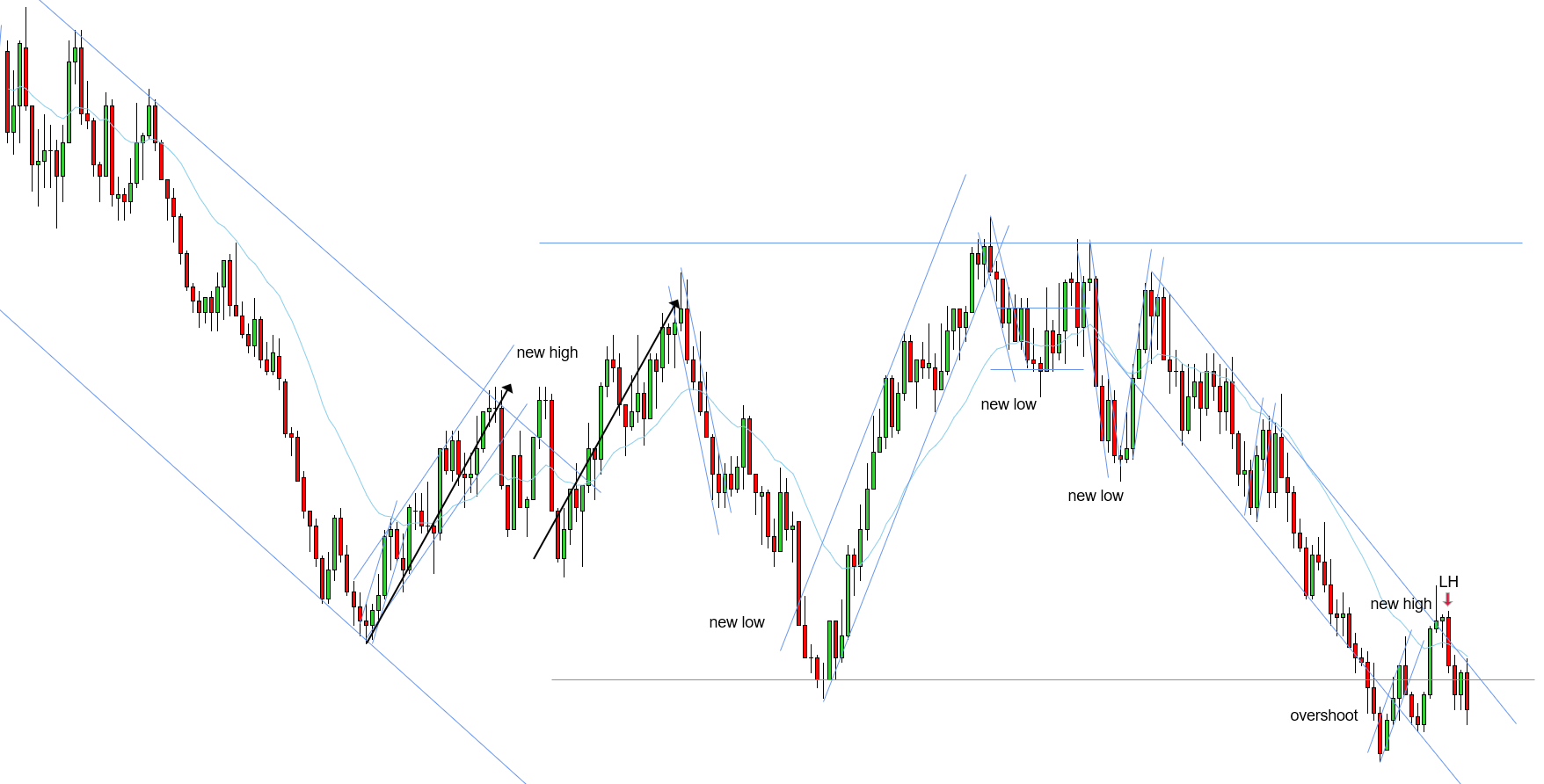

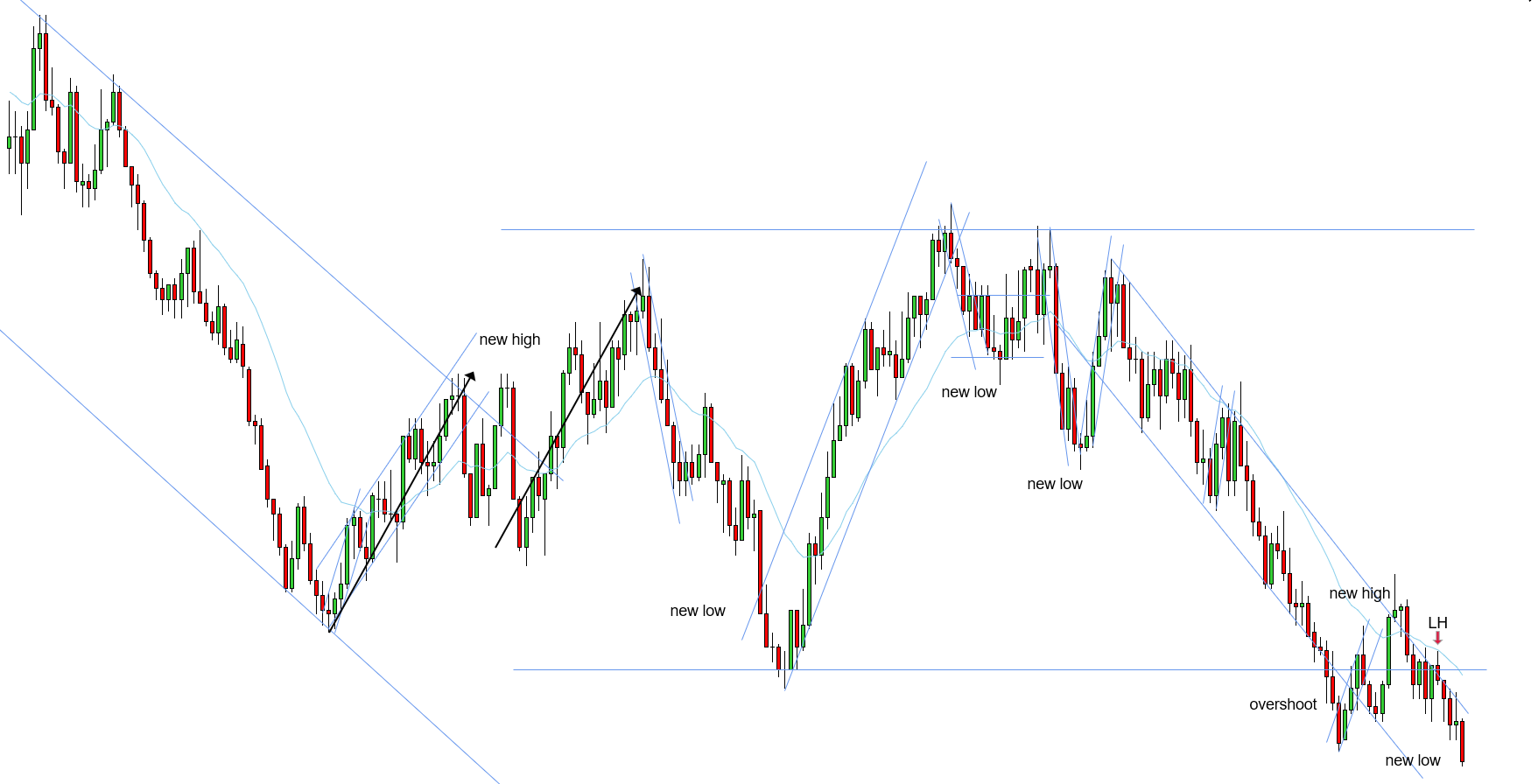

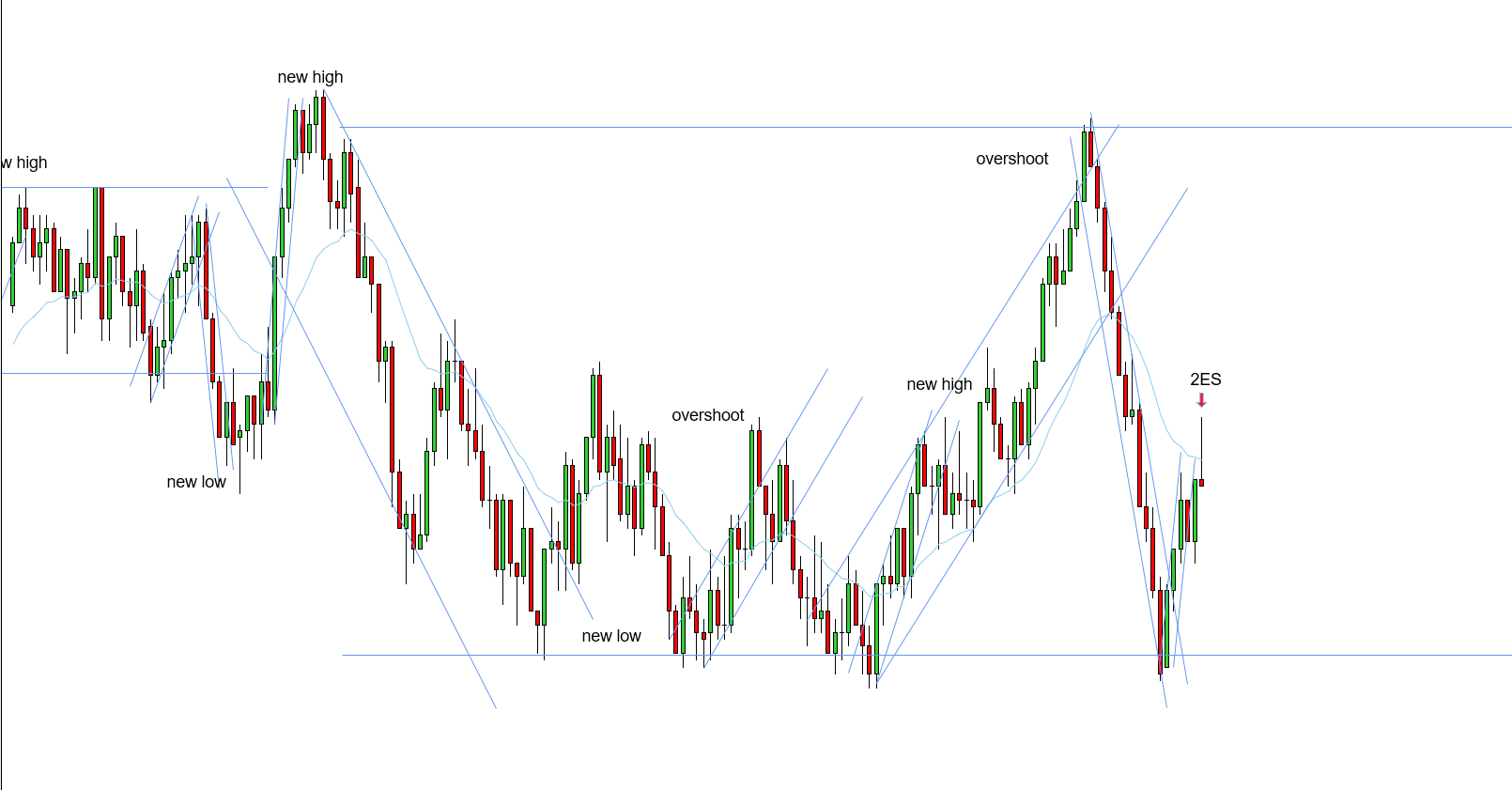

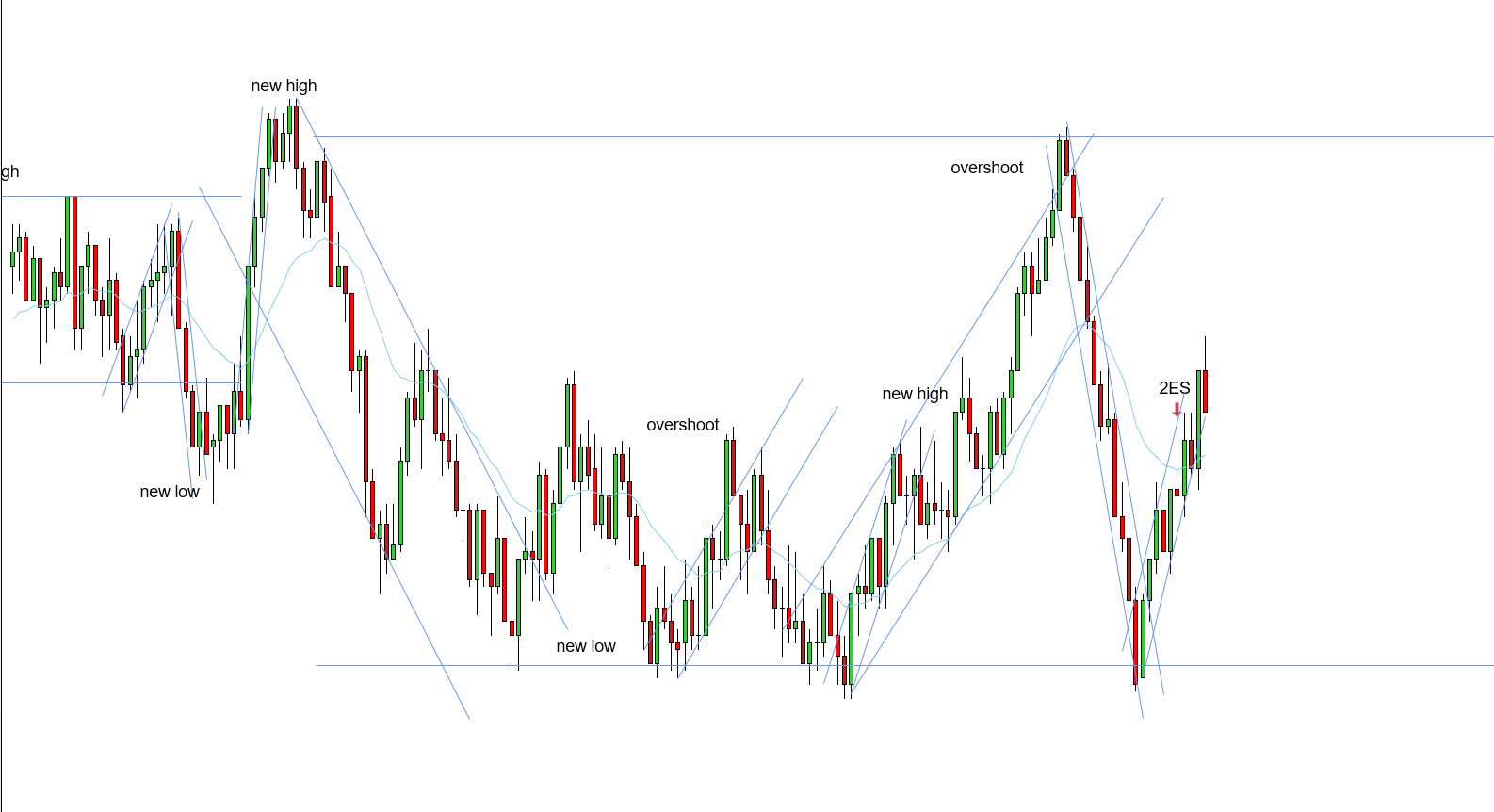

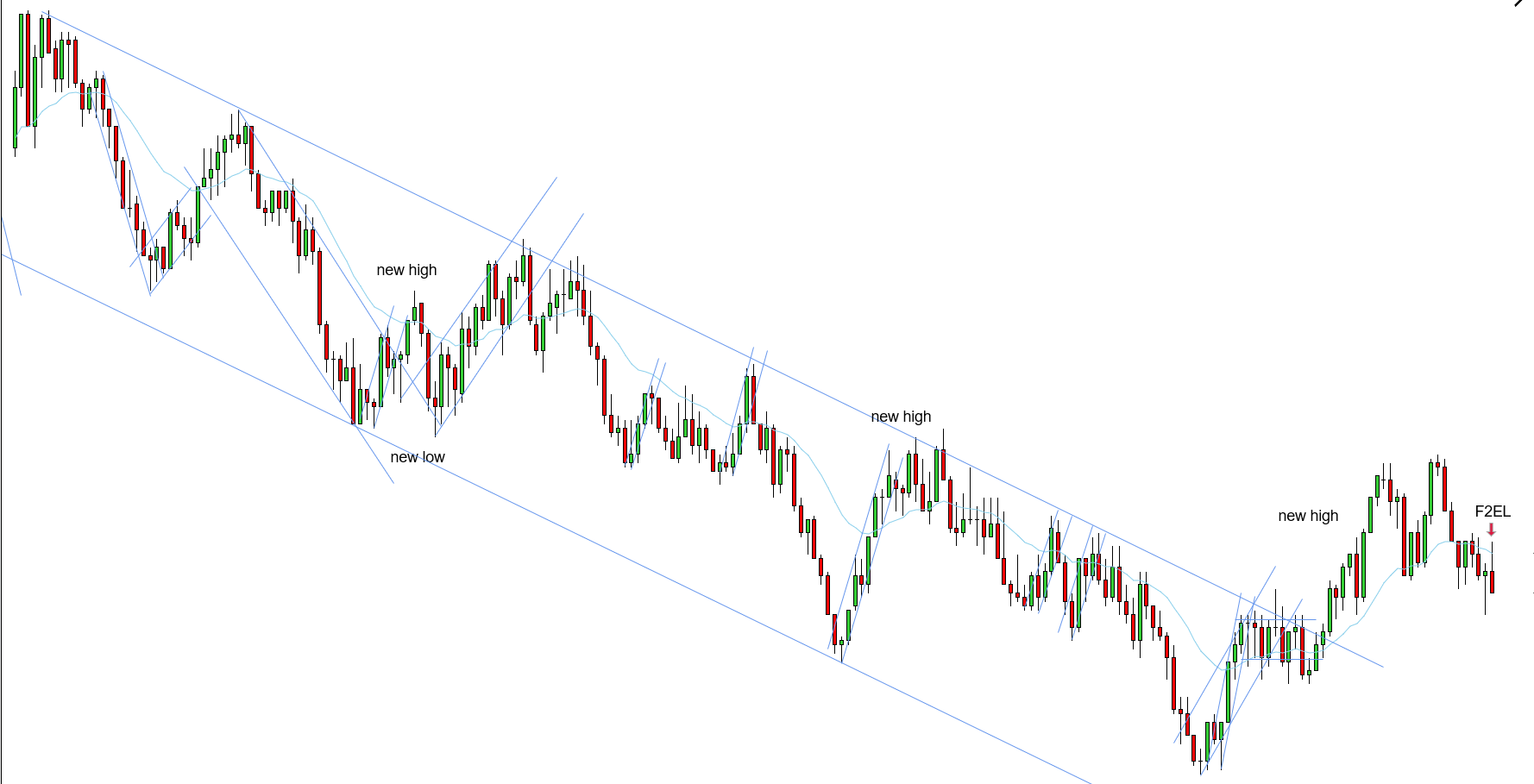

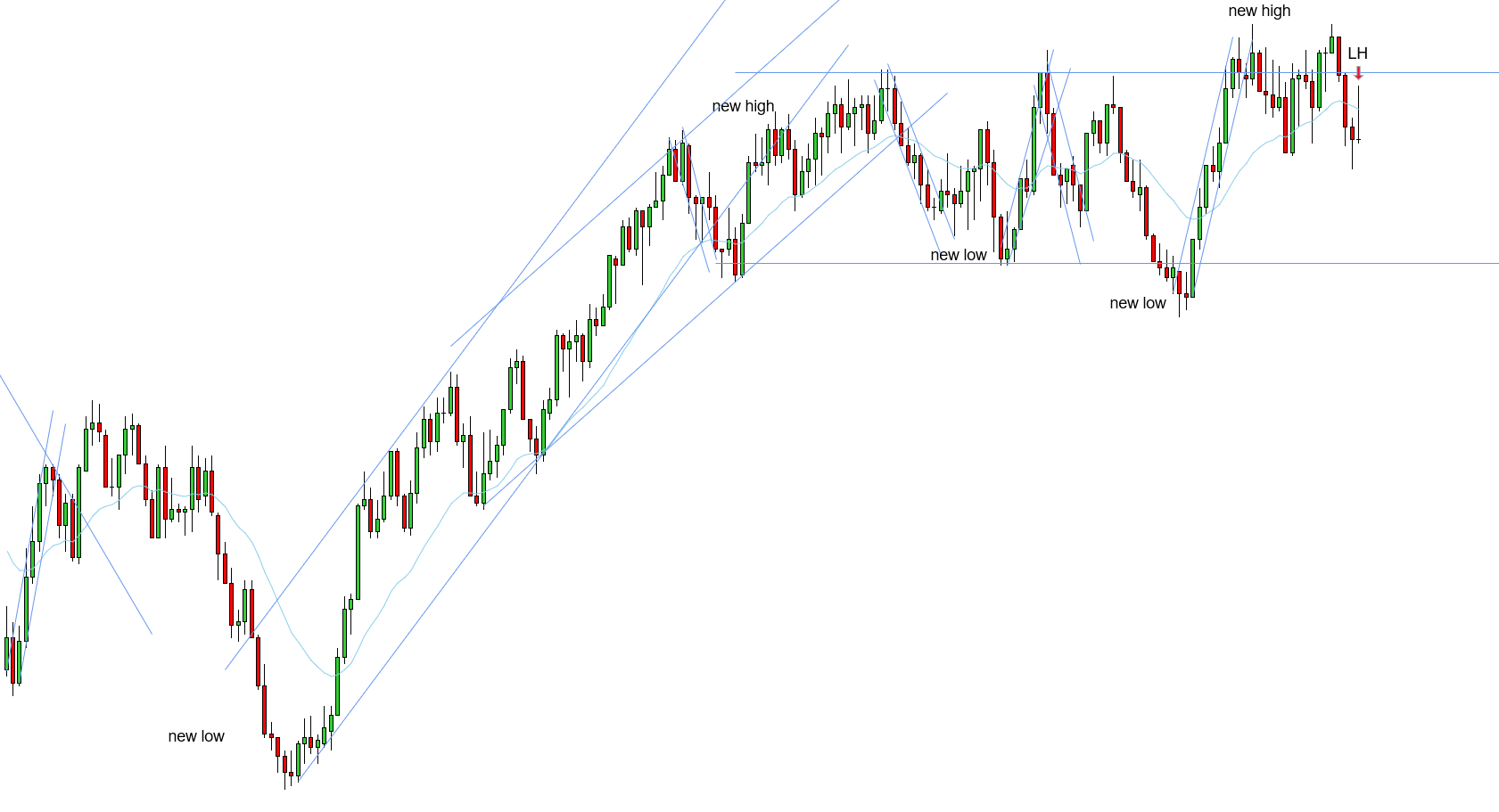

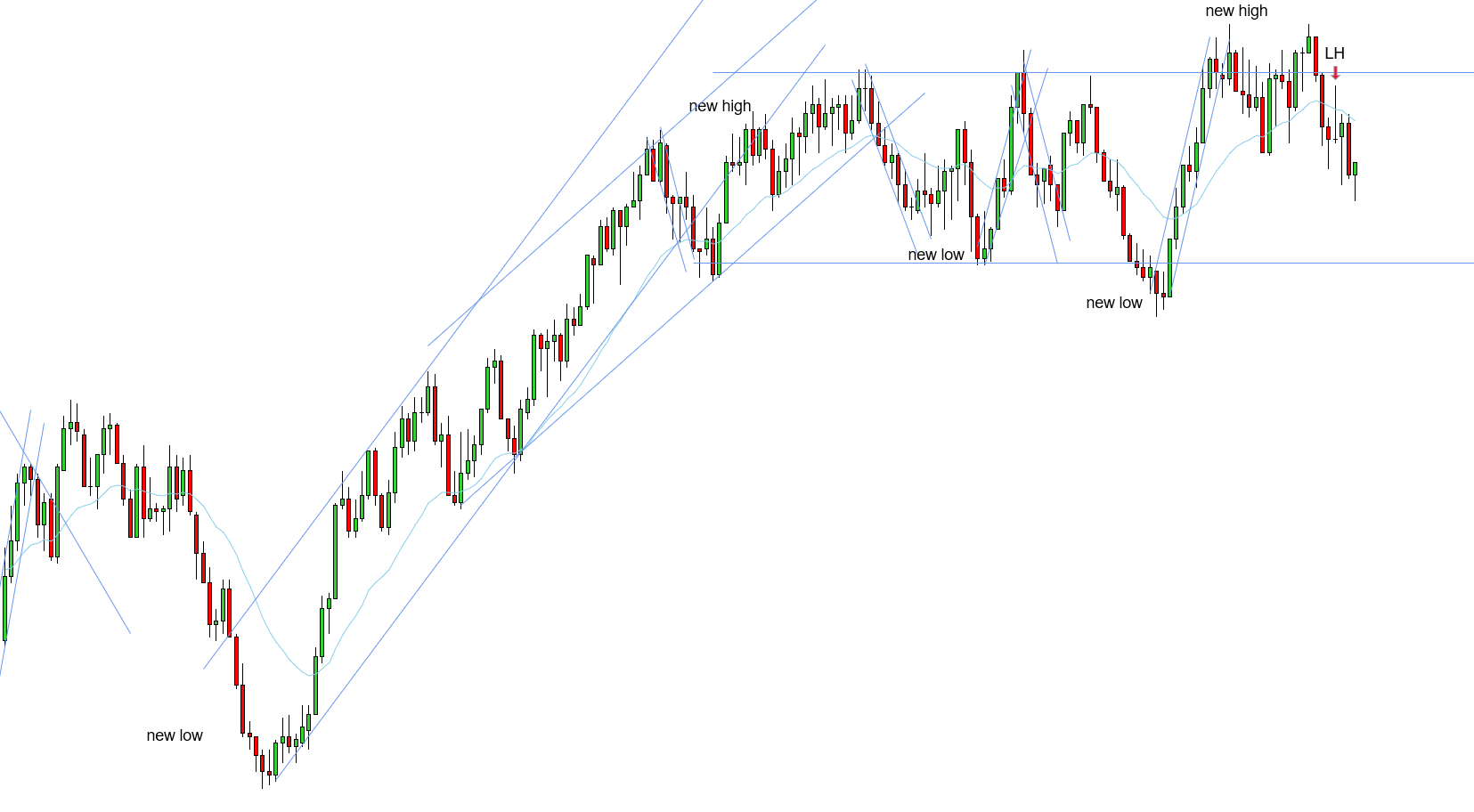

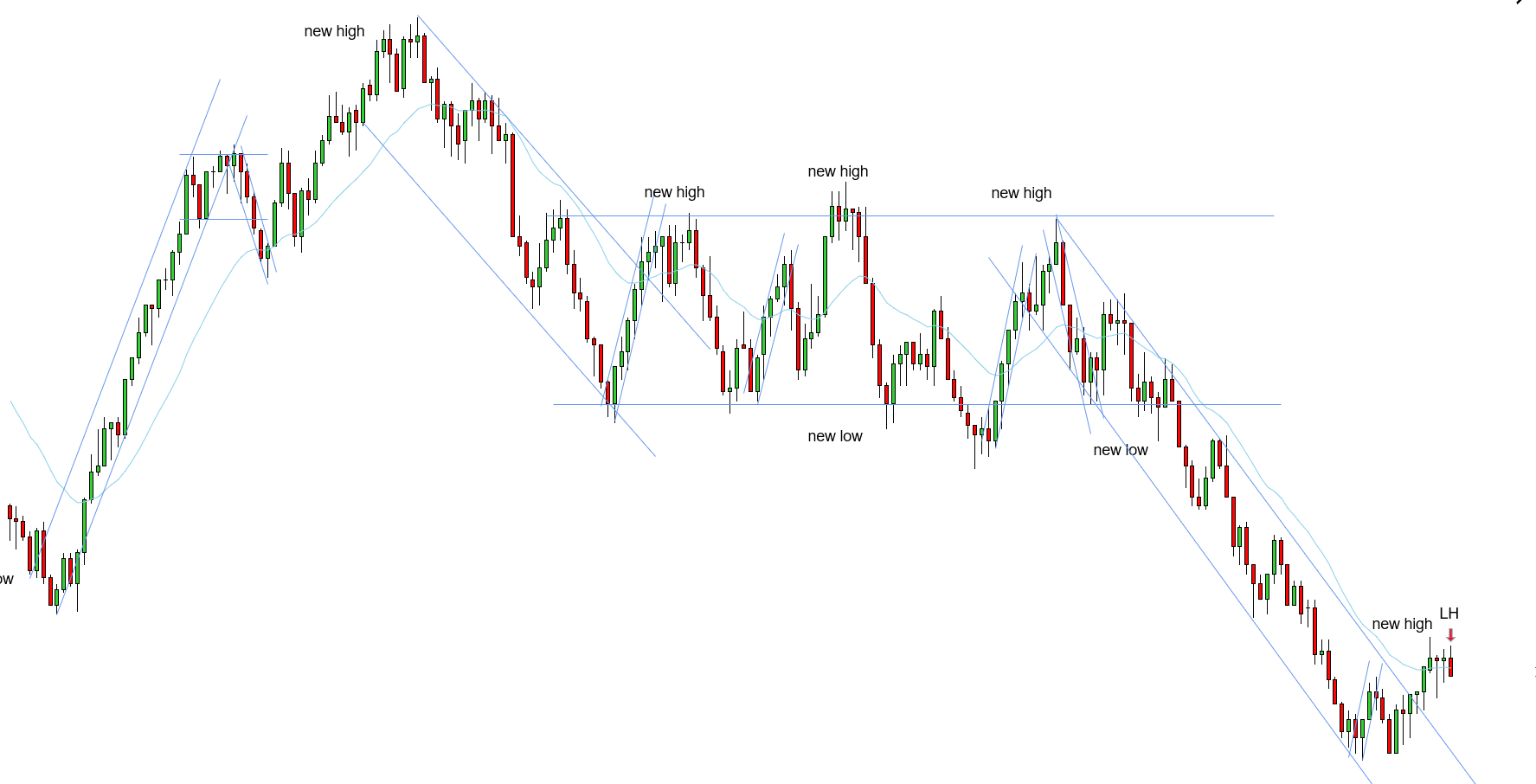

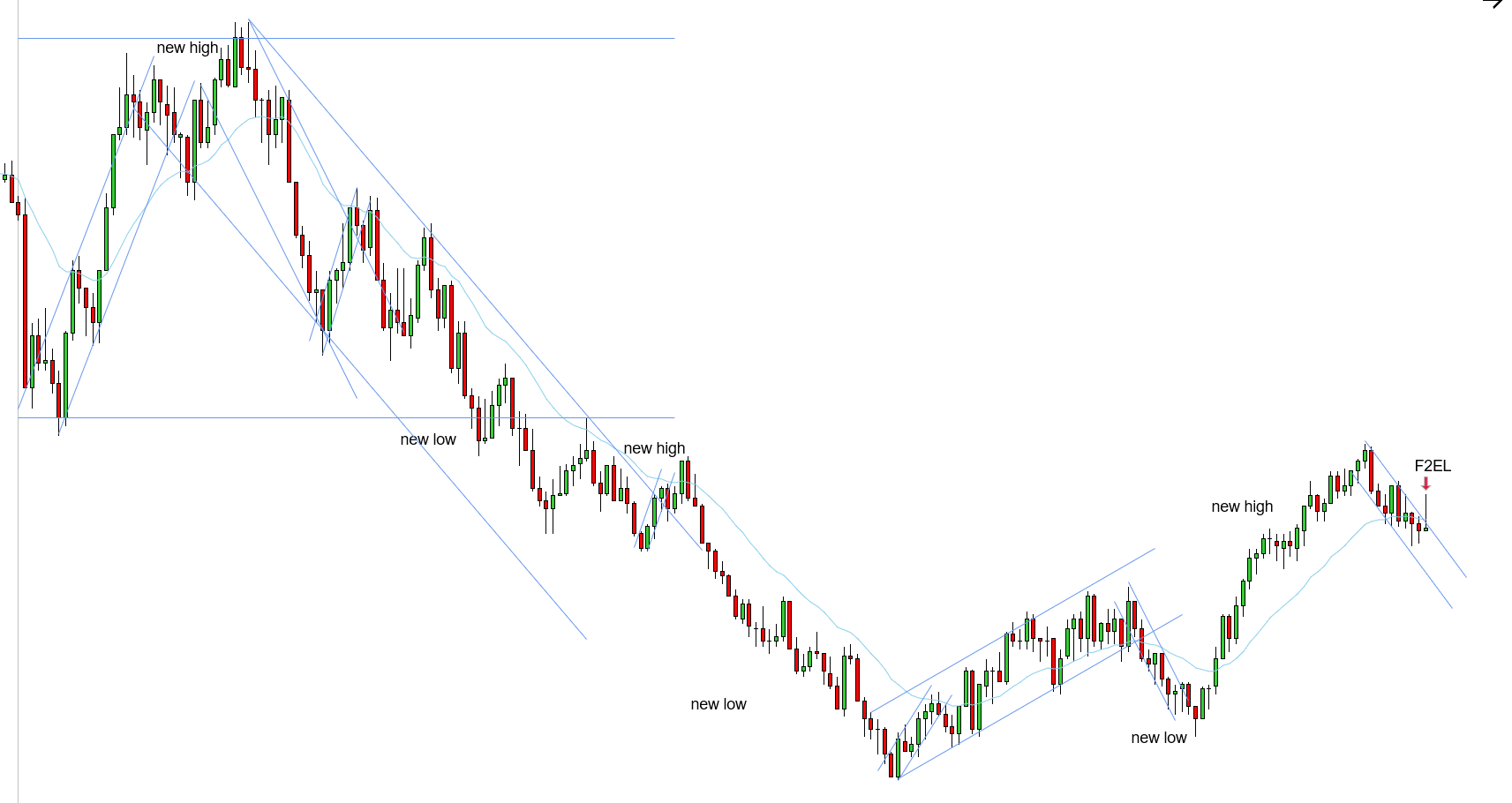

LH - 10/16/2025

W - LH confirming 2ES, can be viewed as F2EL - with trend

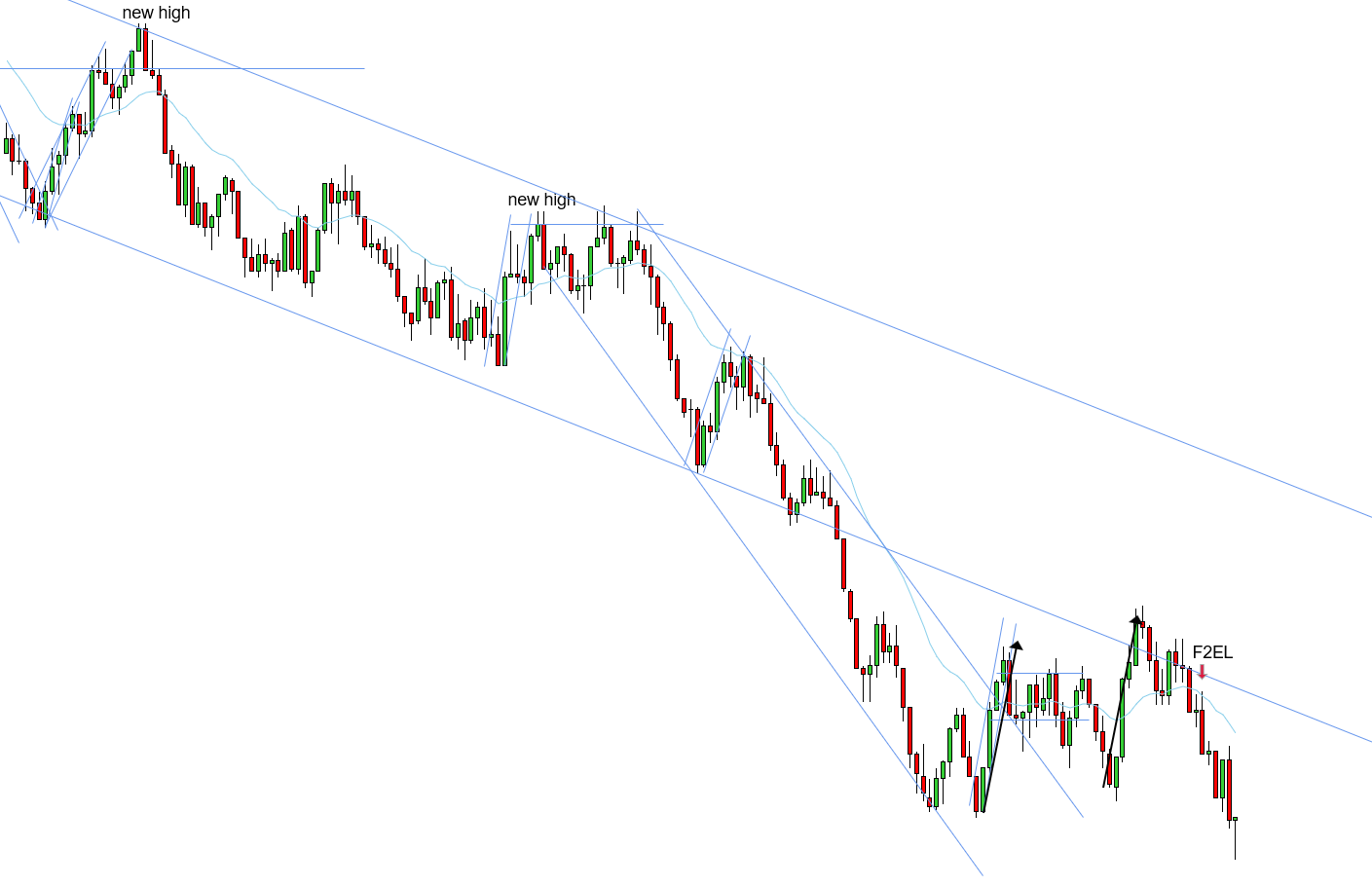

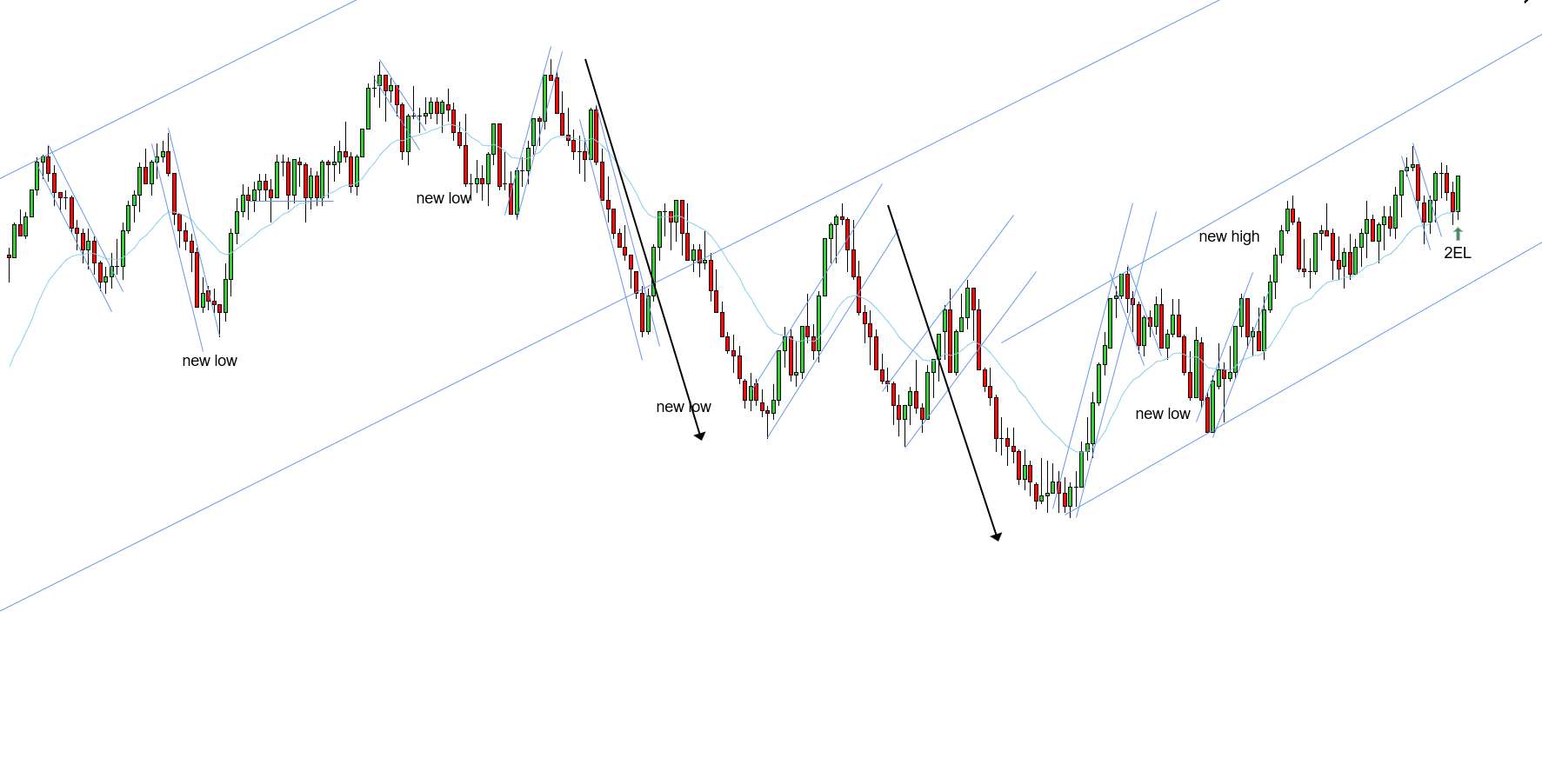

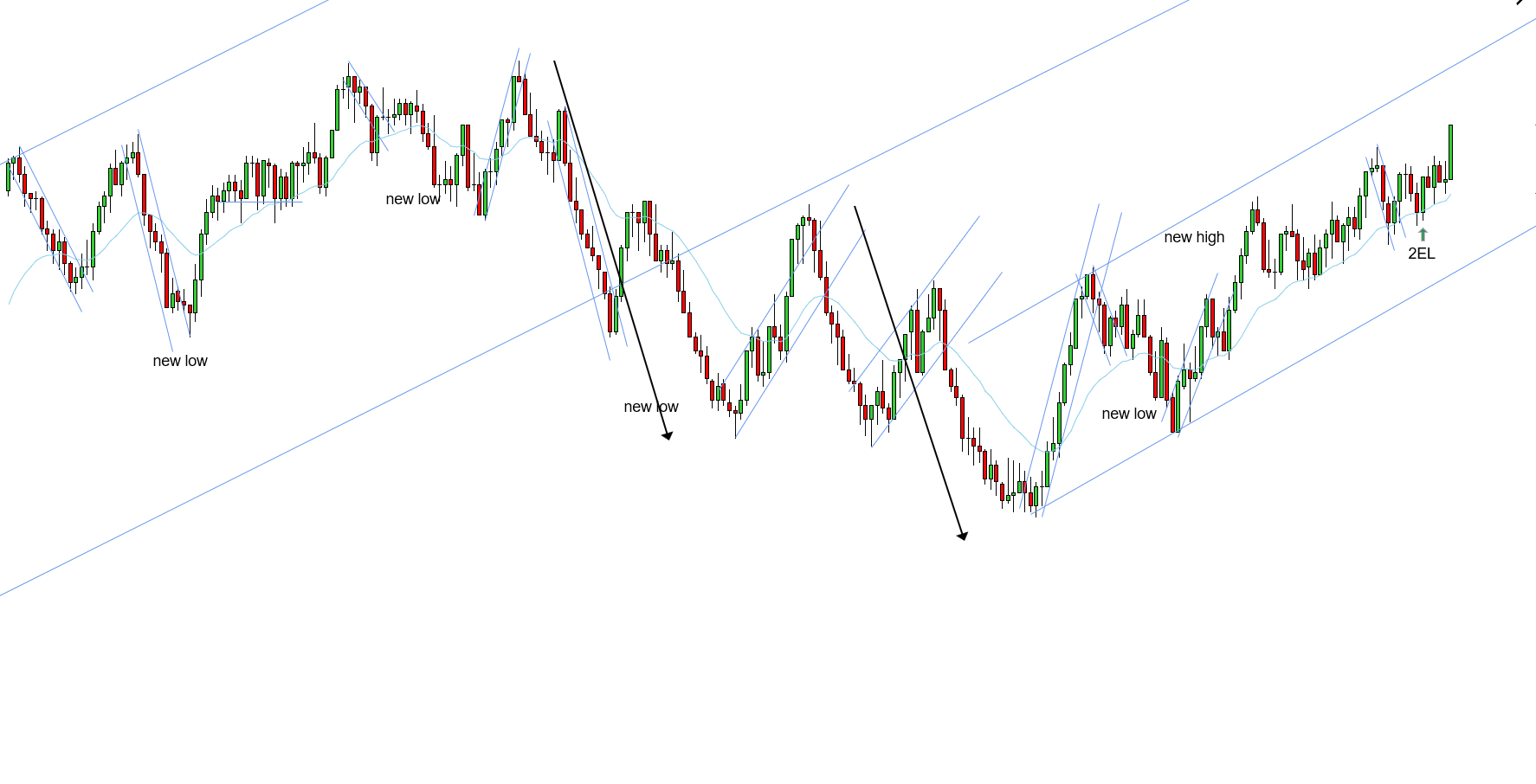

F2EL - 10/16/2025

W - 2 broad legs up - downtrend needs a new low

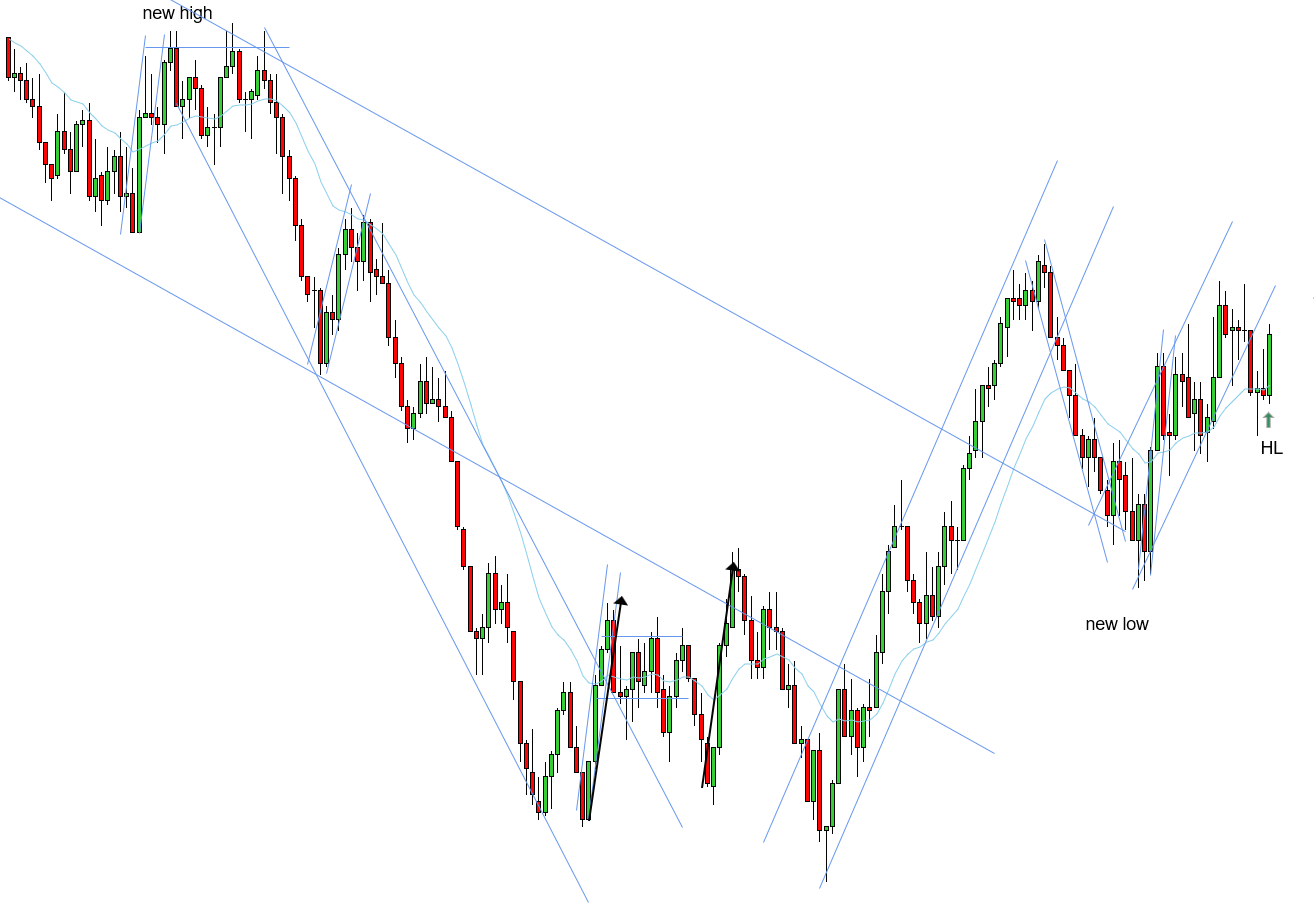

HL - 10/16/2025

W - HL confirming the 2EL - uptrend needs a new high

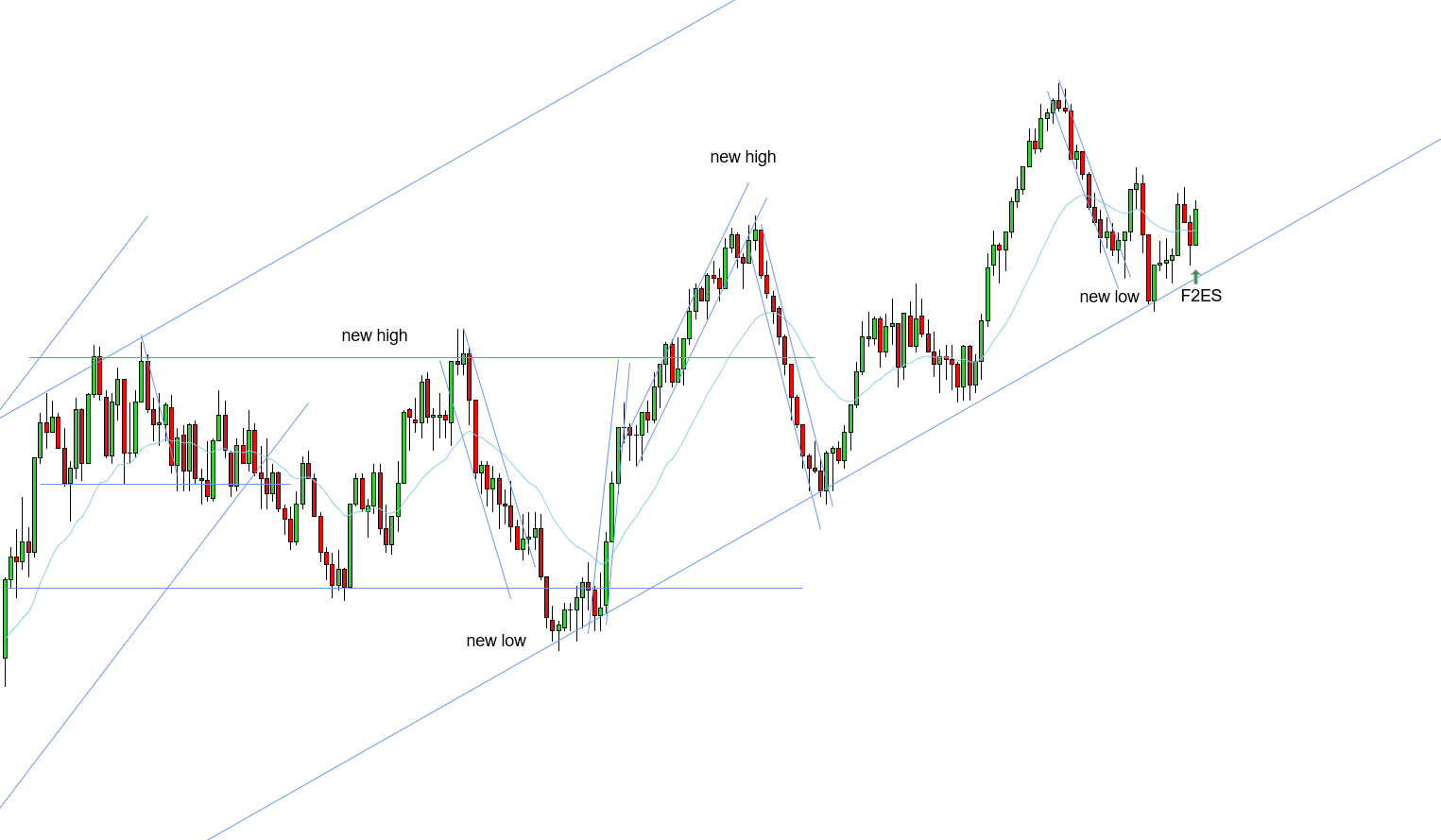

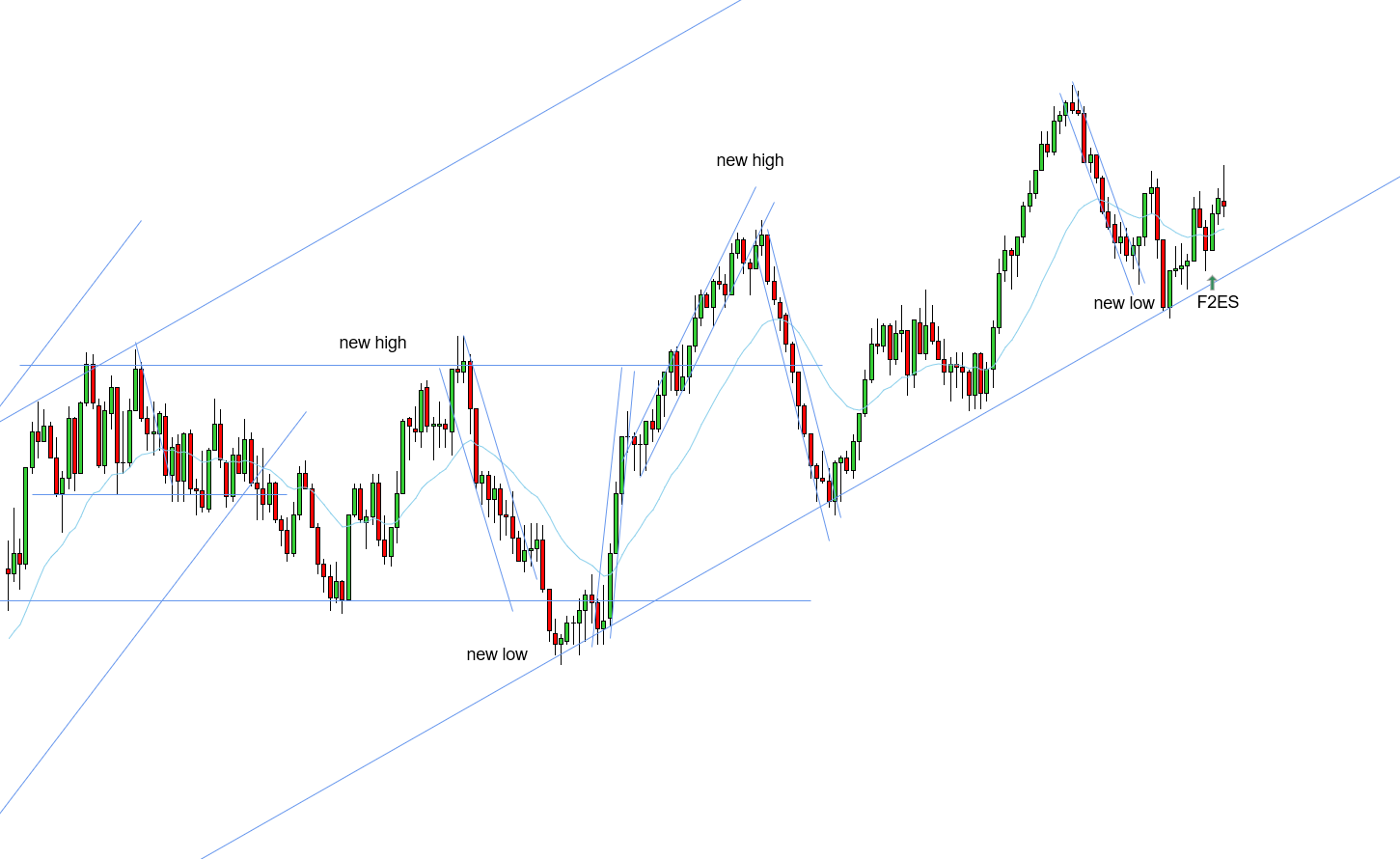

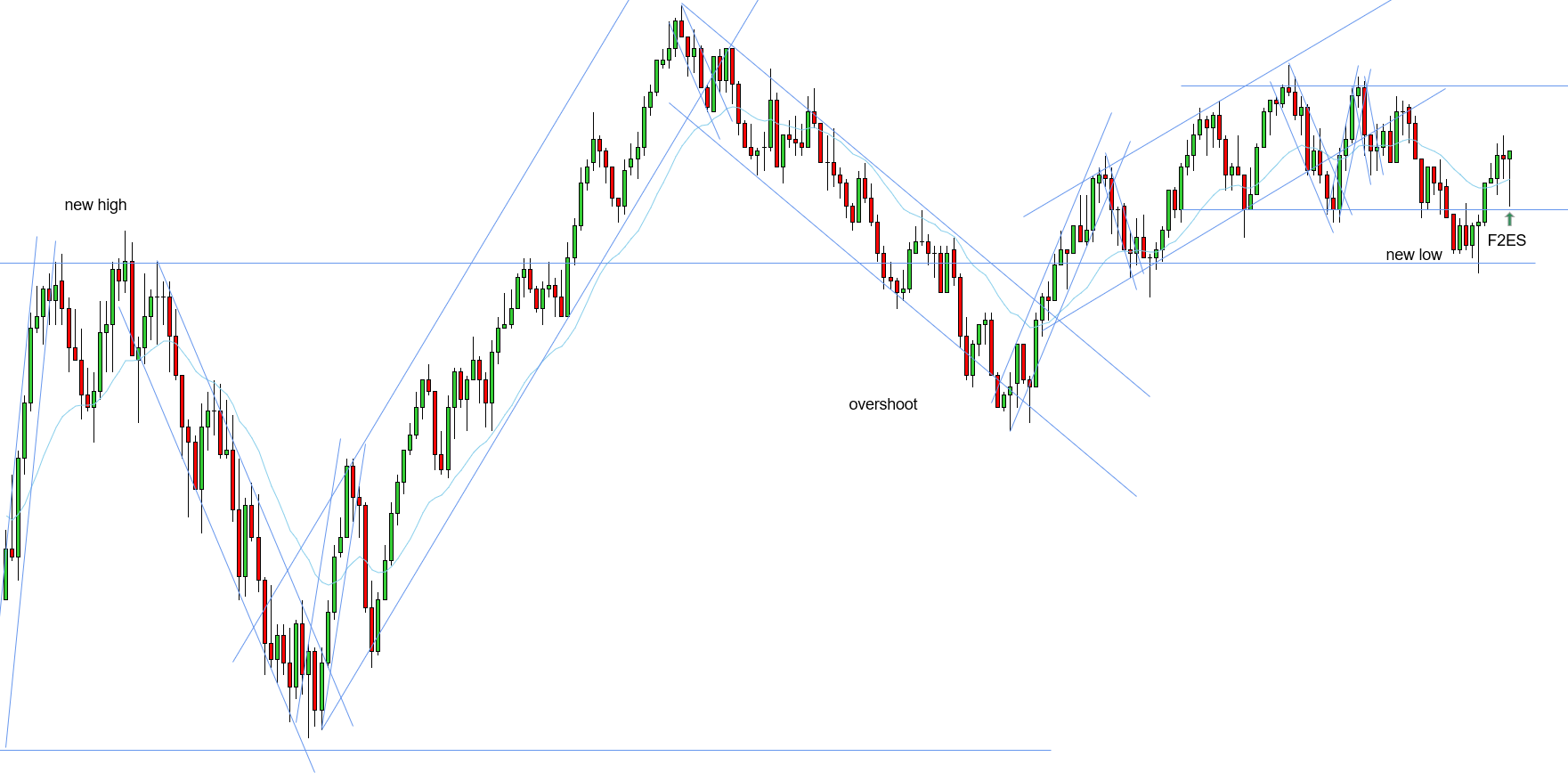

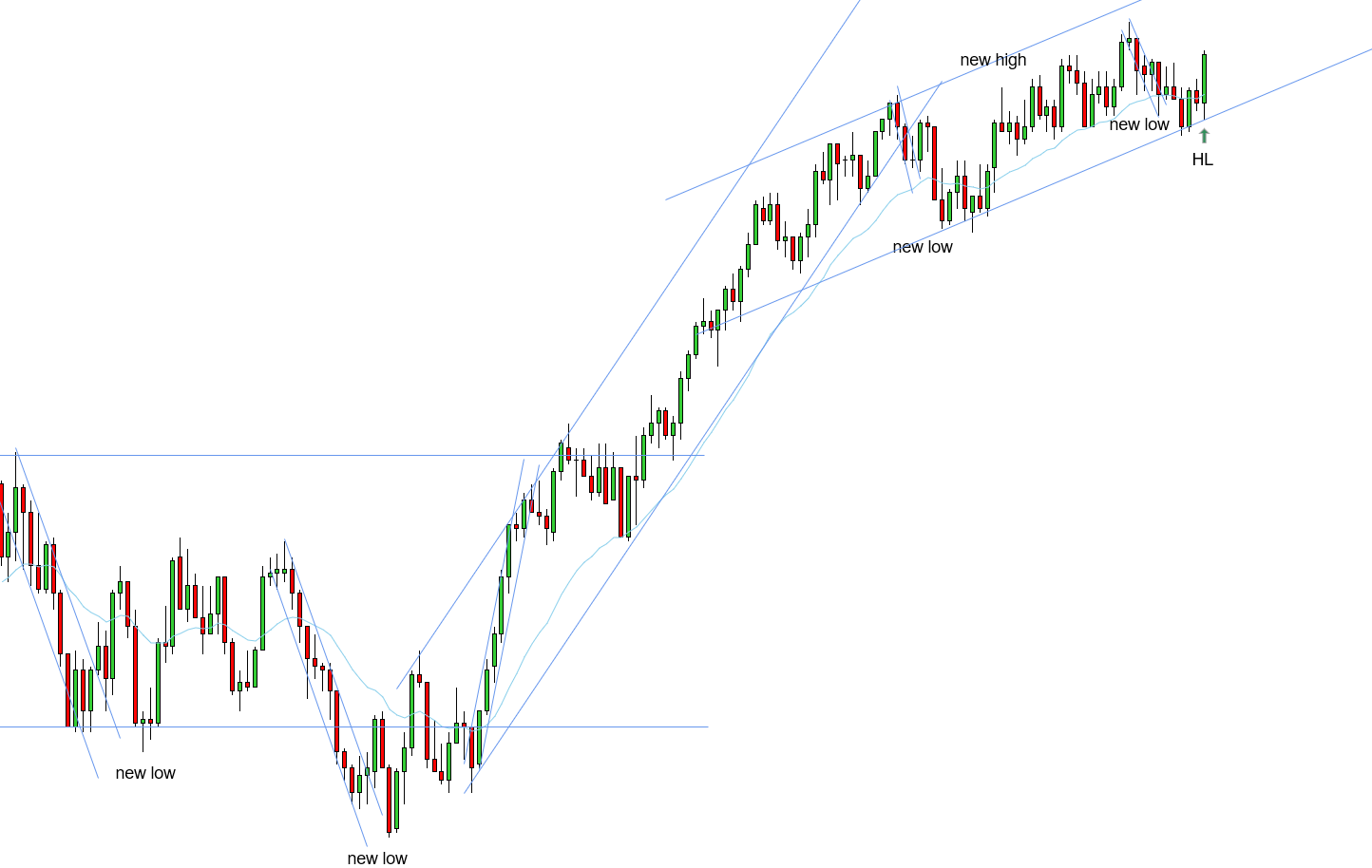

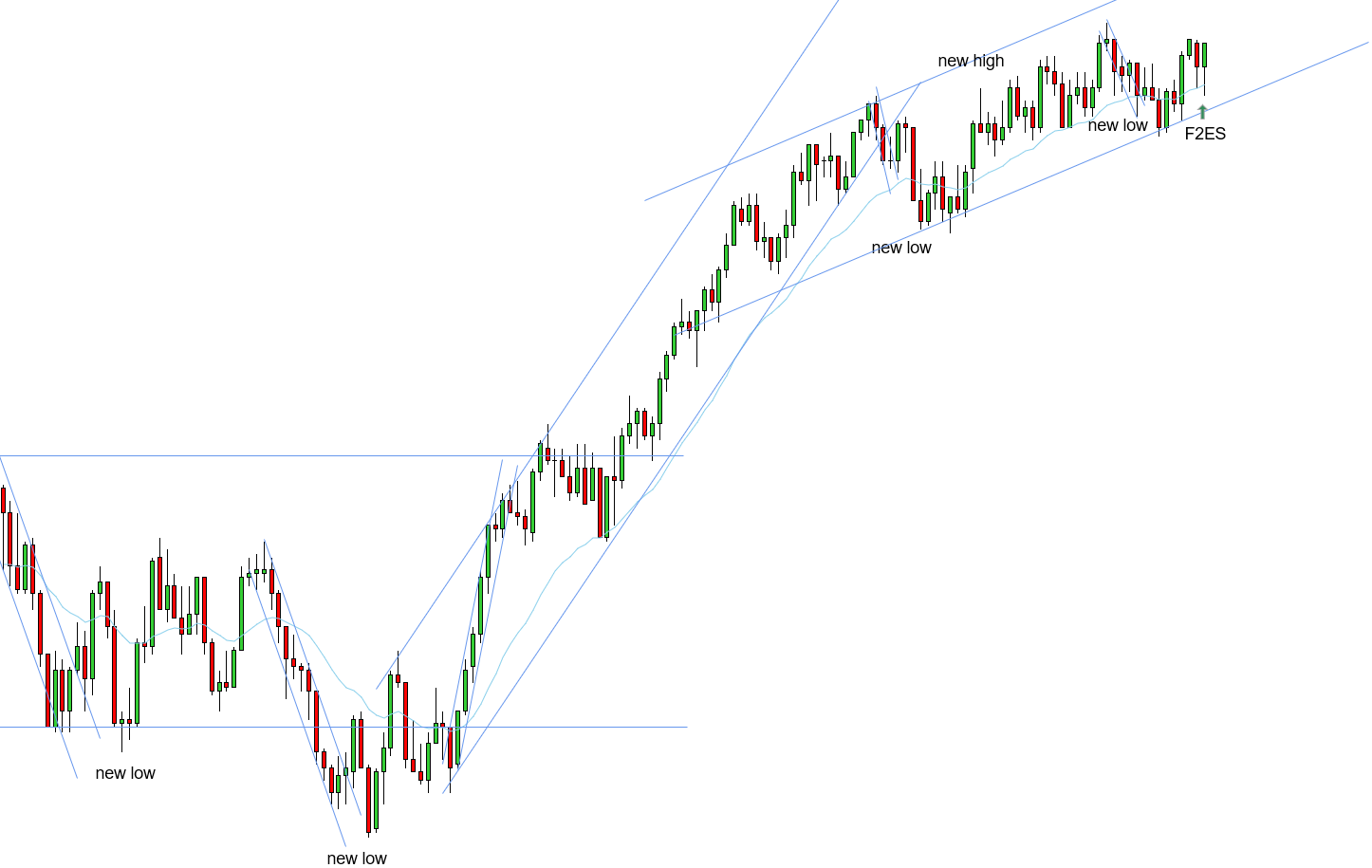

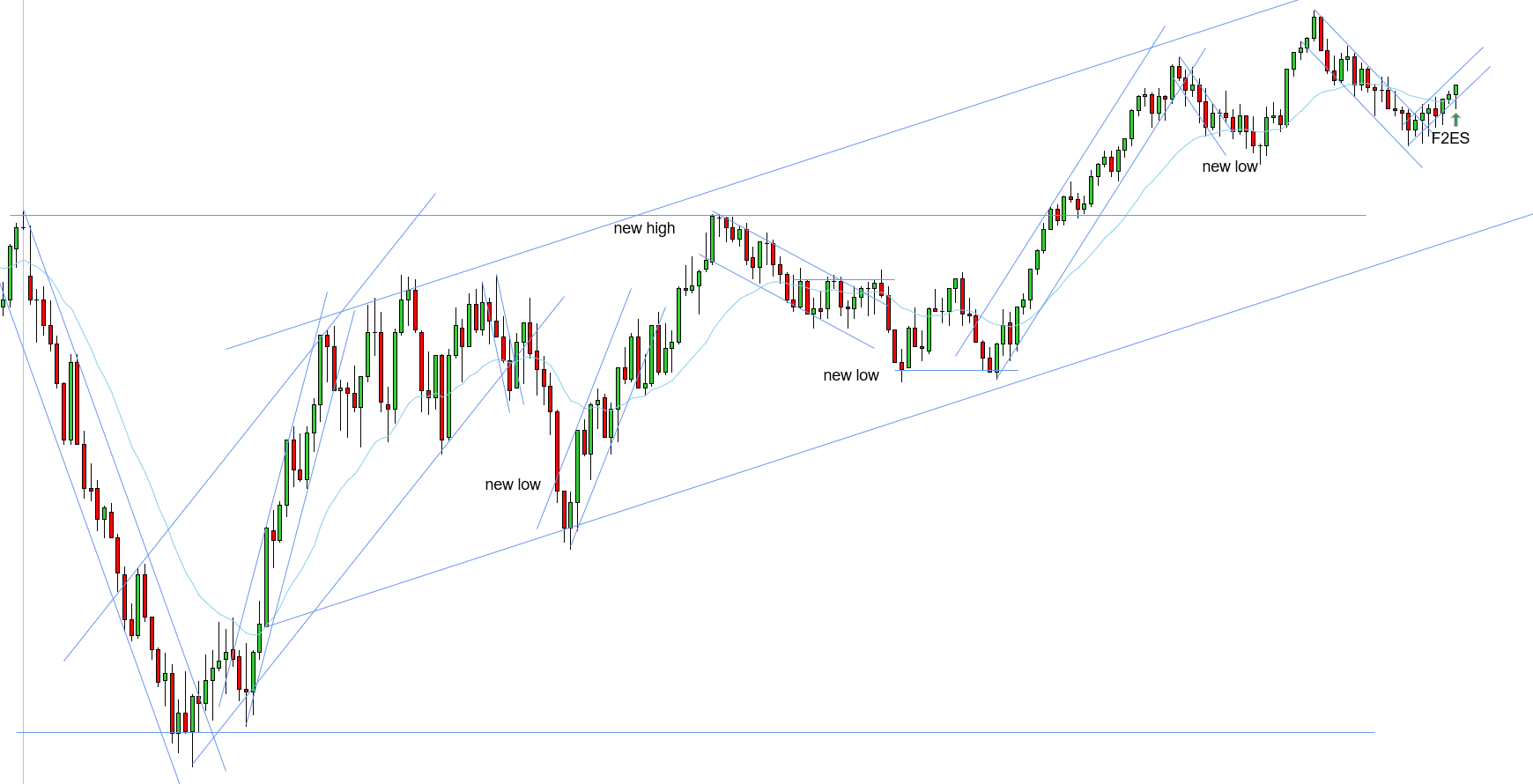

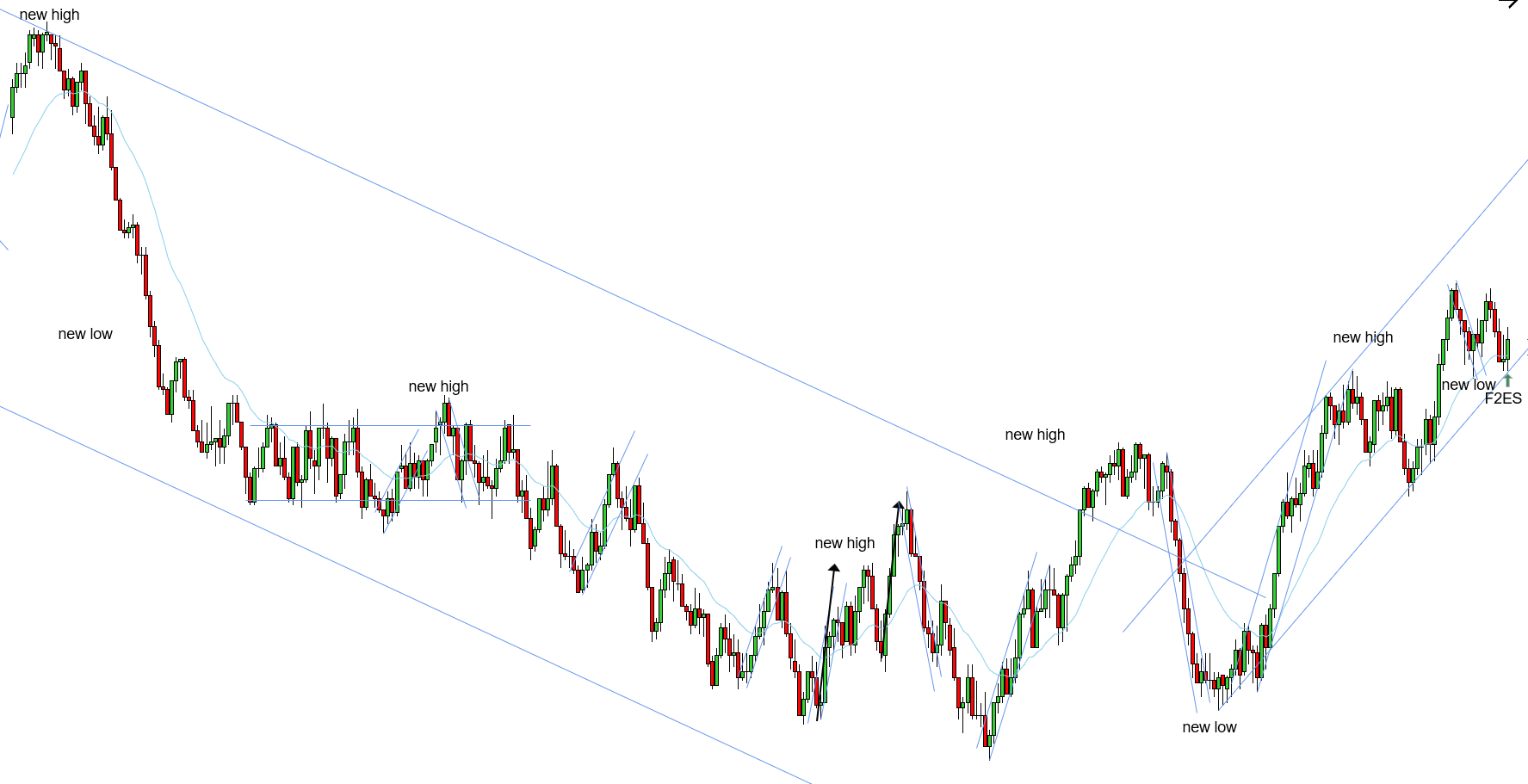

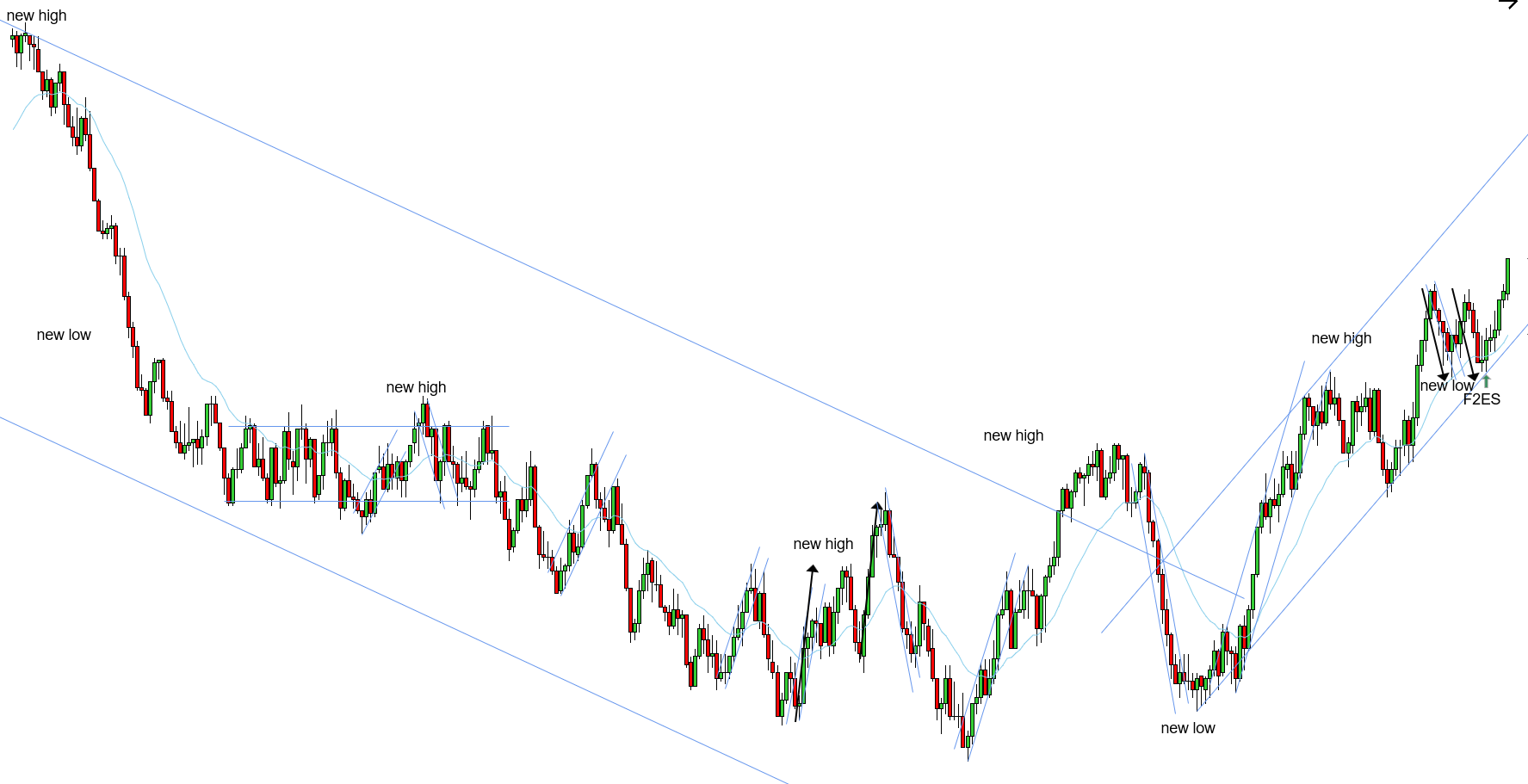

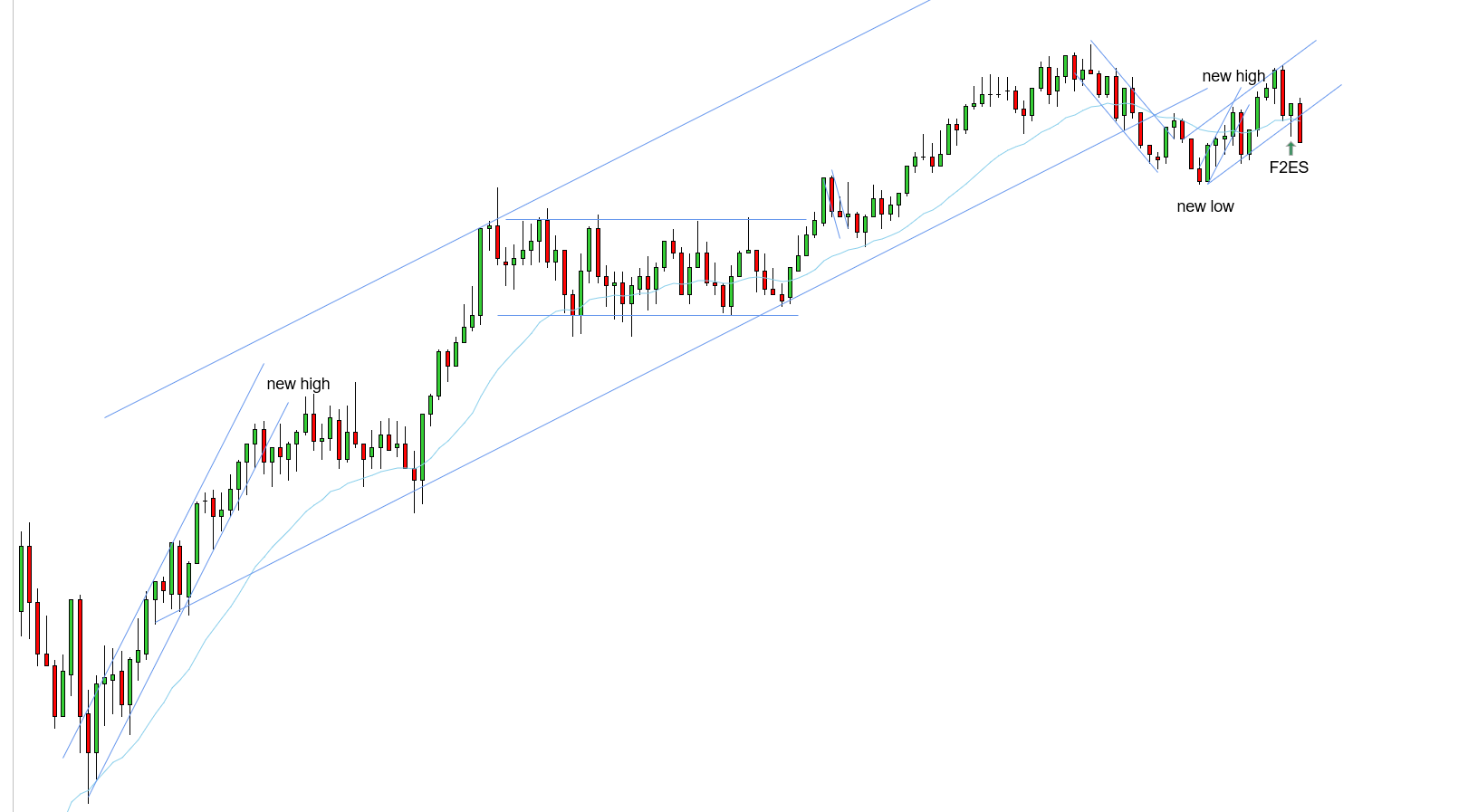

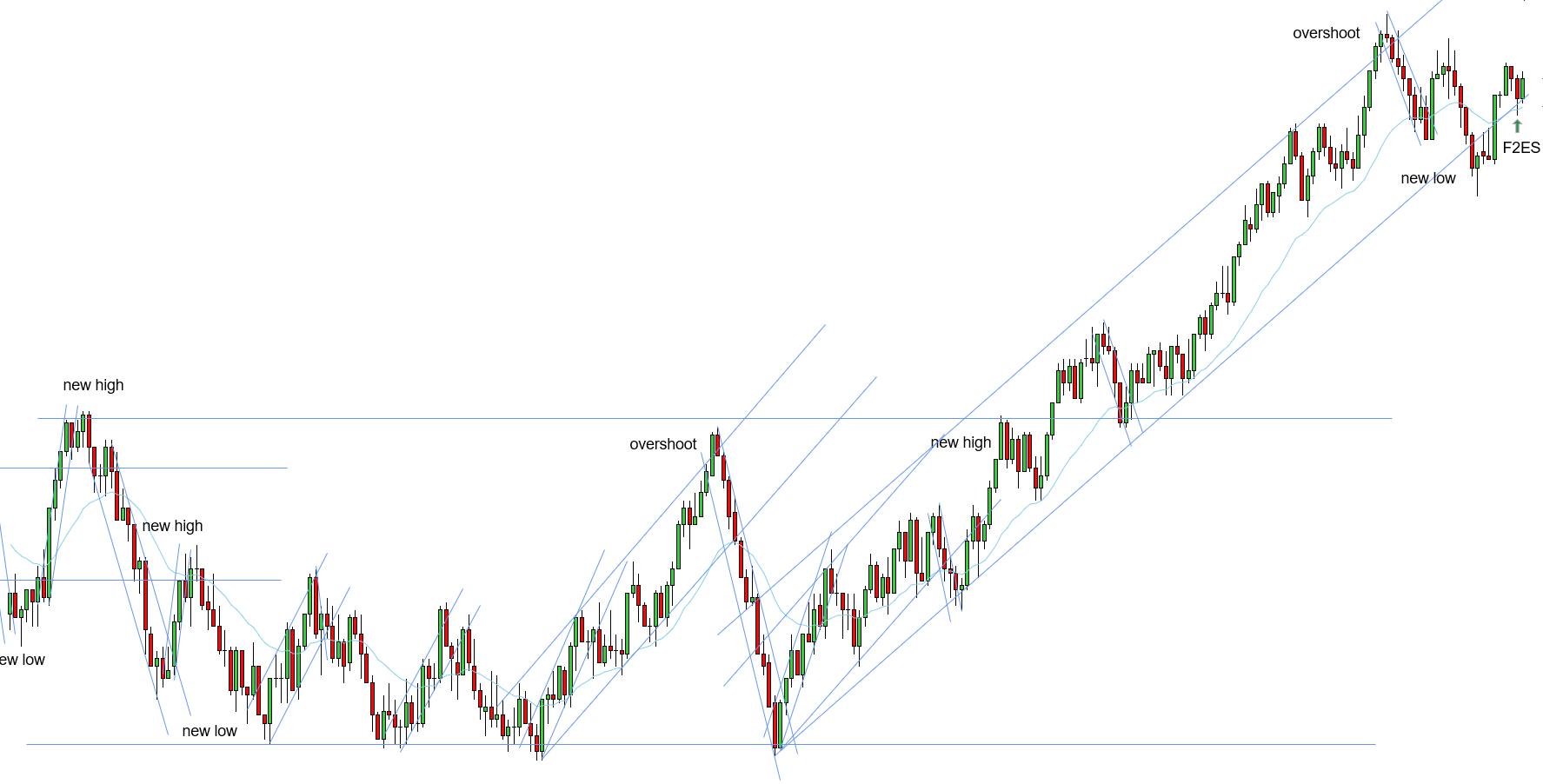

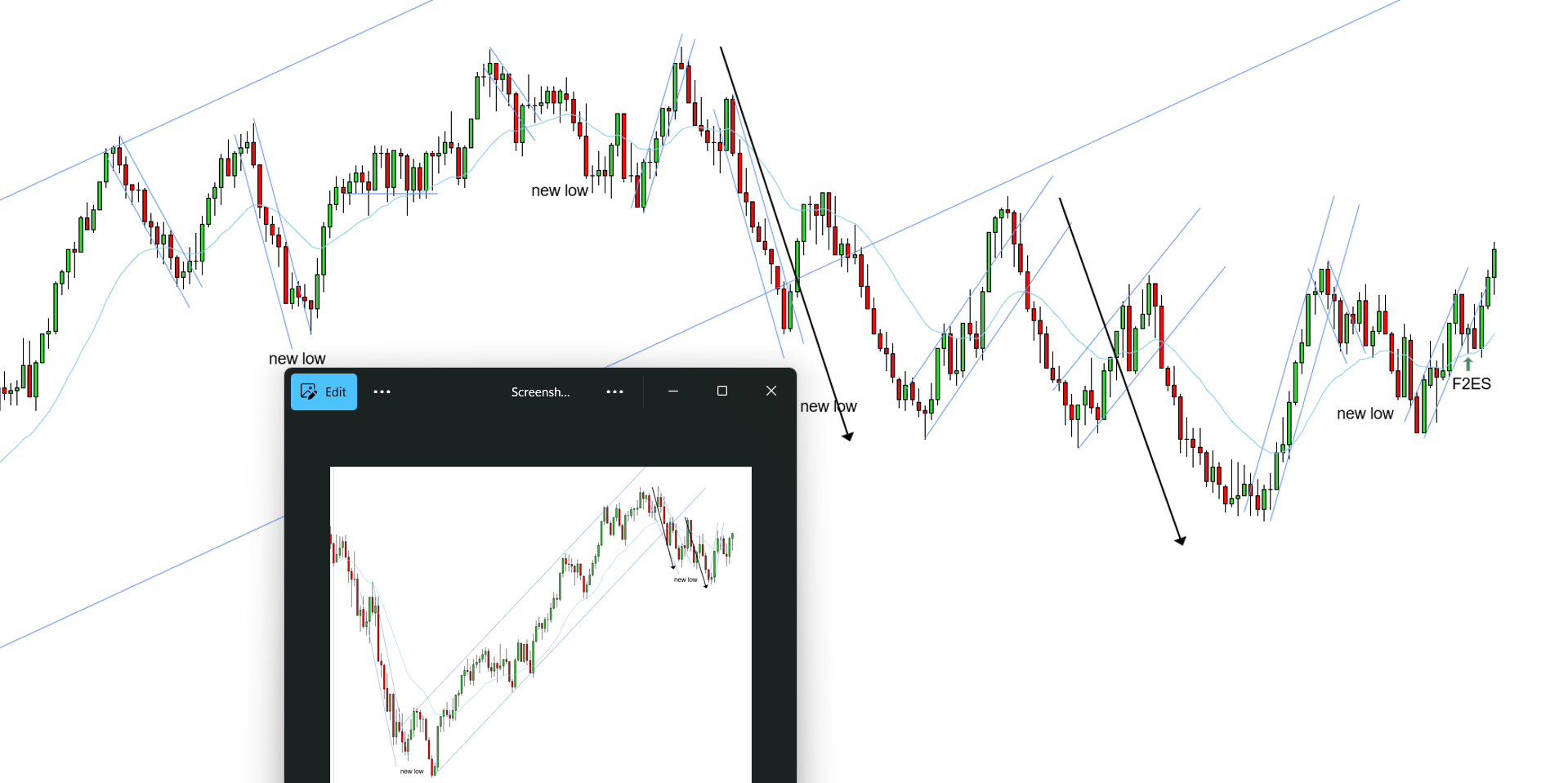

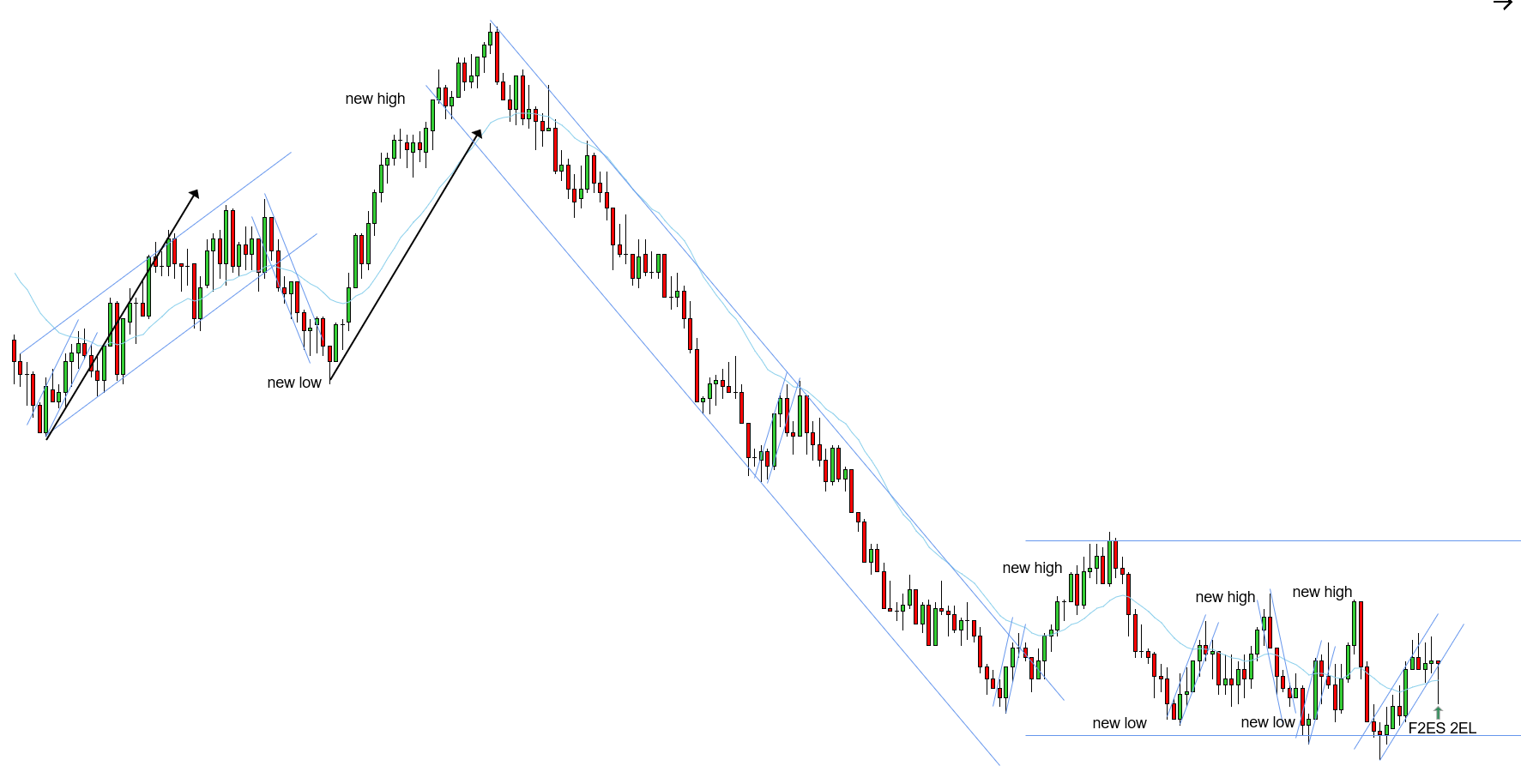

F2ES - 10/17/2025

W - Double bar entry - STT played out - bounced at trendline - F2ES above the EMA to start next push phase

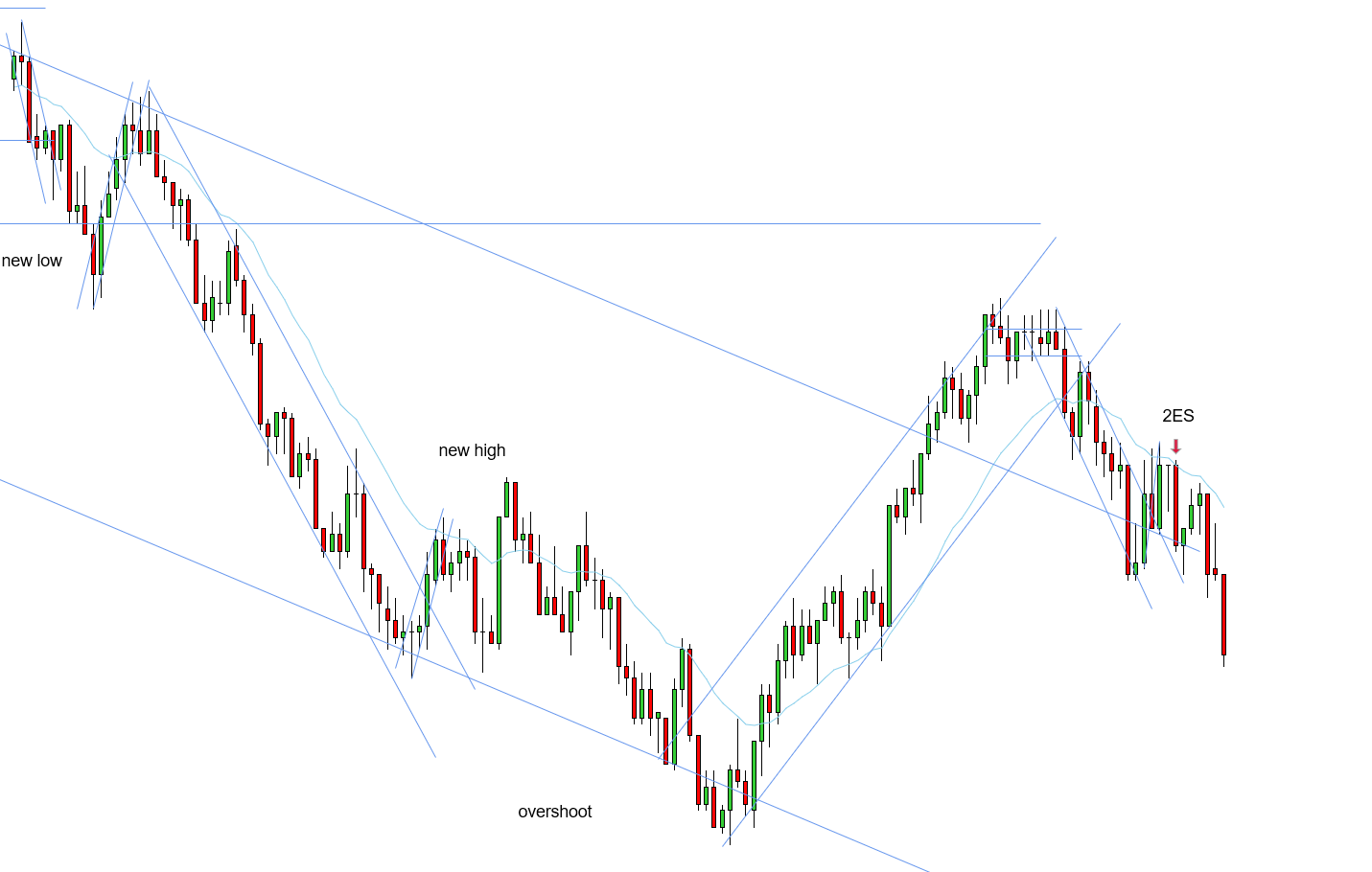

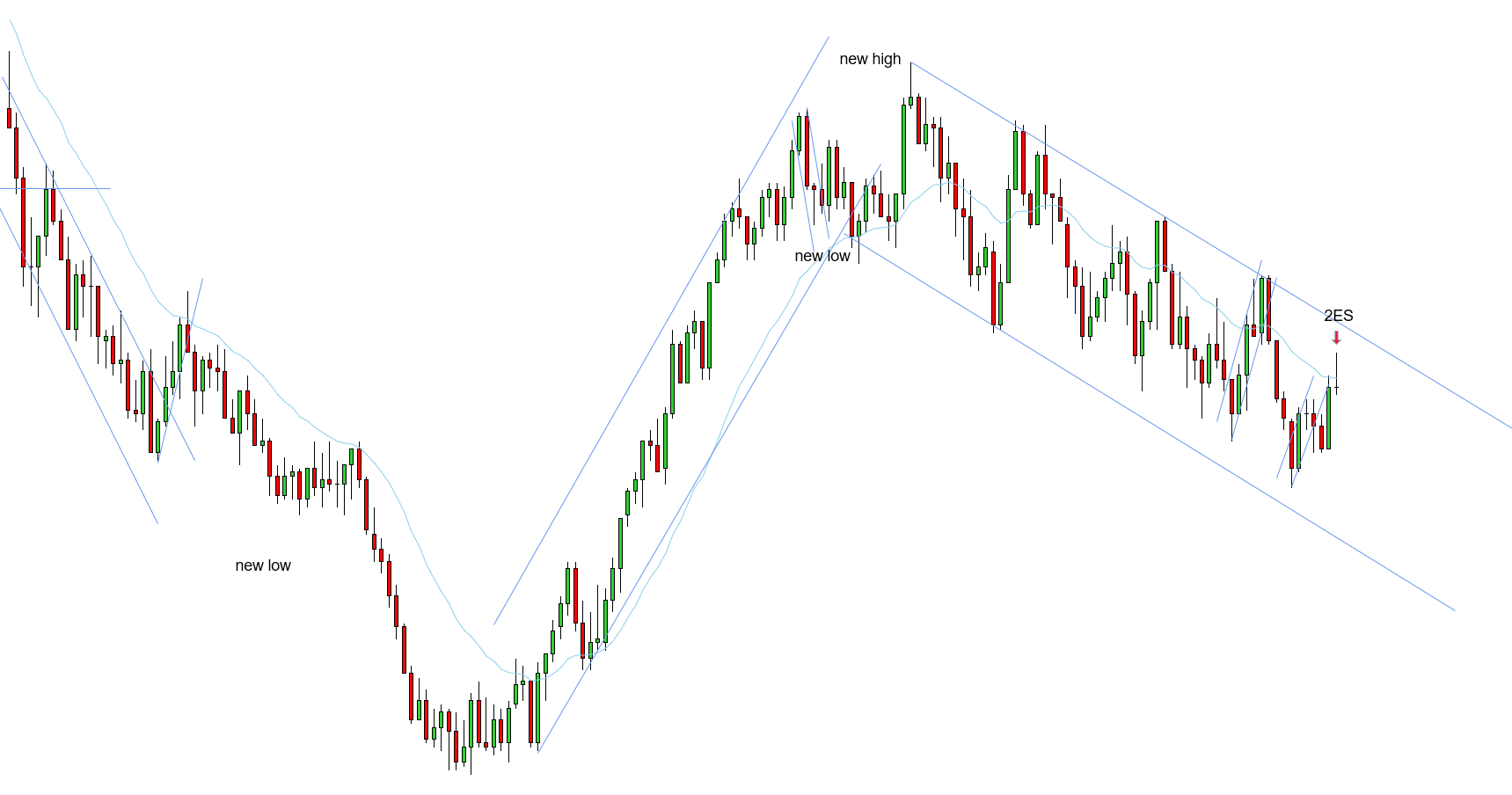

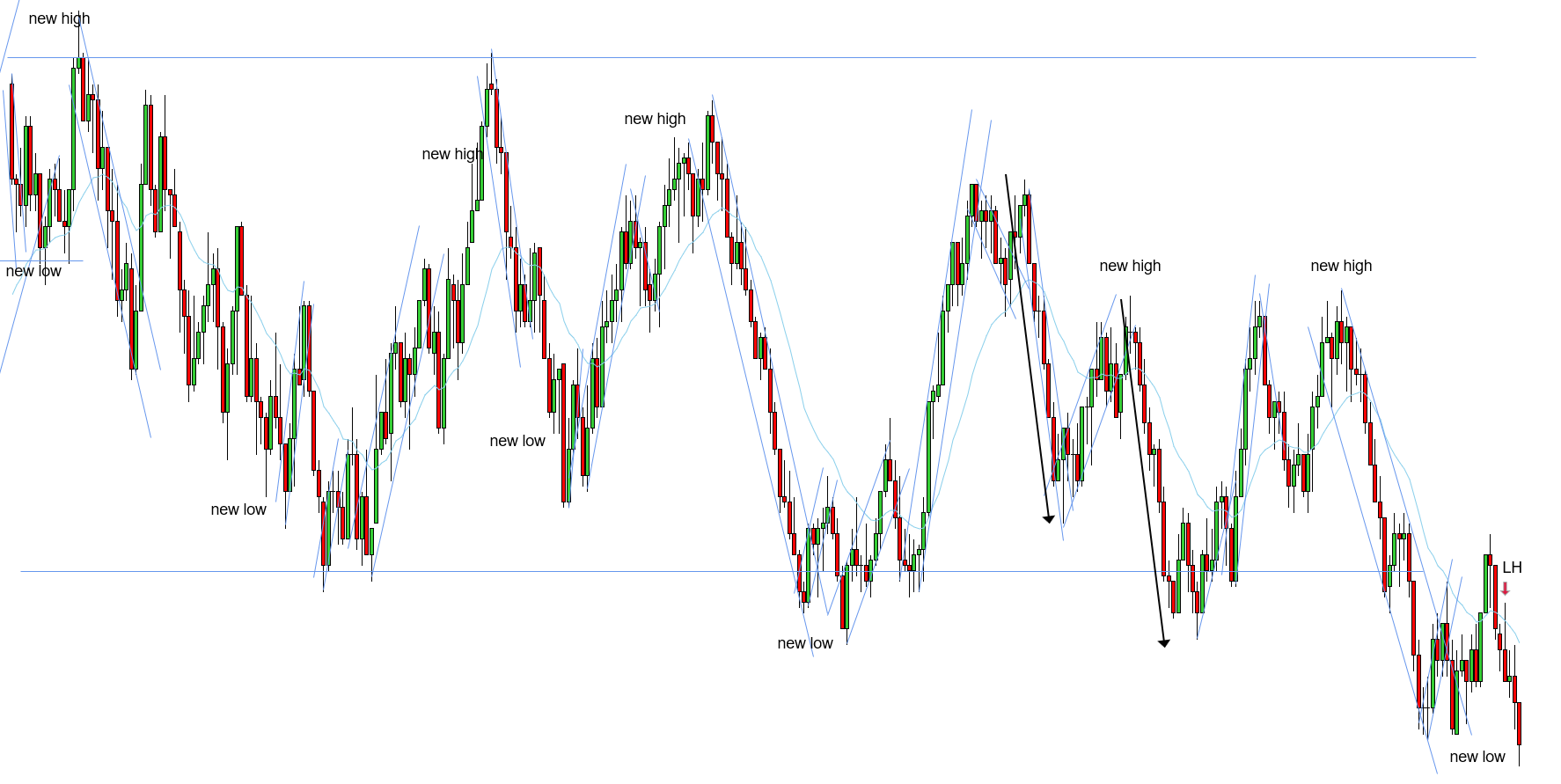

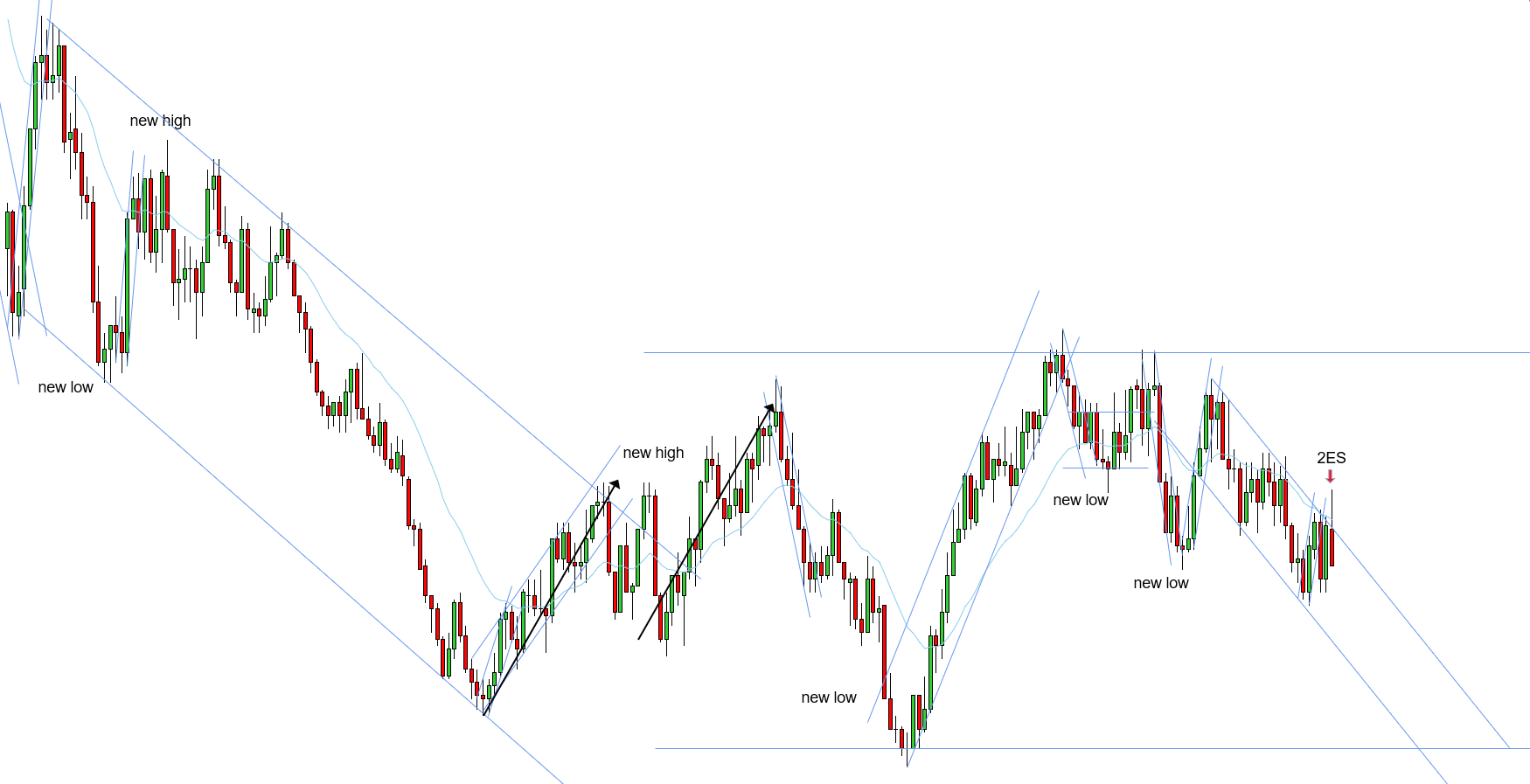

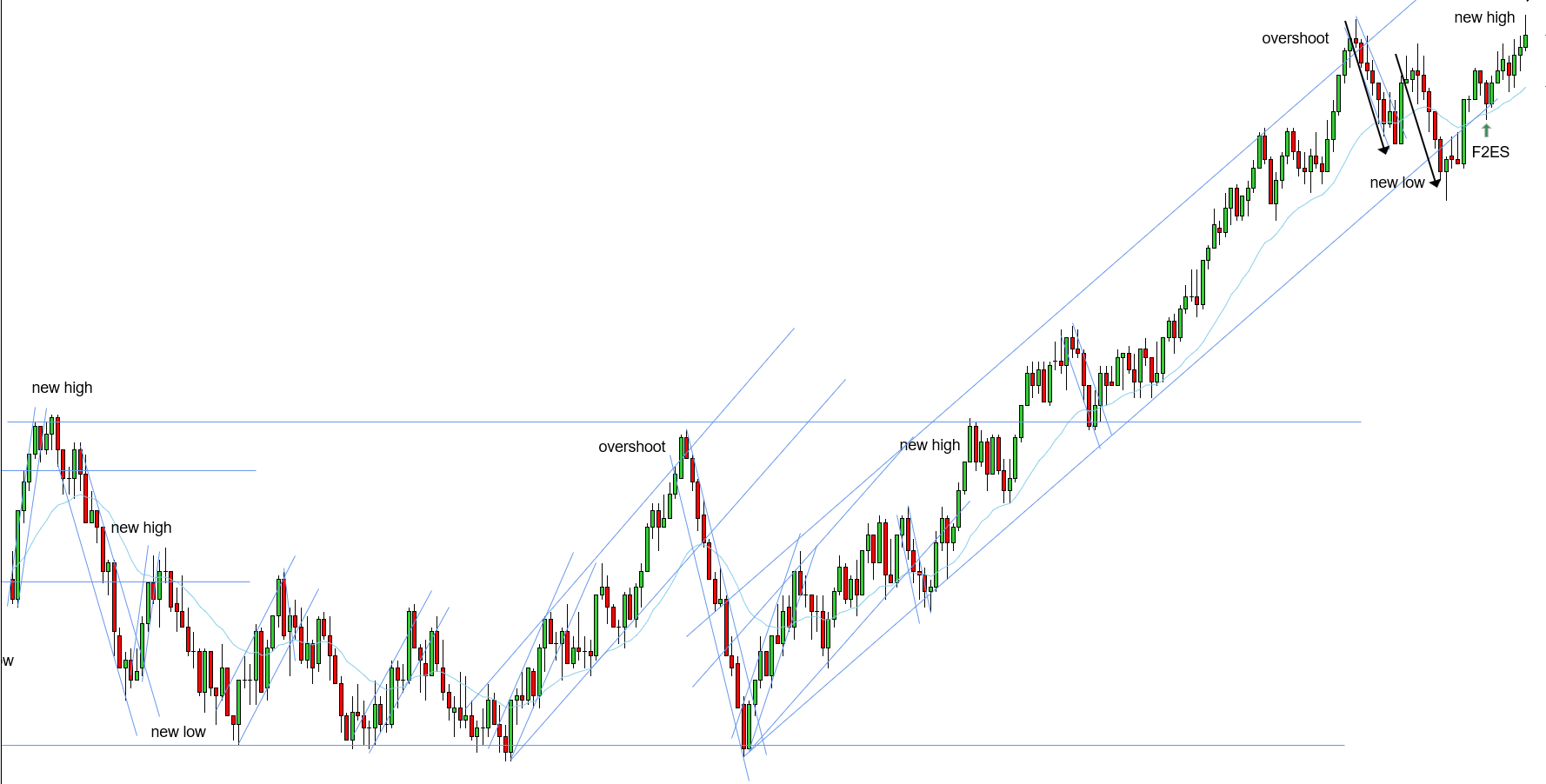

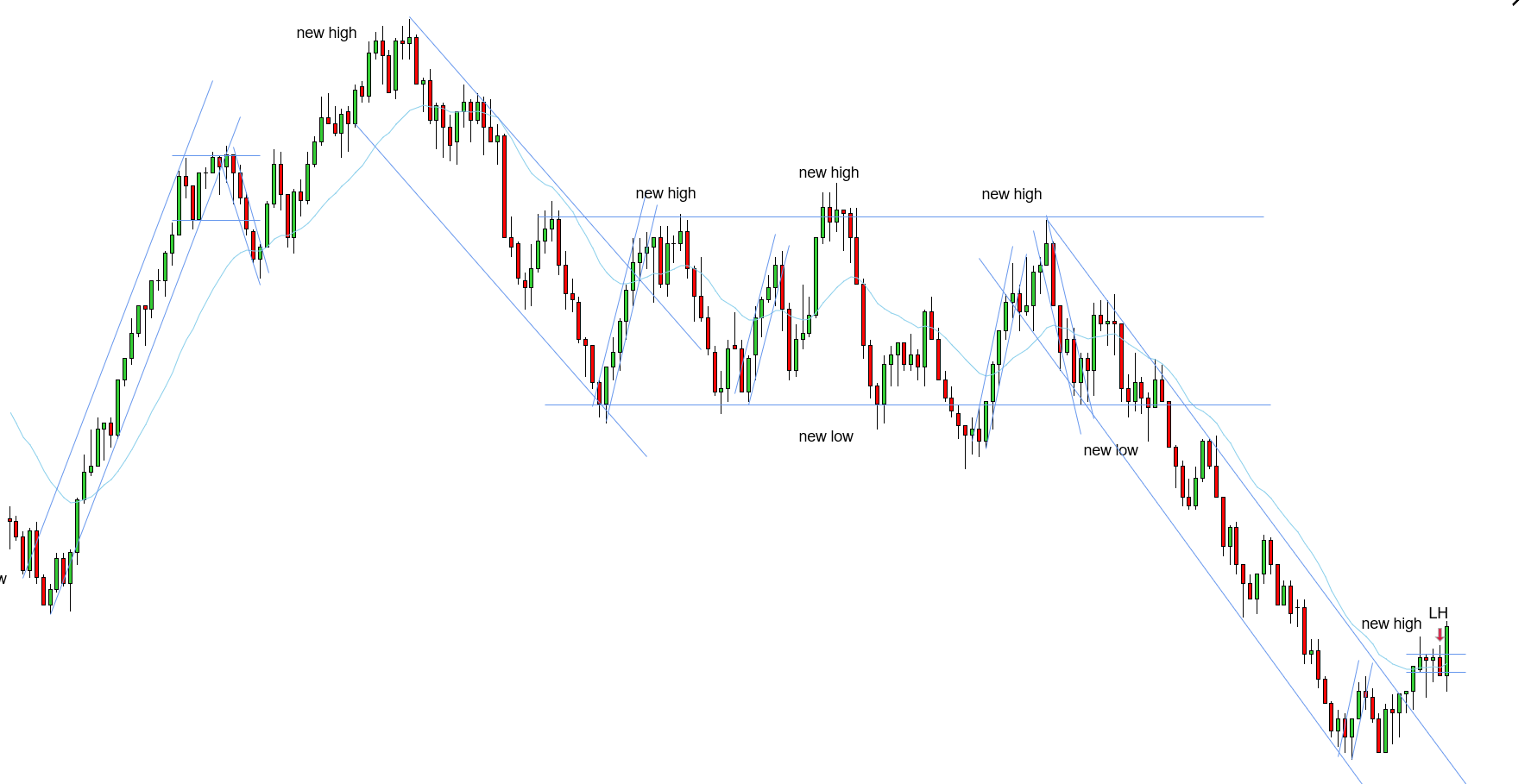

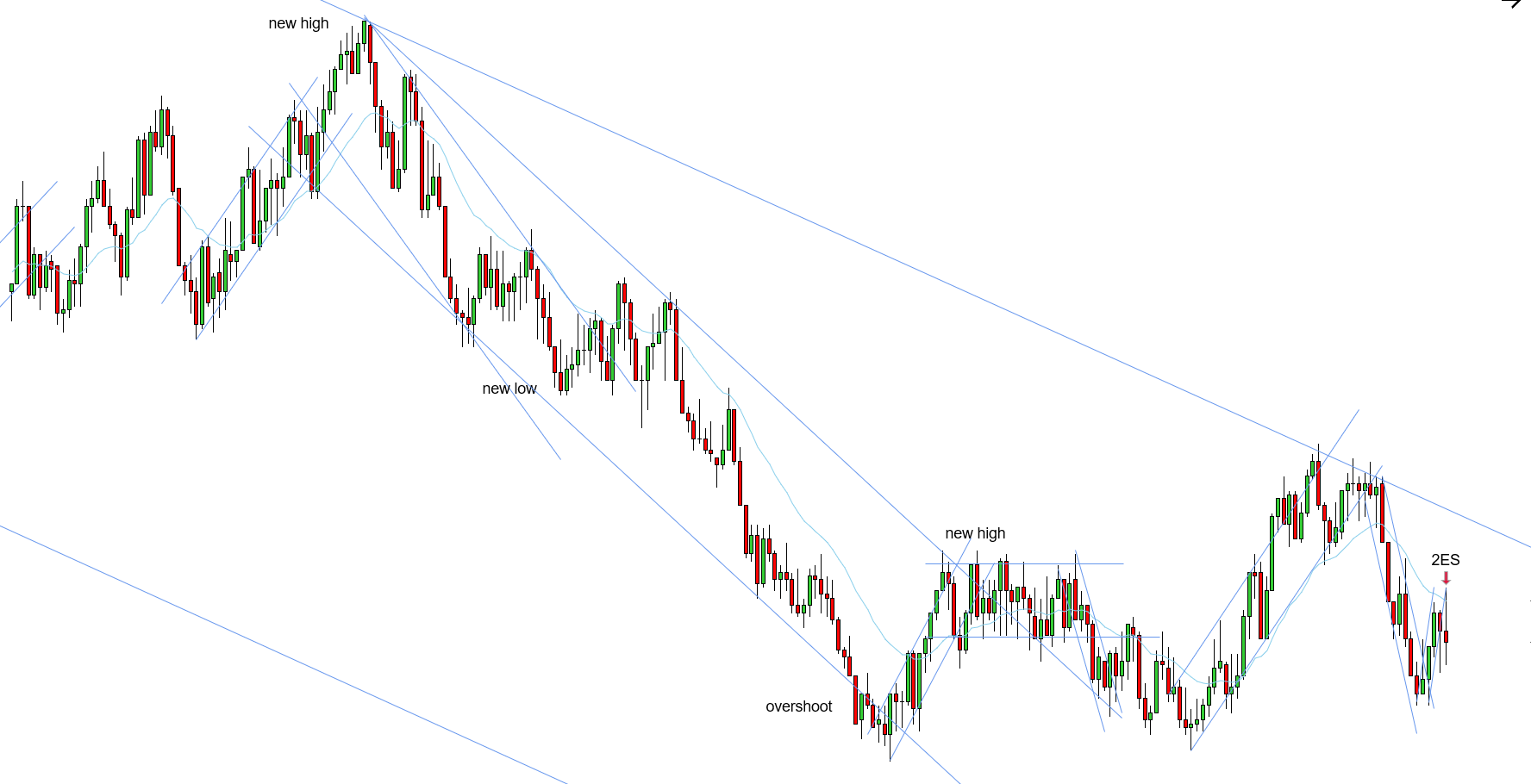

2ES - 10/17/2025

W - Range structure - downtrend needs a new low

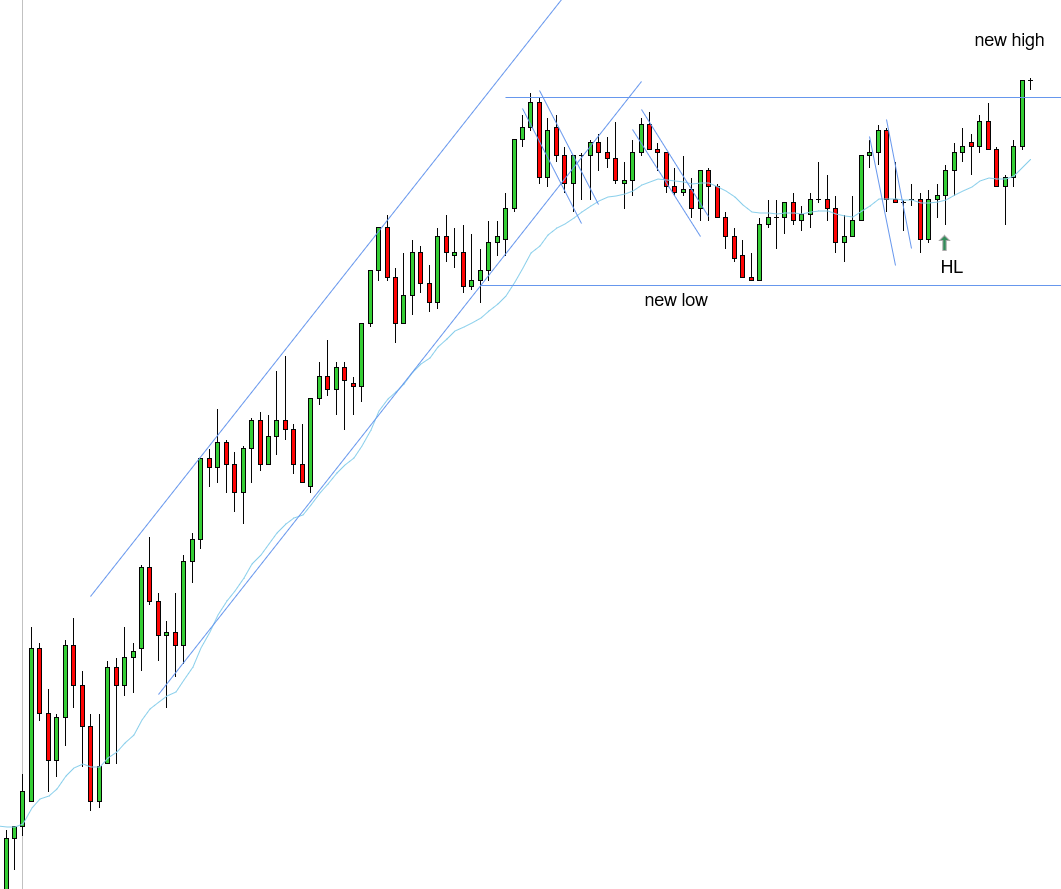

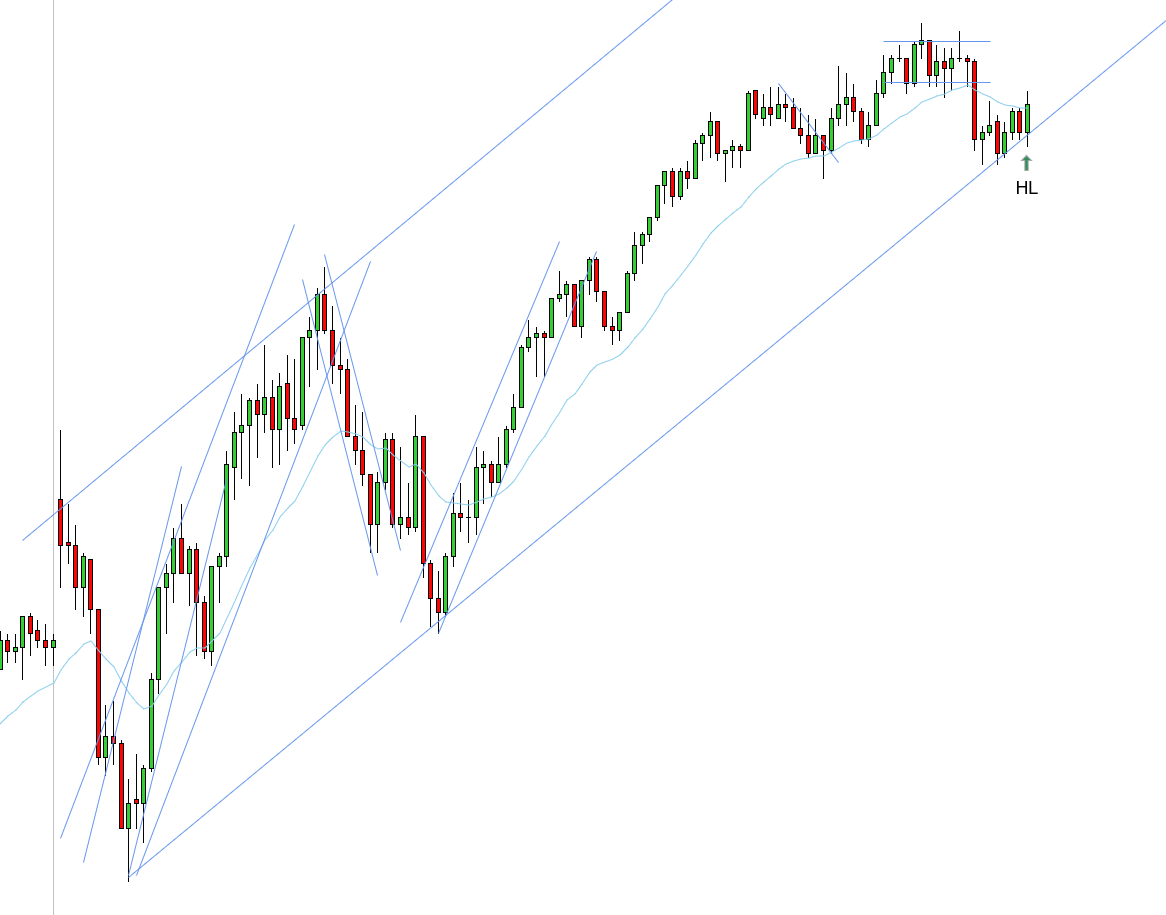

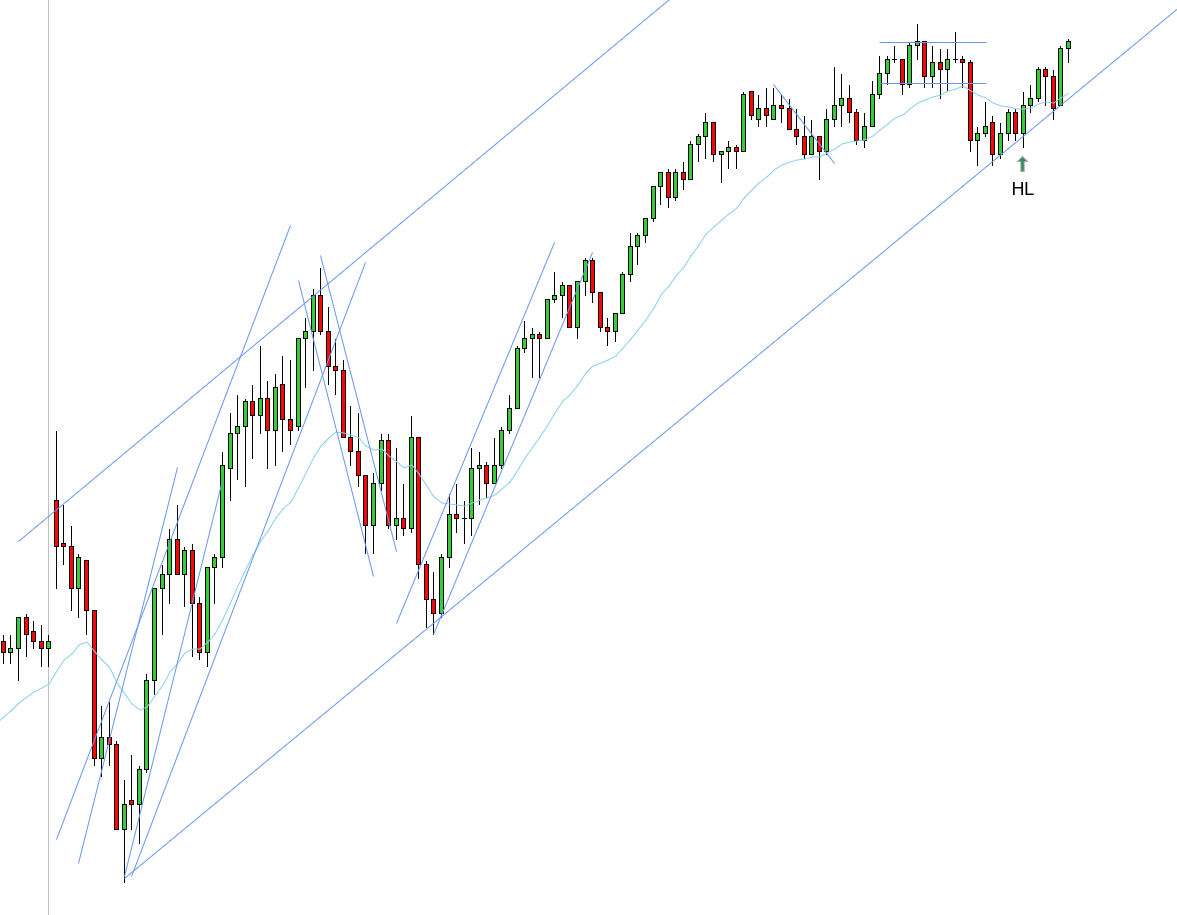

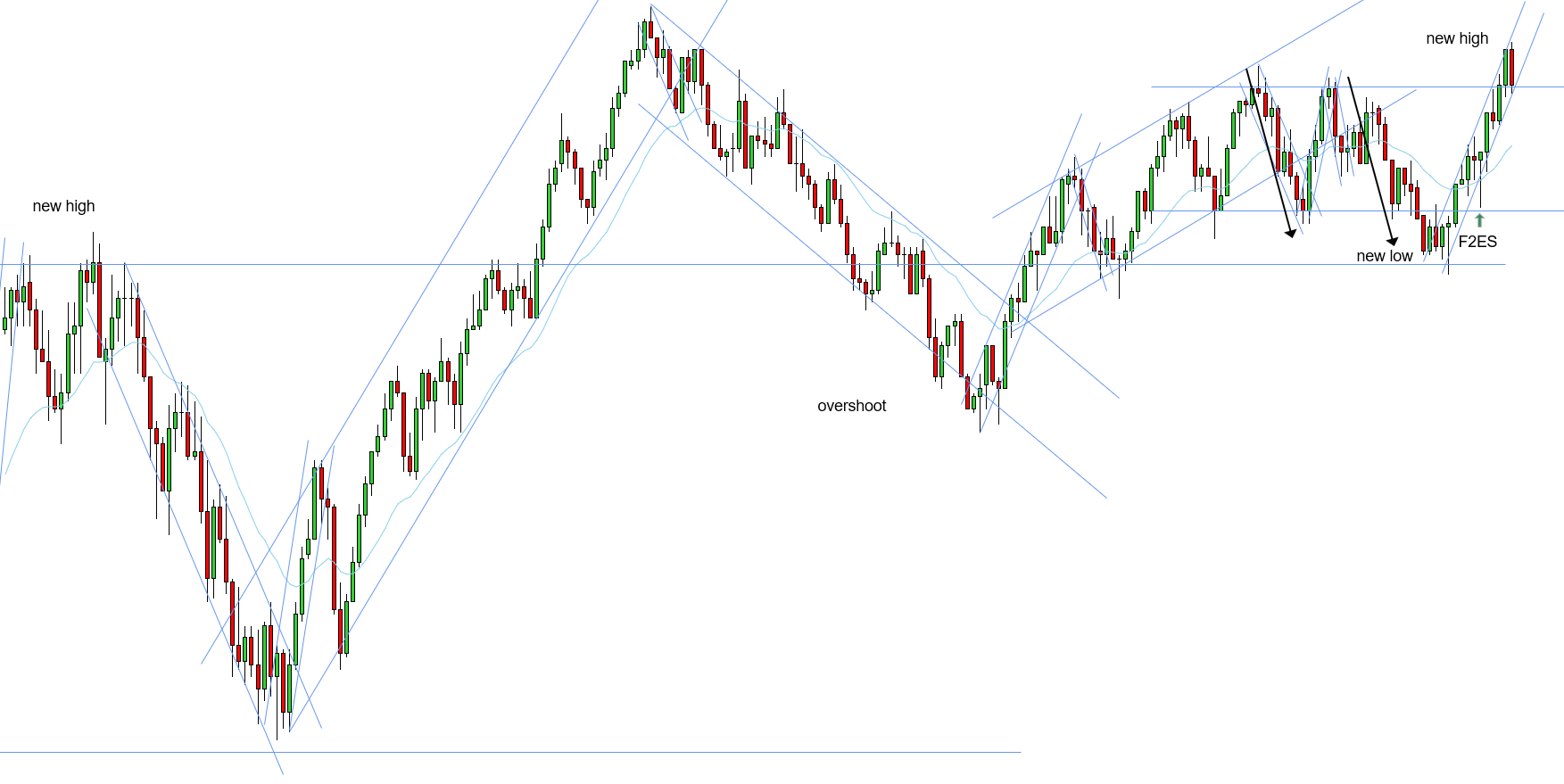

HL - 10/20/2025

W - Trendline held - HL closing above EMA - 2 key entry points, EMA & trendline

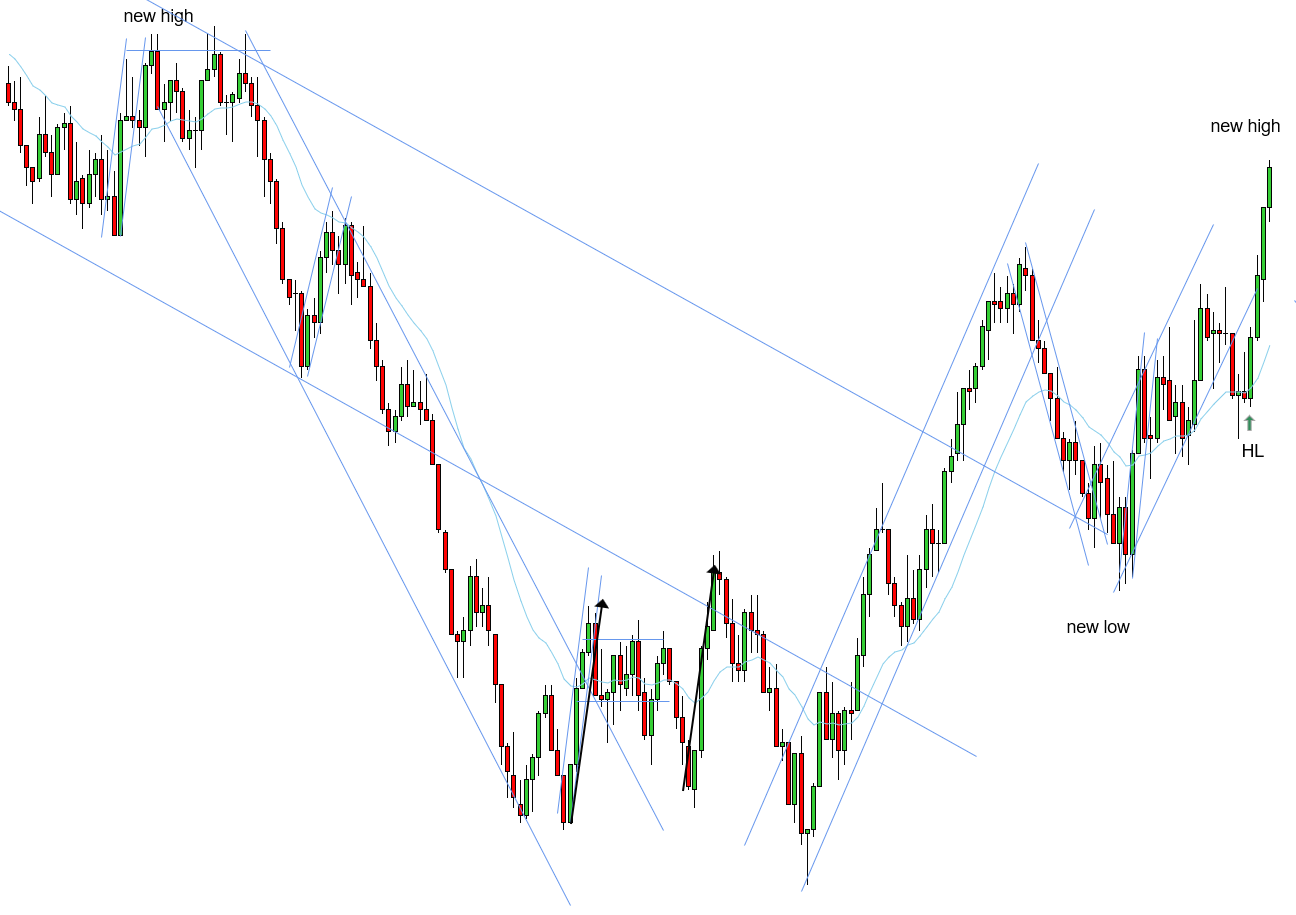

HL - 10/20/2025 (2)

L - There is a case for wider downtrend needing a new low - also, HL didn’t form right after push above EMA, instead pushed quite far up - 2EL is needed

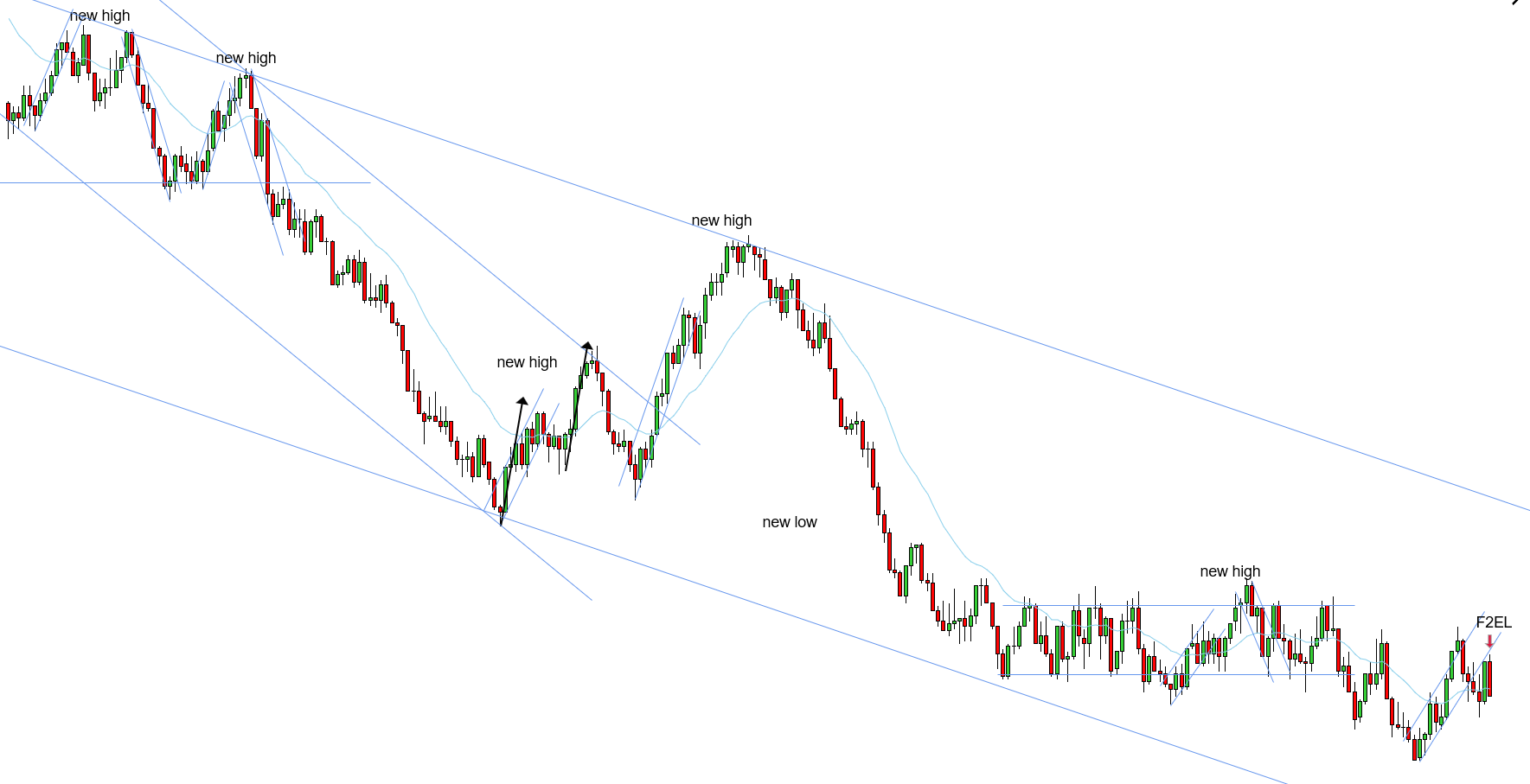

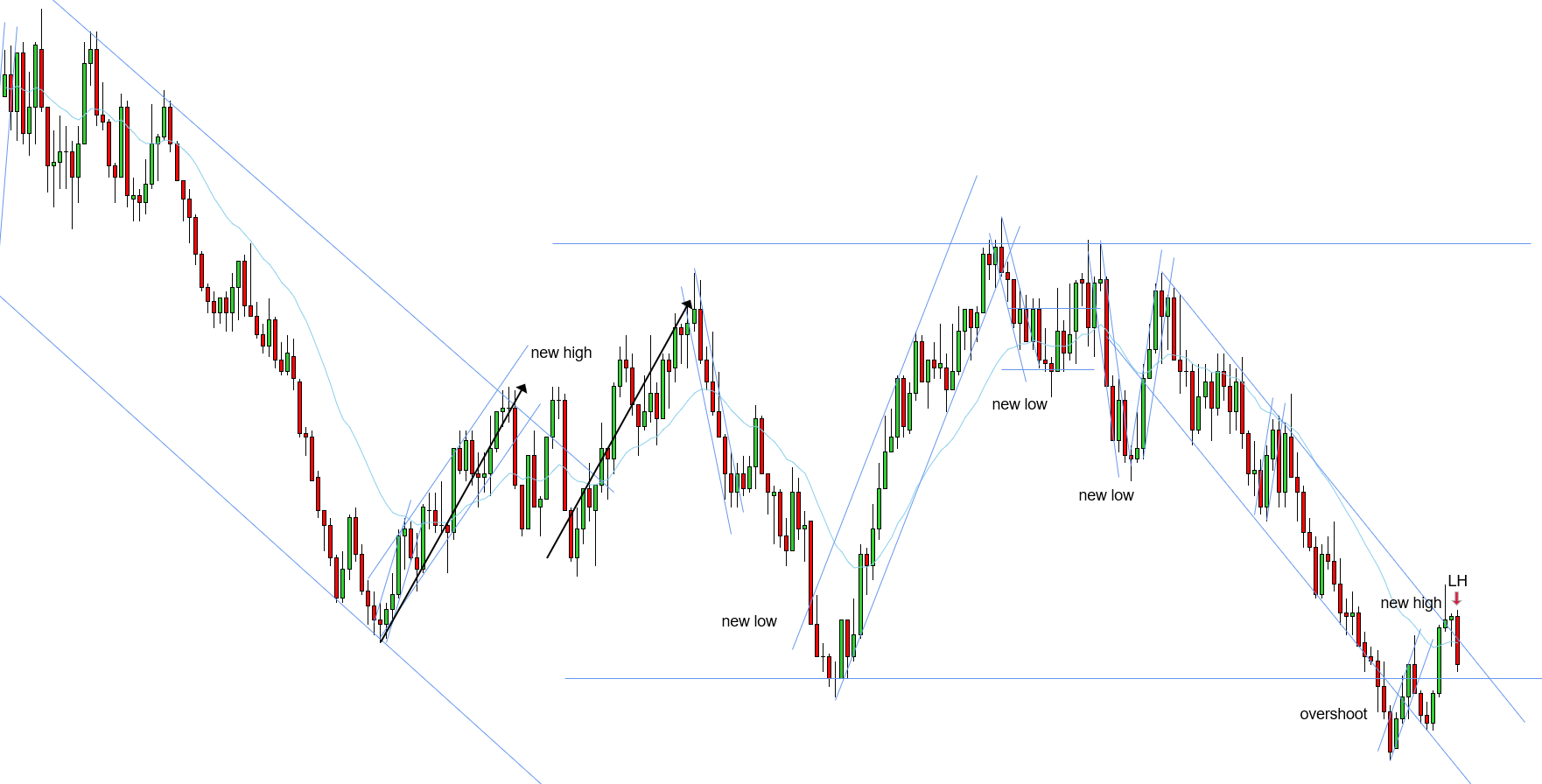

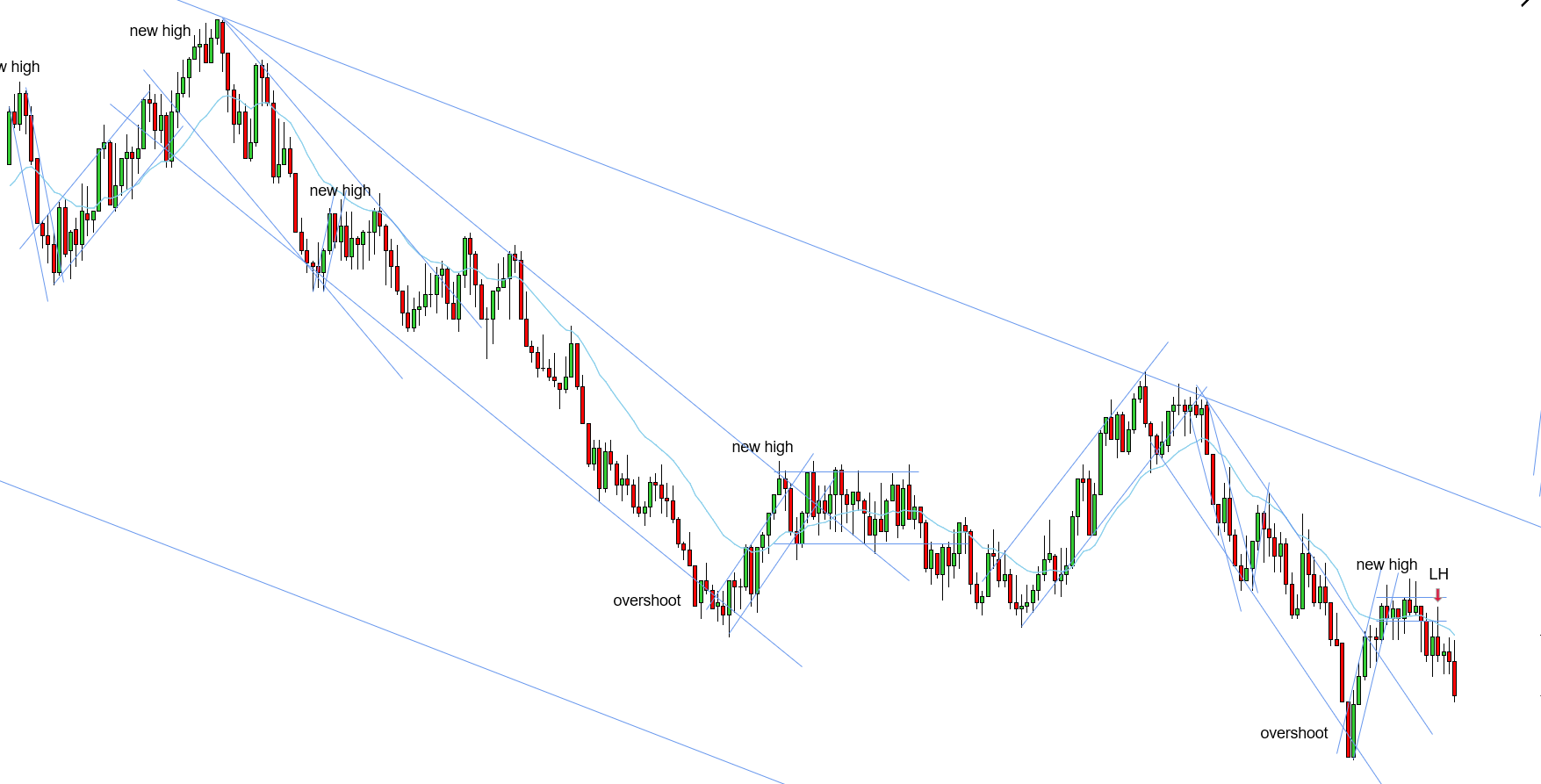

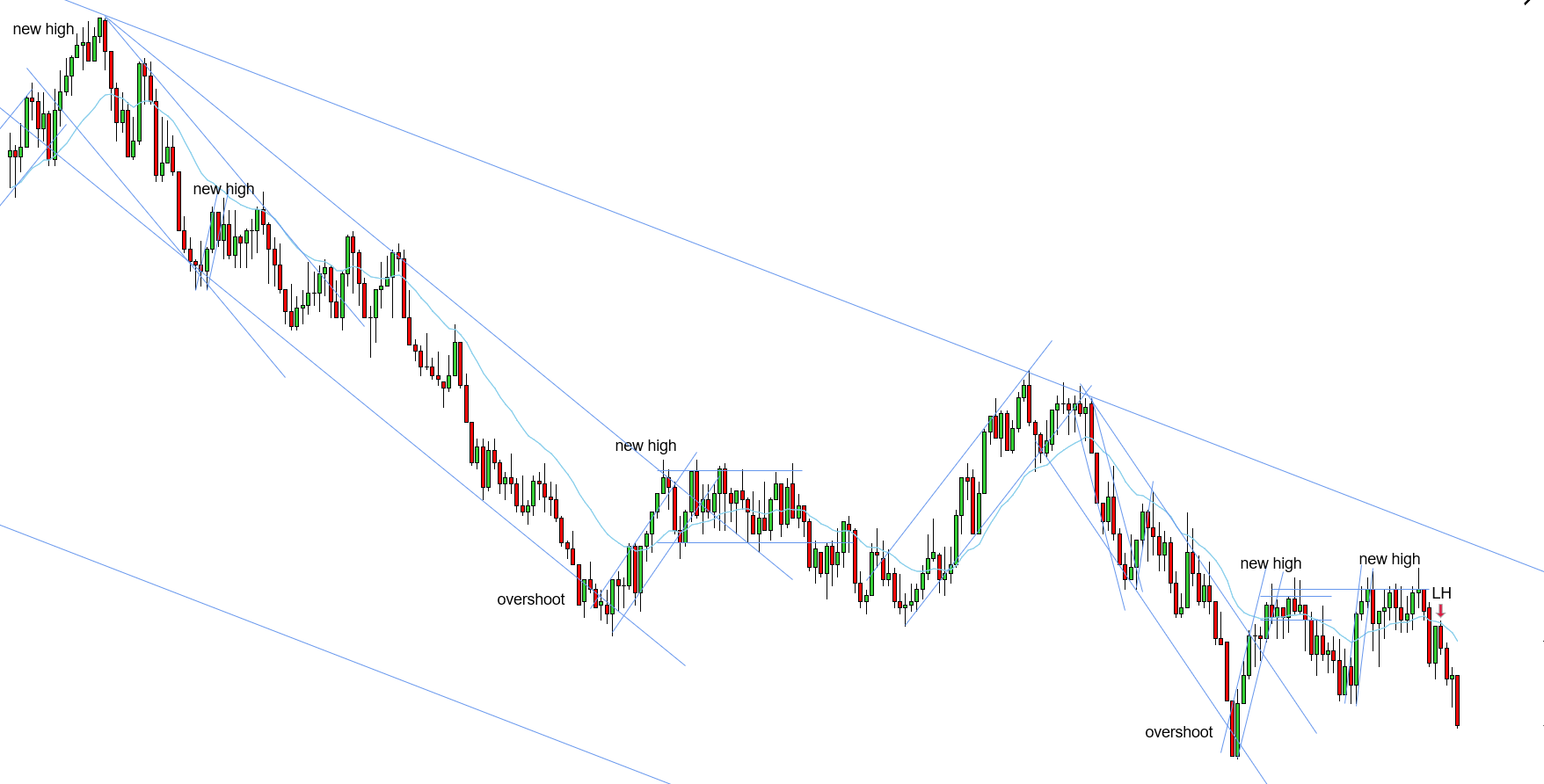

LH - 10/22/2025

W - 2 legs up - new high for the uptrend - main downtrend needs a new low - LH closing below the EMA

F2EL - 10/22/2025

L - Main downtrend needs a new low - F2EL to new low - minor support, however, downtrend still needed a new low - decent trade

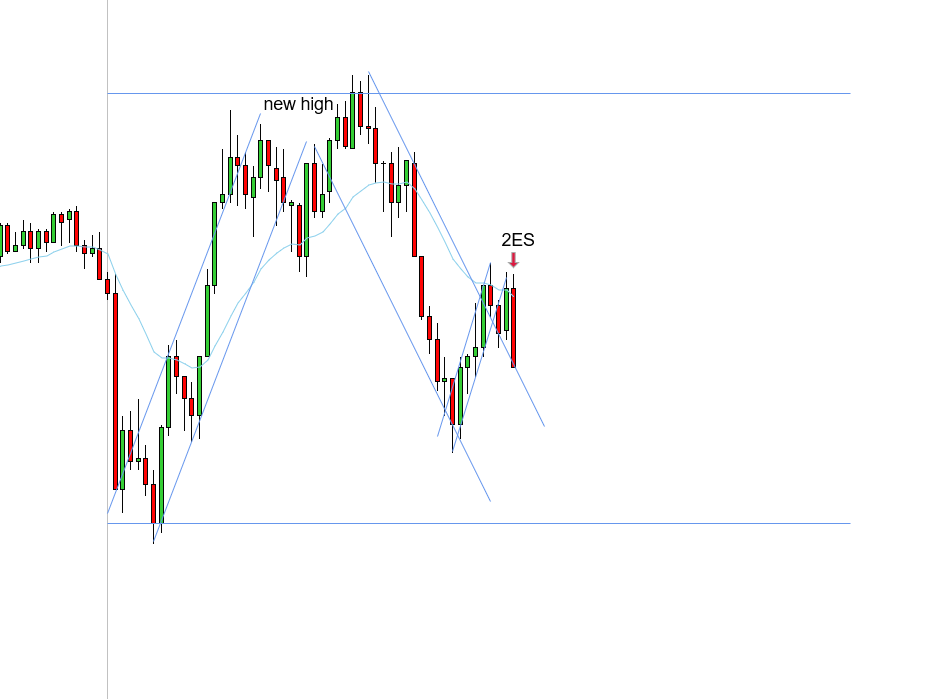

2ES - 10/22/2025

W - Two downtrends need a new low - deep limit since the bar closed so far down

2EL - 10/22/2025

W - 2-legged pullback - 2EL at the EMA - in trend

HL - 10/23/2025

W - Broad 2 legs down - 2 uptrends need new high - HL at the support of the range - (It’s technically not HL, but one of those that often form at the support of the range, there’s no word for it so it’s called HL)

HL - 10/23/2025 (2)

L - Too steep - looks like one leg, no pullback in between - buying at the top of the move

F2ES - 10/23/2025

W - 2 uptrends need a new high - range support held - F2ES above the EMA (a little worrisome that the F2ES broke below the HL, however, given all the reasons mentioned above, positives outweigh the one negative, it’s worth the risk)

2EL - 10/23/2025

W - 2EL BOPB - in trend

2EL - 10/24/2025

W - Main uptrend needs a new high - 2EL off 2 key entry points, EMA & trendline - expecting new high for the uptrend.

HL - 10/24/2025

L - Risked because we traded up into the range and we didn’t reach the support on the last 2EL which is a bullish sign - 10K didn’t look like a range, there was higher lows and it was more bullish - I had a limit 3 ticks back to get out before range highs - decent trade

HL - 10/28/2025

L - Thomas - “Market is so sideways, on 10K looks like barcode, we also traded down strongly. It’s just so sideway and stacked to take anything. I need clear trend to follow. There is no edge here.”

2EL - 10/28/2025

W - 3rd swing confirmation of uptrend - 3 key entry points - 10K aligned - double bar entry - the risk was quite low (10 ticks for db entry) - this could be risked a tick back and not a deeper limit even though it seems like db entry moved a bit up because there is room to scalp out before the high and the risk is low

F2ES - 10/28/2025

W - Downtrend played out with a break and a new low - F2ES at 2 key entry points - start of new push phase

F2ES - 10/28/2025 (2)

W - Main uptrend needs a new high - triple test held and HL traders got trapped buying too far from the EMA - prices corrected and formed a F2ES right at the EMA - F2ES confirmed new high of the uptrend

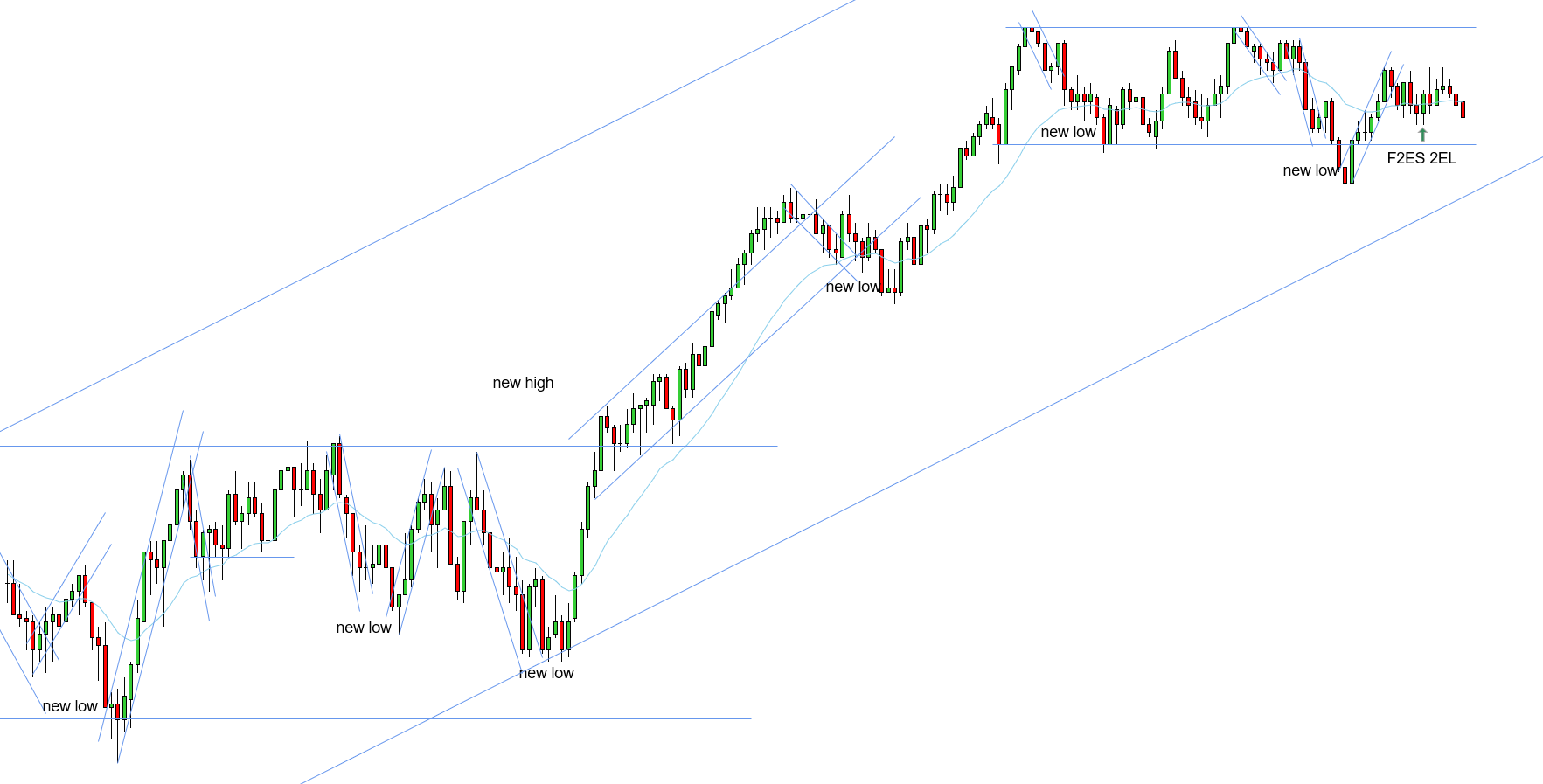

2EL - 10/29/2025

W - 2 main uptrends needed a new high - 2 legs back, bearish correction played out - 2EL mini TT expecting a new high of the uptrends

2EL - 10/29/2025 (2)

W - 3rd swing confirmation - downtrend played out with break and a new low, 2 legs back - 2EL at 2 key entry points

HL - 10/29/2025

W - HL confirming the 2EL and 3rd swing confirmation - downtrend played out with break and a new low, 2 legs back - HL at 2 key entry points

Double Trap - 10/30/2025

W - Uptrend needs a new high - 2 legs back - double trap closing above the EMA

HL - 10/30/2025

W - Uptrend needs a new high - 2 legs back - HL is confirming the double trap - triple test

2ES - 10/30/2025

W - Downtrend in play - 2 legs back - 2ES at the EMA, in trend

LH - 10/30/2025

W - LH worked but per Thomas, “It previously looked like a range and this LH seemed quite steep. There was an imbalance, but I wasn’t sure. F2EL is preferred.” - It could have been a break and a new low of the downtrend and a wider uptrend being established to pull prices back into the range, a F2EL would have negated this read.

2ES - 10/31/2025

W - Downtrend needed a new low - triple test - 2 key entry points - per Thomas, “everything aligned, no conflicting variables”

LH - 10/31/2025

W - Downtrend needed a new low - 2 legs up - LH confirming the F2EL - expecting new low for the downtrend

2ES - 10/31/2025 (2)

L - Double bar entry - prices were stacked, which led to another pullback - good to be patient on this stacked area - after reloading my data, the stacked area is much more apparent

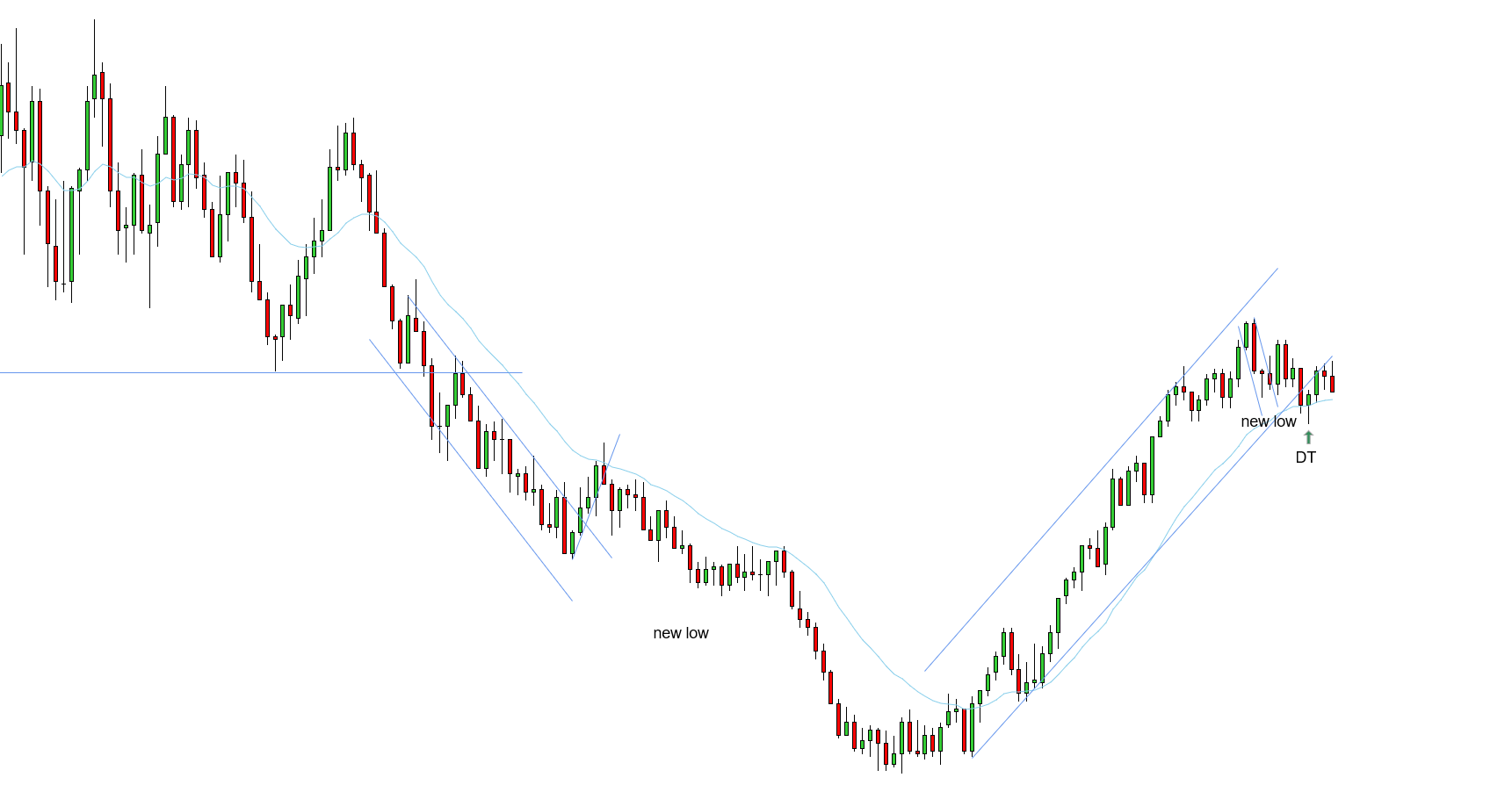

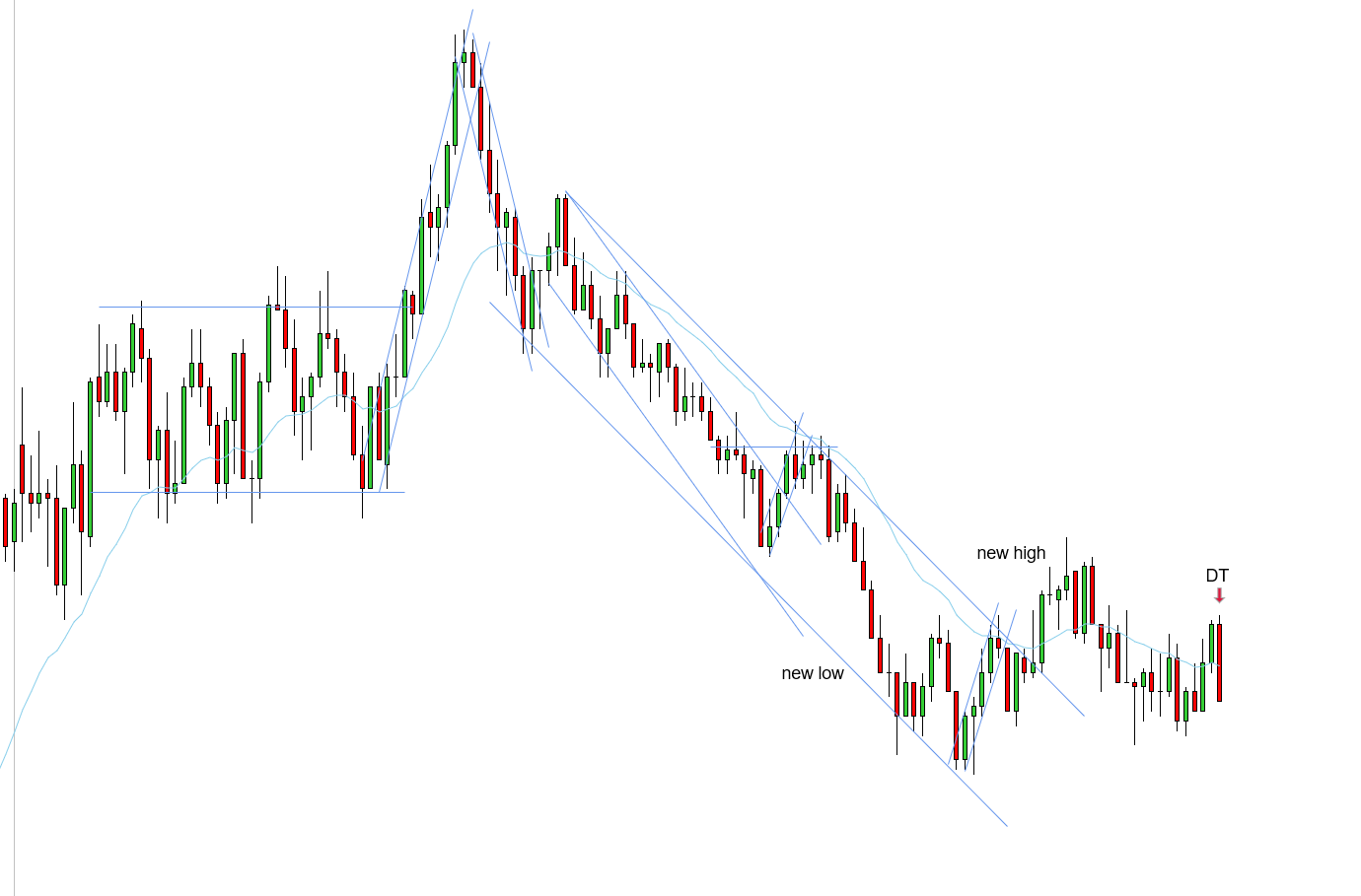

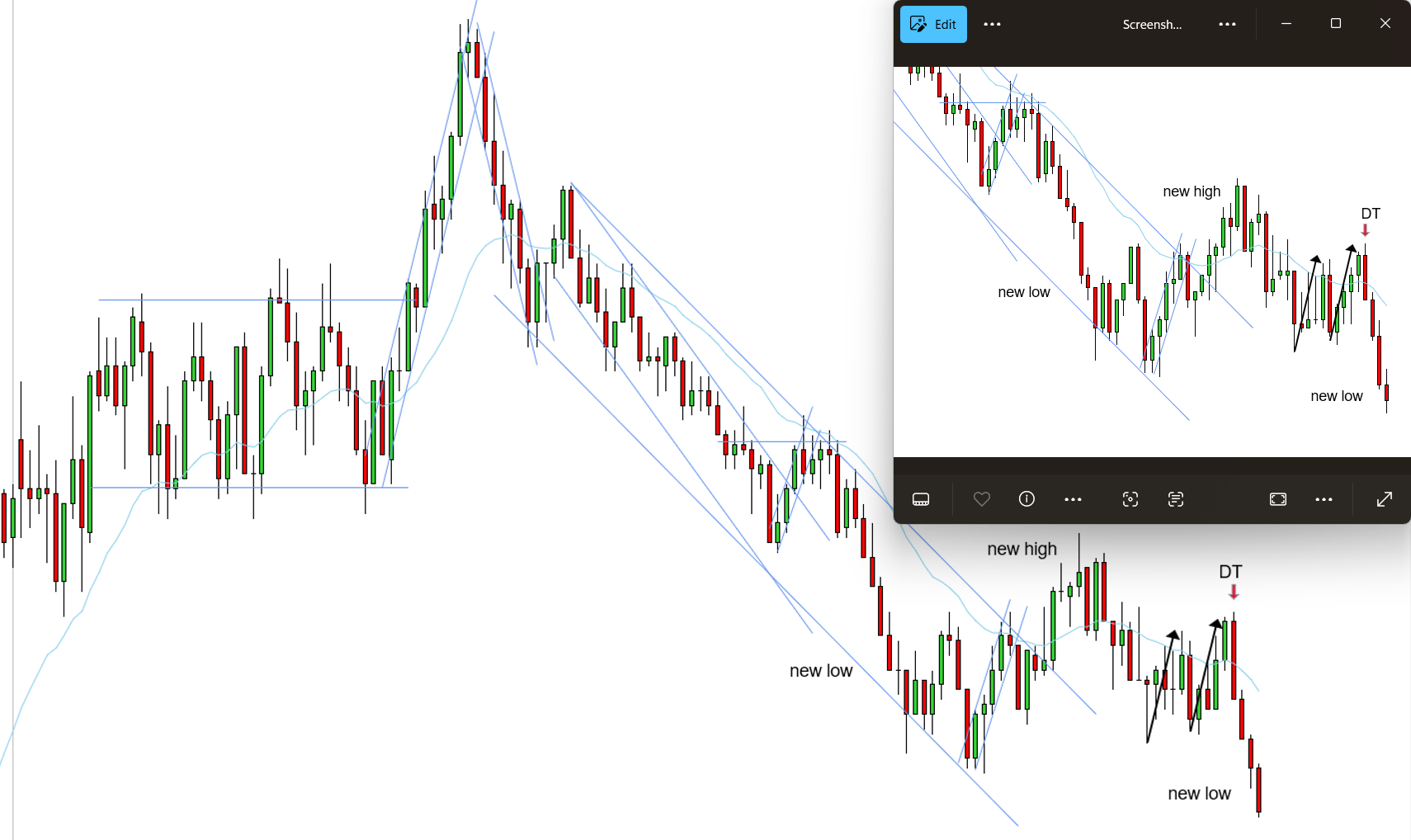

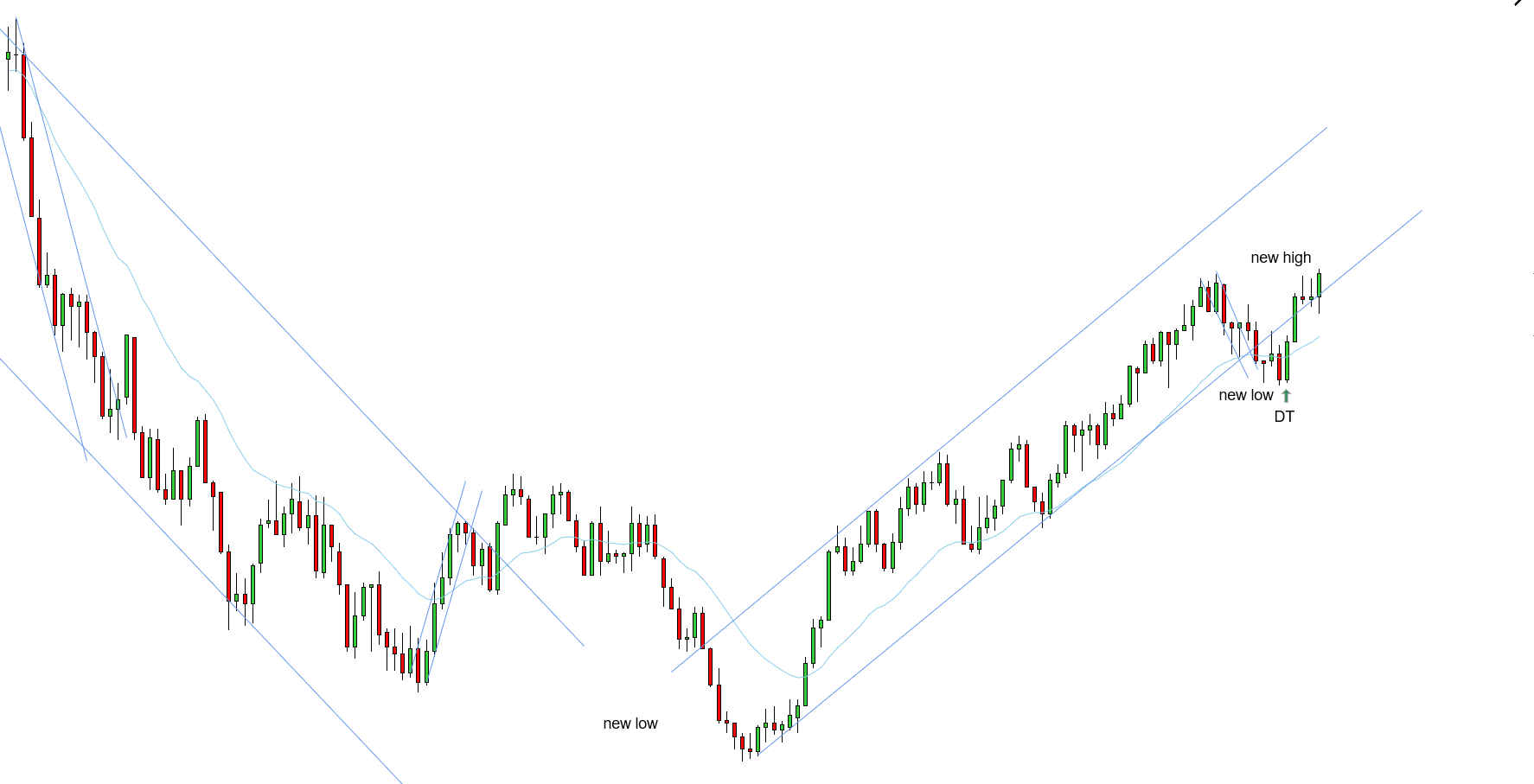

DT - 10-31-2025

W - Main downtrend needs a new low - 2 legs back - double trap closing below the EMA - double trap freed itself out of the stacked area

F2ES TT - 10/31/2025

L - Spike and a channel needs a new high - support is holding prices with the triple test - 2 key entry points - a bit riskier given the big setup bar and overshoot, however, worth the risk - per Thomas, “F2ES combined with the quadruple test - overshoot can come into play but chances are high uptrend will get the new high given the F2ES and quadruple test - great trade to take a chance on”

LH - 10/31/2025 (2)

W - Downtrend is confirmed - uptrend play out with a break and new high - downtrend held prices - LH closing below the EMA to start the next push phase

HL - 11/03/2025

W - Downtrend played out with a break and a new low - reversal uptrend in play - uptrend needs a new high - HL confirming the 2EL

HL - 11/04/2025

W - Uptrend in play - downtrend played out with a break and a new low - HL at 2 key entry points - expecting the next push phase

HL (2) - 11/04/2025

W - Secondary spike and a channel pattern after break and new high of the uptrend - instead of reversing the market after new high, prices held in the spike and a channel pattern, signaling continuation - downtrend played out with a break and new low - HL confirmed the 2EL and spike and a channel pattern - A deeper limit was needed as the bar was quite big

F2ES - 11/04/2025

W - Spike and a channel got confirmed - F2ES above the EMA expecting the next push phase

LH - 11/04/2025

W - Downtrend needed a new low - LH confirmed the F2EL and sort of acted as a 2ES - just a normal LH without confirming the F2EL would not be enough given overshoot and the strong bullish leg but since we got a F2EL below the EMA we expect a new low for the downtrend and the LH confirms that F2EL.

F2ES - 11/05/2025

L - I asked Thomas the question, “Given we are in a main uptrend, I was under the impression we didn’t need a new low for the downtrend if we got a F2ES above the EMA?” Per Thomas, “This was a very weak uptrend - corrections were very strong - wider uptrend barely confirmed - so for this reason I respected correction channel - it comes due to weak uptrend structure instead of strong one.” - Thomas comments in the video, “Weak uptrend, not a strong uptrend by any means - every single pullback was long, deep, and breaks the EMA (important to keep in mind for future sessions) - correction channel is most likely going to get new low.”

HL - 11/05/2025

L - Uptrend in play - downtrend played out with a break and a new low - push back above the EMA and formed HL - Great trade to take a chance on expecting bullish bias to resume

HL - 11/05/2025 (2)

W - Uptrend in play - support held prices - HL above the EMA, is also a 2EL

HL - 11/05/2025 (3)

L - You want to see the HL formed right at the EMA, this one pushed through the EMA and came back, in this scenario you need a 2EL.

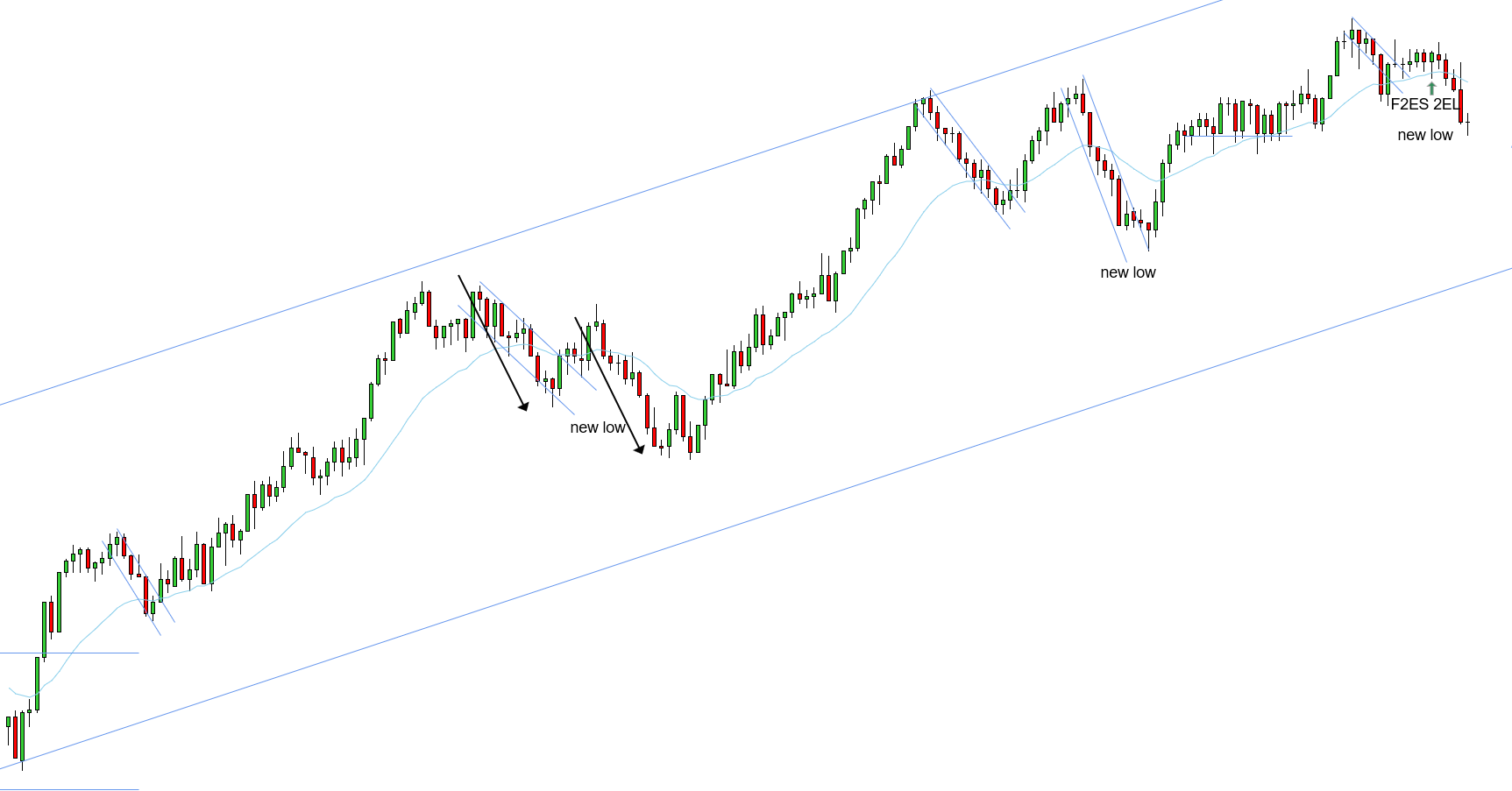

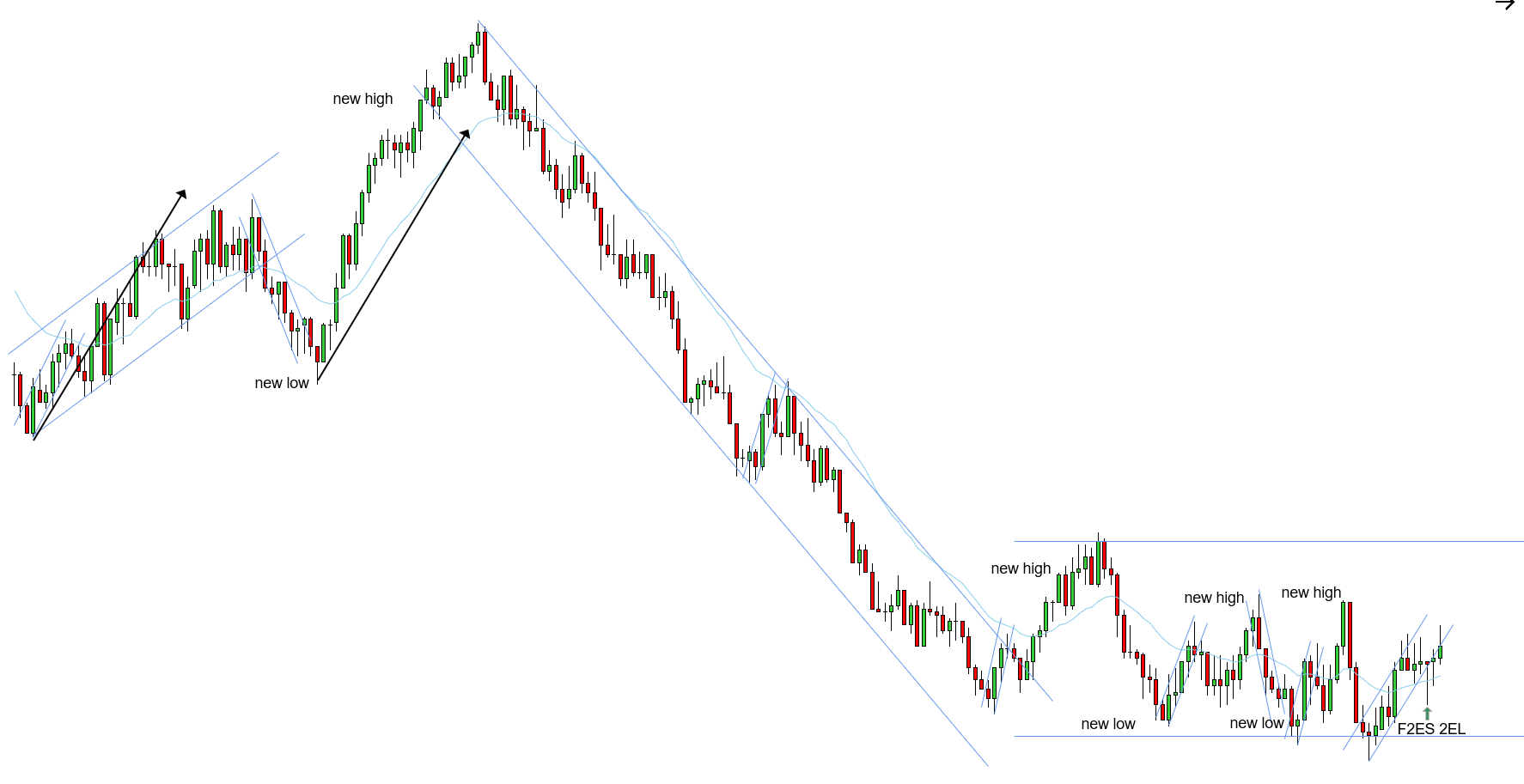

F2ES 2EL - 11/05/2025

L - Decent trade to take a chance on - it was a little stacked which makes it more aggressive; however, it was still decent - range instead of an uptrend - expect a new high for the STT uptrend - better to be patient on the HL and wait for a 2EL which we got - worth the risk

F2EL - 11/06/2025

W - Downtrend in play - F2EL closing below the EMA - 2ES traders got trapped taking the 2ES too early as it was above the EMA with a STT uptrend in play, however, the F2EL was the ultimate trap closing below the EMA - per Taylor, “the location locally relative to the EMA for the F2EL is probably not good on other days where the bias isn’t so strong, given this bias, it’s a great trade.”

LH - 11/06/2025

W - Downtrend in play - LH confirming the 2ES, closing below the EMA - Main thing here is were in a confirmed downtrend, the corrections aren’t very strong and the LH is closing below the EMA - even though there a STT uptrend in play, the main trend is down and the LH closing below the EMA is a resumption of the trend - there was a LH right before this one which was a similar repeat pattern, however, it didn’t close below the EMA like this one - in that case we would need a F2EL, here LH is enough.

F2ES - 11/06/2025

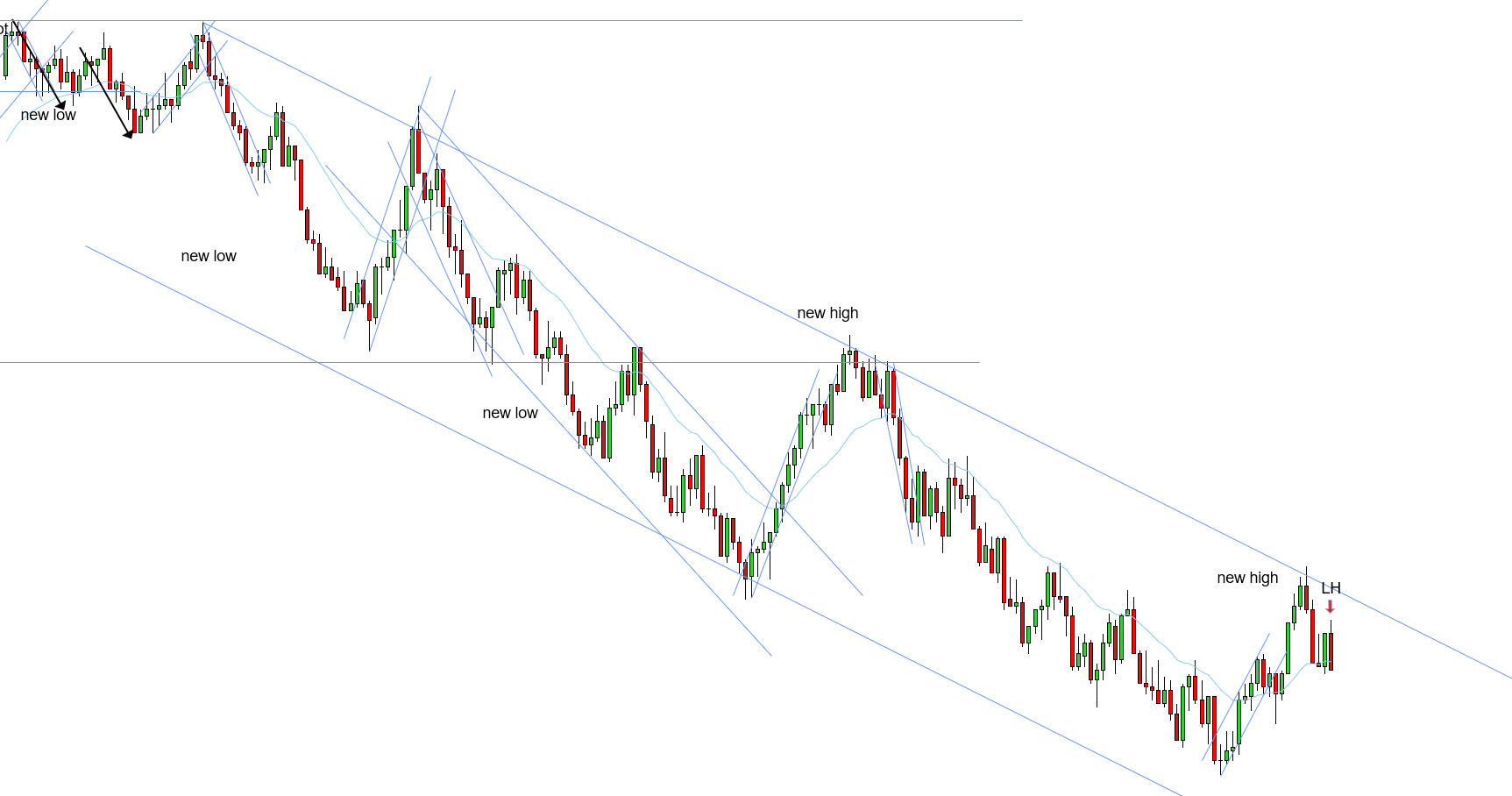

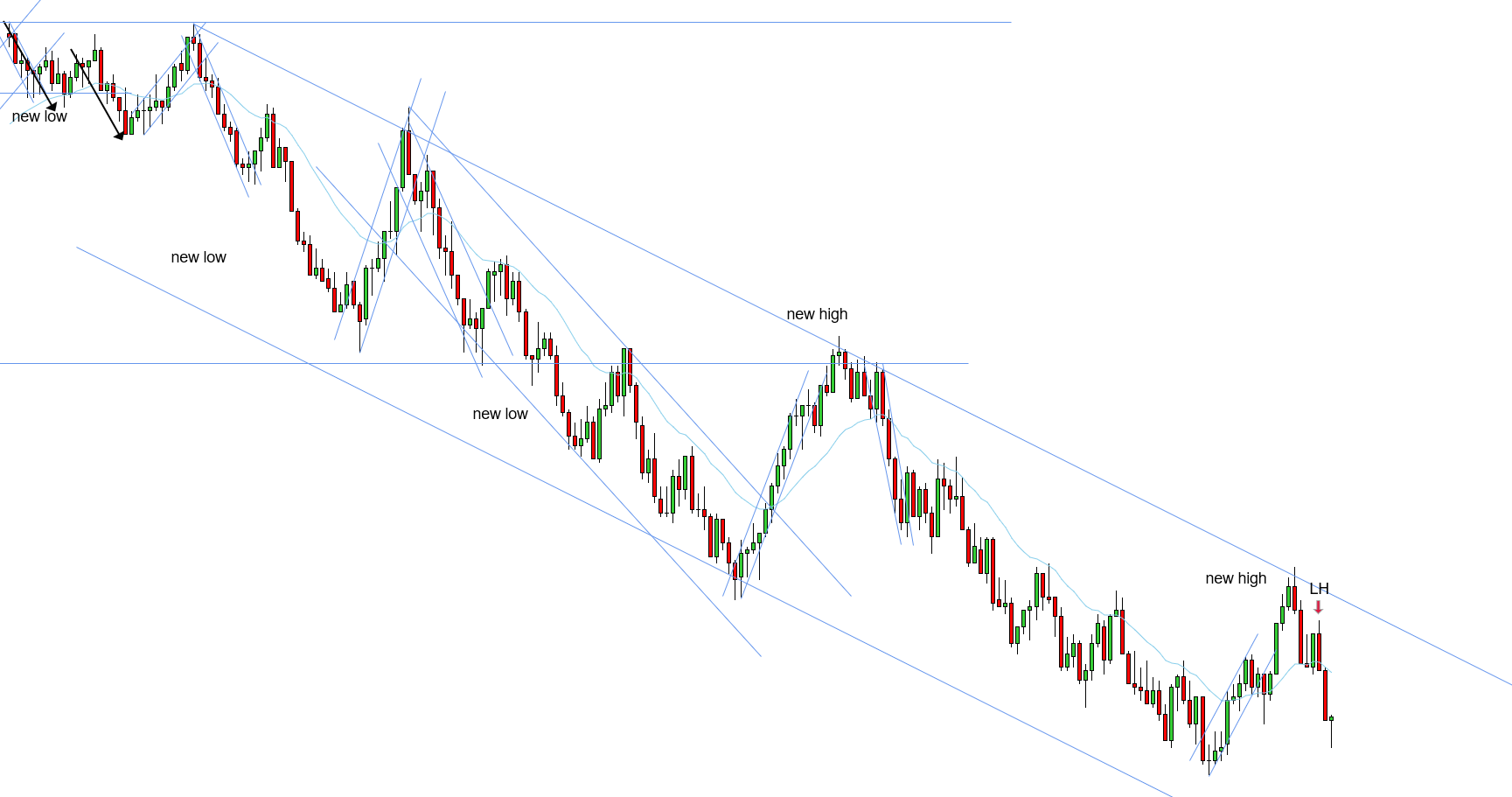

W - After break and a new high for the tighter uptrend, prices continued working higher instead of reversing or consolidating allowing us to draw a wider uptrend - The main thing that was a strong signal for this F2ES was how broad the 2 legs were - the 2 broad legs gave confidence that the bearish correction was over and the bullish bias was resuming, also confirming the wider uptrend.

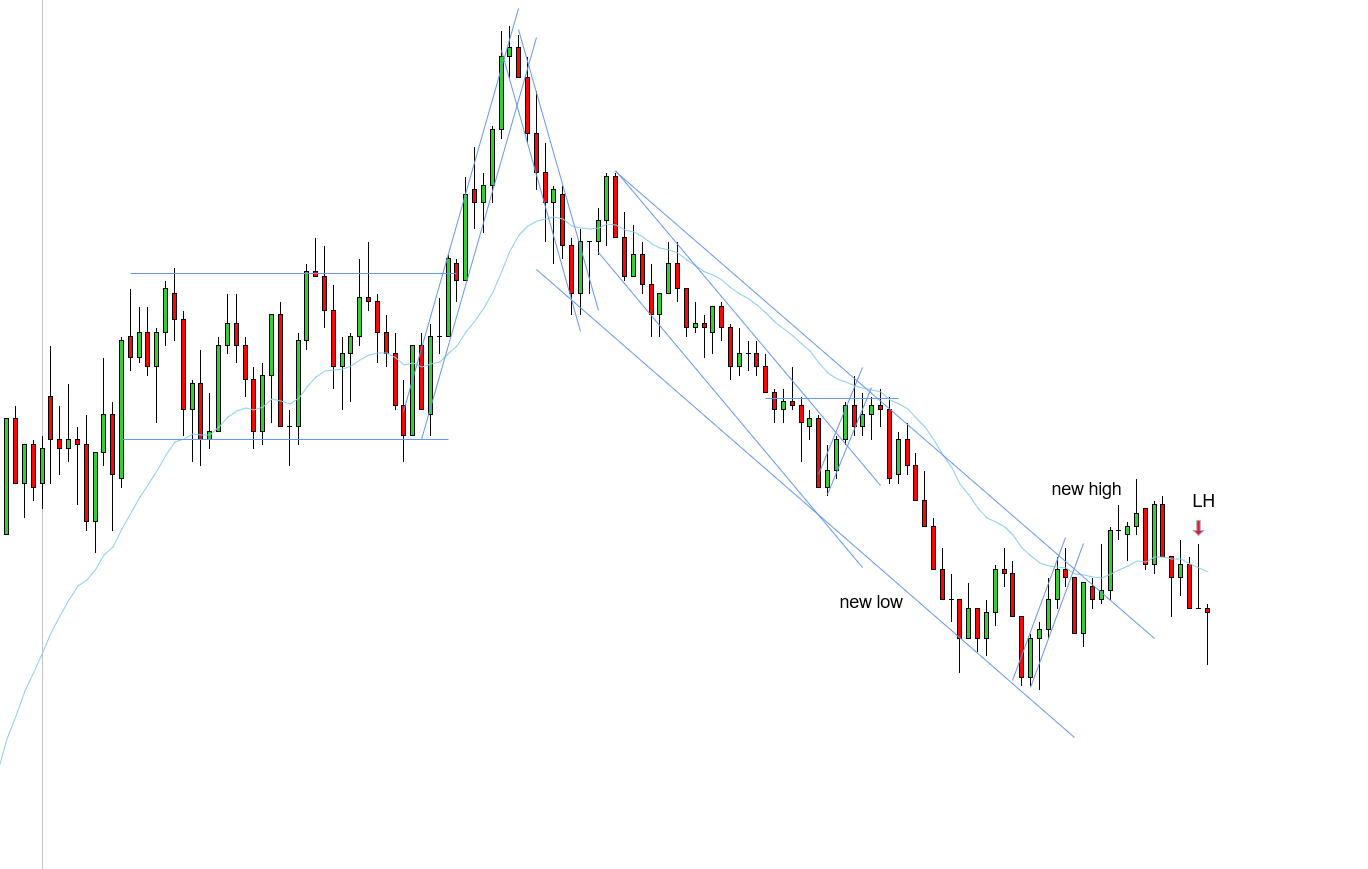

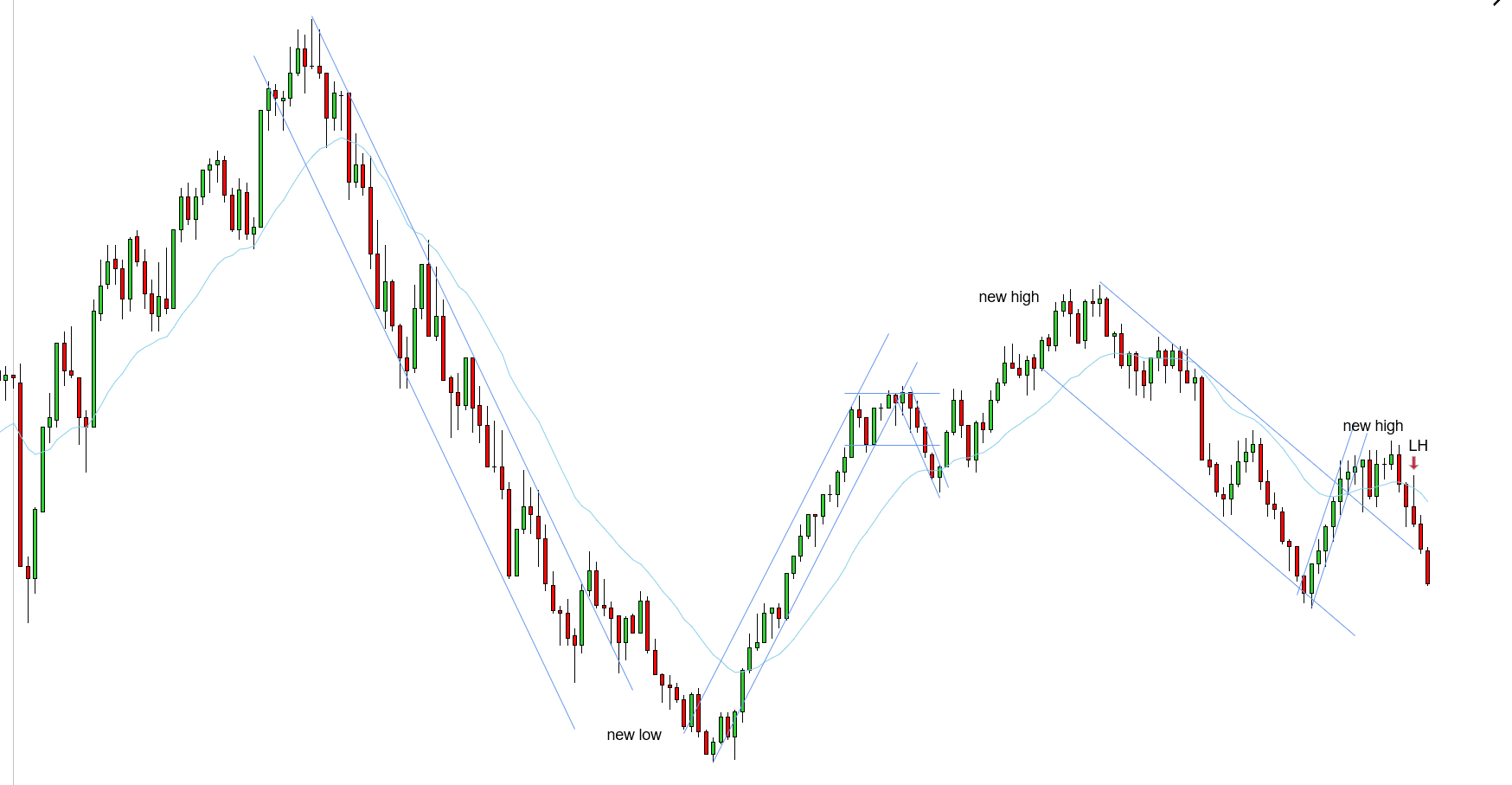

LH - 11/07/2025

L - Per Thomas, “LH seems not good - correction had more legs and we had potential overshoot (he had different bars for potential overshoot) - we bounced off the trend channel line with stronger pullback - we can see it doesn’t look like 2 legs but a bunch of consistent smaller legs which further confirms the stronger bullish correction channel and possible wider uptrend” - he’s saying all those legs up shown in the 1st image signal a good chance of a wider uptrend, even though the trendline held. Another clue here is how we bounced off the trendline with a stronger correction, breaking the EMA and working higher consistently.

LH - 11/07/2025 (2)

L - Per Thomas, “Hard to skip - I would take the LH as well” - downtrend needs a new low - uptrend played out with a break and a new high - push below the EMA and formed a LH expecting a new low for the downtrend - good trade to take a chance on

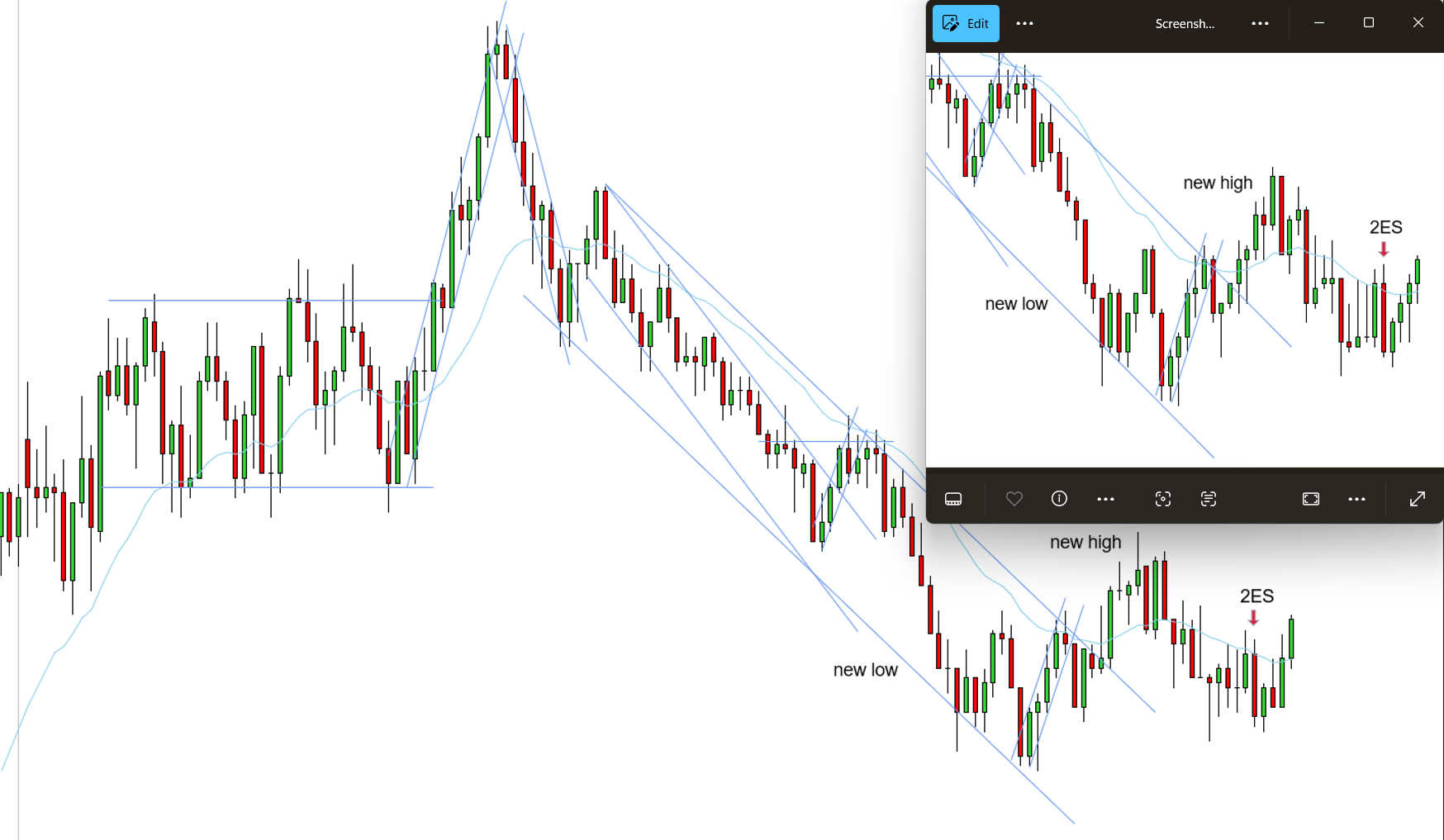

2ES - 11/07/2025

W - Trading range got established - prices broke the previous swing low signaling a possible wider downtrend - 2ES at two key entry points - 3rd swing confirmation of the trendline

LH - 11/07/2025 (3)

W - Downtrend needs a new low - 2 broad legs, uptrend played out with a break and a new high - would need to skip a 2ES at the EMA due to overshoot - however, LH is confirming the 2ES, closing below the EMA, expecting a new low for the downtrend.

LH - 11/07/2025 (4)

W - Downtrend still needs a new low - uptrend and overshoot played out with a break and a new high - LH is confirming the F2EL which formed a little far from the EMA - prices pulled back and formed a LH at the EMA - expecting a new low for the downtrend

2EL - 11/07/2025

W - Uptrend needs a new high - broad 2-legged pullback to the EMA - 2EL at the EMA expecting a new high for the uptrend

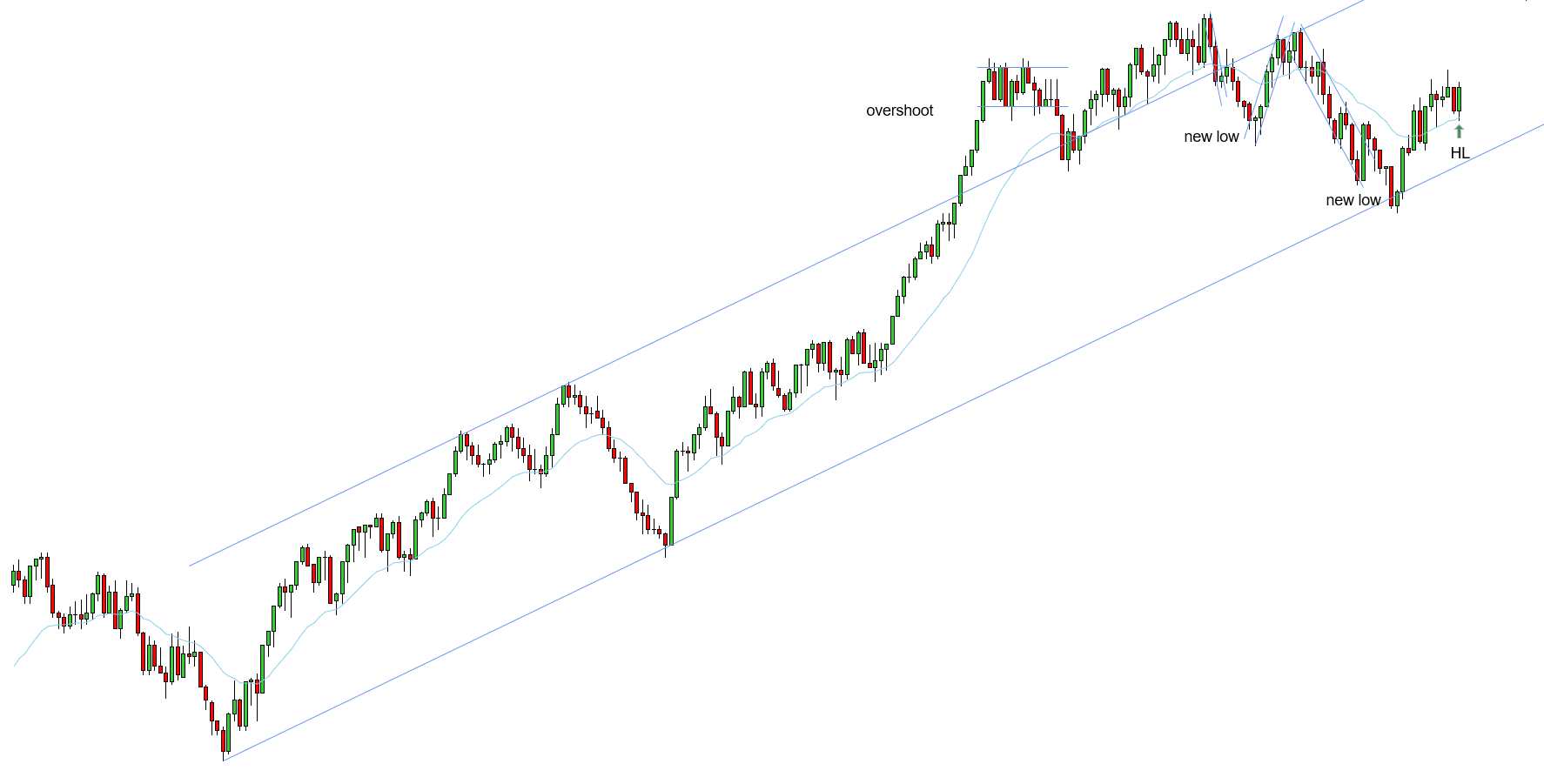

2EL - 11/10/2025

W - Spike and a channel was confirmed by the 3rd swing - prices pushed out of range and came back and tested it and formed a 2EL - this 2EL was also a F2ES counting from the lows - 3 setups in one, 2EL F2ES BOPB

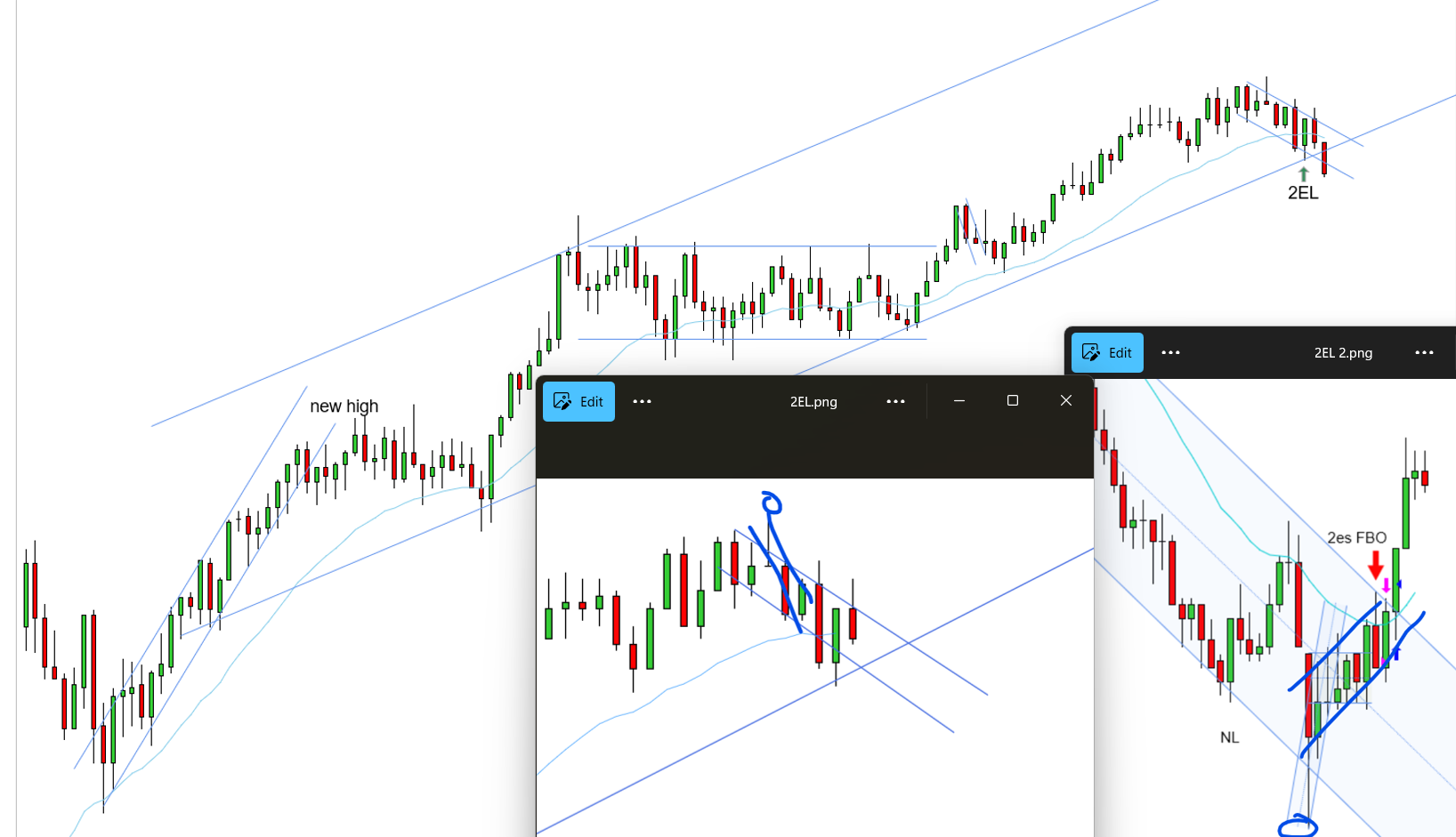

2EL - 11/10/2025 (2)

L - I asked Thomas, “What made you draw the wider STT on this 2EL instead of a tighter one? It looks quite similar to the first 2EL (the 2EL F2ES BOPB right before) where you drew a tighter STT?” Per Thomas, “I didn’t like how if you draw tight channel, you have to draw it so far up from the top of the wick, that is generally not optimal.” Thomas sent the 2 photos attached as examples.

F2ES - 11/10/2025

L - Main uptrend needs a new high, however, the tighter uptrend just played out with a break and a new high - the secondary wider uptrend is not confirmed yet - you need a 2EL to confirm the secondary wider uptrend since the tighter STT played out - you have the right idea thinking about the secondary wider uptrend, given the main uptrend needs a new high, however, you need a 2EL to confirm it given the tighter STT played out

HL - 11/10/2025

W - Main uptrend needs a new high - prices pushed out of the small range, stacked area, and came back and tested it, forming a HL BOPB which is also a F2ES if you count from the lows - it is a bit stacked, however, given all the positives just mentioned, the positives outweigh that one negative - great context

HL - 11/10/2025 (2)

W - This setup worked, however, not a good trade - this HL formed too high and into range highs - the main uptrend still needs a new high, however, the HL was supposed to form when prices pushed above the EMA which it did but it never got a trigger - prices pushed too far up for this HL, in this case we would need a 2EL

2ES - 11-10-2025

L - Main downtrend needed a new low - 2ES at two key entry points - it was a bit stacked, however, good context expecting new low for the main downtrend - after the fact, there ended up being overshoot, however, I was playing no overshoot when watching live given the context for the main downtrend needing a new low and the 2 broad legs which likely negated the overshoot - however, no worries, nothing is 100% in trading, good trade to take a chance on

2EL - 11/10/2025 (3)

W - 2EL with trend - downtrend played out with a break and a new low - 2EL closing above the EMA

2EL - 11/10/2025 (4)

W - 2EL at 2 key entry points - also a continuation of the F2ES - expecting the next push phase

HL - 11/10/2025 (3)

W - Uptrend needs a new high - downtrend played out with a break and a new low - HL above the EMA confirming 2EL and new high for the uptrend - Question to Thomas, “I struggle when prices move too far up and we need a 2EL. I was under the impression we like to see HL right after prices push above the EMA, whereas here we pushed up a bit from the EMA. At what point on this trade do we need to wait for the 2EL?” - Thomas response, “For too far you have to compare to the swing high. There is still so much room to the last swing high (new high target) that you are still buying quite low. So much room for scalp and more. On top of that there weren’t any conflicting variables since downtrend played out. Just spike up.”

HL - 11/07/2025

W - Main uptrend needs a new high - overshoot leads to break of a channel and new high is expected - downtrend played out with a break and a new low - F2ES above the EMA is expected to get a new high for the main uptrend - F2ES formed as a bearish bar with the body far from the EMA, however, prices corrected to the EMA and formed a HL of the F2ES while we still expect a new high for the main uptrend - 10K supported this thesis with overshoot leading to a break of the channel, downtrend played out with a break and a new low, and a 2EL formed on the 10K after 2 broad legs expecting a new high for the main uptrend

LH - 11/11/2025

W - Downtrend needed a new low - prices broke out of the range and came back and tested it (BOPB) - 2ES closed above the EMA, however, prices pushed below the EMA and formed a LH confirming the 2ES and downtrend needing a new low

F2ES - 11/11/2025

W - Prices broke out of range and came back and tested it (BOPB) and prices continued working higher - This was the point where prices shifted market cycles from a range to a bullish trend - If range was the market cycle, prices were supposed to pull back into range but the fact that the EMA held prices and they pushed higher signaled a bullish trend was in play - I was then looking for a 2EL to capitalize on the bullish trend, however, the 2EL formed too far from the EMA - prices pulled back to the EMA and formed a F2ES - this entry needed to be taken on a limit given how high it closed with enough room to get out before the highs

F2ES - 11/11/2025 (2)

W - Main uptrend needs a new high - overshoot leads to a break of a channel and a new high is expected - prices formed 2 broad legs signaling the bearish correction was over, then a F2ES is expected above the EMA to capitalize on the uptrend needing a new high - a F2ES formed above the EMA as a double bar entry as expected, leading to a new high for the main uptrend

2EL FBO - 11/11/2025

W - Main big downtrend to the left played out with a break and a new low so the market cycle was the small trading range - STT downtrend played out with a break and a new low and prices formed a 2EL FBO - given that the main big downtrend to the left played out with a new low and range was the main pattern; most breakouts fails, STT downtrend played out with a new low and 2EL FBO was a good trade to expect prices to push back into the range as most breakouts fail and range was the main pattern

2ES - 11/11/2025

L - Since the uptrend with overshoot didn’t have a new high there’s a good chance that range is the main pattern, therefore, since the downtrend reached the potential support, there could be strong buying pressure off the support - for this reason, it’s better to draw the STT uptrend a little bit wider than tighter and in this case wait for a LH to confirm the 2ES - if this 2ES formed the same way but before reaching the potential support, it would be okay to draw the STT tighter and take this 2ES, but since it reached the potential support in this potential trading range, it’s better to wait for the LH as confirmation - if the STT uptrend legs were more broad, it would be okay to take a 2ES in this same area, however, how it formed, you can easily make a case for 1 leg

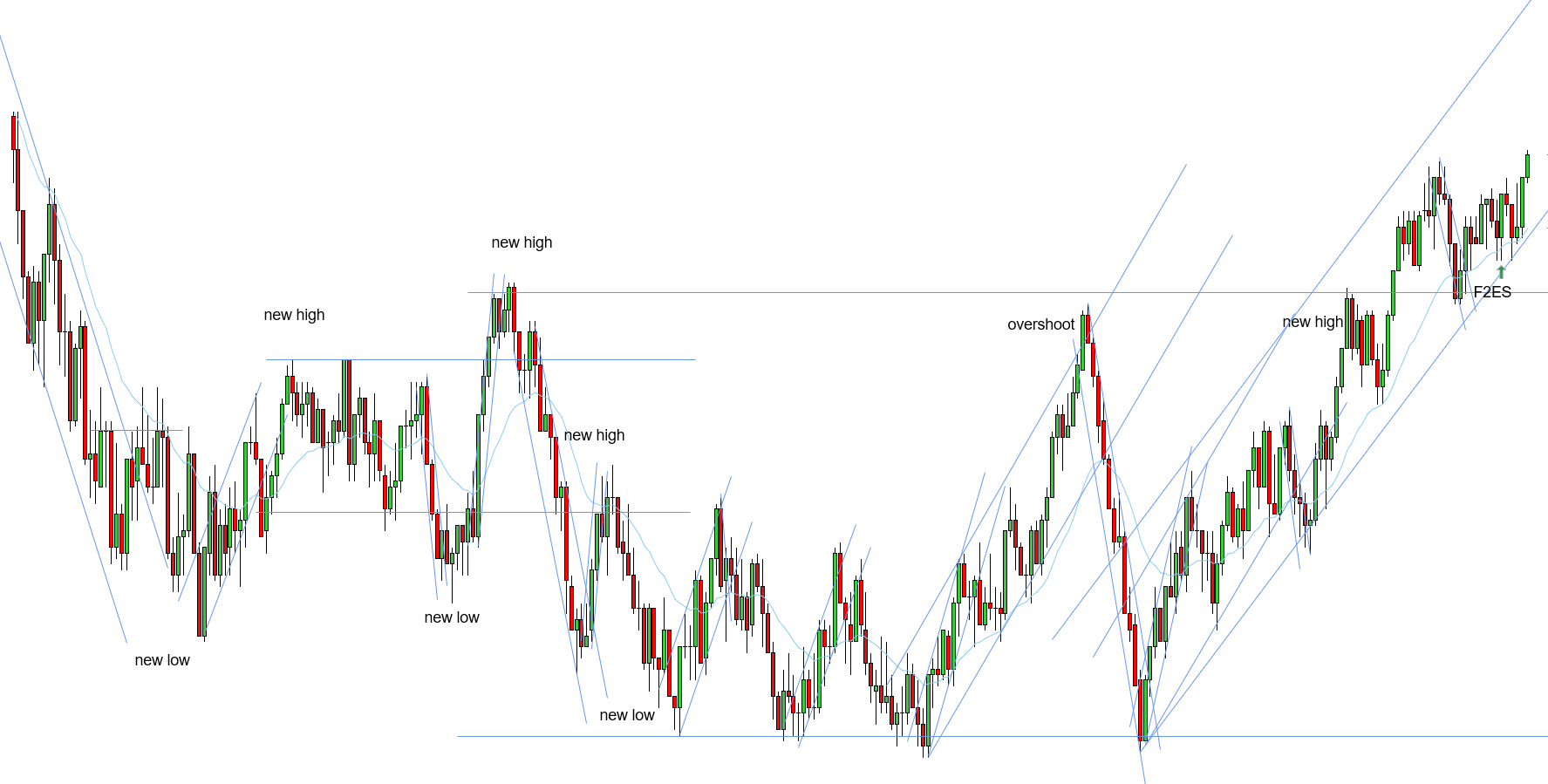

LH - 11/12/2025

W - Main downtrend in play - STT uptrend played out with a break and a new high and main downtrend held prices - a LH or F2EL is expected to start the next push phase - prices pushed below the EMA and formed a LH as expected

2ES - 11/12/2025

W - Main downtrend in play - a 2ES at the EMA is expected to capitalize on the trend in play - a 2ES formed as a double bar entry - this 2ES should be took with a limit to have room to get out below the swing low

F2EL - 11/12/2025

W - Main downtrend needs a new low - uptrend played out with a break and a new high - prices pushed below the EMA and formed a LH, however, a LH isn’t enough given how strong the correction was - a F2EL was needed to expect a new low for the main downtrend - prices formed a F2EL as expected confirming a new low for the main downtrend

LH - 11/12/2025 (2)

W - Downtrend needs a new low - STT uptrend played out with a break and a new high - after a new high for the STT uptrend, a push below the EMA and a LH or F2EL is expected to get the new low for the downtrend - prices pushed below the EMA and offered a LH

LH - 11/13/2025

W - Main downtrend is the bias - most recent downtrend needs a retest - overshoot leads to break of a channel and a retest is still expected - prices created a new high for the STT uptrend - prices pushed out of the congestion, came back and tested it and formed a LH BOPB - the most recent downtrend is still expected to get a retest

LH - 11/13/2025 (2)

W - Main downtrend is the bias - most recent downtrend still needs a retest - STT uptrend played out with a new high and the triple test held - prices pushed below the EMA and formed a LH - 2 broad bullish legs and the most recent downtrend is still expected to get a retest

2ES - 11/13/2025 (2)

W - It worked for a small scalp but better to be patient here - STT uptrend looked like 1 leg, you could easily make a case for a wider STT shown here instead of the tighter one shown in the first image - after the fact, the wider STT ended up being in play and prices created a new high, however, the 2ES still worked for a small scalp but better to be patient - it would be better to wait for a LH to expect prices to continue working lower in the downtrend

DT - 11/14/2025

W - Uptrend needs a new high - STT downtrend played out with a break and a new low - no conflicting variables - double trap formed as a double bar entry - expect a new high for the uptrend

LH - 11/14/2025

W - Range is the structure - uptrend played out with a break and a new high - the way the new high formed so broad made a wider uptrend highly unlikely further confirming the range structure - prices pushed back into the range and formed a LH confirming the range and expecting prices to push lower

F2ES 2EL - 11/14/2025

L - Per Thomas, "stacked and not fully at the EMA with the body. The way it went sideways suggested second leg down is needed."

F2ES - 11/14/2025 (2)

W - Main uptrend needs a new high - downtrend played out with a break and a new low - 2 broad legs down - F2ES closed above the EMA, expecting a new high for the main uptrend - after the push up, you are able to widen the uptrend instead of overshoot because we expect the main uptrend to get a new high and would be looking for a 2EL - there ended up being overshoot but it was more likely at the time it wasn't given the main uptrend needed a new high

F2ES - 11/14/2025 (3)

W - Main uptrend needs a new high - F2ES closing above the EMA expecting a new high or the main uptrend

2EL - 11/14/2025

W - Two uptrends need a new high, main uptrend and secondary uptrends need a new high - STT downtrend played out with a break and a new low - 2EL at the EMA expecting a new high for both uptrends - 10K aligned with this analysis, main uptrend in play, break and new low for the downtrend, push above the EMA expecting a new high for the main uptrend - setup worked for a scalp

F2ES - 11/14/2025 (4)

L - Three uptrends need a new high, the main uptrend and the two secondary uptrends - downtrend played out with a break and new low - prices pushed above the EMA and a new high is expected for all the uptrends - F2ES formed which is what is expected, however, it formed with the body too far from the EMA - lots of times when the signal bar is too far from the EMA like this one, there can be a small pullback and form a 2EL closer to the EMA just like it did here - great context, this F2ES is just a bit too early given how the signal bar formed - 2EL was the entry to be patient for given how the F2ES formed, however, the 2EL never came back for a limit as it was 24 ticks

2EL - 11/14/2025 (2)

W - Three uptrends need a new high, the main uptrend and the two secondary uptrends - downtrend played out with a break and new low - prices pushed above the EMA and a new high is expected for all the uptrends - F2ES formed which is what is expected, however, it formed with the body too far from the EMA - lots of times when the signal bar is too far from the EMA like this one, there can be a small pullback and form a 2EL closer to the EMA just like it did here - it's better to be patient and wait for prices to pull back to the EMA and form a 2EL like here - great entry to capitalize on all uptrends needing a new high

2EL - 11/14/2025 (3)

W - Main uptrend needs a new high - after break and new high for the tight secondary channel prices pushed higher again, allowing a wider secondary channel to be drawn given the main uptrend needed a new high - prices formed a 2EL double bar entry with two broad bearish legs - the two broad bearish legs strengthen the setup as they don't allow for a wider STT downtrend to be drawn - great context and setup to take a chance on

2EL - 11/17/2025

W - Uptrend needed a new high - 2 broad legs - the 1st push had a significant push up creating the broad 2nd leg and didn't reach a new high by 1 tick, therefore, a new high is still expected - 2EL formed at the EMA with 2 broad legs, still expecting new high for the uptrend - in terms of drawing the trendline in play or a break and new high, "Per Thomas, "when the break of the trendline is so tiny that it's easy to draw a tad wider and break is so far from the EMA, if the EMA holds, there is likely a wider channel that required a "real" break.

LH - 11/17/2025

W - Downtrend needed a new low - STT uptrend played out with a break and a new high - prices pushed below the EMA and formed a LH, expecting a new low for the downtrend

LH - 11/17/2025 (2)

L - Per Thomas review, “LH is at the level of the EMA - not a convincing break below the EMA because a STT uptrend could be drawn for 2nd leg - it’s better to see prices push strongly below EMA because it’s getting quite congested with the EMA in the middle of the bars - the LH didn’t form strong enough, we needed to see something convincingly below the EMA, we were still above the EMA with the EMA in the middle of the bars”

2EL - 11/17/2025 (2)

L - Uptrend needs a new high - 2EL at the EMA - good trade to take a chance on - downtrend ended up getting a new low but no worries, good trade to take a chance on, these trades work lots of times

F2EL - 11/17/2025

W - Downtrend in play - EMA continues to hold within the downtrend - STT uptrend was in play for the 2ES - EMA held prices and formed a F2EL, expecting prices to continue working lower

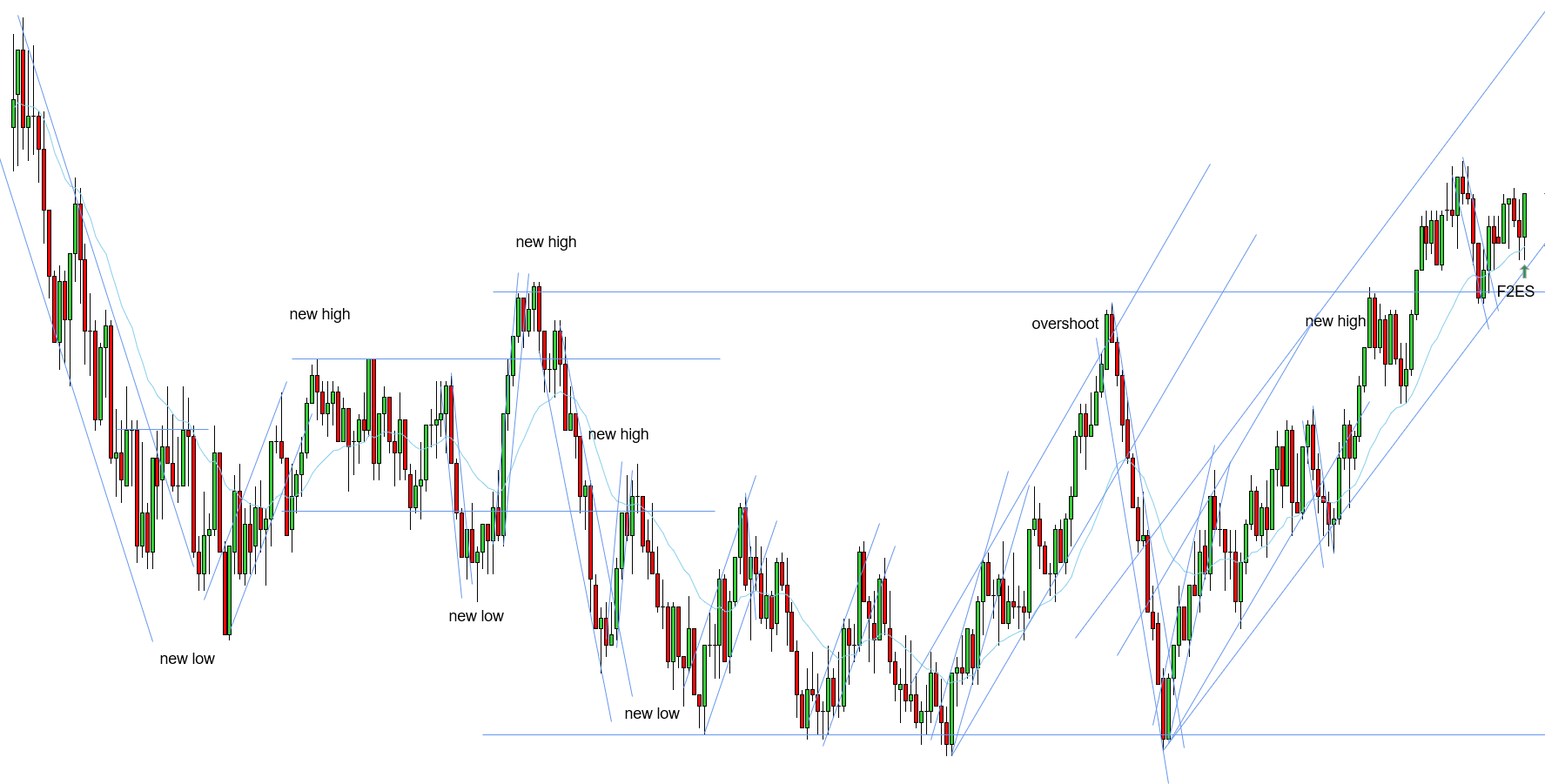

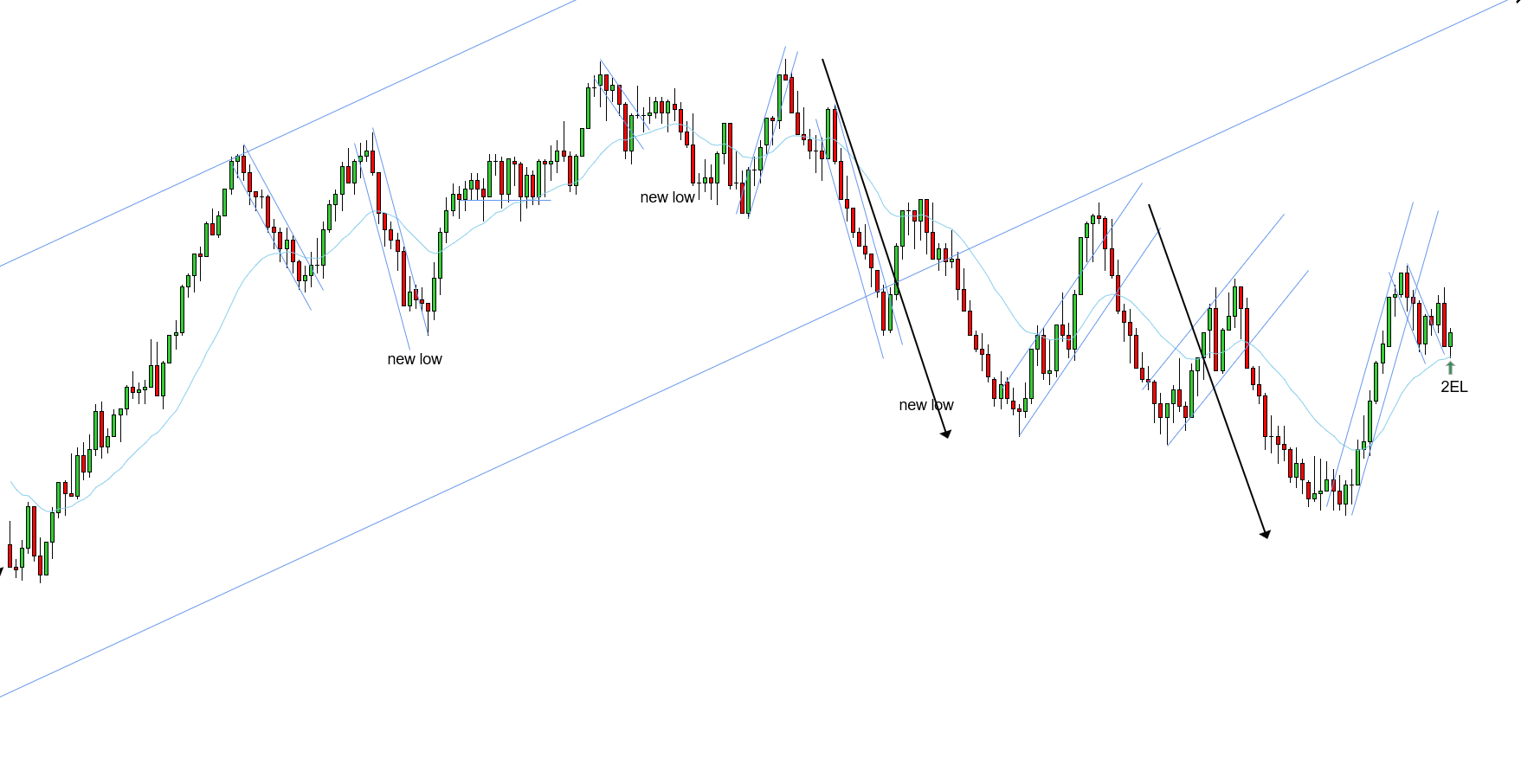

2ES - 11/13/2025 (4)

W - Range is the structure - downtrend needs a new low - STT uptrend attempted to create new high, but prices were held by the EMA - 2ES formed as a double bar entry - would need to take on a limit - expecting a new low for the downtrend

2ES - 11/13/2025

W - The tighter downtrend played out with a break and a new low, however, since there’s so many pushes lower with consistent lower highs and lower lows, there must be an explanation why prices keep trending lower and that is that there is a wider downtrend in play - therefore, with a downtrend in play and the first break of the downtrend, a new low is expected - STT uptrend played out with a break and new high and 2ES formed right at the EMA while expecting a new low for the downtrend.

F2EL - 11/13/2025

W - There is 2 broad legs up making the wider uptrend highly unlikely given how broad the legs were, therefore, it makes sense to expect a reversal - prices pushed below the EMA confirming that seller are stronger and in the market - prices formed a F2EL confirming the analysis, great trade to take a chance on

2ES - 11/13/2025 (5)

W - Downtrend needs a new low - STT uptrend played out with a break and a new high - prices formed a 2ES at the EMA expecting a new low for the downtrend - 2ES formed as a double bar entry with a tail at the bottom of the double bar, however, there is no conflicting variables here, it’s crystal clear that downtrend is in play, STT uptrend played out and we expect a new low for the downtrend.

F2ES 2EL - 11/13/2025

W - Since we’re going to sideways, it was most likely that prices were in a consolidation given there wasn’t an uptrend established for reversal and prices formed a bottoming pattern signifying the bearish bias was depleting - with that being said, it was most likely that we were in a consolidation - prices pushed above the EMA and formed a F2ES 2EL - STT uptrend needs a new high - based on short term recent price action, this is a good F2ES 2EL to take a chance on for a small scalp

2ES - 11/13/2025 (3)

W - There was a stronger bearish bias into consolidation, so downtrend continuation is likely because prices traded down into the consolidation - uptrend played out with a break and a new high instead of reversing the market and prices had a strong push down below the EMA - STT uptrend played out with two broad legs and prices formed a 2ES at the EMA combined with the 3rd swing confirmation of the trendline, two key entry points - the setup was a bit aggressive since you wouldn’t know for sure if there was overshoot or not of the channel, however, given how broad the two STT uptrend legs were, it’s likely not to be overshoot.

LH - 11/17/2025 (3)

W - Downtrend is in play - the most recent downtrend had overshoot - the bigger downtrend was too broad and is mainly for bias (see 2nd image), so we need to play the most recent downtrend and in this case since it had overshoot we need to respect the overshoot - overshoot played out with a break and a new high - prices formed a congestion so a BOPB is expected to continue the downtrend working lower - prices broke out of the congestion and formed a LH BOPB - the signal bar was weak so, it’d be better to be patient, however, the context was great and should be studied for next time that there’s a better signal bar.

2ES - 11/13/2025 (6)

W - Trendline held - most recent channel in play - expecting a continuation of the push phase while also testing the lows of the most recent channel - STT uptrend played out with a break and a new high - 2ES formed at the EMA while expecting a continuation of the push phase