ECON 101 EXAM 2

1/117

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

118 Terms

Economic growth brings wealth which increases..

societal well being

higher infant survival rates are in

wealthy countries

GDP per capita facts:

most of worlds population is poor compared to America

73% of worlds population live in countries with a GDP per capita thats less than average

Everyone used to be poor facts:

distribution of world income tells us that poverty is normal while wealth is not

for must of human history there wasn’t any long run growth in real per capita GDP

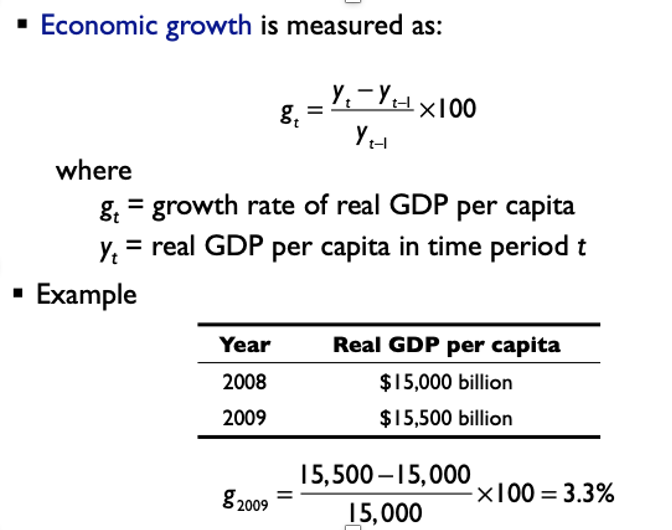

economic growth is measured as

growth rate of real GDP per capita

Rule of 70

length of time necessary for a growing variable to double

Rule of 70 example

Real GDP per capita is growing at annual growth rate of 3.5% then it will double in:

70/3.5= 20 years

Growth miracles

- slow and consistent economic growth

- U.S. is one the wealthiest country ever because it grew slowly but consistently for over 200 years

- From 1950 to 1970 Japan grew 8.5% per year.

growth disasters

- Nigeria's minimal economic growth since 1950

- Argentina's decline in per capita GDP from 1900 to 2000.

Wealth of Nations

causes of growth in GDP per capita:

factors of production

incentives

insistutions

Factors of production

physical capital

human capital

technological knowledge

physical capital

tools such as: machines, structures, and equipment

more/better physical capital makes workers more productive

physical capital is increased by investing

human capital

knowledge and skills that workers get through education, training, and experience

example: degree, internships, problem solving skills, expertise in specific fields

allows workers to use more sophisticated tools

human capital is increased with education

technical knowledge

knowledge about how the world works, that is used to produce goods and services

We increase technological knowledge with research and development.

Improved technological knowledge increases productivity

Institutions

institutions of economic growth include laws, regulations, customs, practices, organizations, and social norms.

Incentives of economic growth

• Property rights

• Honest government

• Political stability

• A dependable legal system

• Competitive and open markets

Property Rights

Institutions crucial for fostering investment in physical and human capital

important for encouraging technological innovation

Honest Government - Impact

Resources spent on bribery can't be invested in machinery or equipment.

Honest Government - Corruption

-Acts as a drain on resources, diverting funds from productive uses.

Political Stability

Civil wars and dictatorships can hinder economic growth.

Dependable Legal system

Facilitates contracts and protects parties against expropriation.

Dependable legal system - Challenges

Uncertain property rights hinder borrowing and investment.

Competitive Open Markets

Key to optimal resource allocation

Competitive Open Markets - barriers

Inefficient regulations and trade restrictions impede efficiency

Ultimate causes of wealth

Natural resources, transport accessibility, geography, history, culture, and luck influence economic growth.

Cutting Edge Growth

growth due to new ideas

Catching up Growth

growth due to capital accumulation

Production Function

expresses a relationship between output of economy and the factors of production

Production Function Equation

Physical Capital (K), Human Capital × Labor (eL), and Ideas (A).

Y = F(A, K, eL)

simplify to y= F(k) if..

A (ideas) and eL(labor) are constant

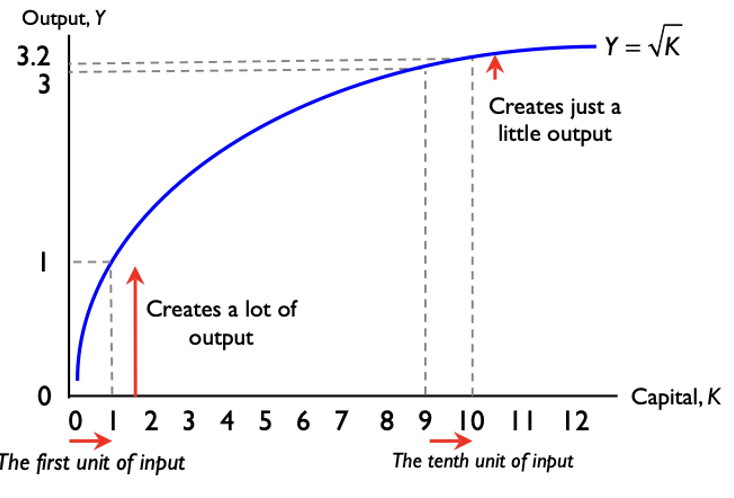

typical production function is

Y = √K

increases in K deliver increases in Y

Capital is..

output that is saved and invested rather than consumed

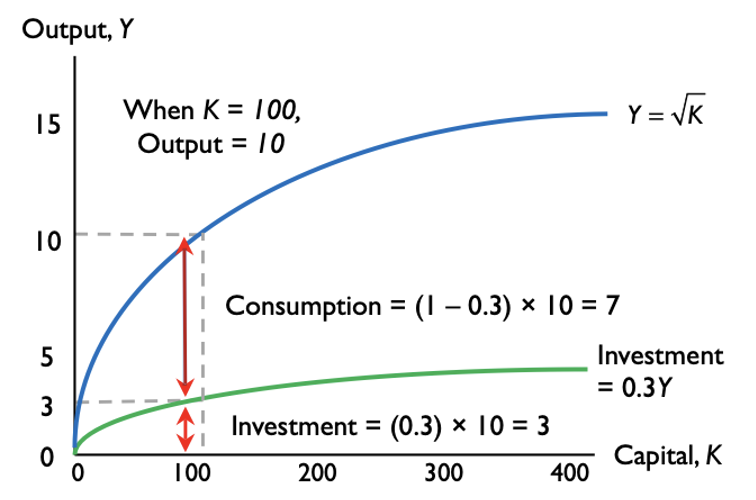

Capital/ Investment example:

Out of 10 units produced, 7 consumed, 3 invested.

Investment Fraction: γ (gamma), where γ = 3/10 = 0.3.

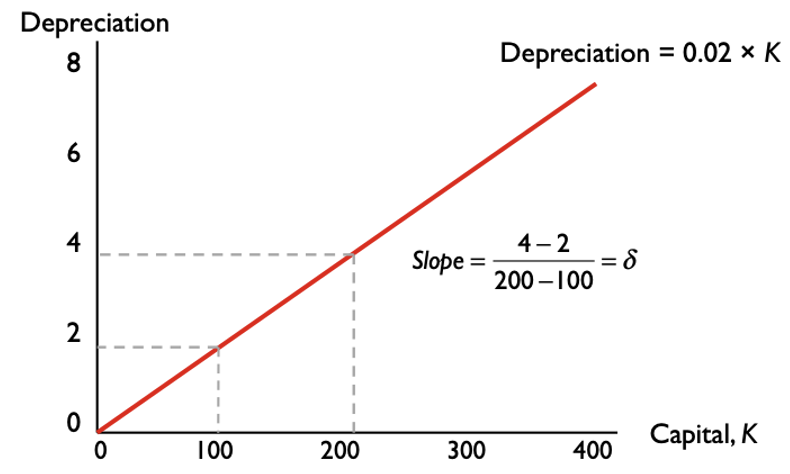

Capital Depreciation definition

Capital wears out over time

ex: If 100 units of capital, 2 might depreciate, leaving 98 for the next period

Depreciation Equation

δ (delta) = 2/100 = 0.02

ex: If 100 units of capital, 2 might depreciate, leaving 98 for the next period

Investment > Depreciation

Capital and output grow

Investment = Depreciation

Capital and output remain constant (steady state)

Investment < Depreciation

Capital shrinks, and output decreases

Higher investment rates lead to..

more capital and increased output

Countries with high investment rates..

have higher GDP per capita

Solow model predicts zero economic growth in the long run but better ideas..

can keep the economy growing even in the long run

Solow model with tech

A stands for ideas that increase productivity; our production function is:

Y=A K

Reasons for patents:

products/methods can be copies

imitators have lower costs and cant copy them

increase incentives to develop new products

governments role in economy:

create incentives to produce new ideas

encourage production of new ideas though subsidies/tax breaks

universities train scientists to research/develop new products

Large markets mean

increased incentives

4 factors that determine Supply of Savings

smoothing consumption

impatience

marketing + psychological factors

interest rates

consumption is most high during..

working years

you can Smooth Consumption by…

saving during working years and spend during retirement

Impatience

the more impatient a person is the more likely their savings will be low, ex: criminal, addict, smoker

Marketing/Psychological Factors

ppl save more if saving is presented as natural/default alternative

ex: retirement savings plan participation was 25% higher in business that used automatic enrollment than opt-in feature

higher interest rate

more amount saved

3 factors that determine Demand of Borrowing

smoothing consumption

investment

interest rates

consumption smoothing

ppl borrow to smooth their consumption

ex: borrowing to invest in their education

Investment - Demand of Borrowing

business borrow to finance large projects

low interest rates

greater demand to borrow

Suppliers of Loanable funds (savers) trading with demanders of loanable funds(borrowers) creates…

market for funds

interest rates adjust to..

equalize savings and borrowing

Surplus is created when

interest rate > equilibrium, and quantity of savings > quantity of savings demanded

Shortages are created when..

interest rate < equilibrium, the quantity of savings < quantity of savings demanded

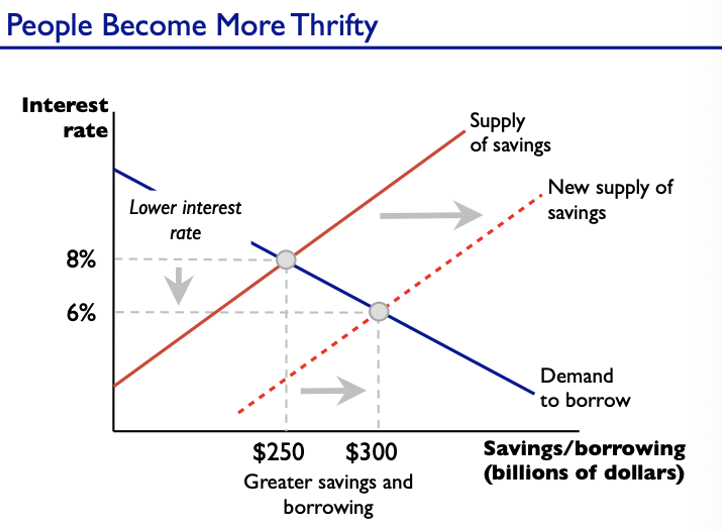

Supply and Demand Shift

changes in economic conditions

ex: ppl becoming more thrifty, investors less optimistic

Financial Intermediaries

banks, bond markets, stock markets

Financial Intermediaries job is..

reduce the costs of moving savings from savers to borrowers and mobilize savings toward productive uses

banks receive savings..

and loan them to borrowers

corporation acknowledges debt by..

issuing bond (corporate IOU)

bonds are a way to raise..

large sum of money for long-lived assets

a risky company has to pay

higher interest

US gov bonds/ treasury securities are desirable because

because they are easy to buy and sell, and the U.S. government is unlikely to default

T- bonds

30 year bonds, pay interest every 6 months

T- notes

range from 2 to 10 years, pay interest every 6 months

T - bills

range from a few days to 26 weeks, interest paid at maturity

Zero coupon bonds/ discount bonds

only pay at maturity

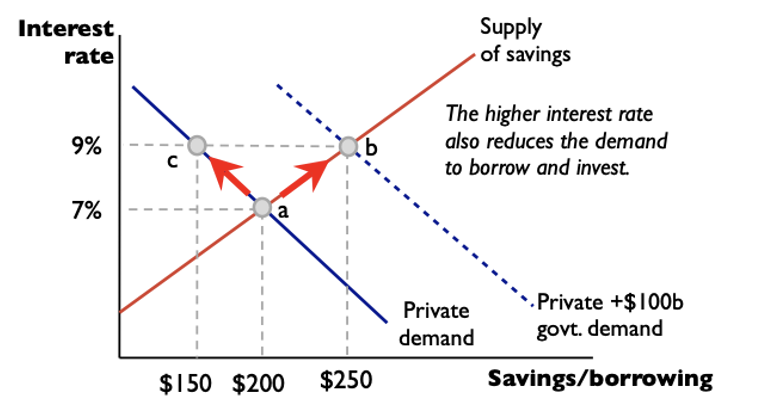

an increase in gov borrowing shifts..

private consumption and investment

Value of bond at maturity is called

Face Value

formula for rate of return (receiving interest rate) on zero coupon bond is…

=(FV- Price / Price ) x 100

arbitrage

buying and selling of equally risky assets

stock

A certificate of ownership in a corporation

stocks are traded in

stock exchanges

Initial Public Offering (IPO)

The first time a corporation sells stock to the public in order to raise capital

Financial Intermediaries are..

bridges between savers and borrowers

Intermediation can fail due to:

- insecure property(bank accounts) rights

- politicized lending

- government bank

- interest rate controls

- inflation

- bank failures and panics

insecure property (bank accounts) rights ..

negatively affect savings and investments

ex: When Argentina froze bank accounts in 2001, many banks went under and Argentinians lost their savings

Price controls on interest rates

cause the loanable funds market to malfunction (shortage of savings)

Usury Laws

impose a maximum amount on the interest rate that can be charged

Government owned banks

have slower growth in per capita GDP

Bank failures/panics cause

people to lose all their savings

Owners equity

The value of the asset minus the debt, or E = V − D.

Leverage Ratio

The ratio of debt to equity, or D/E.

A house worth $400,000 with 20% down and a mortgage of $320,000. What is the equity?

$400,000 – $320,000 = $80,000

A house worth $400,000 with 20% down and a mortgage of $320,000. What is the leverage?

$320,000/$80,000 = 4

2008 Financial Crisis happened because..

failing asset prices and high debt which caused panic

Unemployed workers

adults who dont have a job but are looking for one

To be counted as unemployed you have to be:

16 years+

not in prison

a civilian looking for work

Unemployment Rate equation

(Unemployed/ Unemployed + Employed) ×100= Unemployed / Labor Force ×100 =

January 2019, there were 6.5 million people unemployed in the U.S. and 156.7 million employed. Together, the employed and the unemployed make up the labor force of 163.2 million. What is the unemployment rate?

(6.5 / 6.5 + 156.7) x 100 = (6.5/163.2) x 100 = 3.98%

Unemployment means the economy is..

underperforming

Discouraged workers

Workers who have given up looking for work but still want a job

Underemployment

ppl who have jobs and are employed but dont work as much as they would like to

ex: taxi driver with PhD in Physics

Frictional unemployment is..

short term unemployment

Frictional unemployment is caused by..

ordinary difficulties of matching employee to employer

ex: finding a job that you want at a wage that you will accept and that

the employer will pay

Large portion of the total unemployment in U.S. is..

frictional unemployment