Class 2 - Secondary Data Analysis and Qualitative Research

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

30 Terms

pros and cons of secondary data

pros:

accessible

inexpensive

quick

cons:

relevancy

accuracy

methods - important questions

how was the data collected (context of where participant was), was there an adequate response rate (how many were asked vs how many responded), data quality, sampling technique, sufficient sample size?

how was the questionnaire designed (leading questions?), are the analyses appropriate for the questions, when was the data collected?

triangulation

using different methods to assess the same problem

there’s no perfect method, using multiple helps with accuracy

purpose and content

why was the data collected

how were the variables defined (ie. how was the construct measured?)

whenever possible, use original source

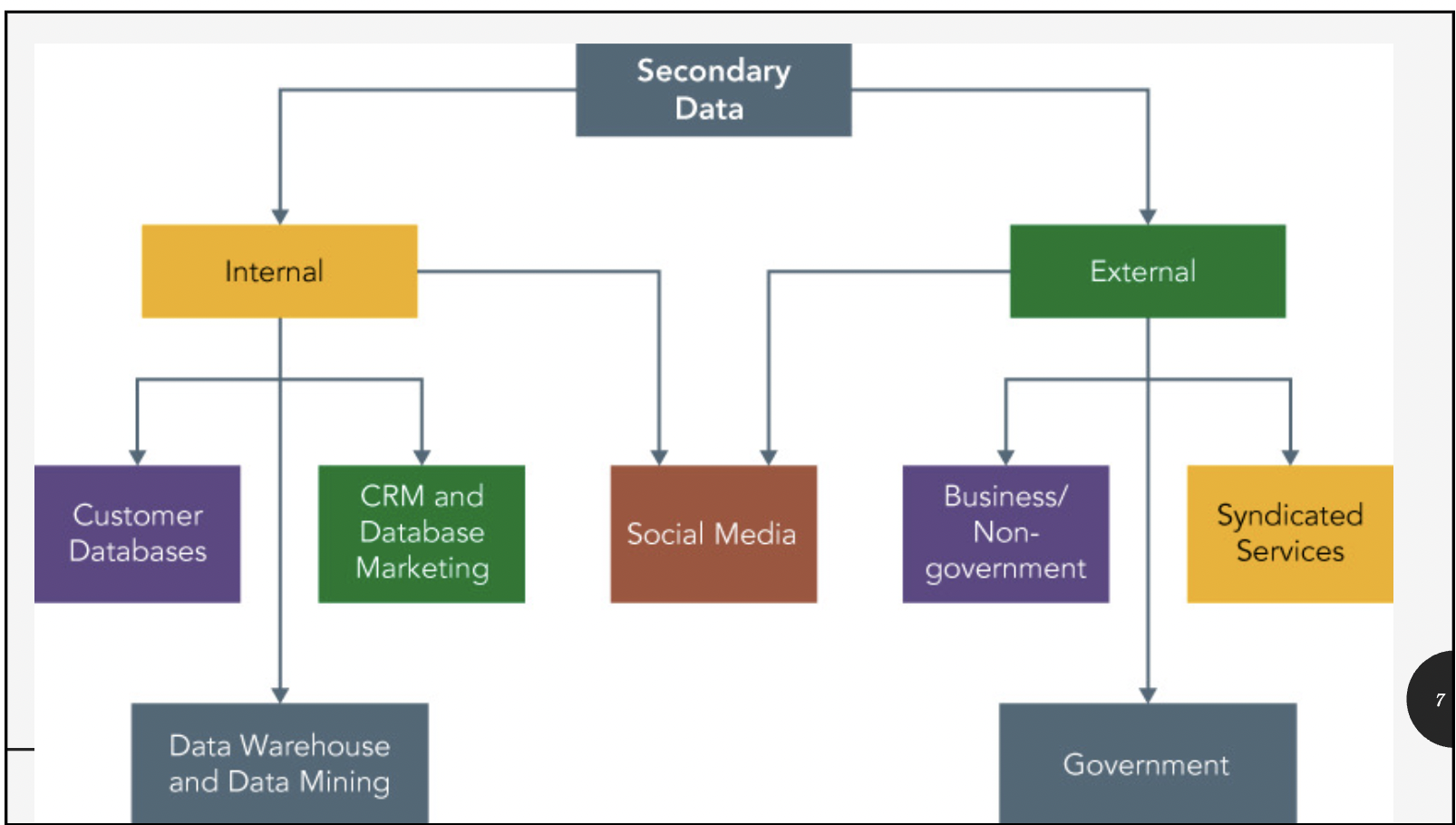

secondary data sources

internal secondary data

customer databases

sales calls, invoices, warranty activations, loyalty programs

data warehouse and mining

company wide, operational, CRM, help discover patterns of data and inform marketing strategy

external secondary data

business sources

company info (S&Ps, Moodys), AMA publications, EBSCO database, SSCI (social science citation index)

government sources

census data (eg. household info., age, marital status etc.), categorized geographically

world FactBook, FedWorld, Bureau of Labour Statistics, etc.

syndicated services

data collected by market research firms that serve the information needs of many companies

syndicated sources

units of measurement:

households/ consumers

panels - purchase, media

surveys - psychographic and lifestyle, advertising evaluation, general

electronic scanner services - volume data tracking, scanner panels, scanner panels with cable tv

institutions

retailers, wholesalers - audits

industrial firms - direct inquiries, clipping services, corporate services

panel surveys

regularly conducted surveys

predesigned questionnaire

comprehensive

representative or targeted

participant has info about the survey, what’s going to be asked, purpose, etc.

syndicated panel surveys (or omnibus panels)

don’t measure the same variable

cross-sectional

arious survey techniques

targeted examples

pyschographics

psychological variables

attitudes, values, beliefs, motivation, goals, physical needs

psychological measures of lifestyle (AIOs)

varies in term of state or trait, traits are more stable

advertising evaluation

assess ad effectiveness

standardized measures

recall

persuasion

ad reactions

general surveys

general purchase and consumer behaviour

politics, sports, business, health

survey pros and cons

pros:

flexible, specific segment, predictive

cons:

drawbacks of self report (gaps between what people report and what they actually do, why triangulation is important)

biased questions?

media panels

used to select appropriate ads. track consumer behaviour after ad

passively measures TV viewing

Tv ratings and audience estimates

Purchase / Media Panels pros and cons

pros:

higher quality data (panel vs sample survey)

can be longitudinal

cons:

not always representative

biased behaviour due to involvement

scanner data

volume tracking scanner panel data

occurs at point of sale, can be coupled with media panel

qualitative research

largely unstructured and exploratory

best when you don’t have a theory or hypothesis

smaller samples, data is text (like a transcript of interview)

qualitative research procedures

direct (non disguised) (participants know general idea of study)

focus groups

depth interviews

indirect (disguised)

projective techniques

association techniques

completion techniques

construction techniques

expressive techniques

focus groups

trained moderator, minimally structured, unexpected findings

groups of 8-12, respondents should have something in common, 1-3 hours, video recroded

meant to facilitate conversation, want participants to be as similar as possible, prior experiences with product, don’t want people who have participated in a lot of focus groups

moderator must be kind, sensitive, involved, encourage conversation, get specifics

practical applications of focus groups

perceptions / preference

impressions of new product

generating new ideas

creative concepts

price impressions

depth interviews

semi structured

one on one

want to uncover lived experiences

build rapport and have a real conversation

encourage elaboration, ask open ended questions

depth interviews pros and cons

pros:

direct to respondent

large exchange of information

no conformity

cons:

expensive and difficult to source

quality depends on interview skills

qualitative analysis - coding

assigning meaning to passages of text, first analytic step of data analysis process

segment emerging themes into categories

make categories represent abstract (theoretical) ideas

meaningful analysis or themes that emerge out of the data

two steps of qualitative coding

initial coding

focused coding

initial coding

large quantities of raw qualitative data, reading through and finding themes

remain open to explore possibilities

guides core conceptual categories

what is this data a study of?

what does the data suggest?

from whose point of view?

what theoretical category does this indicate?

focus coding

category development, try to abstract and turn into broader themes / categories

direct, selective, conceptual

identify most significant /frequent codes

merge similar codes to form higher-level, more abstract codes (ie. broader overall themes that fit the data)

stop this process at saturation (when you consistantly see the same results)

ethnography

a qualitative method involving the immersion of researchers into consumers' natural environments—homes, workplaces, or stores—to observe actual behaviors, routines, and pain points

recording the life of a particular group, entials sustained participation and observation of their community or social world

often includes supplementary data from documents, diagrams, maps, photographs, and sometimes formal interviews)

netnography

an interpretive, qualitative methodology that adapts ethnographic research techniques to study consumer behavior, online cultures, and social interactions within digital communities

an ethnogrpahy conducted among online communities