Payment and Coverage in O&P

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

Where does money in an O&P clinic come from?

customer

payer

Customer

customers have the ability to negotiate services/fees with partners such as O&P businesses

entity that orders care for a patient and pays for the services/device provided

terms of payment agreed upon in negotiated contract between O&P practice and customer

Who is the Customer?

hospital, SNF, worker’s compensation, VA

Payer

entity with a set code/fee schedule for services/products

entity who pays for patient services but is not the ordering provider

reimbursement is determined by a fixed fee schedule and compliance with coverage policies

Who is the Payer?

Medicare, Medicaid, TRICARE, Commercial insurance, and other healthcare insurances

Public Payers

government programs like: Medicare, Medicaid, or Veterans Health Administration

Private Payers

Commercial like: United Healthcare, Anthem, Aetna, Cigna, Humana, BCBS, etc.

What are the key differences between public and private insurance?

funding

eligibility

provider choice

cost-sharing

Medicare Facts

Federal health insurance program for people age 65+ OR with certain disabilities.

added to the Social Security Program in 1965

consists of several different parts

complex and controversial program

funded by payroll taxes

beneficiaries pay for some basic coverage, deductibles and gaps in coverage but generally low cost

Medicare Eligibility

US citizen or 5 year permanent resident

65 yrs or older

under 65 with disabilities or people of any age with End-Stage Renal Disease

Medicare Enrollment

3 months before your birth month (when you turn 65) to 3 months after it

Medicare Part A

Hospital Insurance

original Medicare through the federal government

Medicare Part B

Medical Insurance

original Medicare through the federal government

Medicare Part C

Medicare Advantage/Replacement

bundled plans that include part A, part B, and usually part D from a private insurance company

Medicare Part D

Prescription Drug Coverage

from a private insurance company

Medicare Supplement Plan/ Medigap

Medigap

will help fill some of the gaps that Original Medicare doesn’t cover

additional insurance that you can buy from a private company

helps pay your share of (out of pocket) costs

O&P services are billed under Medicare Part ____.

B

Medicare Part A: Hospital Insurance

Medicare pays the facility

often single bundled payment using a Prospective Payment System (PPS)

most O&P services are often considered part of the bundled payment

SNF/hospital becomes the customer with payment and coverage dictated by contract negotiated between parties (i.e. O&P business and facility)

Three parts of Medicare Part A: Hospital Insurance

Inpatient Hospital Care

inpatient stay classified into diagnosis related groups (DRGs)

DRG determines how much hospital is paid for entire stay

all O&P devices consolidated into payment, no carve out

Skilled Nursing Facility Care

only “Step Down Care” (Sub Acute Hospital Care)

specific eligibility

requires 3 day hospital stay prior to SNF care and subject to 100 days of coverage

per day payments

PPS called the Patient Driven Payment Model (PDPM) based on clinical presentation

custom prostheses are not subject to SNF consolidated billing

Hospice

Medicaid

joint federal and state public program

Medicaid Eligibility

people with significant needs including pregnant women; children, especially those with special needs; disabled people; and elderly people, including those who need long term care services and support

income below the federal poverty level

$15,060 for individual (2024)

Private or Commercial Insurance

Offered in both individual and group plans

individual plans purchased directly from insurance company or through the Health Insurance Marketplace

group plans provided through employer

Higher patient cost sharing, broader access to service and providers.

deductible

co-insurance

annual out of pocket limits

Deductible

an amount an individual policyholder must pay before the insurance company will pay on their behalf

Co-insurance

percentage of costs of a covered health care service policyholder pays after the deductible is paid

Annual Out of Pocket Limits

highest amount an individual or family must pay in a plan year before the insurance plan pays 100% of the costs

Veterans Health Administration (VA)

All veterans enrolled in the VA health care system are eligible for O&P devices.

O&P provided directly by VA-employed CPOs OR indirectly through contracted O&P clinics.

Service members, active or retired, can have both VA benefits and TRICARE.

VA

healthcare system and payer for veterans

TRICARE

public health insurance for active or retired members of service and their families

Worker’s Compensation

state mandated insurance program providing benefits to employees who have suffered a job-related injury or illness

often managed by 3rd party organizations serving as intermediary (ex. One Call Care Management, CorVel)

SNF and Hospitals

facilities can become pay sources

patients are on Medicare Part A stay or when payers using similar bundled payment system

financial responsibility and billing can be complex and misunderstood

2 day rule

codes not subject to SNF consolidated billing

billing and reimbursement dictated by contract between facility and O&P business

What is the 2 day rule?

allows O&P to bill Medicare Part B while on a Part A stay as long as the pt is discharged in 2 days to HOME not a SNF

Individual patient

Non covered services

Advanced Beneficiary Notice (ABN) required to collect money from Medicare beneficiary

common for other payer policies to mandate similar waivers prior to collecting money directly from a beneficiary

responsibility of provider (O&P business) not beneficiary (patient) to know the insurance policy and covered services

Deductibles or co-insurance

Coverage

How and when will an item or device be covered by a pay source?

It usually start with Medicare

many insurers follow Medicare policy to set own

recognized as benchmark for industry

highly regulated Federal program

evidence based policy

clinicians must be informed on policy to properly code

Social Security Act (SSA)

passed in 1935, establishing Social Security

Medicare added in 1965

sets the groundwork for coverage

coverage can be vague

National Coverage Determination (NCD)

policies created by CMS that grant, limit, or exclude coverage

more specific than the SSA

apply nationally

developed and published by CMS through evidence based processes

few NCDs relevant to O&P

Medicare Coverage Partners

DME MAC - Durable Medical Equipment Medicare Administrative Contract

private insurance company contracted by Medicare to process Durable Medical Equipment, Orthotics, and Prosthetics (DMEPOS) claims and develop policy

Local Coverage Determinations (LCDs): what is medically necessary? what is the coverage criteria?

difficult to change requiring public meetings and comments

Policy Articles: provides statutory limitations on coverage and coding guidelines

more readily updated and changed - do not require public comment

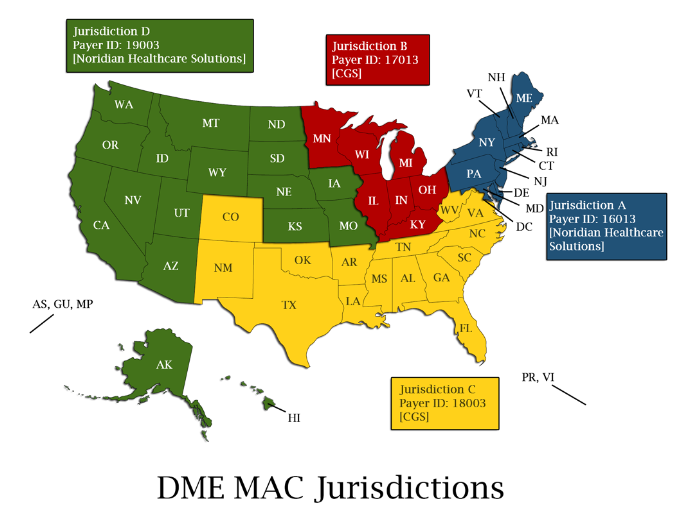

DME MACs

organized by geographic region (A, B, C, and D)

LCDs are effective only within the issuing region

Non-Medicare Coverage

policy documents exist for most payers

follow the guideline outlined in the specific pay source policy you are working with

when policy is non-specific or silent, follow Medicare rules