Institutions Ch 7 (Done)

1/58

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

59 Terms

Mortgages

__________ are loans to individuals or businesses to purchase homes, land, or other real property

Many mortgages are securitized

Securitization occurs when securities are packaged and sold as assets backing a publicly traded or privately held debt instrument

Mortgages differ from bonds and stocks

Mortgages are backed by a specific piece of real property

Primary mortgages have no set size or denomination

Primary mortgages generally involve a single investor

Comparatively little information exists on mortgage borrowers

Four basic types of mortgages are issued by financial institutions:

Home mortgages are used to purchase one- to four-family dwellings (called “single-family mortgages”)

$12.55 trillion outstanding in 2021

Multifamily dwelling mortgages are used to purchase apartment complexes, townhouses, and condominiums

$1.88 trillion outstanding

Commercial mortgages are used to finance the purchase of real estate for business purposes

$3.31 trillion outstanding

Farm mortgages are used to finance the purchase of farms

$0.30 trillion outstanding

collateral

All mortgage loans are backed by a specific piece of property that serves as ____________ to the mortgage loan

down payment

A ______________is a portion of the purchase price of the property a financial institution requires the mortgage borrower to pay up front

Private mortgage insurance (PMI)

____________________________ is generally required when the loan-to-value ratio is more than 80% (i.e., the borrower makes a down payment of less than 20%)

Federally insured mortgages

Repayment is guaranteed by either the Federal Housing Administration (FHA) or the Veterans Administration (VA)

Conventional mortgages are not federally insured

amortized

A mortgage is ___________ when the fixed principal and interest payments fully pay off the mortgage by its maturity date

Balloon payment mortgages

________________________ require fixed monthly interest payments for a 3- to 5-year period, at which point full payment of the mortgage principal is due

Fixed-rate mortgages

___________________ lock in the borrower’s interest rate

Therefore, required monthly payments are fixed over the life of the mortgage and lenders assume interest rate risk

Adjustable-rate mortgages (ARMs)

________________________________ have interest rates tied to some market interest rate

Required monthly payments can change

Discount points are fees or payments made when a mortgage loan is issued (at closing)

One discount point paid up front is equal to 1 percent of the principal value of the mortgage

Discount points

_________________are fees or payments made when a mortgage loan is issued (at closing)

Mortgage contracts generally require the borrower to pay an assortment of fees to cover the mortgage issuer’s costs of processing the mortgage

E.g., application fee, title search, title insurance, appraisal fee, loan origination fee, closing agent and review fees, etc.

Mortgage refinancing occurs when a mortgage borrower takes out a new mortgage and uses the proceeds obtained to pay off the current mortgage

Mortgages are most often refinanced when a current mortgage has an interest rate that is higher than the current interest rate

The fixed monthly payment made by a mortgage borrower generally consists partly of repayment of the principal borrowed and partly of the interest on the outstanding (remaining) balance of the mortgage

During the early years of the mortgage, most of the fixed monthly payment represents interest on the outstanding principal and a small amount represents a payoff of the outstanding principal

amortization schedule

An ___________________ shows how the fixed monthly payments are split between principal and interest

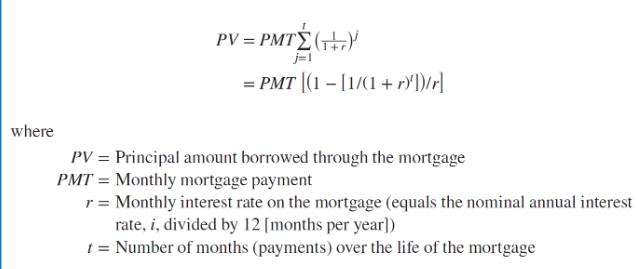

The present value of a mortgage can be written as:

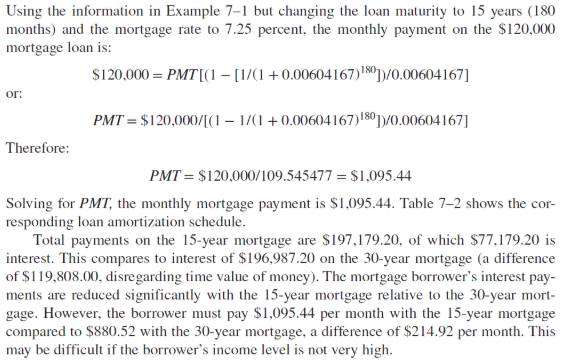

Comparison of Interest Paid

Jumbo mortgages are those that exceed the conventional mortgage conforming limits

Limits are set by the two government-sponsored enterprises, Fannie Mae and Freddie Mac, and are based on the maximum value of any individual mortgage they will purchase from a mortgage lender ($726,200 in 2023, with some exceptions)

Jumbo mortgages

_________________are those that exceed the conventional mortgage conforming limits

Subprime mortgages are mortgages to borrowers who have weakened credit histories

These borrowers may have weakened credit due to payment delinquencies and possibly more severe problems such as charge-offs, judgments, and bankruptcies

Subprime mortgages

_________________ are mortgages to borrowers who have weakened credit histories

Alt-A mortgages are considered riskier than a prime mortgage and less risky than a subprime mortgage

Interest rates on Alt-A loans are usually between prime and subprime rates

Alt-A mortgages

__________________ are considered riskier than a prime mortgage and less risky than a subprime mortgage

Option ARMs are adjustable rate mortgages that offer the borrower several monthly payment options:

Minimum payment option - Lowest of the four payment options and carries the most risk

Interest-only payment - Monthly payments must increase substantially after the initial interest-only period lapses

30-year fully amortizing payment - Borrower pays both principal and interest on the loan, based on a 30-year term

15-year fully amortizing payment - Based on a 15-year term

Option ARMs

______________ are adjustable rate mortgages that offer the borrower several monthly payment options:

Minimum payment option

Lowest of the four payment options and carries the most risk

Interest-only payment

Monthly payments must increase substantially after the initial interest-only period lapses

30-year fully amortizing payment

Borrower pays both principal and interest on the loan, based on a 30-year term

15-year fully amortizing payment

Based on a 15-year term

Second mortgages are loans secured by a piece of real estate already used to secure a first mortgage

Should a default occur, the second mortgage holder is paid only after the first mortgage is paid off

Second mortgages

_________________ are loans secured by a piece of real estate already used to secure a first mortgage

Home equity loans

__________________ let customers borrow on a line of credit secured with a second mortgage on their homes

Reverse-annuity mortgages (RAMs)

Borrower receives regular monthly payments from a financial institution rather than making them

When the RAM matures (or the borrower dies), the borrower (or the borrower’s estate) sells the property to retire the debt

RAMs are attractive mainly to older homeowners who have accumulated substantial equity in their homes

FIs remove mortgages from their balance sheets through one of two mechanisms:

By pooling recently originated mortgages together and selling them in the secondary market

By securitizing mortgages (i.e., by issuing securities backed by newly originated mortgages)

Advantages of securitization:

FIs can reduce their liquidity risk, interest rate risk, and credit risk

FIs generate fee income, which helps to offset the effects of regulatory constraints

Mortgage market is unique in that the U.S. government is deliberately involved in the development of its secondary markets

In 1938, the government established the Federal National Mortgage Association (FNMA, or Fannie Mae) to buy mortgages from depository institutions so they could lend to other mortgage borrowers

To encourage continued expansion in the housing market and to promote competition for FNMA, the U.S. government created the Government National Mortgage Association (GNMA, or Ginnie Mae) and the Federal Home Loan Mortgage Corporation (FHLMC, or Freddie Mac)

Mortgage Sales

FIs have sold mortgages and commercial real estate among themselves for over 100 years

A large part of correspondent banking involves small banks making loans that are too big for them to hold on their balance sheets and selling parts of these loans to large banks with whom they have had a long-term deposit and lending correspondent relationship

Large banks often sell parts of their loans (i.e., participations) to smaller banks

correspondent banking

A large part of _____________________involves small banks making loans that are too big for them to hold on their balance sheets and selling parts of these loans to large banks with whom they have had a long-term deposit and lending correspondent relationship

Mortgage sales occur when an FI originates a mortgage and sells it to an outside buyer

May be sold with or without recourse

Securitization of mortgages involves the pooling of a group of mortgages with similar characteristics, the removal of these mortgages from the balance sheet, and the subsequent sale of interests in the mortgage pool to secondary market investors

Mortgage-backed securities allow mortgage issuers to separate the credit risk exposure from the lending process itself

There are three major types of mortgage-backed securities:

Pass-through security

Collateralized mortgage obligation (CMO)

Mortgage-backed bond

Pass-through mortgage securities

__________________________ “pass through” promised payments of principal and interest on pools of mortgages created by FIs to secondary market participants holding interests in the pools

Three agencies are directly involved in the creation of mortgage-backed pass-through securities

Government National Mortgage Association (GNMA; Ginnie Mae)

Federal National Mortgage Association (FNMA; Fannie Mae)

Federal Home Loan Mortgage Corporation (FHLMC; Freddie Mac)

government-related issuer standards

Private mortgage issuers, such as banks and thrifts, also purchase mortgage pools, but they do not conform to _______________________

Government National Mortgage Association (GNMA)

Began operations in 1968 when it split off from the Federal National Mortgage Association (FNMA)

Government-owned agency with two major functions: sponsoring mortgage-backed securities programs of FIs and providing timing insurance

Federal National Mortgage Association (FNMA)

Originally created in 1938 and, since 1968, FNMA has operated as a private corporation owned by shareholders

Creates mortgage-backed securities (MBSs) by purchasing packages of mortgage loans from banks and thrifts

Federal Home Loan Mortgage Corporation (FHLMC)

Performs a similar function to that of FNMA except that its major securitization role has historically involved thrifts

Government Sponsorship and Oversight of FNMA and Freddie Mac

FNMA and FHLMC represent a huge presence in the financial system, as they have over 44 percent of the single-family mortgages and mortgage pools in the U.S.

In the early 2000s, these two agencies came under fire for several reasons

The Housing and Economic Recovery Act of 2008 gave the authority for the government’s takeover of the GSEs

The takeover of Fannie and Freddie, and specifically the commitment to meet all of the firms’ obligations to debt holders, exposes the U.S. government to a potentially large financial risk

To date, Treasury has provided $119.8 billion to Fannie Mae and $71.6 billion to Freddie Mac to keep them solvent

FHFA told the two GSEs in October 2019 to prepare for transition out of government control

Collateralized mortgage obligations (CMOs) are mortgage-backed bonds with multiple bond holder classes, or tranches

Each bond holder class has a different guaranteed coupon

Mortgage prepayments retire only one tranche at a time, so all other trances are sequentially prepayment protected

Collateralized mortgage obligations (CMOs)

______________________________________ are mortgage-backed bonds with multiple bond holder classes, or tranches

Mortgage-backed bonds (MBBs)

MBBs are bonds collateralized by a pool of assets, also called asset-backed bonds

The relationship for MBBs is one of collateralization rather than securitization; the cash flows on the mortgages backing the bond are not necessarily directly connected to interest and principal payments on the MBB

International investors participate in U.S. mortgage and mortgage-backed securities markets

The value of mortgages held by foreign banks has decreased by 67.2 percent (from $51.6 billion in 1992 to $16.9 billion in 2014), before rebounding to $91.1 billion in 2021

This compares to primary mortgages issued and held by domestic entities of $18.06 trillion in 2021

After the United States, Europe is the world’s second-largest and most developed securitization market

Germany is one of the countries that moved toward making widespread use of securitization in its mortgage markets

Synthetic securitizations are a far more common form of mortgage financing in countries outside the U.S.

Refers to structured transactions in which banks use credit derivatives to transfer the credit risk of a specified pool of assets to third parties, such as insurance companies, other banks, and unregulated entities

Can replicate the economic risk transfer characteristics of a traditional securitization without removing the portfolio of assets from the originating bank’s balance sheet

Reasons to prefer synthetic securitization might include the complexity and prohibitive cost of a traditional securitization transaction as well as its potentially unfavorable tax implications