Business Finance WW4. AU4

1/25

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

working capital

current assets - current liabilities

working capital ratio

current assets / current liabilities

receivable turnover ratio

net credit sale / avg accounts receivable

day sales outstanding

365 / receivable turnover ratio

inventory turnover ratio

COGS / average inventory

days in inventory

365 / Inventory turnover ratio

cash conversion cycle

days in inventory + day sales outstanding - days payable outstanding

operating cycle

days in inventory + day sales outstanding

cost of discount foregone

opportunity cost when the customer does not pay within the cash discounted period

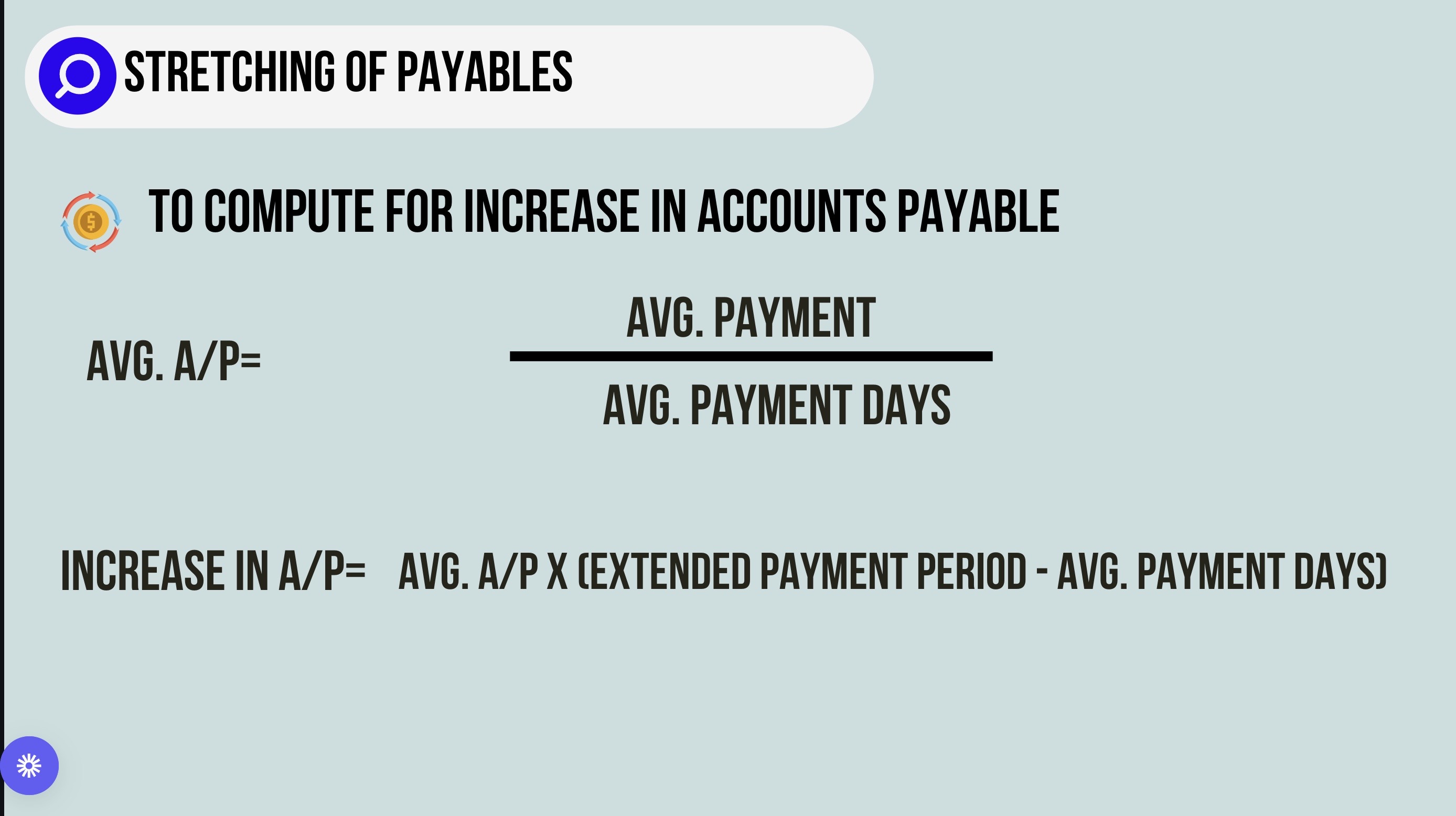

stretching of payables

avg accounts payable

increase in accounts payable

average accounts payable

avg payment / avg days of payment

increase in a/p

avg a/p x (extended payment period - avg. payment days)

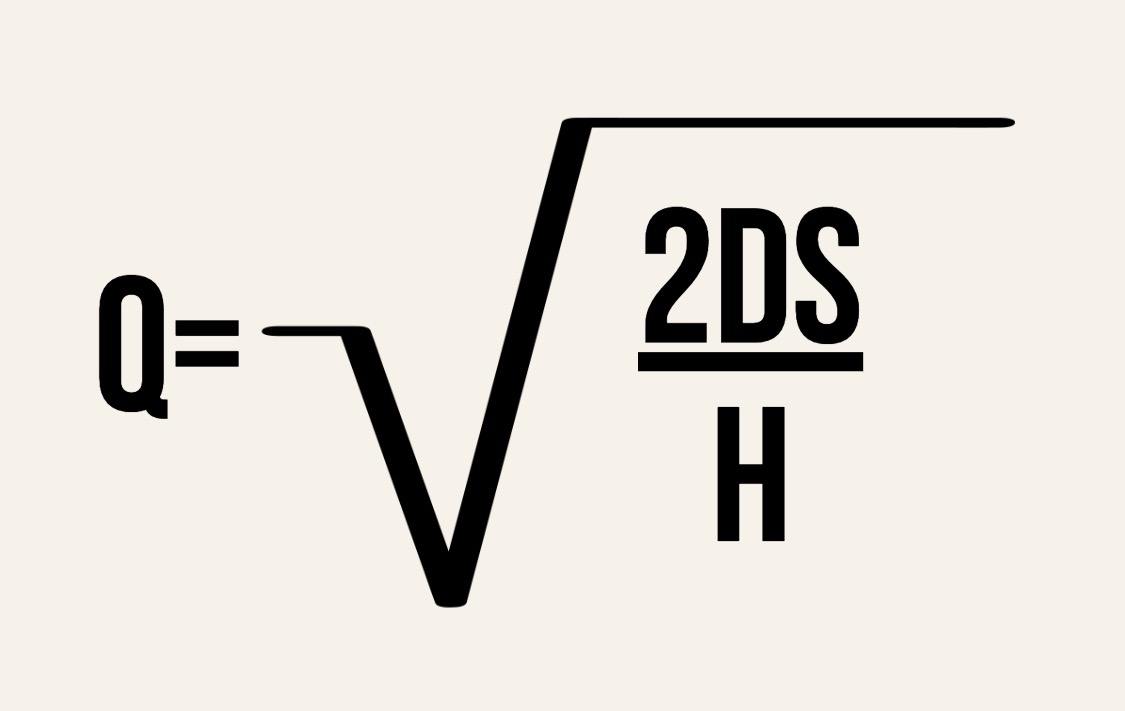

economic order of quantity

ideal quantity of units a company should purchase to meet demand while minimizing inventory costs such as holding costs, shortage costs, and order costs

Q= EOQ units

D = Demand in units (annually)

S = Order Cost (PER PURCHASE)

H = Holding costs or Carrying Cost (per unit, per year)

holding costs

[FOR EOQ]

multiply the number after “order of x units at a price of” by the carrying cost

demand in units

[FOR EOQ]

phrases like “annual requirement of x” or “places an order of x units.”

make sure to convert it to annual

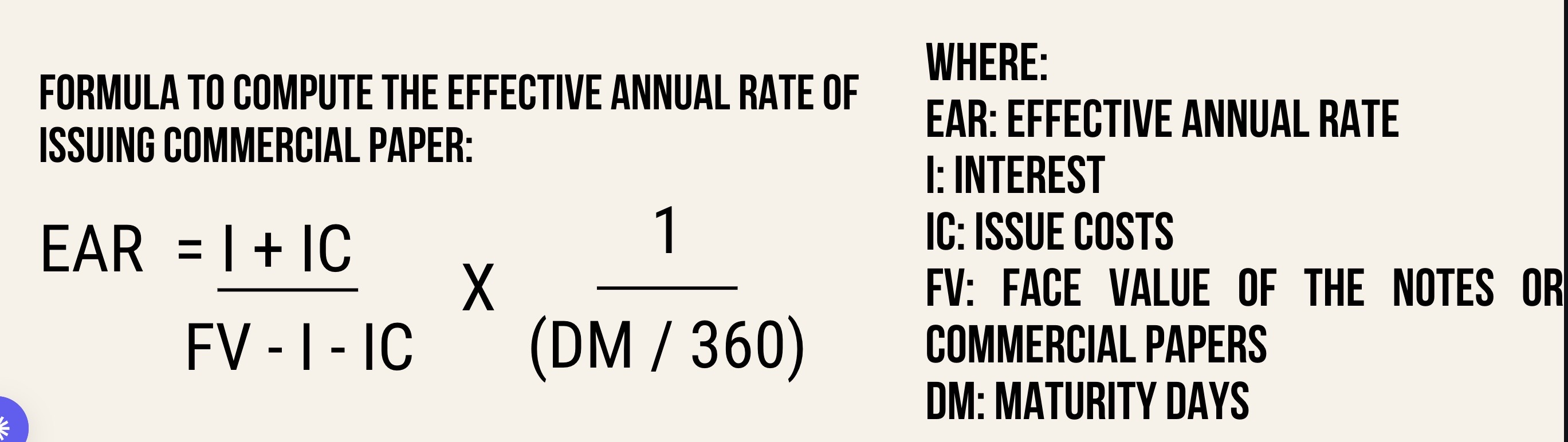

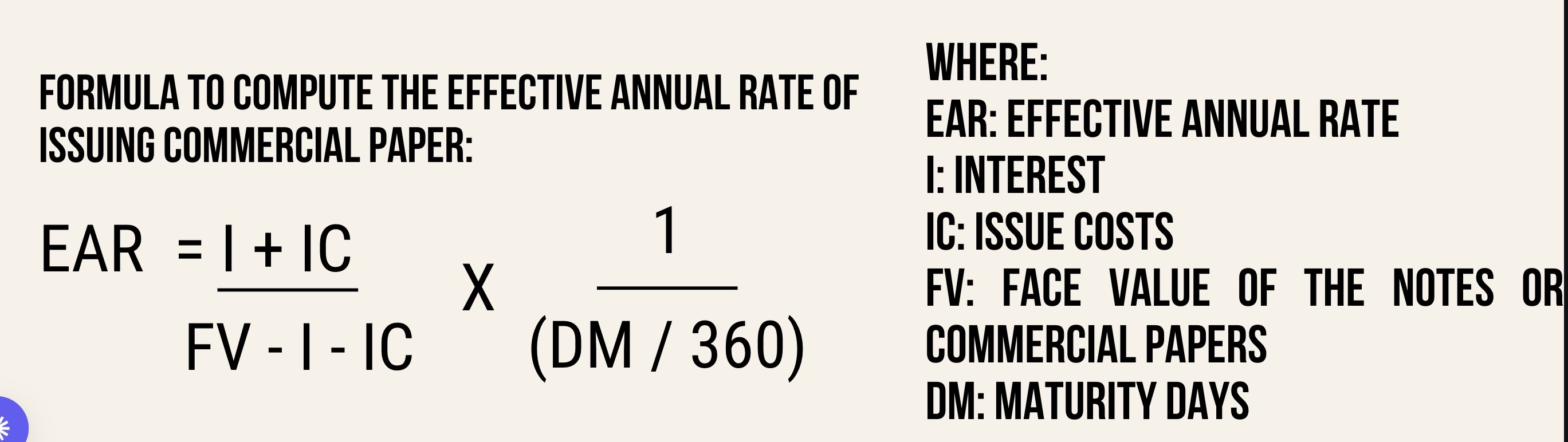

cost of commercial paper

compute for amount of interest

use the EAR formula

amount of interest

[FOR cost of commercial paper, cost of factoring a/r,

Face Value x Interest Rate x days / 360

EAR cost of commercial paper

EAR = Effective Annual Rate

I: Interest

IC: Issue Costs

FV: Face Value

DM: Maturity Days

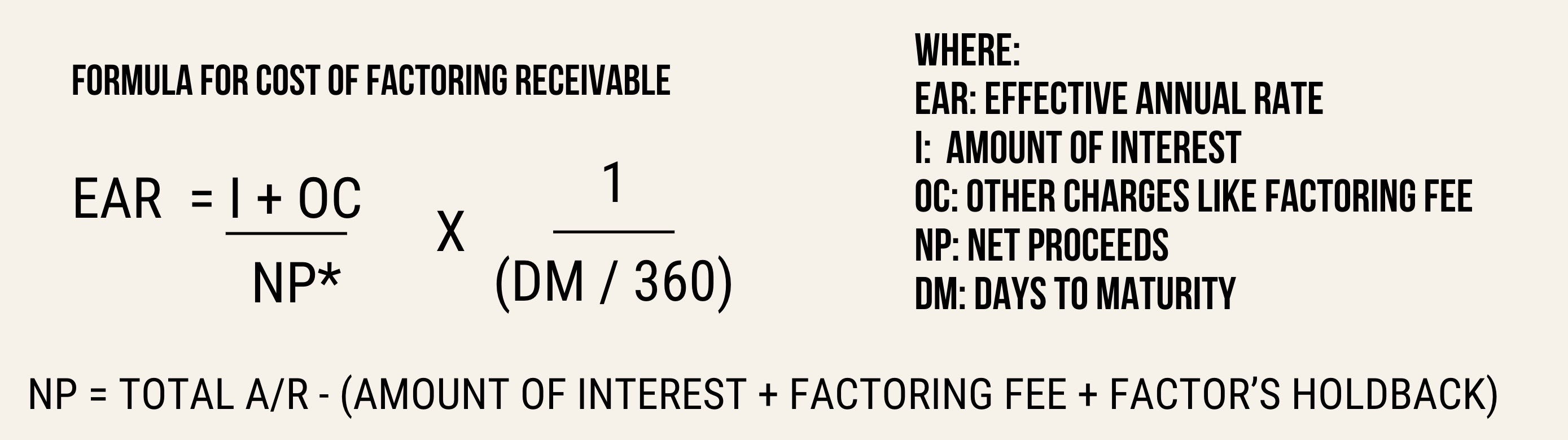

cost of factoring accounts receivable

compute for amount of interest

compute for factoring fee

compute for factor’s holdback

compute for net proceeds

compute for cost of factoring receivableS

net proceeds

[2ND TO LAST STEP OF COST OF FACTORING ACCOUNTS RECEIVABLE]

= Total A/R - (Amount of Interest + Factoring Fee + Factor’s Holdback)

cost of debt

Interest Rate of the long-term debt x (1-corporation’s income tax rate)

cost of preferred shares

dividends per share / market value per preferred share

cost of common shares

expected cash per dividend share / market value per ordinary share + dividend growth rate

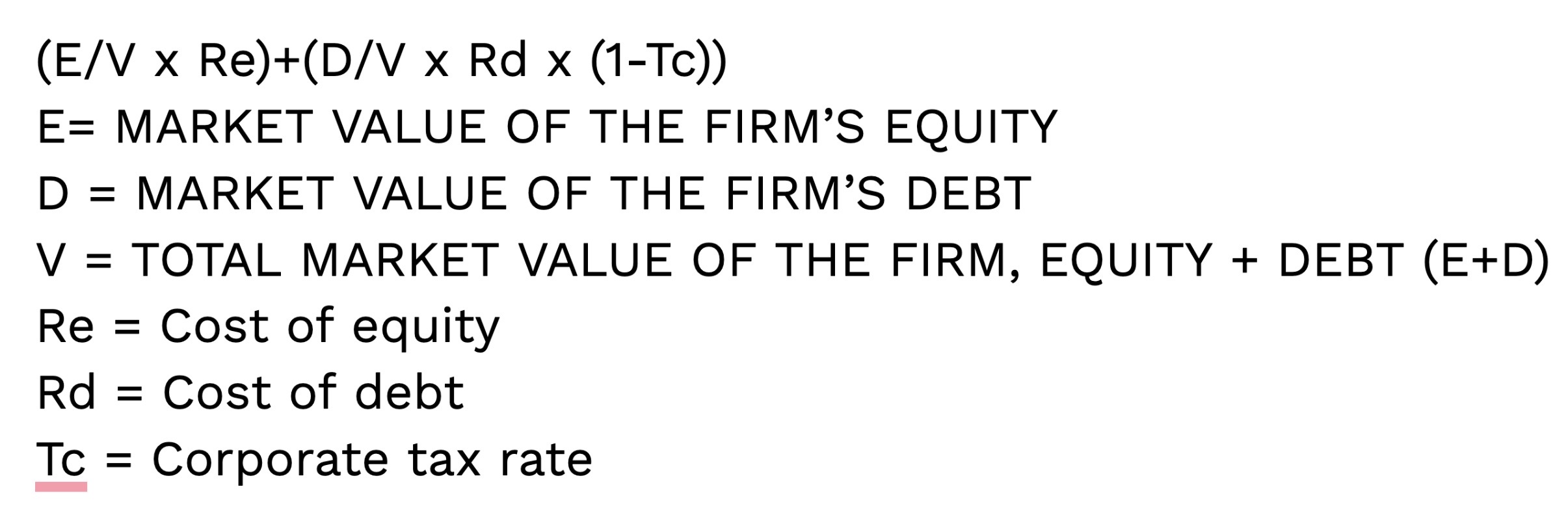

weighted average cost of capital

(E/V + Re) + (D/V x Rd x (1-Tc))

add-on interest

based on outstanding loan balance and whatever interest is added to the principal payment

discounted interest

what you get when discount amount is deducted from the principal amount