Notes Receivable

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

1,102,080

On December 31,2021, Flirt Company sold for 3,000,000 an old equipment having an original of 5,400,000 and carrying amount of 2,400,006. The terms of the sale were 600,000 downpayment and 1,200,000 payable each year on December 31 of the next two years. The sale agreement made no mention of interest. However, 9% would be a fair rate for this type of transaction. The present value of an ordinary annuity of 1 of 9% for two years is 1.76. What is the carrying amount of the note receivable on December 31, 2022?

1,654,600

Pangasinan Company is a dealer in equipment. On December 31, 2021, the entity sold an equipment in exchange for a noninterest-bearing note requiring five annual payments of 500.000. The first payment was made on December 31,2022. The market interest for similar notes was 8% for 5 periods is 3.99. What is the carrying amount of the note receivable on December 31,2022?

88,000 loss

Ayala Company sold an equipment with a carrying amount of 800,000, receiving a non interest-bearing note due in three years with a face amount of 1,000,000. The interest rate on similar obligations is estimated at 12%. The present value of I at 12% for three periods is 0.712. What amount should be reported as gain or loss on sale of equipment? Indicate whether gain or loss.

2,664,000

On December 31, 2021, Park Company sold used equipment with carrying amount of 2,000,000 in exchange for noninterest-bearing note of 5,000,000 requiring ten annual payments of 500,000. The first payment was made on December 31, 2022. The market interest for similar note was 12%. The present value of an ordinary annuity of 1 at 12% is 5.65 for ten periods and 5.33 for nine periods. What is the carrying amount of note receivable on December 31, 2022?

2,825,000

On December 31, 2021, Park Company sold used equipment with carrying amount of 2,000,000 in exchange for noninterest-bearing note of 5,000,000 requiring ten annual payments of 500,000. The first payment was made on December 31, 2022. The market interest for similar note was 12%. The present value of an ordinary annuity of 1 at 12% is 5.65 for ten periods and 5.33 for nine periods. What is the carrying amount of note receivable on December 31, 2021?

300,000 loss

On January 1, 2021, Emma Company sold equipment with a carrying amount of 4,800,000 in exchange for a 6,000,000 noninterest-bearing note due January 1,2024. There was no established price for the equipment. The prevailing rate of interest for a note of this type on January 1,2021 was 10%. The present value of 1 at 10% for three periods is 0.75. What amount should be reported as gain or loss on sale of equipment? Indicate whether gain or loss.

758,200

Pasadena Company sold machinery to Rodac Company on January 1, 2021 for which the cash selling price was 7,582.000. Rodac entered into an installment sale contract with Pasadena at an interest rate of 10%. The contract required payments of 2,000,000 a year over five years with the first payment due on December 31, 2021. What amount of interest income should be reported in 2021?

825,000

On December 31, 2021, Park Company sold used equipment with carrying amount of P2,000,000 in exchange for a noninterest-bearing note of P5,000,000 requiring ten annual payments of P500,000. The first payment was made on December 31, 2022.The market interest for similar note was 12%. The present value of an ordinary annuity of 1 at 12% is 5.65 for ten periods and 5.33 for nine periods. What is the gain on sale of equipment to be recognized in 2021?

85,440

Ayala Company sold an equipment with a carrying amount of P800,000, receiving a noninterest-bearing note due in three years with a face amount of P1,000,000. There is no established market value for the equipment. The interest rate on similar obligations is estimated at 12%. The present value of 1 at 12% for three periods is 0.712. What amount should be reported as interest income for first year?

100,000

On June 30, 2021, Green Company accepted a customer's P2,500,000 noninterest-bearing one-year note in a sale transaction. The product sold normally sells for P2,300,000. What amount should be reported as interest revenue for the year end December 31, 2021?

1,995,000

Pangasinan Company is a dealer in equipment. On December 31, 2021, the entity sold an equipment in exchange for a noninterest-bearing note requiring five annual payments of P500,000. The first payment was made on December 31, 2022.The market interest for similar notes was 8%. The PV of 1 at 8% for 5 periods is .68, and the PV of an ordinary annuity of 1 at 8% for 5 periods is 3.99. On December 31, 2021, what is the carrying amount of the note receivable?

260,000

Touch Company sold a piece of machinery with a list of price of P1,600,000 to Archer Company at the beginning of current year. Archer Company issued a noninterest-bearing note of P1,700,000 due in one year. Touch Company normally sells this type of machinery for 90% of list price. What amount should be recorded as interest revenue for the current year?

556,000

Jean Company purchased from Carmina Company a P2,000,000, 8%, five-year note that required five equal annual payments of P500,900. The note was discounted to yield a 9% rate to Jean Company. At the date of purchase, Jean Company recorded the note at the present value of P1,948,500. What is the total interest revenue earned by jean Company over the life of this note?

10,000

On June 1, 2021, Yola Company loaned Dale P500,000 on a 12% note, payable in five annual installments of P100,000 beginning January 1, 2022.In connection with this loan, Dale was required to deposit P5,000 in a noninterest-bearing escrow account.The amount held in escrow is to be returned to Dale after all principal and interest payments have been made.Interest on the note is payable on the first day of each month beginning July 1, 2021. Dale made timely payments through November 1, 2021.On January 1, 2022, Yola received payment of the first principal installment plus all interest due.On December 31, 2021, what is the accrued interest receivable on the loan?

1,000,000

Frame Company has an 8% note receivable dated June 30, 2021, in the original amount of P1,500,000. Payments of P500,000 in principal plus accrued interest are due annually on July 1, 2022, 2023 and 2024. What is the balance of note receivable on July 1, 2022?

80,000

Frame Company has an 8% note receivable dated June 30, 2021, in the original amount of P1,500,000. Payments of P500,000 in principal plus accrued interest are due annually on July 1, 2022, 2023 and 2024. 2. In the June 30, 2023 statement of financial position, what amount should be reported as a current asset for interest on the note receivable?

250,000

On June 30, 2021, Pink Company sold goods for P5,000,000 and accepted the customer's 10% one-year note in exchange. The 10% interest rate approximates the market rate of return. What amount should be reported as interest income for the year ended December 3, 2021?

159,600

Pangasinan Company is a dealer in equipment. On December 31, 2021, the entity sold an equipment in exchange for a noninterest-bearing note requiring five annual payments of P500,000. The first payment was made on December 31, 2022.The market interest for similar notes was 8%. The PV of 1 at 8% for 5 periods is .68, and the PV of an ordinary annuity of 1 at 8% for 5 periods is 3.99. What amount of interest income should be reported for 2022?

1,782,000

On December 31, 2021, Jet Company received two P1,000,000 notes receivable from customers in exchange for services rendered. On both notes, interest is calculated on the outstanding principal balance at the annual rate of 3% and payable at maturity. The note from Hart Company, made under customary trade terms, is due in nine months and the note from Maxx Company is due in five years. The market interest rate for similar notes on December 31, 2021 was 8%. The compound interest factors to convert future value into present value at 8% follow: (Present value of 1 due in nine months 0.944) (Present value of I due in five years 0.680) What is the carrying amount of notes receivable on December 31, 2021?

625,000

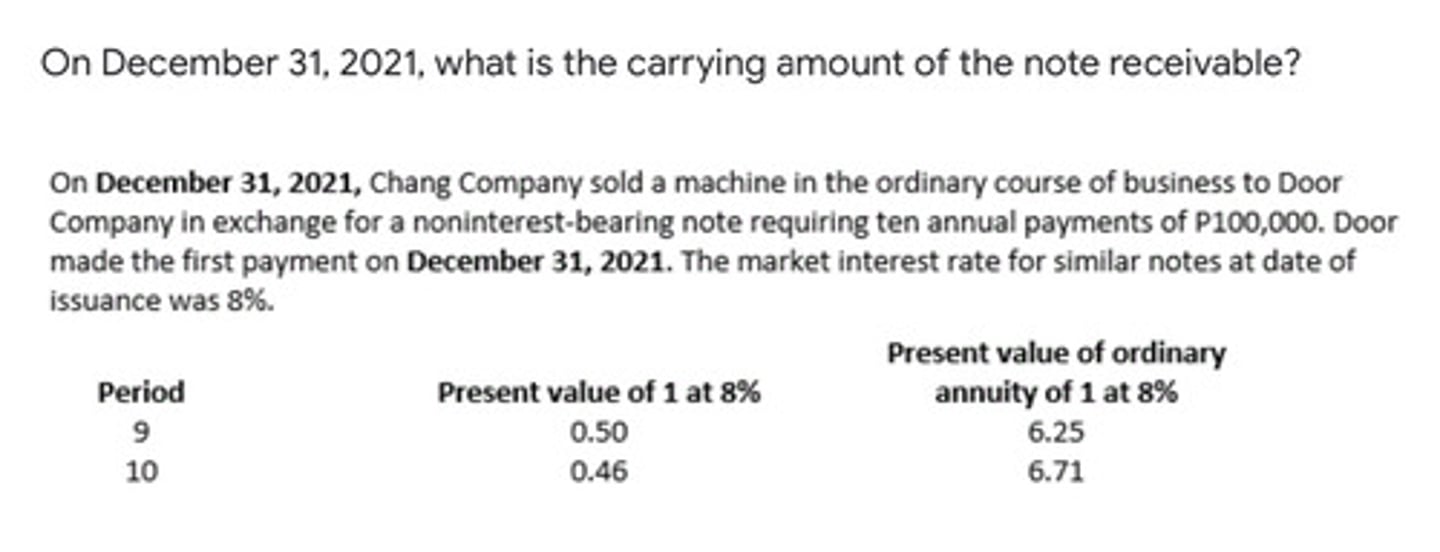

On December 31,2021, what is the carrying amount of note receivable?

4,744,600

Alamo Company sold a factory on January 1, 2021 for P7,000,000. The entity received a cash down payment of P1,000,000 and a 4-year, 12% note for the balance. The note is payable in equal annual payments pf principal and interest of P1,975,400 payable on December 31 of each year until 2024. What is the carrying amount of the note receivable on December 31, 2021?

450,000

On January 1, 2021, Emme Company sold equipment with a carrying amount of P4,800,000 in exchange for a P6,000,000 noninterest-bearing note due January 1, 2024. There was no established price for the equipment. The prevailing rate of interest for a note of this type on January 1, 2021 was 10%. The present value of 1 at 10% for three periods is 0.75. What amount should be reported as interest income for 2021?

339,000

On December 31, 2021, Park Company sold used equipment with carrying amount of P2,000,000 in exchange for a noninterest-bearing note of P5,000,000 requiring ten annual payments of P500,000. The first payment was made on December 31, 2022.The market interest for similar note was 12%. The present value of an ordinary annuity of 1 at 12% is 5.65 for ten periods and 5.33 for nine periods. What amount should be recognized as interest income for 2022?

330,000

On January 1, 2021, Mill Company sold a building and received as consideration P1,000,000 cash and a P4,000,000 noninterest-bearing note due on January 1,2024. There was no established exchange price for the building, and the note had no ready market. The prevailing rate of interest for a note of this type was 10%. The present value of 1 at 10% for three periods is 0.75. What amount of interest revenue should be included in the 2022 income statement?

190,080

On December 31, 2021, Flirt Company sold for P3,000,000 an old equipment having an original of P5,400,000 and carrying amount of P2,400,000. The terms of the sale were P600,000 down payment and P1,200,000 payable each year on December 31 of the next two years. The sale agreement made no mention of interest. However, 9% would be a fair rate for this type of transaction. The present value of an ordinary annuity of 1 at 9% for two years is 1.76. What is the interest income for 2022?