accounting ch. 1

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

22 Terms

investors

individuals or organizations that provide money to a business in exchange for ownership (such as stock) and expect to earn a return on their investment, usually through dividends and/or increase in the value of the business over time

creditors

individuals or organizations that lend money to a business and expect to be repaid, usually with interest, by a specific date

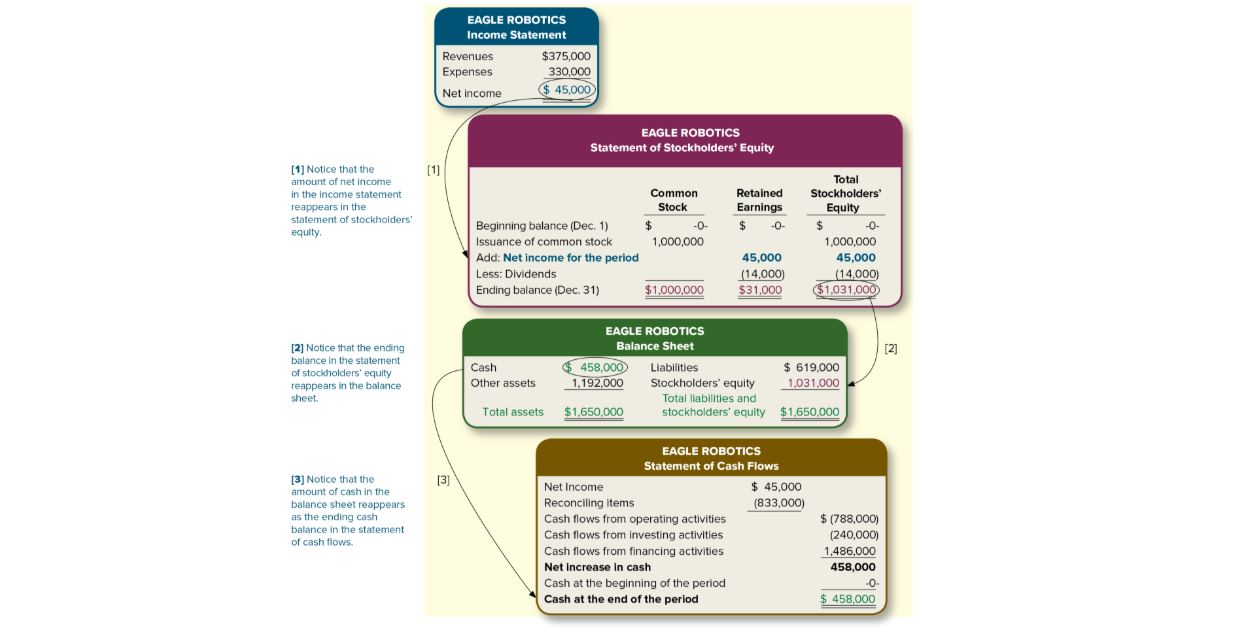

financing activities

transactions the company has with investors and creditors, such as issuing common stock and borrowing money from a local bank

investing activities

transactions involving the purchase and sale of resources that are expected to benefit the company for several years, such as the purchase of equipment or buildings

operating activities

include transactions that relate to the primary operations of the company such as providing products and services to customers and the associated costs of doing so, like rent, salaries, utilities, taxes, and advertising

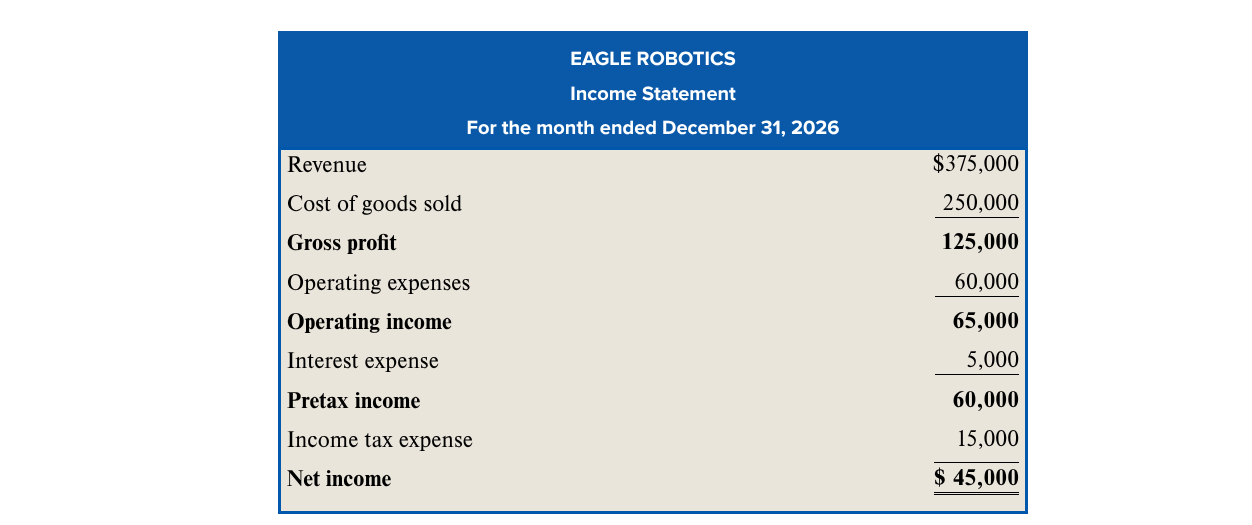

income statement/statement of operations

summarizes a company’s revenues, expenses, and net income over a specific period of time

revenues

amounts a company is entitled to receive from its customers for the products sold and services provided during the current period

expenses

costs of providing products and services (and other business activities) incurred during the current period such as salaries, utilities, etc.)

net income

difference between revenues and expenses

net income/net loss =

revenue - expenses

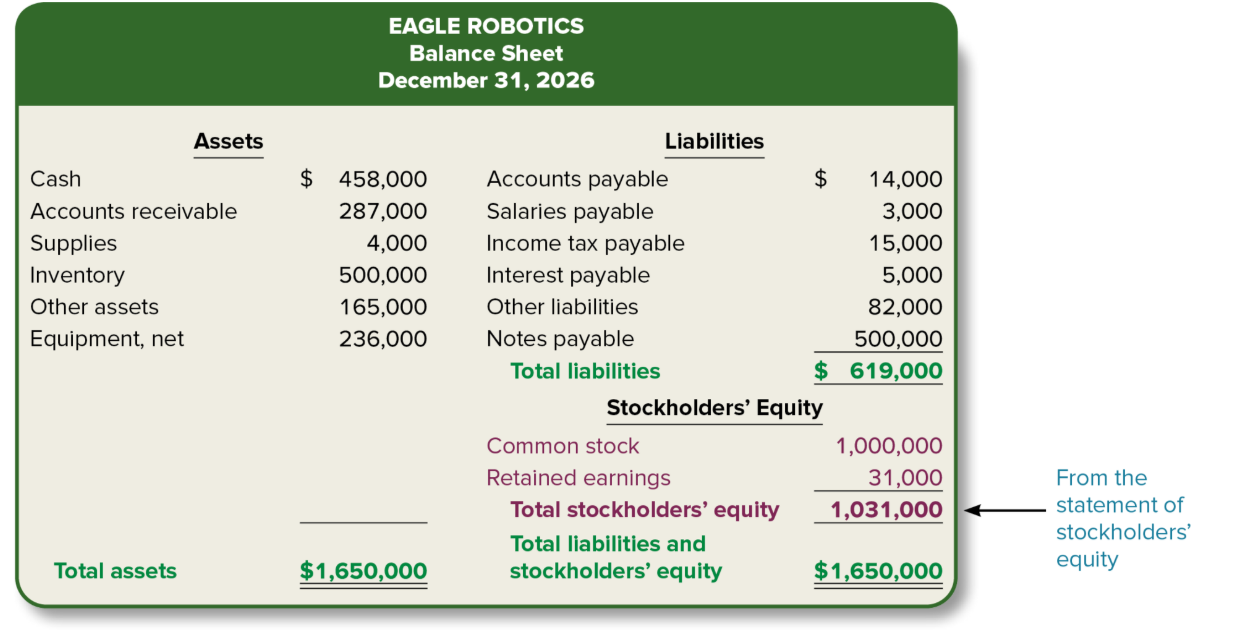

balance sheet/statement of financial position

provides a snapshot of the company’s financial position at a specific point in time

assets

resources of a company expected to generate future benefits

liabilities

obligations of a company, including amounts owed to creditors

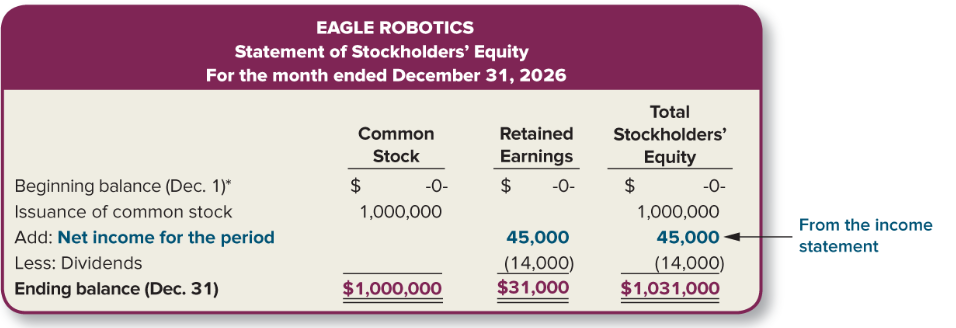

stockholders’ equity/owner’s salary

difference between assets and liabilities, representing the residual value available for the company’s owners after all the debts have been paid

common stock

(external source of equity) represents amount invested by stockholders (owners) when they purchase shares of stock

ending common stock =

beginning common stock + new issuances

retained earnings

(internal source of equity) represent all net income minus all dividends over the life of the company

ended retained earnings =

beginning retained earnings + net income - dividends

statement of stockholder’s equity example

balance sheet example

Links Among Financial Statements

income statement example