ECON 2105 EXAM FOUR

1/84

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

85 Terms

nominal GDP

GDP is measured in today’s prices; price*quantity; changes due to price and/or quantity

real GDP

GDP is measured in constant price to excl effects of price changes; only changes due to the quantity of output produced, isolates growth in output. average of year’s price*quantity

consumer price index (CPI)

measure of the average price people pay over time for goods and services they buy. more formally it is an index that tracks the average price consumers pay over time for a representative basket of goods and services. these goods and services are referred to as the basket

the inflation rate is the percentage change in the price of a fixed basket of goods

inflation rate

((price level this year—price level last year)/price level last year)*100

basket of goods

add up goods people buy, price x quantity, tally cost of basket, calc inflation rate as the percentage change in the price of the basket

challenges of measuring the true cost of living

quality improvements can hide price decreases

new products can make you better off, thereby reducing your cost of living

you can save money by substituting

cpi doesn’t count substitution bias

how various measures of inflation in consumer price differ and what each is useful for

CPI is used for cost-of-living adjustments

indexation clauses - auto adjust wages in line with CPI, government indexes social security

monetary policy focuses on the personal consumption expenditure deflator

PCE - personal consumption expenditure deflator (PCE deflator) alt measure of inflation use diff basket of goods and services that also incl items that you consume but don’t pay for directly like medical care, continually updated goods to acct for sub bias

when forecasters look for the underlying trend in inflation they consult an alternative measure of inflation that exl food and energy

business prices

inflation experienced by businesses is measured by the producer price index

Producer Price Index (PPI) measures the price of inputs into the production process

GDP deflator tells us about the changing prices of all goods and services produced

calc on a basket of goods/services that represents everything the U.S. economy produces (incl capital goods, excl imported goods)

can used to convert nominal GDP into real GDP

GDP deflator

GDP deflator = (nominal GDP/real GDP)*100

something in today’s dollars =

another time’s dollars * (price level today/price level in another time)

real variable

variable that adjusts for inflation

nominal variable

measured in dollars whose values may fluctuate over time, as a result, nominal variable can rise or fall due to either changing quantities or inflation

base year

year that adjusts variables into dollars from a specific year

real GDP

real value in XX dollars = nominal value in year t dollars * (price level in XX/price level in year t)

nominal interest rate

measures the return in dollars, stated interest rate w/out a correction for the effects of inflation

real interest rate

measures what you can buy with those dollars. accounts for the influence of inflation.

interest rate in terms of changes in your purchasing power

real interest rate formula

real interest rate = nominal interest rate — inflation rate

money illusion

tendency to focus on nominal dollar amounts— can lead you to be fooled by inflation

can distort decisions

can lead to mispricing

creates nominal wage rigidity (reluctance to cut nominal wages)

money

any asset that’s regularly used in transactions

functions of money

medium of exchange

unit of account

store of value

money as a medium of exchange

you give money in exchange for another item instead of needing a double coincidence of wants; is only effective if its widely accepted

benefits of money as a medium of exchange

eliminates constraint of double coincidence of wants and allows you to specialize

money as a unit of account

common unit that people use to measure economic value; important that the common unit is stable to simplify comparison and eases communication

benefits of money as a unit of account

easier to apply opportunity cost; if one pound of apples cost a dollar and one pound of oranges is a dollar twenty-five then you know you have to give up more apples to get a pound of oranges

money is a store of value

saving in order to shift wealth to future / storing purchasing power for the future

inflation undermines the productive benefit of money

high / unpredictable inflation erodes the functions of money

medium of exchange: sellers don’t know how much the money is going to be worth when they get a chance to try and convert it into things that they want; may feel more secure to barter

store of value: if prices are rising so fast that the $100 worth of goods you earn one week will only buy you half as much the following week, it can be harder to know what payments in money are worth

unit of account: when its value is uncertain, the price denominated in dollars is less informative when you aren’t sure what a dollar is worth.

hyperinflation

extremely high rates of inflation; if prices are at least doubling each month, it is hyperinflation

costs of hyperinflation

can make life harder — decreasing purchasing power can make it difficult to purchase anything

erodes all the functions of money

costs of expected inflation

creates menu costs for sellers — the marginal benefit for adjusting you price is that you will shift to a price that covers the rising cost of your inputs, the higher inflation and the faster your costs rise the larger your marginal benefit leading to more frequent price adjustment

creates shoe-leather costs for buyers — when inflation is high, the marginal cost of holding money is high leading people to hold less of this. we lose time as buyers from constantly moving money around to preserve its value

menu costs

marginal costs of adjusting prices

shoe-leather costs

costs incurred trying to avoid holding cash

the costs of unexpected inflation

inflation confuses the signals that prices send (i.e. an increase in price showcases greater demand, signaling to producers to expand production) however inflation’s rise in prices will tell producers to expand production without an increase demand

inflation redistributes from savers/lenders to borrowers because most loans specify repayment schedules in nominal terms and so unexpected inflation changes the real value of your repayments

inflation fallacy

mistaken belief that inflation destroys purchasing power, the buyer becomes a unit poorer but the seller becomes a unit richer. your wages increase because you sell your labor at a higher price allowing you to continue purchasing

macroeconomic investment

spending on new capital

colloquial investment

incurring an up-front cost in the hope of receiving future benefits

saving vs investment

saving is the money you have left over after paying for your consumption spending which could be put in the bank/stock/or at home but no new capital is purchased

trading existing assets vs investment

trading incl the use of alr existing assets, whereas investment need you to buy NEW capital

investment vs depreciation

investment adds to the capital stock; depreciation subtracts

capital stock

total quantity of capital at a point in time

this year’s capital stock = last year’s stock — depreciation + new investment over past year

rises when new investment > depreciation, declines depreciation> new investment

types of invesment

business investment in

equipment

structures

intellectual property

housing (new houses and renovations)

inventory investment (is negative when businesses run down their invetories)

business investment

money that businesses spend on new capital assets, accts for the bulk of investment in the economy

incl. equipment, structures, and intellectual property

housing invesment

investments in building new houses and/or apartments. incl homes you plan to live in and those that you plan to rent out. renovations to the home are counted in this.

existing homes don’t count bc they don’t create any new capital

inventories

invest by maintaining inventories of raw materials, wips, and unsold goods. (i.e. cars you test drive at the local dealership)

change in inventories is only a tiny share of investment but it’s volatile bc unsold goods build up quickly when sales are weak. inventory investment can be negative when stocks of unsold goods dry up. bc of this volatility changing inventories account for a big chunk of quarter-to-quarter movements in investment

investment drives the business cycle

investment drives the business cycle, bc it fluctuates dramatically as business conditions change, it plays an outsized role in driving the year-to-year economic fluctuations. When GDP declines by 2% investment may decline by 20% but when GDP increases by 4% investment may increase by 10x as much

investment and the future

investment decisions are extremely sensitive to expectations about the future state of the economy. investment is also sensitive to interest rates and lending standards bc businesses often have to get a loan to fund their investments

investment vs capital stock

investment changes quickly, capital stock changes slowly

capital stock is an accumulation of investments made over many previous years (—depreciation). capital stock rises gradually and doesn’t change much from time to time, thus providing a relatively stable link between last year’s economy and today’s economy

investment—the flow of new spending on capital—can change rapidly as its based on future expectations, i.e. if investors think a company is going bankrupt they are less likely to invest in it.

investment is a key driver of long term prosperity

the more capital your workers have to work with the more output they’ll be able to produce (to a point); education is another important driver of how much workers but in investments in human capital are not counted in macroeconomic investment

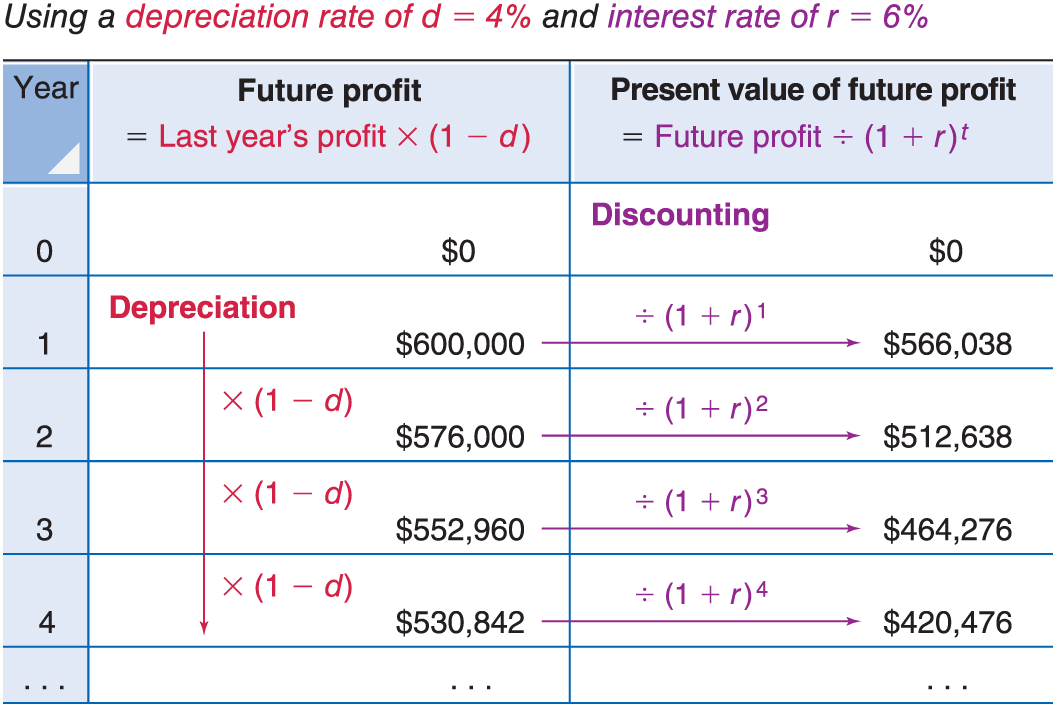

investment tool 1: compounding

the accumulation of money over time, as you earn interest on both your principal and accrued interest

future value in one year

future value in one year = present value +( r * present value)

future value in t years (COMPOUND)

future value in t years = present value*(1+r)^t

investment tool 2: discounting

converting future value into their equivalent present value

future value in t years (DISCOUNT)

present value = future value in t years / (1+r)^t

evaluate investment opportunity steps

calc upfront costs — cost-benz principle

predict future profits, taking into account depreciation

calc present value of all benefits and costs (use valuation formula to calc the present value of stream of profits)

invest if the present value benefits exceeds the present value of costs

future revenue

future revenue = last year’s revenue* (1—d)

valuation formula

present value of a stream of payments = next year’s profit / r(interest rate)+d(depreciation rate)

rational rule for investors

next years profit / r(interest rate)+d(depreciation rate) ≥ upfront cost

user cost of capital

user cost of capital = (r + d)*C

compare user cost of capital with next year’s additional profit

next year’s profit ≥(r+d)*C

marginal benefit ≥ marginal cost

following the rational rule for investor, the number of projects that proceed depend on how many will meet the the test that

next year’s profit/(real interest rate+depreciation rate) > C (real cost of capital)

invest vs real interest rate

investment declines as the real interest rate rises. the higher the real interest rate the lower the present value of future profits

investment line

the line that shows how lower real interest rates lead to higher levels of investment

factors that shift the investment line to the right

any change in business conditions that makes investment more profitable will cause an increase in investment

increases in expectations of future profits

decreases in the price of capital goods

reduces the depreciation rate

decreases in the real interest rate

factors that shift the investment line to the left

any change in business conditions that makes investment less profitable will cause an decrease in investment

changes that lead to expected future profits fall

upfront cost of investing to rise

depreciation to rise

real interest rate to rise

investment Line shifter: technological advances

techno advances that make capital equipment more productive will boost the profits that you’ll generate from buying that equipment then there is a greater incentive to invest more

investment line shifter: expectations

investment is motivated by expectations about future profits.

if managers are optimistic about future economic conditions they’ll forecast new investments are likely to yield robust profits, thus investing more at a given real interest rate shifting the line to the right.

but if they are pessimistic about future economic conditions this will lead them to conclude fewer investment projects will be profitable shifting the line to the left

investment line shifter: corporate taxes

the higher the corporate tax rate, the smaller the share of future profits that your company gets to keep, effectively reducing the profit you’ll get to keep from your investment, this reduces investment at any given interest rate shifting the investment line to the left.

tax breaks increase revenue hence profit earned from product, shifting the investment to the right.

investment line shifter: learning standards and cash reserves

upfront costs are typically financed by borrowing funds from the bank. banks set high-interest rates when they cannot asses the risk for projects or they don’t want to lend bc of the riskiness.

investments tend to be higher when companies face less restrictive lending standards or when they have enough cash reserves that they don’t need to rely on banks thus shifting the line to the right

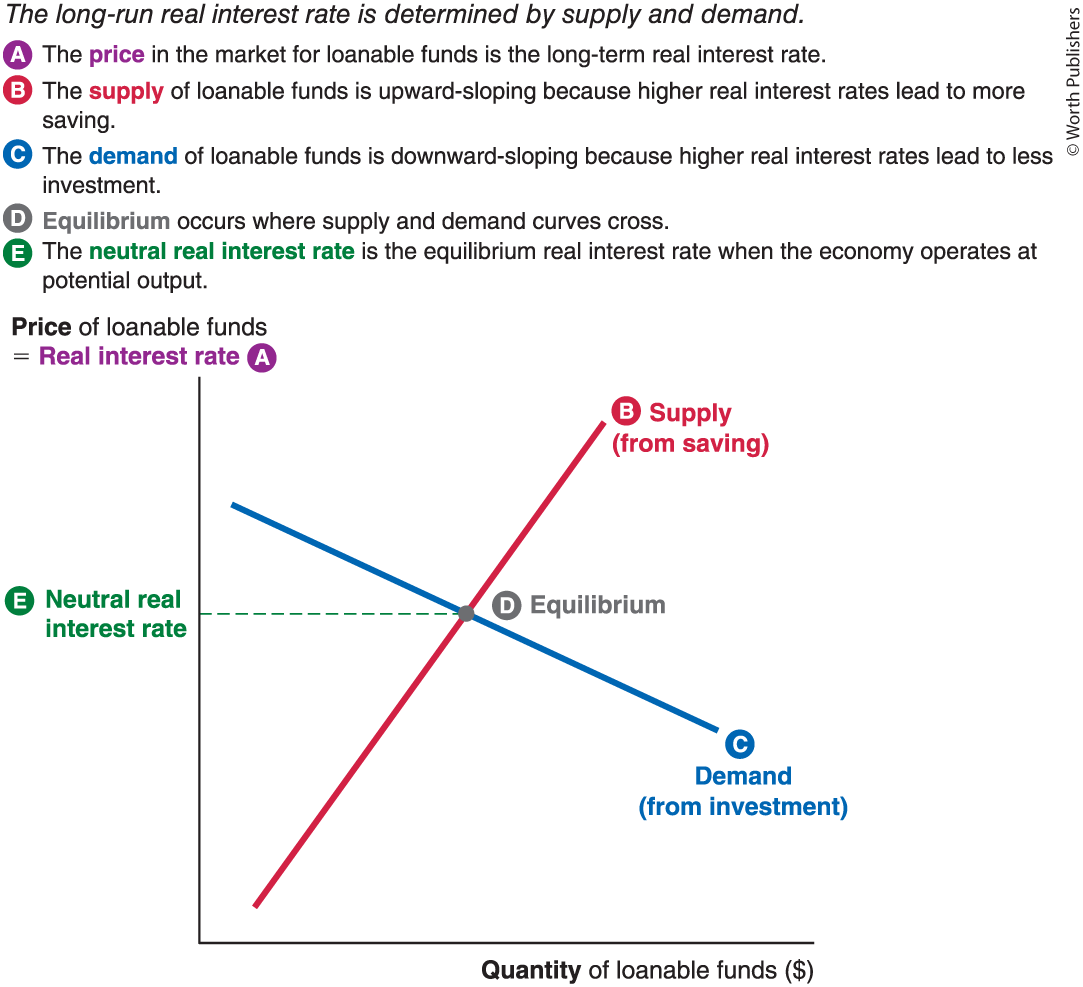

market for loanable funds

the market for the funds used to buy, rent, or build capital. savers supply funds and investors demand them. the marketplace in the financial sector—banks, the bond market, and stock market

price of a loan (in market for loanable funds)

the long term real interest rate

supply of loanable funds

upward sloping because higher real interest rates lead to more saving

demand of loanable funds

downward sloping because higher real interest rates lead to less investment

equilibrium in the market for loanable funds

occurs where the demand for loanable funds meets the supply for loanable funds

neutral real interest rate

equilibrium real interest rate when the economy operates at its long run potential output.

real interest rate is determined by

supply and demand, when they hit equilibrium.

shifts in supply of loanable funds

decrease in saving shifts the supply of loanable to the left leading to a higher real interest rate

increasing in saving shifts the supply of loanable to the right leading to a lower interest rate

supply of loanable funds shifter: changes in personal saving by private savers

any factor that shifts people’s willingness to save will shift the supply (i.e. pandemic caused people to stay home and cut back spending while government sent stimulus checks, increased saving and moved curve to the right, the opposite occurred when vaccines were released)

personal saving

saving by households of whatever income they don’t spend or pay as taxes. (i.e. putting money in the bank paying down your debt bc it frees up loanable funds for others to use)

supply of loanable funds shifter: government saving shifts due to changing budget surpluses and deficits

when government revenues exceed outlays (the amount of money that you have to spend in order to buy something or start a project) the gov budget is in surplus so it accumulates extra funds. typically uses these funds to repay government debt which frees up those funds for others to borrow, aka government saving. this increases the supply of loanable funds available to fund investment.

by contrast, a budget debt means that the government is spending more than it takes in, reducing the supply of loanable funds available to businesses because the government must borrow to fund its deficit

essentially, surplus = saving = lower real interest rates = incr in supply of loanable funds

deficit = dissaving = higher real interest rates = decr in supply of loanable funds

government saving

saving by the government

crowding out

decline in private investment due to a larger budget deficit. arises because government borrowing leads to higher real interest rates which effectively crowds out some of the firms looking for loans to fund their own investments

supply of loanable funds shifter: foreign saving shifts due to global shocks

foreign saving lent to domestic companies shifts the supply of loanable funds to the right and can push down neutral real interest rate

the opposite shifts it to the left

foreign saving/net financial inflos

funding that comes from foreigners lending money to a nation’s people

shifts in the demand for loanable funds

any factor that shifts the investment line will shift the demand for loanable funds will shift. demand for loanable funds will increase and shift to the right in response to

technological advances incr productivity

expectations of stronger future profits

corporate tax cuts that mean businesses keep more of their profits

easier lending standards that allow more businesses to qualify for a loan (alternatively if businesses have larger cash reserves they won’t need a loan to fund their investments)

an increase in investment shifts the demand for loanable funds to the right leading to a higher real interest rate ( and a decrease in demand → left shift → lower real interest rate)

secular staganation

the recent decline of the neutral real interest rate

how does nominal interest rate affect saving and investment

saving and investment only respond to the real interest rate. a change in nominal interest rate has no impact on the supply or demand for loanable funds