Chapter 14: Short-term finance and investments

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

What are the main types of short-term financing?

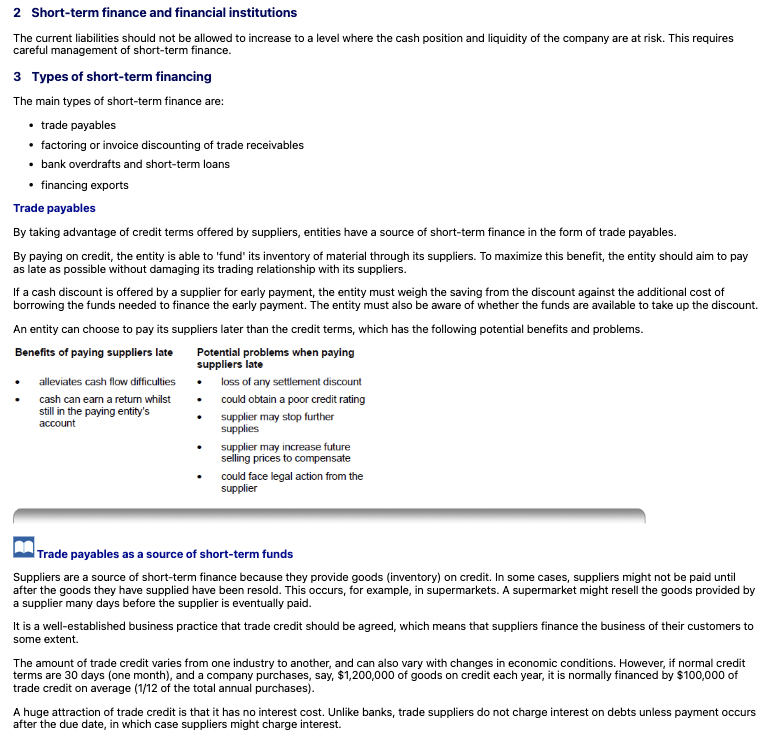

What are the benefits and potential problems of paying suppliers late?

Why are trade payables considered a source of short-term finance?

How does trade credit function in practice as short-term financing?

What are the two ways receivables can be used as a source of short-term finance?

What are the three services typically provided by a factoring company?

What are the benefits of factoring for a business?

What is invoice discounting and how does it differ from factoring?

Why might new businesses prefer invoice discounting over factoring?

What is a financial institution and what services does it provide?

What short-term finance options do financial institutions offer?

What are the two main types of short-term borrowing from banks?

What are the advantages and disadvantages of bank overdrafts?

What is a bank loan and how does it differ from an overdraft?

What are some methods of financing exports and managing export credit risk?

What is a documentary credit (irrevocable letter of credit) and what problem does it solve?

What is a bill of exchange and when is it used?

What are the two types of bills of exchange?

What is meant by discounting a bill of exchange?

What are the key features of bills of exchange?

What is export factoring and how does it work?

Instrument | What It Is | Simple Example |

|---|---|---|

Bank Notes | Physical currency (like £10 or £50 notes) | You give someone a £20 note — they can now spend it or pass it on |

Bearer Bonds | Bonds with no registered owner; the holder receives the interest + value | You buy a £1,000 bearer bond and hand it to your friend — they can now claim the payment |

Certificates of Deposit (CDs) | Time deposits issued by banks that earn interest and can be sold to others | A business buys a 6-month CD, then sells it to another business before it matures |

Bills of Exchange | Written promises to pay a specific amount at a future date | An exporter sells goods with a bill of exchange for £50,000 due in 90 days, then sells the bill to a bank for early cash |

Treasury Bills (T-Bills) | Short-term government debt sold at a discount | An investor buys a £10,000 T-bill for £9,800 and can sell it to someone else before it matures |

What is forfaiting and how does it differ from export factoring?

What are key features of forfaiting?

Why do businesses make short-term investments?

What are examples of short-term investment options for surplus cash?

What criteria should a business consider for short-term investments?

What should a business consider before investing surplus cash?

What is maturity in the context of short-term investments and why is it important?

What does return refer to in short-term investing?

What risks are associated with short-term investments?

Why are equities generally unsuitable for short-term investments?

What is liquidity and why does it matter for short-term investments?

Why is diversification important in short-term investments?

What are the two main categories of interest-bearing accounts?

What are the features of instant access bank deposit accounts?

What limitations might apply to savings accounts that allow early withdrawal?

What are money market deposits?

Why is timing important for money market deposits?

How is interest earned on a deposit or savings account calculated?

What are the day count conventions for interest calculations?

What is a negotiable instrument?

Give examples of negotiable instruments used for short-term investment.

What is a Certificate of Deposit (CD)?

What options does an investor have with a CD before maturity?

Why are CDs considered more attractive than money market deposits?

What makes bills of exchange attractive short-term investments?

How are bills of exchange typically purchased and why?

What determines the yield on a bill of exchange?

What are Treasury bills and why are they popular short-term investments?

How are Treasury bills priced and redeemed?

📘 Negotiable Instruments — Summary Table with Examples

Instrument | What It Is | Practical Example (in context) |

|---|---|---|

Bank Notes | Physical cash. Legally, whoever holds it owns it and can use it for transactions. | You hand someone a £20 note — they can immediately spend or deposit it. Ownership transfers without a record. |

Bearer Bonds | A bond with no registered owner — whoever holds it is entitled to the interest and repayment. | You buy a £1,000 bearer bond and give it to your friend. They now receive the future interest and repayment. |

Certificate of Deposit (CD) | A fixed-term deposit with a bank that earns interest. Can be sold to others before maturity. | A business invests £100,000 in a 6-month CD at 4% interest, then sells it to another investor after 3 months. |

Bill of Exchange | A written promise to pay a set amount on a future date. Can be sold or discounted early. | An exporter sells £50,000 of goods and the buyer accepts a 90-day bill. The exporter sells it to a bank for £48,500. |

Treasury Bill (T-Bill) | Short-term government debt sold at a discount, redeemed at full value. | An investor buys a T-bill for £9,800 and receives £10,000 at maturity in 91 days. Can sell it earlier if needed. |

Commercial Paper | Short-term, unsecured corporate debt, issued at a discount, and negotiable. | A large firm issues £1M of commercial paper at a discount to raise quick funds, repaying full value in 60 days. |

🧾 What is a Certificate of Deposit?

A Certificate of Deposit (CD) is a fixed-term savings product offered by banks. When you buy a CD, you're locking your money in with the bank for a set period in exchange for interest.

🔒 Think of it like:

You give the bank money, promise not to touch it, and they promise to give it back later with interest.

🎯 Key Features

Feature | What it means |

|---|---|

Fixed term | You agree to leave the money for a set time (e.g. 3 months, 6 months, 1 year) |

Fixed return | You know upfront how much interest you’ll earn |

Low risk | Very safe — often insured or backed by strong banks |

Limited access | Usually can’t withdraw early without a penalty or selling the CD to someone else |

💼 Example: How It Works

A company has £100,000 it won’t need for the next 6 months.

The bank offers a 6-month CD at 4% annual interest.

The company buys the CD.

🔢 Interest Calculation: Interest=£100,000×0.04×612=£2,000\text{Interest} = £100,000 × 0.04 × \frac{6}{12} = £2,000Interest=£100,000×0.04×126=£2,000

So, after 6 months, the company receives:

£100,000 principal

£2,000 interest

🔄 Selling a CD Early

If the company needs the money before 6 months, they usually can’t withdraw early, but they can sell the CD to someone else.

That’s why some CDs are called negotiable certificates of deposit (NCDs) — they can be sold on the secondary market.

❓ Why Do Banks Offer CDs?

Banks borrow your money through the CD.

They use it to make loans or investments at a higher rate.

You get a guaranteed return, they get funds to work with — win-win.

✅ Summary (in plain English):

A Certificate of Deposit is a safe way to earn fixed interest on money you won’t need for a while.

It’s not for people who need quick access, but it’s great for predictable returns.

What are the benefits of investing in short-dated government bonds?

How do market interest rates affect bond prices?

What are examples of other short-term investments besides those already discussed?

Why are corporate bonds generally unsuitable for short-term cash surplus investments?

What is commercial paper (CP)?

Why is commercial paper not usually suitable for short-term investments by trading entities?

Corporate Bonds What are they?

Corporate bonds are long-term debt instruments issued by companies to raise finance. Investors lend money in return for regular interest payments (coupons) and repayment of the principal at maturity.

Key Features:

Maturity: typically 5–30 years

Pays fixed or floating interest

Tradable in bond markets

Credit-rated (e.g. AAA, BBB)

Repayment of principal at maturity

Pros for Companies:

Raises capital without giving up ownership

Interest payments are often tax-deductible

Pros for Investors:

Predictable income

Priority over shareholders if the company fails

Cons:

Fixed cost regardless of performance

May affect credit rating if overused

Commercial Paper What is it?

Commercial paper is a short-term, unsecured debt instrument issued by large, creditworthy companies to fund short-term needs like payroll or inventory.

Key Features:

Maturity: up to 1 year (usually 30–90 days)

Issued at a discount, repaid at face value

No interest payments — return is the difference between issue price and face value

Not usually traded — held to maturity

Only available to strong, reputable companies

Pros for Companies:

Cheaper and quicker than bank loans

No collateral required

Pros for Investors:

Higher return than Treasury bills

Short-term and relatively safe (if issuer is highly rated)

Cons:

Not available to smaller or riskier companies

Not suitable for long-term funding

📄 Example: Commercial Paper in Practice Company:

TechPro Ltd – a large, credit-rated technology manufacturer.

Situation:

TechPro needs £20 million to buy raw materials and pay suppliers over the next 60 days while waiting for customer payments.

Instead of taking out a short-term bank loan (which involves paperwork, fees, and higher interest), TechPro chooses to issue commercial paper.

How it works:

Issue amount (face value): £20,000,000

Term: 60 days

Discount rate: 4.5% annualised

Day count basis: 360 days

Step 1: Calculate Issue Price Discount=£20,000,000×0.045×60360=£150,000\text{Discount} = £20,000,000 \times 0.045 \times \frac{60}{360} = £150,000 Discount=£20,000,000×0.045×36060=£150,000 Issue price=£20,000,000−£150,000=£19,850,000\text{Issue price} = £20,000,000 - £150,000 = £19,850,000 Issue price=£20,000,000−£150,000=£19,850,000

So, investors buy the commercial paper today for £19.85 million.

Step 2: At maturity (in 60 days)

TechPro repays the full face value of £20 million to investors.

Investors earn £150,000 as profit (the difference between what they paid and what they receive).

Why this works:

TechPro gets cash immediately without giving up control or assets.

Investors get a low-risk return in a short time.

TechPro’s strong credit rating gives investors confidence the company will repay on time.