4.2 - Export subsidies in high tech industries

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

Are high tech industries concentrated

Often highly concentrated

mono/oli gopoly → high markups

High entry costs protects firms from new entrants

large amount of K needed to become competitive - scope for sub

Subsidy doesn’t make sense in perfect comp - other incentives used

High tech industries & Govt subsidies

Receieve substantial subsidies

HTI are K intensive

Need large amount of capital up front to invest

Govt needs to subsidies or many firms wont

Sub reduces costs → firms more competitive → displace foreign comp

US / Europe HTI example and how sub given

Aircraft industry

US sub - low interest loans from Govt agency

EU sub - given direct to firm

UK sub - Freeports (give tax relief - sub as HTI use these areas intensively)

Why do Govt want HTI

Possible spillover benefits + other positive externalities

knowledge diffusion → productivity gains

Subsidy = production increase = externalities increase + competitiveness UP → profits UP

If profits > sub then net gain

Strategic use of sub

Govt plays game to attract HTI and encourage them to relocate to H

BUT if everyone subsidises then no net gain for anyone

all lose cost of sub - INEFFICIENT

Boeing vs Airbus example - Assumptions

Imperfect comp

2 firms (duopoly) - Both firms profitable

Each firm has 2 options - produce or nor produce

compete for sales (ignore dom sales - no CS)

Welfare only dependent on profits from sales to RoW + cost of sub

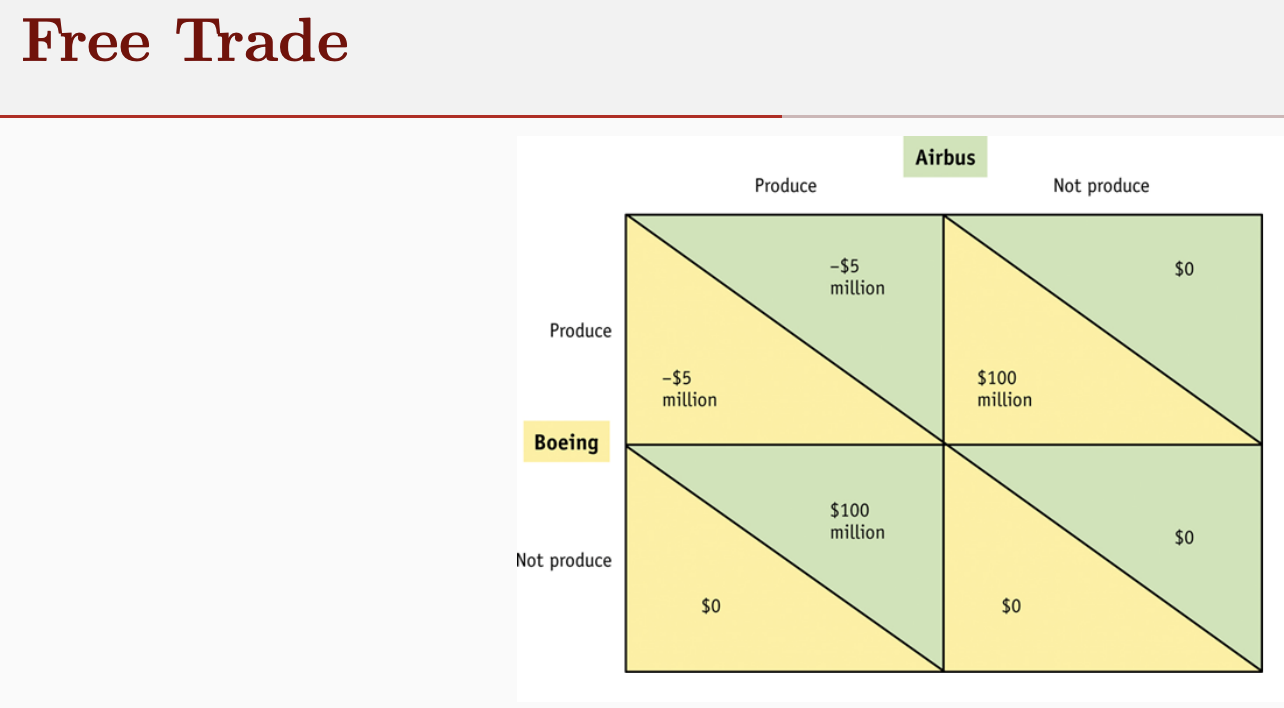

Boeing vs Airbus example - FT

Symmetrical payoffs

Best response when 1 firm produces is to not produce

1st mover advantage key

NE is when 1 firm produces and the other doesnt

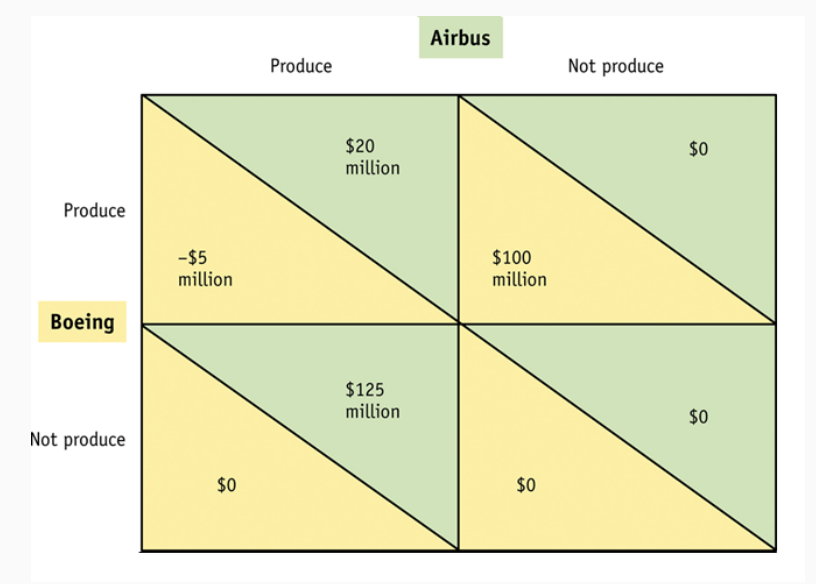

Boeing vs Airbus example - Subsidy to Airbus

Govt might want to change equilibrium so firm makes positive profits even if other 1st producer (subsidies)

EU provides $25m sub if Airbus produces

hoping spillovers > $25m (profit 125-25 sub = 100m)

New Best Response for Airbus is to produce even if B produces

BR for B is to not produce

New NE is A produces but B not producing - shifted equilibrium

Boeing vs Airbus example - Subsidy to B

US may respond with own sub to incentivise production

identical $25m sub

New NE when both produce

A&B get $20m profit BUT sub cost = $25m

Net welfare = -$5m for both EU & US (INEFFICIENT)

transfers losses from firms → Govt (nationalises losses)

Are subsidy wars inefficient

Yes

This supports WTO strategy of fighting X subsidies

allows tariffs on F firms who sub to discourage subsidies

Nations may keep increasing sub to incentivise firm to stay

fight for highest sub = welfare keeps falling + inefficiency growing

hard to compute losses in reality though