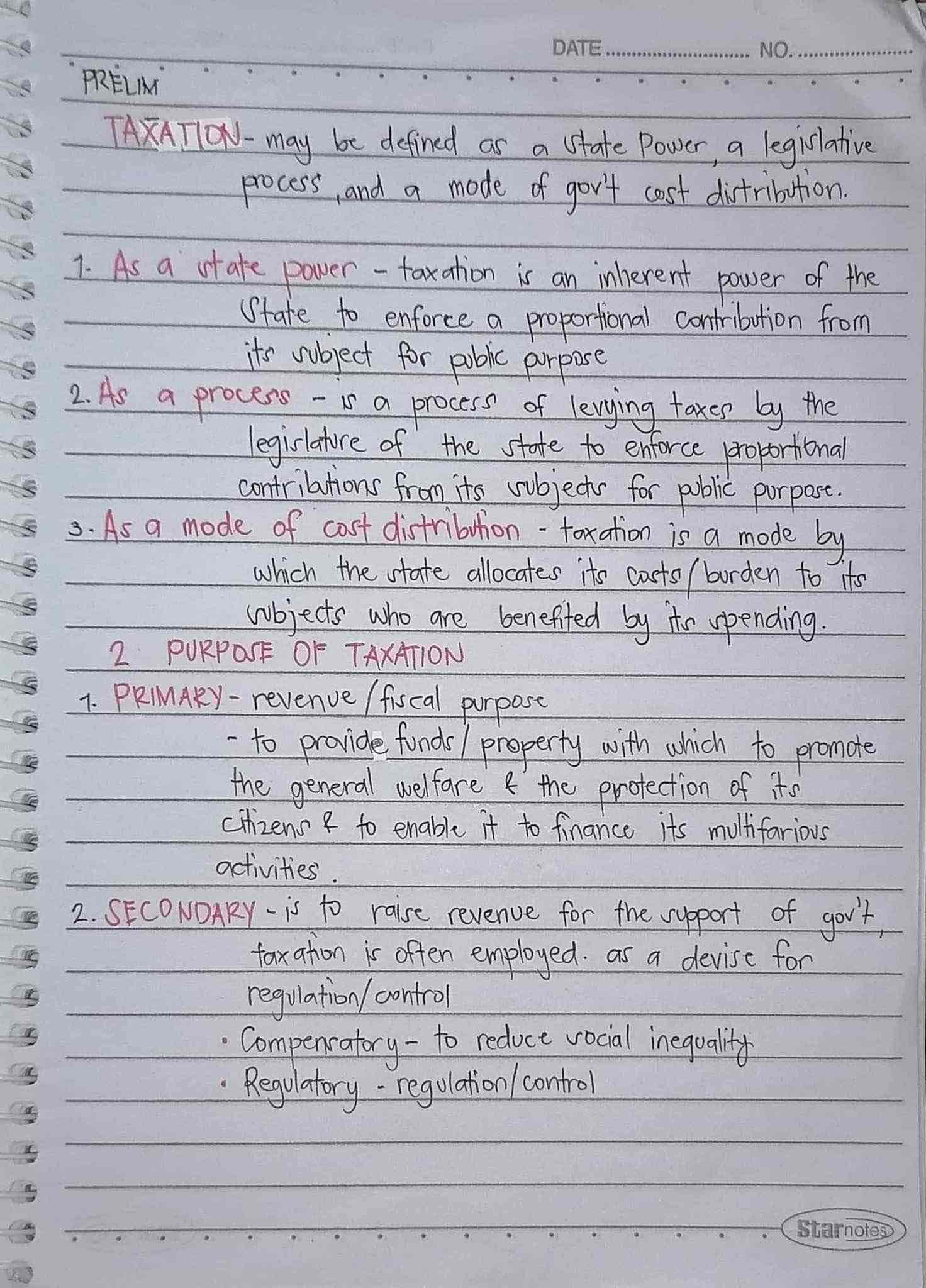

TAXATION- may be defined as a state Power, a legilative process, and a mode of gor't cost distribution. As a utate power - taxation is an inherent power of the State to enforce a proportional contribution from its vubject for public purpose the state to enforce proportional contrations from its vubjeds for pablic purpase. 3. As a mode of cost distribution - taxation is a mode by which the state allocates its casts burden to its wubjects who are benefited by tir upending. 2 PURPOSE OF TAXATION 1- PRIMAR) - revenue fiscal purpose - to provide tunds property with which to promote the general welfare & the protection of tr citizens & to enable it to finance its multifarious activities. 2. SECONDARY - is To raire revenue for the upport of gor't taxation is often employed. as a devise for regulation/ control • Compenratory - to reduce vocial inequality • Regulatory - regulation control

0.0(0)

Card Sorting

1/5

There's no tags or description

Looks like no tags are added yet.

Last updated 1:41 PM on 9/18/24

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

6 Terms

1

New cards

2

New cards

3

New cards

4

New cards

5

New cards

6

New cards