3.3.2 - investment appraisals

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

13 Terms

What is investment appraisal?

Investment appraisal is the process of assessing the financial viability of an investment project using quantitative methods (such as payback period, ARR, and NPV) to judge whether the project is worth undertaking.

What is the planning process in investment appraisal?

The planning process in investment appraisal involves identifying, analysing, and evaluating potential investment projects before a business commits money. It includes:

Setting objectives (what the investment aims to achieve)

Identifying possible investment options

Estimating costs and expected returns

Forecasting cash flows

Applying appraisal methods (payback, ARR, NPV)

Comparing alternatives

Assessing risks and uncertainties

Making a final decision based on financial viability and strategic fit

What is the payback method in investment appraisal?

The payback method measures how long it takes for an investment to recover its initial cost from the net cash inflows it generates. It focuses on speed of return and helps businesses assess how quickly they can get their money back.

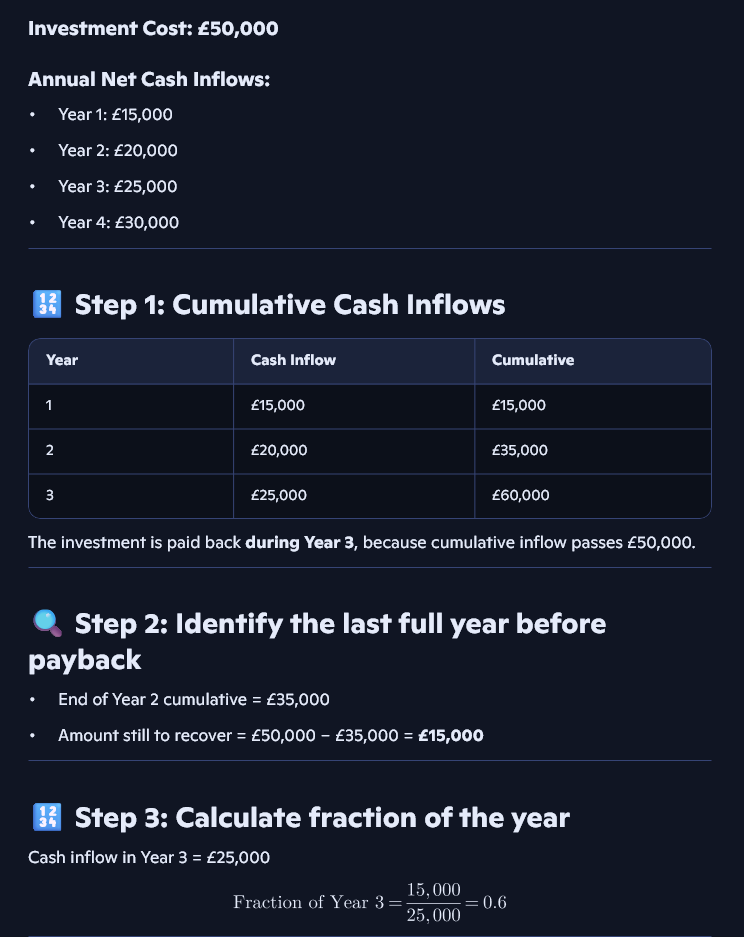

How do you calculate the payback period?

List the annual net cash inflows from the investment.

Add the cash inflows cumulatively until the total equals (or exceeds) the initial investment.

Identify the last full year before payback is reached.

Use the formula to calculate the remaining fraction of the year:

\mathrm{Fraction\ of\ year}=\frac{\mathrm{Amount\ still\ to\ recover}}{\mathrm{Cash\ inflow\ in\ the\ next\ year}}

Payback period = Full years + Fraction of year

simple payback

cost of inital investment / average yearly net cash flow

what is ARR

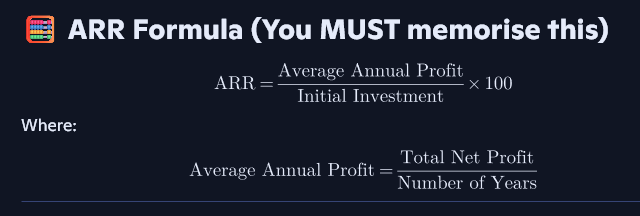

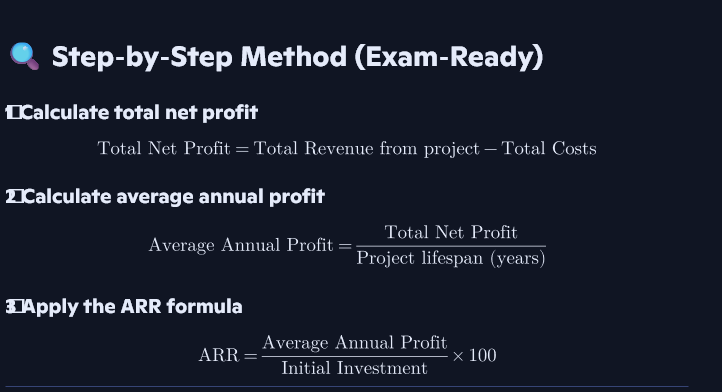

ARR measures the average annual profit a project makes as a percentage of the initial investment.

It’s used in investment appraisal to compare different projects.

forumla for ARR

ARR method

worked example

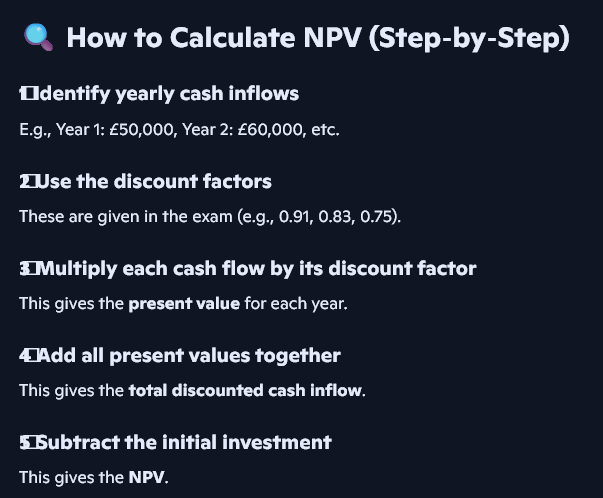

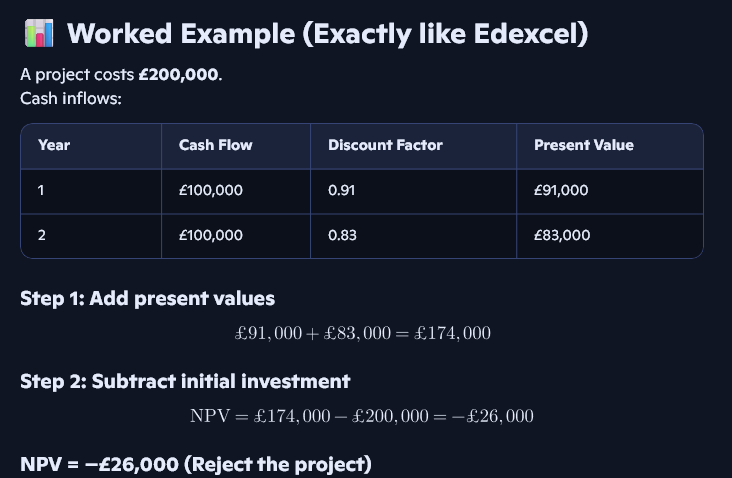

NPV

Net profit value - measures the total return on an investment after disocunting future cashflows

how to calculate

worked example

limitations of investment appraisals

payback limitation - very simple, only looks at the speed of payback and does not look at profitability

ARR limitations - does not take into account the effects of time on the value of money

NPV limitations - very complicated, not used by small businesses, also results depend on the rate of discount used; the higher the rate, the more likely it is that the project will be rejected as unprofitable