Theme 1-Market failure & Government intervention

1/52

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

53 Terms

What is the basic economic problem?

infinite wants,finite resources therefore choices must be made

what questions concerning allocation of resources arise from this problem?

What to produce

How to produce

For whom to produce

technical efficiency

concerned with maximising outputs for a given set of inputs

productive efficiency

concerns minimising costs for given outputs

Allocative efficiency

measures whether resources allocated to those goods and services demanded by consumers

How does markets allocate resources efficiently

prices send signals to producers and consumers about society’s needs and wants and the relative scarcity of inputs

three functions of the price mechanism in the efficient allocation of resources

Rationing

Signaling

Incentive

Best allocation of resources is achieved when…

benefits to consumers=costs of producers

Market failure

occurs when the price mechanism causes an inefficient allocation of resources,leading to a net welfare loss.Consequently,resources are not allocated to their best or optimum use.

Allocative inefficiency may occur when a good may be:

overproduced and over-consumed because the market price is too low

under-produced and under-consumed because the market price is too high

partial market failure

occurs when the market exists,but it produces either the wrong quantity of a product or at the wrong price,leading to overproduction or underproduction

complete market failure

occurs when the market simply does not exist,leading to no production of a good or service

Types of market failure

Externalities

Public goods

Information gaps

Externalities

where the markets fail to bring the best result for society as a whole.An externality is a cost or benefit that is imposed onto a third party that is not priced into the final cost or benefit of a good

for example- A factory that pollutes the environment creates cost to society,but those costs are not priced into the final good it produces

public goods

there are goods such as lighthouses that cannot be provided by a free market as there is no obvious way in which a private firm could charge all users or indeed would want to provide the goods at all as there is little to no profit incentive in their provision.’free rider problem’

information gaps

where buyers or sellers have imperfect information about a product. In order for markets to allocate resources effectively and efficiently,it is important that the economic agents have a good information about the markets in order to make rational decisions

Example of a market failure in real life

Financial crisis 2008:

excessive risks taken by too big to fail banks

assumed no macroeconomic consequences e.g externalities

Section 1: Externalities

costs or benefits that are external to an exchange.They are third party effects,ignored by the price mechanism

exists where the market fails to bring the best result for society as a whole

Private cost (PC)

the cost of an activity to an individual economic unit such as consumers or a firm

Social cost (SC)

cost of an activity not just to the individual economic unit that creates the cost,but to the rest of society as well.

Negative externality

occurs when SC>PC

positive externality

happens if the value or benefit to society (SOCIAL BENEFIT) exceeds the benefit to the private individual economic unit that created it (PRIVATE BENEFIT)

free market will not lead to optimumallocation of resources if..

the full cost or benefit is not reflected in the market due to externalities

why is there a makert failure if a producer does not pay the full cost of what is produced

too much of that good may be produced and there is a market failure because the free market lead to over-production of goods with negative externalities.

Third parties

individuals,organisations,property owner or resources that is indirectly affected

Negative production externalities

is said to esxist when a thrid party is adversely affected as a result of a firms production decisions.

e.g coal fired power station will incur private costs of raw materials ,wages etc but will also impose external costs on third parties such as the visual impact of an ugly building,poor air quality affecting the health of nearby residents etc.

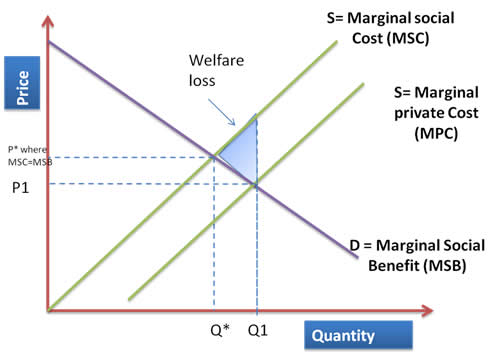

diagrammatic (marginal) analysis of negative production externalities - 2 supply curves

S1 or Sfirm accounts only for the firms internal or private (financial) costs which is refers to as marginal private cost

S2(above S1) or Strue takes into account the additional costs to society which is referred to as marginal social cost

marginal private cost (MPC)

the cost to the firm of producing an additional unit of output

marginal social cost (MSC)

MPC+MEC(marginal external cost)

what happens to MEC-the cost to third parties of producing one more unit of output at higher levels of output?

it will be higher (e.g the impact on the environment of burning an extra litre of diesel in an already polluted area is greater than if that area were free from pollution) the msc curve will diverge from the mpc curve and the gap (MEC) will get bigger

negative externalities graph

positive consumption externalities

exists when the benefit to society of an economic transaction are greater than the individual consumer of the good or service,so there are additional benefits to third parties.

positive consumption ecternality benefits

private (PB)

external(EB)

social(SB)

private benefit

benefits to individual/firm directly involved in the transaction (e.g the higher future earnings potential as a result of higher education)

external benefits

benefits to third parties not direclty involved with the production/consumption decision (e.g the higher tax revenues collected from higher earning graduates and the lower crime rates too. )

social benefits

the total benefits to society of a particular decision, i.e private and external (so SB=PB+EB) if SB>PB then a positive consumption externality is said to exist

case study-vaccination

external benefits

reduced treatment cost for nhs

fewer days lost to sickness

higher tax revenues due to longer working life

herd immunity people who are unable to be vaccinated or dont respond to it face lower risk of contracting

diagramatic (marginal) analysis of positive consumption externalities 2 demand curves:

D1 or Dcons only accounts for the individuals assessment of private benefits which is more technically referred to as marginal private benefit

D2(above D1) or Dtrue which takes into account additional benefits to society which is referred to as marginal social benefit

marginal private benefit

the benefit to the individual of consuming an additional unit

marginal social benefit

MPB+MEB(marginal external benefits)

positive consumption externality graph

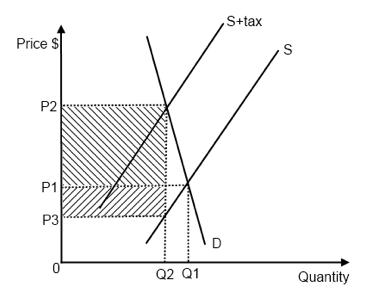

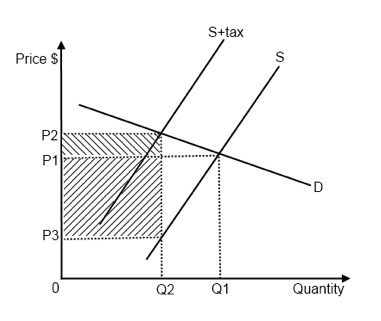

Indirect taxation

also known as an expenditure or sales tax is imposed on producers by the government so consumers pay indirectly

two types of indirect taxation

specific or unit tax

ad valorem tax

specific or unit tax

tax levied on volume e.g excise duties.The amount of tax levied does not change with the value of the goods nut with the amount or volume of the goods purchased e.g excise duties on alcohol,tobacco,petrol

ad valorem tax

a tax levied as a percentage of the value of the good.Most goods have a 20% VAT charge.NB some goods such as petrol carry both specific and ad valorem taxes

how does indirect tax effect externalities

it internalises the externality e.g raise the price ans reduce output of the good to achieve the social optimum by making the consumer and producer take account of the external costs and benefits through their pocket

the incidence of tax

refers to how the burden of tax is distributed between firms and consumers the incidence

arguement in favour of using indirect tax

internalises negative externalities ( polluter pays)

tax revenue from e.g tobacco sales could be hypothecated (ear marked or ring fenced) e.g school education programmes on health risk of smoking

can be targeted at a specific problem

essential goods and services could lower rates or be exempted

tax evasion on indirect tax harder than direct tax where individuals may self assess

arguements against using indirect tax

regressive-falls hardest on low income earners

loss of consumer surplus

if too high it makes the uk internationally uncompetitive e.g petrol/diesel

blunt instument e.g responsible drinkers as well as problem drinkers pay the same

ineffective in reducing goods that are highly inelastic PED e.g cigarettes and alcohol