Unit 6: Fiscal and Monetary Policy

1/78

Earn XP

Description and Tags

Merged flashcards from several presentations of Unit 6 in an Economics class.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

79 Terms

AD-AS model

A model that helps visualize the entire economy’s behavior and effects of potential governmental intervention based on aggregate demand and aggregate supply in an economy

Where the two curves meet determine real GDP, average price levels, and current business cycle status

Aggregate demand (AD)

The total amount of spending on goods and services in the entire economy

Fiscal policy

Policies developed by a government relating to taxes and spending

Monetary policy

Policies developed by a government relating to interest rates and the money supply

Aggregate supply (AS)

The aggregate quantity of output supplied to the economy, modeled through a curve showing its relationship to the aggregate price level

Short-run aggregate supply (SRAS)

An upward-sloping curve showing output changes with price levels in the short run

Short-run aggregate supply shifts (SRAS shifts)

Created by input costs, technology, productivity, and supply shocks relating to a company’s total production of supply

Long-run aggregate supply (LRAS)

A vertical line representing the economy’s maximum total potential output, fixed by long-term factors like labor, capital, and technology and not price levels

Long-run equilibrium

The state where the economy’s aggregate demand, short-run aggreate supply, and long-run aggregate supply curves all intersect at a single point — indicating that the economy is at maximum potential and demand is being adequately fulfilled

Potential output

Full employment and output where AD, SRAS, and LRAS all intersect

Output gap

Any difference between actual aggregate output and potential output

Recessionary gap

Occurs when aggregate output falls below potential output

Inflationary gap

Occurs when aggregate output rises above potential output

Taxes

How federal, state, and local governments primarily raise money to pay for schools, roads, and national programs

Raises or lowers aggregate demand as part of the government’s fiscal policy for cooling or growth

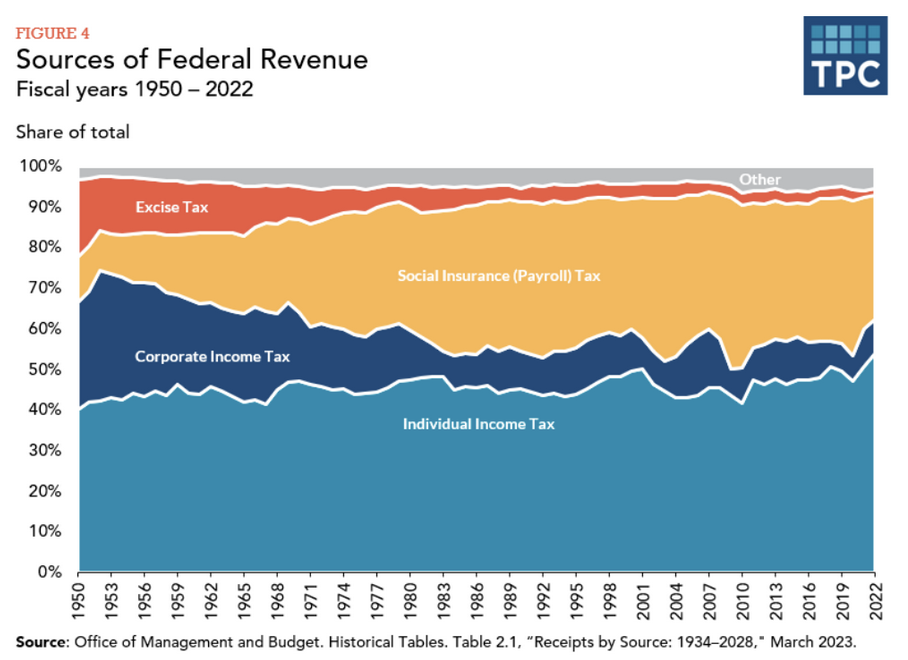

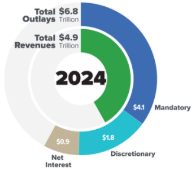

Government revenue

Money the government receives from taxes and other sources

About 84% of this comes from individual income taxes and payroll taxes for Social Security and Medicare

About 11% of this comes from corporate income taxes

The remaining 5% comes from excise taxes, tariffs, fees, and other sources

Congress

The body of government given the power to “lay and collect taxes” according to Article I, Section 8 of the Constitution for:

The payment of debt

The common defense

General welfare

Cannot levy taxes on religious services, exports, or polls, as they were used to restrict voting in the past

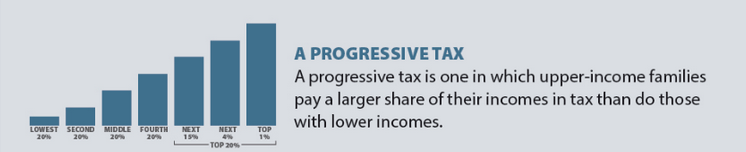

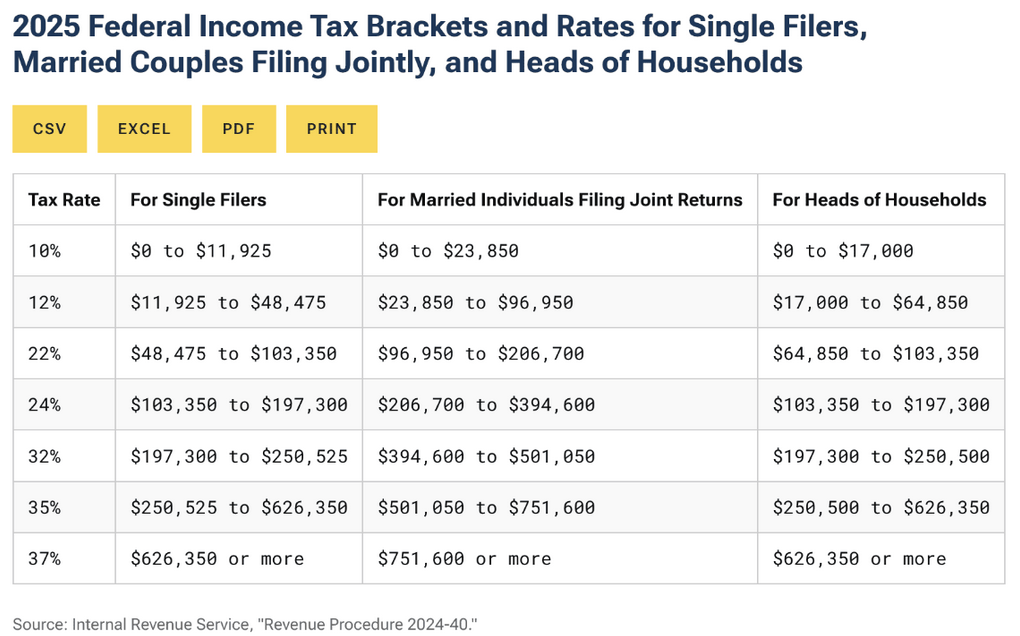

Progressive tax

A tax structure that makes a person’s effective tax rate rise with their income level, as seen in the federal income tax

Serves as an automatic stabilizer to reduce tax burdens on the low income while increasing taxes on the higher income

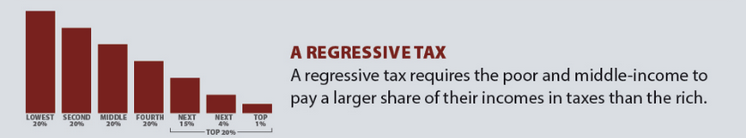

Regressive tax

A tax structure that makes a person’s effective tax rate fall with their income level, as seen in sales taxes

Higher income households spend a lower portion of their incomes on taxable goods and services

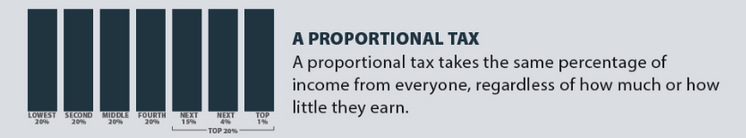

Proportional tax

A tax structure that makes a person’s tax rate the same across all income levels with minimal deductions or exemptions

Tax base

The income, property, good, or service that is subject to a tax; seen in the forms of personal earnings, company profits, real estate, and goods and services sold

Pay as you earn

A tax collection system where money is withheld from a paycheck throughout the year by employers to avoid a large tax bill during filing season

Taxable income

The income one earns (minus exemptions and deductions) that can be taxed

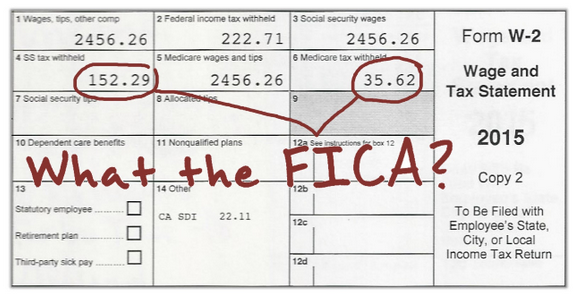

Federal Insurance Contributions Act (FICA)

Act that funds Social Security and Medicare through payroll withholdings and employer contributions

Corporate income tax

A progressive tax paid on corporate profits

Excise tax

A regressive tax on specific items, such as gasoline, cigarettes, and alcohol

Estate tax

A tax on the total value of an estate that changes year-by-year

In 2025, this applied to any estate worth over $13.99 million

Tariffs

Taxes on imported goods

Once one of the most important sources of federal revenue; today, they represent just a tiny share

Intended to protect American industries with better trade deals, lowered trade deficits, and increased government revenue

State revenue

Mostly in the form of:

Personal income taxes

Sales taxes

Excise taxes

Corporate income taxes

Charges (university tuition, tolls, park fees)

Federal funds (for healthcare and low-income programs; one-third of total revenue in many)

Funds are often passed on to lower levels

Local revenue

Revenue that goes to counties, cities, towns, and school and special districts for schools, emergency services, libraries, parks, and utilities in the form of:

Property taxes (largest contributor)

Sales taxes

Income taxes

Fees for utilities, land, and public resources

Intergovernmental transfers

Grant

A portion of money set aside to another entity for a designated program

The federal government offers these to states and localities for healthcare, income support, transportation, and education

Fiscal policy

Policies the government adopts to speed up or slow down economic growth for stable aggregate supply and aggregate demand

Government revenue

Funds that flow into the government from personal income, social insurance, and corporate profit taxes

Education and defense

The largest purchases of the United States using tax revenue

Medicare and Social Security

The largest transfers of the United States using tax revenue

GDP

The sum total of net exports, consumer spending, government spending, and investment spending

Government spending

Spending performed by the government as it purchases goods and services

Consumer spending

Spending performed by consumers

Can be influenced by the government through effects on disposable income with taxes and government transfers

Expansionary fiscal policy

Fiscal policy that increases aggregate demand, decreasing a recessionary gap to shift aggregate demand rightward for a restoration to LRAS

Seen through:

Increasing government spending

Reducing taxes

Increasing government transfers

These all indirectly boost consumer, investment, and government spending

Contractionary fiscal policy

Fiscal policy that reduces aggregate demand, decreasing an inflationary gap to shift aggregate demand leftward for a restoration to LRAS

Seen through:

Reducing government spending

Increasing taxes

Reducing government transfers

These all indirectly lower consumer, investment, and government spending

Discretionary fiscal policy

Fiscal policy that is the result of deliberate actions by policy makers, which can modify taxes or legislation to shift AD to the left or the right

Often used sparingly due to the problems associated with time lags

Time lag

The time between an incident and the adoption of discretionary fiscal policy, caused by:

Delays in the realization of an output gap

The time used to agree on an expansionary or contractionary plan

The time taken to adjust its spending

This can result in a significant delay, potentially even long enough for a market self-correction

Automatic stabilizers

Government spending and taxation rules that cause fiscal policy to be automatically expansionary or contractionary when the economy contracts or expands

Progressive tax policies are an example of this, where lowered tax rates and aid programs apply to the lower income

These can allow for aggregate demand to shift according to this increased or reduced spending

Classical economics

School of thought based on the idea that free markets regulate themselves

Believes that struggling economies can recover on their own

Does not account for the time needed to return to equilibrium

Challenged by the Great Depression with inadequate self-regulation, high unemployment, and immense bank failures

Keynesian economics

School of thought that uses demand-side theory as the basis for encouraging governmental action to help the economy

Developed by John Maynard Keynes, focusing on the economy as a whole with governmental responsibility to boost demand

Drastically changed the role of government in the United States’ free enterprise system, used to fight periods of recession and inflation for full productive economic capacity

John Maynard Keynes

British economist that developed Keynesian economics, promoting more governmental intervention

Multiplier effect

A concept in Keynesian economics that refers to the idea that every one-dollar change in fiscal policy creates a change greater than one dollar in the national income, multiplying the effects of changes in fiscal policy

Spending multiplier

Aspect of the mutiplier effect that demonstrates how governmental purchases of goods and services boost GDP both directly and indirectly

Seen through defense spending with contractors spending money that flows throughout the economy

Supply-side economics

School of thought based on the idea that the supply of goods drives the economy

Taxes thus have a strong negative effect on economic output

Laffer Curve

A graph that illustrates the effects of taxes on revenue, demonstrating how a moderate optimal tax rate can produce more revenue than a lower or higher tax

Budget gap

Occurs when the government spends more or less than it earns in the budget

Budget surplus

Occurs in any year when revenues exceed expenditures, with more money going into the Treasury than coming out of it

Budget deficit

Occurs in any year when expenses exceed expenditures, with more money coming out of the Treasury than going into it

Often a common characteristic of the economy in recent decades

Can be dealt with through money creation for small amounts and debt through bonds for larger amounts

Savings bond

A bond that allows people to loan the government small amounts of money, and in return, they earn interest on the bonds for up to 30 years

Treasury bills

Short-term bonds that have maturity dates of 26 weeks or less

Treasury notes

Bonds that have maturity dates of 2 to 10 years

Treasury bonds

Bonds that have maturity dates of 30 years after issue

National debt

The total amount of money the federal government owes to bondholders

Increases every year there is a budget deficit and the federal government borrows money to cover it

Best viewed as a percentage of GDP over time due to the large amount

Concerns have been raised over the goverment’s large interest payments and foreign involvement

National deficit

The amount of money the government borrows for one fiscal year

Crowding-out effect

Occurs with a higher national debt and reduced funds available for businesses as funds are used to pay for interest

Crowds out private firms that would have borrowed these funds for investment spending, potentially reducing economic growth

Gramm-Rudman-Hollings Act (1985)

An act that created automatic across-the-board cuts in expenditures if the deficit exceeded a certain amount

While it did exempt many programs, the Supreme Court ruled that some parts of the Act were unconstitutional

Further revisions led to a shifted focus towards spending control, not significantly reducing the national debt

Monetary policy

The actions of the Federal Reserve to manage the money supply and credit conditions to achieve sustainable economic growth

This affects interest rates (the cost of borrowing money), which in turn can affect the level of spending and investment in the economy

Must be carefully timed and planned for steady and sustainable pacing

Dual Mandate

The two duties of the Federal Reserve to promote maximum employment and price stability

Maximum employment

The highest level of employment that the economy can sustain while maintaining a stable inflation rate (generally considered to be 2%)

Price stability

A low and stable rate of inflation maintained over an extended period of time

Federal Open Market Committee (FOMC)

The group within the Federal Reserve System that conducts monetary policy

5 Reserve Bank Presidents and 7 Governors have voting rights while the rest are simply part of the committee

Meets 8 times a year, 2 days at a time to assess appropriate monetary policy decisions

Their set target rate goes on to affect the market, business, employment, and inflation later on

Reserve balance accounts

Where banks can hold cash at the Federal Reserve

These are used for loans to other banks in a federal funds transaction

Federal funds transaction

The transfer of funds from one bank’s reserve account to another bank’s reserve account

Federal funds rate (FFR)

The interest rate agreed upon in a federal funds transaction between two banks

Set by the Federal Reserve through a target level achieved with open market operations

Helps influence rates in the economy as well as business and consumer decisions

Required reserve

The amount of money banks are required to keep in their deposits

Lowering of this can increase the money supply and aid high unemployment

Raising of this can reduce lending and aid high inflation

Not often adjusted compared to other methods of administering monetary policy

Discount rate

The interest rate the Federal Reserve charges on loans to financial institutions

Primarily used to ensure sufficient funds are available in the economy

Set above the Federal Funds Rate

Prime rate

The rate of interest that banks charge on short-term loans to their best customers

This is affected by the Federal Funds and discount rates

Open market operations

The buying and selling of government securities in order to alter the supply of money through transactions

Is the most important and most often used tool employed by the Federal Reserve to implement monetary policy

Easy money policy

Policy that increases the money supply with lower interest rates to encourage investment spending

Tight money policy

Policy that decreases the money supply with higher interest rates, lowering investment spending to avoid high inflation

Inside lag

The time it takes to identify and implement a policy

More severe for fiscal policy because it includes changes in taxes and spending, as monetary policy does not have to go through Congress and the President

Outside lag

The time it takes for a policy to have an effect

More severe for monetary policy because it primarily affects business investment plans, which may not have a full effect on spending for several years

Keynesian economics

An economic school of thought that emphasizes fiscal policy over monetary policy, smoothing out the business cycle with government spending

Monetarism

An economic school of thought established by Milton Friedman that believes that the money supply is the most important factor in macroeconomics

Classical economics

An economic school of thought that believes in self-correction, recommending against new policies and arguing that governmental intervention disrupts the proper functioning of a free-market economy