theory part of component 4

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

Technical analysis

MP already reflects realistic value, share prices, and indices volumes. look at price movement, basic philosophy

Technical analysis basic assumptions

Market demand is determined by the interaction of supply and demand, which is influenced by many factors. Prices tend to form certain trends and these will continue for a reasonable time. A trend will change due to changes in supply and demand

share price indexes

Dow Jones and co, Wall Street Journal, Dow theory, Dow Jones Industrial Average (DJIA is the share price index)

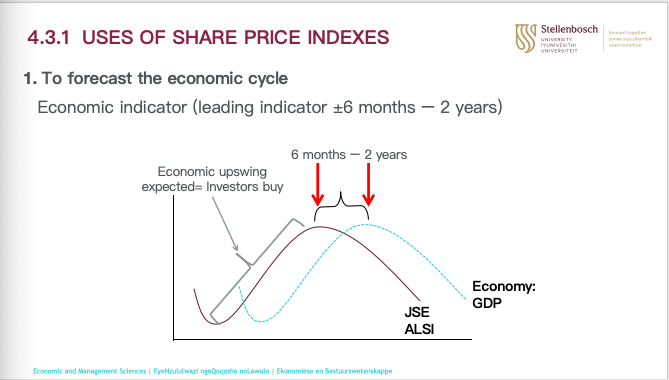

uses of share price indexes: to forecast economic cycle

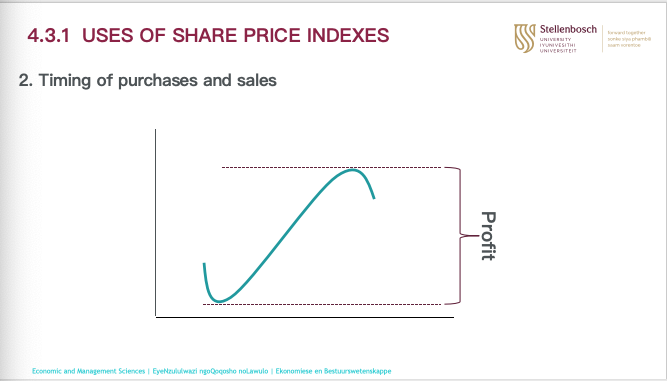

uses of share price indexes: timing of purchase and sales

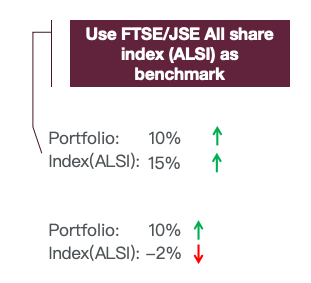

evaluating performance of a portfolio

use of share price indexes: quantifying of risk(Beta anaylsis)

Beta analysis quantifys the sensitivity of a share’s price relative to a sector or general market, higher beta analysis=higher risk

uses of share price indexes: determine speculative activities

By viewing market indexes along with volume and rand value of shares traded, one can determine if activities and movements is purely speculative

THE FTSE/JSE AFRICA INDEX

Financial mail(FM) index- price weighting

Rand daily Mail(RDM)- equal weighting

JSE actuarial index series- market capitalisation

Charts and Technical indicators

focus on past trading activities and price movements to forecast the future. use charts and technical analysis indicators to identfytrends in market and assist with trading activities and timing

DOW-theory

Primary trend

secondary trend

short-term fluctuations

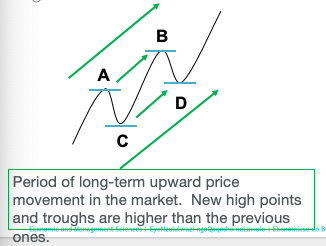

PRIMARY TREND: Long-term trends: bull market

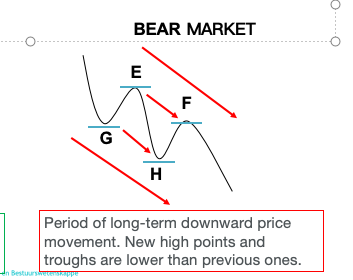

PRIMARY TREND: Long-term trends: Bear market

secondary trend

long-term trend interrupted by periods where price moves in the opposite direction. In a bull market, it is during a reasonable period of price declining, 3 weeks-months and must drop at least a third of the movement

short term fluctuations

study daily fluctuations

Bar Charts

price of share indicated on vertical axis and horizontal axis is time

point and figure chart

assists in analysing price trends, one-dimensional graph, vertical axis price or index value and horizontal axis no value or time dimension. price increase: X, decrease: O

trend lines: Lines that indicate LT price trends

support lines: at the bottom of most formations, if price falls through support line its time to sell and will stabilise at lower level

trend lines: resistance lines

at top of most formations, if price goes above this its time to purchase and will stabilize at higher price

buy and sell signals: 200 day average can be utilised Purchase signals

200 day average flattens or starts rising after decline and daily share price breaks average line in upward movement. if share price is above 200 day line and drops towards average line but does not cross and the starts rising again

buy and sell signals: 200 day average can be utilised sell signals

if 200 day line flattens or declines after a rise and daily share price breaks the average line in downward movement or if share price is below 200 day average and it starts rise towards average line but does not cross and drops again

market breadth

measures direction of overall market: some indices reflect only the price movement of a small number of selected companies, even in market cap indices bigger companies effect the index more that small ones

plot values of cumulative change column together with values of FTSE/JSE ALSI

moving in same direction: strong market

opposite direction: market is weak

Relative strength index(RSI)

momentum indicator, between 0-100, identify buy/sell. RSI value<30=oversold, RSI value>70=overbought. RSI=100-[100/(1+RS)]