mgt 181 - ch 21

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

48 Terms

George and Pat just made an agreement to exchange currencies based on today's exchange rate. Settlement will occur tomorrow. Which one of the following is the exchange rate that applies to this agreement?

spot exchange rate

Mr. Black has agreed to a currency exchange with Mr. White. The parties have agreed to exchange C$12,500 for $10,000 with the exchange occurring 4 months from now. This agreed-upon exchange rate is called the:

forward rate

The condition stating that the interest rate differential between two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate is called:

interest rate parity

Which one of the following states that the current forward rate is an unbiased predictor of the future spot exchange rate?

unbiased forward rates

Which one of the following states that the expected percentage change in the exchange rate between two countries is equal to the difference in the countries' interest rates?

uncovered interest parity

Which one of the following supports the idea that real interest rates are equal across countries?

international Fisher effect

Which one of the following is the risk that a firm faces when it opens a facility in a foreign country, given that the exchange rate between the firm's home country and this foreign country fluctuates over time?

exchange rate risk

The market value of the Blackwell Corporation just declined by 5 percent. Analysts believe this decrease in value was caused by recent legislation passed by Congress. Which type of risk does this illustrate?

political risk

A basic interest rate swap generally involves trading a:

fixed rate for a variable rate

Triangle arbitrage:

I. is a profitable situation involving three separate currency exchange transactions.

II. helps keep the currency market in equilibrium.

III. opportunities can exist in either the spot or the forward market.

Spot trades must be settled:

within two business days

Assume the euro is selling in the spot market for $1.33. Simultaneously, in the 3-month forward market the euro is selling for $1.35. Which one of the following statements correctly describes this situation?

The euro is selling at a premium relative to the dollar

Which one of the following formulas expresses the absolute purchasing power parity relationship between the U.S. dollar and the British pound?

PUK = S0 × PUS

Which of the following conditions are required for absolute purchasing power parity to exist?

I. goods must be identical

II. goods must have equal economic value

III. transaction costs must be zero

IV. there can be no barriers to trade

Absolute purchasing power parity is most apt to exist for which one of the following items?

Silver

Which one of the following formulas correctly describes the relative purchasing power parity relationship?

E(St) = S0 × [1 + (hFC - hUS)]t

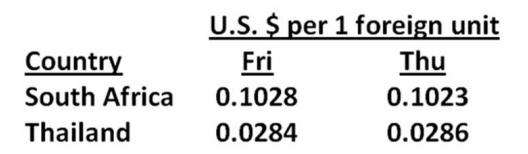

Which one of the following statements is correct given the following exchange rates?

The South African rand appreciated from Thursday to Friday against the U.S. dollar

Which of the following variables used in the covered interest arbitrage formula are correctly defined?

I. RFC: Foreign country nominal risk-free interest rate

III. F1: 360-day forward rate

IV. S0: Current spot rate expressed in units of foreign currency per one U.S. dollar

Interest rate parity:

eliminates covered interest arbitrage opportunities

The interest rate parity approximation formula is:

Ft = S0 × [1 + (RFC - RUS)]t

The unbiased forward rate is a:

predictor of the future spot rate at the equivalent point in time

The forward rate market is dependent upon:

forward rates equaling the actual future spot rates on average over time

Uncovered interest parity is defined as:

E(St) = S0 × [1 + (RFC - RUS)]t

The international Fisher effect states that _____ rates are equal across countries.

Real

Long-run exposure to exchange rate risk relates to:

unexpected changes in relative economic conditions

The type of exchange rate risk known as translation exposure is best described as:

the problem encountered by an accountant of an international firm who is trying to record balance sheet account values

Which of the following statements are correct?

II. Accounting translation gains and losses are recorded in the equity section of the balance sheet.

III. The long-run exchange rate risk faced by an international firm can be reduced if a firm borrows money in the foreign country where the firm has operations.

Which one of the following types of operations would be subject to the most political risk if the operation were conducted outside of a firm's home country?

military weapons manufacturing

How many Euros can you get for $2,200 if one euro is worth $1.2762?

€1,723.87

You are planning a trip to Australia. Your hotel will cost you A$145 per night for seven nights. You expect to spend another A$2,800 for meals, tours, souvenirs, and so forth. How much will this trip cost you in U.S. dollars given the following exchange rates?

$2,559

You want to import $147,000 worth of rugs from India. How many rupees will you need to pay for this purchase if one rupee is worth $0.0203?

Rs 7,241,379

Currently, $1 will buy C$1.2103 while $1.2762 will buy €1. What is the exchange rate between the Canadian dollar and the euro?

C$1.5446

Assume that ¥95.42 equal $1. Also assume that SKr7.7274 equal $1. How many Japanese yen can you acquire in exchange for 3,000 Swedish krone?

¥37,045

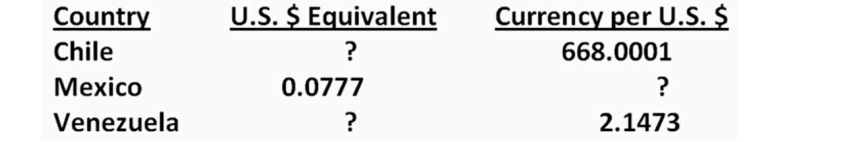

You just returned from some extensive traveling throughout the Americas. You started your trip with $20,000 in your pocket. You spent 3.4 million pesos while in Chile and 16,500 bolivares in Venezuela. Then on the way home, you spent 47,500 pesos in Mexico. How many dollars did you have left by the time you returned to the U.S. given the following exchange rates? (Note: Multiple symbols are used to designate various currencies. For example, the U.S. dollar is notated as "$" or as "USD".)

3,535 USD

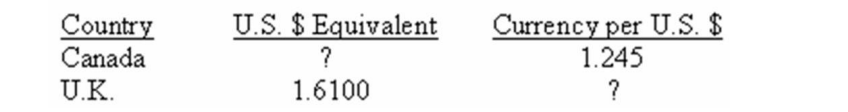

You have 100 British pounds. A friend of yours is willing to exchange 180 Canadian dollars for your 100 British pounds. What will be your profit or loss if you accept your friend's offer, given the following exchange rates?

£10.20 loss

Assume you can buy 52 British pounds with 100 Canadian dollars. How much profit can you earn on a triangle arbitrage given the following rates if you start out with 100 U.S. dollars?

$1.33

Today, you can exchange $1 for £0.6522. Last week, £1 was worth $1.6104. How much profit or loss would you now have if you had converted £100 into dollars last week?

profit of ₤5.03

Today, you can get either 121 Canadian dollars or 1,288 Mexican pesos for 100 U.S. dollars. Last year, 100 U.S. dollars was worth 115 Canadian dollars or 1,291 Mexican pesos. Which one of the following statements is correct given this information?

$100 converted into Canadian dollars last year would now be worth $95.05

The camera you want to buy costs $230 in the U.S. How much will the identical camera cost in Canada if the exchange rate is C$1 = $0.8262? Assume absolute purchasing power parity exists.

$278.38

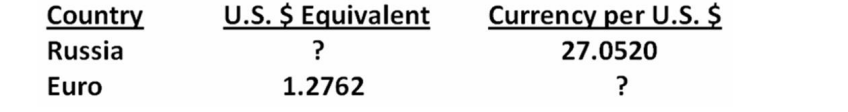

A new coat costs 3,900 Russian rubles. How much will the identical coat cost in Euros if absolute purchasing power parity exists and the following exchange rates apply?

€112.97

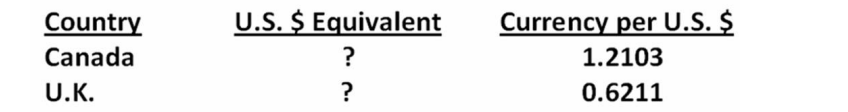

In the spot market, $1 is currently equal to £0.6211. Assume the expected inflation rate in the U.K. is 4.2 percent while it is 3.1 percent in the U.S. What is the expected exchange rate one year from now if relative purchasing power parity exists?

£0.6279

In the spot market, $1 is currently equal to £0.6211. Assume the expected inflation rate in the U.K. is 2.6 percent while it is 4.3 percent in the U.S. What is the expected exchange rate four years from now if relative purchasing power parity exists?

£0.5799

Assume the current spot rate is C$1.2103 and the one-year forward rate is C$1.1925. The nominal risk-free rate in Canada is 3 percent while it is 4 percent in the U.S. Using covered interest arbitrage you can earn an extra _____ profit over that which you would earn if you invested $1 in the U.S.

$0.005

Assume the current spot rate is C$1.1875 and the one-year forward rate is C$1.1724. The nominal risk-free rate in Canada is 4 percent while it is 3 percent in the U.S. Using covered interest arbitrage you can earn an extra _____ profit over that which you would earn if you invested $1 in the U.S.

$0.023

Assume the spot rate for the Japanese yen currently is ¥99.31 per $1 and the one-year forward rate is ¥97.62 per $1. A risk-free asset in Japan is currently earning 2.5 percent. If interest rate parity holds, approximately what rate can you earn on a one-year risk-free U.S. security?

4.20 percent

Assume the spot rate for the British pound currently is £0.6211 per $1. Also assume the one-year forward rate is £0.6347 per $1. A risk-free asset in the U.S. is currently earning 3.4 percent. If interest rate parity holds, what rate can you earn on a one-year risk-free British security?

5.66 percent

A risk-free asset in the U.S. is currently yielding 4 percent while a Canadian risk-free asset is yielding 2 percent. Assume the current spot rate is C$1.2103. What is the approximate three-year forward rate if interest rate parity holds?

C$1.1391

Assume the spot rate on the Canadian dollar is C$1.1847. The risk-free nominal rate in the U.S. is 5 percent while it is only 4 percent in Canada. What one-year forward rate will create interest rate parity?

C$1.1734