2.7 Reasons for government Intervention

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

51 Terms

Why do governments intervene in mixed economies?

Governments intervene in mixed economies for several reasons, including:

Correct market failure: To address sub-optimal allocation of resources.

Earn government revenue: To fund essential services, public, and merit goods.

Promote equity: To reduce the opportunity gap between the rich and poor.

Support firms: To help key domestic industries remain competitive globally.

Support poorer households: To reduce poverty through redistribution policies.

How do governments earn revenue through intervention?

Governments raise revenue through methods such as taxation, privatization, sale of licenses (e.g., 5G licenses), and the sale of goods/services.

What are some ways governments promote equity?

Ways governments promote equity include:

Laws to protect workers: e.g., minimum wage laws, health and safety laws.

Laws to prevent monopolies: To avoid higher prices.

Laws to prevent environmental damage.

How do governments support firms in a global economy?

Governments support key industries by:

Providing subsidies or tax breaks.

Limiting foreign competition until new domestic firms are well-established.

What are four common methods governments use to intervene in markets?

Four common methods are indirect taxation, subsidies, maximum prices, and minimum prices.

What is an indirect tax?

An indirect tax is a tax paid on the consumption of goods/services, only paid if consumers make a purchase. It is usually levied by the government on demerit goods to reduce quantity demanded (QD) and/or to raise government revenue.

Why does an indirect tax cause the supply curve to shift?

Indirect taxes are levied by the government on producers, which increases their costs of production, causing the supply curve to shift left.

What are the two main types of indirect taxes?

The two main types of indirect taxes are specific tax and ad valorem tax.

Define a specific tax.

A specific tax is a fixed tax per unit of output (a specific amount), such as 3.25/packet of cigarettes.

Define an ad valorem tax.

An ad valorem tax is a tax that is a percentage of the purchase price, such as Value Added Tax (VAT).

How does the supply curve shift differently for a specific tax versus an ad valorem tax?

For a specific tax, the supply curve shifts left by a parallel amount (the fixed tax per unit). For an ad valorem tax, the two supply curves diverge because a percentage tax means more tax is paid at higher prices.

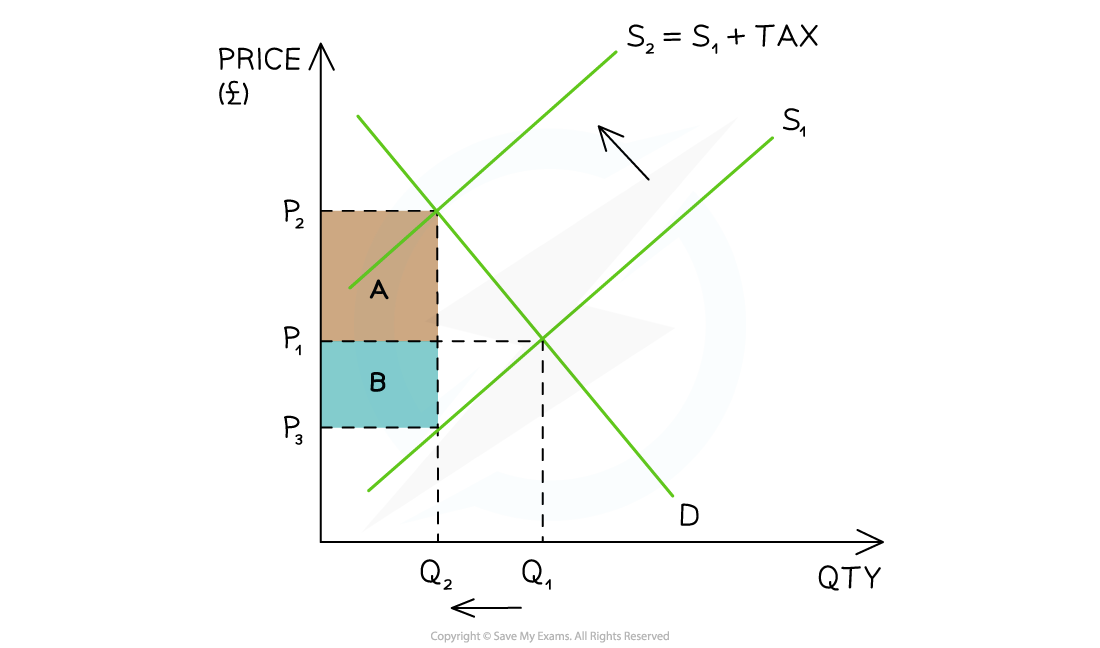

In a market with an indirect tax, how can you calculate the consumer incidence of the tax?

The consumer incidence (share) of the tax is equal to the area: (P2 - P1) \times Q2, where P1 is the initial equilibrium price, P2 is the new equilibrium price consumers pay, and Q2 is the new equilibrium quantity.

In a market with an indirect tax, how can you calculate the producer incidence of the tax?

The producer incidence (share) of the tax is equal to the area: (P1 - P3) \times Q2, where P1 is the initial equilibrium price, P3 is the price producers receive after the tax, and Q2 is the new equilibrium quantity.

In the context of an indirect tax, how is the government's tax revenue calculated?

Government tax revenue is calculated as (P2 - P3) \times Q2, where P2 is the price consumers pay, P3 is the price producers receive, and Q2 is the new equilibrium quantity.

What are two advantages of indirect taxes?

Advantages include:

Raises the price and reduces the quantity demanded of demerit goods, reducing external costs.

Raises revenue for government programs.

What are two disadvantages of indirect taxes?

Disadvantages include:

Effectiveness depends on price elasticity of demand (PED); if inelastic, consumers continue purchasing.

May help create illegal markets or force producers to lay off workers if output falls significantly.

How does the Price Elasticity of Demand (PED) affect tax incidence?

For an inelastic product, producers pass on a much higher proportion of the tax to consumers.

For an elastic product, producers pass on a much smaller proportion of the tax to consumers.

What is a producer subsidy?

A producer subsidy is a per unit amount of money given to a firm by the government.

What are two reasons governments provide producer subsidies?

Governments provide subsidies to:

Increase production of certain goods.

Increase the provision of a merit good (e.g., making electric cars more affordable).

How does a subsidy impact the supply curve and market equilibrium?

A subsidy shifts the supply curve right (or down) from S to S + subsidy. This leads to a lower market price (P2) and a higher quantity demanded (Q2).

How is the total cost of a subsidy to the government calculated?

The total cost to the government of a subsidy is calculated as: (P3 - P2) \times Q2, where P3 is the price producers receive after adding the subsidy, P2 is the new market price consumers pay, and Q2 is the new equilibrium quantity.

What are two advantages of producer subsidies?

Advantages include:

Can be targeted to help specific domestic industries or encourage preferred consumer behavior (e.g., electric cars).

Lowers prices and increases demand for merit goods.

What are two disadvantages of producer subsidies?

Disadvantages include:

Distorts the allocation of resources and has an opportunity cost for government spending.

Can disincentivize firms from becoming more efficient and are prone to political pressure/lobbying.

What are the two common types of price controls used by governments?

The two common types of price controls are maximum price (price ceiling) and minimum price (price floor).

Define a price ceiling (maximum price).

A price ceiling is a legally imposed maximum price set by the government below the existing free market equilibrium price (P_e), meaning sellers cannot legally sell the good/service at a higher price.

What are some reasons governments use price ceilings?

Governments use price ceilings to:

Help consumers by making goods/services more affordable.

Keep rents lower in housing rental markets (long-term use).

Act as short-term solutions during unusual price increases (e.g., petrol prices or Covid supplies).

How does a price ceiling affect market equilibrium?

A price ceiling (P{max}) set below the free market price (Pe) causes:

A contraction in quantity supplied (Q_S) because the lower price reduces the incentive to supply.

An extension in quantity demanded (Q_D) because the lower price increases the incentive to consume.

This creates a condition of excess demand (shortage) equal to QD - QS.

How do price ceilings affect consumer surplus?

When price ceilings create excess demand:

Overall consumer surplus decreases in the longer term as suppliers adjust and supply less.

For individual consumers who acquire the good at the lower price, their consumer surplus increases.

Many consumers may be unable to purchase the product at all.

What are two advantages of using price ceilings?

Advantages of price ceilings include:

Some consumers benefit by purchasing at lower prices, increasing their consumer surplus.

They can stabilize markets short-term during disruptions (e.g., essential supplies).

What are two disadvantages of using price ceilings?

Disadvantages of price ceilings include:

Many consumers are unable to purchase due to the shortage.

Producers lose out as the price is below what they would normally receive, causing producer surplus to fall.

Unmet demand can encourage illegal (black/grey) markets.

They distort market forces and lead to inefficient allocation of resources.

Governments may need to intervene further to meet excess demand.

Define a price floor (minimum price).

A price floor is a legally imposed minimum price set by the government above the existing free market equilibrium price (P_e), meaning sellers cannot legally sell the good/service at a lower price.

What are some reasons governments use price floors in product markets?

Governments use price floors in product markets to:

Help producers by ensuring they receive a higher price for their goods.

Decrease consumption of a demerit good (e.g., alcohol) by making it more expensive.

How does a price floor affect market equilibrium in product markets?

A price floor (P{min}) set above the free market price (Pe) causes:

An extension in quantity supplied (Q_S) because the higher price increases the incentive to supply.

A contraction in quantity demanded (Q_D) because the higher price decreases the incentive to consume.

This creates a condition of excess supply (surplus) equal to QS - QD.

What are two advantages of using price floors in product markets?

Advantages of price floors in product markets include:

In agricultural markets, producers benefit from higher prices (governments may purchase excess supply).

When used for demerit goods, output falls, potentially reducing external costs.

What are two disadvantages of using price floors in product markets?

Disadvantages of price floors in product markets include:

It costs the government to purchase excess supply, creating an opportunity cost.

Producers may become over-dependent on government help.

If producers lower output to match quantity demanded at the minimum price, it could lead to unemployment in the industry.

What is a National Minimum Wage (NMW)?

A National Minimum Wage (NMW) is a legally imposed wage level that employers must pay their workers, typically set above the market wage rate and often varying by age.

How does a National Minimum Wage (NMW) affect the labour market?

An NMW (W1) imposed above the market wage rate (We) causes:

The supply of labour to increase from Qe to QS (workers are incentivized by higher wages).

The demand for labour to decrease from Qe to QD (firms face higher production costs).

This results in excess supply of labour, leading to potential unemployment equal to QS - QD.

What are two advantages of using minimum wages?

Advantages of minimum wages include:

Guarantees a minimum income for the lowest-paid workers.

Higher income levels can increase consumption in the economy.

May incentivize workers to be more productive.

What are two disadvantages of using minimum wages?

Disadvantages of minimum wages include:

Raises production costs for firms, which may lead to higher prices for goods/services.

If firms cannot raise prices, they might lay off workers, increasing unemployment (QS - QD).

Why do governments directly provide services?

Governments often provide public goods and services to improve the lives of the population and enhance equity, such as healthcare services to ensure everyone can access treatment, and public goods like roads and parks that private firms won't provide due.

What are some characteristics of directly provided public services?

Public services:

Are beneficial for society.

Are not provided by private firms due to the free rider problem (e.g., roads, parks, national defense).

Are usually provided free at the point of consumption, making them accessible regardless of income.

Provide both private and external benefits to society.

Are paid for through general taxation.

What are the advantages of direct government provision of services?

Advantages include:

Accessibility to everyone, regardless of income.

Provision of goods and services that private firms wouldn't supply (public goods).

Generation of both private and external benefits for society.

What are the disadvantages of direct government provision of services?

Disadvantages include:

Opportunity cost associated with their provision.

Potential for excess demand and long waiting times if products are free (e.g., public hospitals).

Distinguish between legislation and regulation as government intervention methods.

Regulation & Legislation

Legislation: The process of creating laws.

Regulation: The process of monitoring and enforcing laws.

These are often referred to as 'command and control' due to ongoing government intervention.

What is the purpose of government regulation and legislation?

Governments create rules (laws) to limit harm from the external costs of consumption/production. They establish regulatory agencies to monitor compliance and may impose fines or imprisonment for violations (e.g., selling cigarettes to minors).

What are the advantages of government regulation and legislation?

Advantages of regulation and legislation include:

Helping to reduce the external costs of demerit goods.

Fines can generate extra government revenue.

What are the disadvantages of government regulation and legislation?

Disadvantages of regulation and legislation include:

Enforcing laws requires hiring more people for regulatory agencies, creating a cost.

Enforcement can be difficult and complex.

Regulation may inadvertently encourage underground (illegal) markets, potentially leading to even higher external costs.

What are 'consumer nudges' in government intervention?

Consumer nudges are a way for governments to influence individual behaviors and choices without strict regulations. They guide people towards beneficial decisions while preserving freedom of choice, based on behavioral economics principles, with transparency and respect for autonomy.

What are some methods governments use for consumer nudging?

Methods include:

Provision of Information: Clear, accessible information (e.g., nutritional labels, energy ratings).

Default Options: Pre-selected choices (e.g., organ donation opt-out).

Framing and Presentation: Highlighting positive aspects or consequences (e.g., public health campaigns).

Incentives and Disincentives: Encouraging or discouraging behaviors (e.g., EV subsidies, high taxes on polluting vehicles).

Social Norms & Peer Influence: Showcasing positive role models or majority behavior (e.g., reporting littering).

Feedback and Reminders: Reports on energy usage or preventive healthcare reminders.

What are the advantages of using consumer nudges by governments?

Advantages include:

Cost-effective: Relatively low-cost compared to other policy measures.

Preserves freedom of choice: Guides individuals without strict mandates.

Improved public health: Encourages healthier behaviors.

Better decision-making: Simplifies information and aids choices.

Environmental sustainability: Contributes to environmental goals without strict regulations.

What are the disadvantages of using consumer nudges by governments?

Disadvantages include:

Ethical concerns: Critics argue nudges can be manipulative, raising questions about autonomy and consent.

Lack of transparency: Nudges operate subtly, making it hard for individuals to question influences.

Unintended consequences: Citizens might actively work against nudges once aware (e.g., opting out of default options more quickly).

Variable success rates: Effectiveness can differ based on individuals, biases, and cultural backgrounds.