Intermediate Accounting

1/57

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

58 Terms

Net Cash Flow Step 1

Net cash flow from operating activities

Operating Profit

Add depreciation

Add non-borrowing, non-current liabilities

Remove disposal gain/ add disposal loss

Add current asset movements and current liabilities movements excluding overdraft

Add deferred income

Add increase provisions/remove decrease in provisions

Subtotal cash generated from operations

Remove financial cost

Remove tax

Net cash flow

Depreciation Formula

Opening Depreciation - accumulated depreciation on disposal + x = Closing depreciation

Solve for x

Opening and Closing Cash

Opening cash = Balance Sheet Opening Cash - Opening Overdraft

Closing Cash = Balance Sheet Closing Cash - Closing Overdraft

Net Cash Flow

Net cash flow operating + Net cash flow investing + Net cash flow financial = Closing Cash - Opening Cash

PPE

Opening PPE at cost - Cost of PPE disposal + Revaluation + x = Closing PPE

Solve for x

Cash proceeds from PPE disposal

Cash proceeds from PPE disposal = Carrying Amount (±) Gain/Loss

Step 2: Investment

PPE + Cash Proceeds from PPE disposal + Remaining Non-current assets

Step 3: Financing

All borrowing Non-current liabilities + Equity excluding retained earnings + Dividends

Dividends

Dividends Paid = Opening Retained earnings + Profit after tax - closing retained earnings

Stock sales

Stock sales = Opening Stock Capital + Opening Share premium + x = Closing Stock Capital + Closing Share premium

Solve for x

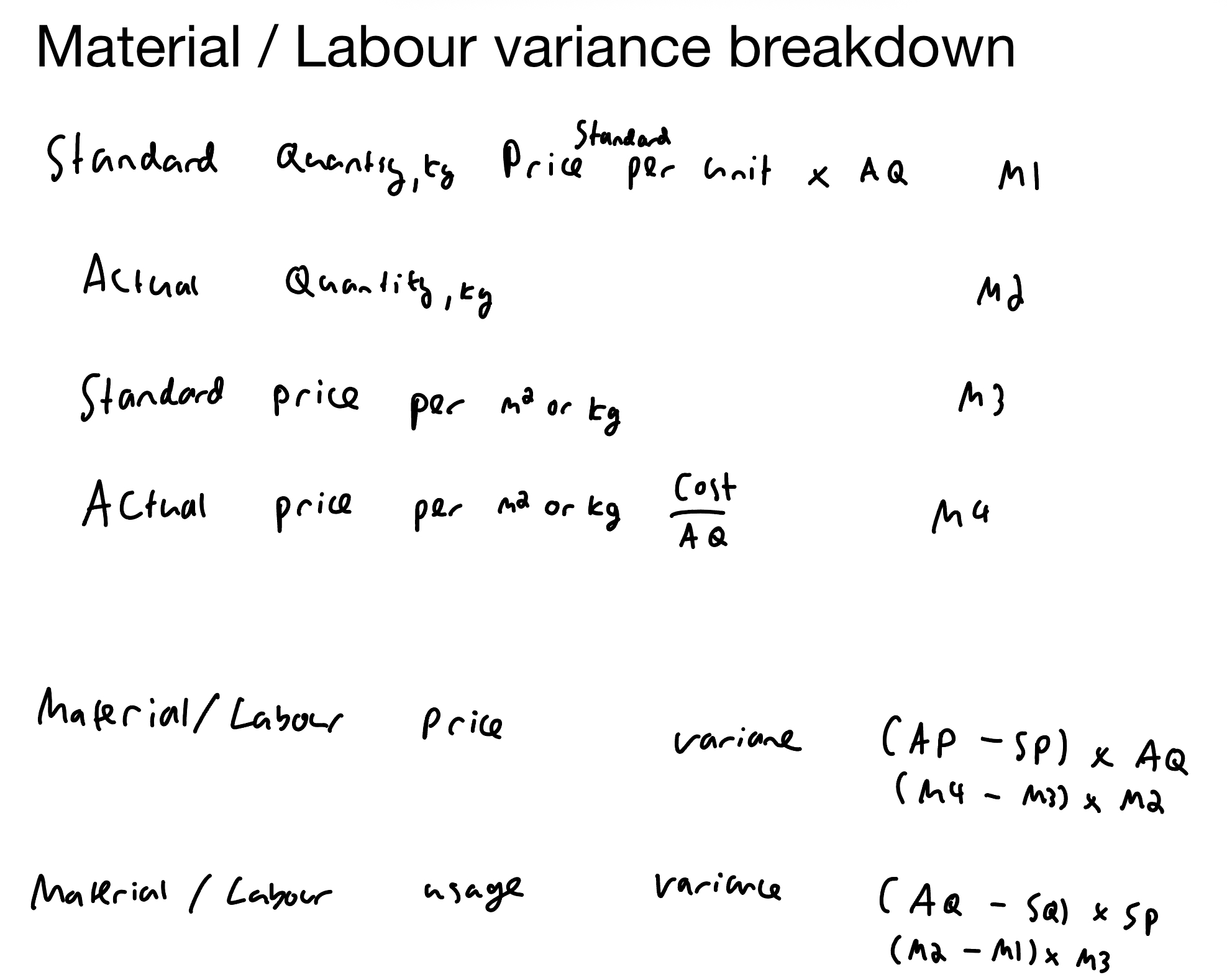

Material usage variance

(AQ − SQ) × SP per unit

Fixed overhead spending variance

Actual FOH − Budget FOH

Sales price variance

(Act SP - Budg SP) * AQ

(Actual units sold - Budgeted units) × Standard contribution per unit

Standard selling price per unit - Standard variable cost per unit

Standard quantity per unit × Actual number of units produced

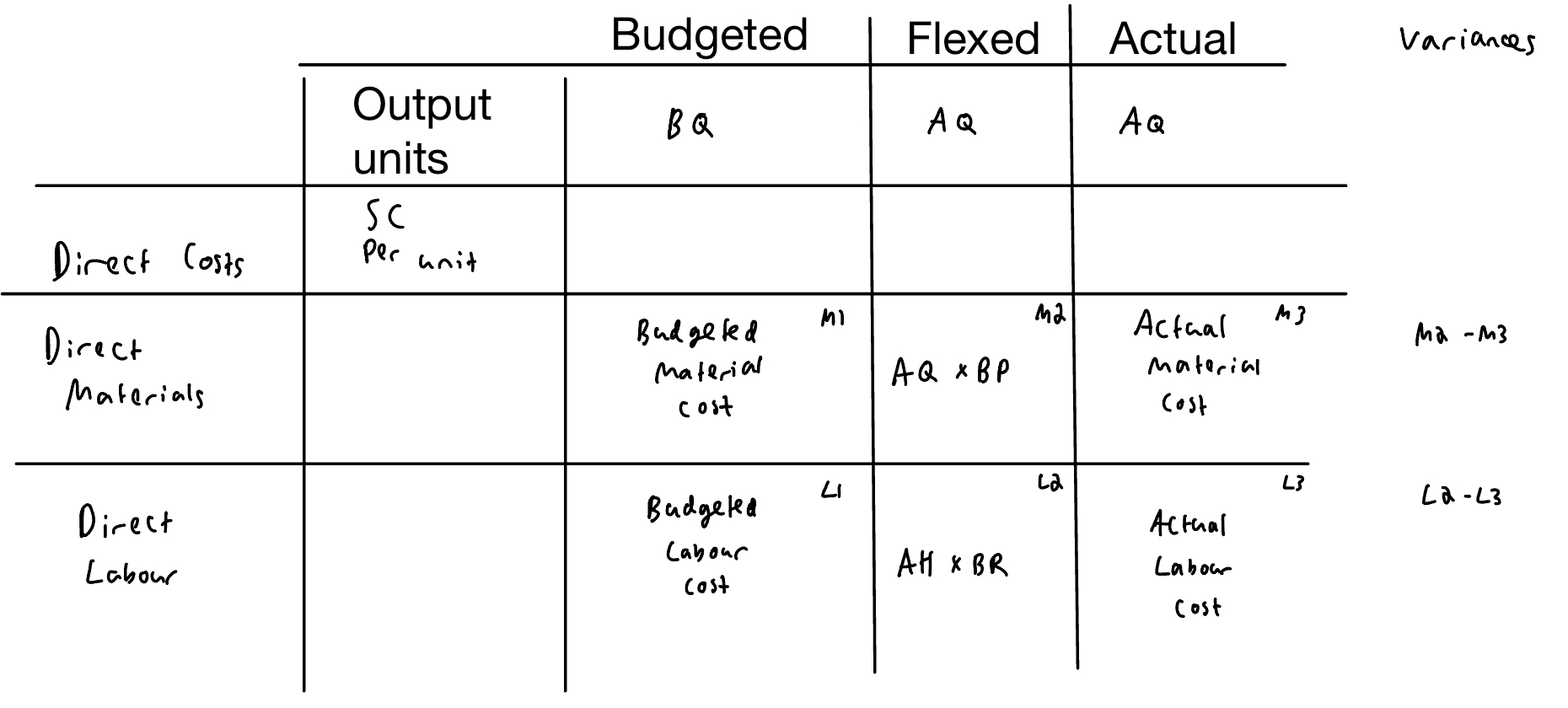

Total direct material and labour variances

Material / Labour variance breakdown

For direct material and labour breakdowns always use the actual count of either hours of quantity

Accounting Rate of Return (ARR) formula

Average annual accounting profit ÷ Midpoint book value

Average annual accounting profit over project life

Total net cashflow over project life - Total Depreciation / Number of Year of project

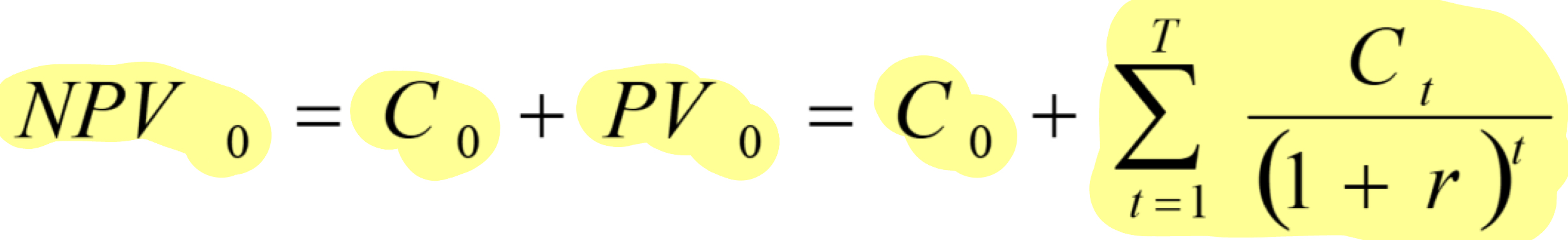

r in NPV formula

the cost of capital can be subbed in as r for projects. Cost of capital similar to interest rate, the rate of investing the money somewhere if you don’t invest in the project

Is NPV usually the most reliable

Yes

IRR limitation due to project length

When the IRR is high (the project is creating

significant surplus value) and the project life is long, the IRR will overstate the true return on the projec

What are relevent cash flows in investment projects

Relevant cash flows are cash flows that would only happen if the project was undertaken.

I.e if a cash flow will happen regardless of project decision, it is not relevant

NPV and Payback period net cash flow

Net cash flow per year = Profit/loss per year + annual depreciation

Tax Paid

Opening Tax liability/payable + Income statement Current Year Taxation + x = Closing Tax liability/payable

Solve for x

Standard fixed overhead absorption rate per unit

Budgeted fixed production overhead / Budgeted number of units

Do you add depreciation if it is included in distribution costs or on the income statement

Yes, you add depreciation regardless

How is overdraft thought of

Overdraft is thought as money owed

Midpoint book value

(Cost of Asset + Residual Value) / 2

Average annual accounting profitAverage annual accounting profit

(Total net cash savings/profit over project life − Total depreciation) / Project life in years